Low charge investing represents a fundamental shift in how investors approach portfolio management, emphasizing cost-efficient strategies that maximize returns by minimizing fees and expenses.

In today’s competitive financial landscape, where even seemingly small percentage differences in fees can compound to significant sums over decades, understanding and implementing low-cost investment approaches has become essential for building long-term wealth.

Welcome to our comprehensive exploration of low charge investing strategies – we’re excited to help you master these wealth-building techniques that can dramatically improve your long-term returns!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

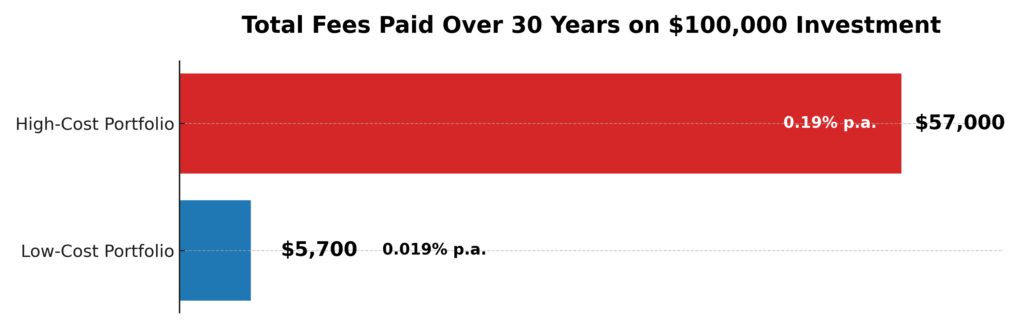

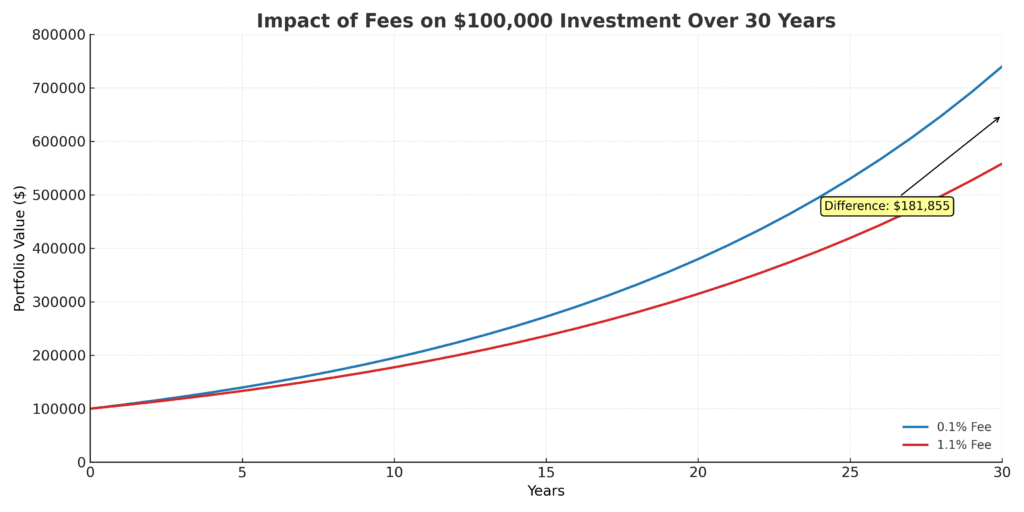

1. Cost Impact on Returns: A 1% annual fee difference can reduce portfolio value by approximately 25% over 30 years due to compound effects. For example, a $100,000 investment growing at 7% annually would reach $761,226 with a 0.1% expense ratio versus $574,349 with a 1.1% expense ratio over three decades.

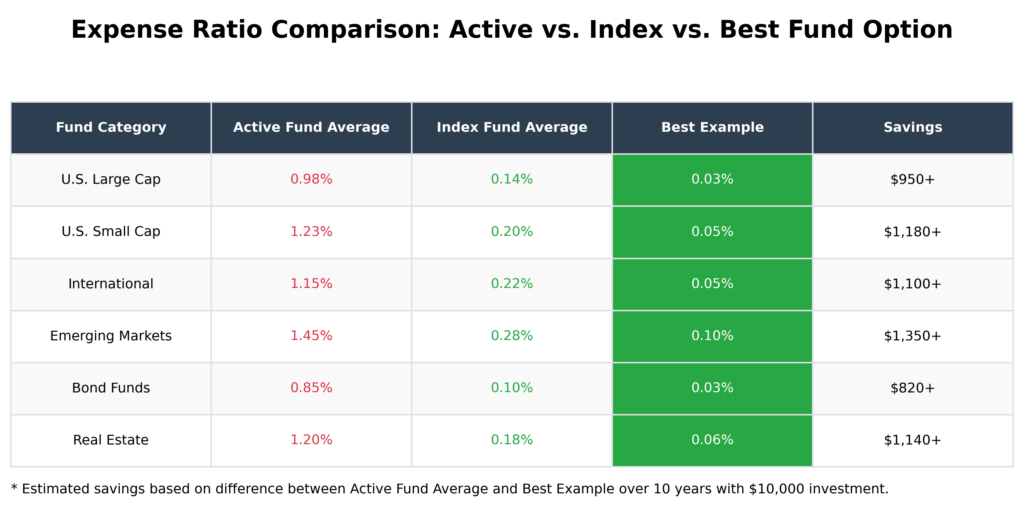

2. Index Fund Advantage: Passive index funds typically charge expense ratios between 0.03% and 0.20%, compared to actively managed funds that average 0.67% to 1.5% annually. Vanguard’s Total Stock Market Index Fund (VTSAX) charges just 0.03%, while many active equity funds charge over 1% annually.

3. Platform Selection Matters: Commission-free brokers like Fidelity, Schwab, and Vanguard offer zero-cost stock and ETF trades, eliminating transaction fees that previously cost $7-$10 per trade. This enables frequent investing without eroding returns through trading costs.

Understanding Low Charge Investing

Low charge investing refers to investment strategies and products designed to minimize costs while maintaining market exposure and diversification. This approach recognizes that investment fees represent a guaranteed reduction in returns, making cost minimization a critical component of successful long-term investing.

The foundation of low charge investing rests on the principle that markets are generally efficient, making it difficult for active managers to consistently outperform market indices after accounting for fees. Academic research, including studies by Nobel laureate Eugene Fama, demonstrates that the majority of actively managed funds fail to beat their benchmark indices over extended periods when fees are considered.

Investment costs typically manifest in several forms: expense ratios, transaction fees, advisory fees, and tax inefficiencies. Expense ratios represent annual fees charged as a percentage of assets under management, while transaction fees occur when buying or selling securities. Advisory fees compensate financial advisors or robo-advisors for portfolio management services.

The mathematical impact of fees becomes apparent through compound interest calculations. A portfolio charging 0.05% annually versus 1.5% annually creates a 1.45 percentage point drag on returns each year. Over decades, this difference compounds dramatically, potentially reducing final portfolio values by 30% or more.

Low charge investing strategies focus on eliminating or minimizing these costs through careful selection of investment vehicles, platforms, and tax-efficient structures. This approach does not sacrifice diversification or risk management but instead achieves these objectives through cost-effective means.

Types and Categories of Low Charge Investments

Index Funds and ETFs

Index funds represent the cornerstone of low charge investing, offering broad market exposure with minimal fees. These funds track specific market indices by holding the same securities in identical proportions, eliminating the need for expensive research teams and active management.

| Fund Type | Average Expense Ratio | Example Fund | Expense Ratio |

|---|---|---|---|

| Large-Cap Index | 0.05% – 0.15% | FXAIX (Fidelity 500) | 0.015% |

| Total Market Index | 0.03% – 0.10% | VTSAX (Vanguard Total Stock) | 0.03% |

| International Index | 0.08% – 0.25% | FTIHX (Fidelity Total International) | 0.06% |

| Bond Index | 0.04% – 0.15% | FXNAX (Fidelity US Bond) | 0.025% |

Exchange-Traded Funds (ETFs) function similarly to index funds but are traded on exchanges, much like individual stocks. ETFs typically offer even lower expense ratios than mutual funds, with many charging less than 0.10% annually.

Target-Date Funds

Target-date funds automatically adjust asset allocation based on the investor’s expected retirement date, becoming more conservative as the target date approaches. Low-cost providers offer these funds with expense ratios between 0.10% and 0.20%, compared to expensive versions charging 0.70% or more.

Robo-Advisors

Robo-advisors provide automated portfolio management using low-cost ETFs, typically charging 0.25% to 0.50% annually. These platforms offer features like automatic rebalancing, tax-loss harvesting, and goal-based investing while maintaining low overall costs.

Benefits of Low Charge Investing

Enhanced Long-Term Returns

The primary benefit of low charge investing lies in improved long-term returns through fee minimization. Mathematical modeling demonstrates that reducing annual fees by 1% can increase portfolio values by 20-30% over 25-30 year periods.

Consider two investors starting with $50,000 and contributing $500 monthly:

- Investor A uses funds with 0.10% expense ratios

- Investor B uses funds with 1.10% expense ratios

- Both achieve 7% gross annual returns

After 30 years:

- Investor A accumulates approximately $1,140,000

- Investor B accumulates approximately $950,000

- Difference: $190,000 (20% more wealth for Investor A)

Another example:

Simplified Portfolio Management

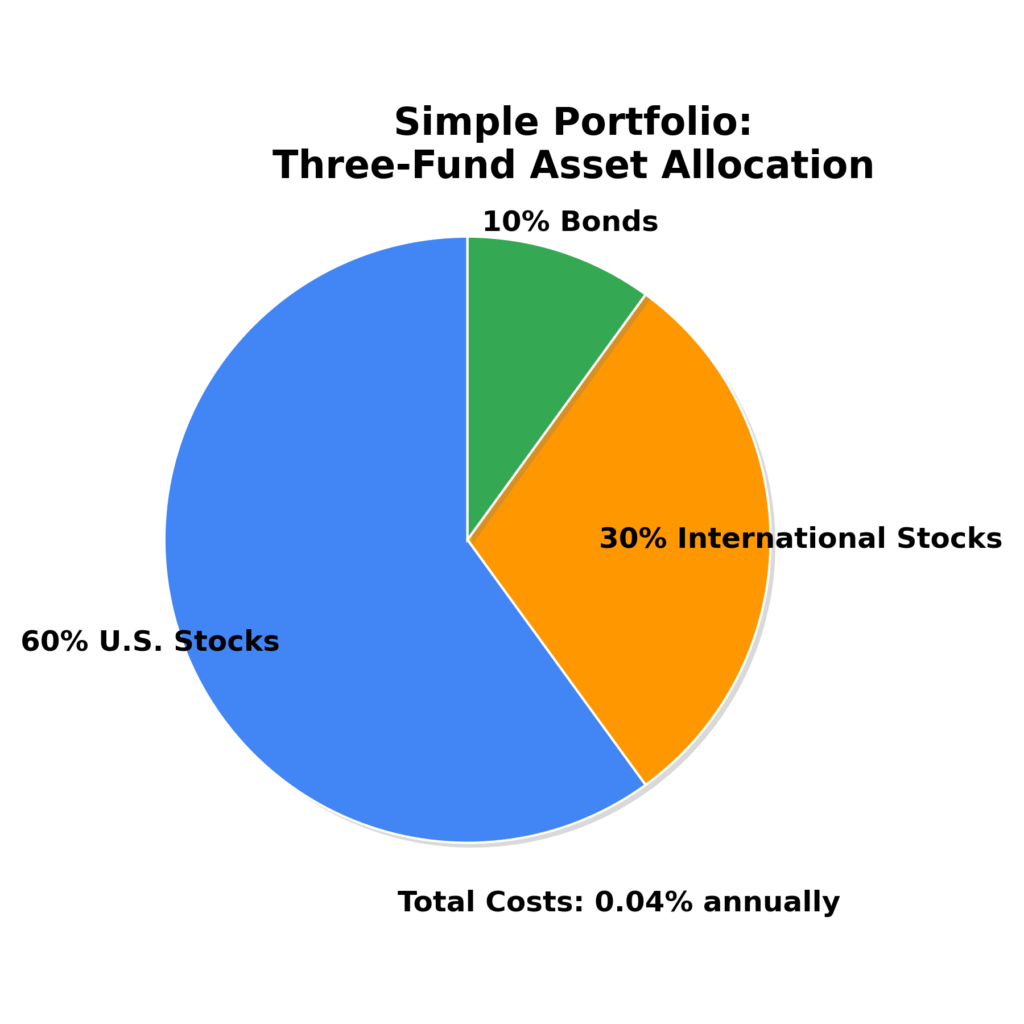

Low-charge investing strategies typically emphasize broad diversification through index funds, reducing the complexity of security selection and portfolio construction. Investors can achieve global diversification using three to five low-cost index funds covering domestic stocks, international stocks, and bonds.

Tax Efficiency

Index funds and ETFs generate fewer taxable events than actively managed funds due to lower portfolio turnover. Turnover ratios for index funds typically range from 5% to 20% annually, compared to 50% to 100% for active funds. Lower turnover results in reduced capital gains distributions and improved after-tax returns.

Transparency and Predictability

Low-cost index funds provide complete transparency regarding holdings and methodology, allowing investors to understand exactly what they own. This transparency contrasts with complex active strategies that may employ derivatives, leverage, or frequent strategy changes.

Challenges and Risks of Low Charge Investing

Market Risk Exposure

Low charge investing typically involves broad market exposure through index funds, meaning investors experience full market volatility without downside protection. During market downturns, these portfolios will decline in line with overall market performance.

Limited Upside Potential

By definition, index funds cannot outperform their benchmark indices. Investors forfeit the possibility of above-market returns that successful active management might provide, though research indicates such outperformance is rare and unpredictable.

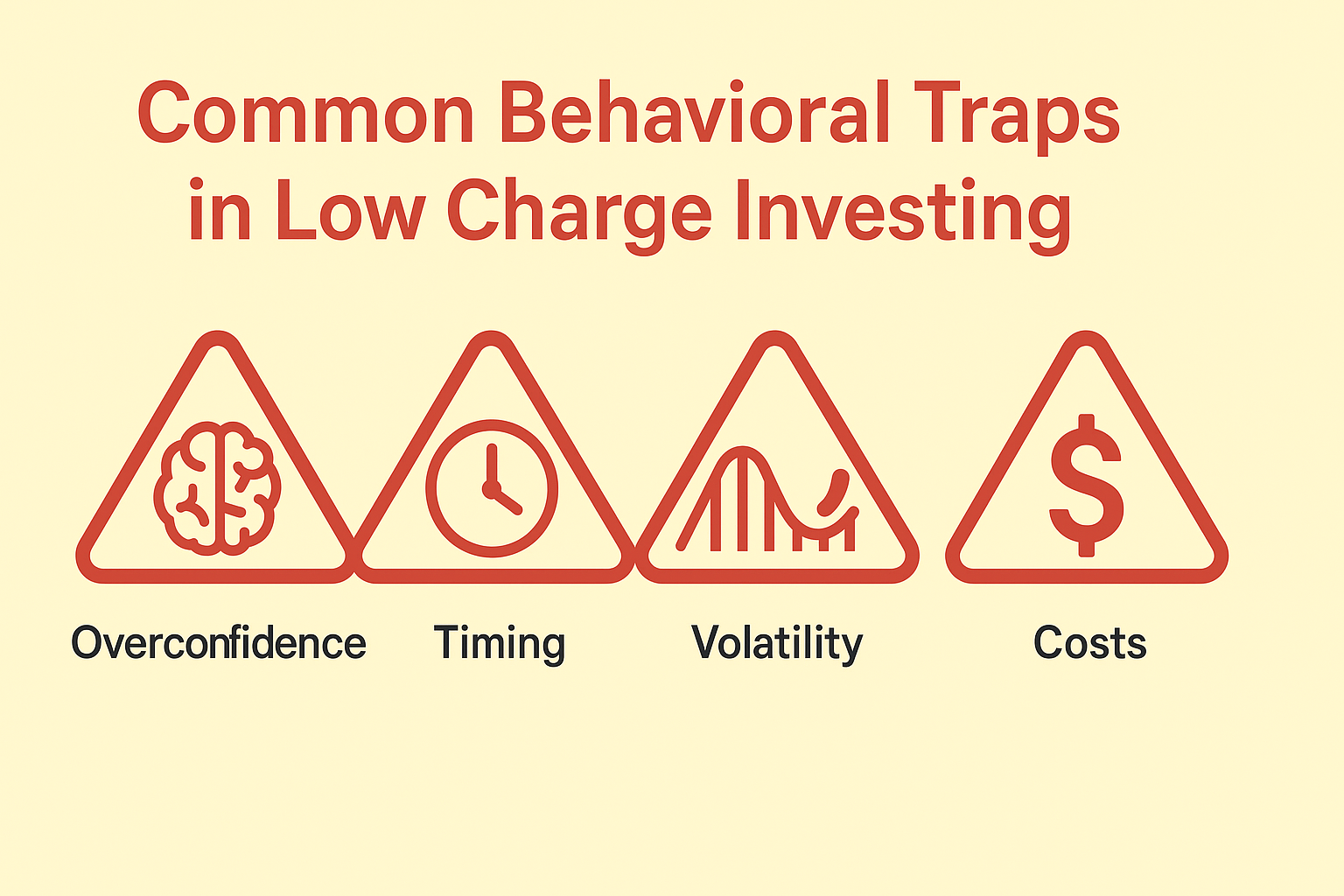

Behavioral Challenges

The simplicity of index investing may lead some investors to believe they can successfully time markets or select individual stocks. Behavioral biases such as overconfidence and recency bias can cause investors to abandon disciplined low-cost strategies during market volatility.

Platform and Fund Selection Complexity

While individual fund selection may be simple, choosing between different low-cost providers and platform features requires research and ongoing evaluation. Investors must consider factors beyond expense ratios, including fund tracking error, tax efficiency, and platform capabilities.

Implementation Strategy

Step 1: Platform Selection

Choose a brokerage platform offering commission-free trading on stocks and ETFs. Leading low-cost providers include:

- Fidelity: Zero expense ratio index funds, no account minimums

- Vanguard: Pioneer in low-cost investing, investor-owned structure

- Schwab: Comprehensive platform with competitive pricing

- Robo-advisors: Betterment, Wealthfront for automated management

Step 2: Asset Allocation Determination

Establish target asset allocation based on age, risk tolerance, and investment timeline. Common approaches include:

- Age-based allocation: (100 – age)% in stocks, remainder in bonds

- Target-date funds: Automatic adjustment based on retirement timeline

- Three-fund portfolio: Total stock market, international stocks, bonds

Step 3: Fund Selection

Select specific index funds or ETFs within each asset class:

| Asset Class | Fund Options | Expense Ratio Range |

|---|---|---|

| US Total Market | VTSAX, FZROX, SWTSX | 0.00% – 0.03% |

| International Developed | VTIAX, FTIHX, SWISX | 0.06% – 0.11% |

| Emerging Markets | VEMAX, FPADX, SCHE | 0.14% – 0.19% |

| US Bonds | VBTLX, FXNAX, SWAGX | 0.025% – 0.05% |

Step 4: Regular Contributions and Rebalancing

Set up automatic contributions to maintain consistent investment habits. Rebalance portfolios annually or when asset allocations drift more than 5% from targets. Most platforms offer automatic rebalancing features for a small additional fee.

Step 5: Tax Optimization

Utilize tax-advantaged accounts (401k, IRA, Roth IRA) before taxable accounts. Hold tax-inefficient investments in tax-sheltered accounts and tax-efficient index funds in taxable accounts. Consider tax-loss harvesting in taxable accounts to offset capital gains.

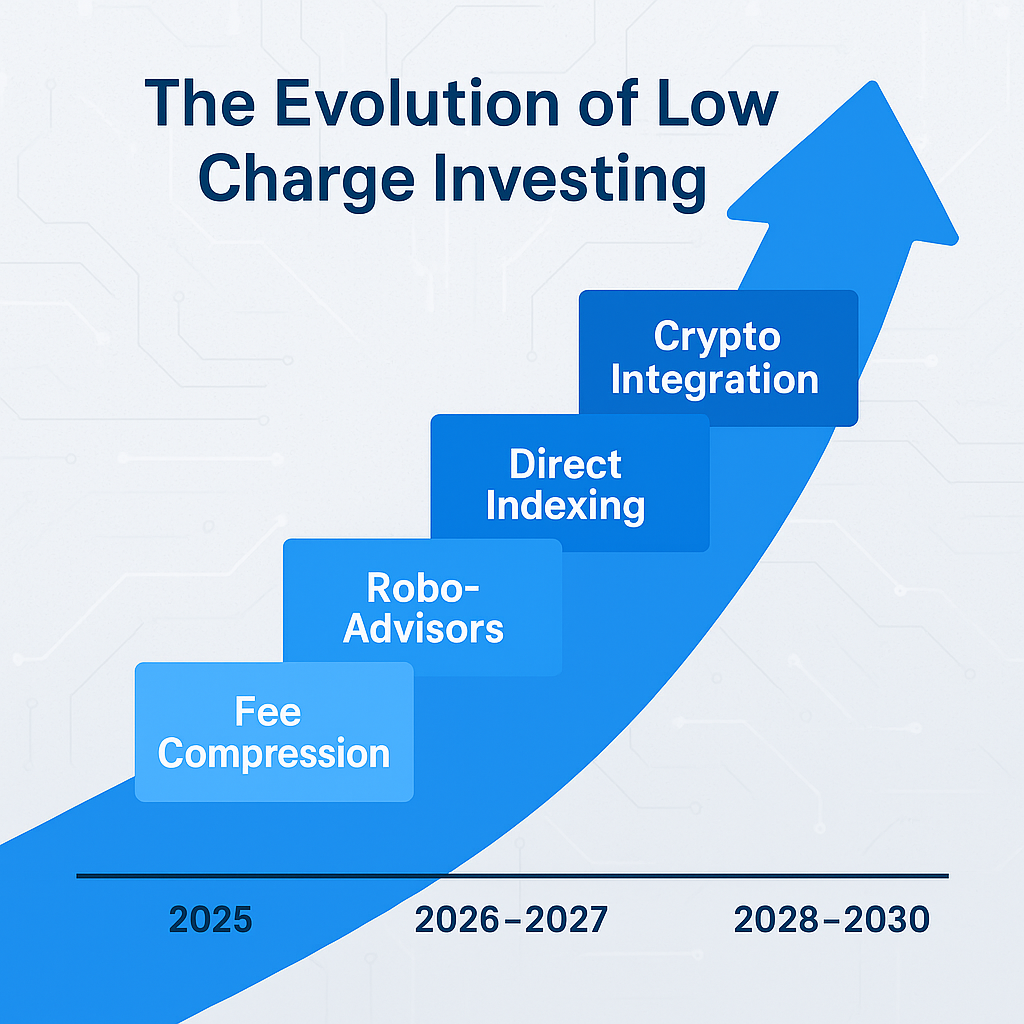

Future Trends in Low Charge Investing

Continued Fee Compression

Industry competition continues driving expense ratios lower, with several providers offering zero-fee index funds. This trend benefits investors but may lead to consolidation among fund providers as profit margins compress.

Enhanced Robo-Advisor Features

Robo-advisors increasingly offer sophisticated features previously available only through expensive human advisors, including tax-loss harvesting, direct indexing, and ESG (Environmental, Social, Governance) investing options.

Direct Indexing Evolution

Direct indexing allows investors to own individual stocks comprising an index rather than fund shares, enabling personalized tax management and customization while maintaining low costs. This approach is becoming accessible to smaller investors through fractional share ownership.

Cryptocurrency Integration

Some low-cost platforms begin incorporating cryptocurrency exposure through Bitcoin and Ethereum ETFs, though these investments carry higher fees and volatility than traditional index funds.

ESG and Factor-Based Investing

Low-cost ESG and factor-based (value, momentum, quality) index funds provide targeted exposure while maintaining expense ratios below 0.30%, making these strategies accessible to cost-conscious investors.

FAQs – Low Charge Investing

1. What is the minimum amount needed to start low charge investing? Most brokers now offer zero minimum account balances, and many index funds require no minimum investment. Investors can start with as little as $1 through fractional share programs, making low charge investing accessible regardless of initial capital.

2. How do expense ratios affect my returns over time? Expense ratios compound over time, creating significant impact on long-term wealth. A 1% annual fee difference can reduce portfolio values by 20-30% over 25-30 years due to compound effects on both principal and returns.

3. Are index funds always better than actively managed funds? While index funds outperform the majority of actively managed funds over long periods after fees, some active funds do achieve consistent outperformance. However, identifying these funds in advance proves extremely difficult, making index funds the more reliable choice for most investors.

4. Should I use ETFs or mutual funds for low charge investing? Both can serve low charge investing strategies effectively. ETFs typically offer slightly lower expense ratios and more trading flexibility, while index mutual funds provide automatic dividend reinvestment and easier fractional investing.

5. How often should I rebalance my low-cost portfolio? Annual rebalancing typically provides optimal results for most investors, though some prefer quarterly rebalancing or threshold-based rebalancing when allocations drift beyond predetermined ranges (typically 5-10%).

6. Can I implement low charge investing in my 401(k)? Yes, most 401(k) plans now offer low-cost index fund options. Look for funds with expense ratios below 0.20% and broad market exposure. If low-cost options are limited, advocate with your employer or HR department for better fund selections.

7. What role do robo-advisors play in low charge investing? Robo-advisors automate low charge investing strategies while adding services like rebalancing, tax-loss harvesting, and goal-based planning. Their fees (typically 0.25-0.50%) may be worthwhile for investors seeking automation and additional features.

8. How do I evaluate different low-cost brokerage platforms? Compare factors beyond just fees, including fund selection, user interface, research tools, customer service, and additional features like automatic investing and tax-loss harvesting. Most major platforms now offer competitive pricing.

9. Is low charge investing suitable for all investment goals? Low charge investing works effectively for most long-term investment goals, including retirement, education funding, and wealth building. However, specialized goals may require different approaches, such as guaranteed income products for immediate retirement needs.

10. How do taxes affect low charge investing strategies? Index funds typically generate fewer taxable events than active funds due to lower turnover, improving after-tax returns. Utilize tax-advantaged accounts first, and consider tax-loss harvesting in taxable accounts to further optimize tax efficiency.

Conclusion

Low charge investing represents a proven approach to building long-term wealth through cost minimization and broad market exposure. By focusing on low-cost index funds, ETFs, and efficient platforms, investors can capture market returns while avoiding the fee drag that significantly impacts portfolio growth over time. T

The mathematical advantage of reducing investment costs by even small percentages compounds dramatically over decades, potentially adding hundreds of thousands of dollars to retirement nest eggs.

The future of low-cost investing continues evolving with technological advancements and increased competition among financial service providers. As fee compression continues and new tools, such as direct indexing, become accessible, investors will benefit from even more sophisticated strategies at lower costs.

However, the fundamental principle remains unchanged: minimizing investment costs while maintaining diversification and discipline provides the most reliable path to investment success for the vast majority of investors.

Success in low charge investing requires not just selecting the right products, but maintaining the discipline to stay invested through market cycles and resist the temptation to chase performance or time markets.

For your reference, recently published articles include:

-

- Why Every Investor Needs Floating Rate Investments Now

- Breaking Free From The Fixed-Rate Investment Trap

- Protect Your Wealth: Floating Rate Against Inflation Now

- Investment Strategy Evaluation – Get The Pro Advice Here

- Investment Risk Management Tools – All You Need To Know

- Investment Strategies Validation Made Simple

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.