Portfolio rebalancing automation represents the intersection of wealth management and technology, allowing investors to maintain their desired asset allocation without constant manual intervention.

In today’s volatile financial markets, automated rebalancing systems help investors enforce disciplined investment strategies while minimizing emotional decision-making and reducing the time burden of portfolio maintenance.

Welcome to our deep dive into portfolio rebalancing automation – we’re excited to help you master this powerful wealth management strategy! Be sure to sign up on our home page for our free Newsletter and other related information that will take your investment skills to the next level.

Key Takeaways

1. Automated rebalancing improves investment discipline and potentially enhances returns by enforcing a “buy low, sell high” mechanism. For example, when stocks dropped 30% during the March 2020 COVID crash, automated rebalancing systems triggered purchases at market lows, positioning portfolios for the subsequent recovery and generating an estimated 1-2% in additional returns compared to non-rebalanced portfolios.

2. Implementing rebalancing automation reduces the behavioral biases that plague manual rebalancing decisions. A 2023 Vanguard study found that investors who utilize automated rebalancing services are 76% less likely to panic-sell during market downturns compared to those who manage rebalancing manually.

3. Modern rebalancing tools offer customization across multiple parameters, including threshold-based vs. calendar-based approaches. Charles Schwab’s Intelligent Portfolio platform, for instance, monitors portfolios daily but only triggers rebalancing when asset classes drift beyond 5% of their targets, thereby balancing trading costs against allocation precision.

Understanding Portfolio Rebalancing

Portfolio rebalancing is the process of realigning the weightings of assets in an investment portfolio to maintain the original or desired level of asset allocation. Over time, as different investments produce different returns, the portfolio’s allocation naturally drifts from its original target. Rebalancing involves periodically buying or selling assets to restore the portfolio to the target allocation.

The traditional rebalancing process requires investors to regularly review their holdings, calculate current allocations, determine which positions need adjustment, and execute the necessary trades. This time-consuming process often leads to postponed rebalancing or emotional decision-making during market volatility.

Automated portfolio rebalancing leverages technology to monitor portfolios continuously and execute trades based on predetermined rules without requiring manual intervention. This automation ensures disciplined adherence to investment strategies regardless of market conditions or behavioral tendencies.

The concept has evolved from basic calendar-based rebalancing to sophisticated systems that incorporate tax-efficiency algorithms, drift thresholds, and even machine learning capabilities to optimize rebalancing decisions.

Modern automated rebalancing systems integrate with portfolio management software, robo-advisors, and brokerage platforms to provide seamless implementation for investors across various wealth levels and technical abilities.

Types of Portfolio Rebalancing Automation

Calendar-Based Rebalancing

Calendar-based systems rebalance portfolios at fixed intervals—typically monthly, quarterly, or annually. These systems execute trades regardless of market movements or allocation drift, providing predictable maintenance schedules.

Examples:

- Wealthfront‘s quarterly automated rebalancing system

- Betterment‘s annual portfolio refresh feature

- Vanguard‘s Personal Advisor Services semi-annual rebalancing

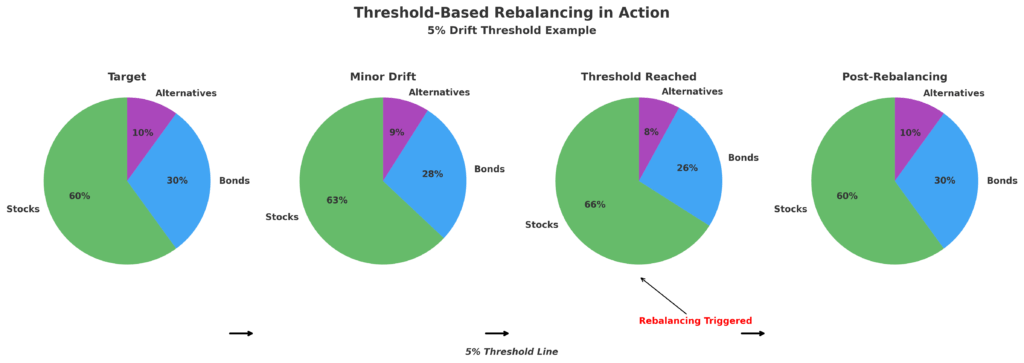

Threshold-Based Rebalancing

Threshold-based systems trigger rebalancing only when allocations drift beyond specified percentages from their targets. This approach typically results in fewer trades than calendar-based systems while maintaining tighter control over risk exposure.

Examples:

- Personal Capital‘s Smart Weighting™ technology (5% threshold)

- Schwab Intelligent Portfolios (5% deviation trigger)

- Fidelity Go’s dynamic threshold system (3-10% based on asset class)

Tax-Optimized Rebalancing

These sophisticated systems prioritize tax efficiency by considering tax implications when selecting which lots to sell, harvesting losses, and coordinating with tax-advantaged accounts to minimize tax consequences.

Examples:

- Wealthfront’s Tax-Loss Harvesting Plus

- Betterment’s Tax-Coordinated Portfolio

- M1 Finance’s intelligent lot selection algorithm

AI-Enhanced Rebalancing

The newest generation of rebalancing automation incorporates machine learning algorithms to predict optimal rebalancing points based on market conditions, tax situations, and historical performance patterns.

Examples:

- SigFig‘s Adaptive Portfolio Management

- Q.ai’s Portfolio Protection feature

- Titan Invest‘s AI-driven rebalancing protocol

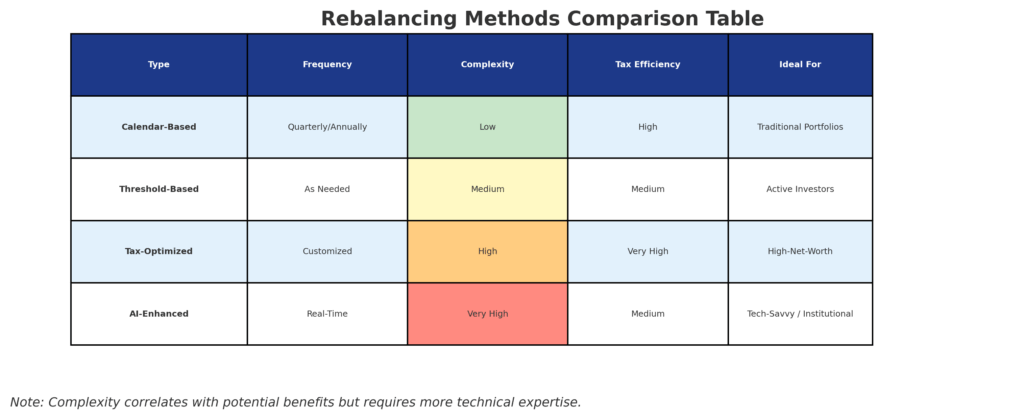

| Type | Frequency | Complexity | Tax Efficiency | Ideal For |

|---|---|---|---|---|

| Calendar-Based | Fixed intervals | Low | Moderate | Beginners, disciplined investors |

| Threshold-Based | Variable (market-dependent) | Medium | High | Growth-oriented investors |

| Tax-Optimized | Variable with tax considerations | High | Very High | High-net-worth investors |

| AI-Enhanced | Dynamic | Very High | Excellent | Sophisticated investors |

Benefits of Automated Rebalancing

Enhanced Discipline and Emotion Management

Automated systems remove emotional biases from investment decisions, enforcing disciplined selling of appreciated assets and purchasing of underperforming ones. This systematic “buy low, sell high” approach counteracts the natural human tendency to chase performance or panic during volatility. According to a 2024 Morningstar study, investors using automated rebalancing services experienced 43% less performance drag from behavioral mistakes compared to self-directed investors.

Time Efficiency and Reduced Monitoring

Manual rebalancing requires consistent monitoring, complex calculations, and multiple trade executions. Automation dramatically reduces the time commitment by handling these processes in the background. The average investor saves approximately 15-20 hours annually by implementing rebalancing automation.

Improved Risk Management

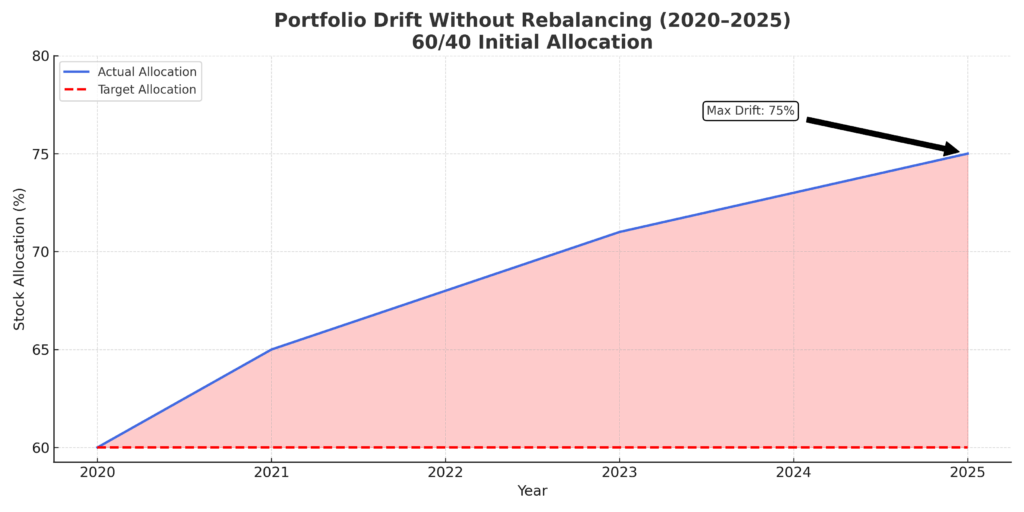

Automated rebalancing maintains the intended risk exposure of a portfolio even as market conditions change. Without rebalancing, portfolios naturally drift toward higher equity allocations during bull markets, potentially exposing investors to greater downside risk than intended. During the 2008-2009 financial crisis, portfolios that hadn’t been rebalanced for three years typically contained 15-20% more equity exposure than their targets, amplifying losses.

Potential Performance Enhancement

While primarily a risk management tool, rebalancing can also enhance returns by systematically selling high and buying low. A Vanguard study covering 1926-2022 found that portfolios rebalanced quarterly earned an average of 0.4% higher annual returns than never-rebalanced portfolios with the same initial allocation.

Tax Optimization Opportunities

Advanced rebalancing systems incorporate tax-loss harvesting and tax-aware trading algorithms, potentially adding 0.5-1.0% in annual after-tax returns according to Betterment’s research. These systems strategically realize losses, defer gains, and coordinate transactions across taxable and tax-advantaged accounts.

Challenges and Risks of Automated Rebalancing

Transaction Costs

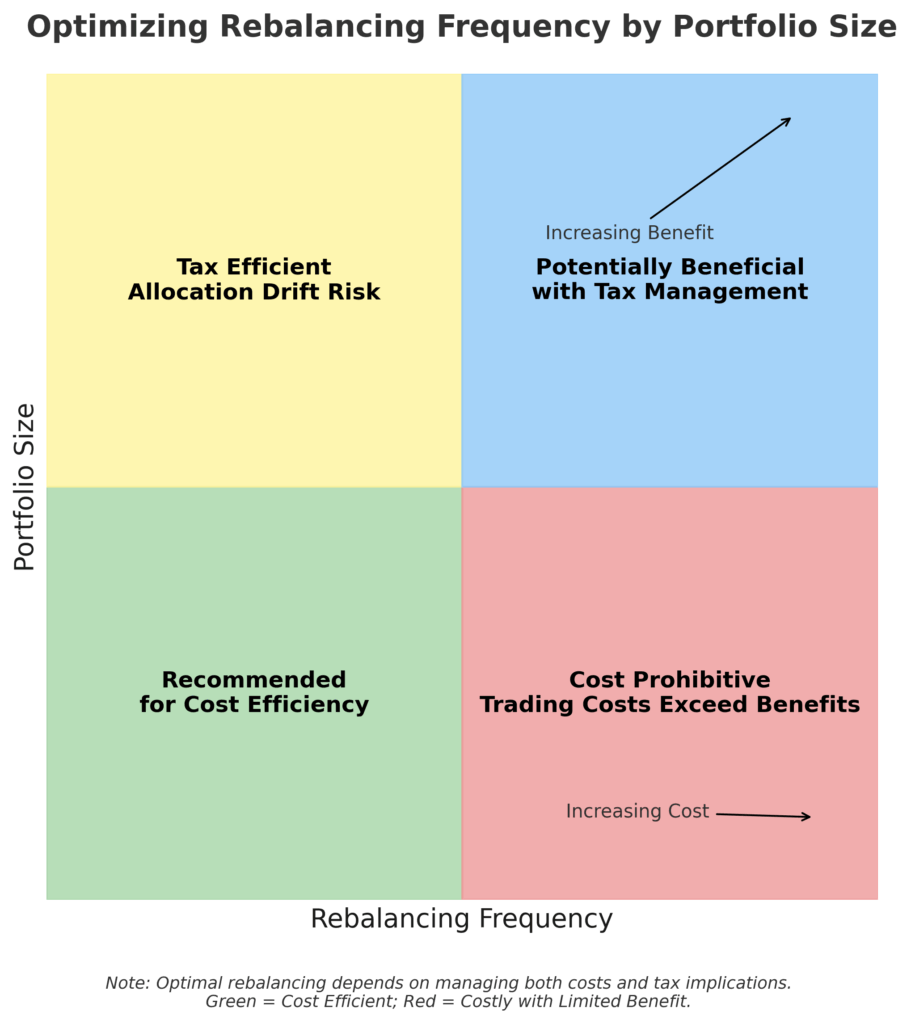

Frequent rebalancing can generate excessive trading costs that erode returns. Automated systems must balance the benefits of precise allocation against the friction of transaction fees, bid-ask spreads, and market impact costs. For portfolios under $100,000, excessively frequent rebalancing can cost 0.2-0.4% annually in trading expenses.

Tax Inefficiency (When Poorly Implemented)

Without proper tax awareness, automated rebalancing can trigger unnecessary capital gains taxes, particularly in taxable accounts. Basic systems that ignore tax implications can generate tax bills that offset the benefits of rebalancing. In high-tax states like California or New York, poorly implemented rebalancing can create tax drags exceeding 1% annually for high-income investors.

Over-Optimization Risks

Excessively complex rebalancing algorithms may lead to over-optimization based on historical patterns that don’t repeat in the future. Systems with too many parameters or those that attempt to time markets based on technical indicators often underperform simpler approaches despite their theoretical sophistication.

Technical Dependencies and System Failures

Automated systems depend on reliable data feeds, correct programming, and consistent execution. Service outages, data errors, or algorithm bugs can lead to missed rebalancing opportunities or incorrect trades. During the March 2020 market volatility, several robo-advisors experienced service disruptions that prevented timely rebalancing at market lows.

One-Size-Fits-All Limitations

Some automated platforms offer limited customization, applying standardized rebalancing protocols that may not address individual investor circumstances, tax situations, or liquidity needs. Investors with unique constraints like concentrated positions, employer stock restrictions, or specialty asset classes may find basic automation insufficient.

Implementation: How to Automate Your Rebalancing

Selecting the Right Automation Approach

- Assess your portfolio complexity

- Simple portfolios (3-5 funds) may use basic automation

- Complex portfolios (multiple accounts, tax considerations) require sophisticated solutions

- Evaluate your technical comfort level

- Non-technical investors: Consider all-in-one solutions

- Technically proficient investors: API-based or programmable options

- Determine customization requirements

- Standard allocations: Robo-advisors suffice

- Custom allocations: Self-directed platforms with automation features

Implementation Options

Robo-Advisor Integration

Platforms like Betterment, Wealthfront, and Schwab Intelligent Portfolios provide end-to-end rebalancing automation with varying levels of customization:

- Setup complexity: Low (1-2 hours)

- Annual cost: 0.25-0.40% of assets under management

- Customization: Moderate

- Tax efficiency: High

Brokerage Automation Tools

Major brokerages offer built-in rebalancing tools with greater control:

- Fidelity’s Auto Rebalance: Calendar-based with customizable thresholds

- Vanguard’s Automatic Investment Program: Contribution-based rebalancing

- TD Ameritrade’s Selective Trading: Rules-based rebalancing with tax considerations

- Setup complexity: Moderate (2-4 hours)

- Annual cost: Often included with brokerage accounts

- Customization: High

- Tax efficiency: Moderate to high

Portfolio Management Software

Dedicated software solutions provide advanced rebalancing features:

- Personal Capital: Monitoring with advisor-assisted rebalancing

- M1 Finance: Dynamic rebalancing with custom “pies”

- Tiller Money: Spreadsheet-based automated tracking with manual execution

- Setup complexity: Moderate to high (3-8 hours)

- Annual cost: $0-150/year or percentage-based

- Customization: Very high

- Tax efficiency: Variable

API and Programming Solutions

For technically advanced investors, programmatic solutions offer maximum control:

- Alpaca Trading API: Code-based automated trading

- Interactive Brokers API: Institutional-level automation capabilities

- Python libraries with broker integration: Custom algorithms with execution capabilities

- Setup complexity: Very high (10+ hours)

- Annual cost: Variable

- Customization: Unlimited

- Tax efficiency: Depends on implementation

Configuration Best Practices

- Establish clear rebalancing parameters

- Threshold triggers (typically 3-5% deviation)

- Maximum rebalancing frequency

- Minimum trade size (to avoid excessive small trades)

- Implement tax-aware settings

- Prioritize tax-advantaged accounts for rebalancing

- Set tax-loss harvesting thresholds

- Configure lot selection methodology

- Create safeguards and notifications

- Transaction confirmation requirements

- Maximum trade size limitations

- Activity alerts and summary reports

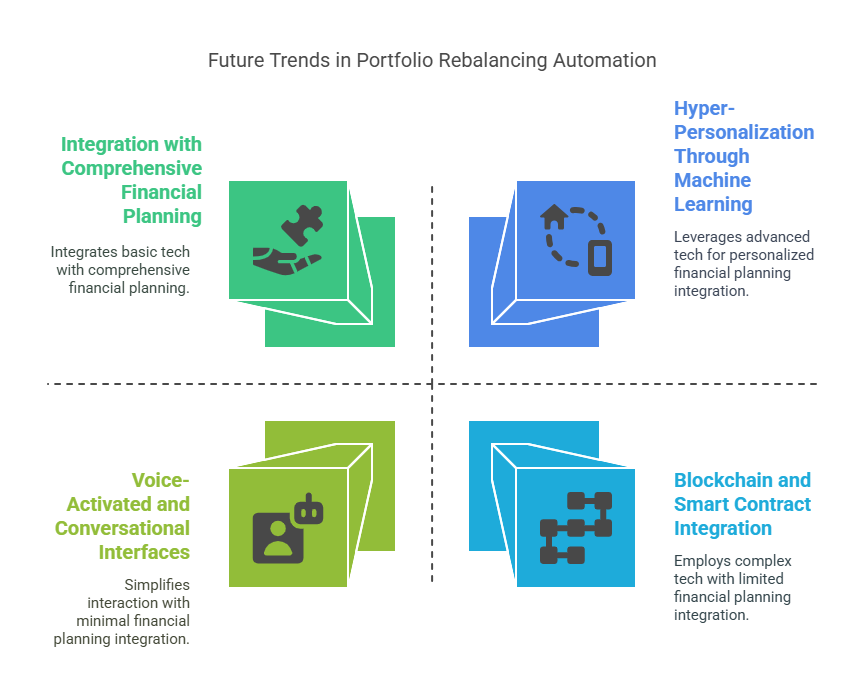

Future Trends in Portfolio Rebalancing Automation

Hyper-Personalization Through Machine Learning

Next-generation rebalancing systems will leverage machine learning to create truly personalized rebalancing strategies based on individual investor behavior, risk tolerance, tax situation, and market conditions. These systems will move beyond one-size-fits-all approaches to dynamically adapt rebalancing parameters based on each investor’s unique financial ecosystem.

Blockchain and Smart Contract Integration

Decentralized finance (DeFi) protocols are beginning to incorporate automated rebalancing mechanisms using blockchain-based smart contracts. These trustless systems can execute rebalancing without intermediaries, potentially reducing costs and increasing transparency. By 2026, an estimated 15% of rebalancing transactions may occur on-chain.

Multi-Factor Optimization

Future systems will simultaneously optimize across multiple factors beyond just asset allocation, including factor exposures, ESG characteristics, tax efficiency, and liquidity needs. This holistic approach will balance competing objectives through advanced mathematical optimization techniques previously available only to institutional investors.

Voice-Activated and Conversational Interfaces

As natural language processing advances, investors will interact with rebalancing systems through conversational interfaces. Voice commands like “rebalance my portfolio but minimize capital gains” will translate into complex execution algorithms, making sophisticated portfolio management accessible to non-technical investors.

Integration with Comprehensive Financial Planning

Rebalancing automation will increasingly operate within broader financial planning frameworks, coordinating with retirement projections, tax planning, estate considerations, and cash flow management. This integrated approach will ensure that rebalancing decisions support long-term financial goals rather than operating in isolation.

FAQs – Portfolio Rebalancing Automation

1. How often should an automated rebalancing system execute trades? The ideal frequency depends on several factors including portfolio size, investment strategy, and transaction costs. Most research suggests that quarterly or threshold-based rebalancing (typically when allocations drift 3-5% from targets) provides the optimal balance between maintaining allocation precision and minimizing costs. For taxable accounts, less frequent rebalancing (semi-annually or annually) often produces better after-tax results.

2. What are the tax implications of automated rebalancing? Automated rebalancing can trigger capital gains taxes in taxable accounts when appreciated assets are sold. Tax-aware rebalancing systems mitigate this by: prioritizing rebalancing in tax-advantaged accounts, coordinating tax-loss harvesting with rebalancing needs, utilizing new contributions for rebalancing instead of selling existing positions, and intelligently selecting tax lots when sales are necessary. The tax impact varies significantly based on these implementation details.

3. How much can automated rebalancing improve investment returns? While primarily a risk management tool, research indicates that disciplined rebalancing can add 0.2-0.5% in annual returns over long periods through the systematic “buy low, sell high” mechanism. Tax-aware rebalancing can contribute an additional 0.3-0.6% in after-tax returns for high-income investors. However, these benefits vary widely based on market conditions, with the greatest advantages occurring during periods of high volatility.

4. What portfolio size justifies implementing rebalancing automation? Sophisticated rebalancing automation becomes cost-effective for portfolios exceeding $100,000, where the benefits typically outweigh implementation costs. However, basic forms of automation are beneficial even for smaller portfolios, particularly through no-additional-cost options like robo-advisors or brokerage rebalancing tools.

5. Can automated rebalancing work with alternative investments? Yes, but with limitations. Advanced systems can incorporate alternatives like real estate, private equity, and hedge funds, but face challenges with valuation frequency, liquidity constraints, and execution limitations. Some platforms allow manual overrides or custom rules for these asset classes, while others exclude them from automated processes.

6. How do I evaluate the effectiveness of an automated rebalancing system? Key performance indicators include: tracking error (deviation from target allocation over time), transaction costs as a percentage of portfolio value, tax efficiency ratio (tax cost versus rebalancing benefit), risk-adjusted returns compared to a non-rebalanced version of the same portfolio, and time saved versus manual rebalancing.

7. What are the cybersecurity risks associated with rebalancing automation? Automated systems with trading authority present security considerations including API access vulnerabilities, credential management risks, and potential for algorithmic manipulation. Investors should prioritize platforms with robust security measures including two-factor authentication, encryption, activity monitoring, and trade confirmation requirements.

8. Can automated rebalancing work across multiple accounts and account types? Yes, advanced household-level rebalancing systems can coordinate across taxable accounts, IRAs, 401(k)s, and other account types to optimize asset location and minimize tax impact. These systems view the investor’s holdings holistically, placing tax-inefficient assets in tax-advantaged accounts while maintaining the overall target allocation.

9. How do market conditions affect automated rebalancing strategies? Market volatility increases both the potential benefits and pitfalls of automated rebalancing. During high volatility, rebalancing opportunities occur more frequently, potentially enhancing returns but also generating more transactions. Smart automation systems adjust parameters during extreme market conditions, sometimes widening thresholds or implementing circuit breakers during unprecedented volatility.

10. What customization options should investors prioritize in rebalancing systems? The most valuable customization features include: adjustable drift thresholds by asset class, tax-loss harvesting integration, minimum trade size settings, exclusion capabilities for restricted or low-basis positions, custom treatment for specialty assets, and notification/approval requirements for trades exceeding specified thresholds.

Conclusion

Portfolio rebalancing automation represents the evolution of a fundamental investment discipline, transforming a traditionally labor-intensive process into an efficient, consistent, and potentially more effective wealth management tool. By removing emotional decision-making, reducing time burdens, and enforcing investment discipline, these systems help investors maintain appropriate risk levels while potentially enhancing returns through systematic buying and selling.

As technology continues advancing, rebalancing automation will likely become increasingly sophisticated while simultaneously becoming more accessible to average investors. The integration of artificial intelligence, conversational interfaces, and holistic financial planning frameworks promises to deliver institutional-quality portfolio management capabilities to individual investors across wealth levels.

For most investors with long-term horizons and diversified portfolios, implementing some form of rebalancing automation represents a significant step toward more effective wealth management in today’s complex and volatile financial markets.

For your reference, recently published articles include:

-

- Investing Myths Debunked: Stop Losing Money Now

- Future-Proof Your Portfolio: Surprising Benefits Of Impact Investing

- Seize The Moment: 7 Market Timing Tools For Strategic Wealth

- Investment Pattern Recognition – All You Need To Know

- Never Miss A Rally Again: Ultimate Market Signal Detection

- Investment Strategy Validation: Double Your Returns Now!

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.