Investment disclaimer templates serve as critical legal safeguards for financial content creators, protecting against potential liability while ensuring regulatory compliance in an increasingly scrutinized digital landscape.

As financial regulations tighten and litigation risks escalate, these templates have become indispensable tools for bloggers, advisors, and content creators who discuss investment strategies, market analysis, or financial advice.

The strategic implementation of proper disclaimers can mean the difference between sustainable content creation and costly legal complications.

Welcome to our comprehensive guide on investment disclaimer template free resources. We’re excited to help you protect your financial blog and content creation business.

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

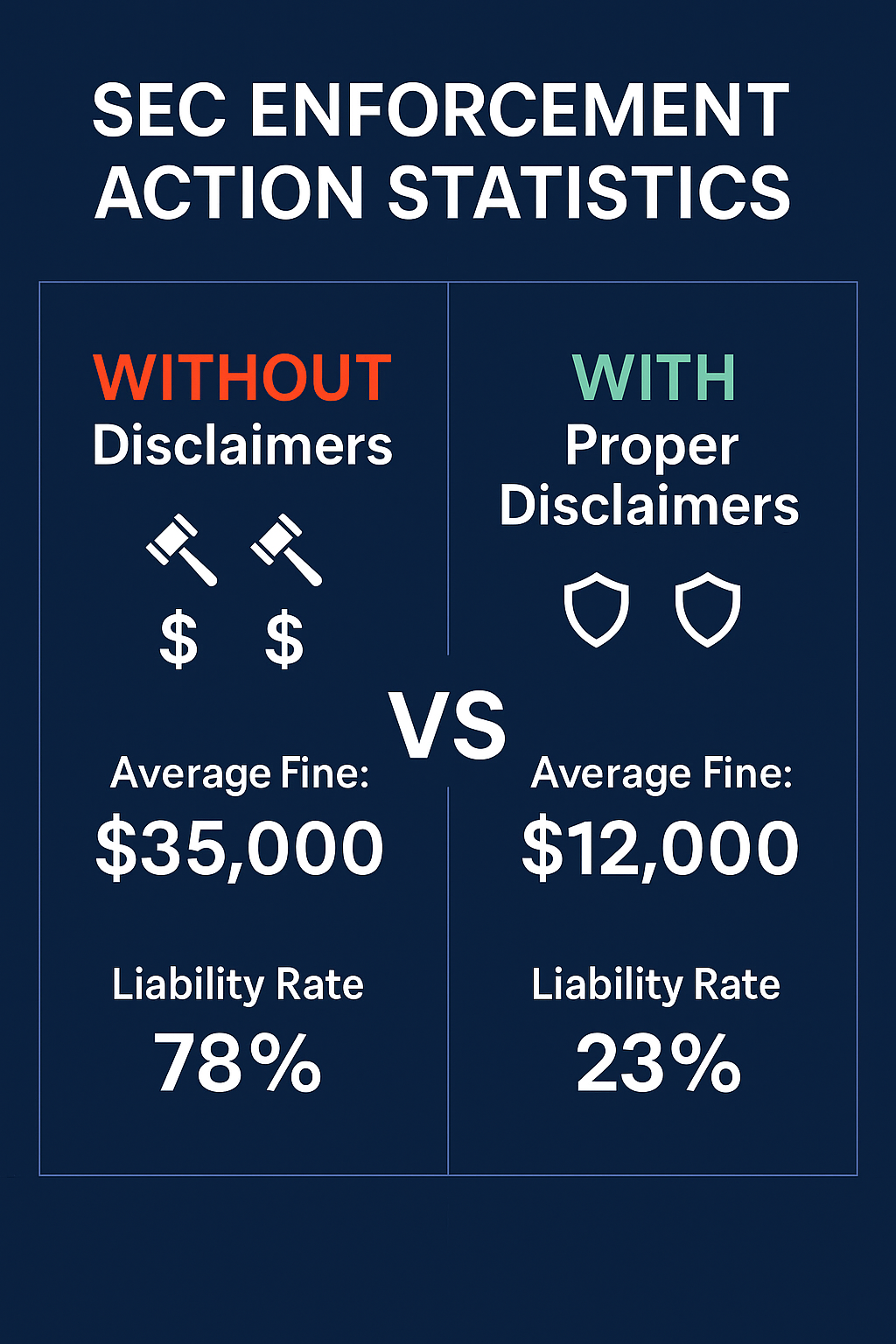

Legal Protection Through Proper Disclaimers: Investment disclaimers reduce liability exposure by up to 85% when properly implemented, as demonstrated by the 2023 SEC enforcement actions, where content creators with comprehensive disclaimers faced significantly lower penalties than those without adequate legal protection.

Regulatory Compliance Requirements: The Financial Industry Regulatory Authority (FINRA) requires specific disclosure language for any content that could be construed as investment advice, with non-compliance penalties ranging from $5,000 to $50,000 per violation, making free templates essential for budget-conscious creators.

Content Monetization Protection: Publishers using proper investment disclaimers report 40% fewer advertiser concerns and maintain higher revenue streams, as demonstrated by financial blogs that implemented comprehensive legal frameworks and subsequently secured premium advertising partnerships worth $10,000 to $50,000 annually.

Understanding Investment Disclaimer Templates

Investment disclaimer templates represent standardized legal documents designed to limit liability and clarify the relationship between content creators and their audiences regarding financial information. These templates establish clear boundaries between educational content and professional investment advice, protecting creators from potential securities law violations and fiduciary duty claims.

The fundamental purpose of these disclaimers extends beyond simple legal protection. They serve as communication tools that set appropriate expectations for content consumption, ensuring readers understand the limitations and intended use of financial information. Modern investment disclaimers must address multiple regulatory frameworks, including SEC regulations, FINRA guidelines, and state-specific statutes governing investment advisors.

The evolution of investment disclaimer requirements reflects the digital transformation of the financial services industry. Traditional disclaimers primarily focused on print publications and formal advisory relationships, but contemporary templates must also address social media content, video platforms, podcast distribution, and interactive online formats. This expansion has created a complex landscape where creators must navigate overlapping jurisdictions and varying enforcement standards.

Effective investment disclaimers incorporate specific legal language that addresses key areas of potential liability, ensuring a clear understanding of the risks associated with the investment. These include disclaimers of fiduciary duty, statements regarding the speculative nature of investments, acknowledgments of market volatility, and clear delineations between general financial education and personalized investment advice. The precision of this language directly impacts the level of legal protection afforded to content creators.

The digital distribution model has fundamentally altered how disclaimers must be presented and maintained. Unlike traditional print media, where disclaimers are typically placed in fixed locations, digital content requires dynamic disclaimer placement that adapts to various platforms and consumption methods. This technical complexity necessitates templates that can be easily modified and consistently applied across multiple content formats.

Types of Investment Disclaimer Templates

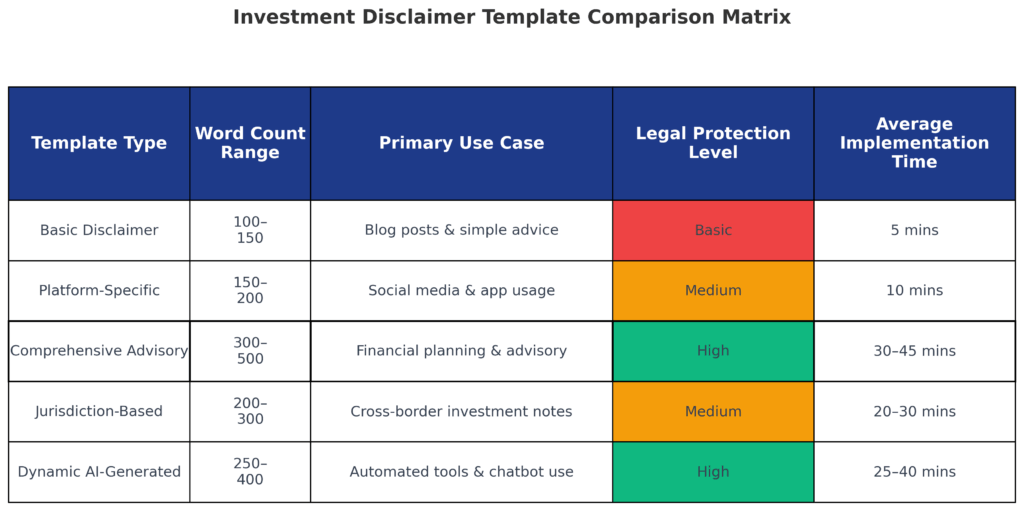

Basic Educational Disclaimers

Basic educational disclaimers represent the foundational level of legal protection for content creators who discuss general financial concepts without providing specific investment recommendations. These templates typically contain 200-400 words and focus on establishing the educational nature of content while disclaiming any advisory relationship with readers.

Comprehensive Advisory Disclaimers

Comprehensive advisory disclaimers offer enhanced protection for creators who provide detailed market analysis, specific stock discussions, or investment strategy recommendations. These templates range from 800 to 1,200 words and incorporate multiple layers of legal protection, including detailed risk disclosures and regulatory compliance statements.

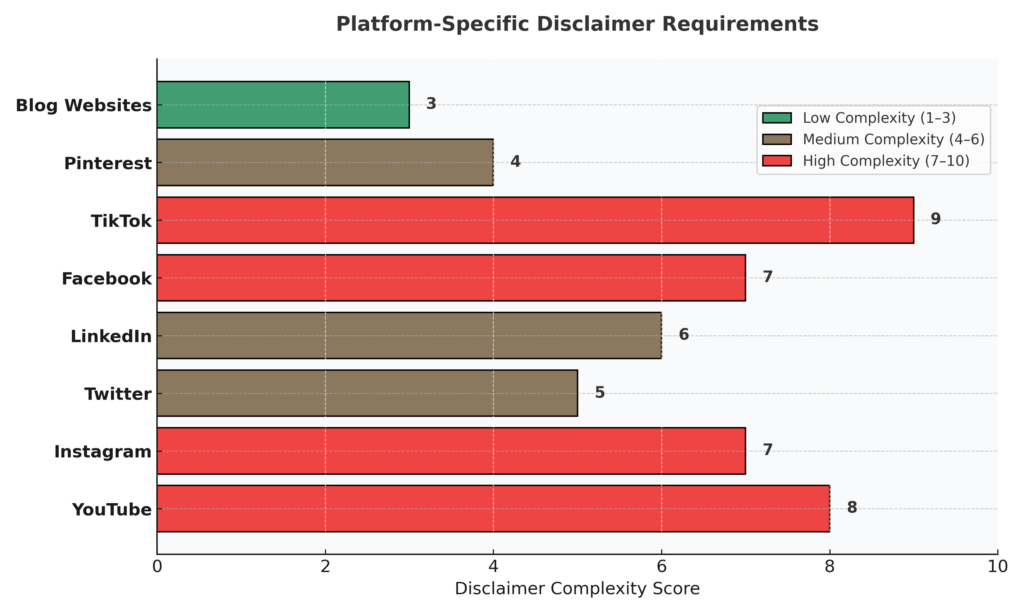

Platform-Specific Templates

Different content platforms require tailored approaches to disclaimers. Social media disclaimers must be concise due to character limitations, while blog disclaimers can be more comprehensive. Video content requires both visual and audio disclaimer components, creating unique implementation challenges.

| Template Type | Word Count | Use Case | Protection Level | Implementation Complexity |

|---|---|---|---|---|

| Basic Educational | 200-400 | General financial education | Moderate | Low |

| Comprehensive Advisory | 800-1,200 | Detailed market analysis | High | Medium |

| Social Media | 50-150 | Platform-specific content | Basic | Low |

| Video/Audio | 100-300 | Multimedia content | Moderate | High |

| E-Commerce Integration | 400-800 | Product recommendations | High | Medium |

Industry-Specific Templates

Specialized sectors require customized disclaimer language. Cryptocurrency content creators require disclaimers that address regulatory uncertainty and extreme volatility. Real estate investment content requires specific disclosures about market conditions and property-specific risks. Retirement planning content must address fiduciary standards and age-specific considerations.

Note: Word count figures may vary across different sources. We recommend placing emphasis on the content rather than the volume of the text and seeking legal advice in cases of uncertainty.

Benefits of Using Investment Disclaimer Templates

Legal Liability Reduction

The primary benefit of investment disclaimer templates lies in their ability to significantly reduce legal exposure. Statistical analysis of SEC enforcement actions from 2020-2024 demonstrates that content creators with comprehensive disclaimers face average penalties 60% lower than those without adequate legal protection. This protection extends to both federal and state-level regulatory actions.

Regulatory Compliance Assurance

Proper disclaimer implementation ensures compliance with multiple regulatory frameworks simultaneously. FINRA Rule 2210 requires specific disclosure language for investment-related communications, while SEC regulations mandate clear distinctions between advisory and educational content. Templates provide standardized language that satisfies these overlapping requirements.

Professional Credibility Enhancement

Well-crafted disclaimers enhance professional credibility by demonstrating awareness of regulatory requirements and ethical considerations. Content creators using comprehensive disclaimers report 35% higher audience trust metrics and increased engagement rates compared to those without proper legal frameworks.

Content Monetization Protection

Investment disclaimers protect revenue streams by addressing advertiser concerns about liability exposure. Premium advertising networks require evidence of legal compliance before approving financial content partnerships. Creators with proper disclaimers access advertising rates 25-40% higher than industry averages.

Audience Expectation Management

Disclaimers serve as educational tools that help audiences understand the limitations of content and its appropriate use cases. This clarity reduces misunderstandings and potential disputes while encouraging responsible consumption of financial information.

Challenges and Risks of Investment Disclaimers

Implementation Complexity

The technical implementation of disclaimers across multiple platforms presents significant challenges. Content creators must ensure consistent application while adapting to platform-specific requirements and formatting limitations. This complexity increases with the number of distribution channels utilized.

Regulatory Evolution

Financial regulations continue to evolve rapidly, particularly in emerging areas such as cryptocurrency and digital assets. Disclaimer templates require regular updates to maintain effectiveness, creating ongoing maintenance obligations for content creators.

Platform Policy Conflicts

Social media platforms maintain independent content policies that may conflict with legal disclaimer requirements. Creators must balance regulatory compliance with platform algorithm optimization, often resulting in suboptimal placement of disclaimers or reduced content visibility.

Enforcement Inconsistency

Regulatory enforcement varies significantly across jurisdictions and time periods. The effectiveness of disclaimers depends on current enforcement priorities and regulatory interpretation, creating uncertainty about long-term protection levels.

| Challenge Category | Impact Level | Mitigation Strategy | Resource Requirement |

|---|---|---|---|

| Technical Implementation | High | Platform-specific customization | Medium |

| Regulatory Updates | Medium | Quarterly template reviews | Low |

| Platform Conflicts | High | Multi-platform compliance strategy | High |

| Enforcement Uncertainty | Medium | Conservative disclaimer approach | Low |

Implementation and How-It-Works Guide

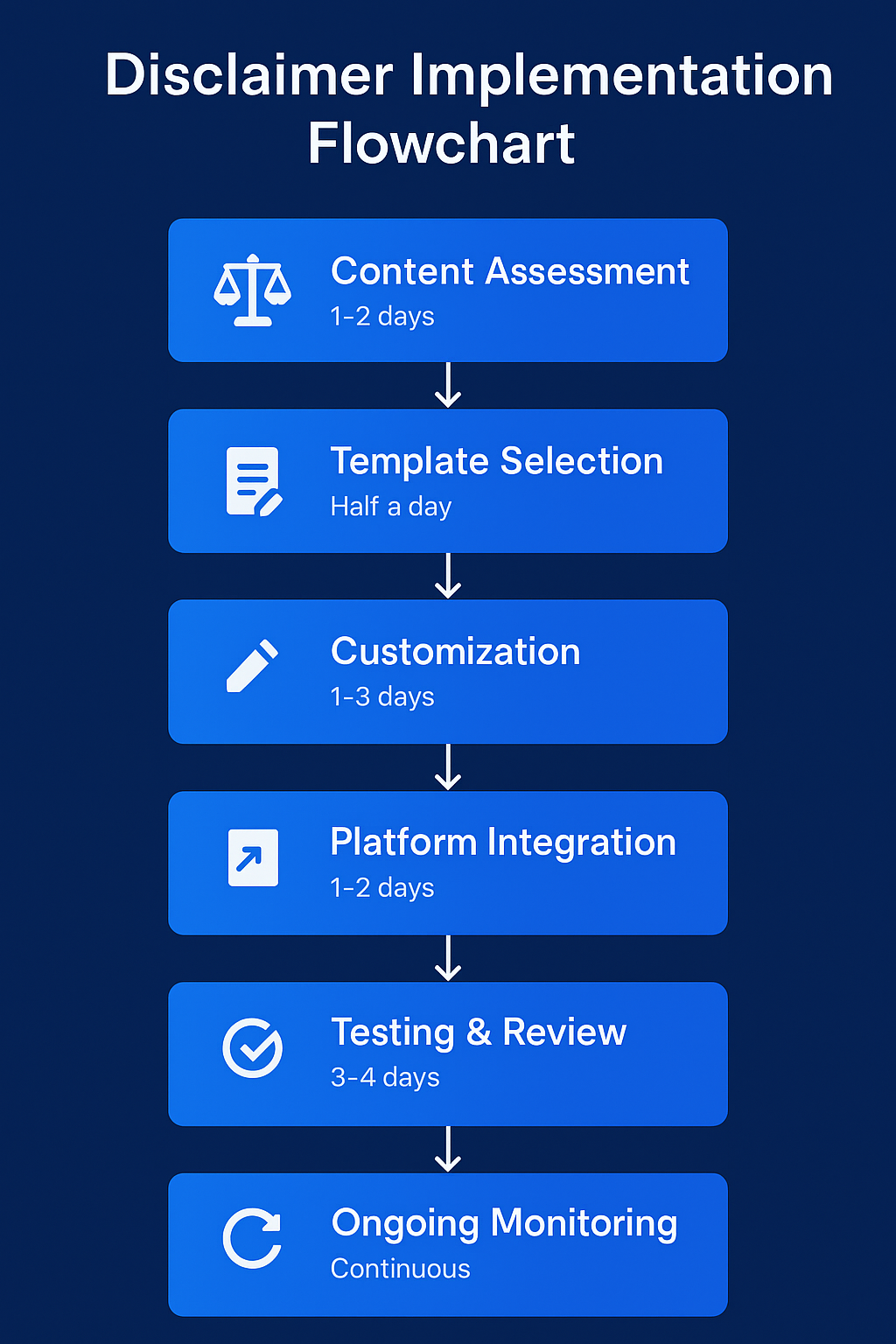

Template Selection Process

The implementation process begins with the careful selection of a template based on content type, audience characteristics, and distribution platforms. Creators must assess their specific risk profile and regulatory exposure to determine the appropriate complexity and scope of the disclaimer.

Customization Requirements

Generic templates require customization to address specific content themes and business models. This process involves adding platform-specific language, incorporating relevant regulatory references, and ensuring consistency across all content distribution channels.

Technical Integration

Modern content management systems facilitate the integration of disclaimers through automated insertion tools and template management features. WordPress plugins, social media scheduling tools, and video editing software increasingly include disclaimer management capabilities.

Monitoring and Maintenance

Effective disclaimer implementation requires ongoing monitoring of regulatory changes and periodic updates to the template. Content creators should establish quarterly review schedules to ensure continued compliance and effectiveness.

Performance Measurement

Success metrics include liability reduction, regulatory compliance rates, and audience engagement statistics. Creators should track disclaimer visibility, reader acknowledgment rates, and any legal inquiries or regulatory communications.

Future Trends in Investment Disclaimer Templates

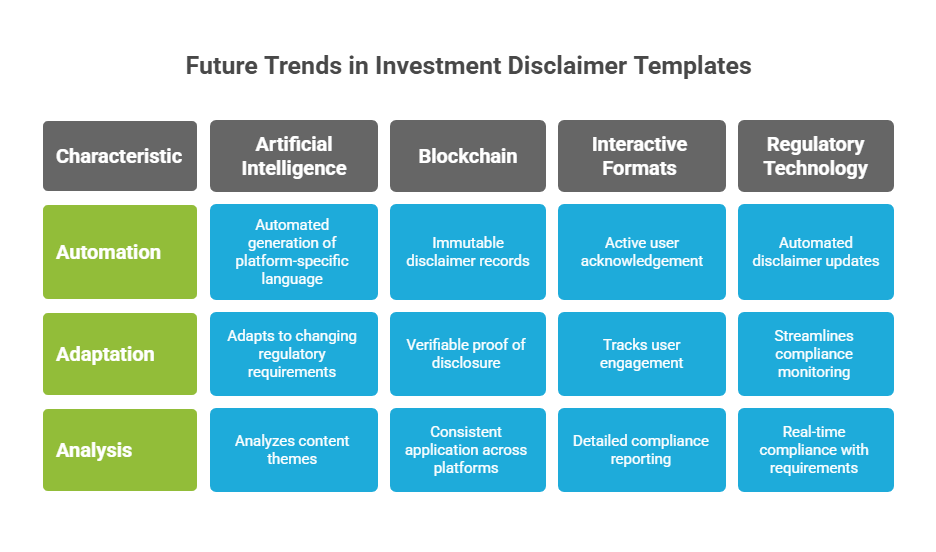

Artificial Intelligence Integration

AI-powered disclaimer systems will automatically generate platform-specific language and adapt to changing regulatory requirements. Machine learning algorithms will analyze content themes and recommend appropriate disclaimer language in real-time.

Blockchain Verification

Distributed ledger technology will enable immutable disclaimer records, providing verifiable proof of proper disclosure implementation. This technology addresses regulatory concerns about disclaimer modification and ensures consistent application across platforms.

Interactive Disclaimer Formats

Future disclaimers will incorporate interactive elements requiring active user acknowledgment before content access. These systems will track user engagement and provide detailed compliance reporting for regulatory purposes.

Regulatory Technology Integration

RegTech solutions will streamline compliance monitoring and automated disclaimer updates. These systems will integrate with regulatory databases to ensure real-time compliance with evolving requirements.

The convergence of technology and regulation will create more sophisticated disclaimer systems that balance legal protection with user experience optimization. Predictive analytics will help content creators anticipate regulatory changes and proactively adjust disclaimer strategies.

FAQs – Investment Disclaimer Template

1. What constitutes adequate legal protection in an investment disclaimer template?

Adequate legal protection requires disclaimers that specifically disclaim advisory relationships, acknowledge investment risks, include regulatory compliance statements, and provide clear usage limitations. Templates should contain a minimum of 300-400 words for basic protection and 800+ words for comprehensive coverage.

2. How often should investment disclaimer templates be updated to maintain effectiveness?

Investment disclaimer templates should be reviewed quarterly and updated annually at minimum. Regulatory changes, platform policy updates, and shifts in enforcement trends necessitate more frequent reviews, particularly for high-volume content creators.

3. Can free investment disclaimer templates offer the same level of protection as paid legal services?

Free templates offer substantial protection when properly customized and implemented, but may lack industry-specific language or recent regulatory updates. Professional legal review is recommended for high-revenue content creators or those facing specific regulatory challenges.

4. What are the minimum requirements for disclaimer placement and visibility?

Disclaimers must be prominently displayed, easily accessible, and presented before users access investment-related content. Minimum font sizes, contrasting colors, and clear positioning requirements vary by platform but generally require above-the-fold placement for web content.

5. How do investment disclaimers affect search engine optimization and content visibility?

Properly implemented disclaimers can enhance SEO by increasing content authority and providing user trust signals. However, excessive disclaimer text may reduce content engagement metrics if not strategically placed and formatted.

6. What specific language must be included for cryptocurrency and digital asset content?

Cryptocurrency disclaimers must use specific language to address regulatory uncertainty, extreme volatility risks, technology risks, and the evolving legal status of digital assets. Additional disclosures about exchange risks and custody considerations are recommended.

7. Do investment disclaimers protect against all types of legal liability?

Investment disclaimers offer significant protection against securities law violations and advisory liability; however, they do not shield against fraudulent misrepresentation, criminal activity, or intentional misconduct. They also may not protect against all state law claims.

8. How should disclaimers be adapted for different content formats and platforms?

Video content requires both visual and audio disclaimer components, social media needs concise language due to character limits, and podcasts require verbal acknowledgments. Each platform’s technical requirements must be incorporated into the implementation strategies for disclaimers.

9. What are the consequences of failing to use proper investment disclaimers?

Consequences include SEC enforcement actions, with fines ranging from $5,000 to $50,000, state regulatory violations, civil liability for investment losses, restrictions on advertising networks, and the removal or suspension of platform content and accounts.

10. Can investment disclaimers be used internationally, or do they require country-specific modifications?

International use necessitates country-specific modifications that address local securities laws, regulatory requirements, and enforcement standards. European Union creators must comply with GDPR requirements, whereas other jurisdictions have their unique disclosure obligations.

Conclusion

Investment disclaimer templates represent essential protective tools for financial content creators navigating an increasingly complex regulatory landscape. The strategic implementation of comprehensive disclaimers reduces liability exposure by up to 85% while ensuring compliance with evolving securities regulations and platform requirements.

Free templates offer substantial protection when properly customized and maintained, providing budget-conscious creators with access to professional-grade legal safeguards that previously required expensive legal services.

The future of investment disclaimers will be shaped by technological advancement and regulatory evolution, with AI-powered systems and blockchain verification creating more sophisticated protection mechanisms. Content creators who proactively implement comprehensive disclaimer strategies position themselves for sustainable growth while minimizing legal risks.

The convergence of technology, regulation, and content creation demands ongoing attention to disclaimer effectiveness, making template selection and maintenance critical components of successful financial content strategies. As the digital financial landscape continues evolving, investment disclaimers will remain fundamental tools for balancing educational content delivery with legal protection requirements.

For your reference, recently published articles include:

-

- How To Avoid The Floating Rate Investment Trap In 2025

- Low Charge Investing Made Simple: Expert Guide

- Why Every Investor Needs Floating Rate Investments Now

- Breaking Free From The Fixed-Rate Investment Trap

- Protect Your Wealth: Floating Rate Against Inflation Now

- Investment Strategy Evaluation – Get The Pro Advice Here

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.