The floating rate investment trap represents one of the most deceptive pitfalls in modern portfolio management, where investors are lured by the promise of rising yields only to discover hidden risks that can devastate returns.

As interest rate volatility continues to dominate financial markets in 2025, understanding this trap has become crucial for protecting capital and achieving consistent investment performance.

Welcome to our comprehensive exploration of the floating rate investment trap – we’re excited to help you navigate these complex markets and protect your portfolio from costly mistakes!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

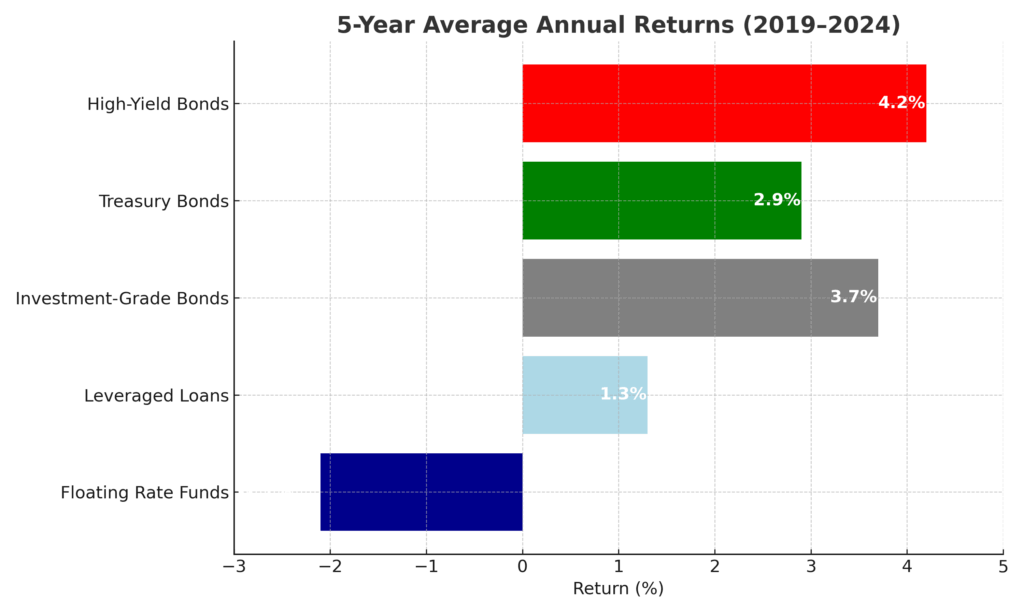

1. Interest Rate Timing Risk: Floating rate investments often perform poorly during rate transition periods, with studies showing average underperformance of 2-4% during the first 12 months of rate cutting cycles. For example, floating rate bond funds experienced significant outflows in late 2024 as investors anticipated Federal Reserve rate cuts.

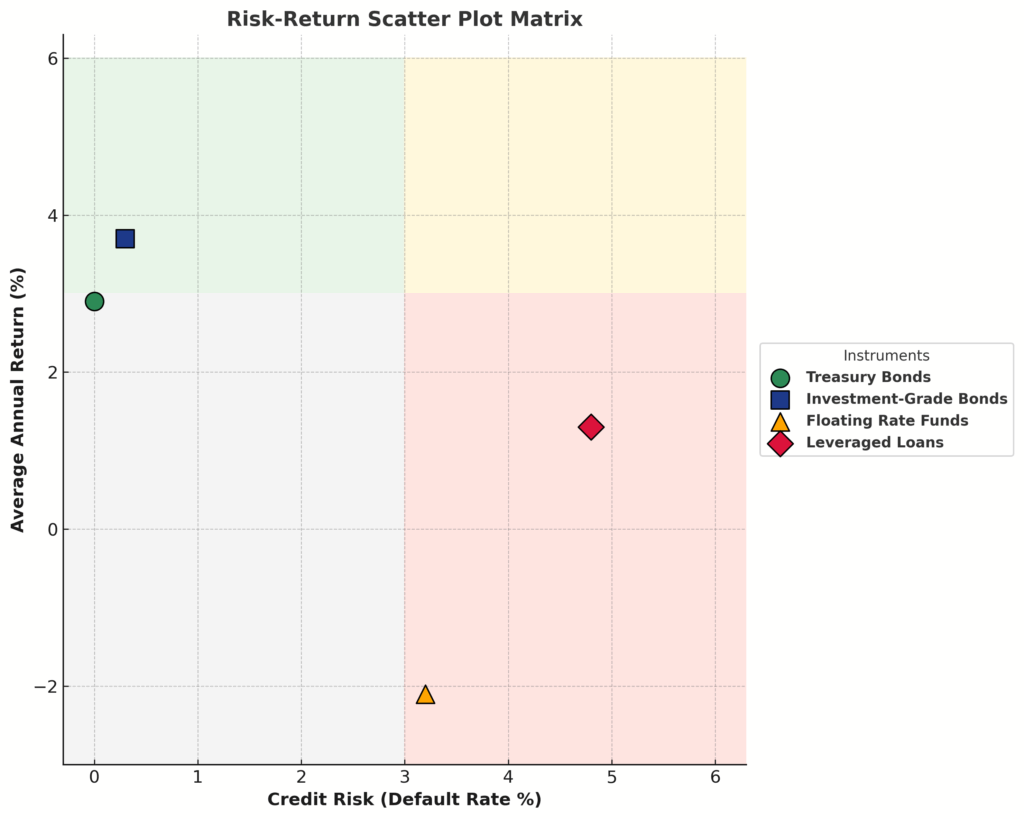

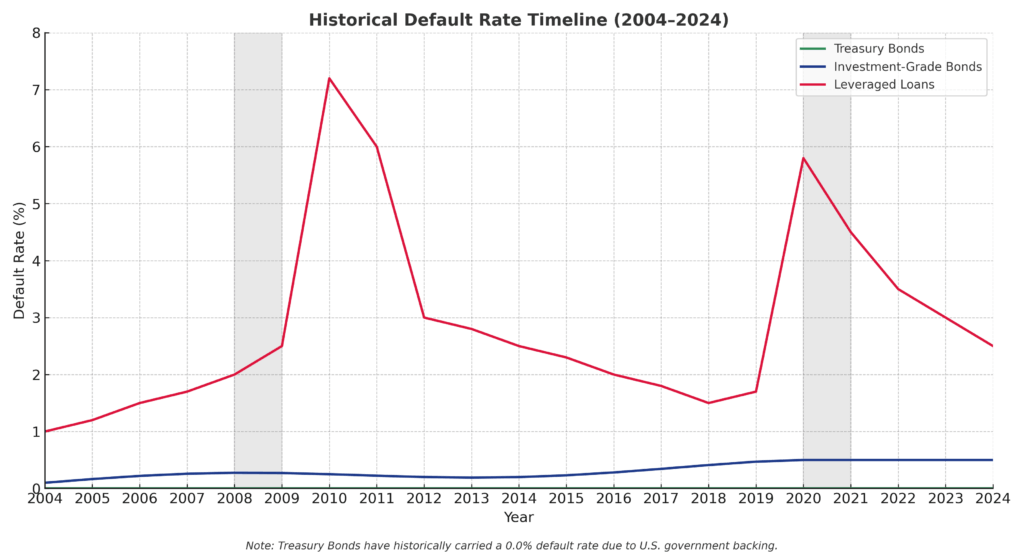

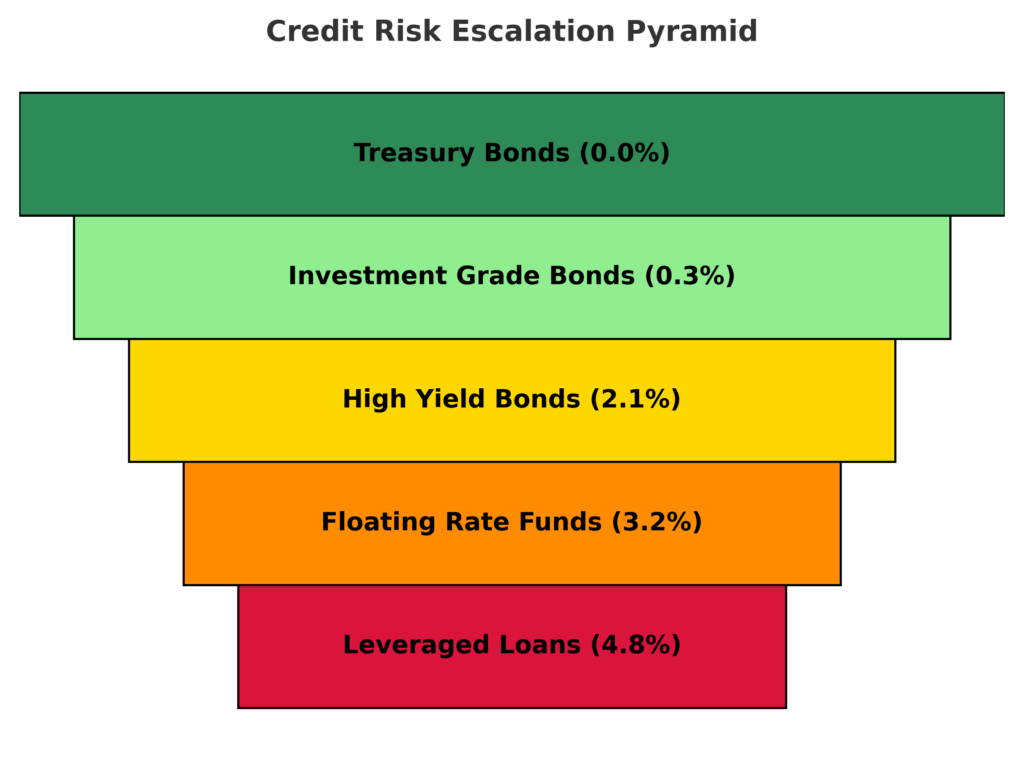

2. Credit Quality Deterioration: Many floating rate instruments carry higher credit risk, with default rates on leveraged loans (a common floating rate investment) reaching 3.2% in 2024 compared to 1.8% for investment-grade bonds. This hidden risk often offsets the benefits of rate protection.

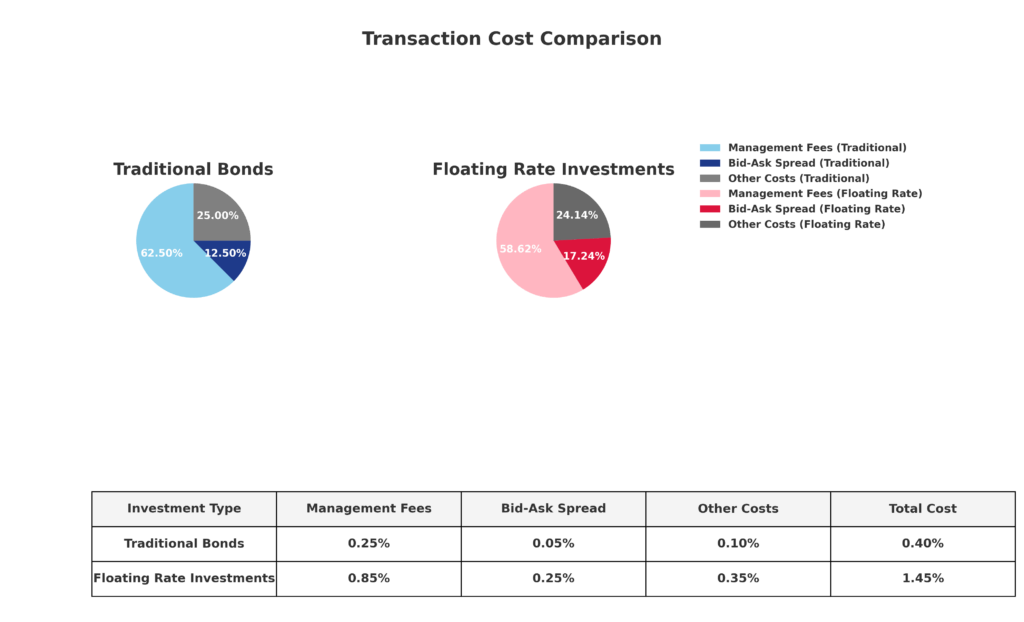

3. Liquidity Premium Costs: Floating rate investments typically trade at wider bid-ask spreads, with average transaction costs of 0.15-0.35% compared to 0.05-0.10% for comparable fixed-rate securities, creating a significant drag on returns over time.

Understanding the Floating Rate Investment Trap

Definition and Core Mechanics

The floating rate investment trap occurs when investors pursue securities with variable interest rates under the assumption that they will benefit from rising rates, only to encounter unexpected risks that erode returns. These investments adjust their coupon payments based on reference rates such as the Secured Overnight Financing Rate (SOFR) or the Federal Funds Rate, creating an illusion of protection against interest rate risk.

The trap manifests when investors fail to account for the complex interactions between rate adjustments, credit spreads, market liquidity, and timing factors. Unlike traditional fixed-rate bonds that decline in value when rates rise, floating rate securities theoretically maintain stable prices. However, this theoretical stability often fails to materialize in practice due to multiple underlying factors.

Floating rate investments encompass a broad category of securities including variable rate bonds, bank loans, floating rate notes (FRNs), and adjustable-rate preferred stocks. These instruments typically reset their interest payments quarterly or semi-annually based on prevailing short-term rates plus a predetermined spread or margin.

The fundamental appeal lies in the promise of rate reset protection – the ability to capture higher yields as interest rates rise. This feature becomes particularly attractive during periods of anticipated monetary tightening, leading many investors to allocate significant portions of their portfolios to these instruments without fully understanding the associated risks.

Market Context and Current Environment

The floating rate investment market has experienced explosive growth, with outstanding leveraged loan issuance reaching $1.4 trillion globally in 2024, representing a 12% increase from the previous year. This growth reflects investors’ appetite for rate-sensitive instruments amid persistent concerns about inflation and uncertainty surrounding central bank policy.

However, the current market environment presents unique challenges. The Federal Reserve’s aggressive rate hiking cycle from 2022-2023, followed by potential easing in 2025, creates a complex backdrop where traditional floating rate benefits may not materialize as expected. Historical analysis reveals that floating-rate investments often underperform during rate transition periods, particularly when transitioning from hiking to cutting cycles.

Types and Categories of Floating Rate Investment Traps

Bank Loan and Leveraged Loan Traps

Leveraged loans represent the largest segment of floating-rate investments, with over $800 billion in outstanding U.S. issuance. These senior secured debt instruments typically carry rates of SOFR plus 300-500 basis points, making them attractive during rising rate environments.

The trap emerges through several mechanisms: covenant deterioration has weakened borrower protections, with covenant-lite loans comprising 85% of new issuance in 2024. Credit quality degradation poses significant risks, as the median debt-to-EBITDA ratio for new leveraged loans reached 6.2 times in 2024, well above historical averages of 4.5 times.

Floating Rate Bond Fund Traps

Floating rate bond funds and exchange-traded funds (ETFs) have attracted over $180 billion in assets under management globally. These funds invest in portfolios of variable rate securities, offering investors diversified exposure without direct security selection.

The trap manifests through duration mismatch, where funds’ actual interest rate sensitivity differs significantly from investor expectations. Management fee drag compounds the problem, with average expense ratios of 0.75-1.25% for actively managed floating rate funds, substantially higher than comparable fixed-income alternatives.

Corporate Floating Rate Note Traps

Corporate floating rate notes (FRNs) issued by investment-grade and high-yield companies present unique trap characteristics. These securities typically trade at spreads to benchmark rates that can widen significantly during market stress, negating the benefits of rate reset protection.

Spread volatility creates the primary trap mechanism, with corporate FRN spreads expanding by 150-300 basis points during market downturns, far exceeding the rate reset benefits. Issuer credit deterioration can result in permanent capital losses that dwarf any interest rate protection benefits.

Benefits and Perceived Advantages

Interest Rate Protection

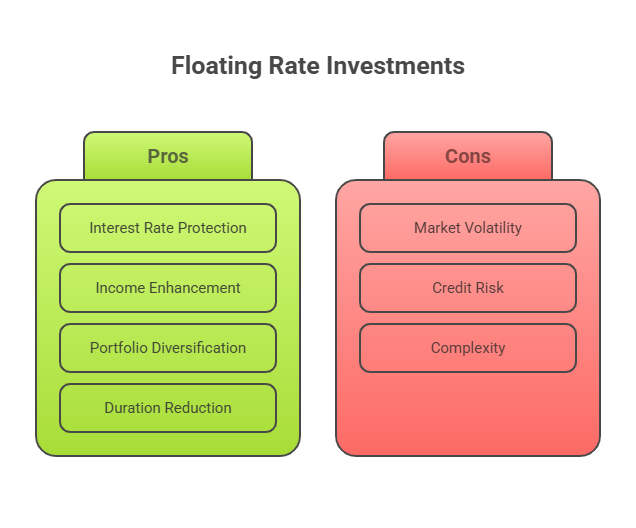

The primary benefit of floating rate investments lies in their theoretical protection against rising interest rates. As reference rates increase, coupon payments adjust upward, maintaining the investment’s yield competitiveness and theoretically stabilizing principal values.

Income enhancement represents another significant benefit, particularly in rising interest rate environments. Floating rate investments typically offer higher current yields compared to comparable fixed-rate alternatives, with average yield premiums of 50-150 basis points across various categories.

Portfolio Diversification Benefits

Correlation benefits emerge from floating-rate investments’ different risk-return profiles compared to traditional fixed-income securities. During periods of rising rates, these investments may provide positive returns while conventional bonds experience losses, enhancing overall portfolio stability.

Duration reduction at the portfolio level occurs when floating-rate investments replace longer-duration fixed-rate bonds, reducing overall interest rate sensitivity and providing more predictable return patterns during volatile rate environments.

Challenges and Risk Factors

Credit Risk Concentration

Elevated default risk represents the most significant challenge facing floating-rate investors. Leveraged loan default rates have historically averaged 3-4% annually, substantially higher than investment-grade corporate bonds at 0.1-0.3%. This risk concentration often goes unrecognized by investors focused primarily on interest rate protection.

Recovery rate uncertainty compounds credit risks, with average recovery rates on defaulted leveraged loans declining to 65% in recent years compared to historical averages of 70-75%. This deterioration reflects weaker documentation standards and increased competition among lenders.

Liquidity and Trading Risks

Market liquidity constraints create significant challenges during stressed market conditions. Floating rate investments often trade in less liquid secondary markets, with bid-ask spreads widening dramatically during volatility periods. Corporate loan trading, for example, typically involves 2-3 week settlement periods compared to next-day settlement for government bonds.

Forced selling dynamics can emerge when floating rate funds face redemption pressures, requiring managers to sell positions at unfavorable prices and creating downward price spirals that affect all investors in the category.

Rate Environment Timing Risks

Transition period underperformance occurs when interest rate cycles shift from rising to falling environments. Historical data shows floating rate investments underperforming during the 6-12 months surrounding Federal Reserve policy pivots, as markets anticipate future rate changes faster than actual reset mechanisms can adjust.

Reset lag effects create temporal mismatches between market rate movements and coupon adjustments. Most floating rate securities reset quarterly, creating periods where investments are exposed to rate movements without corresponding coupon protection.

Implementation and Risk Mitigation Strategies

Portfolio Construction Approaches

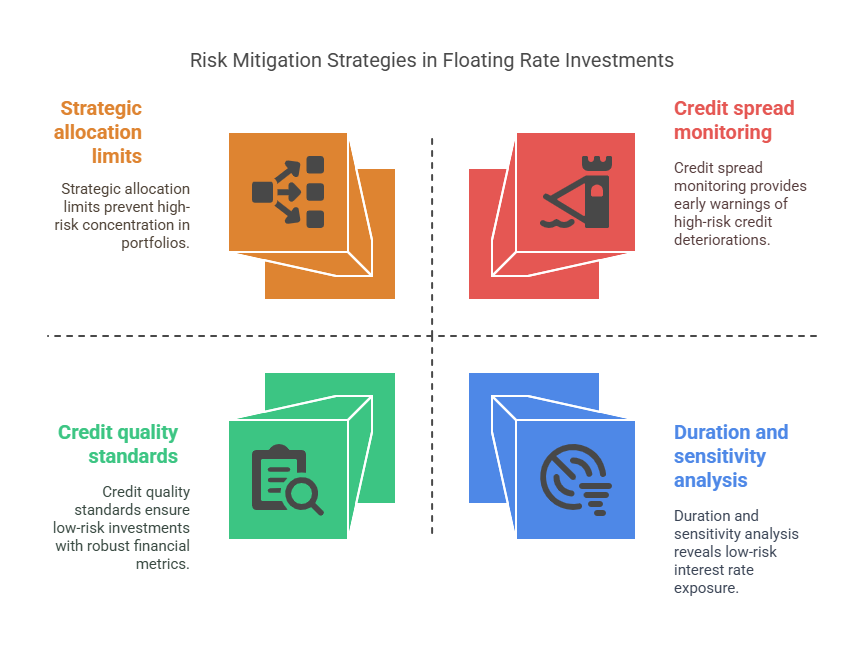

Strategic allocation limits represent the foundation of effective floating rate investment management. Financial advisors typically recommend limiting floating rate exposure to 10-20% of total fixed-income allocations, preventing concentration risks while maintaining diversification benefits.

Credit quality standards require rigorous application, with institutional investors increasingly focusing on loans with debt-to-EBITDA ratios below 5.5x and maintaining minimum interest coverage ratios of 2.0x or higher. These standards help avoid the most vulnerable credits within floating rate categories.

Due Diligence Framework

Manager selection criteria for floating rate funds should emphasize credit research capabilities, risk management processes, and track records during various market cycles. Effective managers demonstrate the ability to navigate both credit selection and market timing challenges.

Underlying security analysis requires examination of covenant structures, collateral quality, and issuer financial metrics. Investors should prioritize securities with strong borrower protections and avoid covenant-lite structures when possible.

Risk Monitoring Systems

Credit spread monitoring provides early warning signals of potential trouble, with widening spreads often preceding credit deteriorations by 6-12 months. Systematic tracking of spread movements across floating rate categories enables proactive risk management.

Duration and sensitivity analysis help investors understand their actual interest rate exposure, which often differs significantly from theoretical zero duration expectations due to credit spread components and market dynamics.

Future Trends and Market Evolution

Regulatory and Structural Changes

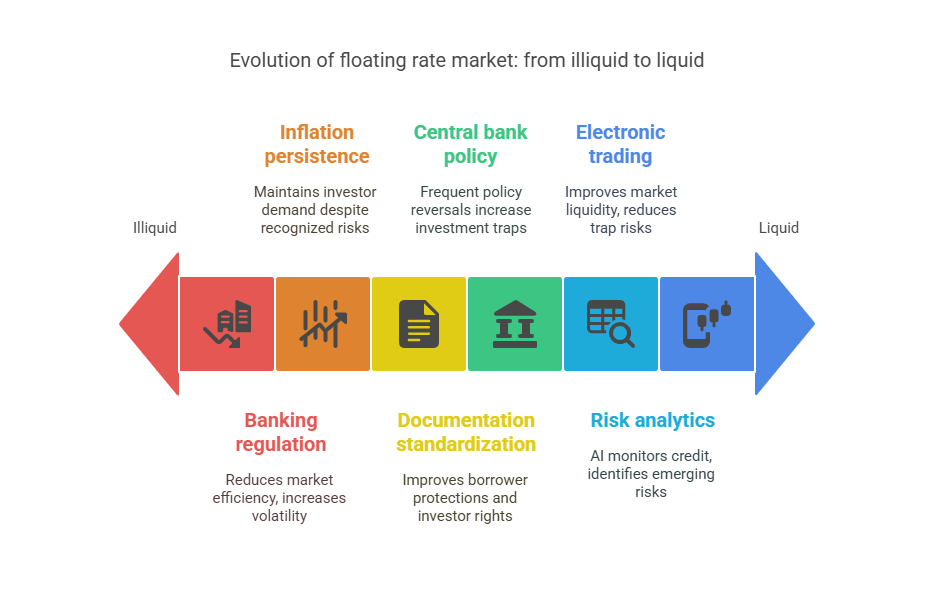

Banking regulation evolution continues to impact floating rate markets, with Basel III implementation affecting bank loan retention and secondary market liquidity. These changes may reduce market efficiency and increase volatility in floating rate investments.

Documentation standardization efforts aim to address covenant deterioration concerns, with industry initiatives focused on improving borrower protections and investor rights. However, implementation progress remains slow due to competitive lending pressures.

Technology and Market Structure

Electronic trading platforms are gradually improving floating rate market liquidity, with estimated electronic trading comprising 25% of loan secondary market volume in 2024, up from 15% in 2022. This technological evolution may reduce some liquidity-related trap risks over time.

Risk analytics advancement through artificial intelligence and machine learning provides enhanced credit monitoring capabilities, potentially helping investors identify emerging risks before they materialize into losses.

Interest Rate Environment Projections

Central bank policy evolution suggests continued volatility in rate environments, with potential for more frequent policy reversals compared to historical patterns. This environment may increase the frequency and severity of floating-rate investment traps.

Inflation persistence concerns may maintain investor demand for floating rate instruments despite recognized risks, potentially perpetuating market conditions that enable trap mechanisms to continue operating.

FAQs – Floating Rate Investment Trap

1. What exactly is a floating rate investment trap?

A floating rate investment trap occurs when investors purchase variable-rate securities expecting protection from rising interest rates, but instead experience losses due to credit deterioration, liquidity constraints, timing mismatches, or other hidden risks that offset the benefits of rate adjustments.

2. How can investors identify a potential floating rate investment trap before investing?

Investors should examine credit quality metrics (debt-to-EBITDA ratios above 6x are warning signs), covenant structures (avoid covenant-lite loans), liquidity characteristics (check bid-ask spreads and trading volumes), and historical performance during rate transition periods.

3. Are floating-rate bond funds safer than individual floating-rate securities?

Floating rate bond funds provide diversification benefits but introduce additional risks, including management fees, forced selling during redemptions, and potential duration mismatches. They are not necessarily safer and require careful manager selection and ongoing monitoring.

4. What role should floating-rate investments play in a balanced portfolio?

Financial advisors typically recommend limiting floating rate exposure to 10-20% of fixed-income allocations, using them primarily as tactical positions during rising rate environments rather than core portfolio holdings.

5. How do floating-rate investments perform during economic recessions?

Floating rate investments often underperform significantly during recessions due to elevated default rates, with leveraged loans experiencing average losses of 8-12% during recession years compared to 2-4% for investment-grade bonds.

6. What are the key differences between bank loans and floating-rate notes?

Bank loans typically offer senior secured positions with higher recovery rates but lower liquidity, while floating rate notes provide better liquidity but often carry subordinated credit positions and higher credit risk.

7. How frequently do floating-rate securities adjust their interest payments?

Most floating-rate securities adjust quarterly, creating 3-month periods where they remain exposed to interest rate movements without protection. Some securities adjust monthly or semi-annually, affecting their rate sensitivity.

8. What credit metrics should investors monitor in floating-rate investments?

Key metrics include debt-to-EBITDA ratios (preferably below 5.5x), interest coverage ratios (minimum 2.0x), covenant structures, and credit spread movements relative to benchmark rates.

9. How do transaction costs affect floating-rate investment returns?

Floating rate investments typically carry higher transaction costs, with bid-ask spreads of 0.15-0.35% compared to 0.05-0.10% for government bonds. These costs can significantly impact returns, especially for frequent traders.

10. What alternatives exist for investors seeking interest rate protection?

Alternatives include short-duration bond funds, Treasury Inflation-Protected Securities (TIPS), variable annuities, and tactical asset allocation strategies that adjust duration based on interest rate expectations.

Conclusion

The floating rate investment trap presents a sophisticated challenge that requires careful analysis and strategic planning to navigate successfully. While these investments offer legitimate benefits during rising rate environments, the associated risks of credit deterioration, liquidity constraints, and timing mismatches often exceed investor expectations.

The key to avoiding these traps lies in maintaining realistic expectations, implementing rigorous due diligence processes, and limiting portfolio exposure to appropriate levels.

Looking ahead to 2025 and beyond, floating-rate investment markets will likely become increasingly complex as regulatory changes, technological advancements, and evolving monetary policy create new dynamics. Successful investors will need to remain vigilant, continuously educate themselves about emerging risks, and work with qualified financial professionals who understand the nuanced challenges these investments present.

By maintaining a balanced perspective and implementing effective risk management strategies, investors can potentially capture the benefits of floating-rate investments while avoiding the costly pitfalls that have trapped many unwary market participants.

For your reference, recently published articles include:

-

- Low Charge Investing Made Simple: Expert Guide

- Why Every Investor Needs Floating Rate Investments Now

- Breaking Free From The Fixed-Rate Investment Trap

- Protect Your Wealth: Floating Rate Against Inflation Now

- Investment Strategy Evaluation – Get The Pro Advice Here

- Investment Risk Management Tools – All You Need To Know

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.