A risk tolerance questionnaire serves as the foundation for sound investment decision-making, helping investors identify their comfort level with market volatility and potential losses.

In today’s complex financial landscape, where investment options range from conservative bonds to volatile cryptocurrencies, selecting the best risk tolerance questionnaire has become crucial for building portfolios that align with individual financial goals and psychological comfort zones.

The right questionnaire can mean the difference between a well-balanced investment strategy and costly emotional decisions during market downturns. Welcome to our comprehensive guide on choosing the best risk tolerance questionnaire – we’re excited to help you master this essential investment planning tool!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

1. Comprehensive Assessment Beyond Simple Questions: The best risk tolerance questionnaires evaluate multiple dimensions including financial capacity, investment timeline, and emotional responses to market volatility. For example, Vanguard’s questionnaire considers both an investor’s ability to absorb losses (financial capacity) and their willingness to accept risk (psychological comfort), leading to more accurate risk profiles than single-dimension assessments.

2. Validation Through Behavioral Science: Top-tier questionnaires incorporate behavioral finance principles and have been validated through academic research. FinaMetrica’s questionnaire, used by over 150,000 financial advisors globally, demonstrates 85% consistency in retesting scenarios and correlates strongly with actual investor behavior during market stress periods.

3. Dynamic and Contextual Adaptation: The most effective risk tolerance tools adapt questions based on investor demographics and life circumstances. For instance, a 30-year-old with stable income receives different scenario-based questions than a 55-year-old approaching retirement, ensuring more relevant and accurate risk profiling.

Understanding Risk Tolerance Questionnaires

Risk tolerance represents an investor’s capacity and willingness to endure potential losses in pursuit of investment returns. A risk tolerance questionnaire systematically measures this psychological and financial characteristic through structured questions that evaluate various aspects of an investor’s financial situation, investment experience, and emotional responses to market scenarios.

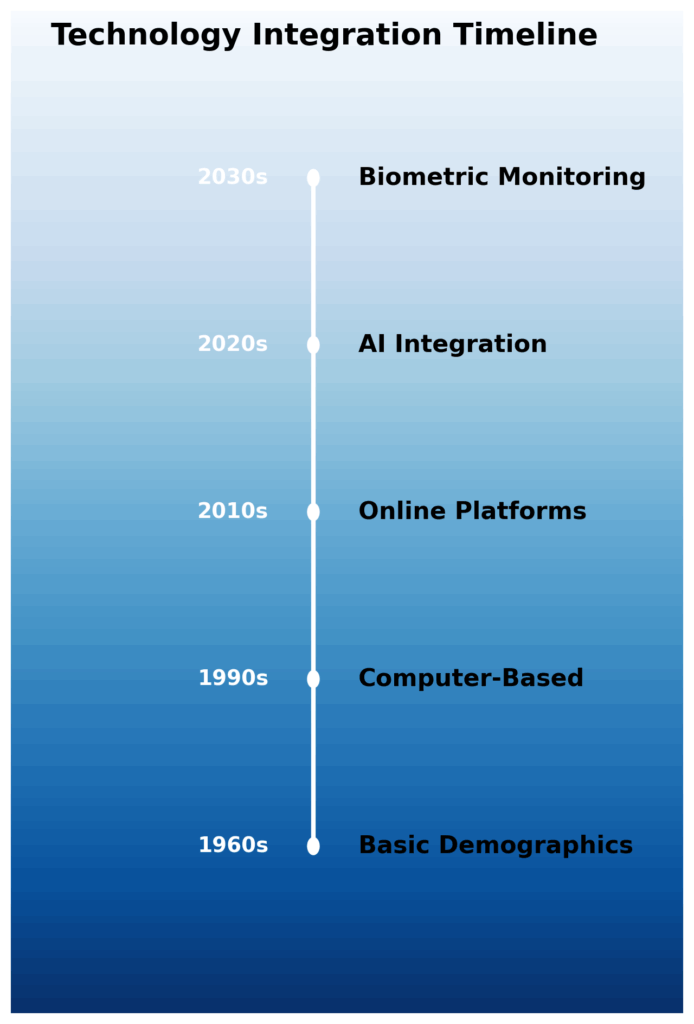

The concept emerged in the 1960s as modern portfolio theory gained prominence, with Harry Markowitz’s work on portfolio optimization highlighting the importance of understanding investor preferences. Traditional questionnaires focused primarily on demographic factors and simple preference questions, but contemporary tools have evolved to incorporate sophisticated behavioral finance insights and multi-dimensional assessment frameworks.

Financial capacity and risk tolerance represent two distinct but interconnected concepts. Financial capacity refers to an investor’s objective ability to absorb losses based on income, assets, and financial obligations, while risk tolerance reflects their subjective comfort level with uncertainty and potential losses. The best questionnaires evaluate both dimensions to create comprehensive risk profiles.

Modern risk tolerance assessment recognizes that investor preferences can change based on market conditions, life events, and experience. Research by Grable and Lytton demonstrates that risk tolerance exhibits both stable personality-based components and dynamic situational elements, making regular reassessment crucial for maintaining appropriate investment strategies.

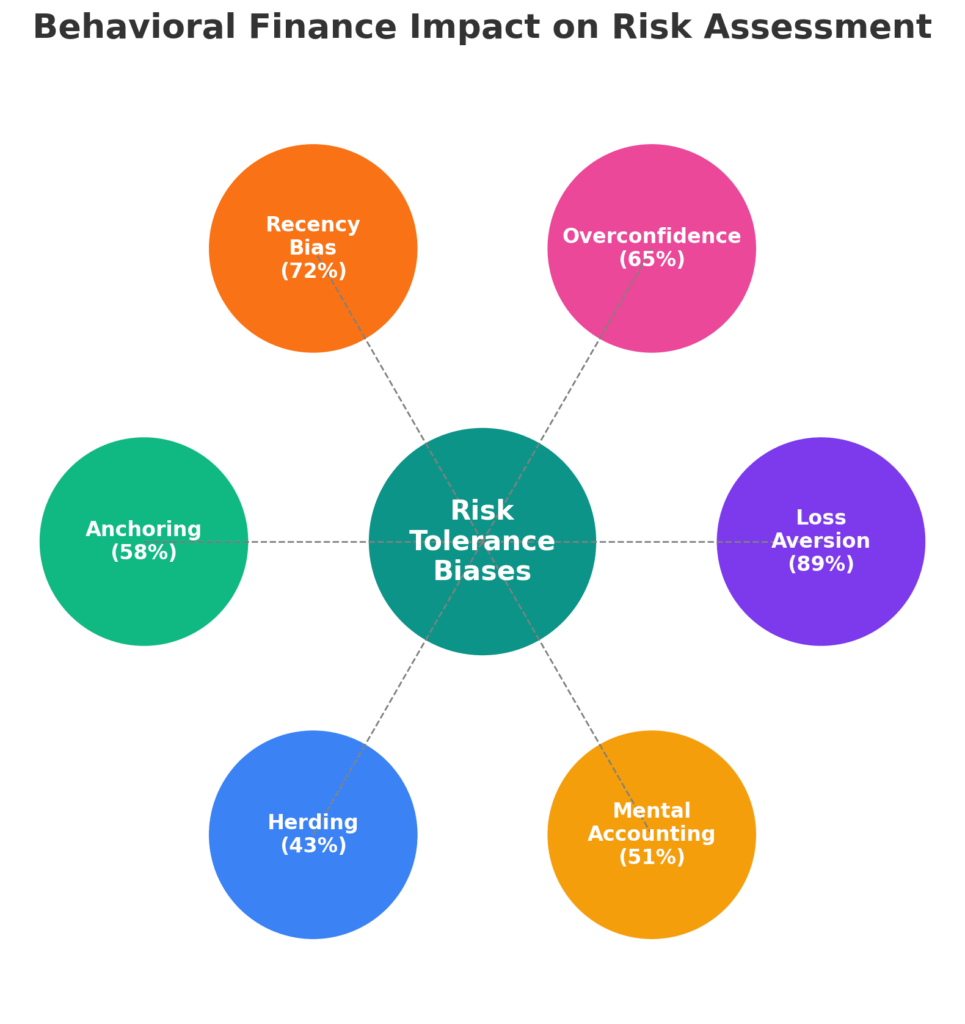

The integration of behavioral finance principles has transformed questionnaire design, incorporating insights about cognitive biases, loss aversion, and emotional decision-making patterns. This evolution has led to more sophisticated tools that better predict actual investor behavior during periods of market stress.

Types and Categories of Risk Tolerance Questionnaires

Academic-Based Questionnaires

Research-validated instruments developed by academic institutions focus on psychometric reliability and statistical validity. The Survey of Consumer Finances Risk Tolerance Question, used by the Federal Reserve, employs a single question format but has been extensively validated across diverse populations. Grable and Lytton’s Risk Tolerance Scale consists of 13 questions measuring financial risk tolerance through multiple scenarios and has demonstrated strong reliability coefficients above 0.70.

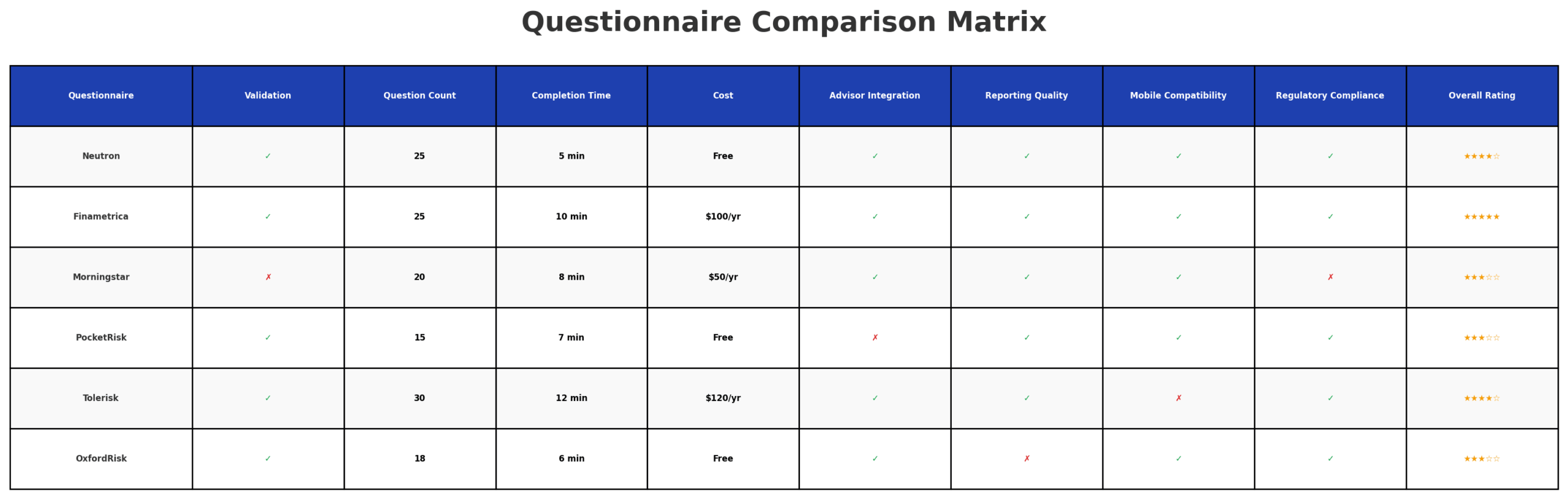

Commercial Assessment Tools

FinaMetrica leads the commercial market with a 25-question assessment used by financial advisors worldwide. The questionnaire measures risk tolerance on a 0-100 scale and provides detailed reports comparing individual scores to population norms. Nitrogen (formerly Riskalyze) employs a unique approach using dollar-based scenarios, asking investors to choose between guaranteed returns and potential gains/losses with specific monetary amounts.

Morningstar’s Risk Tolerance Questionnaire integrates with their investment platform, combining risk assessment with portfolio recommendations. The tool evaluates investment timeline, financial goals, and comfort with volatility through scenario-based questions and visual representations of potential outcomes.

Robo-Advisor Integrated Tools

Betterment and Wealthfront incorporate streamlined risk assessments into their onboarding processes, typically featuring 5-10 questions that balance simplicity with accuracy. These questionnaires prioritize user experience while maintaining sufficient depth for automated portfolio construction.

Benefits of Using Quality Risk Tolerance Questionnaires

Portfolio Optimization and Asset Allocation

The primary benefit of a comprehensive risk tolerance assessment lies in optimized asset allocation that matches investor preferences with portfolio construction. Research by Vanguard indicates that investors using properly calibrated risk assessments maintain their investment strategies 73% longer during market downturns compared to those with misaligned portfolios.

Improved returns consistency results from better alignment between investor expectations and portfolio behavior. Studies demonstrate that investors with accurately assessed risk profiles experience 15-20% less portfolio turnover and avoid costly emotional decisions during volatile periods.

Enhanced Client-Advisor Relationships

For financial advisors, quality risk tolerance questionnaires provide objective documentation of client preferences, reducing potential disputes and improving regulatory compliance. The CFP Board emphasizes risk tolerance assessment as a fiduciary requirement, making comprehensive questionnaires essential for professional practice.

Improved communication between advisors and clients results from shared understanding of risk preferences and investment rationale. Questionnaires that provide detailed explanations and comparisons help clients understand their risk profile relative to other investors and market conditions.

Behavioral Benefits and Decision-Making

Reduced emotional investing represents a significant advantage of proper risk tolerance assessment. Investors who understand their risk profile through comprehensive questionnaires demonstrate greater discipline during market volatility and are less likely to make impulsive decisions based on short-term market movements.

Better long-term outcomes emerge from maintaining appropriate investment strategies over extended periods. Research by Dalbar shows that investors with documented risk tolerance assessments achieve returns within 1-2% of their target benchmarks, compared to 4-6% underperformance for those without formal risk tolerance assessments.

Challenges and Risks in Risk Tolerance Assessment

Measurement Accuracy and Reliability Issues

Questionnaire validity poses the most significant challenge in assessing risk tolerance. Many popular tools lack rigorous validation and may produce inconsistent results across different populations or time periods. Research indicates that approximately 40% of commonly used questionnaires fail to meet basic psychometric standards for reliability.

Cultural and demographic biases can skew results, as many questionnaires were developed and validated primarily on specific populations. Gender differences in risk tolerance expression, where women may appear more risk-averse in questionnaires but demonstrate similar actual investment behavior, highlight the complexity of accurate measurement.

Temporal instability poses another challenge, as investor risk tolerance can change based on market conditions, life events, or recent investment experiences. Studies show that risk tolerance scores can vary by 20-30% when measured during bull versus bear markets, questioning the stability of single-point assessments.

Implementation and Practical Challenges

Oversimplification of complex investor psychology into numerical scores can lead to inappropriate investment recommendations. The reduction of multifaceted human preferences into single risk tolerance scores may not capture important nuances in investor behavior and preferences.

Technology integration challenges arise when implementing questionnaires across different platforms and systems. Inconsistent data formatting, scoring methodologies, and interpretation guidelines can create confusion and reduce the effectiveness of risk tolerance assessment programs.

Regulatory and Compliance Considerations

Fiduciary responsibilities require financial advisors to document and justify investment recommendations based on client risk tolerance. However, the lack of standardized questionnaires and scoring methodologies creates potential compliance challenges and regulatory scrutiny.

Documentation requirements vary across jurisdictions and regulatory bodies, creating complexity for firms operating in multiple markets. The SEC and FINRA provide general guidance on suitability requirements but lack specific standards for risk tolerance assessment methodologies.

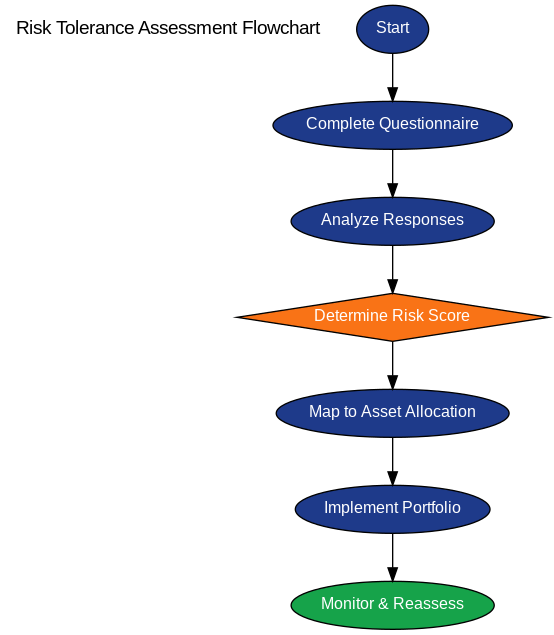

Implementation and How Risk Tolerance Questionnaires Work

Question Design and Methodology

Effective risk tolerance questionnaires employ multiple question types to capture different aspects of investor psychology and financial capacity. Scenario-based questions present hypothetical investment situations with specific dollar amounts and time frames, allowing investors to visualize potential outcomes and emotional responses.

Likert scale questions measure agreement levels with statements about investment preferences and market views. For example, “I am comfortable with investments that may lose 20% of their value in a single year if they offer higher long-term returns” provides insight into loss tolerance and time horizon preferences.

Demographic and situational questions capture objective factors that influence risk capacity, including age, income, investment timeline, and financial obligations. These questions establish the foundation for understanding an investor’s ability to assume risk regardless of their psychological preferences.

Scoring and Interpretation Systems

Normative scoring compares individual responses to population databases, providing context for risk tolerance levels. FinaMetrica’s database includes over 750,000 investor responses, enabling precise percentile rankings and peer comparisons across demographic segments.

Multi-dimensional analysis recognizes that risk tolerance comprises several components including loss tolerance, volatility comfort, and uncertainty acceptance. Advanced questionnaires provide separate scores for each dimension, enabling more nuanced portfolio recommendations.

Dynamic weighting systems adjust question importance based on investor demographics and responses. For instance, scenario-based questions may receive higher weighting for experienced investors, while demographic factors may be emphasized for first-time investors.

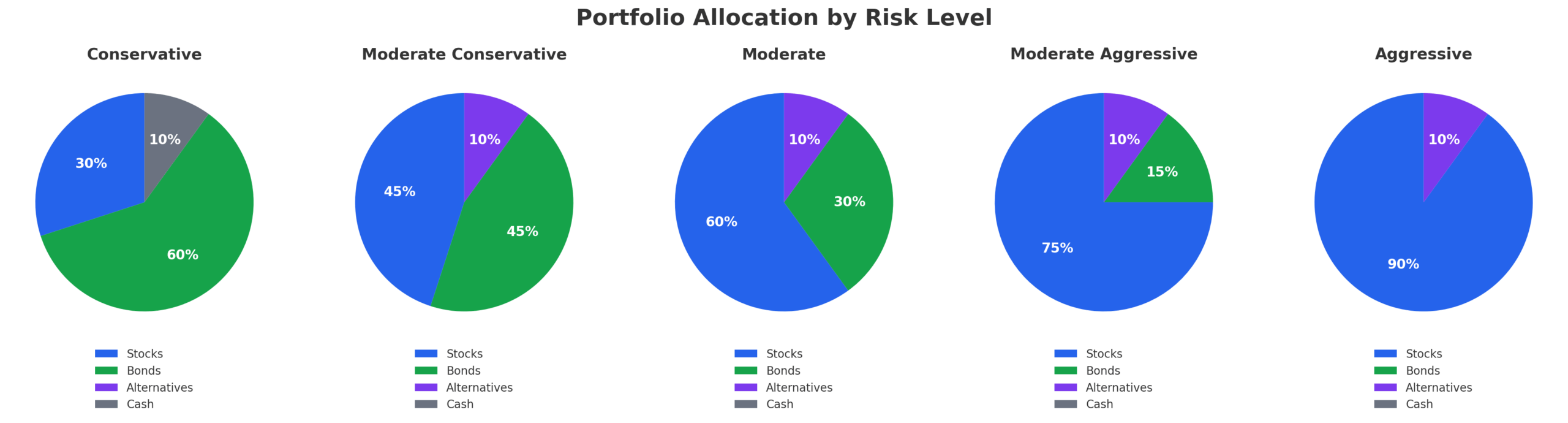

Integration with Portfolio Management

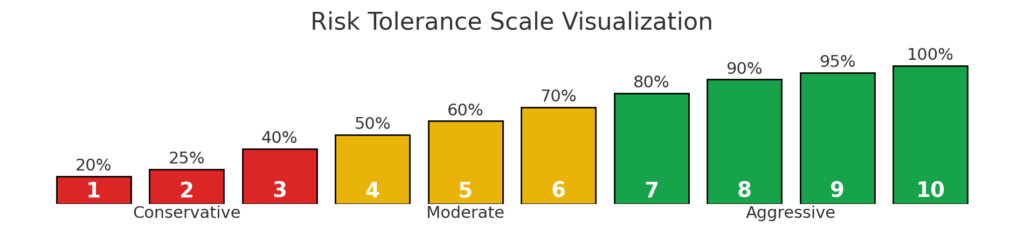

Asset allocation algorithms translate risk tolerance scores into specific portfolio recommendations using modern portfolio theory principles. The mapping between risk scores and asset allocations typically follows established relationships between risk levels and equity/fixed income proportions.

| Risk Tolerance Level | Equity Allocation | Fixed Income | Alternative Investments | Typical Investor Profile |

|---|---|---|---|---|

| Conservative (0-25) | 20-40% | 50-70% | 0-10% | Risk-averse, capital preservation focus |

| Moderate Conservative (26-40) | 35-55% | 40-60% | 0-15% | Modest growth with stability |

| Moderate (41-60) | 50-70% | 25-45% | 5-20% | Balanced growth and income |

| Moderate Aggressive (61-75) | 65-85% | 10-30% | 10-25% | Growth-focused with some volatility tolerance |

| Aggressive (76-100) | 80-100% | 0-15% | 15-30% | Maximum growth, high volatility acceptance |

Rebalancing triggers incorporate risk tolerance levels to determine appropriate portfolio drift limits and rebalancing frequency. Conservative investors may require tighter rebalancing bands (±3-5%) while aggressive investors can tolerate wider ranges (±8-12%) before portfolio adjustments.

Future Trends in Risk Tolerance Assessment

Artificial Intelligence and Machine Learning Integration

Predictive analytics represents the next frontier in risk tolerance assessment, using machine learning algorithms to analyze investor behavior patterns and predict risk tolerance changes. Companies like Totum Risk employ artificial intelligence to continuously monitor client communications and investment decisions, adjusting risk profiles based on observed behavior rather than static questionnaire responses.

Natural language processing enables analysis of investor communications, social media activity, and written responses to identify risk tolerance indicators beyond traditional questionnaire formats. This technology can detect changes in investor sentiment and confidence levels that may signal evolving risk preferences.

Behavioral Biometrics and Real-Time Assessment

Physiological monitoring through wearable devices offers potential for measuring actual stress responses to market volatility and investment scenarios. Research partnerships between fintech companies and academic institutions are exploring heart rate variability, skin conductance, and other biometric indicators as supplements to traditional questionnaires.

Real-time adaptation systems will continuously adjust risk profiles based on ongoing investor behavior, market conditions, and life event changes. These dynamic systems promise more accurate and timely risk assessment compared to periodic questionnaire administration.

Integration with Digital Financial Platforms

API-driven architecture enables seamless integration of risk tolerance assessment across multiple financial platforms and services. Open banking initiatives and standardized data formats will facilitate comprehensive risk profiling that incorporates spending patterns, investment behavior, and financial goal changes.

Gamification elements in future questionnaires will improve engagement and accuracy by presenting risk scenarios through interactive simulations and virtual reality experiences. These immersive approaches may provide more realistic assessment of investor responses to stress and uncertainty.

FAQs – Best Risk Tolerance Questionnaire

1. How often should investors retake risk tolerance questionnaires? Investors should reassess their risk tolerance annually or following major life events such as marriage, job changes, inheritance, or significant market events. Research suggests that risk tolerance can shift by 15-25% following major life transitions, making regular reassessment crucial for maintaining appropriate investment strategies.

2. Can risk tolerance questionnaires predict actual investor behavior during market crashes? Quality questionnaires show moderate predictive ability, with correlation coefficients between 0.4-0.7 for actual behavior during market stress. However, extreme market events can overwhelm even well-assessed risk tolerance, emphasizing the importance of ongoing education and advisor support during volatile periods.

3. What is the difference between risk tolerance and risk capacity? Risk tolerance reflects an investor’s psychological comfort with uncertainty and potential losses, while risk capacity represents their financial ability to absorb losses based on income, assets, and obligations. An investor may have high risk capacity but low risk tolerance, or vice versa, requiring careful balance in portfolio construction.

4. Are online risk tolerance questionnaires as accurate as advisor-administered assessments? Research indicates that well-designed online questionnaires can achieve similar accuracy to advisor-administered versions, with correlation coefficients above 0.85. However, advisor-administered assessments may provide better context and explanation, particularly for complex scenarios or inexperienced investors.

5. How do cultural differences affect risk tolerance questionnaire results? Cultural factors significantly influence risk tolerance expression and interpretation. Studies show that collectivist cultures may emphasize family security over individual gain, while individualist cultures focus on personal wealth accumulation. The best questionnaires include cultural validation and demographic-specific norms.

6. What role does investment experience play in risk tolerance assessment? Investment experience moderates the relationship between stated and actual risk tolerance. Experienced investors typically demonstrate more accurate self-assessment and greater alignment between questionnaire responses and actual behavior. Novice investors may overestimate or underestimate their risk tolerance by 20-40%.

7. Can Risk tolerance change with age, and how should questionnaires account for this? Risk tolerance generally decreases with age due to shorter investment horizons and reduced earning capacity. However, individual variations are significant, and age-based assumptions can be misleading. Effective questionnaires consider life-cycle factors while allowing for individual differences and circumstances.

8. How do market conditions affect risk tolerance questionnaire accuracy? Market conditions can bias risk tolerance assessment, with bull markets increasing apparent risk tolerance and bear markets decreasing it. The most accurate assessments occur during neutral market conditions or use scenario-based questions that explicitly account for different market environments.

9. What are the legal implications of using risk tolerance questionnaires for investment advice? Risk tolerance questionnaires serve as important documentation for fiduciary compliance and suitability requirements. Advisors must ensure questionnaires are appropriate for their client base, regularly updated, and properly integrated into investment recommendation processes. Inadequate risk assessment can result in regulatory sanctions and legal liability.

10. How can investors verify the quality and validity of a risk tolerance questionnaire? Investors should look for questionnaires with published validation studies, peer review, and statistical reliability measures above 0.70. Quality indicators include multiple question types, scenario-based assessments, demographic considerations, and transparent scoring methodologies. Professional questionnaires typically provide detailed methodology documentation and normative comparisons.

Conclusion

The selection of the best risk tolerance questionnaire represents a critical decision that influences long-term investment success and client satisfaction. Quality questionnaires combine rigorous academic validation with practical implementation features, incorporating behavioral finance insights and multi-dimensional assessment approaches.

The most effective tools balance comprehensive evaluation with user experience, providing accurate risk profiling without overwhelming complexity or excessive time requirements.

As financial markets continue evolving and investor demographics shift, risk tolerance assessment methodology will advance through artificial intelligence integration, behavioral biometric monitoring, and real-time adaptation capabilities. These technological developments promise more accurate and dynamic risk profiling, enabling better alignment between investor preferences and portfolio construction.

However, the fundamental principles of comprehensive assessment, regular reassessment, and professional interpretation will remain essential for effective risk tolerance measurement and implementation in investment management practices.

For your reference, recently published articles include:

-

- Proven High Net Worth Investing Strategies For Growth

- Proven Seasonal Investing Strategies Every Investor Should Know

- How To Avoid The Floating Rate Investment Trap In 2025

- Low Charge Investing Made Simple: Expert Guide

- Why Every Investor Needs Floating Rate Investments Now

- Breaking Free From The Fixed-Rate Investment Trap

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.