Investing 101 – Introduction

Ever feel like investing 101 is a secret club and no one gave you the membership card?

You’re not alone. Only 56% of Americans invest in the stock market, and here’s the surprising part: the #1 reason people don’t invest isn’t lack of money – it’s not knowing where to start. Terms like “asset allocation,” “expense ratio,” and “diversification” get thrown around like everyone already understands them. Meanwhile, you’re sitting there wondering what any of it actually means.

Here’s the truth: Most investing advice assumes you already know the basics. Articles jump straight into strategy without explaining the fundamentals. Financial “experts” use jargon without defining it. No one starts at the true beginning.

This guide is different. We’re starting from absolute zero.

By the time you finish reading, you’ll understand what investing 101 actually is (and what it isn’t), the main types of investments and how they work, how the stock market functions, different account types and which you need, risk and return fundamentals, and exactly how to get started.

These are the same basics that every successful investor learned first – including Warren Buffett, who started by reading simple investing books as a teenager.

If you’re ready to take action right now, jump to our complete guide on how to start investing. But if you want to understand the fundamentals first – which will make you a much more confident investor – you’re in the right place.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Welcome to “Finance & Investments” and “let’s start building your wealth!”

Didi Somm & Team

Reading time: 15 minutes to read, forever to benefit from.

Confused by investing terminology? Grab our free Investing Basics Glossary with 50 key terms explained in plain English.

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Table of Contents

What Is Investing 101? (And What It Isn’t)

Let’s start with the simplest definition possible.

Investing = Putting your money to work to grow over time.

When you invest, you buy things – stocks, bonds, funds – that you believe will become more valuable in the future. The goal? Turn $1,000 today into $2,000, $5,000, or even $10,000 down the road.

Think of it this way: Your money sitting in your wallet isn’t doing anything for you. But when you invest it, that money goes to work like an employee, earning more money for you 24/7, even while you sleep.

What Investing Is NOT

Before we go further, let’s clear up some common misconceptions:

Investing is NOT gambling. Gambling is pure luck – roulette, lottery, casino games where the house has a mathematical edge against you. Investing is calculated risk based on company fundamentals, economic trends, and decades of market data. Yes, there’s risk involved, but it’s risk you can manage through research and smart strategies.

Investing is NOT a get-rich-quick scheme. Those late-night infomercials promising you’ll “turn $1,000 into $1 million in 6 months”? That’s not investing – that’s a scam. Real investing is gradual wealth building over years and decades. It’s not exciting, but it works.

Investing is NOT only for wealthy people. You can start investing with as little as $10-100 today. Many investment platforms have eliminated minimum balance requirements entirely.

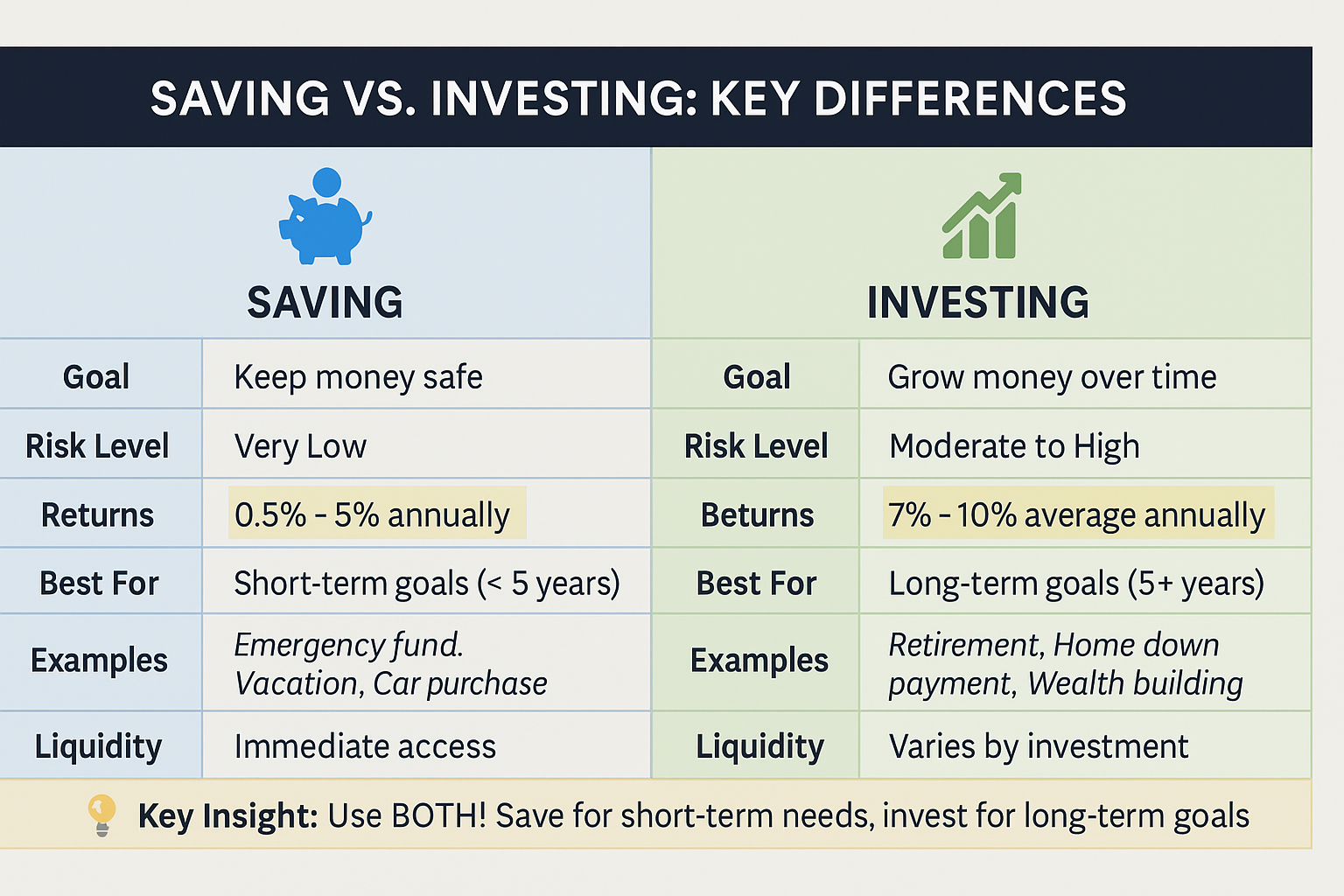

Investing is NOT the same as saving. This one confuses a lot of people, so let’s break it down:

| Saving | Investing |

|---|---|

| Putting money aside to keep safe | Putting money to work to grow |

| Very low risk | Moderate to high risk |

| Low returns (0.5-5% per year) | Higher potential returns (7-10% average per year historically) |

| For short-term goals (< 5 years) | For long-term goals (5+ years) |

| Examples: Emergency fund, vacation, car | Examples: Retirement, home down payment, wealth building |

Why Invest vs Just Save?

Here’s the problem with only saving: inflation eats away at your cash.

If inflation runs at 3% per year (which is fairly typical), that means $100 today will only have $97 of buying power next year. Your money loses value just sitting there, even though the number in your bank account stays the same.

But investments historically outpace inflation. Let’s look at real numbers:

$10,000 over 30 years:

- In a savings account at 3%: $24,272

- Invested in the stock market at 8%: $100,627

- Difference: $76,355

That’s not a typo. The difference is more than $76,000 – and that’s starting with just $10,000.

The Power of Compound Interest

Albert Einstein allegedly said: “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”

Whether Einstein actually said this doesn’t matter – the concept is powerful either way.

Here’s how compound interest works in simple terms: Your money makes money, then that money makes more money, then THAT money makes even more money. It’s like a snowball rolling downhill, getting bigger and bigger.

Example:

- Year 1: You invest $1,000 and earn 10% = $1,100

- Year 2: You earn 10% on $1,100 (not just your original $1,000) = $1,210

- Year 10: That $1,000 becomes $2,594

- Year 30: That same $1,000 becomes $17,449

You didn’t touch it. You didn’t add more money. Time and compound interest did all the work.

This is why starting early matters SO much. Every year you wait to start investing costs you thousands in potential compound growth. Setting and working toward your financial goals becomes much easier when you understand this power.

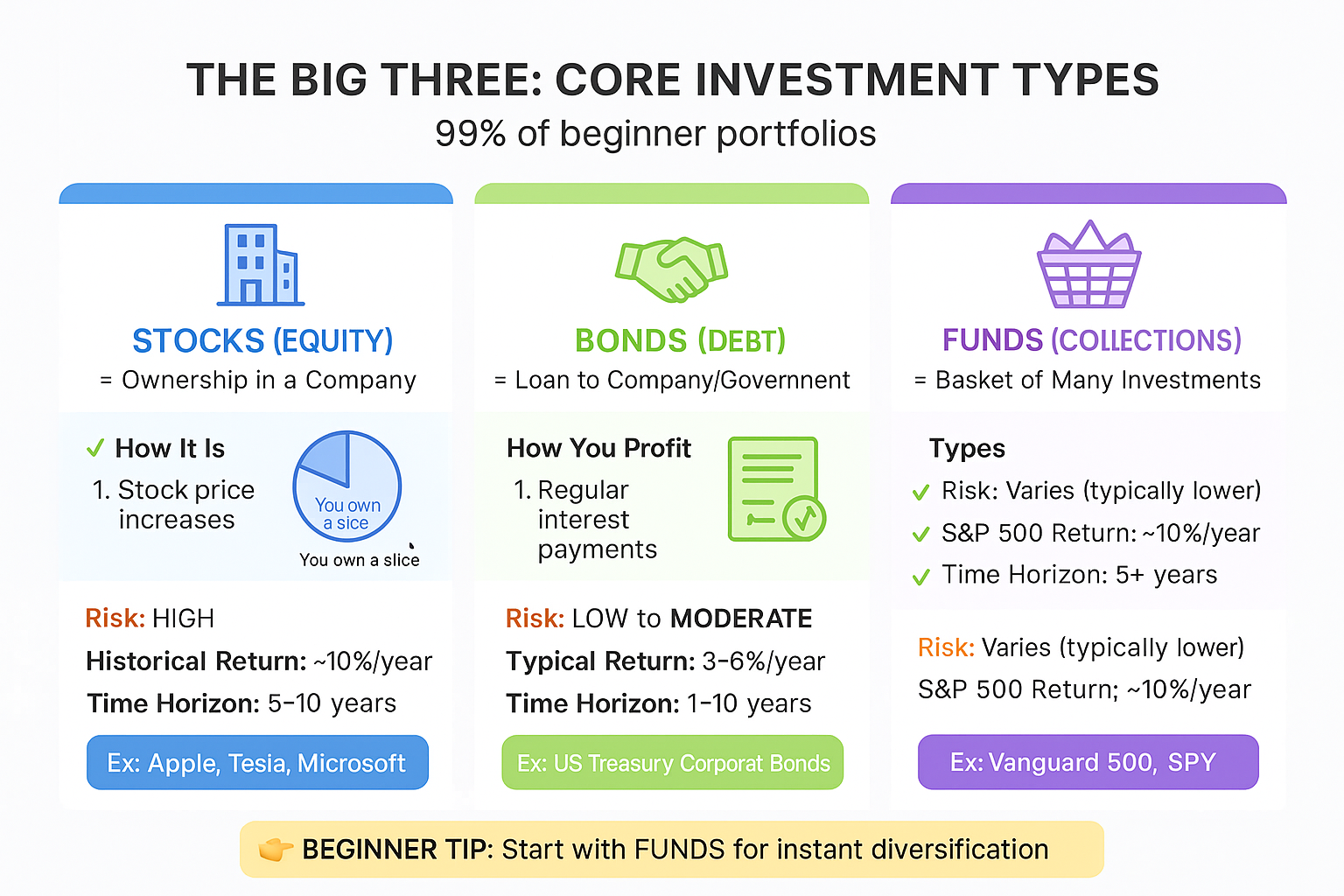

Types of Investments: The Big Three

There are hundreds of different investment types out there – real estate, commodities, cryptocurrencies, collectibles, and more. But 99% of beginner portfolios use three core building blocks: Stocks, bonds, and funds.

Master these three, and you’ll understand how most investing works.

Stocks (Equity / Ownership)

Simple definition: When you buy a stock, you buy a tiny piece of ownership in a company.

Real example: Apple has about 15.5 billion shares outstanding. When you buy 1 share of Apple stock, you literally own 1/15,500,000,000 of Apple. You’re now a partial owner of every iPhone sold, every MacBook manufactured, and every Apple Store around the world. Pretty cool, right?

Think of owning stock like being a silent business partner. When the business does well and makes money, you profit. When it struggles, you might lose money.

How You Make Money from Stocks

There are two ways stocks can make you money:

1. Stock Price Increases (Capital Gains)

This is the one most people think of. You buy low, sell high:

- You buy Apple stock at $150 per share

- Apple grows, launches successful products, increases profits

- The stock price rises to $180 per share

- You sell and make $30 per share profit

2. Dividends (Payments to Shareholders)

Some companies pay part of their profits directly to shareholders:

- Coca-Cola pays about $1.84 per share per year in dividends

- If you own 100 shares, you receive $184 every year

- You get this money whether the stock price goes up or down

It’s like getting a paycheck just for being an owner. Not all companies pay dividends (fast-growing tech companies usually don’t), but many established companies do.

Risk Level: Stocks are volatile – prices swing up and down dramatically. Individual stocks can lose 50-100% of their value if a company fails (remember Blockbuster? Sears? They went to zero).

However, diversified stock portfolios (owning many companies) have historically returned about 10% annually over long periods.

Best Time Horizon: 5+ years, ideally 10+ years. The longer you can hold stocks, the more time they have to recover from short-term drops.

Bonds (Debt / Loans)

Simple definition: When you buy a bond, you’re loaning money to a company or government. They promise to pay you back with interest.

Think of bonds like being a banker. You’re not an owner – you’re a lender collecting interest.

Real example:

You buy a U.S. Treasury Bond:

- You loan $1,000 to the U.S. government for 10 years

- They pay you 4% interest annually ($40 per year)

- After 10 years, you get your original $1,000 back

- Total earned: $400 in interest + $1,000 principal = $1,400

How You Make Money from Bonds

1. Interest Payments (Called “Coupon Payments”)

You receive regular payments – monthly, quarterly, or annually. This income is predictable and reliable, which is why many retirees love bonds.

2. Bond Price Fluctuations

Bond prices move inversely to interest rates (this confuses people, but here’s why):

- If you own a bond paying 4% and new bonds only pay 3%, your bond becomes more valuable (people want your higher rate)

- If new bonds pay 5%, your 4% bond becomes less valuable

- You can sell bonds before maturity, potentially at a profit or loss

Risk Level: Lower than stocks, but not risk-free. Government bonds (especially U.S. Treasury bonds) are considered very safe. Corporate bonds are somewhat riskier—if a company goes bankrupt, you might not get your money back.

Best Time Horizon: 1-10 years, or as a stabilizer in long-term portfolios. Bonds help smooth out the ups and downs of stocks.

Funds (Baskets of Investments)

Simple definition: A fund is one investment that holds hundreds or thousands of stocks and/or bonds. You buy one thing and instantly own many things.

This is like buying a pre-made fruit basket instead of shopping for individual fruits. You get variety without having to pick each item yourself.

Types of Funds

1. Index Funds

- Goal: Match the performance of a market index (like the S&P 500)

- Example: An S&P 500 index fund owns all 500 largest U.S. companies

- Management: Passive (no one is actively picking stocks—the fund just copies the index)

- Fees: Very low (0.03-0.15% per year)

- Philosophy: “If you can’t beat the market, become the market”

2. Mutual Funds

- Goal: Beat the market through active management

- Management: Professional fund managers actively research and pick investments

- Fees: Higher (0.50-2.00% per year) because you’re paying for that expertise

- Reality check: About 90% of actively managed mutual funds fail to beat simple index funds over 10+ years

3. ETFs (Exchange-Traded Funds)

- Structure: Like index funds but trade like stocks

- Flexibility: You can buy and sell anytime during market hours (mutual funds only trade once per day after market close)

- Fees: Often lower than mutual funds

- Example: VOO (Vanguard S&P 500 ETF) tracks the S&P 500 just like an index fund

Want to dive deeper? Learn more about what index funds are and the difference between ETFs and mutual funds.

Why Beginners Should Use Funds

Funds solve the biggest problem for new investors: How do you know which stocks to pick?

Answer: You don’t have to pick.

Comparison:

| Buying Individual Stock | Buying Index Fund |

|---|---|

| Buy Apple stock | Buy S&P 500 index fund |

| Own 1 company | Own 500 companies |

| If Apple drops 40%, you lose 40% | If Apple drops 40%, you lose about 0.8% (Apple is roughly 1/500th of the fund) |

| High risk | Lower risk through diversification |

| Need to research each company | No research needed |

For 99% of beginners, funds – especially low-cost index funds – are the smart choice.

📚 Free Download: Investing Basics Glossary

Master investing terminology with our comprehensive glossary:

✓ 50 key terms explained in plain English

✓ Real-world examples for each term

✓ Organized by category for easy reference

✓ Perfect quick-reference guide

OUR TIP: We recommend you to “download” the “SMART INVESTING GUIDE” from our homepage too!

Understanding Risk and Return

Here’s the golden rule you need to memorize:

Higher potential returns = Higher risk of losses

There’s no such thing as a “high return, zero risk” investment. If someone promises you that, run away -it’s a scam.

The Risk-Return Spectrum

Think of investments on a spectrum:

Low Risk, Low Return → → → → → → → → High Risk, High Return

What Is Risk?

Risk = The possibility your investment decreases in value.

There are several types of investment risk:

- Market Risk: The overall market goes down (2008 financial crisis, 2020 COVID crash)

- Company Risk: An individual company fails (Enron, Lehman Brothers)

- Inflation Risk: Your returns don’t keep up with inflation

- Liquidity Risk: You can’t sell your investment quickly when needed

How to Manage Risk

You can’t eliminate risk, but you can manage it:

1. Diversification: Own many investments, not just one. Don’t put all your eggs in one basket.

2. Time Horizon: Give investments time to recover from drops. Volatility smooths out over long periods.

3. Asset Allocation: Mix stocks and bonds based on your goals and timeline. More on this in a moment.

4. Dollar-Cost Averaging: Invest regularly regardless of price. We’ll explain this concept later.

Historical Perspective on Stock Market Risk

Here’s what actually happened over the past century:

S&P 500 Historical Performance:

- Best year: +52.6% (1954)

- Worst year: -43.8% (1931)

- Average annual return (1926-2023): 10.2%

- Years with losses: 26% of the time

- 20-year periods with losses: 0% of the time (never!)

Key insight: Time is the ultimate risk reducer. The longer you can invest, the safer stocks become.

Short-term? Stocks are risky and unpredictable.

Long-term? Stocks have never lost money over any 20-year period in history.

Affiliate Disclaimer: This page may include Affiliate links, meaning that we get a commission if you decide to purchase through this site at no extra cost to you. Please read our Disclaimer for your info.

Investment Accounts Explained

Here’s something that surprises many beginners: The type of account you use matters just as much as what you invest in.

Different accounts have different tax benefits, rules, and restrictions. Choosing the right account can literally save you tens of thousands of dollars in taxes over your lifetime.

Retirement Accounts (Tax-Advantaged)

These accounts are specifically designed for retirement savings and come with valuable tax benefits.

401(k) – Employer Retirement Plan

What it is: A retirement account offered through your employer. Money is automatically deducted from your paycheck before you even see it (which actually makes saving easier).

Key Features:

- Contribution Limit (2025): $23,000 per year ($30,500 if you’re 50 or older)

- Employer Match: Many companies match 3-6% of your contributions – this is literally FREE MONEY

- Tax Benefit: Contributions reduce your taxable income now; you pay taxes when you withdraw in retirement

- Withdrawal Age: 59½ (you pay penalties and taxes for early withdrawal)

Example: You make $60,000 per year. You contribute 10% ($6,000). Your employer matches 5% ($3,000). Total invested: $9,000. Plus, you only pay taxes on $54,000 instead of $60,000 this year, saving you about $1,320 in taxes.

Bottom line: If your employer offers a match, contribute at least enough to get the full match. Not doing so is leaving free money on the table.

IRA – Individual Retirement Account

What it is: A retirement account you open yourself (not through an employer). You have complete control over where you open it and what you invest in.

Key Features:

- Contribution Limit (2025): $7,000 per year ($8,000 if you’re 50 or older)

- Can have BOTH: You can have a 401(k) AND an IRA

- More choices: Usually more investment options than 401(k)s

- Two types: Traditional IRA and Roth IRA

Traditional IRA vs Roth IRA

| Traditional IRA | Roth IRA |

|---|---|

| Tax deduction NOW | No tax deduction now |

| Pay taxes on withdrawals in retirement | Tax-FREE withdrawals in retirement |

| Best if: High income now | Best if: Lower income now |

| Income limits for deduction | Income limits for contributions ($161k single, $240k married) |

| Required withdrawals at age 73 | No required withdrawals ever |

Simple decision tree:

- Make less than $75k/year? → Roth IRA (your taxes are relatively low now)

- Make more than $100k/year? → Traditional IRA (tax break is valuable now)

- Unsure? → Roth IRA (tax-free growth is extremely powerful)

Taxable Brokerage Account (Regular Investment Account)

What it is: A standard investment account with no special tax benefits, but complete flexibility.

When to use:

- After maxing out your 401(k) and IRA

- For goals before retirement (house down payment, car, etc.)

- If you want to retire before age 59½

- If you’ve hit contribution limits on retirement accounts

Key Features:

- No contribution limits: Invest as much as you want

- No age restrictions: Withdraw anytime without penalties

- Capital gains tax: You pay taxes on profits, but only when you sell

- More flexibility: No rules about when or how you withdraw

Beginner Priority Order

Follow this sequence:

- 401(k) up to employer match (don’t leave free money!)

- Max out Roth IRA ($7,000/year)

- Max out 401(k) ($23,000/year)

- Then open taxable brokerage account

Need step-by-step instructions for opening accounts? Check out our guide on how to start investing.

How the Stock Market Works

Let’s demystify this thing called “the stock market.”

What IS the stock market?

The stock market is simply a place where buyers and sellers trade stocks. Think of it like a farmer’s market, except instead of trading vegetables, people are trading ownership in companies.

Major Stock Exchanges

NYSE (New York Stock Exchange):

- Oldest and largest exchange

- Traditional companies like Coca-Cola, Walmart, Disney

- The one you see on TV with traders on the floor

NASDAQ:

- Tech-focused exchange

- Amazon, Apple, Microsoft, Google, Tesla

- Fully electronic (no trading floor)

How Stock Prices Are Determined

It’s simple supply and demand, just like anything else for sale:

- More buyers than sellers → Price goes up

- More sellers than buyers → Price goes down

What creates buyers and sellers? Company news, earnings reports, economic data, world events, investor emotions – thousands of factors create the constant push and pull.

Stock Market Basics

Market Hours:

- 9:30 AM – 4:00 PM EST, Monday-Friday

- Closed weekends and major holidays

- Pre-market trading: 4:00-9:30 AM

- After-hours trading: 4:00-8:00 PM

Stock Ticker Symbols:

Every stock has a unique 1-5 letter code:

- AAPL = Apple

- MSFT = Microsoft

- TSLA = Tesla

- KO = Coca-Cola

- DIS = Disney

Market Indices (Benchmarks)

These tell you “how the market is doing overall”:

S&P 500: 500 largest U.S. companies (most-watched index)

Dow Jones: 30 major companies (oldest index, dating to 1896)

NASDAQ Composite: Tech-heavy index with over 3,000 stocks

When the news says “The market was up today,” they’re usually referring to these indices.

Bull vs Bear Markets

Bull Market: Prices rising 20%+, optimism high, investors feel confident

- Think of a bull charging upward with its horns

- Average bull market lasts 5.5 years with +178% average gains

Bear Market: Prices falling 20%+, pessimism high, investors feel scared

- Think of a bear swiping downward with its paws

- Average bear market lasts 1.3 years with -36% average losses

Key insight: Bull markets last longer and gain more than bear markets lose. Over time, the market trends upward despite periodic drops.

Core Concepts – Investing 101

Now that you understand the building blocks, let’s cover the core concepts that successful investors use.

Diversification

The concept: Don’t put all your eggs in one basket.

Bad diversification:

$10,000 all in Tesla stock. If Tesla drops 50%, you lose $5,000.

Good diversification:

$10,000 spread across 500 companies via an S&P 500 index fund. If Tesla drops 50%, you lose about $100 (because Tesla is only about 2% of your total holdings).

Why it matters: If one company fails completely, you only lose a tiny portion of your portfolio instead of everything.

This is why funds are so popular – instant diversification.

Asset Allocation

The concept: How you divide your money between stocks, bonds, and cash.

Common allocations:

- Age 25: 90% stocks, 10% bonds (aggressive – you have decades to recover from drops)

- Age 45: 70% stocks, 30% bonds (moderate – balancing growth with stability)

- Age 65: 50% stocks, 50% bonds (conservative – protecting what you’ve built)

Rule of thumb: 100 minus your age = percentage in stocks

So if you’re 30 years old: 100 – 30 = 70% stocks, 30% bonds

This isn’t perfect for everyone, but it’s a good starting point.

Rebalancing

The concept: Periodically adjusting back to your target allocation.

Example:

- Start of year: 70% stocks ($7,000), 30% bonds ($3,000) = $10,000 total

- After 1 year: Stocks grew to $8,000, bonds grew to $3,100 = $11,100 total

- New allocation: 72% stocks, 28% bonds (drifted from your target)

- Rebalance: Sell $200 of stocks, buy $200 of bonds to get back to 70/30

When to do this: Once per year is usually sufficient.

Why it matters: Rebalancing forces you to “sell high, buy low” – selling winners and buying laggards when they’re on sale.

Dollar-Cost Averaging (DCA)

The concept: Investing the same amount regularly regardless of market price.

Example:

You invest $500 every month for a year into an S&P 500 index fund:

- Month 1: Stock price $100, you buy 5 shares

- Month 5: Stock price $80 (market drop!), you buy 6.25 shares

- Month 8: Stock price $120, you buy 4.17 shares

- Month 12: Stock price $110, you buy 4.55 shares

Result: You bought more shares when prices were low (like a sale!) and fewer shares when prices were high. Your average cost per share is lower than if you tried to “time the market.”

Why it works: You don’t have to predict the perfect time to invest. You just keep investing consistently, and math does the rest.

This is exactly what happens when you automatically invest from each paycheck into your 401(k).

Expense Ratios

The concept: The annual fee that funds charge, expressed as a percentage.

Examples:

- 0.03% = $3 per $10,000 invested (very low – typical for index funds)

- 0.50% = $50 per $10,000 invested (moderate – some mutual funds)

- 1.50% = $150 per $10,000 invested (high – actively managed funds)

Why this matters so much:

Over 30 years, a 1% fee versus a 0.1% fee can cost you 20-25% of your total returns. That’s the difference between retiring with $400,000 versus $500,000 – a $100,000 difference just from fees!

Rule: Always choose low-fee investments. Every extra 0.1% in fees is money out of your pocket.

Your Investing 101 Questions Answered

1. How much money do I need to start investing?

Many brokers now have $0 minimums. You can literally start with $1-10.

Realistic starting amounts:

- Absolute minimum: $50-100 (enough to buy fractional shares of index funds)

- Comfortable minimum: $500-1,000 (can build a simple diversified portfolio)

- Ideal starting point: $3,000-5,000 (opens up more options)

But here’s the truth: Don’t wait until you’ve saved some “perfect” amount. Start with $50 per month if that’s what you have. Starting early beats starting with more money later because of compound interest.

Ready to take action? Here’s how to start investing step-by-step.

2. Is investing 101 the same as gambling?

No. Here are the key differences:

Gambling:

- Pure chance (roulette, lottery, slots)

- The house has a mathematical edge against you

- Short-term bets

- Zero-sum game (someone must lose for you to win)

- Expected outcome: You lose money

Investing:

- Based on company fundamentals and economic growth

- The investor has an edge through research, diversification, and time

- Long-term wealth building

- Positive-sum game (the economy grows, so everyone can win)

- Expected outcome: You make money over time

Smart investing is calculated risk management based on decades of data, not gambling.

3. Can I lose all my money investing 101?

With individual stocks: Yes. Companies can and do go bankrupt (Enron, Lehman Brothers, Blockbuster all went to $0).

With diversified index funds: Extremely unlikely – effectively impossible.

For you to lose everything in an S&P 500 index fund, all 500 of America’s largest companies would need to fail simultaneously. That has never happened in history and would require the complete collapse of the U.S. economy.

Worst historical case: During the 2008 financial crisis, the market dropped about 50%. But it fully recovered within 4 years. Anyone who stayed invested is way ahead now.

This is why beginners should stick to diversified funds, not individual stocks.

4. What’s the difference between investing 101 and trading?

- Long-term focus (5+ years)

- Buy and hold strategy

- Building wealth gradually

- Low stress, minimal time commitment

- Higher success rate (90%+ succeed with index funds)

Trading:

- Short-term focus (days, weeks, months)

- Frequent buying and selling

- Trying to profit from price swings

- High stress, time-intensive

- Very low success rate (90% of day traders lose money)

For beginners: Invest, don’t trade. Trading is essentially gambling for most people.

5. Do I need a financial advisor to start investing 101?

No, not for basic investing. This guide plus a simple strategy (low-cost index funds + automatic monthly contributions) is all you need to get started.

Consider an advisor if:

- You have complex finances (business owner, high net worth $1M+)

- You need comprehensive financial planning (estate, tax, insurance)

- You want someone to manage your emotions during market drops

- You truly don’t want to learn the basics yourself

For most beginners: Start with robo-advisors (automated investing platforms) or self-directed index fund investing. Learn here about the best robo-advisors.

6. How long until I see returns?

Short answer: Years, not days or weeks.

Reality:

- Year 1: Might be up 20% or down 10% (high volatility, totally normal)

- Years 1-5: Still volatile with ups and downs, but generally trending positive

- Years 5-10: More consistent growth pattern emerges

- Years 10-30: Compound growth really accelerates, wealth builds substantially

Historical average: About 10% per year over long periods, but with significant year-to-year variation.

In 2019, the market was up 31%. In 2022, it was down 18%. In 2023, it was up 26%. This is normal!

Patience is the #1 investing skill. The investors who get rich are the ones who stay invested through the ups and downs.

7. What if I need the money before retirement?

You have options:

1. Roth IRA: You can withdraw your contributions (not earnings) anytime, penalty-free. So if you contributed $20,000 over 5 years and it grew to $25,000, you can take out $20,000 without penalty.

2. Taxable brokerage account: Withdraw anytime – just pay capital gains tax on profits. No penalties.

3. Emergency fund: This is why you should keep 3-6 months of expenses in a regular savings account (not invested). For short-term needs, you need cash you can access immediately.

Golden rule: Never invest money you might need in the next 5 years. Market drops don’t care about your timeline.

8. Should I wait for the market to drop before investing 101?

No. Market timing doesn’t work – even for professionals.

The data is clear:

- If you waited for “the perfect time” to invest over any 20-year period, you’d miss 95% of the gains

- Missing just the 10 best days in 20 years reduces your returns by 50%

- Time IN the market beats TIMING the market

Best strategy: Start now with whatever you have. Invest consistently regardless of whether the market is up or down. Dollar-cost averaging (remember?) handles this automatically.

Truth: The “perfect time” to invest was 10 years ago. The second-best time is today.

Conclusion – Investing 101 Fundamentals

Let’s do a quick recap.

Your Investing 101 Checklist:

✅ What investing 101 is (and what it isn’t)

✅ The three main investment types (stocks, bonds, funds)

✅ How risk and return work together

✅ Different investment account types

✅ How the stock market functions

✅ Core concepts (diversification, allocation, dollar-cost averaging)

What These Basics Enable

Now that you understand the fundamentals, you’re ready to:

- Open your first investment account without feeling overwhelmed

- Choose appropriate investments for your goals and timeline

- Understand what financial advisors and investing articles are talking about

- Make informed decisions instead of just guessing

- Avoid the most common (and costly) beginner mistakes

The Most Important Lesson

Investing isn’t rocket science. Successful investing is actually quite simple (though not always easy):

- Start early (even with small amounts)

- Invest consistently (automate it if possible)

- Use low-cost diversified funds (index funds are perfect)

- Stay patient through ups and downs (don’t panic sell)

These basics worked for Warren Buffett. They’ve worked for millions of successful investors over decades. And they’ll work for you.

The complicated strategies, exotic investments, and “secret tricks” that financial gurus try to sell you? You don’t need them. This foundation is enough to build serious wealth over time.

Your Next Step

Here’s the thing: Knowledge without action won’t build wealth.

You now understand investing better than most Americans. But understanding alone won’t grow your money – you have to actually start.

The good news? Starting is easier than you think.

Read our complete step-by-step guide on how to start investing and open your first investment account this week. It takes about 15 minutes, and you can start with as little as $50.

You’ve learned the basics. You understand the concepts. You know why investing matters.

Now go use it.

Keep Learning: Get Our Free Investing Resources

Download our Investing Basics Glossary plus get weekly tips for beginner investors delivered to your inbox.

OUR TIP: We recommend you to “download” the “SMART INVESTING GUIDE” from our homepage too!

Recommended Reading: After understanding these basics, dive deeper with The Simple Path to Wealth by JL Collins – the perfect next step for learning index fund investing strategies.

Ready to implement these concepts automatically? Consider robo-advisors like Betterment that build and manage diversified portfolios for you based on your goals.