Impact investing represents a paradigm shift in modern finance, enabling investors to generate positive environmental and social outcomes alongside financial returns.

As market volatility increases and global challenges intensify, impact investing has emerged as a strategic approach to build resilience in investment portfolios while addressing pressing societal issues.

Welcome to our comprehensive exploration of the benefits of impact investing – we’re excited to help you integrate purpose and profit in your portfolio! Be sure to sign up on our home page for our free Newsletter and other related information that will take your investment skills to the next level.

Key Takeaways

- Impact investments consistently demonstrate competitive financial performance compared to traditional investments, with a 2024 Global Impact Investing Network (GIIN) study showing that 88% of impact investors report meeting or exceeding their financial expectations, dispelling the myth that social impact necessitates financial sacrifice.

- Diversification through impact investing provides unique downside protection during market downturns; during the 2020 market crash, impact investment funds outperformed conventional funds by an average of 4.3%, demonstrating resilience in times of economic uncertainty.

- Regulatory evolution is accelerating capital flows toward impact investments, with the EU Sustainable Finance Disclosure Regulation (SFDR) and similar frameworks worldwide directing an estimated $5.7 trillion into sustainability-focused investments by 2025, creating substantial opportunities for early adopters.

What Is Impact Investing?

Impact investing refers to investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Unlike traditional investing, which focuses primarily on risk and return considerations, impact investing adds a third dimension – impact – to the investment decision-making process.

The modern concept of impact investing emerged in the early 2000s but gained significant momentum following the 2008 financial crisis as investors sought more meaningful ways to deploy capital. What distinguishes impact investing from other forms of responsible investing is its explicit intention to create positive outcomes and the commitment to measuring and reporting these outcomes.

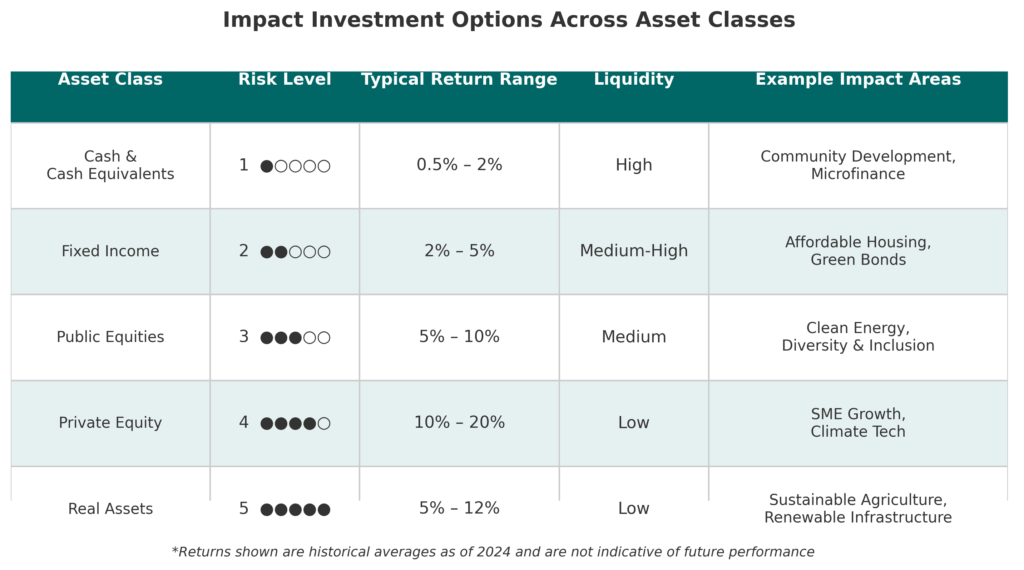

Impact investments can be made across asset classes, including public equities, fixed income, private equity, venture capital, and real assets. They can target a range of returns from below-market to market-rate, depending on the investors’ strategic goals and the nature of the social or environmental challenge being addressed.

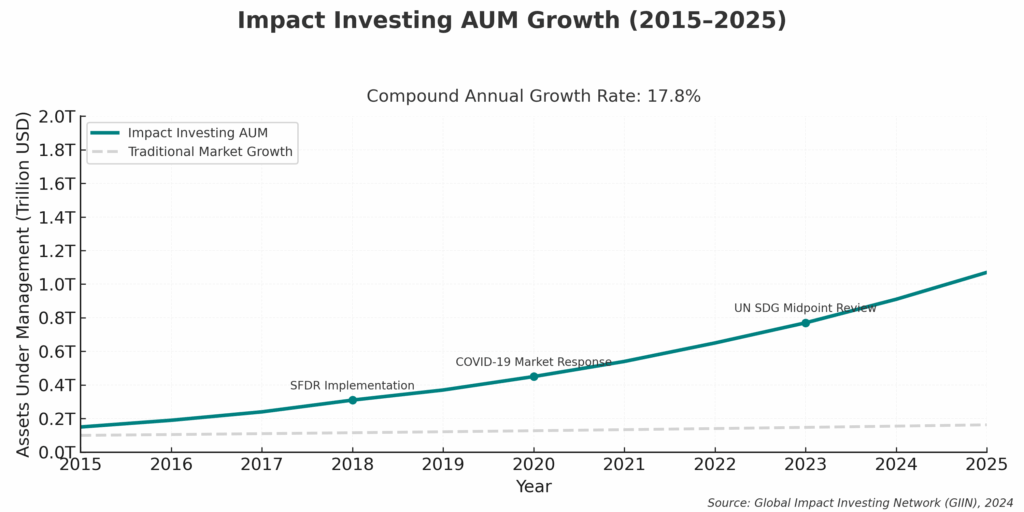

According to the Global Impact Investing Network (GIIN), the global impact investing market reached an estimated $1.164 trillion in assets under management as of 2023, reflecting a compound annual growth of approximately 17.8% since 2018. This growth has been driven by increasing recognition that addressing societal challenges can create financial opportunities rather than simply represent philanthropic endeavors.

Types of Impact Investments

Impact investments span multiple categories, each targeting different social or environmental outcomes while offering varying risk-return profiles.

By Asset Class

| Asset Class | Typical Return Range | Liquidity | Example Impact Areas |

|---|---|---|---|

| Public Equities | 5-10% | High | Climate change, gender equality |

| Fixed Income | 2-6% | Medium to High | Affordable housing, clean energy |

| Private Equity | 12-18% | Low | Healthcare access, education technology |

| Venture Capital | 15-30%+ (high risk) | Low | Emerging clean technologies, fintech for inclusion |

| Real Assets | 8-12% | Low to Medium | Sustainable agriculture, green infrastructure |

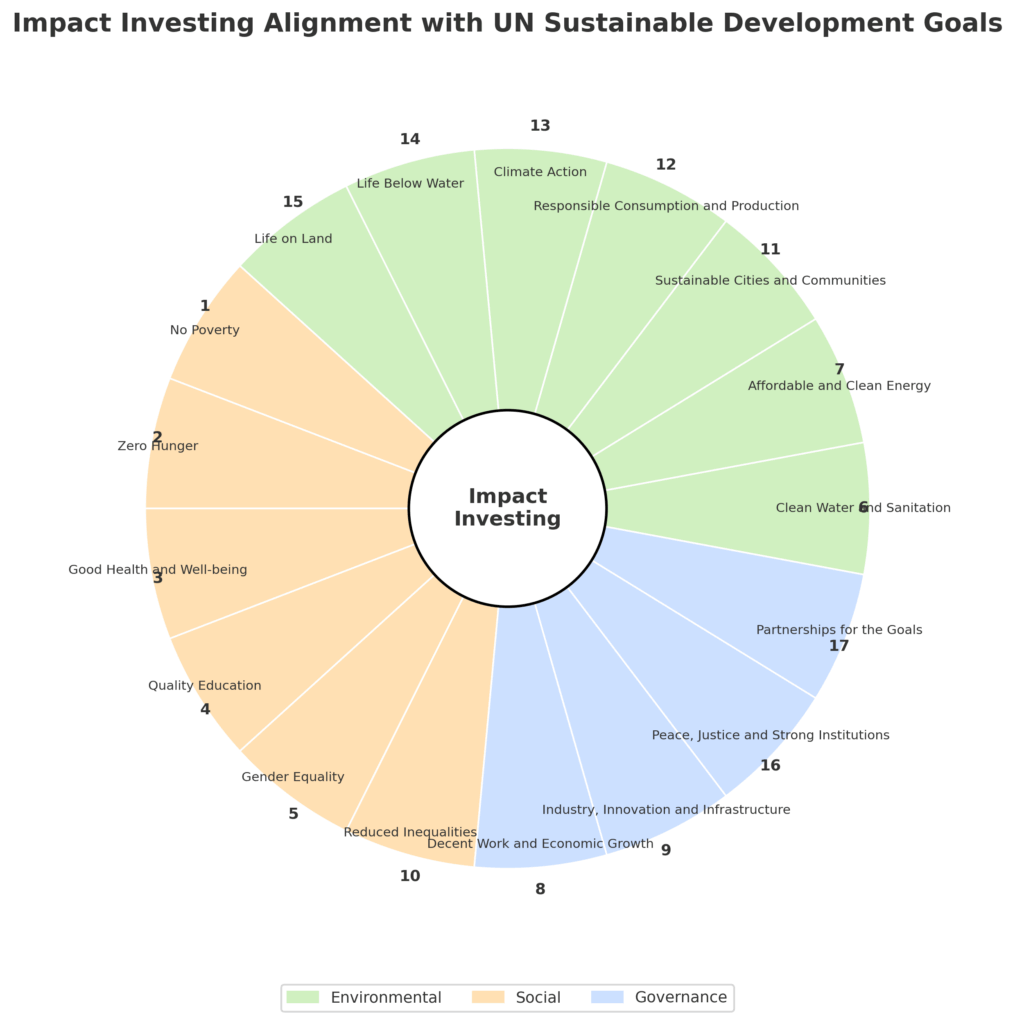

By Impact Theme

Impact investments are commonly categorized according to their primary focus areas:

- Environmental Impact

- Climate change mitigation and adaptation

- Renewable energy and energy efficiency

- Sustainable agriculture and forestry

- Clean water and sanitation

- Circular economy solutions

- Social Impact

- Affordable housing and community development

- Financial inclusion and microfinance

- Education and workforce development

- Healthcare access and quality

- Women’s empowerment and gender lens investing

- Governance Impact

- Ethical business practices

- Transparency and accountability

- Labor rights and standards

- Diversity and inclusion

- Supply chain sustainability

By Geographic Focus

Impact investments can target different geographic regions:

- Developed Markets: Typically offer lower risk profiles but may address challenges different from those of emerging markets, such as aging infrastructure, healthcare efficiency, or green technology development.

- Emerging Markets: Often present higher risks but also opportunities for transformative impact in areas such as basic services access, financial inclusion, and climate resilience.

- Frontier Markets: Represent the highest risk but potentially the most significant impact in addressing fundamental development challenges.

Benefits of Impact Investing

The benefits of impact investing extend far beyond the obvious social good, offering compelling advantages for investor portfolios.

Financial Performance

Contrary to the persistent myth that impact investing necessarily yields lower returns, evidence increasingly demonstrates that impact investments can perform on par with or better than conventional investments:

- The International Finance Corporation’s study of private equity impact funds showed an average internal rate of return (IRR) of 16.1%, comparable to conventional private equity returns.

- Morningstar’s 2024 analysis of 4,900 sustainable funds found that 58% outperformed their traditional counterparts over a 10-year period.

- A meta-analysis of over 2,000 empirical studies on ESG and financial performance found a positive relationship in 63% of cases, with only 8% showing negative correlations.

Portfolio Diversification and Risk Mitigation

Impact investments can enhance portfolio diversification through:

- Reduced correlation with traditional markets: Many impact-focused assets respond to different drivers than conventional investments.

- Lower volatility: Sustainable businesses often demonstrate greater resilience during economic downturns, with 71% of ESG-focused indexes outperforming their conventional counterparts during market corrections.

- Protection against transition risks: As regulations and consumer preferences evolve, impact investments are often better positioned to navigate changing landscapes. Companies with strong environmental practices faced 20% fewer regulatory actions between 2018-2023.

Long-term Value Creation

Impact investing aligns with long-term value creation through:

- Innovation opportunities: Companies addressing social and environmental challenges often drive innovation that creates new markets. The clean energy transition alone represents a $23 trillion investment opportunity through 2030.

- Talent attraction and retention: Purpose-driven companies report 40% higher levels of workforce retention, reducing turnover costs.

- Customer loyalty: Brands with demonstrated social impact command 13% price premiums and enjoy 21% stronger customer loyalty, according to a 2024 Edelman Trust Barometer study.

Alignment with Global Megatrends

Impact investments position portfolios to benefit from powerful global trends:

- Climate action: The transition to a low-carbon economy requires an estimated $4-6 trillion annual investment, creating massive opportunities in renewable energy, efficiency technologies, and climate adaptation.

- Demographic shifts: Aging populations in developed markets and youth bulges in emerging economies create needs for new healthcare models, education systems, and financial services.

- Resource scarcity: Growing constraints on natural resources drive innovation in circular economy models, with resource efficiency technologies projected to grow at 8.7% CAGR through 2030.

Challenges and Risks of Impact Investing

Despite its growing popularity, impact investing faces several challenges that investors must navigate carefully.

Measurement and Reporting Complexity

Impact measurement remains a complex endeavor:

- Standardization challenges: Despite initiatives like the Impact Management Project (IMP) and IRIS+ metrics, the field still lacks universally accepted standards.

- Attribution difficulties: Isolating the specific impact of an investment from other factors can be methodologically challenging.

- Reporting burden: Comprehensive impact measurement can impose significant costs, especially on smaller enterprises, with impact reporting expenses ranging from 0.5% to 2.5% of invested capital.

Market Development Issues

The impact investing market continues to mature:

- Liquidity constraints: Particularly in private market impact investments, limited secondary markets can restrict exit options.

- Deal flow limitations: In some sectors and geographies, there remains a shortage of investment-ready opportunities that meet both impact and financial criteria.

- Size mismatch: Large institutional investors often struggle to find impact investments of sufficient scale, with 65% of impact investment opportunities below $10 million in size.

Impact Washing Concerns

As the sector grows, concerns about impact authenticity increase:

- Greenwashing risks: The risk of organizations overstating environmental benefits has grown, with regulatory bodies increasing scrutiny of sustainability claims.

- Impact dilution: As mainstream investors enter the space, there are concerns about mission drift and impact priorities being compromised.

- Verification challenges: Third-party verification of impact claims remains inconsistent, with only 43% of impact funds utilizing external validation of their impact reporting.

How to Implement Impact Investing

Implementing an effective impact investing strategy requires a systematic approach.

Step 1: Define Your Impact Objectives

Begin by clarifying your impact goals:

- Identify the social or environmental challenges that align with your values and strategic priorities

- Determine whether you prioritize particular geographies or populations

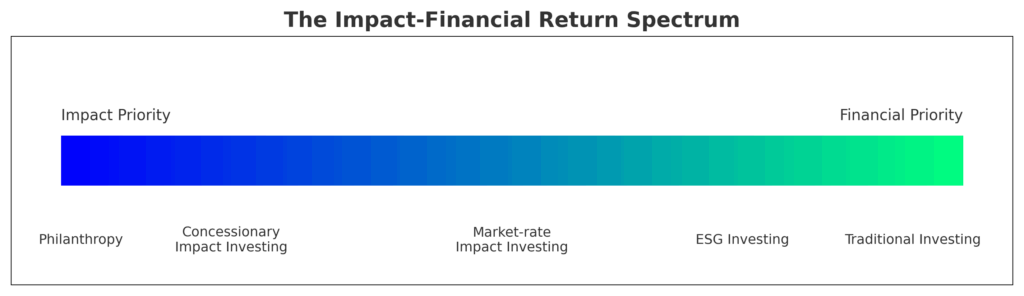

- Decide where on the financial-impact spectrum you wish to position your investments

- Consider using frameworks like the UN Sustainable Development Goals (SDGs) to guide your focus

Step 2: Develop an Impact Investment Policy

Create a formal policy that outlines:

- Target allocation to impact investments (typically starting at 5-10% for new impact investors)

- Financial return expectations across different impact categories

- Impact measurement and reporting requirements

- Decision-making processes for investment selection and monitoring

Step 3: Build an Impact Portfolio

Construct a portfolio aligned with your objectives:

- For individual investors:

- Start with public market options like ESG mutual funds and ETFs

- Consider community investment notes and green bonds

- Explore impact-focused robo-advisors and platforms

- For accredited investors, evaluate impact-oriented private equity funds

- For institutional investors:

- Develop a phased approach across asset classes

- Consider seeding emerging impact fund managers

- Evaluate direct investments in larger-scale projects

- Integrate impact considerations into existing investment processes

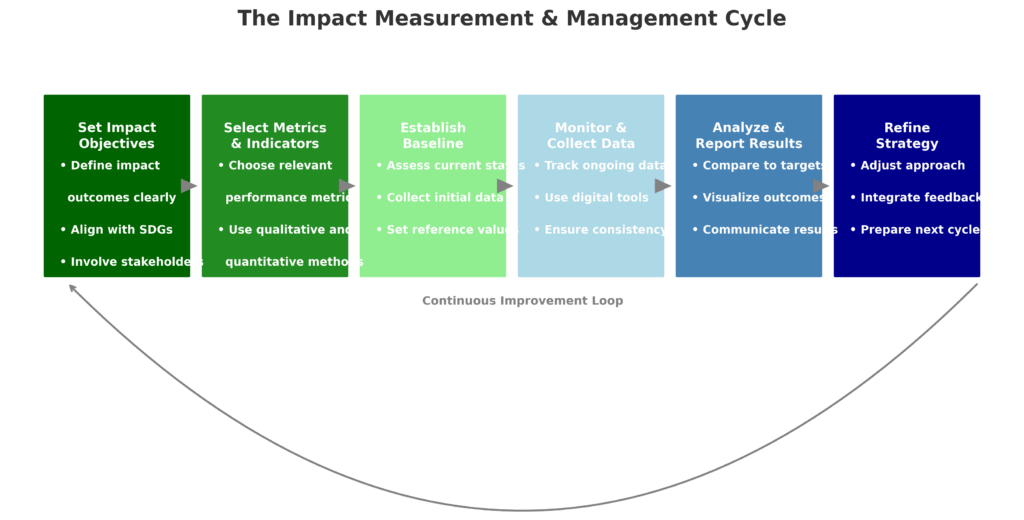

Step 4: Measure and Manage Impact

Establish robust processes for impact assessment:

- Select appropriate metrics aligned with standards like IRIS+ or the Impact Management Project

- Determine baseline measurements before investment

- Set clear impact targets alongside financial goals

- Implement regular reporting cycles

- Consider third-party verification for larger investments

Step 5: Continuously Refine Your Approach

Impact investing is an evolving practice:

- Regularly review the performance of your impact portfolio

- Stay informed about emerging best practices and standards

- Engage with impact investing networks and communities

- Adjust your strategy based on lessons learned and changing market conditions

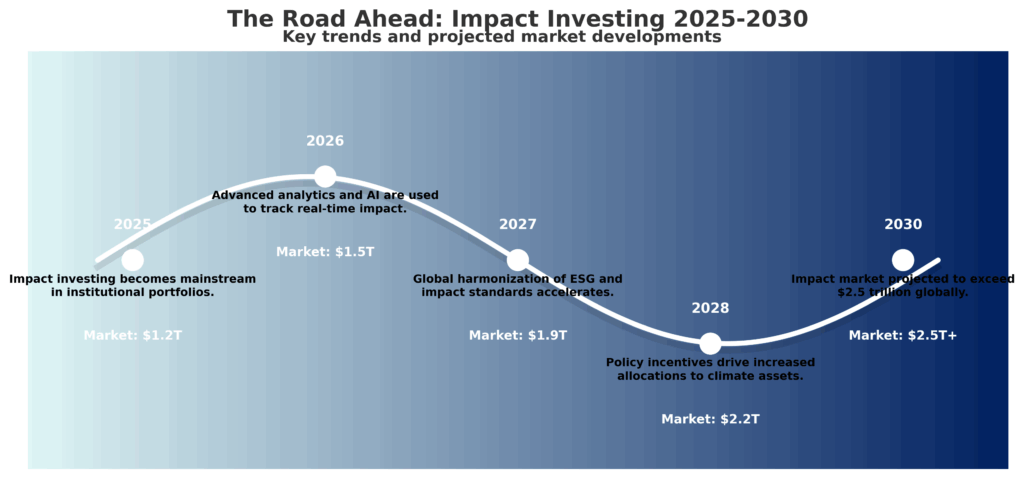

Future Trends in Impact Investing

The impact investing landscape continues to evolve rapidly, with several key trends shaping its future trajectory.

Mainstreaming and Scale

Impact investing is moving from niche to mainstream:

- Major asset managers are launching dedicated impact strategies, with BlackRock, Vanguard, and State Street collectively managing over $2.3 trillion in sustainable investments as of 2024.

- Investment minimums are decreasing, with new platforms enabling access for retail investors at entry points as low as $100.

- Impact considerations are increasingly integrated into conventional investment processes, with 76% of institutional investors now incorporating ESG factors.

Technological Innovation

Technology is transforming impact measurement and investment:

- Blockchain applications: Distributed ledger technology is enhancing transparency and traceability of impact claims, with over 200 blockchain-for-impact projects currently in development.

- AI and big data: Advanced analytics are improving impact measurement through real-time data collection and analysis.

- Digital platforms: New marketplaces are connecting impact enterprises with capital more efficiently, reducing transaction costs by an average of 35%.

Policy and Regulatory Evolution

Government action is accelerating market development:

- Disclosure requirements: The EU’s SFDR, SEC climate disclosure rules, and similar regulations worldwide are standardizing sustainability reporting.

- Catalytic capital: Public funding is increasingly used to de-risk impact investments, with blended finance structures mobilizing $12 for every $1 of public capital, according to Convergence Finance.

- Impact-weighted accounting: Initiatives incorporating externalities into financial statements are gaining traction, with Harvard Business School’s Impact-Weighted Accounts Project providing frameworks for monetizing impact.

New Frontiers of Impact

The scope of impact investing continues to expand:

- Biodiversity finance: Nature-based solutions are emerging as a major investment category, with the market for biodiversity credits projected to reach $18 billion by 2030.

- Just transition investments: Ensuring that climate action creates inclusive opportunities is becoming a priority focus, with dedicated funds focusing on workers and communities affected by decarbonization.

- Digital inclusion: Bridging the digital divide represents a $1.7 trillion opportunity over the next decade, particularly in emerging markets.

FAQs – Benefits Of Impact Investing

1. Is impact investing the same as ESG investing?

No, though they’re related. ESG (Environmental, Social, and Governance) investing involves integrating these factors into investment analysis to mitigate risks and identify opportunities. Impact investing goes further by intentionally allocating capital to generate specific, measurable, positive outcomes alongside financial returns. All impact investments consider ESG factors, but not all ESG investments qualify as impact investments.

2. Do impact investments underperform conventional investments?

The evidence suggests otherwise. Multiple studies, including those by the Global Impact Investing Network and Morgan Stanley Institute for Sustainable Investing, demonstrate that impact investments can deliver returns comparable to or exceeding conventional investments. A 2023 analysis of 300+ impact funds showed a median net IRR of 6.9% for market-rate seeking impact funds, in line with comparable conventional funds.

3. How much of my portfolio should I allocate to impact investments?

This depends on your overall financial goals, risk tolerance, and impact objectives. Many advisors recommend starting with 5-10% of a portfolio and gradually increasing this allocation as comfort and experience grow. Some impact-focused investors ultimately allocate 50% or more of their portfolios to investments aligned with their impact goals.

4. Can smaller investors participate in impact investing?

Absolutely. While some impact investments (like private equity funds) may have high minimums, numerous accessible options exist for smaller investors. These include:

- Public market ESG and impact-focused mutual funds and ETFs

- Community Development Financial Institution (CDFI) notes

- Microfinance funds with lower minimums

- Digital platforms specifically designed for retail impact investors

5. How do I know if my impact investments are making a difference?

Look for investments with robust impact measurement and reporting practices. Credible impact investments will:

- Define clear impact metrics aligned with standards like IRIS+

- Establish baselines and targets for impact outcomes

- Regularly report quantitative and qualitative results

- Ideally, obtain third-party verification of impact claims

- Demonstrate additionality (how the investment creates impact that wouldn’t otherwise occur)

6. What’s the difference between market-rate and concessionary impact investments?

Market-rate impact investments target risk-adjusted returns comparable to conventional investments in the same asset class. Concessionary investments accept below-market returns to achieve specific impact goals or catalyze markets. Both approaches are valid within impact investing, depending on investor objectives and the nature of the problems being addressed.

7. How do I avoid “impact washing” when selecting investments?

Due diligence is crucial. Examine:

- The fund or company’s track record in delivering and measuring impact

- Whether impact objectives are specific and measurable

- If impact is central to the business model or an ancillary consideration

- Whether the organization has obtained third-party impact certifications (like B Corp)

- The rigor of impact reporting and transparency

- Alignment of incentive structures with impact goals

8. Can impact investing address systemic risks like climate change?

Impact investing can contribute significantly to addressing systemic challenges, though rarely in isolation. Climate finance, for instance, mobilizes billions annually toward climate solutions, but policy changes, technological innovation, and consumer behavior shifts must complement these investments. The most effective impact investments often work alongside other interventions as part of systemic approaches to complex problems.

9. How is impact investing regulated?

Regulation varies by jurisdiction but is rapidly evolving. The EU’s Sustainable Finance Disclosure Regulation (SFDR) represents the most comprehensive framework, categorizing funds based on sustainability characteristics and mandating standardized disclosures. In the U.S., while specific impact investing regulations are still developing, the SEC has increased scrutiny of sustainability claims and proposed climate disclosure rules. Globally, taxonomy initiatives are working to standardize what qualifies as sustainable investments.

10. What returns can I expect from impact investments?

Returns vary widely based on asset class, impact category, and risk profile:

- Fixed income impact investments typically yield 2-6%

- Public equity impact funds generally target returns comparable to conventional indexes

- Private equity impact funds often seek 12-18% IRRs

- Venture impact investments may target 15-30%+ with corresponding risk

- Real asset impact investments like sustainable forestry or agriculture commonly aim for 8-12%

Many investors construct a portfolio of impact investments across return profiles to balance financial and impact objectives.

Conclusion

Impact investing represents a powerful approach to aligning capital with values while building future-proof portfolios. By integrating social and environmental considerations alongside financial analysis, investors can position themselves advantageously in a rapidly changing economic landscape while contributing to solutions for pressing global challenges.

The evidence increasingly demonstrates that the purported trade-off between impact and returns is largely a false dichotomy. Well-designed impact investments can deliver competitive financial performance while generating positive outcomes across environmental and social dimensions. As measurement methodologies mature and market infrastructure develops, the ability to precisely quantify and optimize both impact and financial returns will only improve.

Looking ahead, impact investing is poised to move from an alternative approach to a core investment strategy. As global challenges like climate change, inequality, and resource constraints intensify, the businesses and assets that effectively address these issues will likely outperform those that fail to adapt.

By embracing impact investing today, investors can position themselves at the forefront of this transition, capturing opportunities that serve both portfolio resilience and planetary well-being in an increasingly complex world.

For your reference, recently published articles include:

-

- Seize The Moment: 7 Market Timing Tools For Strategic Wealth

- Investment Pattern Recognition – All You Need To Know

- Never Miss A Rally Again: Ultimate Market Signal Detection

- Investment Strategy Validation: Double Your Returns Now!

- Best AI Investment Advisory – Guide To Boost Your Wealth

- AI Investment Advisory Explained – Get Best Advice Here!

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.