The fixed-rate investment trap represents one of the most subtle yet devastating mechanisms for wealth erosion in modern finance, where investors unknowingly lock themselves into stagnant returns while inflation systematically erodes their purchasing power.

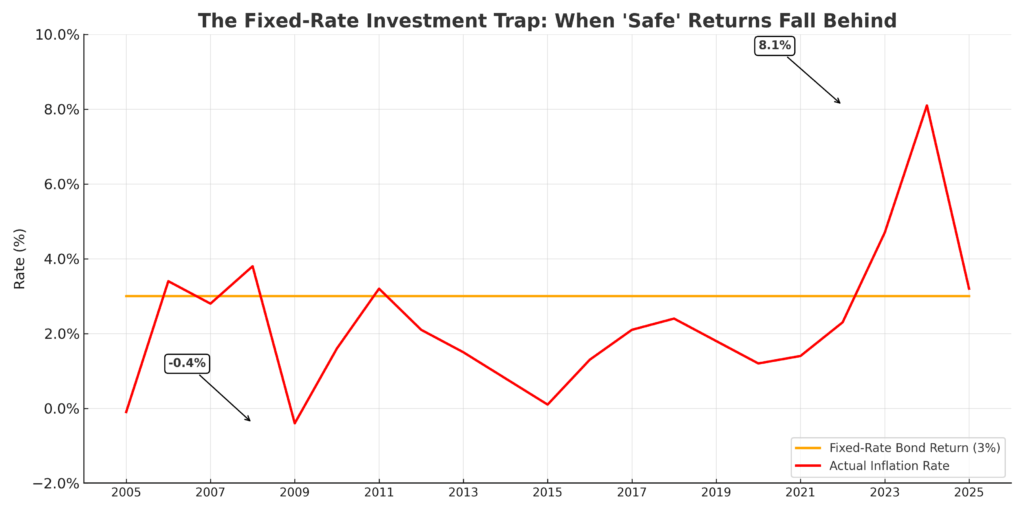

As central banks worldwide navigate unprecedented monetary policies and inflation rates fluctuate between 2-8% annually, millions of investors find their supposedly “safe” fixed-rate investments actually losing real value year after year. Understanding and escaping this trap has become essential for preserving and growing wealth in today’s dynamic economic environment.

Welcome to our comprehensive guide on breaking free from the fixed-rate investment trap – we’re excited to help you protect and grow your wealth with smarter investment strategies!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

- Fixed-rate investments lose purchasing power during inflationary periods: When inflation exceeds 3% annually and fixed-rate returns remain at 2-4%, investors experience negative real returns, effectively losing 1-2% of their wealth’s purchasing power each year.

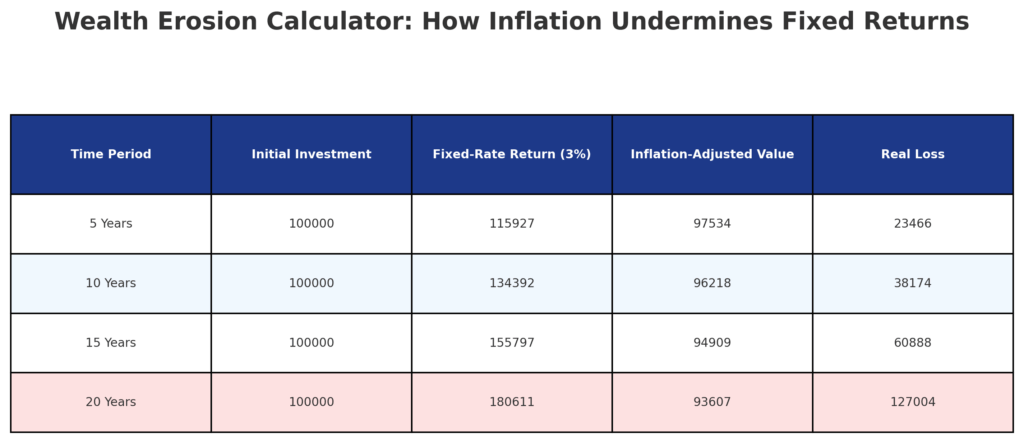

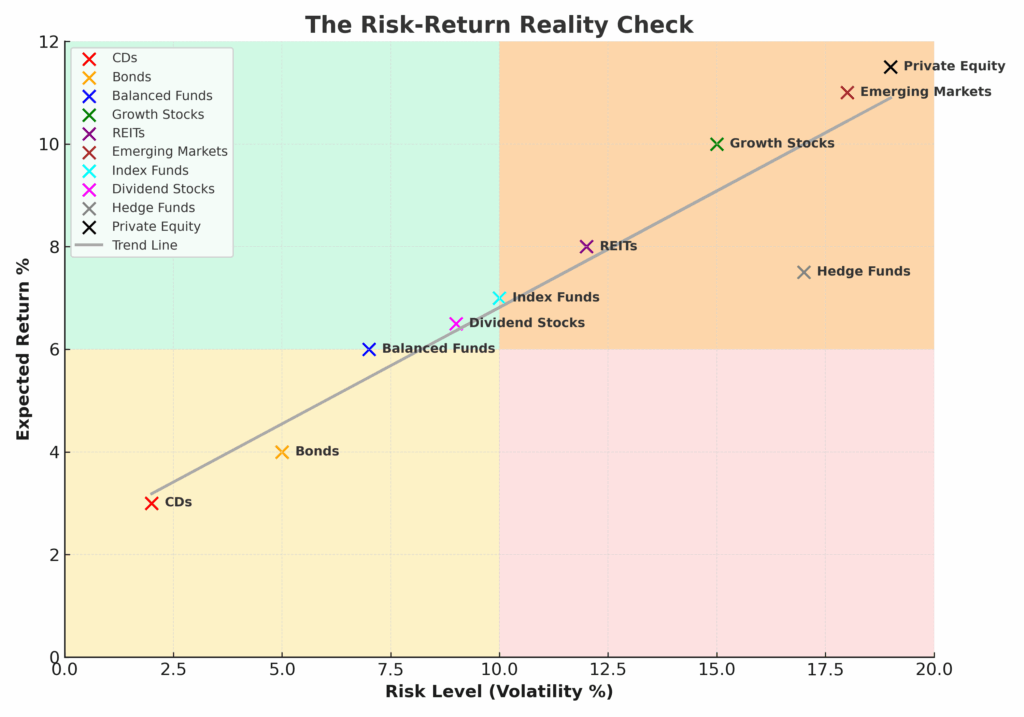

- Opportunity cost compounds over time: A $100,000 investment in a 3% fixed-rate bond over 10 years yields $134,392, while the same amount in floating-rate securities or diversified portfolios could generate $180,000-$250,000, representing a potential loss of $45,000-$115,000.

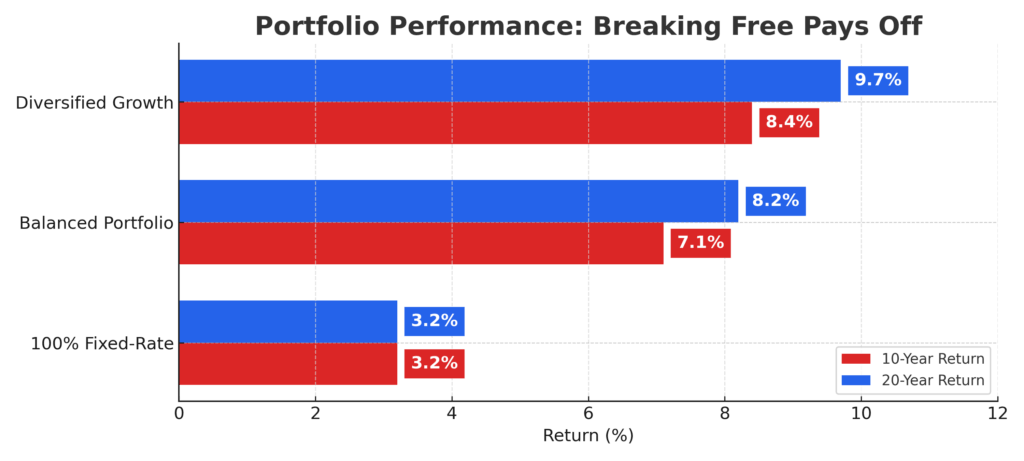

- Diversification beyond fixed-rate instruments is crucial: Portfolios containing 70% or more fixed-rate investments underperform balanced portfolios by 2-4% annually during inflationary cycles, highlighting the importance of incorporating floating-rate securities, equities, and inflation-protected instruments.

Understanding the Fixed-Rate Investment Trap

The fixed-rate investment trap occurs when investors concentrate their portfolios in securities that offer predetermined, unchanging returns regardless of economic conditions. These instruments include traditional bonds, certificates of deposit (CDs), fixed annuities, and savings accounts that lock investors into specific interest rates for extended periods.

This trap becomes particularly insidious during periods of rising inflation or changing interest rates. When inflation increases from 2% to 6%, as witnessed in 2021-2023, investors holding fixed-rate securities earning 3% experience a negative real return of -3%. This means their investments are losing purchasing power at an alarming rate, despite appearing to generate positive returns on paper.

The psychological comfort of guaranteed returns often blinds investors to the hidden costs of this strategy. Financial institutions market fixed-rate products as “safe” and “predictable,” which appeals to risk-averse individuals who prioritize capital preservation over growth. However, this perceived safety creates a false sense of security that can result in substantial wealth erosion over time.

The trap extends beyond individual securities to encompass entire investment philosophies. Many investors, particularly those nearing or in retirement, allocate 60-80% of their portfolios to fixed-rate instruments, believing this approach reduces risk. In reality, this concentration creates inflation risk and opportunity cost risk that can be far more damaging than the market volatility they seek to avoid.

The mathematical reality of the fixed-rate investment trap becomes clear when examining long-term scenarios. An investor placing $500,000 in a 4% fixed-rate bond portfolio during a period when inflation averages 5% will see their purchasing power decline to approximately $375,000 in real terms over 20 years, despite nominal growth to $1.1 million.

Types and Categories of Fixed-Rate Investment Traps

Traditional Fixed-Rate Securities

Government Bonds represent the most common fixed-rate trap, with Treasury bonds offering yields of 3-5% while potentially exposing investors to decades of locked-in returns. When purchased during low-rate environments, these securities can underperform for 10-30 years.

Corporate Bonds provide slightly higher yields of 4-7% but carry additional credit risk alongside interest rate risk. Investment-grade corporate bonds often trap investors in below-inflation returns during economic expansion periods.

Certificates of Deposit (CDs) offer FDIC protection but typically yield 1-4%, making them particularly vulnerable to inflation erosion. The average CD rate of 2.5% provides negative real returns when inflation exceeds 3%.

Structured Fixed-Rate Products

Fixed Annuities promise guaranteed income but often include fees of 1-3% annually while providing returns of 3-5%. These products can trap investors for 5-15 years with surrender charges reaching 10-15% of principal.

Pension Plans with fixed-benefit structures may appear secure but often fail to adjust adequately for inflation. Many pension systems assume 3-4% annual returns while promising benefits that require 6-8% returns to remain sustainable.

Behavioral Fixed-Rate Traps

Cash Hoarding represents an extreme form of the fixed-rate trap, where investors hold excessive cash earning 0-1% while inflation reduces purchasing power by 3-6% annually.

Bank Savings Accounts offering 0.1-0.5% interest rates create significant opportunity costs, particularly for emergency funds exceeding 3-6 months of expenses.

Benefits of Avoiding the Fixed-Rate Investment Trap

Enhanced Purchasing Power Preservation

Investors who diversify beyond fixed-rate instruments maintain purchasing power more effectively during inflationary periods. Floating-rate securities adjust their yields based on benchmark rates, providing natural inflation protection. When the Federal Reserve raises rates from 0.25% to 5.25%, floating-rate bond funds increase their yields accordingly, protecting investors from the fixed-rate trap.

Improved Long-Term Returns

Historical data demonstrates that diversified portfolios outperform fixed-rate concentrated portfolios by 2-4% annually over 20-year periods. A $100,000 investment growing at 8% annually reaches $466,096 in 20 years, compared to $265,330 at 5% fixed rates, representing an additional $200,766 in wealth creation.

Flexibility and Adaptability

Avoiding the fixed-rate trap provides portfolio flexibility to capitalize on changing economic conditions. When interest rates rise, investors with diversified holdings can reinvest maturing securities at higher rates, while those trapped in long-term fixed-rate instruments cannot benefit from improved market conditions.

Reduced Opportunity Cost

Dynamic investment strategies eliminate the substantial opportunity costs inherent in fixed-rate approaches. During bull markets, equity components of diversified portfolios can generate 10-15% annual returns, while fixed-rate securities remain anchored at 3-5% yields.

Challenges and Risks of Escaping the Fixed-Rate Trap

Increased Volatility Exposure

Diversifying beyond fixed-rate investments introduces market volatility that can cause short-term portfolio fluctuations of 10-20%. Investors must develop tolerance for this variability to benefit from long-term superior returns.

Complexity and Management Requirements

Active portfolio management becomes necessary when moving beyond simple fixed-rate strategies. Investors must monitor economic indicators, rebalance allocations, and make periodic adjustments, requiring either personal expertise or professional management fees of 0.5-1.5% annually.

Timing and Execution Risks

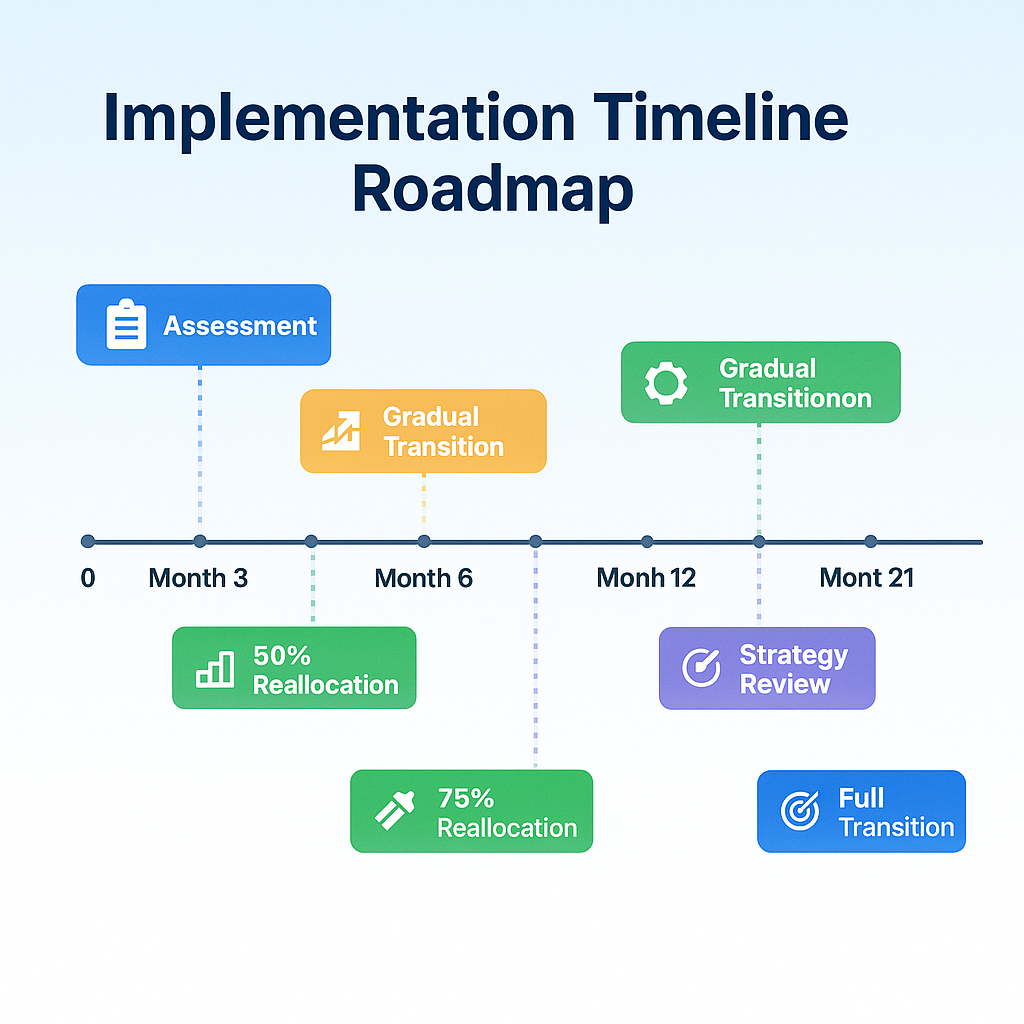

Transitioning from fixed-rate investments involves timing considerations that can impact results. Selling fixed-rate securities during periods of rising interest rates may result in capital losses of 5-15%, requiring careful planning and potentially staggered implementation.

Psychological Comfort Challenges

Many investors experience anxiety when abandoning the perceived safety of fixed returns. This behavioral challenge can lead to poor decision-making during market downturns, potentially undermining the benefits of escape strategies.

Implementation Strategies for Breaking Free

Gradual Portfolio Transition

Dollar-cost averaging out of fixed-rate positions over 12-24 months helps minimize timing risks while providing psychological comfort. Investors can redirect 10-20% of fixed-rate holdings quarterly into diversified alternatives.

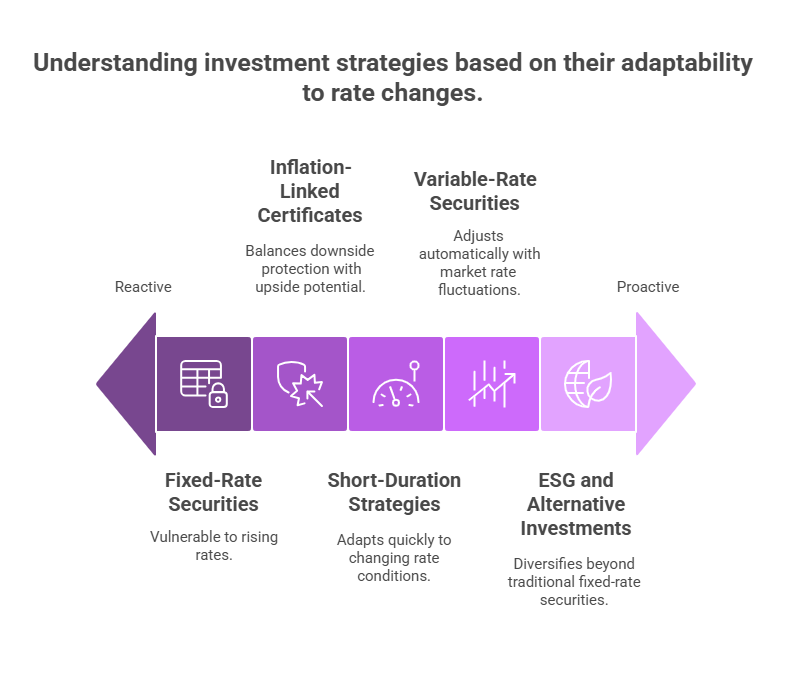

Floating-Rate Security Integration

Floating-rate bonds and bank loan funds provide immediate inflation protection while maintaining income generation. These securities typically yield 2-4% above benchmark rates, adjusting automatically to rate changes.

Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS) offer government backing while adjusting principal values based on inflation measurements. TIPS have provided 2-3% real returns historically, effectively breaking the fixed-rate trap while maintaining conservative risk profiles.

Strategic Asset Allocation

Implementing a 60/40 or 70/30 equity-to-fixed-income ratio provides growth potential while maintaining stability. During inflationary periods, equity components often outpace inflation through pricing power and earnings growth.

Professional Management Solutions

Target-date funds and balanced mutual funds automatically adjust allocations based on market conditions and time horizons. These solutions typically charge 0.3-0.8% annually while providing professional management and diversification.

Future Trends in Fixed-Rate Investment Strategies

Rising Rate Environment Adaptation

Current monetary policy trends suggest continued rate volatility through 2025-2027, making fixed-rate traps increasingly costly. Variable-rate securities and short-duration strategies are gaining popularity as investors seek protection from rate changes.

Technology-Enhanced Solutions

Robo-advisors and algorithmic rebalancing tools are democratizing sophisticated portfolio management, making it easier for individual investors to escape fixed-rate traps through automated diversification and optimization.

Inflation-Linked Product Innovation

Financial institutions are developing new inflation-linked certificates and variable annuities that provide downside protection while offering upside potential. These hybrid products address the fixed-rate trap while maintaining familiar structures for conservative investors.

ESG and Alternative Integration

Environmental, Social, and Governance (ESG) investing and alternative investments are becoming more accessible through mutual funds and ETFs, providing additional diversification options beyond traditional fixed-rate securities.

FAQs – Fixed-Rate Investment Trap

1. What exactly is a fixed-rate investment trap?

A fixed-rate investment trap occurs when investors concentrate their portfolios in securities offering predetermined returns that fail to keep pace with inflation or opportunity costs, resulting in real wealth erosion over time despite nominal gains.

2. How much of my portfolio should be in fixed-rate investments?

Conservative investors should limit fixed-rate allocations to 30-50% of their portfolios, while aggressive investors may hold 10-20%. The specific allocation depends on age, risk tolerance, and financial objectives.

3. Can fixed-rate investments ever be appropriate?

Yes, fixed-rate investments serve important roles in portfolio construction, particularly for near-term liquidity needs, capital preservation during market uncertainty, and providing stability for retirees requiring predictable income.

4. What are the best alternatives to traditional fixed-rate investments?

Floating-rate bonds, TIPS, dividend-growth stocks, REITs, and balanced mutual funds provide inflation protection and growth potential while maintaining reasonable risk levels.

5. How do I transition out of fixed-rate investments without losing money?

Implement a gradual transition strategy over 12-24 months, consider the tax implications of sales, and potentially use bond ladders or CD ladders to minimize timing risks while maintaining income.

6. What role does inflation play in the fixed-rate investment trap?

Inflation is the primary mechanism that creates the trap, as fixed returns become insufficient to maintain purchasing power when inflation exceeds the fixed rate of return.

7. Are there any tax advantages to staying in fixed-rate investments?

Fixed-rate municipal bonds offer tax advantages for high-income investors, and the predictable income can simplify tax planning, but these benefits rarely offset the opportunity costs of the trap.

8. How do interest rate changes affect my fixed-rate investments?

Rising interest rates decrease the market value of existing fixed-rate securities, creating capital losses if sold before maturity, while falling rates increase their value but lock in potentially inadequate returns.

9. What percentage of Americans are caught in the fixed-rate investment trap?

Approximately 40-60% of American investors hold excessive concentrations in fixed-rate securities, particularly older adults who may have 70-80% of their portfolios in such instruments.

10. When should I consider professional help to escape the fixed-rate trap?

Consider professional assistance when portfolio values exceed $250,000, when tax implications are complex, or when you lack the time or expertise to manage a diversified investment strategy effectively.

Conclusion

The fixed-rate investment trap represents a significant threat to long-term wealth preservation and growth, particularly in environments characterized by inflation volatility and changing interest rates. While fixed-rate securities provide psychological comfort through predictable returns, their inability to adapt to economic conditions can result in substantial opportunity costs and purchasing power erosion over time.

The mathematical reality demonstrates that investors concentrating 60-80% of their portfolios in fixed-rate instruments may underperform diversified strategies by 2-4% annually, potentially costing hundreds of thousands of dollars over investment lifetimes.

Breaking free from this trap requires a balanced approach that maintains appropriate fixed-rate allocations while incorporating floating-rate securities, inflation-protected instruments, and growth-oriented investments. The key lies in understanding that true investment safety comes not from guaranteed nominal returns, but from preserving and growing purchasing power over time.

As monetary policies continue to evolve and inflation remains a persistent concern, investors who recognize and escape the fixed-rate investment trap will be better positioned to achieve their long-term financial objectives while maintaining the flexibility to adapt to changing economic conditions.

For your reference, recently published articles include:

-

- Protect Your Wealth: Floating Rate Against Inflation Now

- Investment Strategy Evaluation – Get The Pro Advice Here

- Investment Risk Management Tools – All You Need To Know

- Investment Strategies Validation Made Simple

- Investment Risk Management Software – Best Expert Guide

- Market Sentiment Indicators: Your Edge In Volatile Markets

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.