In an era of persistent inflationary pressures and volatile interest rate environments, floating rate securities emerge as a critical tool for wealth preservation and portfolio protection. These adaptive financial instruments automatically adjust their interest payments based on prevailing market rates, providing investors with a dynamic hedge against the erosion of purchasing power that inflation inevitably brings.

Understanding how to leverage floating rate investments against inflation has become essential for maintaining real returns in today’s challenging economic landscape. Welcome to our comprehensive guide on floating rate against inflation strategies – we’re excited to help you master these powerful wealth protection techniques!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

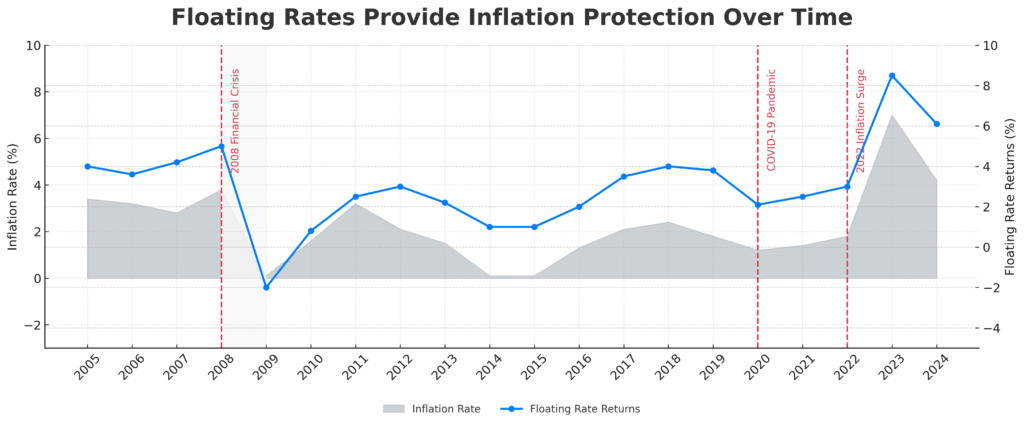

1. Automatic Rate Adjustments Provide Inflation Protection: Floating-rate securities typically reset their interest payments every 30 to 90 days based on benchmark rates, such as SOFR or Treasury bills, ensuring that as inflation drives interest rates higher, investors receive correspondingly increased income payments that help maintain their purchasing power.

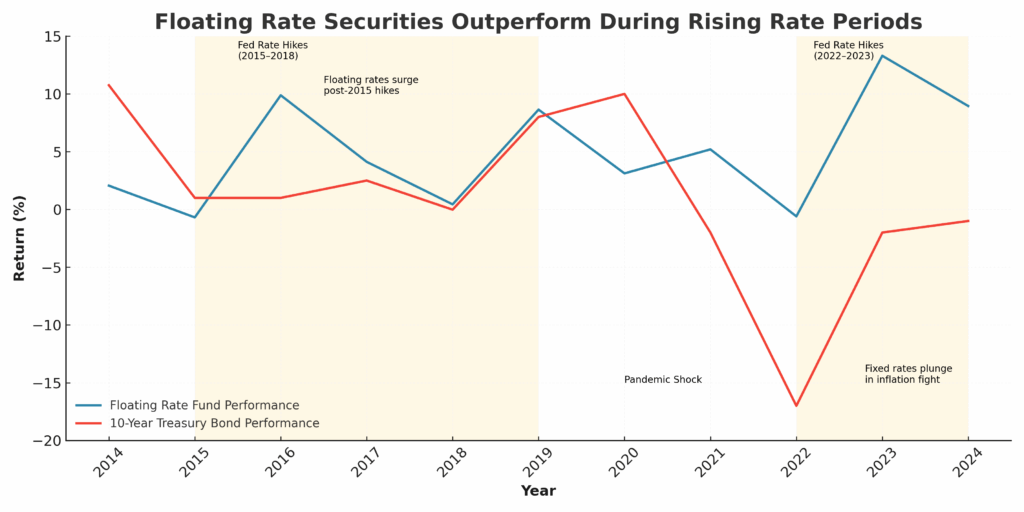

2. Superior Performance During Rising Rate Cycles: Historical data shows that floating rate funds have outperformed fixed-rate bonds by an average of 3-5% annually during periods when the Federal Reserve raises rates, with some floating rate ETFs delivering positive returns of 8-12% during the 2022-2023 rate hiking cycle while traditional bond funds suffered losses.

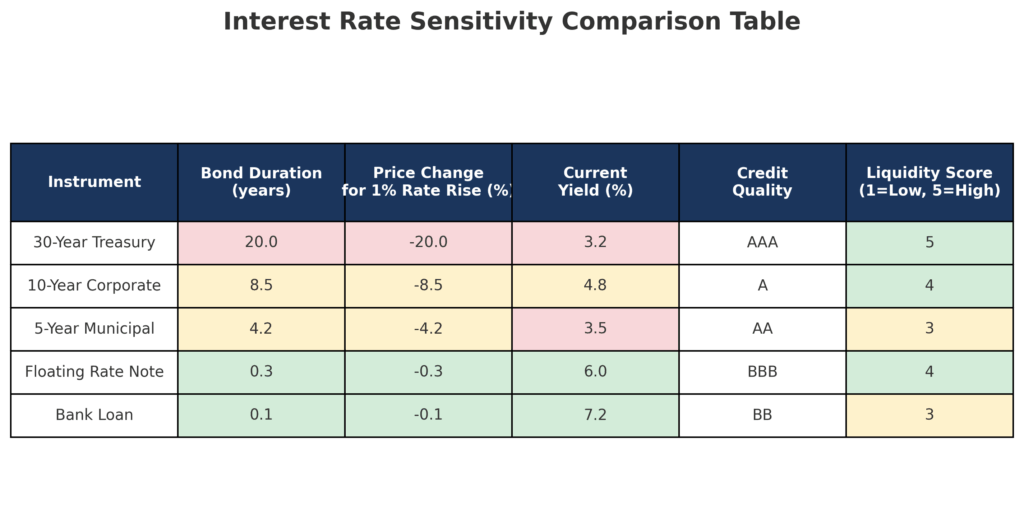

3. Lower Duration Risk Enables Portfolio Stability: Unlike traditional bonds that can lose 10-15% of their value when rates rise by 2-3%, floating rate securities maintain relatively stable principal values due to their short duration characteristics, typically experiencing price volatility of less than 1-2% during significant rate movements.

Understanding Floating Rate Securities

Floating rate securities, also known as variable rate or adjustable rate instruments, represent debt obligations whose interest payments fluctuate based on predetermined benchmark rates. These securities contrast sharply with traditional fixed-rate bonds, where the coupon payment remains constant throughout the security’s life. The fundamental mechanism involves periodic rate resets, typically occurring quarterly, that align the security’s yield with current market conditions.

The primary appeal of floating-rate instruments lies in their inherent ability to adapt to changing interest rate environments. When central banks implement monetary tightening policies to combat inflation, floating-rate securities automatically capture these higher rates, translating into increased income for investors. This automatic adjustment mechanism serves as a natural hedge against interest rate risk and provides protection against the purchasing power erosion that accompanies inflationary periods.

Market participants increasingly recognize floating-rate securities as essential portfolio components during uncertain economic periods. The global floating rate note market has expanded to approximately $2.8 trillion as of 2024, reflecting growing investor demand for rate-sensitive instruments. This expansion demonstrates institutional and retail investors’ acknowledgment of floating rates’ protective characteristics against inflation and rising rate environments.

The mechanics of rate adjustment typically involve adding a predetermined spread or margin to a benchmark rate such as the Secured Overnight Financing Rate (SOFR), Treasury bill rates, or LIBOR (though LIBOR is being phased out). For example, a floating rate note might pay SOFR plus 200 basis points, ensuring that as SOFR rises with inflation expectations, the security’s yield increases proportionally.

Types and Categories of Floating Rate Investments

Bank Loans and Leveraged Loans

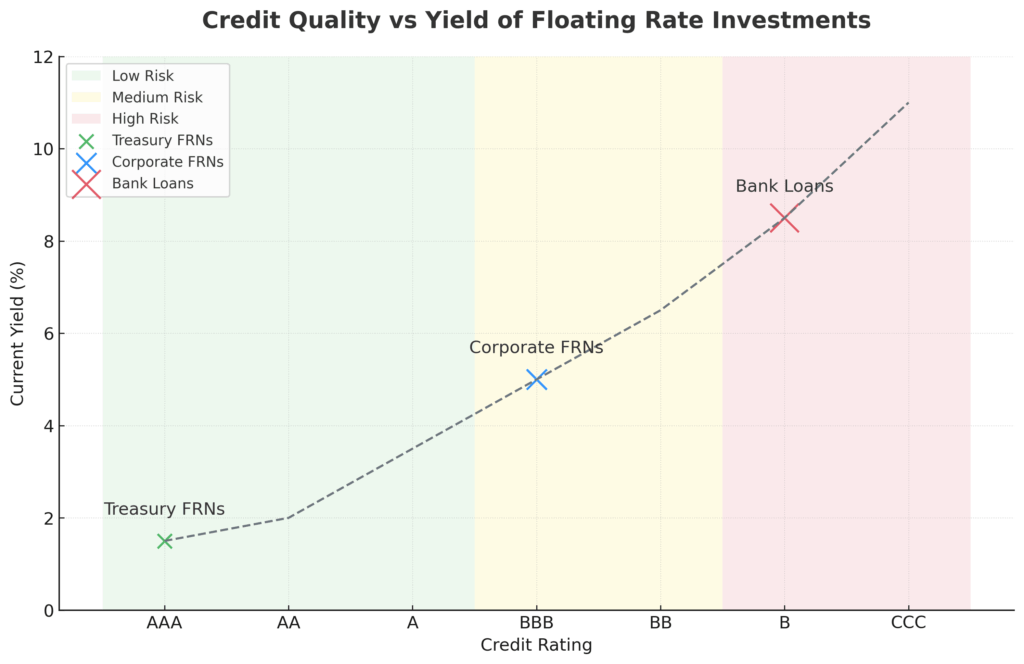

Bank loans, particularly leveraged loans, constitute the largest category of floating-rate investments, representing approximately 60% of the floating-rate market. These senior secured debt instruments typically offer SOFR plus 300-600 basis points, providing substantial yield premiums over government securities. Leveraged loans target companies with higher debt-to-equity ratios but offer senior security positions and often include protective covenants.

Floating Rate Notes (FRNs)

Corporate floating-rate notes issued by investment-grade companies provide lower-risk exposure to rate fluctuations while maintaining credit quality. These instruments typically yield SOFR plus 50-200 basis points, depending on the issuer’s credit rating. Government-issued FRNs, such as Treasury Floating Rate Notes (Treasury FRNs), offer the highest credit quality while providing benchmark rate exposure.

Floating Rate Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) specializing in floating-rate securities provide diversified exposure without requiring individual security selection. Popular options include the Invesco Senior Loan ETF (BKLN) and the SPDR Blackstone Senior Loan ETF (SRLN), which have attracted combined assets exceeding $15 billion.

| Investment Type | Typical Spread | Credit Quality | Liquidity | Minimum Investment |

|---|---|---|---|---|

| Treasury FRNs | SOFR + 0-25 bps | AAA (Government) | High | $100 |

| Corporate FRNs | SOFR + 50-200 bps | BBB to AAA | Medium-High | $1,000-$25,000 |

| Bank Loans | SOFR + 300-600 bps | BB to B | Medium | $25,000+ |

| Floating Rate ETFs | Varies by Holdings | Diversified | High | No minimum |

Benefits of Floating Rate Investments Against Inflation

Interest Rate Risk Mitigation

The primary advantage of floating-rate securities lies in their ability to minimize duration risk. While a 10-year Treasury bond might decline 8-10% in value when rates rise by 1%, floating-rate securities typically experience minimal principal fluctuation due to their short effective duration, which ranges from 0.1 to 0.5 years.

Income Enhancement During Rising Rate Cycles

Historical analysis reveals that floating-rate investments have provided superior income generation during inflationary periods. During the 2004-2006 Federal Reserve tightening cycle, floating rate funds delivered average annual returns of 6.8% compared to 2.1% for intermediate-term government bond funds.

Purchasing Power Preservation

The automatic rate adjustment mechanism ensures that investor income keeps pace with inflation expectations embedded in interest rates. When the Consumer Price Index rises, central banks typically respond with higher policy rates, which directly benefit floating-rate security holders through increased coupon payments.

Portfolio Diversification Benefits

Floating-rate securities exhibit low correlation with traditional fixed-income investments and equity markets during periods of monetary policy transitions. This characteristic enhances portfolio diversification and reduces overall volatility during market stress periods.

Challenges and Risks

Credit Risk Concentration

Many floating-rate investments, particularly leveraged loans, involve higher credit risk exposure. The default rate for leveraged loans averaged 3.1% in 2023, significantly higher than investment-grade corporate bonds’ 0.09% default rate. Investors must carefully evaluate credit quality alongside rate protection benefits.

Liquidity Constraints

Secondary market liquidity for individual floating rate securities can be limited, particularly during market stress periods. The bank loan market experienced significant liquidity challenges during March 2020, with bid-ask spreads widening to 400-500 basis points from typical levels of 50-100 basis points.

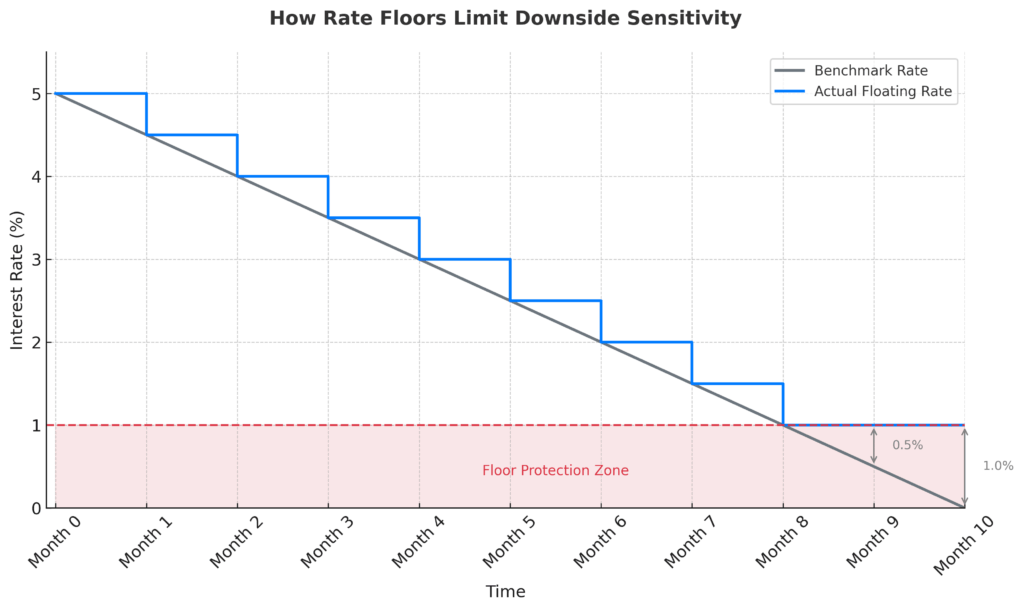

Rate Floor Limitations

Many floating-rate securities include rate floors that limit downside protection when benchmark rates decline significantly. During the 2020 Federal Reserve rate cuts to near-zero levels, floating rate securities with floors at 1-2% provided limited rate sensitivity, reducing their effectiveness as rate hedges.

Expense Ratio Considerations

Floating-rate mutual funds and ETFs typically charge expense ratios of 0.50-1.00%, which is higher than those of traditional bond index funds. These costs can erode returns, particularly in low-rate environments where absolute yields remain modest.

Implementation and How-It-Works Mechanisms

Rate Reset Mechanics

Floating rate securities typically reset their interest rates on predetermined dates, most commonly quarterly. The calculation involves determining the current benchmark rate on the reset date and applying the predetermined spread. For example, a security paying 3-month SOFR plus 250 basis points would calculate its new rate as:

New Rate = Current 3-Month SOFR + 2.50%

Benchmark Selection Impact

The choice of benchmark rate significantly influences performance characteristics. SOFR-based securities tend to react more quickly to Federal Reserve policy changes, while Treasury bill-based instruments may exhibit slight lags. Prime rate-based securities, common in bank loan markets, typically adjust immediately following Federal Reserve rate decisions.

Investment Timing Strategies

Optimal implementation often involves dollar-cost averaging approaches, particularly when entering floating rate positions during rate transition periods. Investors might allocate 10-20% of fixed-income portfolios to floating-rate securities as baseline protection, increasing allocations to 30-40% during anticipated rising-rate cycles.

Portfolio Integration Approaches

Effective implementation requires balancing floating-rate exposure with other fixed-income categories. A typical barbell strategy might combine short-duration floating rate securities with longer-term fixed-rate bonds, providing both rate protection and potential capital appreciation opportunities.

Future Trends and Market Evolution

Regulatory Environment Changes

The transition from LIBOR to SOFR has fundamentally altered floating rate market dynamics, with most new issuances now utilizing SOFR-based benchmarks. This transition is expected to be completed by 2025, potentially creating more standardized pricing and improved liquidity across floating rate markets.

Technology Integration

Blockchain technology and smart contracts are beginning to influence floating-rate security structures, enabling more frequent rate resets and automated adjustment mechanisms. Several financial institutions are piloting quarterly rate resets using distributed ledger technology, potentially reducing administrative costs and improving transparency.

ESG Integration

Environmental, Social, and Governance (ESG) considerations are increasingly influencing floating-rate investment options. Sustainable floating rate funds have emerged, screening investments based on ESG criteria while maintaining rate sensitivity characteristics.

Central Bank Digital Currencies Impact

The potential introduction of Central Bank Digital Currencies (CBDCs) may create new benchmark rate mechanisms, potentially offering real-time rate adjustments for floating rate securities rather than traditional quarterly resets.

FAQs – Floating Rate Against Inflation

1. How quickly do floating-rate securities adjust to inflation changes?

Floating rate securities typically reset their interest rates every 30 to 90 days based on current benchmark rates. While inflation itself doesn’t directly adjust these rates, central bank responses to inflation through monetary policy changes are captured within one to two reset periods, usually within 3-6 months of Federal Reserve policy adjustments.

2. What percentage of a portfolio should be allocated to floating-rate investments?

Financial advisors generally recommend allocating 15-25% of fixed-income portfolios to floating-rate securities during normal market conditions, potentially increasing to 30-40% during anticipated rising rate cycles. The specific allocation depends on individual risk tolerance, investment timeline, and overall portfolio construction.

3. Are floating-rate securities suitable for retirement portfolios?

Floating-rate securities can be appropriate for retirement portfolios, particularly for investors seeking income protection against inflation. However, retirees should balance the credit risk associated with many floating-rate investments against their need for capital preservation, often favoring higher-quality floating-rate options, such as Treasury FRNs.

4. How do floating-rate securities perform during economic recessions?

During recessions, floating-rate securities face a dual challenge: declining benchmark rates reduce income, while credit spreads may widen due to increased default risk. However, their short duration characteristics typically result in less principal volatility compared to long-term fixed-rate bonds during economic stress periods.

5. What are the tax implications of floating-rate investments?

Interest income from floating-rate securities is generally taxed as ordinary income at the federal and state levels. Unlike traditional bonds, which may generate capital gains or losses through price appreciation, the stable principal values of floating rate securities typically minimize capital gains tax implications.

6. Can floating-rate securities lose money during deflationary periods?

Yes, floating-rate securities can experience negative returns during periods of deflation when benchmark rates decline significantly. However, many floating-rate securities include rate floors that provide minimum interest rate guarantees, limiting but not eliminating potential income reduction during severe rate declines.

7. How do floating-rate ETFs differ from individual floating-rate securities?

Floating-rate ETFs offer diversified exposure to hundreds of floating-rate securities, mitigating individual credit risk while maintaining rate sensitivity. ETFs offer superior liquidity and lower minimum investments compared to individual securities, but charge management fees that individual security ownership avoids.

8. What happens to floating-rate securities when interest rates stop rising?

When interest rates stabilize or begin to decline, floating-rate securities will see their income adjust downward at subsequent reset dates. However, their principal values typically remain stable, and they continue providing protection against unexpected rate increases compared to fixed-rate alternatives.

9. Are there international floating-rate investment opportunities?

Yes, floating-rate securities exist globally, including European floating-rate notes, emerging market floating-rate bonds, and international floating-rate funds. However, currency risk becomes an additional consideration for U.S.-based investors, potentially requiring currency hedging strategies.

10. How do floating-rate securities compare to inflation-protected bonds (TIPS)?

Floating-rate securities provide protection against rising interest rates that typically accompany inflation, while TIPS directly adjust their principal based on actual inflation measures. Floating-rate securities may outperform during periods when interest rates increase more rapidly than actual inflation rates, while TIPS provide more direct inflation protection, regardless of interest rate movements.

Conclusion

Floating-rate securities represent an indispensable tool for investors seeking to protect their wealth against the dual threats of inflation and rising interest rates. The automatic adjustment mechanism that characterizes these instruments provides a dynamic hedge that traditional fixed-rate investments cannot match, particularly during periods of monetary policy tightening.

As demonstrated by historical performance data, floating-rate investments have consistently delivered superior returns during rising-rate cycles while maintaining principal stability due to their short duration characteristics.

The evolving landscape of floating-rate investments continues to expand opportunities for investors across a range of risk spectrums, from government-backed Treasury FRNs to higher-yielding leveraged loan funds. While challenges such as credit risk and liquidity constraints require careful consideration, the fundamental value proposition remains compelling: automatic adaptation to changing rate environments provides investors with built-in protection against purchasing power erosion.

As central banks worldwide navigate inflationary pressures and monetary policy normalization, floating rate securities will likely play an increasingly important role in comprehensive wealth preservation strategies, offering investors a proven mechanism for maintaining real returns in an uncertain economic environment.

For your reference, recently published articles include:

-

- Investment Strategy Evaluation – Get The Pro Advice Here

- Investment Risk Management Tools – All You Need To Know

- Investment Strategies Validation Made Simple

- Investment Risk Management Software – Best Expert Guide

- Market Sentiment Indicators: Your Edge In Volatile Markets

- Hot Investing Trends For Next Decade To Watch Now

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.