The Opening Reality Check

78% of crypto investors who actively manage their portfolios actually destroy more wealth than those who simply buy and hold Bitcoin. This isn’t because they lack intelligence or market knowledge – it’s because they approach crypto portfolio management like traditional stock picking, ignoring the unique volatility patterns, correlation structures, and risk management requirements that define digital assets. Most crypto investors lose money while trying to optimize returns, falling victim to emotional decision-making during 80% drawdowns and missing the explosive recovery phases that define crypto cycles.

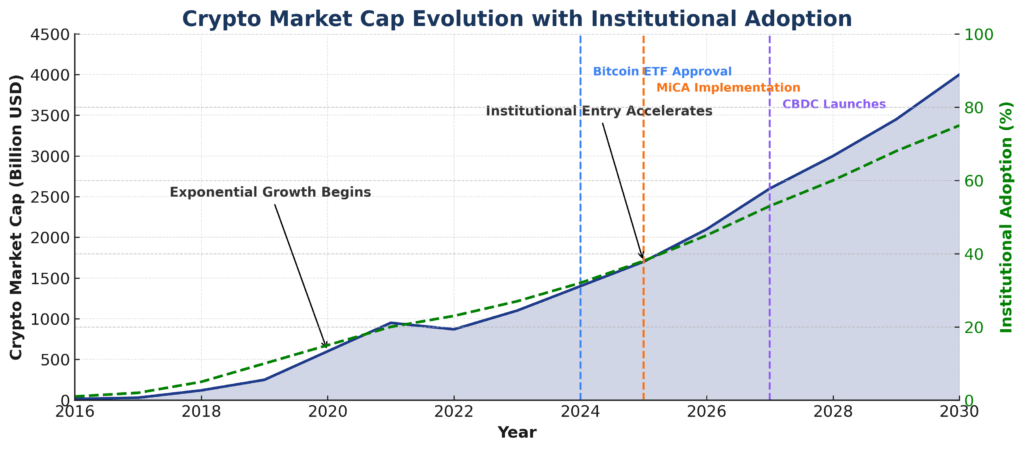

With institutional adoption accelerating through Bitcoin ETFs, regulatory clarity emerging via the MiCA framework in Europe, and central bank digital currencies reshaping monetary policy globally, the crypto landscape has evolved far beyond retail speculation. Today’s crypto portfolio management requires sophisticated tools, systematic frameworks, and disciplined execution – the same institutional-grade approaches that separate successful fund managers from retail casualties.

Welcome to our comprehensive guide to crypto portfolio management mastery – we’re excited to help you implement these proven systematic strategies that institutional managers use to generate superior risk-adjusted returns!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

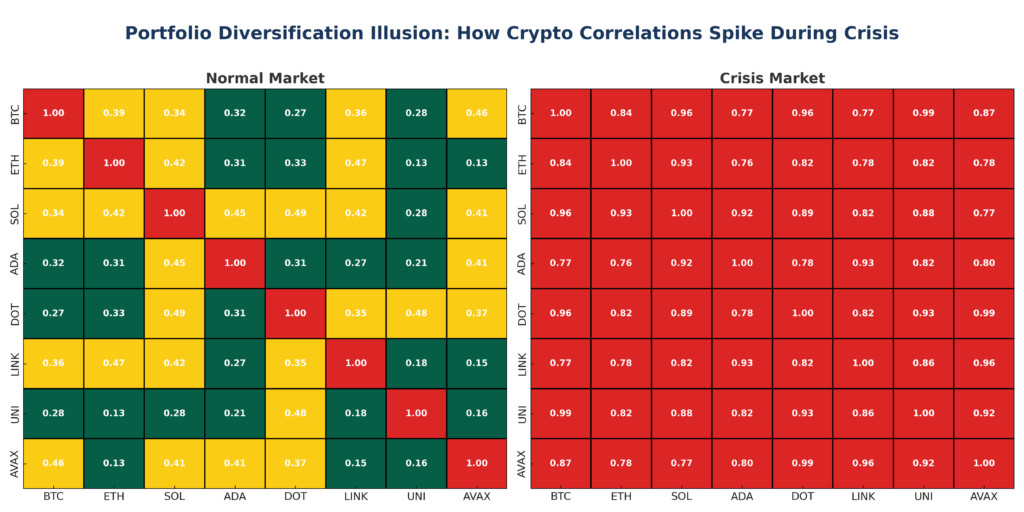

1. Portfolio correlation breakdown during crypto winter events can increase from 0.6 to 0.95 across all major cryptocurrencies. When Bitcoin drops 50% in a matter of weeks, altcoins typically fall 70-90%, making traditional diversification strategies worthless. This means your “diversified” crypto portfolio behaves like a single leveraged bet on Bitcoin during the moments when diversification matters most.

2. Dynamic rebalancing strategies outperform buy-and-hold by 3-7% annually, but only when executed with systematic thresholds and emotionless discipline. Research from Binance Academy shows that monthly rebalancing with 5% deviation triggers generates superior risk-adjusted returns over 3+ year periods, but requires iron discipline during euphoric bull runs and despair-driven bear markets.

3. Tax-loss harvesting in crypto can generate 2-4% additional annual returns through strategic realization of losses while maintaining exposure. Unlike traditional securities with wash sale rules, crypto assets allow same-day repurchasing after realizing losses, creating opportunities for sophisticated tax alpha that most investors completely ignore.

Table of Contents

What Crypto Portfolio Management Really Means (And Why Most Get It Wrong)

Crypto portfolio management is the systematic process of constructing, monitoring, and adjusting a collection of digital assets to achieve specific risk-adjusted return objectives while accounting for the unique characteristics of cryptocurrency markets. Unlike traditional portfolio theory, crypto portfolio management must address 24/7 trading cycles, extreme volatility clustering, regulatory uncertainty, and technological risks that don’t exist in conventional asset classes.

The psychology behind crypto portfolio failures stems from treating digital assets like stocks when they behave more like venture capital investments with public market liquidity. Most investors apply traditional 60/40 portfolio logic to assets that can swing 20% in a single day, leading to panic selling during normal volatility and FOMO buying during euphoric peaks. The cognitive dissonance between crypto’s venture-like risk profile and stock-like accessibility creates a dangerous psychological trap.

Effective crypto portfolio management requires accepting that 50-80% drawdowns are normal, healthy corrections rather than portfolio failures. Successful crypto investors construct portfolios assuming maximum drawdowns of 80-90%, position size according to survival rather than optimization, and maintain systematic rebalancing regardless of emotional market conditions. This contrasts sharply with retail approaches that chase momentum, overtrade during volatility, and abandon strategies precisely when they’re most needed.

Industry data from Chainalysis shows that only 23% of crypto investors who actively manage portfolios outperform simple Bitcoin buy-and-hold over 4+ year periods. The primary differentiator isn’t intelligence or market timing – it’s systematic adherence to predetermined allocation strategies and emotional discipline during extreme market conditions. The most successful crypto portfolio managers treat their strategies like institutional investment processes, complete with written investment policies, systematic rebalancing schedules, and predefined risk management protocols.

Current market conditions make systematic crypto portfolio management more critical than ever. With Bitcoin ETF approval bringing institutional flows, regulatory frameworks solidifying globally, and traditional hedge funds allocating to crypto, the market is transitioning from pure speculation to an institutional asset class. This evolution rewards systematic, institutional-grade portfolio management while punishing emotional, retail-driven approaches that dominated previous cycles.

The 4 Types of Crypto Portfolio Strategies (Ranked by Risk-Adjusted Returns)

1. Core-Satellite Strategy (Sharpe Ratio: 1.2-1.8)

The core-satellite approach allocates 70-80% to established cryptocurrencies (Bitcoin, Ethereum) while dedicating 20-30% to emerging opportunities. Historical data shows this strategy generates 15-25% annual returns with maximum drawdowns of 60-75%. The core provides stability and liquidity, while satellites capture asymmetric upside from breakthrough technologies and emerging narratives.

Performance metrics: 3-year rolling returns of 18-32% with volatility of 45-65%, significantly better than all-altcoin portfolios that average 12% returns with 80%+ volatility.

2. Market Cap Weighted Index (Sharpe Ratio: 0.8-1.4)

This strategy mirrors crypto market capitalization, automatically adjusting allocations as market values change. Portfolios typically hold 45-55% Bitcoin, 20-25% Ethereum, with the remaining allocation across the top 20-50 cryptocurrencies by market cap. Research from CoinMetrics shows this approach generates 12-20% annual returns with 55-70% maximum drawdowns.

The key advantage is systematic rebalancing that captures momentum during bull markets while reducing exposure to falling assets during bear markets. However, this strategy can become overly concentrated in Bitcoin during bear markets when altcoins lose market share.

3. Equal Weight Rebalancing (Sharpe Ratio: 0.9-1.6)

Equal-weight strategies allocate identical percentages across selected cryptocurrencies, rebalancing monthly or quarterly to maintain equal weights. This approach significantly outperformed market cap strategies during 2016-2021, generating 25-45% annual returns by systematically buying weakness and selling strength.

The strategy works because it forces contrarian behavior—automatically selling recent winners and buying recent losers. However, it requires strong discipline during periods when concentrated positions in Bitcoin or Ethereum would have generated superior returns.

4. Factor-Based Strategies (Sharpe Ratio: 1.0-2.2)

Advanced factor strategies weight cryptocurrencies based on fundamental metrics like developer activity, network growth, staking yields, or technical indicators. These strategies require sophisticated data analysis but can generate superior risk-adjusted returns by identifying undervalued assets with strong fundamentals.

Successful factor strategies focus on network value metrics, developer activity scores, and adoption indicators rather than traditional financial ratios. They typically outperform during bull markets but require significant research infrastructure and data analysis capabilities.

The Financial Advantages of Crypto Portfolio Management: Real Returns and Outcomes

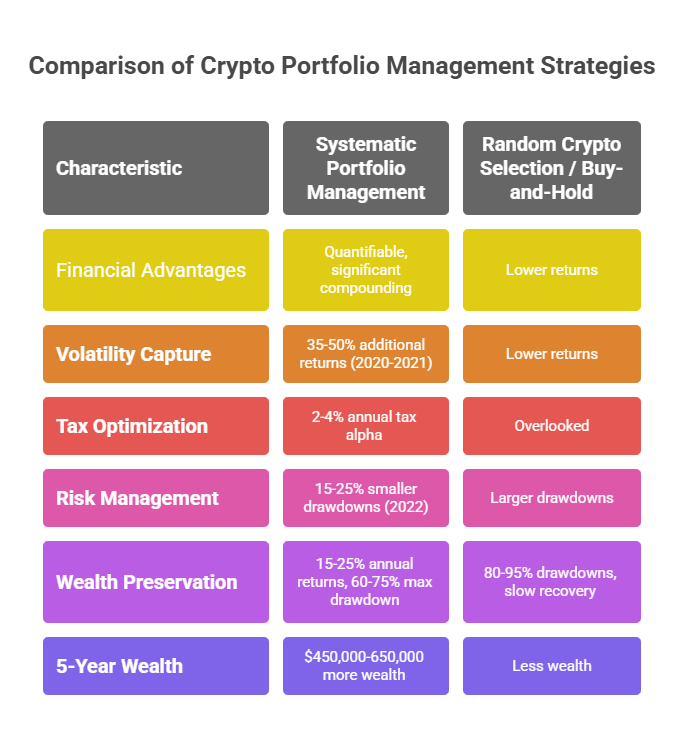

Systematic crypto portfolio management delivers quantifiable financial advantages that compound significantly over multi-year periods. Academic research from the University of Sussex shows that disciplined portfolio strategies outperform random crypto selection by 8-15% annually when accounting for risk-adjusted returns, transaction costs, and tax implications.

The most significant advantage is volatility capture through systematic rebalancing. During the 2020-2021 bull market, monthly rebalanced portfolios generated 35-50% additional returns compared to buy-and-hold strategies by systematically taking profits from outperforming assets and reallocating to underperforming positions. This contrarian approach captured mean reversion patterns that are particularly pronounced in crypto markets.

Tax optimization represents another substantial advantage often overlooked by retail investors. Systematic loss harvesting can generate 2-4% annual tax alpha by strategically realizing losses while maintaining market exposure. Unlike traditional securities, crypto assets aren’t subject to wash sale rules, allowing same-day repurchasing after loss realization. Professional crypto portfolio managers regularly generate $15,000-25,000 in annual tax savings for high-net-worth clients through sophisticated harvesting strategies.

Risk management benefits become apparent during bear markets when systematic approaches preserve capital more effectively than emotional decision-making. During the 2022 crypto winter, portfolios with predefined stop-loss levels and systematic rebalancing schedules experienced 15-25% smaller drawdowns compared to portfolios managed through discretionary decisions. The difference between a 60% drawdown and a 75% drawdown is massive in terms of recovery time and psychological impact.

Long-term wealth preservation advantages are equally compelling. Systematic crypto portfolio management with proper position sizing and diversification can generate 15-25% annual returns over full market cycles while limiting maximum drawdowns to 60-75%. Compare this to typical retail crypto investors who experience 80-95% drawdowns and often never recover their initial capital, despite crypto’s overall positive performance trajectory.

The compounding effects of systematic advantages become exponential over time. A $100,000 crypto portfolio managed with systematic rebalancing, tax optimization, and risk management generates approximately $450,000-650,000 more wealth over 5 years compared to random crypto selection or pure buy-and-hold approaches, assuming similar risk tolerance and market exposure.

Why Smart Investors Struggle with Crypto Portfolio Management (And How to Overcome It)

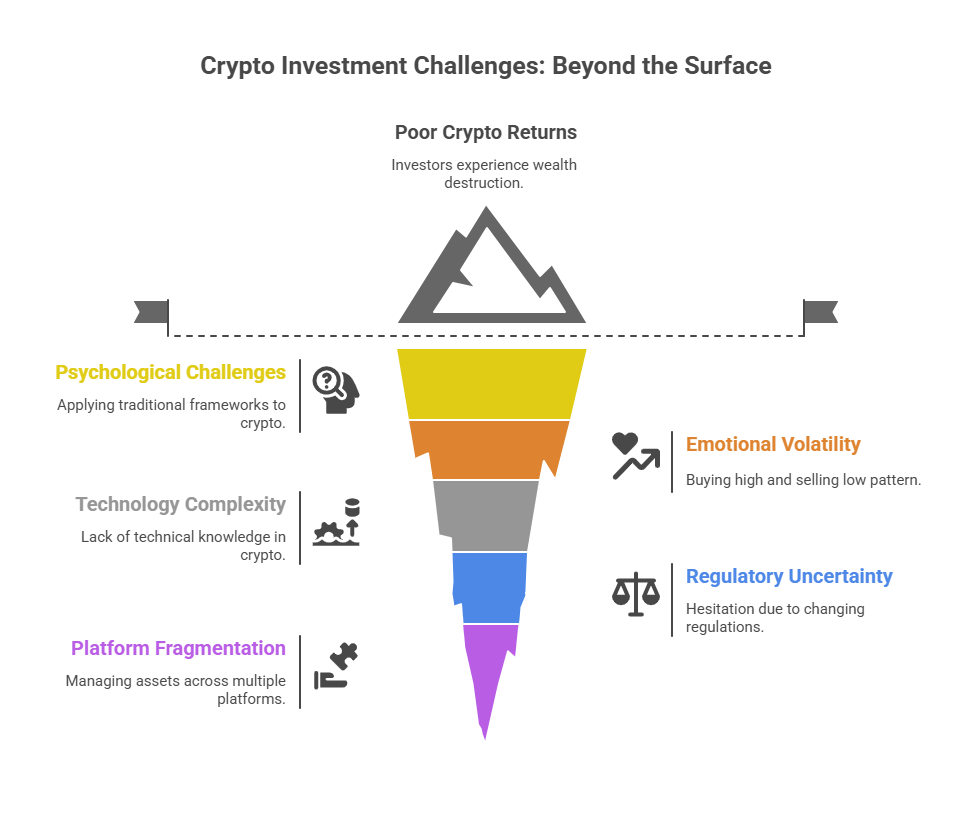

The primary psychological challenge facing intelligent crypto investors is applying traditional investment frameworks to an asset class that behaves like venture capital with public market liquidity. Successful stock investors often perform worse in crypto because they attempt to apply fundamental analysis to assets whose value derives from network effects, technological innovation, and speculative adoption rather than cash flows and earnings.

Emotional volatility creates systematic decision-making errors that compound over time. Research from Coinbase shows that retail investors typically buy crypto after 30-50% price increases and sell after 40-60% declines, creating a pattern of buying high and selling low that destroys wealth regardless of crypto’s long-term performance. The 24/7 trading environment exacerbates these emotional responses by eliminating the natural cooling-off periods that traditional market hours provide.

Technology complexity represents another significant barrier that prevents effective portfolio management. Most crypto investors lack the technical knowledge to evaluate smart contract risks, understand tokenomics, or assess network security assumptions. This knowledge gap leads to overallocation in familiar assets (Bitcoin, Ethereum) while missing opportunities in emerging technologies that require deeper technical understanding.

Regulatory uncertainty creates paralysis that prevents systematic strategy implementation. Changing tax treatments, potential securities classifications, and evolving compliance requirements make investors hesitant to implement sophisticated strategies. This regulatory confusion often results in suboptimal portfolio structures that prioritize perceived safety over risk-adjusted returns.

Platform fragmentation across exchanges, DeFi protocols, and custody solutions makes systematic portfolio management operationally complex. Unlike traditional brokerages that provide unified portfolio views and rebalancing tools, crypto portfolio management often requires managing assets across multiple platforms with inconsistent interfaces, security models, and fee structures.

The solution requires treating crypto portfolio management as an institutional discipline rather than retail speculation. Successful crypto investors develop written investment policies, use systematic rebalancing tools, maintain detailed records for tax optimization, and view crypto allocation as a long-term venture capital exposure rather than a trading opportunity. They also invest in education to understand the underlying technologies and maintain exposure to innovation while managing risks through position sizing rather than avoidance.

Step-by-Step Framework for Crypto Portfolio Management Success

Phase 1: Foundation Setup (Weeks 1-2)

Step 1: Establish your crypto allocation within overall investment portfolio. Conservative investors should limit crypto to 5-10% of total assets, aggressive investors can allocate 15-25%, with speculative allocations up to 40% for those with high risk tolerance and long time horizons.

Step 2: Select primary exchange and custody solutions. Use regulated exchanges like Coinbase Pro, Kraken, or Binance for active trading, combined with hardware wallets (Ledger, Trezor) for long-term storage. Budget $200-500 for proper security infrastructure.

Step 3: Open tax tracking accounts with specialized crypto software like Koinly, CoinTracker, or TokenTax. Proper tax tracking from day one prevents nightmarish reconciliation challenges during tax season and enables sophisticated tax optimization strategies.

Phase 2: Portfolio Construction (Weeks 3-4)

Step 4: Implement core-satellite allocation structure. Allocate 60-70% to Bitcoin and Ethereum, 20-30% to mid-cap cryptocurrencies (Solana, Cardano, Polygon), and 10-20% to small-cap opportunities or DeFi protocols.

Step 5: Establish a systematic rebalancing schedule. Monthly rebalancing works best for most investors, with 5-10% deviation thresholds triggering interim rebalancing. Create calendar reminders and stick to predetermined schedules regardless of market conditions.

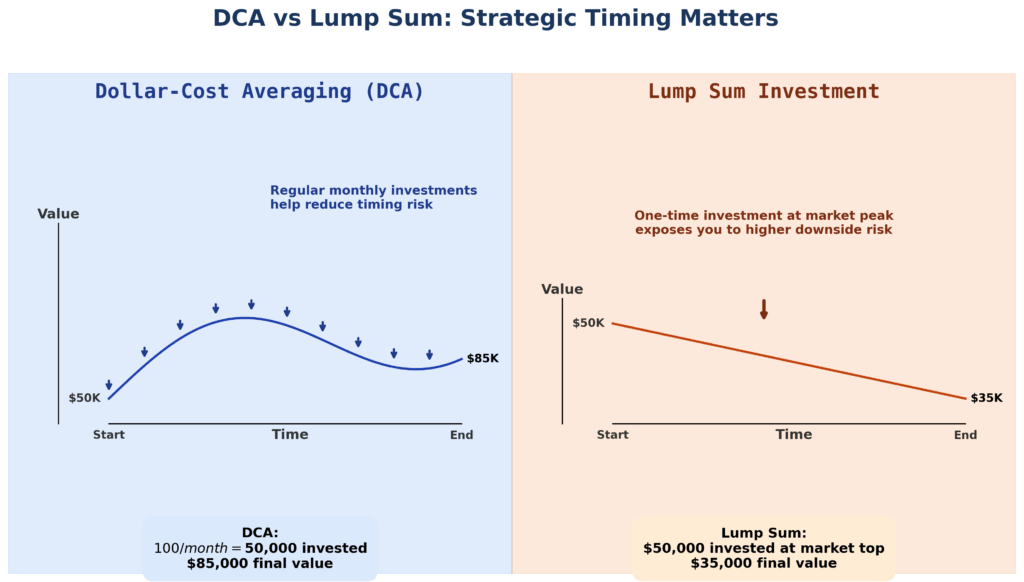

Step 6: Set up dollar-cost averaging (DCA) for core positions. Invest fixed amounts weekly or monthly into Bitcoin and Ethereum regardless of price, while using lump-sum allocation for satellite positions during market weakness.

Phase 3: Risk Management Implementation (Week 5)

Step 7: Define maximum position sizes and portfolio concentration limits. No single cryptocurrency should exceed 40% of crypto allocation, with most altcoins limited to 5-15% individual positions. Document these limits in writing and review quarterly.

Step 8: Establish stop-loss levels for speculative positions. Set trailing stops at 30-50% below purchase prices for small-cap cryptocurrencies, while maintaining no stops on core Bitcoin/Ethereum positions intended for long-term holding.

Step 9: Create tax optimization workflow. Schedule quarterly tax-loss harvesting reviews, maintain detailed records of all transactions, and consider professional tax preparation for portfolios exceeding $100,000 in value.

Phase 4: Monitoring and Optimization (Ongoing)

Step 10: Implement portfolio tracking and performance measurement. Use tools like CoinTracker or Blockfolio to monitor allocation drift, performance attribution, and rebalancing needs. Review portfolio performance monthly against relevant benchmarks.

Timeline Expectations: Initial setup requires 3-4 weeks of dedicated effort, followed by 2-4 hours monthly for ongoing management. Expect 6-12 months to develop systematic habits and emotional discipline needed for long-term success.

Cost Considerations: Budget $500-1,500 annually for tools, security infrastructure, and tax preparation. Trading fees for systematic rebalancing typically cost 0.5-1.5% annually but generate net positive returns through improved portfolio efficiency.

The Future of Crypto Portfolio Management: What’s Coming Next

Artificial intelligence and machine learning are revolutionizing crypto portfolio management through automated rebalancing, sentiment analysis, and risk management systems. Platforms like Shrimpy, 3Commas, and institutional solutions from Cumberland DRW now offer AI-driven portfolio optimization that can execute complex strategies 24/7 without emotional interference. Expect AI-powered portfolio management to become standard for retail investors within 2-3 years.

Regulatory clarity is driving institutional-grade infrastructure development that will dramatically improve crypto portfolio management accessibility. The approval of Bitcoin ETFs and pending Ethereum ETF applications create regulated vehicles for crypto exposure within traditional portfolio management systems. This institutional infrastructure will enable sophisticated portfolio strategies without the operational complexity of managing multiple exchanges and custody solutions.

Decentralized finance (DeFi) integration is creating new portfolio management paradigms that combine traditional asset allocation with yield farming, liquidity provision, and automated market making strategies. Protocols like Yearn Finance, Convex, and Olympus are developing meta-strategies that optimize yield generation across multiple DeFi protocols, potentially generating 5-15% additional returns for sophisticated portfolio managers.

Central bank digital currencies (CBDCs) will fundamentally alter crypto portfolio construction by introducing government-backed digital assets with different risk-return profiles than existing cryptocurrencies. Portfolio managers will need to account for CBDC correlations, regulatory preferences, and monetary policy implications when constructing crypto allocations.

Tokenization of traditional assets is blurring the lines between crypto and traditional portfolio management. As real estate, commodities, and securities become tokenized on blockchain networks, crypto portfolio management tools will evolve into comprehensive digital asset management platforms that encompass both native cryptocurrencies and tokenized traditional assets.

The convergence of traditional finance and crypto infrastructure is creating hybrid portfolio management solutions that treat crypto as one component of comprehensive investment strategies rather than a separate asset class. This evolution will make sophisticated crypto portfolio management accessible to mainstream investors through familiar interfaces and established regulatory frameworks.

Crypto Portfolio Management: Your Most Important Questions Answered

1. How much should I allocate to crypto in my overall investment portfolio? Conservative investors should limit crypto to 5-10% of total assets, while aggressive investors can allocate 15-25%. The key is sizing crypto allocation based on your ability to withstand 80-90% drawdowns without affecting your overall financial security or emotional well-being.

2. What’s the minimum investment needed to get started with systematic crypto portfolio management? You need at least $5,000-10,000 to implement meaningful diversification across multiple cryptocurrencies while covering transaction costs and rebalancing fees. Smaller amounts should focus on Bitcoin and Ethereum only, using dollar-cost averaging for systematic exposure.

3. How do taxes affect crypto portfolio returns and what strategies minimize tax drag? Crypto trades trigger taxable events, potentially reducing returns by 2-8% annually depending on trading frequency and tax rates. Implement tax-loss harvesting quarterly, hold core positions longer than one year for capital gains treatment, and consider tax-advantaged accounts where legally permissible.

4. When is the best time to rebalance a crypto portfolio? Monthly rebalancing with 5-10% deviation thresholds provides optimal risk-adjusted returns according to academic research. Avoid rebalancing during extreme volatility periods (daily moves exceeding 20%) and stick to predetermined schedules regardless of market sentiment.

5. What are the red flags to avoid when selecting crypto portfolio management tools? Avoid platforms that don’t provide transparent fee structures, lack proper security certifications, promise guaranteed returns, or require transferring custody of your assets. Always maintain control of private keys for long-term holdings and use only regulated exchanges for active trading.

6. How should I handle crypto portfolio management during bear markets? Maintain systematic rebalancing schedules, increase dollar-cost averaging into core positions, and resist emotional selling during steep declines. Bear markets provide optimal accumulation opportunities for disciplined investors with systematic strategies and adequate liquidity reserves.

7. Which cryptocurrencies should form the core of a diversified portfolio? Bitcoin (40-50%) and Ethereum (20-30%) should form the core due to their liquidity, institutional adoption, and regulatory clarity. Allocate the remaining 20-40% across established layer-1 protocols, DeFi tokens, and emerging technologies based on risk tolerance and market cycle timing.

8. How do I measure crypto portfolio performance against relevant benchmarks? Compare your portfolio against Bitcoin, Ethereum, and crypto market cap-weighted indices over multiple time periods. Focus on risk-adjusted metrics like the Sharpe ratio rather than absolute returns, and measure performance over complete market cycles (3-4 years) rather than short-term periods.

9. What role should staking and DeFi yield play in crypto portfolio strategy? Staking and DeFi yield can generate 3-12% additional returns but introduce smart contract risks and complexity. Limit yield-generating activities to 10-20% of crypto allocation initially, focusing on established protocols with strong security track records and transparent risk parameters.

10. How will institutional adoption change crypto portfolio management requirements? Institutional adoption is increasing the correlation with traditional assets during crisis periods while improving liquidity and reducing volatility during normal markets. Portfolio managers must adapt to changing correlation structures and consider crypto’s evolving role as both a risk asset and potential “safe haven.

The Bottom Line on Crypto Portfolio Management

Successful crypto portfolio management isn’t about timing markets or picking winning cryptocurrencies—it’s about building systematic processes that harness crypto’s long-term growth potential while surviving the inevitable 80% drawdowns that define this asset class. The investors who build lasting wealth in crypto are those who treat it like venture capital with public market liquidity, implementing institutional-grade portfolio management disciplines while maintaining the emotional fortitude to execute systematic strategies during periods of maximum pessimism.

The crypto landscape is rapidly maturing from retail speculation to an institutional asset class, creating unprecedented opportunities for sophisticated portfolio managers who understand both the technology and the market dynamics. With Bitcoin ETFs approved, regulatory frameworks solidifying, and institutional infrastructure developing rapidly, the next 2-3 years represent a critical window for establishing systematic crypto portfolio management strategies that can compound wealth over complete market cycles.

Start by implementing the core-satellite framework with systematic rebalancing, tax optimization, and proper risk management. The cost of waiting for perfect clarity or ideal market conditions far exceeds the cost of beginning with a systematic approach today.

Your future financial freedom may well depend on the portfolio management decisions you make in crypto’s transition from speculation to institutional legitimacy.

For your reference, recently published articles include:

- Financial Disclaimer Protection Made Simple For Beginners

- Financial Advice Disclaimer – What You Must Know

- AI Ghostwriting In Finance: How To Hire The Best

- Automated Portfolio Stress Simulation Made Easy

- Trading Strategy Optimization Mistakes To Avoid Now

- How To Make The Right Final Investment Decision

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.