Algorithmic trading has revolutionized financial markets by automating trading decisions through sophisticated mathematical models and computational algorithms.

In today’s high-speed markets, where microseconds matter and data volumes are enormous, profitable trading algorithm development has become essential for institutional investors and increasingly accessible to individual traders seeking an edge.

Key Takeaways

- Strategic algorithm development requires a multi-disciplinary approach combining financial knowledge, programming skills, and statistical analysis to identify and capitalize on market inefficiencies, as demonstrated by Renaissance Technologies’ Medallion Fund, which has averaged 66% annual returns before fees since 1988.

- Successful trading algorithms depend on robust testing frameworks that separate development data from validation data to avoid overfitting, exemplified by Two Sigma‘s use of multiple testing environments and scenario analysis to ensure algorithms perform consistently across various market conditions.

- Risk management remains paramount in algorithmic trading systems, with industry leaders like AQR Capital implementing automated circuit breakers that can halt trading operations when algorithms deviate from expected behavior patterns, preventing catastrophic losses like Knight Capital’s $440 million loss in 2012.

Table of Contents

What Is Algorithmic Trading?

Algorithmic trading (also known as algo trading or black-box trading) refers to the use of computer programs and mathematical models to execute trades automatically according to predefined rules and criteria. These trading systems can analyze multiple market indicators across different assets simultaneously at speeds impossible for human traders.

Modern algorithmic trading systems range from simple automation of order execution to complex strategies that analyze vast datasets, incorporating machine learning techniques to adapt to changing market conditions. The complexity spectrum extends from basic moving-average crossover systems that any retail trader can implement to sophisticated high-frequency trading operations requiring specialized hardware and proximity to exchange servers.

The rise of algorithmic trading has fundamentally altered market structure, with algorithms now responsible for approximately 60-70% of trading volume in U.S. equity markets, 50% in futures markets, and growing percentages in forex and even cryptocurrency markets. This dominance reflects the competitive advantages that well-designed algorithms offer: elimination of emotional decision-making, consistent rule application, and the ability to capitalize on opportunities across multiple markets simultaneously.

At its core, algorithmic trading seeks to identify and exploit market inefficiencies faster and more reliably than human traders. Whether capturing tiny price discrepancies through arbitrage or identifying long-term statistical patterns, the common goal is consistent profitability through systematic, disciplined trading approaches.

Types of Trading Algorithms

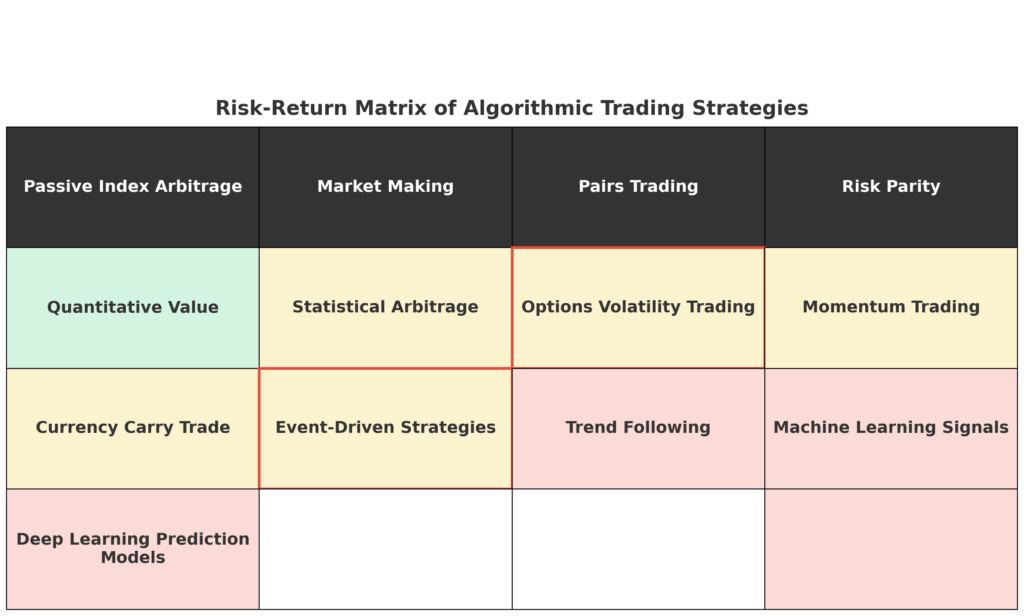

Trading algorithms come in various forms, each designed to exploit specific market conditions or inefficiencies:

| Algorithm Type | Description | Typical Timeframe | Key Performance Metrics |

|---|---|---|---|

| Trend Following | Identifies and rides directional market movements | Medium to long-term | Maximum drawdown, Sharpe ratio |

| Mean Reversion | Exploits price movements returning to historical averages | Short to medium-term | Recovery rate, win/loss ratio |

| Arbitrage | Profits from price discrepancies across different markets | Ultra-short-term | Execution speed, net profit per trade |

| Market Making | Provides liquidity by offering to buy and sell continuously | Ultra-short-term | Bid-ask spread capture, inventory risk |

| Statistical Arbitrage | Leverages statistical relationships between securities | Short-term | Correlation stability, pairs ratio |

| Machine Learning Based | Adapts to market conditions through pattern recognition | Variable | Algorithm adaptability, prediction accuracy |

Trend Following

Trend-following algorithms identify and exploit directional movements in asset prices. These systems typically use technical indicators like moving averages, breakouts, and momentum oscillators to determine when to enter and exit positions. The core premise is that markets often experience extended periods of directional movement that can be profitably traded.

Example strategy: A 50/200 day moving average crossover system that buys when the 50-day moving average crosses above the 200-day moving average (golden cross) and sells when it crosses below (death cross).

Mean Reversion

Mean reversion strategies operate on the principle that prices tend to revert to their historical average over time. These algorithms identify overbought or oversold conditions and take contrarian positions expecting price normalization.

Example strategy: Bollinger Band trading system that buys when price touches the lower band (indicating oversold conditions) and sells when it reaches the upper band (indicating overbought conditions).

Arbitrage

Arbitrage algorithms exploit price inefficiencies between related instruments, markets, or exchanges. These price discrepancies might exist for mere milliseconds, requiring extremely fast execution capabilities.

Example strategy: Triangular arbitrage in forex markets, converting Currency A to B to C and back to A for a risk-free profit when market inefficiencies occur.

Statistical Arbitrage

Statistical arbitrage (stat arb) strategies rely on statistical relationships between securities rather than pure price differences. These include pairs trading and more complex multiple-asset correlation strategies.

Example strategy: Pairs trading between two historically correlated stocks like Coca-Cola and Pepsi, shorting the outperformer and buying the underperformer when their relative prices diverge significantly.

Benefits of Algorithmic Trading

Algorithmic trading offers numerous advantages over discretionary trading approaches:

- Elimination of Emotional Bias: Algorithms execute trades based solely on predefined criteria, removing fear, greed, and other emotional factors that often impair human decision-making.

- Superior Execution Speed: Algorithms can analyze market data and execute trades in milliseconds or even microseconds, essential for exploiting short-lived opportunities.

- Enhanced Order Accuracy: Automated systems eliminate manual order entry errors that can be costly in fast-moving markets.

- Backtesting Capability: Historical performance analysis allows traders to evaluate strategy performance across different market conditions before risking real capital.

- Diversification Across Strategies: Algorithms can simultaneously implement multiple uncorrelated strategies, reducing overall portfolio risk.

- 24/7 Market Monitoring: Automated systems can continuously monitor markets across global time zones without fatigue.

- Systematic Strategy Improvement: Performance metrics can be systematically analyzed to refine algorithms iteratively.

- Reduced Transaction Costs: Optimal order routing and timing can minimize market impact and trading costs, particularly important for high-frequency strategies.

Challenges and Risks

Despite its potential advantages, algorithmic trading presents significant challenges and risks:

Technical Challenges

- Infrastructure Requirements: High-performance computing, reliable connectivity, and specialized software are essential and can be costly.

- Data Quality Issues: Algorithms are vulnerable to bad data inputs, requiring robust data cleaning and validation processes.

- Latency Concerns: Even milliseconds of delay can render certain strategies unprofitable, creating an expensive arms race for speed.

- Implementation Shortfall: Slippage between theoretical and actual execution prices can erode expected profitability.

Market Risks

- Algorithm Obsolescence: Market dynamics change constantly, requiring continuous strategy adaptation.

- Crowded Trades: Popular strategies may become overcrowded, reducing effectiveness as more capital pursues the same opportunities.

- Black Swan Events: Unexpected market shocks can cause algorithms to perform in unpredictable ways.

- Liquidity Risks: Market liquidity can disappear rapidly during stress periods, creating execution problems.

Regulatory and Operational Risks

- Regulatory Scrutiny: Algorithmic trading faces increasing regulatory oversight, with potential compliance costs and operational constraints.

- System Failures: Technical glitches can lead to significant losses, as demonstrated by Knight Capital’s $440 million loss in 2012 due to a software bug.

- Cybersecurity Vulnerabilities: Trading systems are prime targets for cyberattacks that could compromise strategy integrity or cause financial losses.

Implementation: Building Your First Trading Algorithm

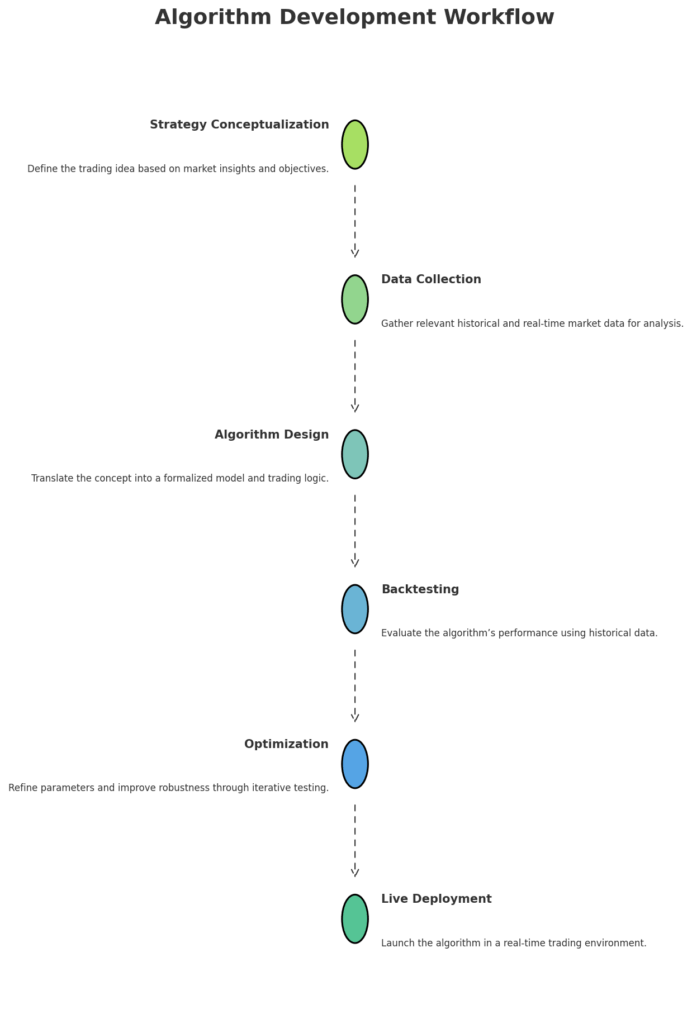

Developing profitable trading algorithms involves several key steps:

1. Strategy Conceptualization

Begin with a clear market hypothesis based on:

- Identifiable market inefficiency

- Logical economic rationale

- Definable edge that can persist over time

Example: A hypothesis might be that certain stocks overreact to earnings surprises and subsequently revert toward previous trading ranges, creating a mean-reversion opportunity.

2. Data Collection and Preparation

Gather and prepare the necessary data:

- Historical price data at appropriate intervals

- Fundamental data (if relevant to strategy)

- Alternative data sources (news sentiment, social media, etc.)

- Economic indicators and other exogenous variables

Data preparation typically involves:

- Handling missing values

- Adjusting for corporate actions (splits, dividends)

- Normalizing data formats

- Creating derived features

3. Strategy Development and Coding

Translate your market hypothesis into executable code:

- Define precise entry and exit criteria

- Establish position sizing rules

- Set risk management parameters

- Code execution logic

Sample pseudocode for a simple moving average crossover strategy:

# Pseudocode for simple moving average crossover

def calculate_signals(data):

# Calculate moving averages

data['MA_short'] = data['close'].rolling(window=50).mean()

data['MA_long'] = data['close'].rolling(window=200).mean()

# Generate signals

data['signal'] = 0

data.loc[data['MA_short'] > data['MA_long'], 'signal'] = 1 # Buy signal

data.loc[data['MA_short'] < data['MA_long'], 'signal'] = -1 # Sell signal

return data

4. Backtesting and Optimization

Test your strategy against historical data:

- Split data into in-sample (for development) and out-of-sample (for validation)

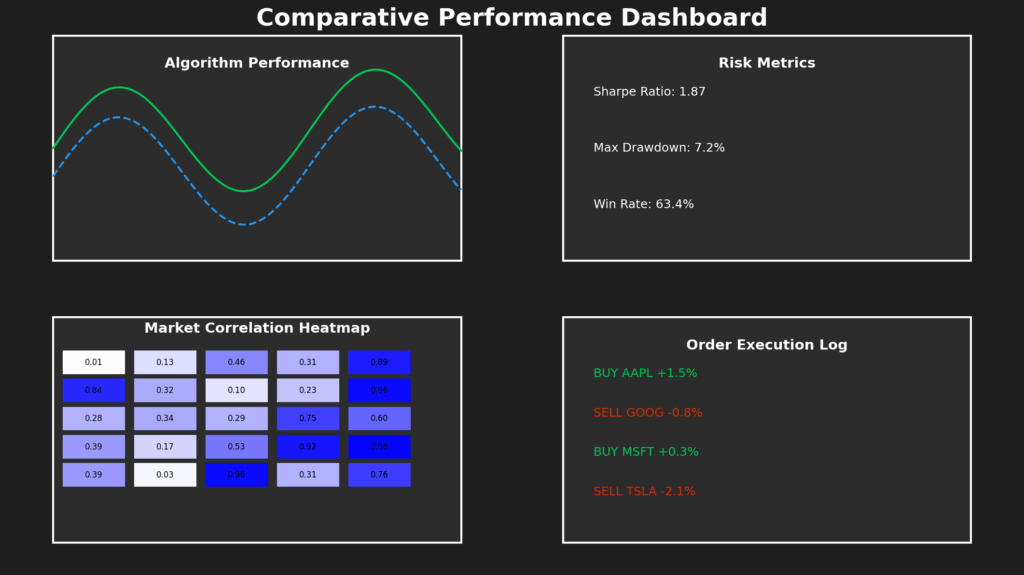

- Calculate key performance metrics (Sharpe ratio, drawdown, win rate)

- Test sensitivity to parameter changes

- Validate across different market regimes

Optimization methods include:

- Grid search across parameter ranges

- Walk-forward optimization

- Machine learning-based parameter selection

5. Risk Management Implementation

Build robust risk controls:

- Position sizing limits

- Stop-loss mechanisms

- Exposure caps

- Drawdown circuit breakers

- Correlation monitoring

6. Live Implementation and Monitoring

Deploy your algorithm to live markets:

- Begin with small position sizes

- Compare actual performance to backtest expectations

- Monitor for technical issues

- Track market condition changes

Future Trends in Algorithmic Trading

The algorithmic trading landscape continues to evolve rapidly:

Machine Learning Integration

Traditional rule-based algorithms are increasingly incorporating machine learning techniques:

- Deep learning for pattern recognition

- Reinforcement learning for adaptive strategy development

- Natural language processing for news and sentiment analysis

- Unsupervised learning for anomaly detection

Alternative Data Utilization

Beyond traditional market data, algorithms now incorporate:

- Satellite imagery

- Social media sentiment

- Credit card transaction data

- Mobile device location information

- Web traffic analysis

Quantum Computing Applications

Though still emerging, quantum computing promises:

- Exponentially faster option pricing

- More complex portfolio optimization

- Enhanced pattern recognition capabilities

- Breakthrough cryptographic applications

Regulatory Technology (RegTech)

As algorithmic trading faces increased scrutiny:

- Automated compliance monitoring systems

- Real-time risk analysis tools

- Audit trail generation

- Market abuse detection systems

Democratization of Access

Tools and platforms making algorithmic trading more accessible:

- Cloud-based backtesting environments

- API-driven broker connectivity

- Algorithm marketplaces

- Reduced infrastructure costs

FAQs – Trading Algorithm Development

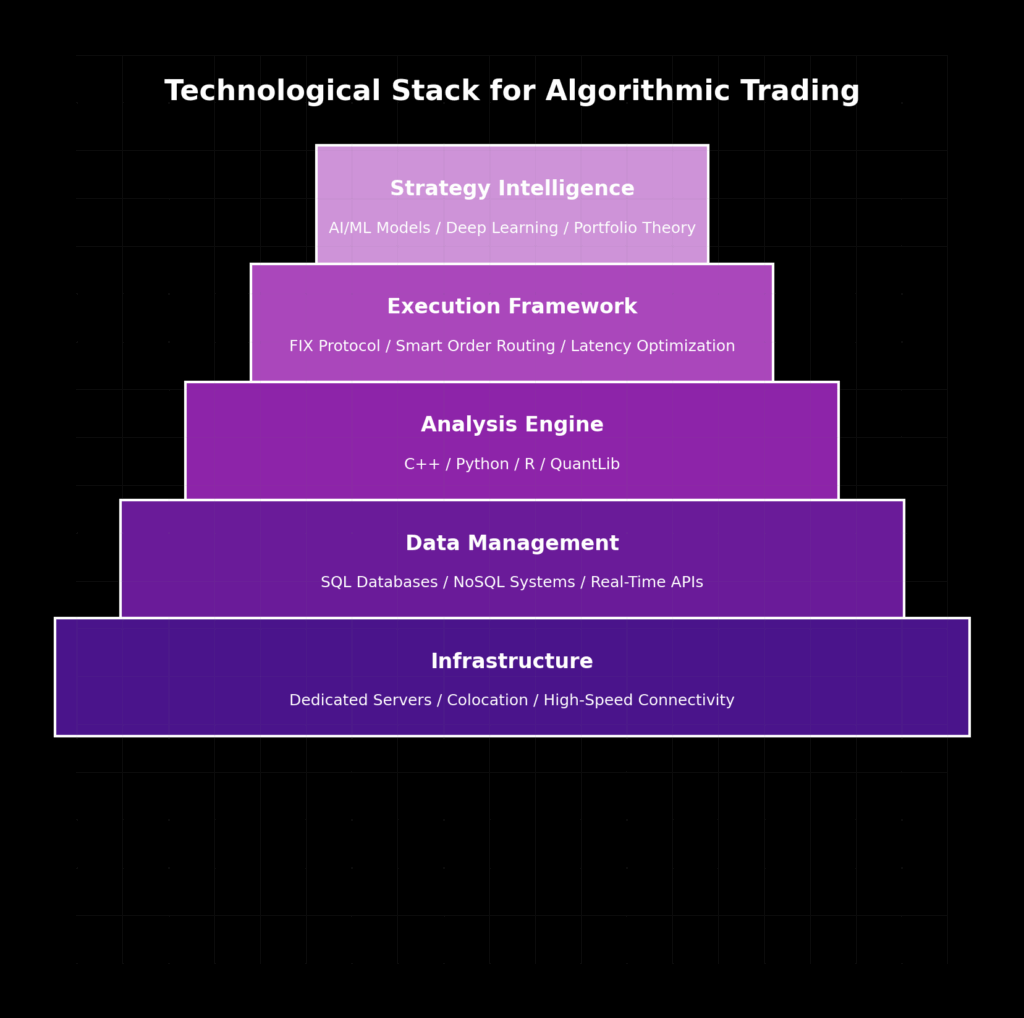

1. What programming languages are best for algorithmic trading?

Python has become the industry standard due to its rich ecosystem of financial libraries (pandas, numpy, scikit-learn), though C++ remains important for high-frequency trading where microsecond performance matters. Other popular languages include R (for statistical analysis), Java, and specialized platforms like MATLAB.

2. How much capital is required to start algorithmic trading?

While institutional algorithmic trading often involves millions of dollars, retail traders can begin with as little as $5,000-$10,000 on platforms that offer API access. However, more capital ($50,000+) provides better diversification possibilities and reduces the impact of transaction costs on overall returns.

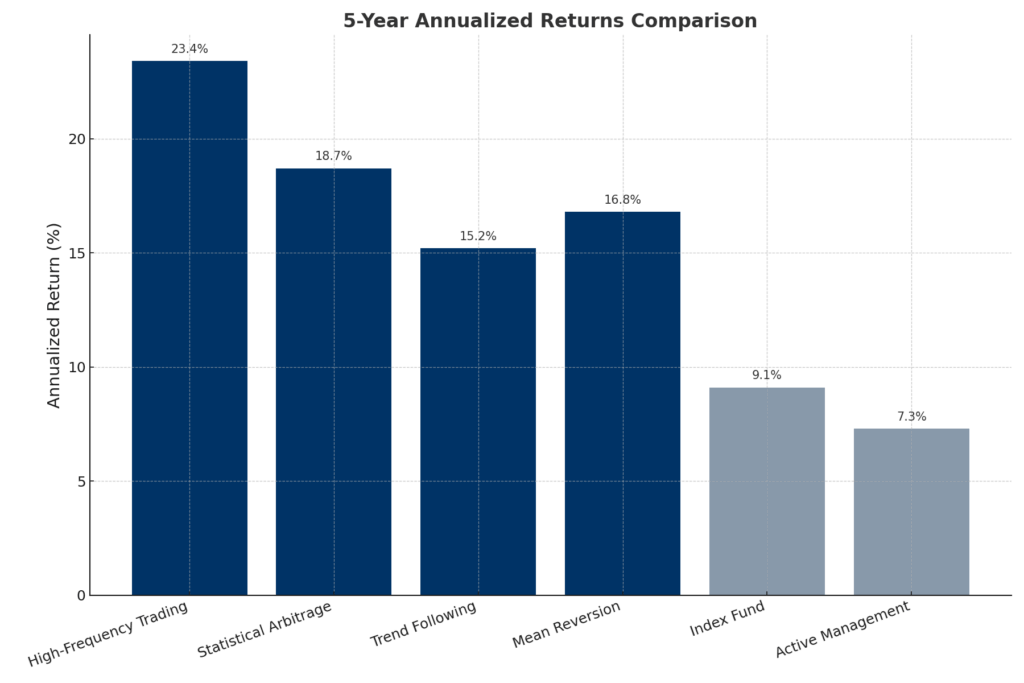

3. What are the typical returns from algorithmic trading?

Returns vary enormously based on strategy, risk tolerance, and market conditions. Institutional quantitative funds might target 10-15% annual returns with low volatility (Sharpe ratios above 1.0), while higher-risk retail strategies might seek 25-40% with correspondingly higher drawdowns.

4. How do you prevent overfitting when developing trading algorithms?

Best practices include: separating development data from validation data, using walk-forward testing, focusing on robustness rather than optimization, limiting the number of strategy parameters, requiring a logical explanation for each strategy component, and testing across different market regimes.

5. Are machine learning algorithms better than traditional rule-based strategies?

Not necessarily. Machine learning excels at finding complex patterns but can be prone to overfitting and difficult to interpret. Traditional rule-based strategies often prove more robust and maintainable over time. Many successful firms use a hybrid approach, incorporating machine learning within a framework of traditional financial theory.

6. How frequently do trading algorithms need to be updated?

Market dynamics change constantly, requiring regular algorithm maintenance. Simple trend-following strategies might need quarterly reviews, while statistical arbitrage or market-making algorithms often require weekly or even daily adjustments to parameters. Machine learning systems may incorporate continuous learning mechanisms.

7. What infrastructure is needed for algorithmic trading?

Requirements vary by strategy frequency. Long-term strategies can run on standard computers with reliable internet connections. Higher-frequency approaches require dedicated servers, co-location services near exchanges, specialized data feeds, and redundant systems to prevent downtime.

8. How do algorithmic traders manage risk?

Comprehensive risk management includes: position sizing rules (often limiting exposure to 1-2% of capital per trade), stop-loss mechanisms, correlation analysis to prevent overexposure to related assets, volatility-based adjustments, drawdown limits, and automated circuit breakers that can halt trading when anomalies are detected.

9. Are algorithmic trading strategies transferable across different markets?

While the underlying principles may transfer, successful implementation requires market-specific adaptations. Liquidity profiles, trading hours, transaction costs, and regulatory environments differ significantly across equities, futures, forex, and cryptocurrency markets, necessitating careful recalibration.

10. How can beginners learn algorithmic trading?

Beginners should build foundations in three core areas: financial markets knowledge, programming skills, and statistical analysis. Practical education paths include online courses from platforms like Coursera and Udemy, quantitative finance textbooks, open-source trading platforms like QuantConnect or Backtrader, and paper trading to gain experience without financial risk.

Conclusion

Algorithmic trading represents the intersection of finance, mathematics, and computer science, offering powerful tools to systematically capture market opportunities. While the potential rewards are substantial, success requires disciplined development processes, robust testing frameworks, and comprehensive risk management systems.

The democratization of technology has made algorithmic trading increasingly accessible to individual traders, though the complexity and competitive nature of markets ensure that innovation remains essential for sustained profitability.

Looking ahead, the integration of machine learning techniques and alternative data sources will likely accelerate, creating new opportunities while potentially increasing market efficiency. As computational capabilities expand and costs decrease, the barriers to entry will continue to lower, though regulatory scrutiny will almost certainly increase in parallel.

For those willing to develop the necessary cross-disciplinary skills, algorithmic trading offers a fascinating and potentially lucrative frontier in financial markets.

For your reference, recently published articles include:

- Professional Investment Portfolio Reporting – Best Guide For You

- Market Data Visualization – Best Tools To Boost Your Wealth

- Stay Legal, Get Rich: Investment Compliance Monitoring Made Easy

- Portfolio Attribution Analysis: The Ultimate Guide

- Protect Your Wealth: Investment Risk Mitigation Secrets of the Rich

- Trading Strategy Backtesting: The Ultimate Path To Profits

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.