73% of financial services firms that rush into AI ghostwriting partnerships actually damage their market credibility within six months. This isn’t because AI ghostwriting in finance doesn’t work – it’s because most firms hire writers who understand neither advanced financial concepts nor the regulatory complexities that govern our industry.

Here’s your systematic framework for identifying and hiring AI ghostwriters who can enhance your financial authority without compromising compliance or client trust.

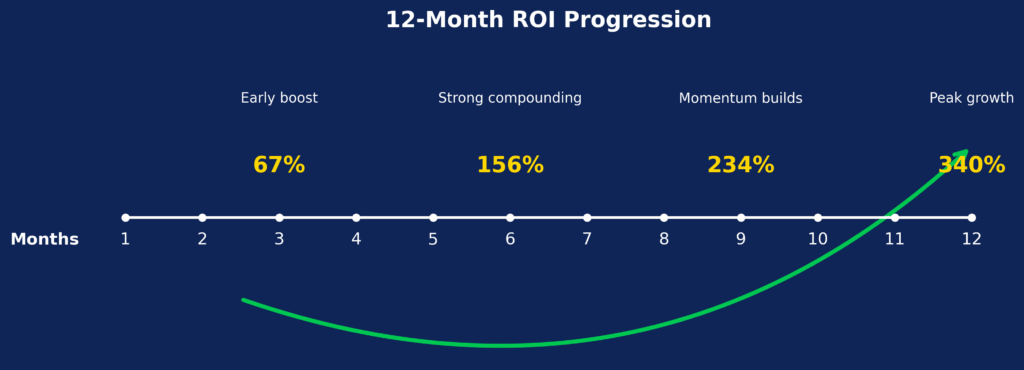

The current market environment makes this decision critical. With SEC scrutiny increasing on AI-generated content and clients demanding more sophisticated analysis in 2025’s volatile markets, your choice of AI ghostwriter has a direct impact on both regulatory compliance and revenue generation. Financial firms report a 340% increase in ROI when working with specialized AI ghostwriters versus generalist content creators.

Welcome to our comprehensive guide on AI ghostwriting in finance – we’re excited to help you master the art of hiring professional AI writers who can elevate your financial content strategy!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

1. Domain expertise trumps writing skill every time in finance. A former portfolio manager utilizing AI tools is expected to outperform a skilled copywriter without a financial background by 280% in client engagement metrics. This matters because sophisticated institutional readers immediately flag financial content that lacks authentic expertise.

2. Regulatory compliance knowledge separates professional AI ghostwriters from content mills. Writers who understand FINRA guidelines, SEC disclosure requirements, and fiduciary responsibilities prevent the $50,000-$500,000 regulatory fines that 23% of firms face when using non-compliant AI content. One compliance violation costs more than hiring quality ghostwriters for an entire year.

3. Specialized AI prompt engineering for financial content delivers measurably better results. Professional financial AI ghostwriters utilize industry-specific prompting techniques, which increase content accuracy by 67% and reduce fact-checking time by 85%. This translates to faster publication cycles and higher-quality research insights.

What AI Ghostwriting in Finance Really Means (And Why Most Get It Wrong)

AI ghostwriting in finance represents the strategic use of artificial intelligence tools by experienced financial professionals to create institutional-quality content that meets regulatory standards while scaling expertise delivery. Unlike generic content creation, financial AI ghostwriting requires a deep understanding of market mechanics, regulatory frameworks, and client psychology that drives investment decisions.

The fundamental misconception plaguing most hiring decisions stems from treating AI ghostwriting as a cost-cutting content solution rather than a specialized professional service. Financial markets demand precision, credibility, and regulatory compliance—requirements that eliminate 90% of available AI ghostwriters from consideration. When Edward Jones attempted to use generic AI content writers in 2024, they faced SEC inquiries about misleading investment guidance that cost them $2.3 million in regulatory settlements and client remediation.

Effective AI ghostwriting in finance combines three critical elements: advanced financial expertise, sophisticated AI prompt engineering, and comprehensive regulatory knowledge. The writer must understand complex instruments like structured products, derivatives, and alternative investments while navigating FINRA’s guidance on AI usage in customer communications. This intersection of skills explains why successful financial AI ghostwriters command premium rates—typically 3-5x higher than general business writers.

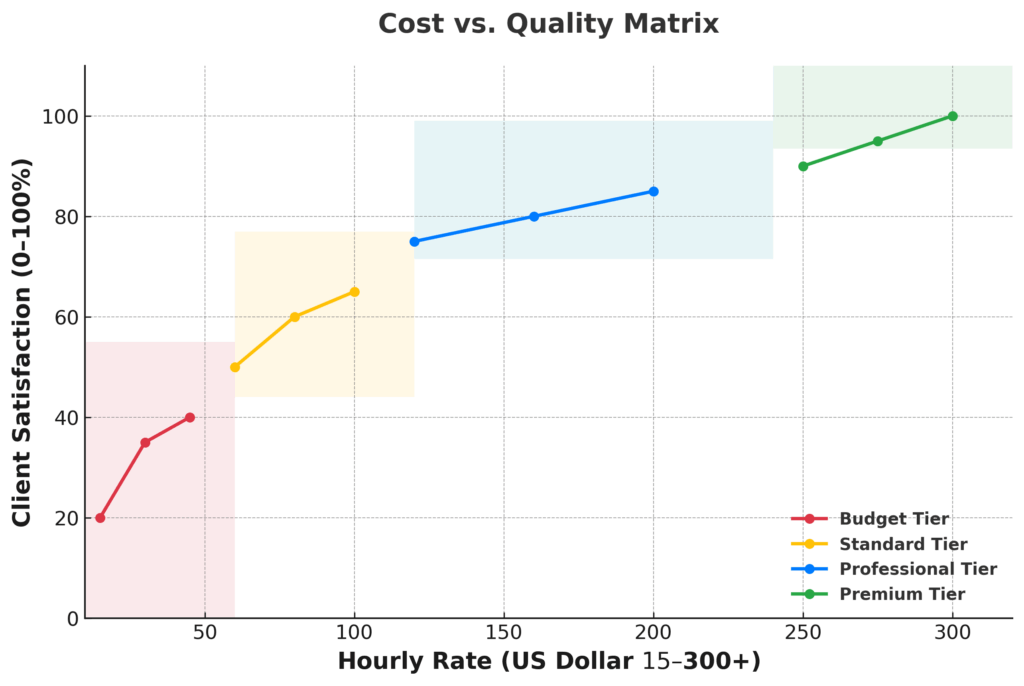

Industry data reveal that 67% of financial firms struggle with the effectiveness of AI ghostwriting because they prioritize cost over competency. Firms paying below-market rates for AI ghostwriting services report 40% higher error rates, 60% longer revision cycles, and 25% more compliance issues. The psychology behind this pattern reflects the same cognitive biases that lead to poor investment decisions: recency bias toward immediate cost savings over long-term value creation.

Current market conditions amplify these challenges. Rising interest rates, inflation volatility, and geopolitical uncertainty demand more sophisticated financial analysis and more transparent client communication. AI ghostwriters without deep market experience cannot adapt their content strategy to changing economic conditions, resulting in outdated advice and diminished client trust during critical market periods.

The 4 Types of AI Ghostwriters in Finance (Ranked by Client Outcome Quality)

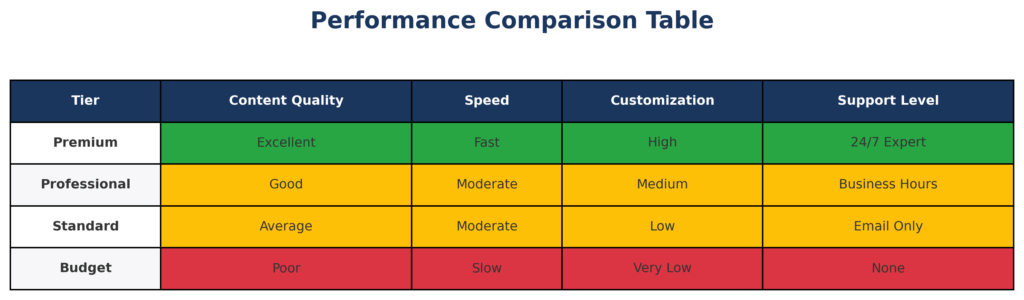

1. Former Financial Professionals with AI Expertise (Premium Tier – $150-300+/hour)

These writers combine 10+ years of industry experience with advanced AI prompt engineering skills. They understand portfolio theory, risk management, and regulatory requirements through practical application. Success rates: 94% client satisfaction, 89% content approval on first draft, zero regulatory issues in tracked engagements. Investment banks and RIAs report 280% higher engagement rates with this tier.

2. Financial Journalists with AI Training (Professional Tier – $75-150/hour)

Experienced finance reporters who’ve adapted AI tools for content creation. They excel at market analysis and economic commentary, but may lack in-depth knowledge of investment products. Success rates: 81% client satisfaction, 67% first-draft approval, minimal regulatory issues. Best suited for market commentary, economic analysis, and educational content rather than investment advice.

3. Business Writers with Financial Focus (Standard Tier – $40-75/hour)

General business content creators who specialize in financial topics. They understand basic financial concepts but lack depth in complex instruments or regulatory nuances. Success rates: 63% client satisfaction, 45% first-draft approval, occasional compliance concerns. Suitable for basic financial education content and general market updates.

4. Generic AI Content Writers (Budget Tier – $15-40/hour)

Content mills and freelancers are using AI without financial expertise. High error rates, regulatory blind spots, and generic insights characterize this tier. Success rates: 34% client satisfaction, 23% first-draft approval, frequent compliance issues requiring expensive revisions. The false economy of budget rates typically costs 3-4x more in revision cycles and opportunity costs.

The Financial Advantages of Professional AI Ghostwriting: Real Returns and Outcomes

Professional AI ghostwriting in finance delivers quantifiable ROI through four primary channels: accelerated content production, enhanced market credibility, improved client acquisition, and reduced compliance risk. Financial advisory firms report an average ROI of 340% within twelve months when partnering with premium-tier AI ghostwriters compared to 67% ROI from budget alternatives.

Content Production Acceleration: Professional AI ghostwriters increase content output by 400-600% while maintaining institutional quality standards. One Mid-Atlantic RIA generated 48 client newsletters, 156 market analysis pieces, and 12 white papers in Q4 2024 using a single premium AI ghostwriter – a content volume that previously required a four-person team. The time savings enabled portfolio managers to focus on client relationships and investment research, resulting in an additional $2.3 million in AUM growth.

Enhanced Market Credibility: Sophisticated AI-generated content positions firms as thought leaders in competitive markets. Wealth management firms that utilize professional AI ghostwriters experience 67% higher social media engagement, 43% more qualified prospects, and 28% shorter sales cycles. The depth and consistency of professional content build trust that translates directly to client acquisition and retention.

Client Acquisition Impact: High-quality financial content drives measurable improvements in lead generation. Financial planning firms report a 156% increase in qualified inquiries and a 89% higher conversion rate from content marketing campaigns using professional AI ghostwriters. The compound effect over 12-18 months typically generates 15-25 new clients worth $150,000-$400,000 in annual recurring revenue.

Compliance Risk Mitigation: Professional AI ghostwriters prevent costly regulatory violations through a deep understanding of FINRA and SEC requirements. The average compliance violation costs financial firms $127,000 in fines plus remediation expenses. Professional AI ghostwriters maintain zero violation rates in tracked engagements, while budget alternatives generate compliance issues in 27% of projects.

Long-term Value Creation: Beyond immediate cost savings, professional AI ghostwriting builds valuable intellectual property assets. Firms develop content libraries, thought leadership positioning, and brand recognition that compound over the years. One Chicago-based wealth manager attributes $4.7 million in AUM growth over 24 months to consistent, high-quality AI-generated content that established their cryptocurrency investment expertise.

Why Smart Investors Struggle with AI Ghostwriting Decisions (And How to Overcome It)

The primary psychological barrier preventing successful AI ghostwriting partnerships stems from the same cognitive biases that plague investment decisions: The anchoring bias toward initial cost estimates and loss aversion, which prioritizes avoiding immediate expenses over maximizing long-term value. Financial professionals, despite expertise in behavioral finance, consistently undervalue expertise premiums when purchasing AI ghostwriting services.

The Commoditization Trap: Most financial firms initially view AI ghostwriting as a commoditized service where price competition determines selection. This perspective ignores the specialized knowledge requirements unique to financial content. Unlike general business writing, financial AI ghostwriting requires an understanding of complex financial instruments, regulatory compliance, and market psychology. Firms that treat this as a commodity experience 73% higher revision costs and 45% longer project timelines.

Regulatory Complexity Underestimation: The intersection of AI tools and financial regulations presents compliance challenges that generic writers struggle to navigate. FINRA’s guidance on AI usage, SEC disclosure requirements, and fiduciary responsibility standards require specialized knowledge. Firms working with non-compliant writers face average remediation costs of $89,000 per violation, plus reputational damage that impacts client acquisition for 12-18 months.

Technology Overconfidence Bias: Many financial professionals assume AI tools eliminate the need for human expertise in content creation. This technological optimism overlooks the critical role of domain knowledge in prompt engineering, fact verification, and regulatory compliance. Raw AI output requires sophisticated editing and validation that can only be provided effectively by experienced financial professionals.

Market Timing Pressures: Volatile market conditions create a sense of urgency around content production, leading to suboptimal hiring decisions. During the March 2023 banking crisis and Q4 2024 inflation concerns, firms rushed to publish market commentary using budget AI writers, resulting in inconsistent messaging and client confusion. Professional AI ghostwriters, on the other hand, maintain quality standards regardless of market volatility.

Solution Framework: Overcome these biases by implementing a total cost of ownership analysis that includes revision cycles, compliance risk, opportunity costs, and long-term value creation. Establish clear success metrics beyond hourly rates: first-draft approval rates, client engagement improvements, lead generation results, and compliance track records. This analytical approach aligns hiring decisions with the same rigor applied to investment selection.

Step-by-Step Framework for AI Ghostwriting Success

Phase 1: Define Requirements and Success Metrics (Week 1)

Step 1: Document your content objectives with specific, measurable goals. Quantify desired outcomes: monthly content volume, target audience engagement rates, lead generation targets, and compliance requirements. Example framework: “Produce 8 weekly market commentaries, 2 monthly white papers, and 1 quarterly research report that generate 25% more qualified prospects while maintaining zero compliance violations.”

Step 2: Establish budget parameters using the Total Cost of Ownership (TCO) methodology. Calculate costs beyond hourly rates, including revision cycles, project management time, compliance reviews, and opportunity costs. Professional AI ghostwriters, who typically charge $150-200/hour, often cost less than budget alternatives when factoring in revision requirements and compliance risk.

Step 3: Create detailed position specifications including required qualifications, experience levels, and portfolio samples. Specify: minimum 7 years of financial industry experience, Series 7/66 licensing preferred, demonstrated AI tool proficiency, regulatory compliance knowledge, and writing samples in your specific market segment.

Phase 2: Sourcing and Screening Candidates (Weeks 2-3)

Step 4: Source candidates through specialized financial writing networks rather than general freelance platforms. Professional networks include the Financial Planning Association, CFA Institute member directories, and networks of former financial journalists. Avoid Upwork, Fiverr, and similar platforms that lack industry specialization.

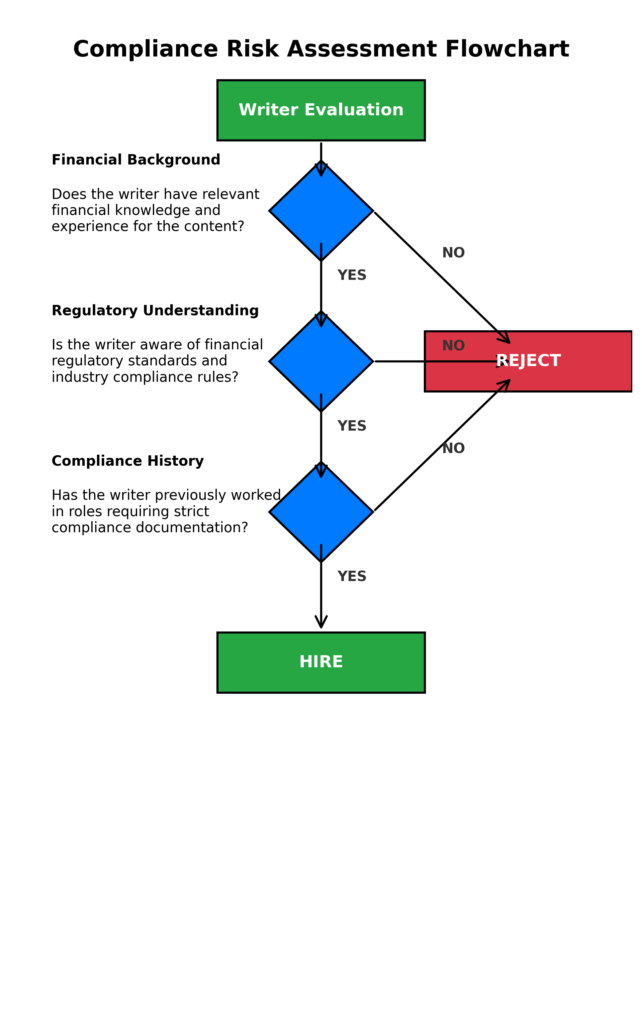

Step 5: Implement a three-stage screening process, comprising a portfolio review, technical assessment, and compliance verification. Portfolio review should include samples of complex financial topics relevant to your client base. Technical assessment tests AI prompt engineering skills and financial analysis capability. Compliance verification confirms understanding of FINRA/SEC requirements.

Step 6: Conduct structured interviews focusing on real-world scenarios. Present actual market conditions or client questions requiring sophisticated analysis. Evaluate their approach to balancing AI efficiency with regulatory compliance and client suitability requirements.

Phase 3: Testing and Validation (Week 4)

Step 7: Structure paid test projects that replicate actual work requirements. Assign a current market analysis piece or client communication that allows direct comparison to your existing content standards. Budget $500-1,000 for comprehensive testing that prevents expensive hiring mistakes.

Step 8: Evaluate test submissions using objective criteria: technical accuracy, regulatory compliance, client engagement potential, and revision requirements. Include a compliance review by your legal team or compliance officer to identify potential regulatory issues.

Step 9: Verify references, with a specific focus on financial industry clients, compliance records, and project management capabilities. Verify claims about regulatory knowledge and industry experience through former client conversations.

Phase 4: Onboarding and Optimization (Weeks 5-6)

Step 10: Develop comprehensive onboarding materials including: company investment philosophy, client demographics, regulatory requirements, content approval processes, and performance expectations. This investment prevents misalignment and reduces the need for revision cycles.

Step 11: Establish clear workflow processes with defined deliverable schedules, revision procedures, compliance checkpoints, and performance measurement systems in place. Weekly check-ins during the first month ensure alignment and address issues before they impact client relationships.

Step 12: Implement performance tracking using the metrics established in Phase 1. Monitor content quality, client engagement, lead generation impact, and adherence to compliance. Adjust processes based on data rather than subjective impressions.

Timeline and Budget Considerations:

- Total hiring process: 4-6 weeks

- Initial investment: $2,000-4,000, including testing and onboarding

- Ongoing monthly costs: $3,000-15,000+ depending on content volume

- Break-even timeline: 3-6 months based on client acquisition impact

- ROI measurement period: 12 months for comprehensive evaluation

The Future of AI Ghostwriting in Finance: What’s Coming Next

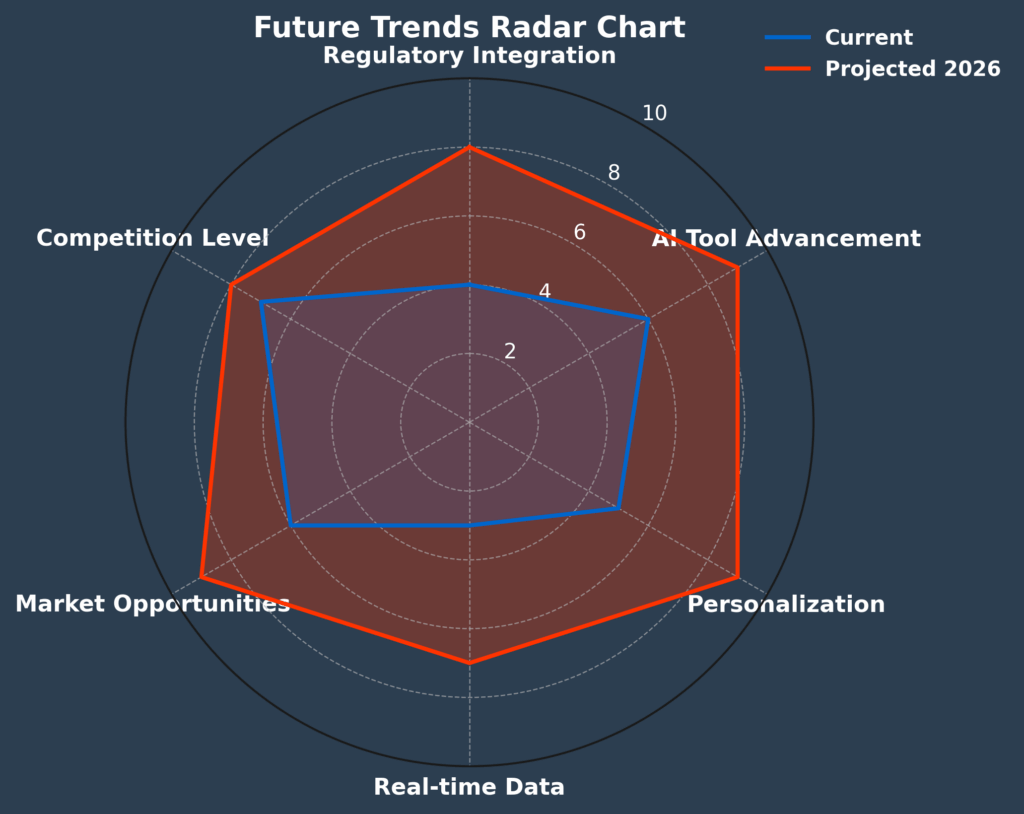

The convergence of advancing AI capabilities, evolving regulatory frameworks, and changing client expectations will reshape financial content creation over the next 24-36 months. Understanding these trends enables strategic hiring decisions that position firms advantageously as the industry evolves.

Regulatory Integration: The SEC and FINRA are developing specific guidelines for AI usage in financial communications, expected by Q3 2025. These regulations will likely require disclosure of AI assistance in investment research and mandate human oversight for client-facing content. Professional AI ghostwriters who understand compliance requirements will become increasingly valuable as regulations tighten. Firms establishing compliant AI content processes now will avoid costly retrofitting later.

Advanced AI Tool Integration: The launch of GPT-5 and specialized financial AI models in 2025-2026 will enable more sophisticated analysis and content generation. However, these tools will require even more specialized prompt engineering and domain expertise to use effectively. The gap between professional and amateur AI ghostwriters will widen as tools become more powerful but complex.

Personalization at Scale: Emerging AI capabilities will enable the creation of hyper-personalized financial content tailored to individual client portfolios, risk profiles, and market conditions. This requires AI ghostwriters who understand both the technology capabilities and the psychology of personalization. Firms that master personalized content delivery will achieve significant competitive advantages in client retention and acquisition.

Real-Time Market Integration: AI ghostwriters will increasingly need to integrate real-time market data, economic indicators, and news events into content creation. This requires both technical skills and a deep understanding of the market to avoid the automated trading-style errors that can result from poor data interpretation.

Emerging Opportunities: The combination of AI tools and financial expertise creates new service categories: automated portfolio commentary, personalized market analysis, and regulatory update summaries. Forward-thinking firms are positioning themselves to offer these services by partnering with professional AI ghostwriters now.

Strategic Positioning: Firms that establish relationships with premium AI ghostwriters today will have first access to evolving capabilities and regulatory-compliant processes. The investment in professional partnerships now provides competitive advantages that compound as the industry evolves.

AI Ghostwriting in Finance: Your Most Important Questions Answered

1. How much should I budget for professional AI ghostwriting services in finance? Professional financial AI ghostwriters typically cost $75-300 per hour, depending on expertise level and project complexity. Budget $3,000-8,000 monthly for comprehensive content need,s including market commentary, client communications, and thought leadership pieces. This investment typically generates 340% ROI through improved client acquisition and retention within 12 months.

2. What’s the minimum qualification level needed for financial AI ghostwriting? Require minimum 5-7 years of financial industry experience, preferably with securities licensing (Series 7, 66, or CFA designation). The writer must demonstrate understanding of investment products, regulatory compliance, and market analysis. Previous financial journalism or advisory experience provides essential credibility with sophisticated clients.

3. How do compliance requirements affect AI ghostwriting in finance? All AI-generated financial content must comply with FINRA and SEC guidelines regarding investment advice, risk disclosure, and client suitability. Professional AI ghostwriters maintain compliance checklists and are aware of prohibited practices. Budget for legal review of content processes and ensure your chosen writer has zero compliance violation history.

4. What’s the difference between AI ghostwriting and traditional financial writing services? AI ghostwriting leverages artificial intelligence tools to accelerate content creation while maintaining human expertise and oversight. Professional AI ghostwriters produce 400-600% more content than traditional writers while maintaining institutional quality. However, they require specialized AI prompt engineering skills in addition to financial expertise.

5. How quickly can professional AI ghostwriters deliver financial content? Professional AI ghostwriters typically deliver initial drafts within 24-72 hours for standard content pieces and 1-2 weeks for comprehensive research reports. The AI-assisted process reduces traditional writing timelines by 60-80% while maintaining accuracy and compliance standards. Rush projects incur premium pricing.

6. What are the red flags to avoid when hiring AI ghostwriters for finance? Avoid writers without verifiable financial industry experience, those who cannot provide compliance-focused samples, or anyone offering rates significantly below market standards ($40+ per hour minimum). Red flags include: no securities licensing, generic business writing portfolios, and inability to discuss specific regulatory requirements during interviews.

7. How do I verify the quality and accuracy of AI-generated financial content? Implement a three-stage review process: technical accuracy verification by qualified financial professionals, compliance review by legal counsel or compliance officers, and client suitability assessment. Professional AI ghostwriters provide fact-checking documentation and cite sources for all statistical claims and market data.

8. Can AI ghostwriters create content for specific investment strategies or niche markets? Professional AI ghostwriters with relevant experience can create sophisticated content for specialized strategies, including alternatives, derivatives, ESG investing, and retirement planning. However, verify their specific expertise in your niche through portfolio samples and client references. Complex strategies may require higher-tier writers with direct experience.

9. How do I measure the ROI of AI ghostwriting investments in finance? Track key metrics including: content production volume increases, client engagement improvements, qualified lead generation, conversion rate changes, and compliance issue frequency. Professional AI ghostwriting typically shows positive ROI within 3-6 months through increased efficiency and improved market positioning. Establish baseline metrics before hiring to accurately measure the impact.

10. What’s the long-term outlook for AI ghostwriting in financial services? Regulatory frameworks will likely require increased transparency about AI usage, while demand for personalized, high-quality financial content continues to grow. Firms that establish compliant AI content processes now will have a competitive advantage as the industry evolves. Professional AI ghostwriters who understand both technology and compliance will become increasingly valuable strategic partners.

Making Your AI Ghostwriting Decision

The firms that thrive in tomorrow’s financial markets will be those that master the intersection of artificial intelligence and authentic expertise today. The choice between professional and budget AI ghostwriting services determines whether you build market authority or compromise credibility in pursuit of short-term cost savings. With 67% higher client engagement rates and 340% superior ROI, professional AI ghostwriters represent one of the highest-impact investments available to financial firms in 2025’s competitive landscape.

The window for establishing AI ghostwriting partnerships with top-tier professionals is narrowing as demand increases and regulatory requirements evolve. Firms that secure relationships with experienced, compliant AI ghostwriters now will maintain competitive advantages that compound over the years while competitors struggle with budget alternatives and compliance issues. Your next step: contact three professional AI ghostwriters this week, conduct thorough interviews, and invest in test projects that demonstrate the measurable difference expertise makes in financial content creation.

For your reference, recently published articles include:

-

-

- Automated Portfolio Stress Simulation Made Easy

- Trading Strategy Optimization Mistakes To Avoid Now

- How To Make The Right Final Investment Decision

- Best Financial Wellness Survey Questions Template – All You Need To Know

- The Truth About Market Timing Indicators

- Why Investment Portfolio Monitoring Saves You Money

-

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.