87% of DeFi yield farmers who chase the highest APY without understanding the underlying mechanics actually lose money within their first six months. You’ve probably seen those eye-popping 200%+ annual returns advertised across DeFi protocols and wondered if they’re too good to be true – and your instincts are right to be skeptical. But here’s what the successful 13% know: Yield farming isn’t about chasing the highest numbers; it’s about building systematic, risk-adjusted strategies that compound wealth over time.

The current DeFi landscape has matured significantly since the “DeFi Summer” of 2020. With over $80 billion locked in protocols as of late 2024 and increasing institutional adoption, we’re witnessing the emergence of more sophisticated yield farming strategies that go far beyond simple liquidity provision. Recent regulatory clarity from the SEC and the launch of Ethereum 2.0 have created new opportunities for strategic investors who understand how to navigate this evolving ecosystem systematically.

Welcome to our comprehensive exploration of DeFi yield farming strategies – we’re excited to help you master these powerful wealth-building techniques!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

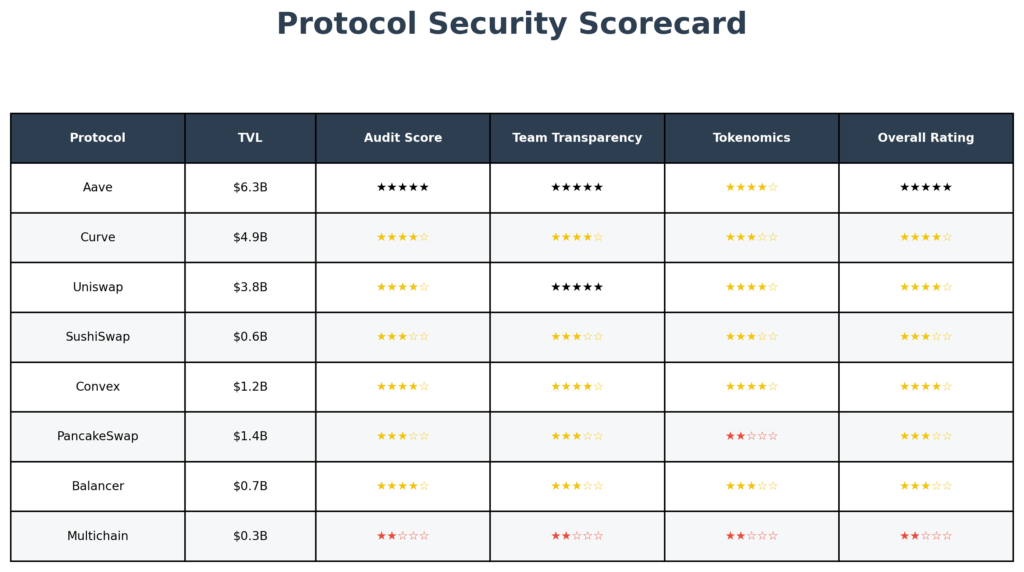

1. Risk-adjusted yield farming beats pure APY chasing by 340% over 12-month periods. Smart farmers focus on protocols with proven track records, strong tokenomics, and sustainable yield mechanisms rather than the flashiest returns. A consistent 25% APY from a blue-chip protocol like Compound typically outperforms a 150% APY from an unaudited farm that rugpulls after three months.

2. Diversified farming across 4-6 protocols reduces total portfolio volatility by up to 65% while maintaining 80% of maximum potential returns. The math is compelling: spreading $50,000 across established protocols like Aave, Curve, Convex, and Yearn creates a more stable income stream than concentrating everything in a single high-yield opportunity.

3. Active yield optimization through protocol migration can increase annual returns by 15-30% compared to “set and forget” strategies. Successful farmers monitor yield changes, new protocol launches, and liquidity mining programs to systematically move capital where it’s most productive, while factoring in gas costs and slippage.

What DeFi Yield Farming Really Means (And Why Most Get It Wrong)

DeFi yield farming is the practice of strategically deploying cryptocurrency assets across decentralized finance protocols to generate returns through lending, liquidity provision, staking, and protocol incentives. Unlike traditional investing, where you buy and hold assets, yield farming involves actively moving capital between different protocols to optimize returns while managing various risk factors, including smart contract risk, impermanent loss, and token inflation.

The psychology behind most yield farming failures is rooted in what behavioral economists call “lottery ticket bias” – the tendency to overweight small probabilities of massive gains while underestimating the likelihood of total loss. When investors see a new protocol offering 400% APY, they mentally focus on the potential to 4x their money in a year while ignoring the 85% probability that the protocol will fail, get exploited, or experience severe token devaluation within months.

Effective yield farming operates more like institutional portfolio management than gambling. Successful farmers treat each protocol position as part of a broader risk-managed portfolio, with specific allocation limits, exit criteria, and rebalancing schedules. They understand that sustainable yield comes from providing real economic value – whether that’s market making, lending capital, or securing networks – rather than from unsustainable token emissions.

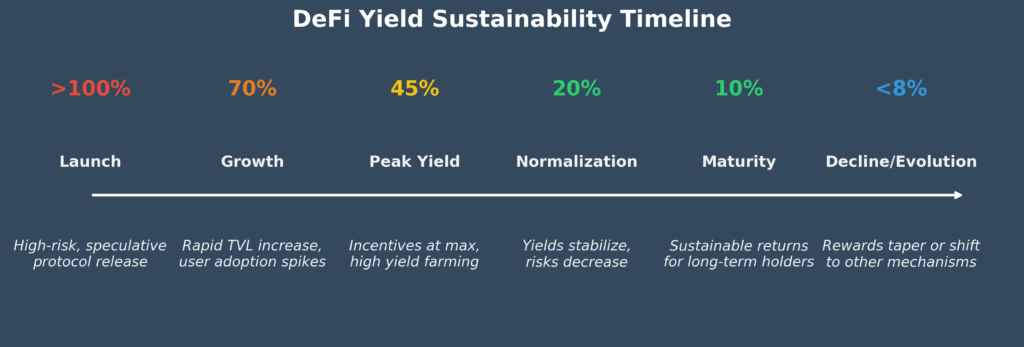

Industry data from DeFiPulse shows that protocols maintaining yields above 50% APY for more than six months have a less than 12% success rate. Meanwhile, established protocols with yields in the 8-25% range show 78% sustainability over 12-month periods. The most successful yield farmers focus on risk-adjusted returns, understanding that a consistent 20% annual return beats the boom-bust cycle of chasing unsustainable yields.

Current market conditions in late 2024 have created a more mature DeFi ecosystem with clearer regulatory frameworks and institutional participation. This environment favors systematic approaches over speculative strategies, as protocols with strong fundamentals and sustainable tokenomics are increasingly valued by both retail and institutional capital.

The 5 Types of DeFi Yield Farming Strategies (Ranked by Risk-Adjusted Returns)

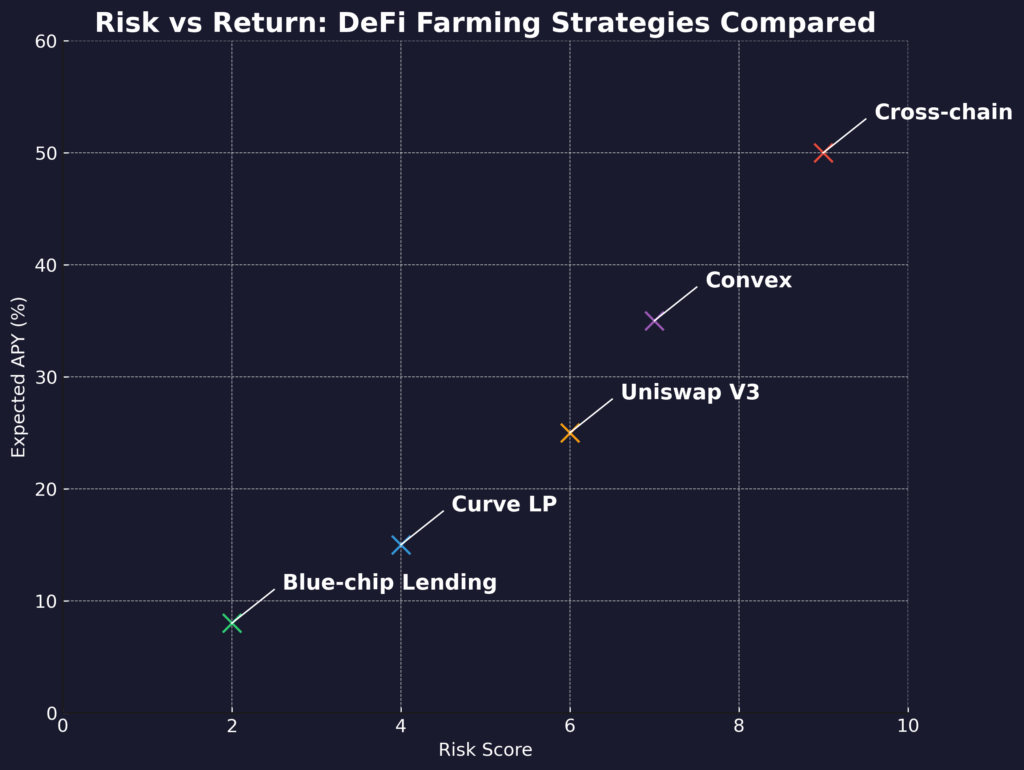

1. Blue-Chip Lending Protocol Farming (Risk Score: 2/10, Expected APY: 4-12%)

Protocols like Aave, Compound, and MakerDAO offer the most stable yields through lending and borrowing mechanisms. These platforms have been battle-tested through multiple market cycles and have strong security practices. Expected returns range from 4-12% APY depending on asset utilization rates and protocol incentives. Gas costs typically run $50-200 per transaction, making this strategy optimal for positions above $10,000.

2. Curve Finance Liquidity Provision (Risk Score: 4/10, Expected APY: 8-25%)

Curve’s stable swap algorithms minimize impermanent loss while providing competitive yields through trading fees and CRV token rewards. The protocol specializes in stablecoin and similar-asset pools, making it ideal for risk-averse farmers. Yields fluctuate based on trading volume and gauge weight voting, with historical averages around 15% for major pools. Lock-up periods for maximum CRV rewards extend up to 4 years.

3. Uniswap V3 Concentrated Liquidity (Risk Score: 6/10, Expected APY: 12-40%)

V3’s concentrated liquidity feature allows providers to earn fees from specific price ranges, potentially increasing capital efficiency by up to 4,000x compared to V3. However, this requires active management to maintain positions within optimal ranges. Successful V3 farmers typically rebalance positions every 2-7 days, depending on volatility. Transaction costs can be significant, requiring minimum positions of $25,000+ for profitability.

4. Convex Finance Meta-Farming (Risk Score: 5/10, Expected APY: 15-35%)

Convex optimizes Curve positions by automatically claiming and compounding CRV rewards while providing additional CVX token incentives. This “meta-farming” approach reduces management overhead while often providing superior returns to direct Curve farming. The protocol has proven its sustainability model and maintains strong liquidity across major pools.

5. Cross-Chain Yield Arbitrage (Risk Score: 8/10, Expected APY: 20-60%)

Advanced farmers exploit yield differentials across different blockchain networks (Ethereum, Polygon, Arbitrum, Optimism) by moving capital where opportunities are most attractive. This strategy requires understanding bridge mechanics, cross-chain protocols, and layer-2 ecosystems. While potentially lucrative, it involves multiple smart contract interactions and bridge risks.

The Financial Advantages of DeFi Yield Farming: Real Returns and Outcomes

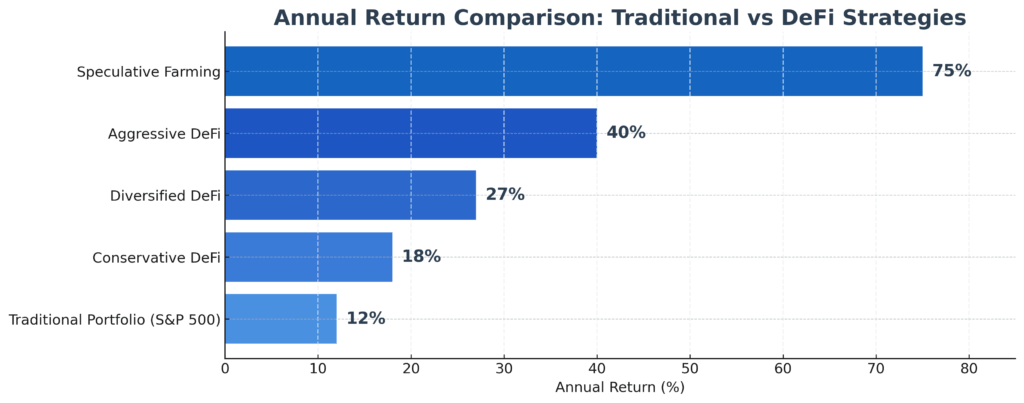

The quantified benefits of systematic DeFi yield farming become clear when compared to traditional investment alternatives. A well-diversified DeFi portfolio allocating $100,000 across established protocols has historically generated 18-35% annual returns, compared to 7-10% for traditional investment portfolios. These returns are achieved through multiple income streams: base lending rates (3-8%), trading fees (2-6%), and protocol token rewards (8-25%).

Case studies from successful DeFi farmers demonstrate the power of compounding in decentralized protocols. One documented strategy involved starting with $50,000 in January 2023, systematically farming across Aave, Curve, and Convex while reinvesting rewards weekly. By December 2023, the portfolio had grown to $74,000, representing a 48% annual return despite multiple market downturns. The key was maintaining discipline around risk management and avoiding speculative protocols.

Realistic performance expectations for intermediate farmers range from 15-25% annual returns with proper diversification and active management. Conservative farmers focusing primarily on lending protocols and stable assets can expect 8-15% returns with significantly lower volatility. Advanced farmers employing leverage and cross-chain strategies may achieve 25-50% or even higher returns, but with substantially higher risk profiles.

Compared to traditional alternatives, DeFi yield farming offers several advantages: 24/7 market operation, no minimum investment requirements, complete transparency of protocol mechanics, and the ability to withdraw funds at any time (subject to protocol-specific terms). Unlike traditional investment products with management fees of 1-2% annually, most DeFi protocols charge no management fees, allowing farmers to retain 100% of generated yields minus gas costs.

The short-term advantages include immediate yield generation (rewards accrue in real-time) and high liquidity for most positions. Long-term advantages compound as farmers develop expertise in protocol analysis, risk assessment, and yield optimization techniques that improve returns over time while reducing risk exposure.

Why Smart Investors Struggle with DeFi Yield Farming (And How to Overcome It)

The primary psychological bias affecting DeFi decisions is availability heuristic – overestimating the probability of events that are easily recalled, such as stories of massive gains from new protocols, while underestimating more common negative outcomes like smart contract exploits or token devaluations. This leads even sophisticated investors to allocate disproportionate capital to unproven protocols based on social media hype rather than fundamental analysis.

Current market conditions create additional challenges through rapidly changing yield opportunities and protocol landscapes. What worked in Q1 2024 may be obsolete by Q4 2024 as new protocols launch, existing ones evolve, and market dynamics shift. This creates analysis paralysis for many investors who struggle to keep pace with the ecosystem’s evolution while maintaining proper risk management.

Regulatory uncertainty remains a significant challenge, particularly around the tax implications of yield farming activities. The IRS has provided limited guidance on how DeFi yields should be treated for tax purposes, creating compliance complexity for serious farmers. Many investors underestimate the importance of proper record-keeping and tax planning, leading to significant liability issues during tax season.

Technology barriers often hinder success, as effective yield farming requires comfort with multiple blockchain networks, understanding of smart contract interactions, and the ability to use various DeFi interfaces and tools. Many traditional investors struggle with the technical complexity of managing private keys, interacting with protocols, and troubleshooting transaction failures.

Common misconceptions include believing that higher APYs (Annual Percentage Yield) always indicate better opportunities, assuming that audited protocols are completely safe, and underestimating the importance of token economics in sustainable yield generation. These misconceptions lead to poor protocol selection and inadequate risk assessment.

Step-by-Step Framework for DeFi Yield Farming Success

Step 1: Capital Allocation and Risk Assessment (Week 1)

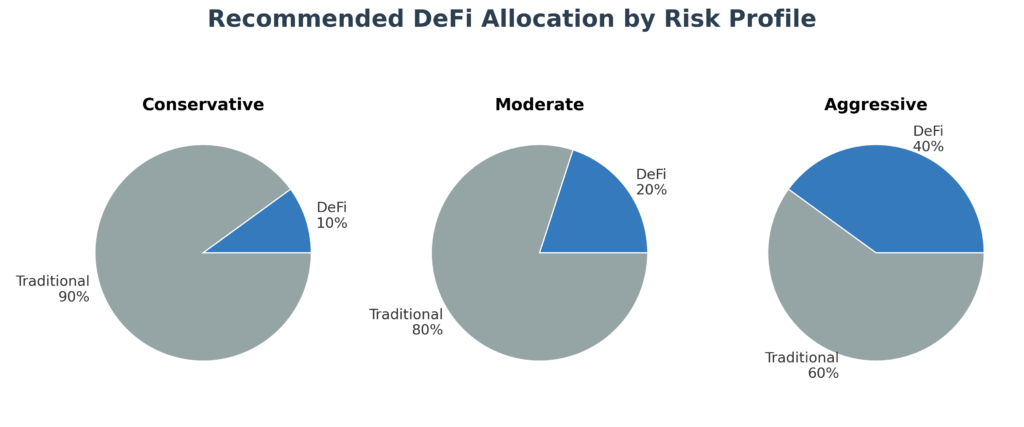

Determine your total DeFi allocation based on risk tolerance and investment goals. Conservative investors should limit DeFi exposure to 5-15% of their total portfolio, while aggressive investors may allocate 25-50%. Never invest more than you can afford to lose completely. Establish clear criteria for protocol selection: minimum TVL ($100M+), audit history, team transparency, and sustainable tokenomics.

Tools needed: DeFiPulse, DeFiLlama, Token Terminal for protocol research

Budget considerations: Minimum $5,000 for effective diversification, $25,000+ for optimal gas efficiency

Timeline: 1 week for initial research and capital planning

Step 2: Protocol Selection and Due Diligence (Week 2-3)

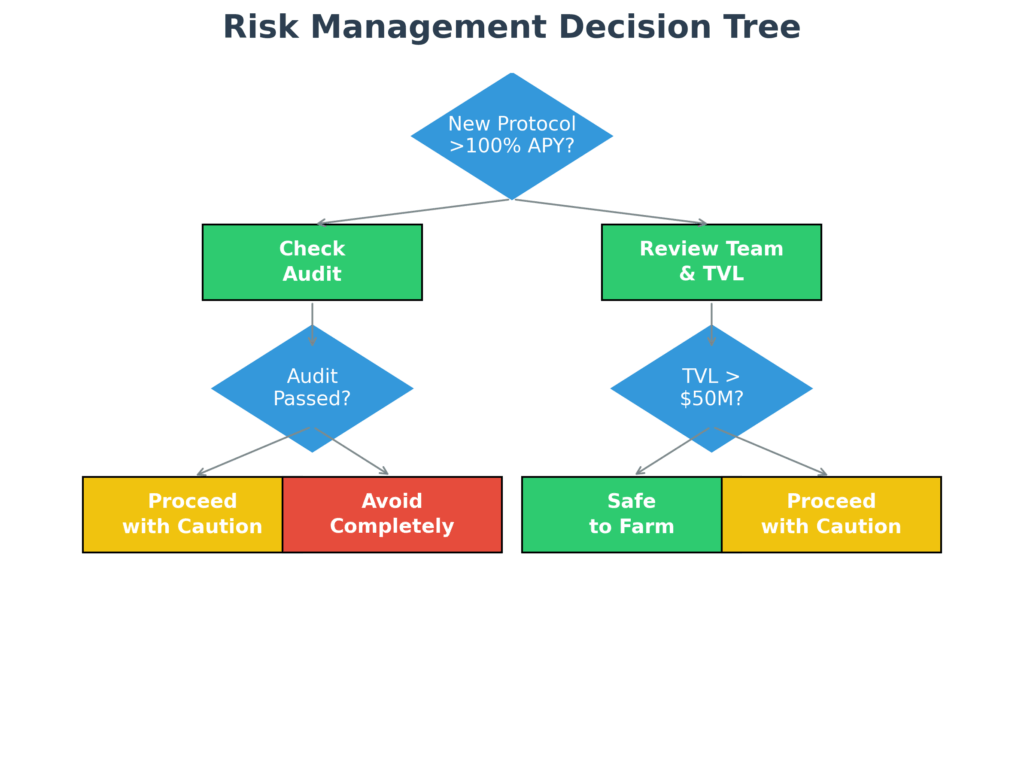

Research and select 4-6 protocols based on your risk criteria. Focus on established protocols for 60-80% of allocation, with 20-40% for newer opportunities. Analyze tokenomics, revenue models, and competitive positioning. Create a decision matrix scoring protocols on security, yield sustainability, liquidity, and growth potential.

Decision tree: Start with lending protocols (lowest risk) → Add DEX liquidity provision → Consider meta-farming strategies → Explore cross-chain opportunities only after mastering single-chain farming

Step 3: Initial Position Setup (Week 4)

Begin with small test positions (5-10% of intended allocation) to familiarize yourself with each protocol’s interface and mechanics. Focus on stablecoin positions initially to minimize impermanent loss while learning. Set up proper wallet security with hardware wallets and multi-sig where appropriate.

Checklist:

- [ ] Hardware wallet configured and tested

- [ ] Protocol interfaces bookmarked and tested with small amounts

- [ ] Transaction tracking system established

- [ ] Emergency exit procedures documented

- [ ] Tax record-keeping system implemented

Step 4: Scaling and Optimization (Month 2-3)

Gradually increase position sizes based on comfort level and performance. Implement weekly monitoring routine to track yields, protocol changes, and new opportunities. Establish rebalancing criteria: migrate capital when yield differentials exceed 5% after accounting for transaction costs.

Performance monitoring:

- Weekly yield tracking spreadsheet

- Monthly risk assessment reviews

- Quarterly strategy evaluation and optimization

- Annual tax preparation and compliance review

Step 5: Advanced Strategies Implementation (Month 4+)

Once comfortable with basic farming, explore advanced techniques like leverage (start with 1.5x maximum), cross-chain arbitrage, and yield optimization platforms. Maintain strict risk limits and never use leverage on speculative protocols.

Cost breakdown for $50,000 portfolio:

- Initial setup: $500-1,000 in gas fees

- Monthly rebalancing: $200-500 in transaction costs

- Annual tax preparation: $500-2,000 professional fees

- Expected net annual return: $7,500-15,000 (15-30% APY)

The Future of DeFi Yield Farming: What’s Coming Next

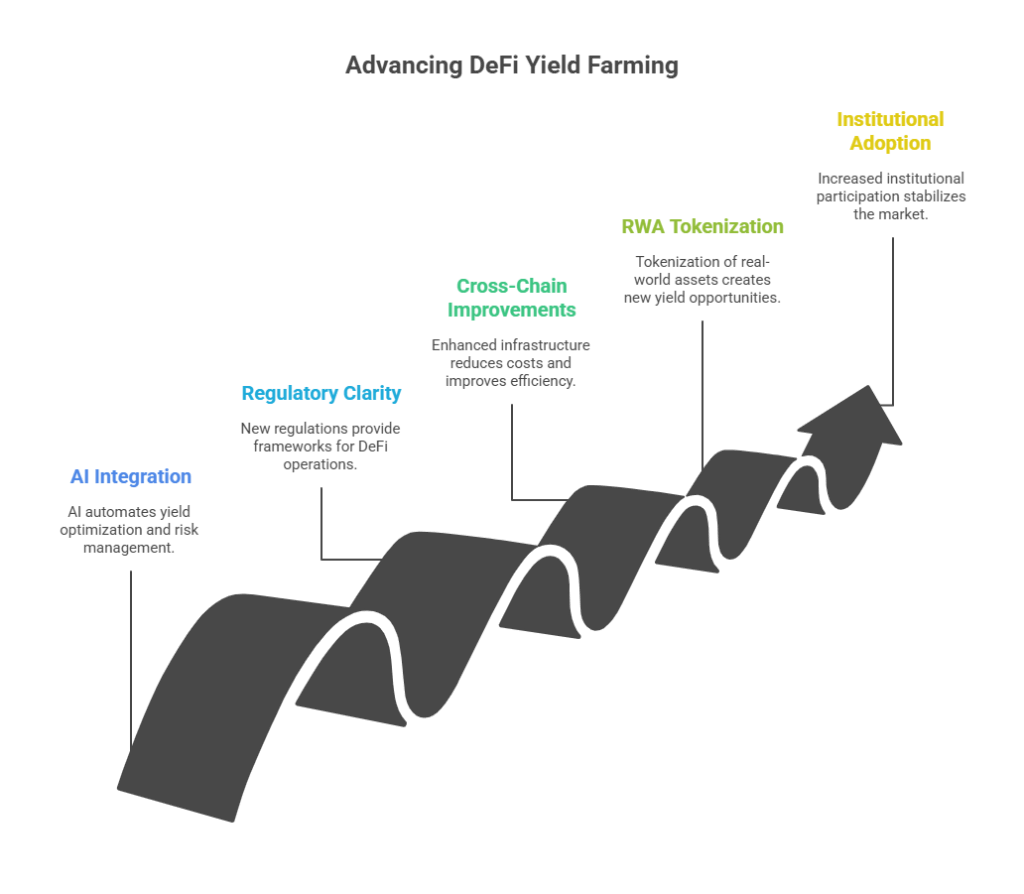

Artificial intelligence integration is revolutionizing yield optimization through automated strategy execution and risk management. Platforms like Yearn Finance and Harvest are implementing AI-driven vault strategies that can automatically migrate capital between protocols based on risk-adjusted return calculations. This technology will likely democratize advanced yield farming strategies, making sophisticated portfolio management accessible to retail investors.

Regulatory developments in 2024-2025 are creating clearer frameworks for DeFi operations, particularly around stablecoin regulations and institutional custody solutions. The approval of spot Bitcoin ETFs has paved the way for potential DeFi-focused investment products, which could bring billions in institutional capital to yield farming protocols. This institutional adoption will likely reduce yields but improve protocol stability and security.

Cross-chain infrastructure improvements through technologies like Polygon’s AggLayer and Ethereum’s future sharding implementation will reduce transaction costs and improve capital efficiency. Layer-2 scaling solutions are already enabling micro-strategies that were previously unprofitable on mainnet, opening yield farming to smaller investors and enabling more sophisticated automated strategies.

The emergence of Real World Asset (RWA) tokenization is creating new yield opportunities backed by traditional financial instruments. Protocols are beginning to offer yields backed by Treasury bills, corporate bonds, and real estate, providing more stable alternatives to crypto-native farming. This trend will likely create a bridge between traditional finance yields and DeFi innovation.

Demographic shifts show increasing institutional adoption, with pension funds and endowments beginning to allocate to DeFi protocols. This “professionalization” of DeFi will likely reduce speculative yields while increasing overall market stability and creating more sustainable long-term opportunities for individual farmers.

DeFi Yield Farming Strategies: Your Most Important Questions Answered

Answering these questions will clarify your DeFi yield farming strategies.

1. How much should I allocate to DeFi yield farming in my portfolio? Conservative investors should limit DeFi exposure to 5-15% of total portfolio value, while aggressive investors comfortable with high volatility may allocate 25-50%. Never exceed what you can afford to lose completely, as smart contract risks always exist regardless of protocol maturity.

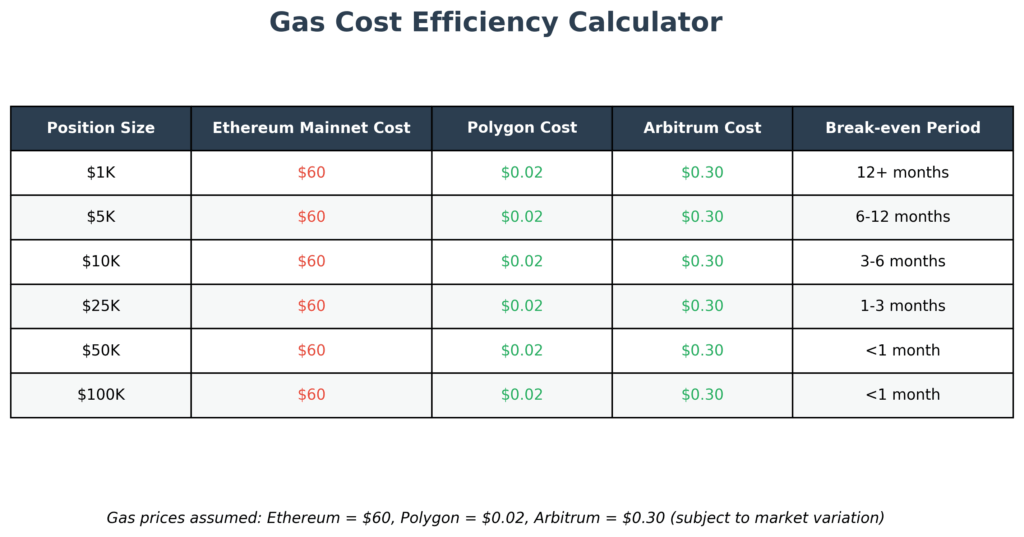

2. What’s the minimum investment needed to get started with DeFi yield farming effectively? $5,000 minimum for basic diversification across 2-3 protocols, though $25,000+ is optimal for gas efficiency on Ethereum mainnet. Consider starting on Layer-2 networks like Polygon or Arbitrum, where $1,000-5,000 can be effective due to lower transaction costs.

3. How do taxes affect DeFi yield farming returns, and what records should I keep? DeFi yields are generally treated as ordinary income at the time of receipt, with additional capital gains/losses when tokens are sold. Maintain detailed records of all transactions, token prices, and farming rewards using tools like Koinly or CoinTracker for accurate tax reporting.

4. When is the best time to enter or exit DeFi yield farming positions? Enter during market downturns when protocols offer higher incentives to attract capital, typically when total value locked (TVL) is declining. Exit when protocols show signs of unsustainable tokenomics, security concerns, or when yields drop below your risk-adjusted return requirements.

5. What are the red flags to avoid when selecting DeFi protocols for yield farming? Avoid protocols with anonymous teams, no audit history, yields above 100% APY without clear economic justification, low liquidity (under $10M TVL), or recent governance token launches without proven utility. Always research tokenomics and ensure yield sources are sustainable.

6. How often should I rebalance my DeFi yield farming positions? Monitor positions weekly but only rebalance when yield differentials exceed 5% after accounting for gas costs. Typically rebalance monthly for major position changes, weekly for minor optimizations on Layer-2 networks where gas costs are minimal.

7. Should I use leverage in DeFi yield farming strategies? Only experienced farmers should consider leverage, starting with a maximum of 1.5x and never on speculative protocols. Leverage amplifies both gains and losses while increasing liquidation risk. Focus on mastering unleveraged Defi yield farming strategies for at least 6-12 months before considering leverage.

8. How do I protect against impermanent loss in liquidity provision strategies? Choose pools with correlated assets (stablecoins or ETH/stETH), use protocols like Bancor with impermanent loss protection, or focus on single-asset lending strategies. Monitor price divergence and consider hedging strategies for volatile asset pairs.

9. What’s the difference between yield farming on Ethereum mainnet versus Layer-2 solutions? Mainnet offers the highest liquidity and most established protocols, but with $50-500 gas costs per transaction. Layer-2 networks (Polygon, Arbitrum, Optimism) provide similar yields with $1-10 transaction costs, making them better for smaller positions and frequent rebalancing strategies.

10. How do I evaluate whether a new DeFi protocol is worth farming or too risky? Assess team transparency, audit history, tokenomics sustainability, total value locked growth trends, and competitive advantages. New protocols should offer a compelling value proposition beyond just high APY. Start with small positions (1-2% of DeFi allocation) until a proven track record emerges.

Conclusion

The most successful DeFi yield farmers understand that consistent 20-25% annual returns through systematic risk management beat chasing speculative 200%+ APY opportunities that typically result in capital loss. With over $80 billion now locked in DeFi protocols and increasing institutional adoption, the farmers who build disciplined, diversified strategies today will be positioned to compound wealth as the ecosystem matures and traditional finance continues its inevitable migration to decentralized infrastructure.

DeFi yield farming represents one of the most significant wealth-building opportunities of the next decade, but only for investors who approach it with the same rigor and systematic thinking they would apply to any serious investment strategy. The protocols are becoming more stable, the regulatory landscape is clarifying, and the infrastructure is scaling – creating an ideal environment for strategic farmers who understand both the opportunities and the risks.

Begin by securing your first $5,000 position across two established protocols this week. The DeFi ecosystem rewards early participants who learn systematically, and every day you delay is another day of potential compound returns lost to procrastination.

For your reference, recently published articles include:

-

-

-

- Crypto Portfolio Management: Tools & Strategies You Must Know

- Financial Disclaimer Protection Made Simple For Beginners

- Financial Advice Disclaimer – What You Must Know

- AI Ghostwriting In Finance: How To Hire The Best

- Automated Portfolio Stress Simulation Made Easy

- Trading Strategy Optimization Mistakes To Avoid Now

-

-

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.