In today’s volatile interest rate environment, floating rate investments have emerged as essential portfolio components that adjust their yields automatically with market conditions.

Unlike traditional fixed-income securities that lose value when rates rise, floating rate investments provide dynamic income streams that increase alongside interest rate movements. This adaptive characteristic makes them particularly valuable for investors seeking protection against inflation and rising interest rates.

Welcome to our comprehensive guide to floating rate investments – we’re excited to help you master these powerful portfolio protection strategies!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

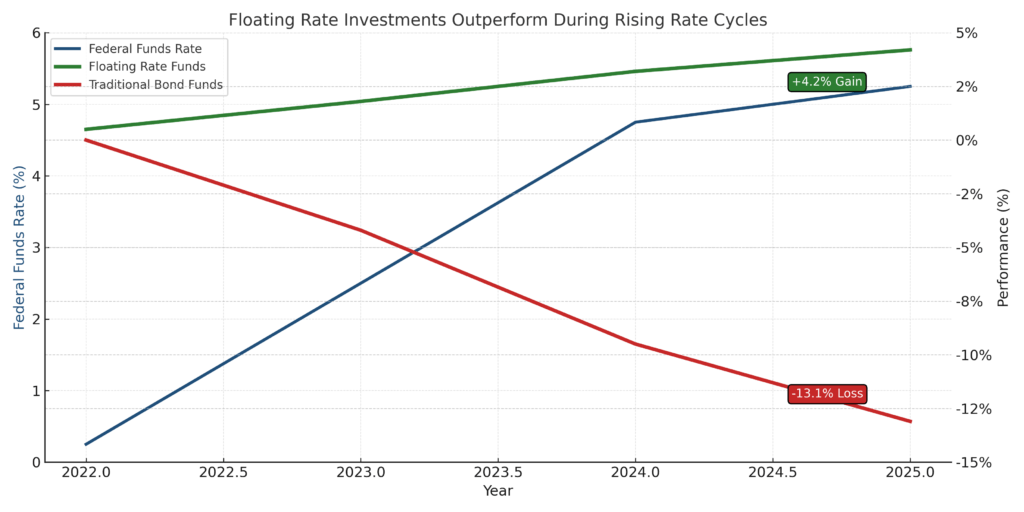

1. Rate Protection Advantage: Floating rate investments automatically adjust their interest payments when benchmark rates change, protecting investors from the inverse relationship between bond prices and interest rates. For example, when the Federal Reserve raised rates by 525 basis points between March 2022 and July 2023, floating rate funds gained approximately 4.2% while traditional bond funds lost 13.1%.

2. Inflation Hedge Capability: These investments typically maintain purchasing power during inflationary periods by increasing payouts as rates rise. During the 2021-2022 inflation surge, floating rate loan funds delivered positive returns of 2.8% while the aggregate bond market declined by 13.0%.

3. Portfolio Diversification Benefits: Floating rate investments exhibit low correlation with traditional fixed-income securities, providing diversification benefits that enhance overall portfolio stability. Studies show correlation coefficients between floating rate loans and investment-grade bonds averaging just 0.35, compared to 0.85 between different fixed-income categories.

Understanding Floating Rate Investments

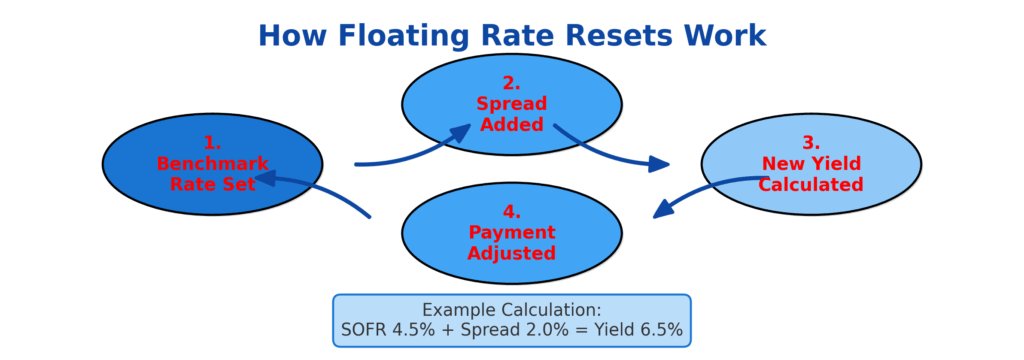

Floating rate investments are financial instruments whose interest payments adjust periodically based on predetermined benchmark rates, typically the Secured Overnight Financing Rate (SOFR), Prime Rate, or LIBOR. These securities reset their coupon payments at regular intervals, usually quarterly or semi-annually, ensuring that investors receive compensation that reflects current market conditions.

The fundamental mechanism involves a spread over the benchmark rate. For instance, a floating rate note might pay SOFR plus 200 basis points, meaning if SOFR is 4.5%, the investment yields 6.5%. When SOFR increases to 5.0%, the investment automatically adjusts to yield 7.0%, providing immediate benefit from rising rates.

This structure contrasts sharply with fixed-rate investments, where coupon payments remain constant regardless of market movements. Traditional bonds experience duration risk, where rising rates decrease their market value. Floating rate investments minimize this risk through their rate-reset mechanism, maintaining relatively stable prices while providing variable income.

The floating rate market encompasses various instruments, from corporate loans and bonds to preferred stocks and exchange-traded funds. The leveraged loan market alone represents approximately $1.4 trillion in outstanding obligations, with floating rate structures dominating this space due to borrowers’ desire for refinancing flexibility and lenders’ preference for rate protection.

Types of Floating Rate Investments

Bank Loans and Leveraged Loans

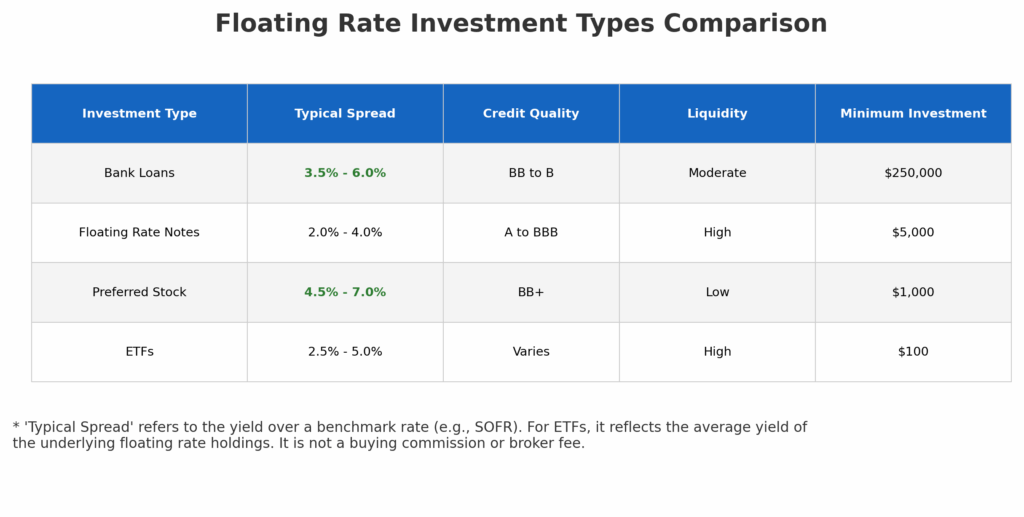

Bank loans represent the largest category of floating rate investments, with institutional loans totaling over $1.3 trillion in the United States. These senior secured obligations typically feature:

- Spreads: 200-500 basis points over benchmark rates

- Seniority: First lien positions in bankruptcy proceedings

- Covenants: Financial maintenance requirements protecting lenders

- Maturity: Average terms of 5-7 years

Floating Rate Notes (FRNs)

Corporate floating rate notes offer more liquid alternatives to bank loans, with approximately $400 billion in outstanding issuances. Key characteristics include:

- Credit Quality: Investment-grade to high-yield ratings

- Reset Frequency: Quarterly or semi-annual adjustments

- Minimum Rates: Floor provisions preventing negative yields

- Liquidity: Active secondary market trading

Floating Rate Preferred Stock

Preferred securities with floating rate features provide equity-like returns with debt-like characteristics:

- Dividend Yields: Typically 4-8% above benchmark rates

- Tax Treatment: Qualified dividend income for individuals

- Perpetual Nature: No fixed maturity dates

- Call Options: Issuer redemption rights after specific periods

Exchange-Traded Funds (ETFs)

Floating rate ETFs offer diversified exposure through professionally managed portfolios:

| Fund Type | Assets Under Management | Average Expense Ratio | Primary Holdings |

|---|---|---|---|

| Bank Loan ETFs | $45 billion | 0.65% | Senior Secured Loans |

| Corporate FRN ETFs | $12 billion | 0.20% | Investment Grade Notes |

| Preferred Stock ETFs | $8 billion | 0.45% | Floating Rate Preferreds |

Benefits of Floating Rate Investments

Interest Rate Protection

The primary advantage of floating rate investments lies in their rate sensitivity mitigation. Traditional fixed-income portfolios experience significant losses during rising rate environments, with duration-adjusted losses of 7-10% per 100 basis point rate increase. Floating rate investments maintain stable principal values while increasing income distributions.

Inflation Hedging

Real return preservation becomes critical during inflationary periods. Floating rate investments typically correlate positively with inflation expectations, as central banks raise rates to combat price pressures. Historical analysis shows floating rate loans maintained positive real returns during 85% of inflationary periods since 1990.

Credit Spread Opportunities

Many floating rate investments trade at credit spreads reflecting issuer-specific risks rather than interest rate duration. This creates opportunities for active managers to capture value through credit analysis and selection, potentially generating alpha beyond benchmark returns.

Liquidity and Flexibility

Modern floating rate instruments offer varying degrees of liquidity to meet different investor needs:

- Daily Liquidity: ETFs and mutual funds providing immediate access

- Weekly Liquidity: Interval funds with periodic redemption windows

- Institutional Liquidity: Direct loan participations for qualified investors

Challenges and Risks

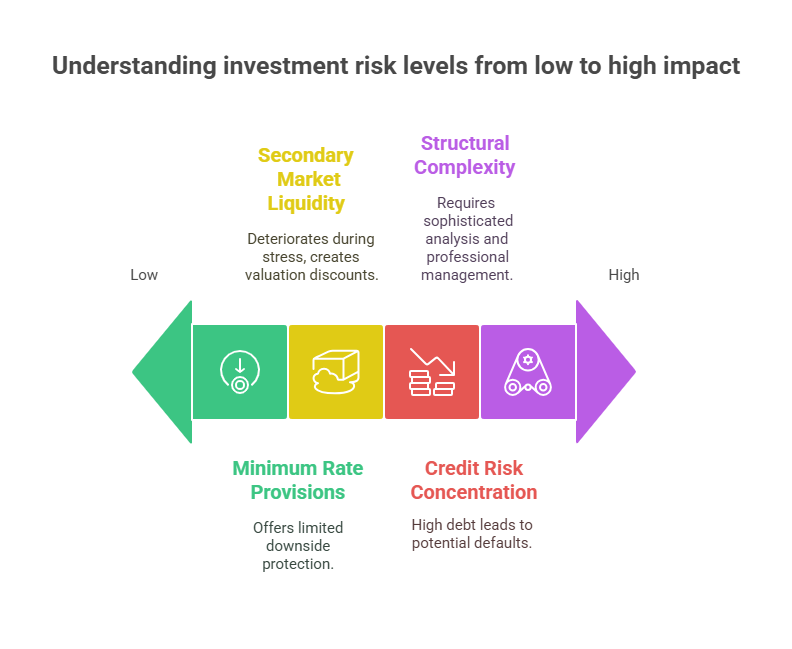

Credit Risk Concentration

Default risk represents the primary concern for floating rate investors, particularly in leveraged loan markets where borrowers maintain higher debt levels. Historical default rates average 3-4% annually for leveraged loans, compared to 0.5-1.0% for investment-grade bonds.

Market Liquidity Constraints

Secondary market liquidity can deteriorate during stress periods, creating valuation discounts and redemption challenges. The 2020 market disruption saw floating rate fund discounts widen to 15-20% below net asset values before Federal Reserve intervention restored stability.

Complexity and Due Diligence

Structural complexity requires sophisticated analysis of covenant packages, security provisions, and refinancing risks. Individual investors may lack resources for comprehensive credit evaluation, necessitating reliance on professional management.

Interest Rate Floor Limitations

Many floating rate investments include minimum rate provisions that limit downside protection during falling rate environments. These floors typically range from 0-100 basis points, potentially reducing yields below market rates when benchmarks decline significantly.

Implementation Strategies

Portfolio Allocation Framework

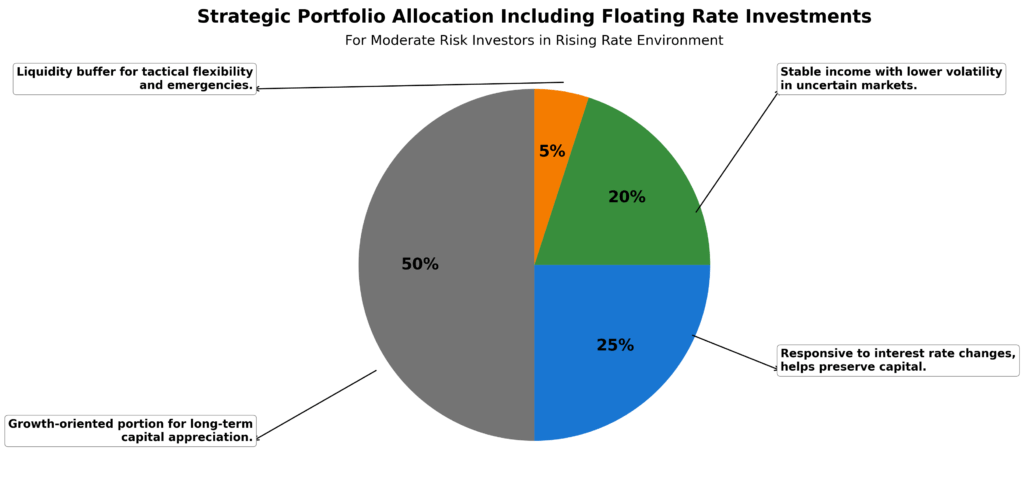

Strategic allocation to floating rate investments typically ranges from 10-30% of fixed-income portfolios, depending on interest rate outlook and risk tolerance. Conservative investors might allocate 10-15%, while aggressive portfolios could reach 25-30% during rising rate cycles.

Fund Selection Criteria

Due diligence factors for floating rate fund selection include:

- Credit Quality: Average rating and default history

- Expense Ratios: Management fees and operational costs

- Liquidity Terms: Redemption frequency and restrictions

- Manager Experience: Track record and investment process

Timing Considerations

Market timing strategies focus on Federal Reserve policy cycles and yield curve positioning. Optimal entry points typically occur before rate hiking cycles, while exits may be appropriate when rates plateau or begin declining.

Risk Management

Portfolio construction should incorporate:

- Diversification: Multiple fund managers and strategies

- Credit Quality Mixing: Combining investment-grade and high-yield exposures

- Liquidity Laddering: Varying redemption terms across holdings

- Monitoring Systems: Regular performance and risk assessment

Future Trends

Regulatory Evolution

Basel III requirements continue reshaping bank lending markets, potentially increasing floating rate investment opportunities as banks seek to transfer credit risk to institutional investors. The risk retention rules may expand direct lending by insurance companies and pension funds.

Technology Integration

Digital platforms are democratizing access to floating rate investments through improved pricing transparency, automated portfolio management, and enhanced liquidity solutions. Blockchain technology may enable fractional ownership of individual loans and real-time settlement systems.

ESG Integration

Environmental, Social, and Governance criteria increasingly influence floating rate investment selection, with ESG-focused funds growing at 25% annually. Sustainable financing frameworks are being integrated into loan documentation and covenant structures.

Market Expansion

Emerging market floating rate opportunities continue expanding, with local currency instruments providing currency hedging benefits alongside rate protection. Asian markets particularly show strong growth potential, with floating rate issuance increasing 40% annually.

FAQs – Floating Rate Investments

1. What is the minimum investment amount for floating rate investments?

Minimum investments vary significantly by instrument type. ETFs require only the cost of a single share (typically $20-50), while mutual funds often have $1,000-$2,500 minimums. Direct loan investments typically require $250,000-$1,000,000 minimum commitments for institutional access.

2. How often do floating rate investments adjust their yields?

Most floating rate investments reset quarterly, though some adjust monthly or semi-annually. The reset frequency is specified in the investment documentation and typically aligns with the underlying benchmark rate publication schedule.

3. Can floating rate investments lose money?

Yes, floating rate investments can experience losses due to credit deterioration, default events, or market liquidity constraints. While they minimize interest rate risk, they retain credit risk and may decline in value if issuers’ financial conditions worsen.

4. Are floating rate investments suitable for retirement accounts?

Floating rate investments can be appropriate for retirement accounts, particularly for investors seeking current income and inflation protection. However, the tax implications of frequent rate adjustments should be considered, making tax-deferred accounts potentially more suitable.

5. How do floating rate investments perform during recessions?

Performance varies depending on the specific type and credit quality. Investment-grade floating rate notes typically outperform during recessions, while leveraged loans may experience higher default rates and price volatility during economic downturns.

6. What happens to floating rate investments when interest rates fall?

When rates decline, floating rate investments typically experience reduced income payments but maintain stable principal values. Many include interest rate floors that provide minimum yield protection, though these may limit the full benefit of rate increases.

7. How do floating rate investments compare to TIPS for inflation protection?

Both provide inflation protection but through different mechanisms. TIPS adjust principal based on CPI changes, while floating rate investments adjust income based on interest rate movements. Floating rate investments typically provide more immediate adjustment to rate changes.

8. Can individual investors access leveraged loan markets directly?

Direct access to leveraged loans typically requires institutional investor status and significant minimum investments. Individual investors generally access these markets through mutual funds, ETFs, or business development companies (BDCs) that pool investor capital.

9. What are the tax implications of floating rate investments?

Tax treatment depends on the specific instrument. Corporate bonds generate ordinary income, while some preferred stocks may qualify for favorable dividend tax rates. Frequent rate adjustments can create varying income levels throughout the year, complicating tax planning.

10. How liquid are floating rate investments compared to traditional bonds?

Liquidity varies significantly by instrument type. Floating rate ETFs offer daily liquidity, while direct loan investments may have limited secondary market activity. During market stress, liquidity can deteriorate across all floating rate categories, though typically less severely than high-yield bonds.

Conclusion

Floating rate investments represent essential portfolio components for navigating today’s dynamic interest rate environment. Their ability to provide automatic yield adjustments, inflation protection, and diversification benefits makes them particularly valuable during periods of monetary policy uncertainty. While these investments carry credit risks and complexity considerations, their advantages in rising rate scenarios and portfolio diversification justify strategic allocation across various investor profiles.

The future outlook for floating rate investments remains positive, supported by continued regulatory changes, technological advances, and expanding market opportunities. As central banks navigate post-pandemic monetary policy normalization, floating rate investments offer investors the flexibility and protection needed to maintain portfolio performance across varying economic conditions.

Strategic implementation through diversified fund selection and appropriate risk management can help investors capture these benefits while managing associated risks effectively.

For your reference, recently published articles include:

-

- Breaking Free From The Fixed-Rate Investment Trap

- Protect Your Wealth: Floating Rate Against Inflation Now

- Investment Strategy Evaluation – Get The Pro Advice Here

- Investment Risk Management Tools – All You Need To Know

- Investment Strategies Validation Made Simple

- Investment Risk Management Software – Best Expert Guide

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.