In today’s fast-paced financial landscape, Wall Street analysts are increasingly turning to automation tools to enhance their research capabilities, process large amounts of data, and gain a competitive advantage.

Investment research automation has transformed from a luxury into a necessity, with AI-powered tools enabling analysts to uncover insights faster, eliminate human bias, and make data-driven decisions with unprecedented efficiency.

Key Takeaways

- AI-powered research tools have become essential for Wall Street analysts, enabling them to process vast amounts of data in seconds rather than days, with even the most savvy research analysts having limitations to what they can access through traditional search channels without automation assistance.

- The implementation of research automation creates measurable efficiency gains, with tools like Bloomberg’s AI-powered earnings call summaries providing what Joyce Meng, Managing Director at Fact Capital, describes as “a big edge” by streamlining the process of reading and synthesizing trends across companies.

- Adoption of investment research automation is accelerating, as analysts seek competitive advantages in a market where the speed at which the investment world operates today requires investors to have access to real-time updates and relevant insights about the companies and industries that matter to them.

Table of Contents

What is Investment Research Automation?

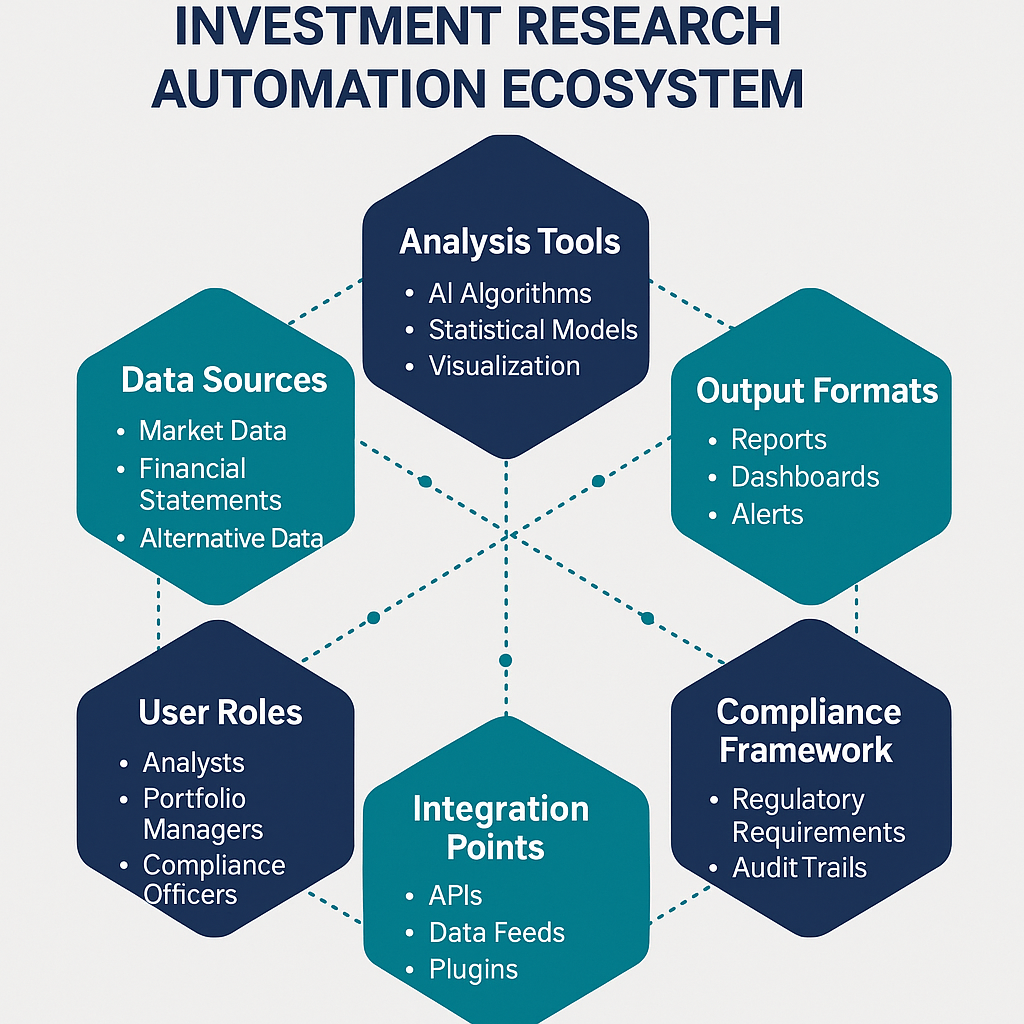

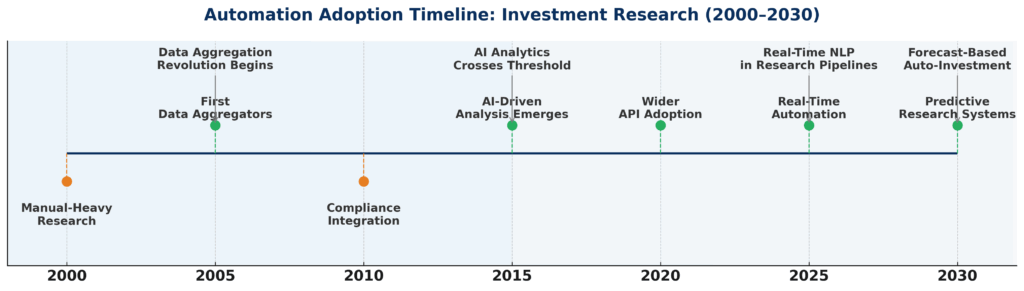

Investment research automation refers to the use of advanced technologies, particularly artificial intelligence and machine learning algorithms, to streamline and enhance the process of gathering, analyzing, and interpreting financial data for investment decision-making. This automation approach transforms what was once a manual, time-consuming process into a streamlined workflow where computers handle repetitive tasks, process enormous datasets, and even generate insights that human analysts might miss.

In the current financial landscape, research automation has become increasingly sophisticated. Modern systems can automatically monitor earnings reports, analyze market trends, identify patterns in trading data, and even generate natural language summaries of complex financial documents. The most advanced tools incorporate predictive analytics capabilities that can forecast market movements based on historical data and current conditions.

The evolution of investment research automation has been driven by several factors. First, the explosion of available financial data has made manual analysis practically impossible. Second, advances in AI and machine learning have created powerful new analytical capabilities. Third, competitive pressures have forced financial institutions to seek any possible edge in speed and accuracy.

For Wall Street analysts specifically, automation tools have become indispensable for staying competitive in a field where being first to spot a trend or identify an opportunity can make the difference between profit and loss. These professionals now rely on automation to handle data collection and initial analysis, freeing them to focus on applying their expertise to interpret results and make recommendations.

The transformative impact of automation on investment research cannot be overstated. Where analysts once spent days manually compiling and analyzing financial statements, news reports, and market data, automated systems now accomplish the same tasks in seconds, with greater accuracy and without human bias or fatigue.

Types of Investment Research Automation Tools

Data Aggregation and Processing Tools

These platforms serve as the foundation for automated research by collecting, organizing, and standardizing financial data from multiple sources. They eliminate the need for manual data entry and ensure analysts have access to comprehensive, accurate information.

Key players include:

- Bloomberg Terminal: The gold standard for financial data, Bloomberg offers a comprehensive trading solution that brings together pricing, analytics, liquidity, automation, and execution in one place. Its BloombergGPT large language model is specifically trained on financial data.

- FactSet: FactSet is working on generative AI for workflow automation, providing a comprehensive platform that includes both financial data and analytical tools. Their AI-based transcript assistant allows users to ask questions about the content of earnings calls.

- Quandl: A premier platform for accessing a wide range of alternative and financial data, particularly useful for hedge funds that leverage alternative data for investment strategies.

- S&P Capital IQ: Offers extensive financial data, company information, and analytical tools.

AI-Powered Analytics Platforms

These tools use artificial intelligence to analyze financial data, identify patterns, and generate insights beyond what human analysts might detect.

Notable examples:

- Tickeron: Features a Pattern Search Engine that empowers users to spot and predict patterns on asset charts, thereby amplifying their market analysis capabilities.

- TrendSpider: Provides market feeds for a variety of assets, including US stocks, digital assets, and currencies with automated technical analysis features.

- Trade Ideas: Offers a suite of investment algorithms that enhance user trading experiences, including risk and reward analysis for specific assets.

- WallStreetZen: Makes it easy for individual investors to perform in-depth research and get new stock ideas in minutes, not hours. It aggregates the latest financial data and summarizes a stock’s fundamental strengths and weaknesses.

Document Analysis and Natural Language Processing Tools

These specialized tools focus on extracting valuable information from text-based financial documents like earnings reports, SEC filings, and news articles.

Leading solutions:

- Sentieo: Combines financial research, data management, and analytics in one platform. Its advanced search engine utilizes natural language processing and machine learning to quickly surface relevant information across millions of documents.

- Brightwave AI: Described as “a partner in thought,” analysts can direct it to track down information and report back, streamlining the research process.

- AlphaSense: Provides AI-powered search across financial documents, helping analysts find relevant information quickly.

Market Monitoring and Alert Systems

These platforms continuously track market movements, news, and other financial data, alerting analysts to significant developments in real-time.

Key options:

- Visualping: An AI website monitoring tool that automatically monitors any web page. When a change is detected on the page, you get an email alert with an AI-generated summary of the change.

- Black Box Stocks: A potent artificial intelligence investing software renowned for its intuitive design and efficient pre-market alerts.

- Charli: By simply adding tickers to a portfolio, Charli generates a comprehensive equity research report in minutes and provides a portfolio dashboard view with key guidance.

Benefits of Investment Research Automation

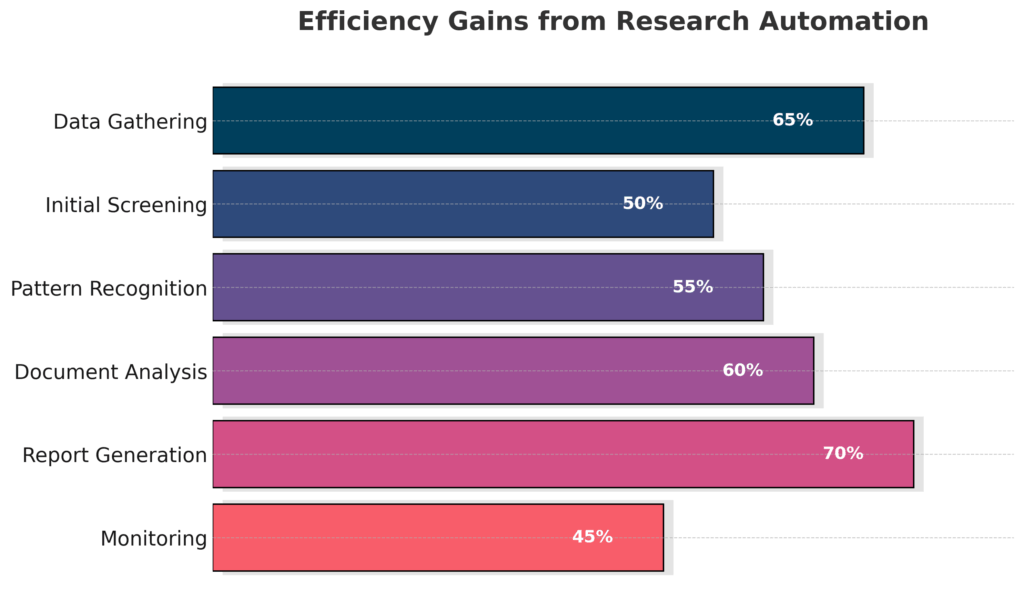

Enhanced Efficiency and Time Savings

Investment research automation dramatically reduces the time required to gather and analyze financial data. Tasks that once took days or weeks can now be completed in minutes or seconds, allowing analysts to process far more information and cover a broader range of investments.

The time saved through automation enables analysts to focus on higher-value activities like developing investment theses, communicating with clients, and making strategic decisions. This shift from data processing to data interpretation represents a significant evolution in the role of financial analysts.

Improved Accuracy and Reduced Human Error

Automated systems eliminate many common sources of human error in financial analysis, such as calculation errors, data entry errors, and overlooking relevant information. This leads to more reliable research outcomes and better investment decisions.

Consistency is another major advantage of automated research. Unlike human analysts, who may approach similar analyses differently due to factors such as time constraints or personal biases, automated systems apply the same methodologies consistently across all analyses.

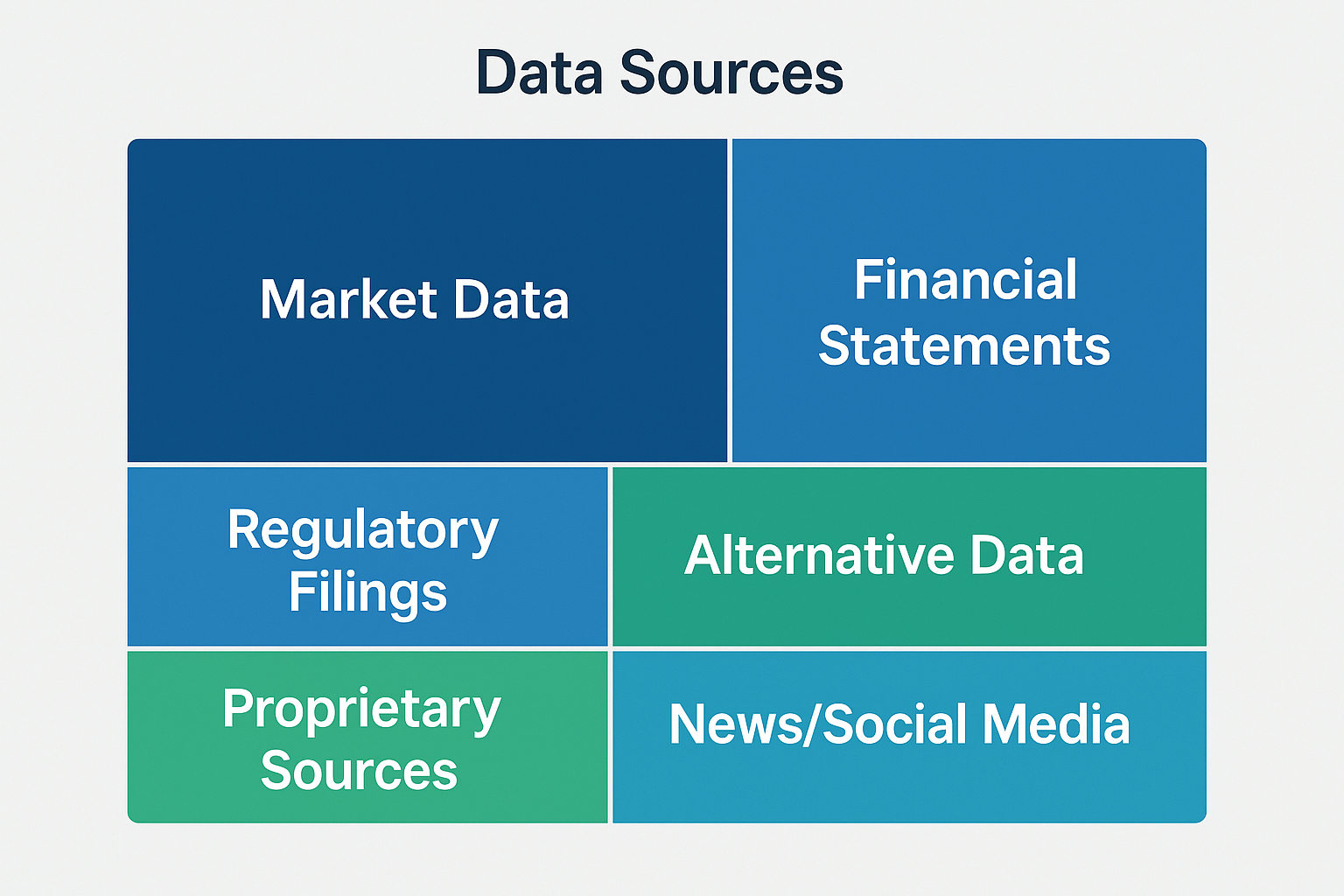

Access to Broader Data Sets

Research automation tools can process and analyze vast amounts of data from diverse sources that would be impossible for human analysts to cover manually. This includes traditional financial data as well as alternative data sources, such as social media sentiment, satellite imagery, and web traffic.

The ability to incorporate alternative data into investment analysis provides a competitive edge, as these non-traditional data sources often contain valuable signals about company performance or market trends before they become widely apparent.

Real-Time Analysis and Decision Making

Automated research tools can monitor markets continuously and provide real-time updates and analyses, enabling faster responses to market changes. This capability is particularly valuable in fast-moving markets where timing is crucial.

Many advanced platforms also incorporate predictive analytics capabilities, using historical data and machine learning to forecast potential market movements. These predictions help analysts anticipate changes rather than merely reacting to them.

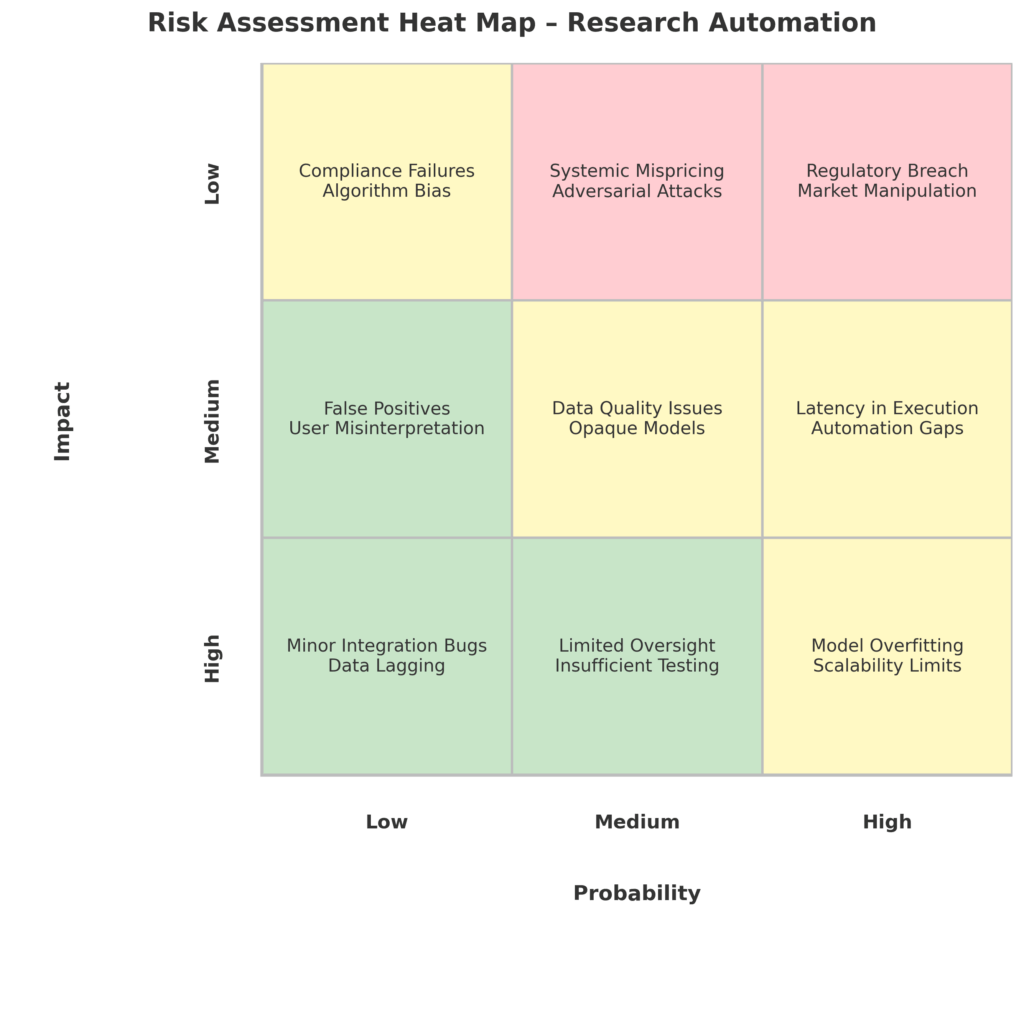

Challenges and Risks of Research Automation

Data Quality and Reliability Issues

Automated research systems are only as good as the data they analyze. Poor-quality, incomplete, or inaccurate data can lead to flawed analyses and potentially costly investment errors. Organizations must invest in data quality assurance processes to mitigate this risk.

The proliferation of financial data sources also raises concerns about data consistency and comparability. Automated systems must be able to reconcile information from different sources that may use varying methodologies or definitions.

Over-reliance on Algorithmic Decisions

There’s a risk that analysts may become overly dependent on automated tools, accepting their outputs without sufficient critical evaluation. This can lead to poor decisions when algorithms fail to account for unusual market conditions or unique company situations.

While AI can process vast amounts of data and identify complex patterns, it still isn’t inherently superior to traditional index investing. The technology serves as a sophisticated tool rather than a magical solution for superior performance, as demonstrated by the performance of some AI-powered ETFs.

High Implementation and Maintenance Costs

Sophisticated research automation platforms often come with significant costs. As of January 2025, the annual cost for a single Bloomberg terminal subscription is $31,980, making it prohibitively expensive for smaller firms or individual analysts.

Beyond the initial implementation costs, organizations must also budget for ongoing maintenance, updates, and staff training to ensure effective use of these complex tools.

Cybersecurity and Data Privacy Concerns

Financial data is highly sensitive, and automated research systems that store and process this information become potential targets for cyberattacks. Organizations must implement robust security measures to protect both proprietary and client data.

Regulatory compliance adds another layer of complexity, as financial institutions must ensure their automated research processes adhere to relevant data protection and privacy regulations, which vary across jurisdictions.

Implementation: How to Adopt Research Automation

Assessing Your Research Needs

Before implementing automation tools, organizations should conduct a thorough assessment of their current research processes to identify bottlenecks, inefficiencies, and areas where automation can add the most value. This evaluation should consider the specific types of investments, markets, and timeframes relevant to the organization’s strategy.

Understanding user requirements is equally important. Different stakeholders – portfolio managers, risk analysts, compliance officers – may have varying needs from automated research systems. Gathering input from all potential users helps ensure the selected solutions will deliver maximum value.

Selecting the Right Tools for Your Strategy

When evaluating potential automation tools, organizations should consider several factors:

- Compatibility with existing systems: New tools should integrate smoothly with the current infrastructure.

- Scalability: The solution should be able to grow with the organization’s needs.

- Customization options: Different investment strategies may require different analytical approaches.

- User interface and experience: Even the most powerful tools provide limited value if they’re too difficult to use.

Many organizations benefit from a phased implementation approach, starting with tools that address the most pressing needs or offer the quickest return on investment, then gradually expanding their automation capabilities.

Integration with Existing Workflows

Successful implementation requires thoughtful integration of automated tools into existing research workflows. This often involves redefining processes and roles to make optimal use of the new capabilities while preserving valuable human expertise.

Training is crucial for ensuring analyst adoption and effective use of new tools. Beyond technical training on how to use the systems, analysts may need guidance on interpreting automated outputs and incorporating them into their decision-making processes.

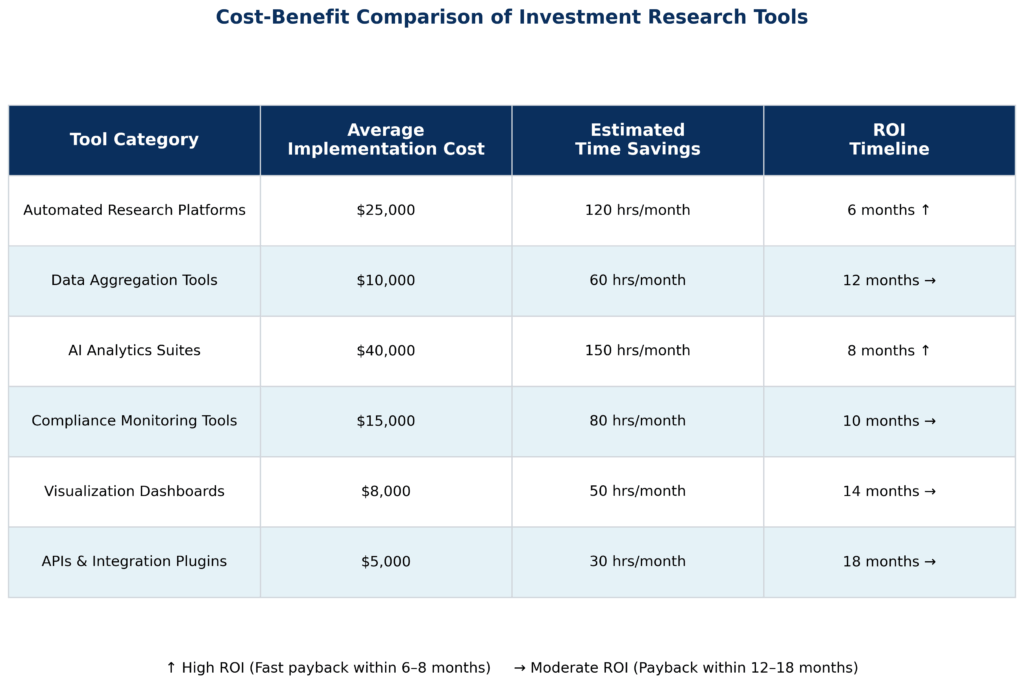

Measuring ROI and Performance Improvements

Organizations should establish clear metrics for evaluating the impact of research automation, such as:

- Time saved on routine research tasks

- Increase in coverage (number of securities analyzed)

- Improvement in prediction accuracy

- Reduction in research-related errors

- Enhancement in investment performance

Regular assessment against these metrics helps organizations refine their automation strategy and justify continued investment in these technologies.

Future Trends in Investment Research Automation

Advanced AI and Machine Learning Capabilities

The future of investment research automation will be shaped by continued advances in artificial intelligence and machine learning. New algorithms will deliver even more sophisticated pattern recognition, predictive capabilities, and natural language understanding.

One of the most innovative developments in AI-powered investment analysis is the use of “synthetic data”—artificially generated datasets that mirror the statistical properties and relationships found in real financial markets. This approach helps overcome limitations in historical data for rare market events.

Integration with Alternative Data Sources

The integration of alternative data into automated research will continue to expand. Sources such as satellite imagery, social media sentiment, credit card transaction data, and IoT sensors are providing new insights into company performance and market trends.

Advanced systems will increasingly combine traditional financial data with alternative sources, creating more comprehensive and forward-looking analyses that can identify opportunities and risks before they become apparent in conventional metrics.

Democratization of Research Tools

Historically, sophisticated research tools were available only to large financial institutions with substantial resources. This is changing as more affordable, cloud-based solutions emerge, making advanced analytical capabilities accessible to smaller firms and individual investors.

Koyfin markets itself as the Bloomberg terminal for retail investors, offering many similar features at a fraction of the cost. This trend toward democratization will continue, leveling the playing field in financial markets.

Regulation and Compliance Integration

Future research automation systems will increasingly incorporate regulatory compliance features. As financial regulations continue to evolve, particularly around data privacy and algorithm transparency, automated tools will need to adapt to ensure users remain compliant.

We can expect to see more “explainable AI” features that provide transparency into how automated systems reach their conclusions, addressing regulatory concerns about “black box” decision-making in financial contexts.

FAQs – Investment Research Automation

1. What are the essential automated research tools every Wall Street analyst should consider?

Bloomberg Terminal, FactSet, and Capital IQ form the foundation of many analysts’ toolkits, providing comprehensive financial data and basic analytical capabilities. For more specialized needs, tools like Sentieo for document analysis, TrendSpider for technical analysis, and Visualping for web monitoring can provide additional advantages.

2. How much can investment research automation reduce the time spent on routine tasks?

The efficiency gains from automation vary depending on the specific tasks and tools, but many organizations report time savings of 50-80% on routine research activities like data gathering, initial screening, and report generation. This allows analysts to focus more time on interpretation and strategy development.

3. What is the typical return on investment for implementing research automation?

ROI varies widely based on the scale of implementation and specific use cases. However, organizations typically see returns through improved productivity (analysts covering more securities), enhanced accuracy (fewer costly errors), and potentially better investment performance. Most firms report positive ROI within 12-18 months of implementation.

4. How can smaller firms with limited budgets leverage research automation?

Smaller firms can start with more affordable cloud-based solutions that offer subsets of the capabilities found in premium platforms. Many providers now offer tiered pricing models, allowing firms to access key features without the full cost of enterprise solutions. Strategic prioritization of which aspects of the research process to automate first can also help maximize return on limited investment.

5. Will automation eventually replace human analysts?

While automation is transforming the analyst role, it’s unlikely to replace human expertise entirely. While the timing is uncertain, it seems inevitable that AI will take over much of the repetitive, grunt work handled by financial analysts, but humans will remain essential for interpreting results, developing investment theses, understanding complex market dynamics, and communicating with clients.

6. How do automated tools address biases in investment research?

Properly designed automated systems can help reduce certain types of biases, such as recency bias, confirmation bias, and availability bias, by applying consistent methodologies across all analyses. However, algorithms themselves can contain biases based on their design or training data. The best approach combines automated analysis with human oversight to identify and correct for potential algorithmic biases.

7. What skills do analysts need to develop to work effectively with automated research tools?

Modern analysts need a combination of financial expertise and technological literacy. Understanding data science concepts, basic programming, and how to interpret algorithmic outputs are increasingly valuable skills. Equally important is the ability to know when to trust automated results and when human judgment should override them.

8. How are regulatory bodies approaching the increasing use of automation in financial research?

Regulatory approaches vary by jurisdiction, but common themes include concerns about algorithm transparency, data privacy, and system reliability. Some regulators are implementing requirements for explainability in automated financial systems and establishing frameworks for validating algorithmic outputs. Organizations implementing automation should stay informed about evolving regulations in all markets where they operate.

9. Can automated research tools help identify opportunities in private markets?

While public markets have more readily available data, advanced research automation is increasingly being applied to private markets as well. Specialized tools can analyze alternative data sources to gain insights into private companies, and natural language processing can extract information from unstructured documents, such as pitch decks and founder interviews.

10. How can organizations ensure the security of proprietary research and data when using automated tools?

Security considerations should be central to any automation implementation. Key measures include robust access controls, data encryption, regular security audits, and careful vendor due diligence. Organizations should also have clear policies regarding data handling and consider whether certain highly sensitive analyses should remain outside automated systems.

Conclusion

The automation of investment research represents one of the most significant transformations in the financial industry in recent decades. By leveraging AI, machine learning, and other advanced technologies, Wall Street analysts can process unprecedented volumes of data, uncover hidden patterns, and generate insights with remarkable speed and precision.

However, the most successful implementations of research automation recognize that technology works best as an enhancement to human expertise rather than a replacement for it. The future belongs to analysts and organizations that can effectively combine the computational power and pattern recognition capabilities of machines with the contextual understanding, creativity, and judgment that humans bring to the investment process.

As we look ahead, the continued evolution of AI capabilities, the expansion of available data sources, and the increasing accessibility of sophisticated tools will further accelerate this transformation. Organizations that thoughtfully embrace automation while developing the human skills needed to effectively leverage these tools will be best positioned to thrive in the new landscape of investment research.

For your reference, recently published articles include:

- Global Expense Management Tools – Save Your Time And Money

- Business Credit Cards No Foreign Transaction Fee – Get Best Advice Here

- 7 Beginner Mistakes In ETF Investing: The Expert Guide

- Unlock Hidden Perks: Best Credit Cards For Freelancers Revealed!

- Build A Fortune: Trading Algorithm Development Made Simple

- Professional Investment Portfolio Reporting – Best Guide For You

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.