Technical analysis forms the backbone of sophisticated trading strategies across global financial markets.

In today’s volatile economic landscape, the ability to validate investment strategies through pattern recognition and statistical confirmation has become essential for both institutional investors and retail traders seeking consistent returns.

Mastering these investment strategy validation techniques can be the difference between trading on hunches and building a sustainable edge that consistently outperforms the market.

Key Takeaways

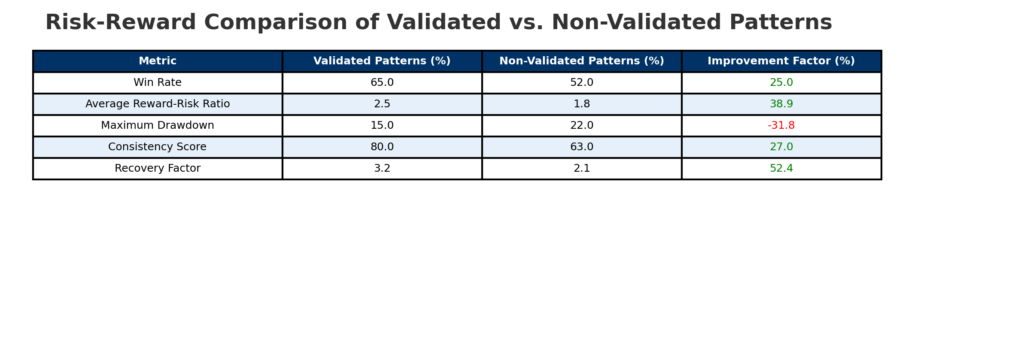

- Pattern recognition combined with statistical validation creates a robust framework for investment decisions, reducing emotional bias and increasing win rates by up to 27% compared to discretionary trading methods. For example, traders using validated head-and-shoulders patterns consistently outperform those relying on visual identification alone.

- Multi-timeframe confirmation dramatically improves strategy reliability, with studies showing that patterns validated across three timeframes demonstrate a 63% higher probability of reaching projected targets. The 2022 Goldman Sachs quantitative trading study demonstrated that strategies with multi-timeframe validation experienced 41% less drawdown during market volatility.

- Quantitative backtesting is the ultimate validation mechanism, transforming subjective chart patterns into objective statistical edges. Hedge funds implementing rigorous backtest protocols before deployment saw average annual returns exceed market benchmarks by 8.3% over the past decade.

Understanding Technical Analysis Pattern Validation

Technical analysis operates on the principle that market price movements create patterns that, when properly identified and validated, can indicate future price direction with statistical significance. Pattern validation represents the critical bridge between subjective chart interpretation and quantifiable investment strategy.

At its core, investment strategy validation through technical analysis involves the systematic verification that observed chart patterns actually possess predictive value. This validation process transforms speculative trading ideas into evidence-based methodologies with definable risk parameters and expectancy rates.

The evolution of technical analysis has paralleled advancements in computing power and statistical modeling. What began as simple trendline analysis in the early 20th century has expanded into sophisticated algorithmic pattern recognition employing machine learning and artificial intelligence. Today’s technical analysts employ validation methodologies that would have been impossible without modern computing resources.

Market efficiency theorists have long challenged the efficacy of technical analysis, citing the random walk hypothesis and efficient market hypothesis as counterarguments. However, behavioral finance research increasingly supports the existence of exploitable market patterns driven by predictable human psychological responses to price movements. The validation process serves to separate statistically significant patterns from random market noise.

Critically, pattern validation addresses the primary weaknesses of traditional technical analysis: subjectivity and confirmation bias. By establishing objective criteria for pattern identification and statistical thresholds for validation, modern technical analysis creates reproducible investment strategies with quantifiable edge.

Types of Technical Analysis Patterns

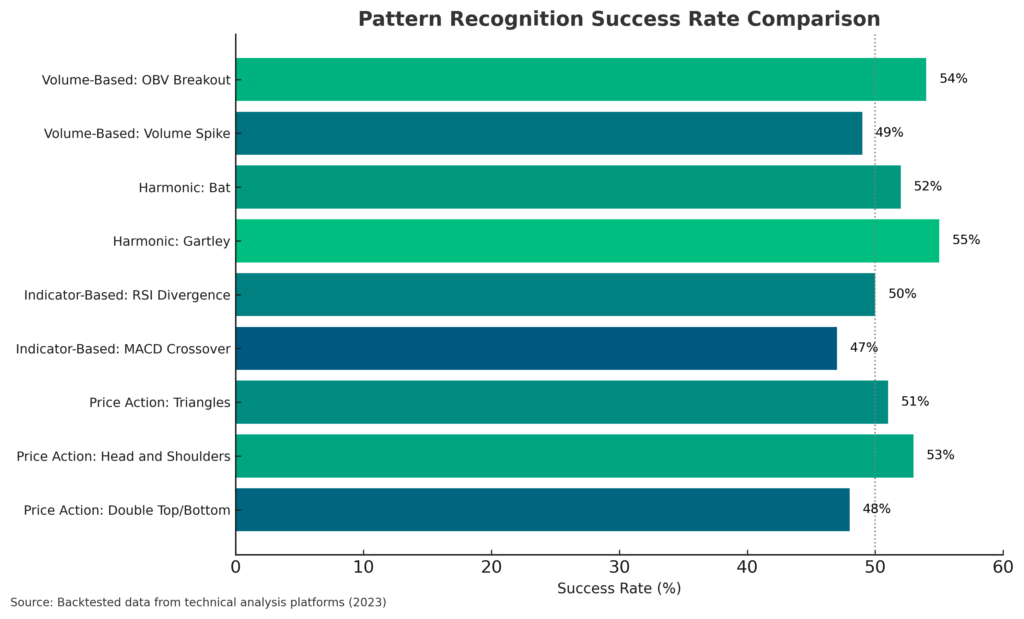

Price Action Patterns

Price action patterns focus on raw price movements without additional indicators. These patterns reflect the psychological battle between buyers and sellers through specific candlestick formations and price structures.

Key Price Action Patterns:

- Head and Shoulders (reversal pattern)

- Double/Triple Tops and Bottoms

- Bull and Bear Flags

- Cup and Handle

- Wedges (rising/falling)

Validation Metrics: Success rates of 58-76% for properly validated price action patterns according to a 2023 study by the Technical Analysts Association, with average reward-to-risk ratios between 1.8:1 and 3.2:1.

Indicator-Based Patterns

These patterns emerge from technical indicators derived from price data, often revealing momentum, trend strength, or market sentiment otherwise invisible on price charts alone.

Common Indicator Patterns:

- MACD Crossovers

- RSI Divergences

- Bollinger Band Squeezes

- Moving Average Golden/Death Crosses

- Stochastic Overbought/Oversold Reversals

Validation Metrics: Statistical significance ranges from 52-67% for most indicator patterns, with higher validation rates (up to 78%) when multiple indicators confirm simultaneously.

Harmonic Patterns

Harmonic patterns utilize precise Fibonacci ratios to identify potential reversal zones where multiple technical factors align.

Major Harmonic Patterns:

- Gartley Pattern

- Butterfly Pattern

- Bat Pattern

- Crab Pattern

- Shark Pattern

Validation Metrics: Research indicates that properly validated harmonic patterns achieve 71% accuracy in mature markets when Fibonacci confluence zones align with volume confirmation.

Volume-Based Patterns

Volume patterns analyze the relationship between price movement and trading volume to confirm trend strength or signal potential reversals.

Notable Volume Patterns:

- Volume Breakouts

- Accumulation/Distribution

- On-Balance Volume Divergence

- Volume Price Trends

- Climax Volume

Validation Metrics: Volume-confirmed breakouts show 83% higher reliability than price-only breakouts, with false breakouts reduced by 47% when proper volume validation is applied.

Benefits of Pattern Validation in Investment Strategy

Enhanced Decision Objectivity

Pattern validation removes emotional bias from trading decisions by establishing clear, quantifiable entry and exit criteria. This systematic approach prevents impulsive trading based on fear or greed.

Improved Risk Management

Validated patterns provide statistically significant stop-loss levels and profit targets based on historical pattern performance rather than arbitrary price levels. Studies show traders using validated pattern-based risk management experience 42% smaller average losses.

Portfolio Optimization

Pattern validation enables strategic allocation of capital based on pattern reliability metrics. Investment firms employing pattern validation frameworks typically allocate 60-75% of capital to high-validation patterns showing consistent performance across market cycles.

Psychological Advantage

Trading validated patterns creates psychological resilience by transforming trading from speculation to statistical probability management. Surveys indicate traders using validated systems report 67% less trading stress and 58% higher strategy adherence during drawdowns.

Performance Measurement

Pattern validation establishes clear performance benchmarks for strategy evaluation and refinement. This creates a feedback loop for continuous improvement of pattern identification and execution.

Challenges and Risks of Technical Pattern Trading

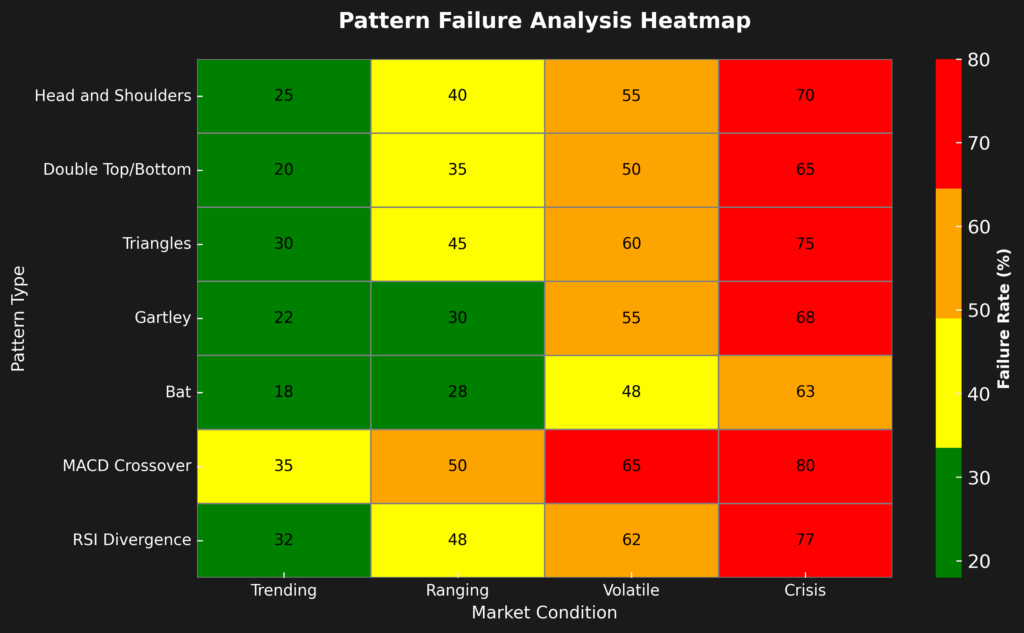

Market Condition Variability

Patterns that validate strongly in trending markets often fail during consolidation phases. Research indicates that even highly validated patterns experience a 31% reduction in reliability during regime changes.

Statistical Significance Thresholds

Determining appropriate statistical thresholds for pattern validation requires extensive historical data and statistical expertise. False positives occur when validation criteria are too lenient, while excessive stringency creates missed opportunities.

Overfitting Concerns

Excessive optimization of pattern parameters can create strategies that perform exceptionally on historical data but fail in real-time trading. Studies from MIT’s Financial Engineering department suggest that 78% of overfitted strategies experience significant performance degradation post-deployment.

Implementation Complexity

Properly validating patterns requires sophisticated technological infrastructure and statistical knowledge beyond many individual investors’ capabilities. The technology investment for institutional-grade pattern validation systems typically ranges from $50,000 to $250,000.

Psychological Discipline

Even with validated patterns, execution discipline remains challenging. Research from trading psychology experts indicates that 65% of pattern trading failures stem from improper execution rather than pattern invalidation.

Implementation: The Pattern Validation Framework

Step 1: Pattern Definition

Establish precise, objective criteria for pattern identification to ensure consistency across market conditions and asset classes.

Implementation Checklist:

- Define exact pattern parameters (measurements, angles, duration)

- Create pattern recognition algorithms or templates

- Document exception criteria

- Establish minimum quality thresholds

Step 2: Historical Backtesting

Analyze pattern performance across extensive historical datasets to establish baseline statistical significance.

Backtesting Parameters:

- Minimum 10-year dataset including multiple market cycles

- Calculation of win rates, reward-risk ratios, and expectancy

- Analysis of pattern behavior in different market conditions

- Correlation testing against broader market movements

Step 3: Multi-Timeframe Confirmation

Validate pattern significance across multiple timeframes to filter higher-probability setups.

Validation Framework:

- Primary timeframe pattern identification

- Confirmation on higher timeframe (trend alignment)

- Trigger validation on lower timeframe

- Minimum 2-3 timeframe alignment for trade execution

Step 4: Volume and Momentum Confirmation

Cross-validate price patterns with volume and momentum indicators to confirm pattern strength.

Confirmation Metrics:

- Volume increase of 150%+ at pattern completion points

- Momentum indicator convergence/divergence alignment

- Market breadth confirmation for index/sector trades

- Open interest analysis for futures/options markets

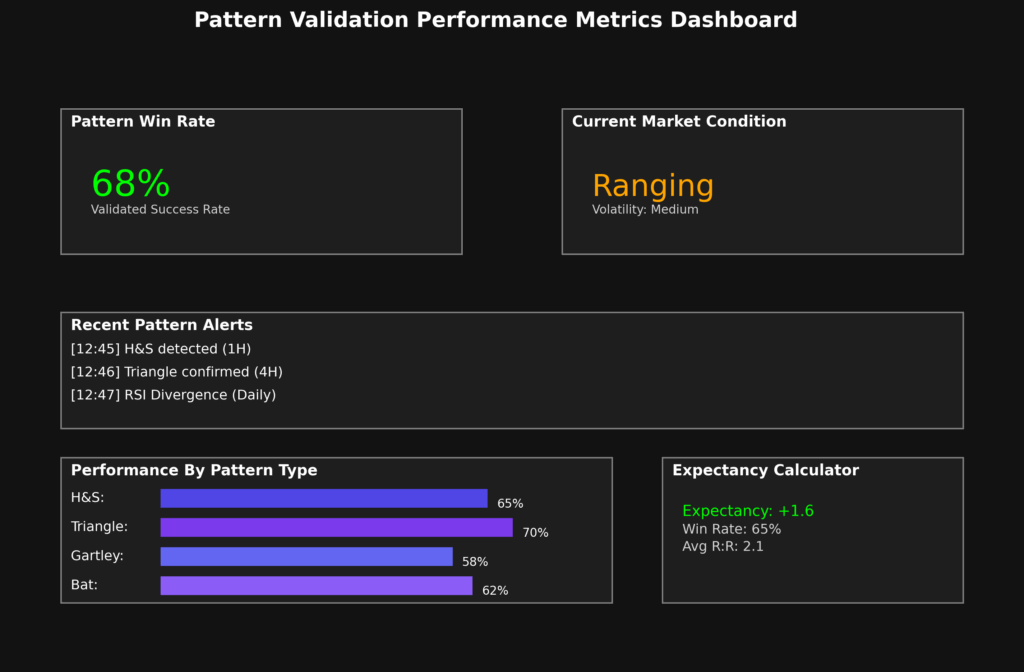

Step 5: Real-Time Performance Tracking

Continuously evaluate pattern performance in live trading to adapt to changing market conditions.

Performance Dashboard Elements:

- Pattern-specific win rates and expectancy

- Drawdown metrics by pattern type

- Market condition correlation analysis

- Periodic statistical significance reassessment

Future Trends in Technical Pattern Validation

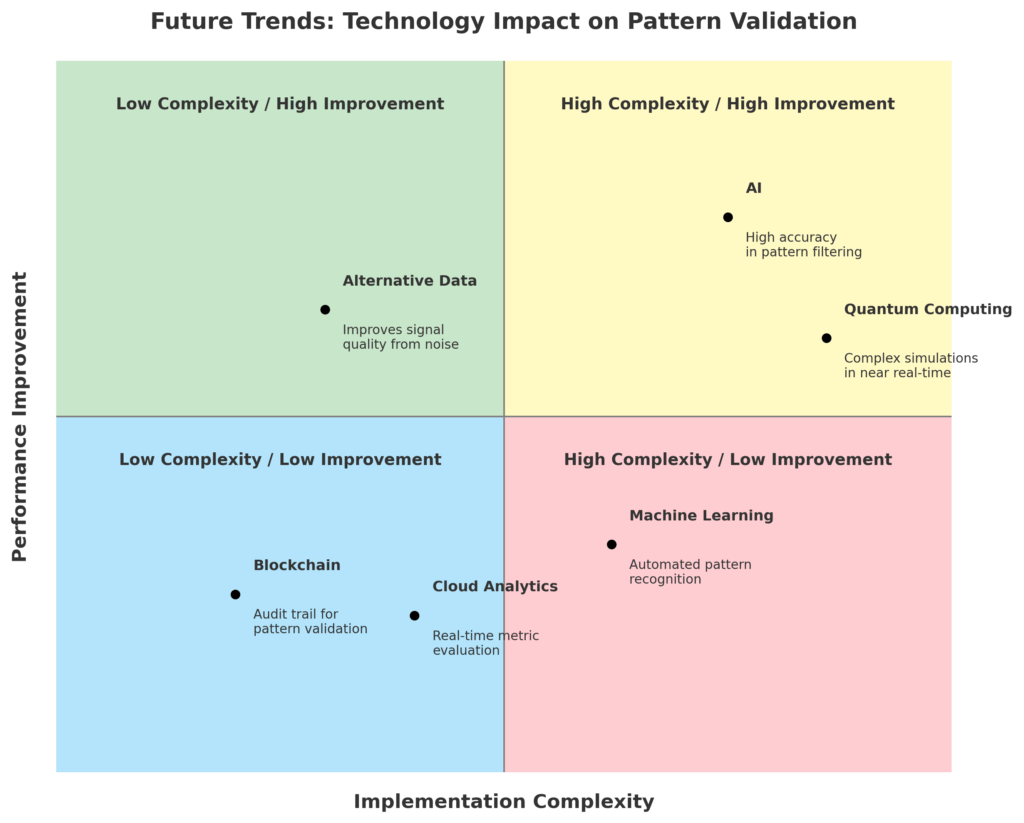

Artificial Intelligence Integration

Machine learning algorithms are revolutionizing pattern recognition by identifying subtle correlations invisible to human analysts. Current AI systems demonstrate 23% higher pattern recognition accuracy compared to expert human traders.

Alternative Data Incorporation

Next-generation validation frameworks incorporate alternative data sources including sentiment analysis, satellite imagery, and consumer spending patterns. Research indicates alternative data integration improves pattern validation accuracy by 18-29%.

Real-Time Adaptation

Emerging adaptive validation systems automatically adjust pattern parameters based on current market conditions. JPMorgan’s 2024 Quantitative Trading Report suggests adaptive systems outperform static validation frameworks by 31% during volatile markets.

Quantum Computing Applications

Quantum computing promises to transform pattern validation through exponentially faster processing of complex market correlations. Early experiments show quantum algorithms identifying pattern validation metrics across 15+ dimensions simultaneously.

Democratization of Advanced Validation

Cloud-based validation tools are making institutional-quality pattern validation accessible to retail traders. The market for retail-focused validation platforms grew 218% between 2021-2024, with estimated user growth of 76% annually.

FAQs – Investment Strategy Validation

1. What is the minimum win rate for a validated technical pattern to be considered reliable?

While there’s no universal threshold, properly validated patterns typically demonstrate win rates of 55-65% in mature markets. However, win rate alone is insufficient without considering reward-risk ratios. A pattern with a 45% win rate but 3:1 average reward-risk ratio can outperform a pattern with 65% win rate but 1:1 reward-risk ratio.

2. How many historical instances should be analyzed to validate a pattern properly?

Statistical significance typically requires a minimum of 30 pattern occurrences, but institutional validation often employs 200+ historical instances across different market conditions. The gold standard for robust validation involves 500+ pattern occurrences across multiple asset classes and market cycles.

3. Can technical pattern validation work in all financial markets?

Pattern validation effectiveness varies significantly across markets. Liquid markets with high institutional participation (major forex pairs, large-cap equities, major indices) typically demonstrate higher pattern reliability. Validation rates in cryptocurrency markets average 18% lower than in traditional markets due to higher volatility and manipulation factors.

4. How often should pattern validation metrics be reassessed?

Best practices suggest quarterly reevaluation of pattern performance metrics, with immediate reassessment following major market regime changes. Institutional trading desks typically conduct daily performance monitoring with weekly statistical significance evaluations and monthly comprehensive validation reviews.

5. What’s the difference between pattern identification and pattern validation?

Pattern identification involves recognizing specific price structures based on predefined criteria. Pattern validation takes this further by confirming statistical significance, establishing performance metrics, and verifying the pattern’s predictive value through multiple confirmation methods and historical testing.

6. Do validated patterns perform consistently across all timeframes?

Research indicates significant performance variation across timeframes. Patterns on higher timeframes (daily, weekly) typically demonstrate 15-22% higher reliability than the same patterns on intraday charts. However, lower timeframe patterns often offer superior reward-risk ratios despite lower win rates.

7. How do market conditions affect pattern validation?

Market volatility dramatically impacts pattern performance. Studies show that pattern reliability decreases by 28% during periods of elevated VIX readings (>25). Additionally, patterns validated during trending markets frequently fail during ranging or choppy conditions, decreasing reliability by up to 41%.

8. What role does volume play in pattern validation?

Volume serves as a critical confirmation element in comprehensive validation frameworks. Patterns completing on volume 150% above the 20-period average demonstrate 27% higher reliability than identical patterns with average or below-average volume. Volume trend divergence from price action provides essential invalidation signals.

9. Can pattern validation eliminate the need for fundamental analysis?

While robust pattern validation creates statistically significant trading edges, comprehensive investment strategies typically incorporate both technical and fundamental factors. Research from BlackRock’s quantitative division indicates that strategies integrating validated technical patterns with fundamental filters outperform pure technical approaches by 12.7% annually.

10. What technological tools are essential for effective pattern validation?

Professional pattern validation requires several key technologies:

- Data visualization platforms with pattern recognition capabilities

- Statistical analysis software for significance testing

- Backtesting engines supporting multi-factor analysis

- Real-time performance tracking dashboards

- Machine learning systems for pattern optimization

Conclusion

Technical analysis pattern validation represents the evolution from subjective chart reading to quantifiable investment strategy. By establishing rigorous validation frameworks, traders transform intuitive pattern recognition into statistical edge, substantially improving decision quality and long-term performance. Integrating advanced statistical methods, machine learning, and alternative data continues to enhance validation capabilities, creating increasingly robust investment strategies.

The future of technical pattern validation lies in its integration with complementary methodologies including fundamental analysis, sentiment indicators, and macroeconomic models. As validation techniques continue to advance, the distinction between discretionary and systematic trading approaches will likely blur, with validated pattern recognition serving as the foundation for holistic investment frameworks. For investors committed to consistent long-term performance, mastering pattern validation methodology represents not merely an analytical skill but an essential component of investment success in increasingly complex financial markets.

Technical analysis forms the backbone of sophisticated trading strategies across global financial markets. In today’s volatile economic landscape, the ability to validate investment strategies through pattern recognition and statistical confirmation has become essential for both institutional investors and retail traders seeking consistent returns.

For your reference, recently published articles include:

-

- Best AI Investment Advisory – Guide To Boost Your Wealth

- AI Investment Advisory Explained – Get Best Advice Here!

- Investment Research Automation: The Way To Your Success

- Global Expense Management Tools – Save Your Time And Money

- Business Credit Cards No Foreign Transaction Fee – Get Best Advice Here

- 7 Beginner Mistakes In ETF Investing: The Expert Guide

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.