High net worth investing strategies represent sophisticated portfolio management approaches specifically designed for individuals with substantial liquid assets, typically exceeding $1 million.

These advanced investment methodologies combine institutional-grade opportunities, alternative asset classes, and tax-optimization techniques to generate superior risk-adjusted returns. In today’s volatile financial landscape, understanding and implementing these proven strategies has become essential for preserving and growing substantial wealth portfolios.

Welcome to our comprehensive exploration of high net worth investing strategies – we’re excited to help you unlock these elite wealth-building techniques!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

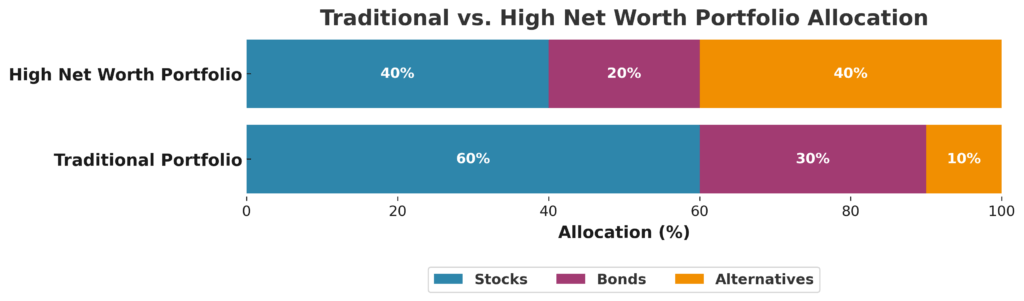

1. Diversification Beyond Traditional Assets: High net worth investors achieve superior returns by allocating 30-50% of their portfolios to alternative investments such as private equity, hedge funds, and real estate investment trusts (REITs), compared to the typical 5-10% allocation in standard portfolios. For example, Yale University’s endowment has generated an average annual return of 10.9% over the past 20 years by maintaining 70% alternative asset allocation.

2. Tax-Efficient Wealth Preservation: Strategic tax planning through vehicles like charitable remainder trusts and qualified opportunity zones can reduce effective tax rates by 15-25% annually. A high net worth individual earning $2 million annually could save $300,000-$500,000 in taxes through proper implementation of these strategies.

3. Professional Management and Exclusive Access: Ultra-high net worth investors typically outperform by 2-4% annually through access to institutional-quality investment managers and exclusive opportunities unavailable to retail investors, such as pre-IPO investments and private debt instruments with minimum investments of $250,000 or more.

Understanding High Net Worth Investing Strategies

High net worth investing strategies encompass a comprehensive framework of investment approaches specifically tailored for affluent individuals and families with investable assets exceeding $1 million. These strategies differ fundamentally from conventional retail investment approaches through their emphasis on sophisticated risk management, alternative asset allocation, and institutional-quality opportunities.

The foundation of high net worth investing rests on three pillars: portfolio diversification beyond traditional securities, active tax optimization, and access to exclusive investment vehicles. Unlike standard investment portfolios that primarily focus on stocks and bonds, high net worth strategies incorporate complex instruments such as private equity funds, hedge funds, commodities, and structured products.

Modern high net worth investing has evolved significantly since the 2008 financial crisis, with wealthy investors increasingly seeking uncorrelated assets that provide portfolio stability during market downturns. According to recent industry data, high net worth individuals now allocate an average of 32% of their portfolios to alternative investments, compared to just 18% in 2010.

The sophistication level of these strategies requires specialized knowledge and often necessitates collaboration with family offices, private wealth managers, and investment advisors who possess expertise in complex financial instruments. This professional guidance becomes particularly crucial when navigating regulatory requirements, tax implications, and risk assessment for alternative investments.

Risk management in high net worth investing extends beyond traditional portfolio theory to encompass tail risk hedging, currency diversification, and geopolitical risk mitigation. These sophisticated approaches recognize that wealthy individuals face unique risks, including concentrated wealth exposure, regulatory changes affecting high earners, and inflation erosion of purchasing power.

The minimum threshold for accessing many high net worth investment opportunities typically ranges from $250,000 to $1 million per investment, creating natural barriers that limit these strategies to affluent investors. This exclusivity often translates to enhanced returns due to reduced competition and access to institutional-quality deal flow.

Types and Categories of High Net Worth Investing Strategies

Alternative Investment Strategies

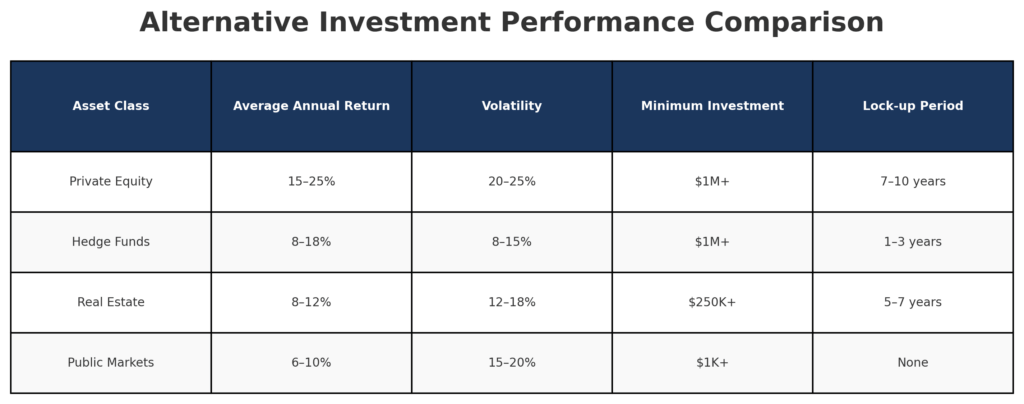

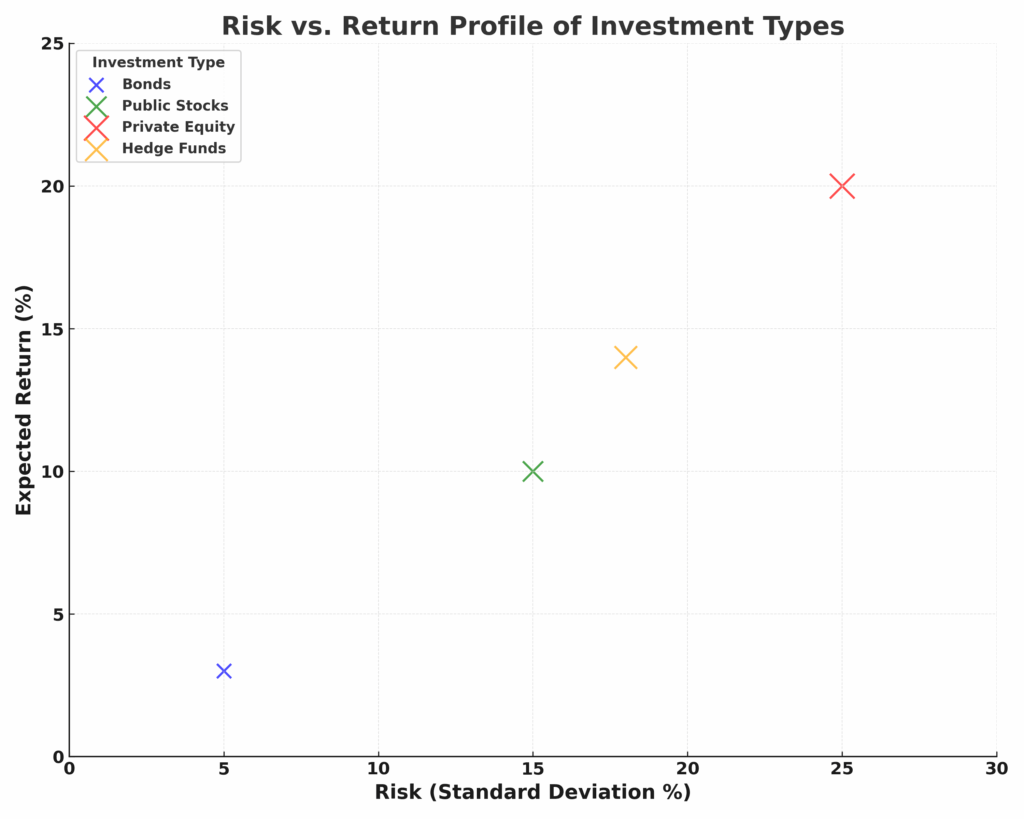

Private Equity and Venture Capital represent cornerstone strategies for high net worth portfolios, offering potential returns of 15-25% annually over 7-10 year investment horizons. These investments provide access to companies before public market entry, with successful venture capital funds historically delivering returns exceeding 20% annually.

Hedge Fund Strategies employ sophisticated techniques including long-short equity, merger arbitrage, and global macro approaches. Top-tier hedge funds typically require minimum investments of $1-5 million and target annual returns of 12-18% with lower volatility than traditional equity markets.

Real Estate Investment Strategies encompass direct property ownership, real estate investment trusts (REITs), and real estate private equity funds. Commercial real estate investments often generate annual returns of 8-12% through rental income and property appreciation, while providing inflation hedging benefits.

Tax-Optimized Investment Vehicles

Municipal Bond Strategies offer tax-free income particularly beneficial for high-income investors facing marginal tax rates of 37-40%. High-grade municipal bonds typically yield 3-5% tax-free, equivalent to 5-8% taxable yields for high net worth investors.

Qualified Opportunity Zone Investments provide significant tax advantages including deferral of capital gains taxes and potential elimination of taxes on appreciation. These investments require 10-year holding periods but can result in effective tax rates near zero for patient investors.

Charitable Remainder Trusts enable wealthy individuals to convert highly appreciated assets into diversified income streams while receiving immediate tax deductions. These strategies can provide annual income of 5-8% while reducing estate tax exposure.

International and Currency Diversification

Global Investment Strategies incorporate emerging market exposure, developed international markets, and currency hedging techniques. International diversification typically reduces portfolio volatility by 15-20% while maintaining similar return expectations.

Currency Trading and Hedging strategies protect against dollar depreciation and capitalize on global economic trends. Professional currency overlay programs can add 1-3% annual returns while reducing currency risk exposure.

Benefits of High Net Worth Investing Strategies

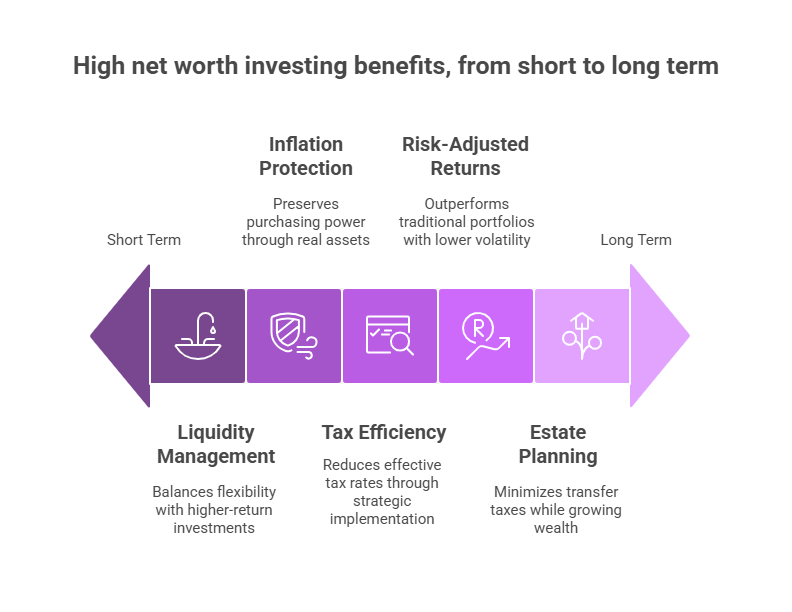

The primary advantage of sophisticated high net worth investing strategies lies in their ability to generate superior risk-adjusted returns through access to institutional-quality investments and professional management. Historical data indicates that properly diversified high net worth portfolios outperform traditional 60/40 stock-bond allocations by 2-4% annually while exhibiting lower volatility during market downturns.

Tax efficiency represents another significant benefit, with strategic implementation potentially reducing effective tax rates by 20-30% annually. High net worth investors utilizing tax-loss harvesting, asset location optimization, and strategic charitable giving can substantially enhance after-tax returns compared to traditional investment approaches.

Inflation protection through alternative assets provides crucial purchasing power preservation for wealthy individuals. Real assets including real estate, commodities, and infrastructure investments historically maintain value during inflationary periods, protecting wealth from currency debasement.

Liquidity management benefits enable high net worth investors to maintain portfolio flexibility while accessing illiquid, higher-return investments. Professional wealth managers structure portfolios to provide adequate liquidity for lifestyle needs while maximizing allocation to long-term, illiquid opportunities.

Estate planning integration allows high net worth strategies to simultaneously grow wealth and minimize transfer taxes. Techniques such as grantor-retained annuity trusts (GRATs) and charitable lead trusts can transfer substantial wealth to heirs while reducing gift and estate tax exposure.

Challenges and Risks in High Net Worth Investing

Complexity and Due Diligence Requirements pose significant challenges for high net worth investors, particularly when evaluating alternative investments with limited transparency and complex fee structures. Private equity and hedge fund investments require extensive due diligence processes that can take 3-6 months to complete properly.

Liquidity Constraints represent a primary risk factor, as many high-return alternative investments require lock-up periods of 3-10 years. Investors must carefully balance illiquid investments with liquid reserves to meet unexpected cash flow needs without forced liquidations at unfavorable times.

Regulatory and Tax Complexity creates ongoing compliance challenges, particularly for international investments and alternative structures. Changes in tax law can significantly impact strategy effectiveness, requiring continuous monitoring and potential restructuring of investment approaches.

Manager Selection Risk becomes critical when accessing alternative investments through fund structures. Poor manager selection can result in substantial underperformance, with bottom-quartile private equity funds often generating returns below public market alternatives.

Concentration Risk emerges when high net worth individuals have significant portions of their wealth tied to specific investments, sectors, or geographic regions. Proper diversification requires ongoing monitoring and rebalancing to maintain appropriate risk exposures.

Fee Impact can substantially erode returns in complex investment structures, with some alternative investments carrying total annual fees of 3-5%. Careful fee analysis and negotiation become essential for maintaining net return objectives.

Implementation and How High Net Worth Strategies Work

Portfolio Construction Process

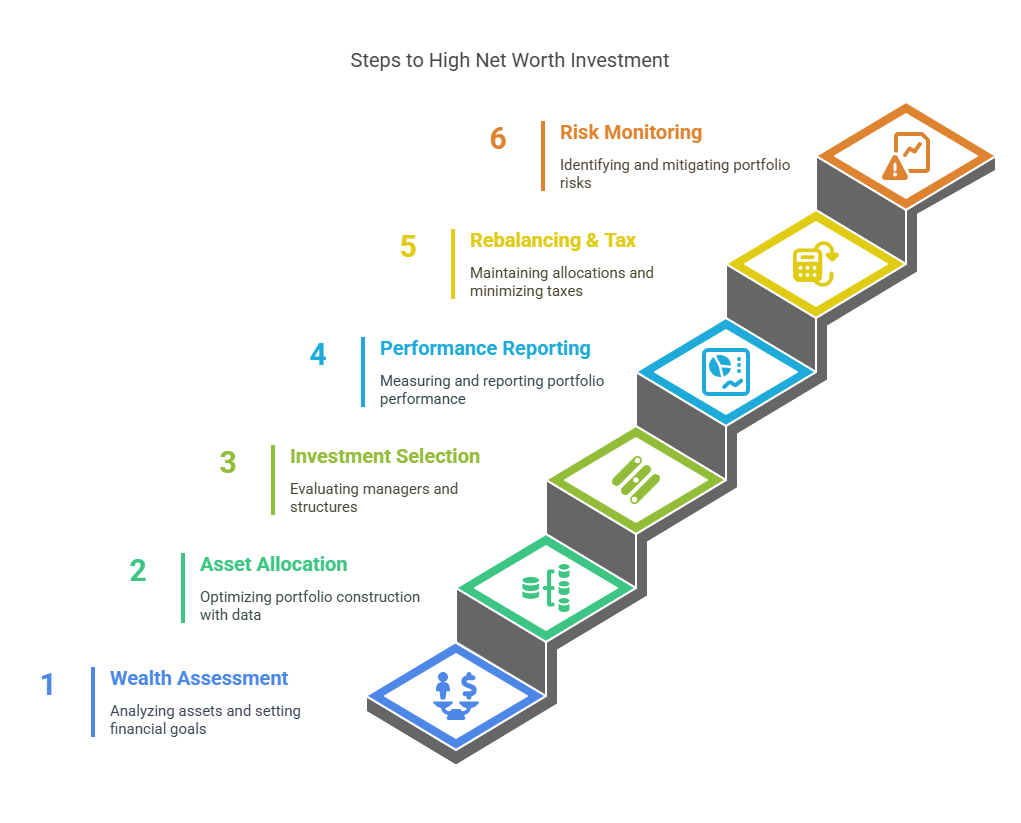

The implementation of high net worth investing strategies begins with comprehensive wealth assessment and goal setting, typically conducted by certified financial planners or family office professionals. This process involves analyzing current assets, income streams, tax situations, and long-term objectives to create customized investment policy statements.

Asset allocation modeling utilizes sophisticated software and historical data to optimize portfolio construction across traditional and alternative investments. Modern portfolio theory applications for high net worth investors incorporate additional factors including tax efficiency, liquidity needs, and risk tolerance across multiple asset classes.

Investment vehicle selection requires careful evaluation of fund managers, fee structures, and investment terms. This process often involves reviewing hundreds of potential investments to identify top-quartile managers and optimal investment structures for specific portfolio objectives.

Ongoing Management and Monitoring

Performance measurement and reporting in high net worth portfolios requires specialized systems capable of handling complex investments and tax considerations. Professional wealth management platforms provide consolidated reporting across multiple investment vehicles and custodians.

Rebalancing and tax management involves systematic processes for maintaining target allocations while minimizing tax impact. Tax-loss harvesting, asset location optimization, and strategic rebalancing can add 1-2% annually to after-tax returns through proper implementation.

Risk monitoring and hedging utilizes advanced analytics to identify portfolio vulnerabilities and implement protective strategies. Tail risk hedging and volatility management techniques help preserve wealth during market stress periods.

Future Trends in High Net Worth Investing

Technology Integration and Digital Assets

Artificial Intelligence and Machine Learning applications are revolutionizing investment research and portfolio management for high net worth investors. AI-driven analytics now enable identification of investment opportunities and risk factors previously undetectable through traditional analysis methods.

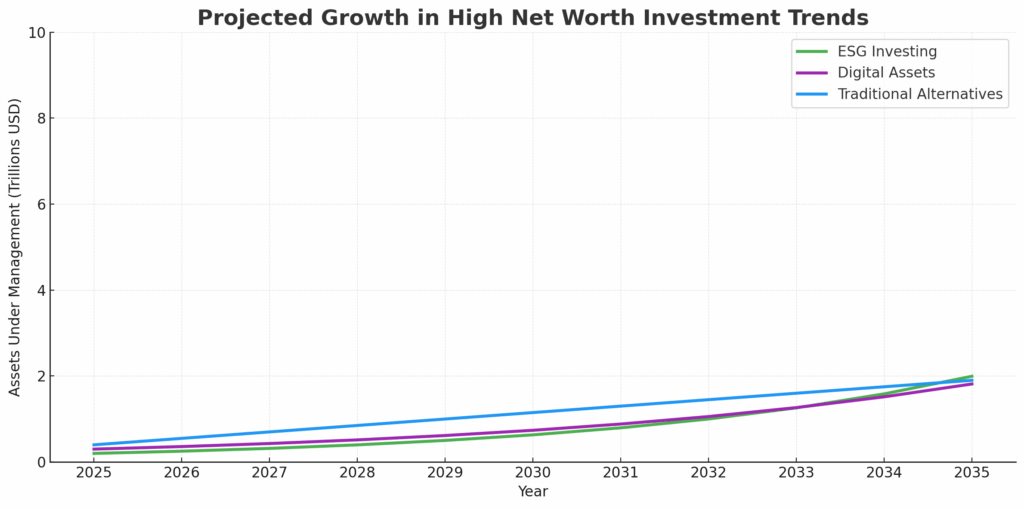

Cryptocurrency and Digital Assets are gaining acceptance among high net worth investors, with 25% of wealthy individuals now including digital assets in their portfolios. Institutional-grade cryptocurrency funds and blockchain investments are becoming mainstream components of sophisticated portfolios.

Robo-Advisory Integration for high net worth investors combines human expertise with algorithmic efficiency, particularly for tax optimization and rebalancing functions. These hybrid approaches can reduce management costs while improving execution efficiency.

Environmental, Social, and Governance (ESG) Integration

Sustainable Investing Strategies are becoming standard components of high net worth portfolios, with ESG-focused investments representing over $2 trillion in assets under management globally. Impact investing opportunities now offer competitive returns while addressing social and environmental challenges.

Climate-Related Investment Opportunities include renewable energy projects, carbon credit trading, and climate adaptation infrastructure. These investments provide portfolio diversification while capitalizing on the transition to sustainable energy systems.

Regulatory Evolution and Market Access

Regulatory Changes continue expanding accredited investor definitions and alternative investment access, potentially increasing competition for high-quality opportunities while creating new investment categories.

Cross-Border Investment Facilitation through international tax treaties and regulatory harmonization is expanding global investment opportunities for high net worth individuals seeking geographic diversification.

FAQs – High Net Worth Investing Strategies

1. What minimum net worth qualifies for high net worth investing strategies?

Most financial institutions define high net worth individuals as those with liquid investable assets exceeding $1 million, though ultra-high net worth strategies typically require $5-25 million in assets. The minimum investment thresholds for specific strategies vary significantly, with some alternative investments requiring $250,000-$1 million minimum commitments.

2. How do high net worth investing strategies differ from traditional portfolio management?

High net worth strategies incorporate alternative investments, sophisticated tax optimization, and institutional-quality opportunities unavailable to retail investors. These approaches typically allocate 30-50% to alternatives versus 5-10% in traditional portfolios, while emphasizing tax efficiency and risk management techniques beyond conventional diversification.

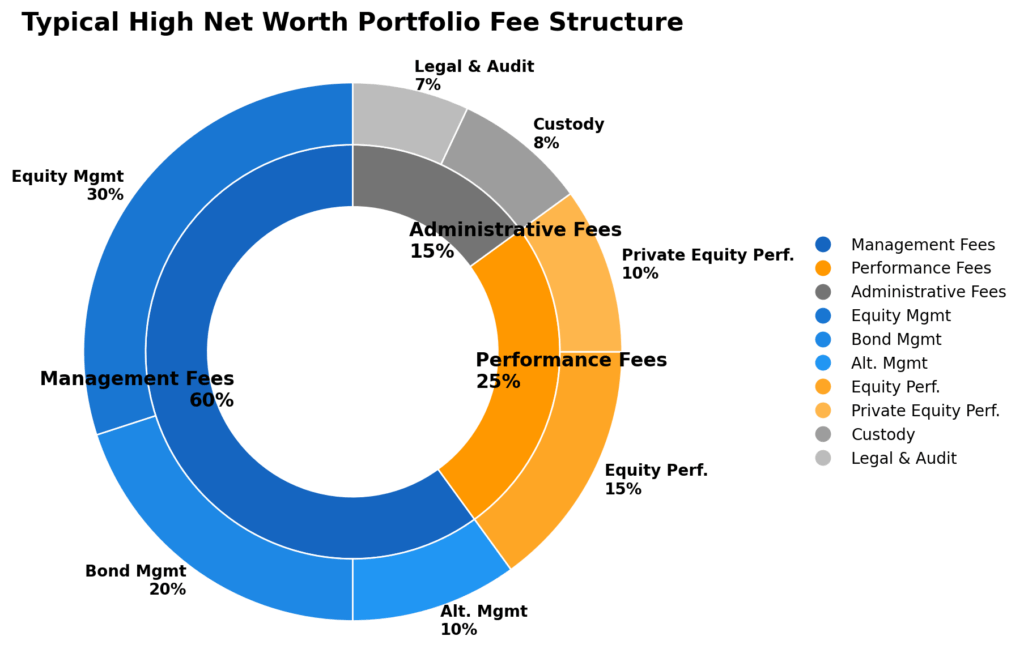

3. What are the typical fees associated with high net worth investment strategies?

Fee structures vary significantly across investment types, with traditional asset management fees ranging from 0.5-1.5% annually, while alternative investments may charge 1-2% management fees plus 15-25% performance fees. Total portfolio costs for comprehensive high net worth strategies typically range from 1-3% annually depending on alternative allocation levels.

4. How long should investors commit to high net worth investing strategies?

Most high net worth strategies require long-term commitment horizons of 7-10 years to achieve optimal results, particularly for alternative investments with extended lock-up periods. However, portfolio construction should maintain 12-24 months of liquid reserves to meet unexpected cash flow needs without disrupting long-term investment strategies.

5. What tax advantages do high net worth investing strategies provide?

Strategic tax optimization through municipal bonds, qualified opportunity zones, charitable trusts, and tax-loss harvesting can reduce effective tax rates by 15-25% annually. High net worth investors often achieve after-tax returns 2-4% higher than traditional approaches through proper tax-efficient investment structuring.

6. How important is international diversification for high net worth portfolios?

International diversification typically comprises 20-40% of high net worth portfolios, providing currency diversification, access to global growth opportunities, and reduced correlation with domestic markets. Emerging market exposure and developed international markets can reduce overall portfolio volatility while maintaining return expectations.

7. What role do alternative investments play in high net worth strategies?

Alternative investments including private equity, hedge funds, real estate, and commodities typically represent 30-50% of high net worth portfolios. These investments provide higher return potential, inflation protection, and low correlation with traditional securities, though they require longer investment horizons and higher minimum investments.

8. How do investors evaluate and select investment managers for complex strategies?

Manager selection involves comprehensive due diligence including performance analysis, risk management evaluation, operational assessment, and reference checks. The process typically requires 3-6 months and often involves third-party consultants specializing in alternative investment manager evaluation and selection.

9. What liquidity considerations are important for high net worth investing?

Liquidity management requires maintaining 6-24 months of expenses in liquid investments while maximizing allocation to higher-return illiquid opportunities. Proper liquidity planning prevents forced liquidations during market downturns and ensures access to emergency funds without disrupting long-term investment strategies.

10. How do high net worth investors protect against market volatility and economic uncertainty?

Risk management techniques include tail risk hedging, geographic diversification, currency hedging, and alternative investment allocation. Professional wealth managers employ sophisticated risk monitoring systems and implement protective strategies including options overlays and volatility management to preserve wealth during market stress periods.

Conclusion

High net worth investing strategies represent sophisticated approaches to wealth management that extend far beyond traditional portfolio construction, incorporating alternative investments, tax optimization, and institutional-quality opportunities to generate superior risk-adjusted returns.

The implementation of these strategies requires careful planning, professional guidance, and long-term commitment, but historically delivers enhanced performance through access to exclusive investments and advanced risk management techniques.

The evolution of high net worth investing continues accelerating through technology integration, ESG considerations, and expanding global opportunities, creating new possibilities for wealth preservation and growth. Success in implementing these strategies depends on understanding their complexity, maintaining appropriate liquidity reserves, and working with experienced professionals who can navigate the sophisticated landscape of alternative investments and tax optimization.

As markets become increasingly complex and traditional investment approaches face headwinds from low interest rates and market volatility, high net worth investing strategies will likely become even more critical for affluent individuals seeking to preserve and grow their wealth over the long term.

For your reference, recently published articles include:

-

- Proven Seasonal Investing Strategies Every Investor Should Know

- How To Avoid The Floating Rate Investment Trap In 2025

- Low Charge Investing Made Simple: Expert Guide

- Why Every Investor Needs Floating Rate Investments Now

- Breaking Free From The Fixed-Rate Investment Trap

- Protect Your Wealth: Floating Rate Against Inflation Now

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.