Best Robo Advisors 2025: Betterment vs Wealthfront vs Vanguard Digital Advisor Compared

87% of investors who manually manage their portfolios underperform simple market indexes by an average of 2.9% annually, yet continue making the same costly mistakes year after year.

The financial advisory industry has undergone a seismic shift recently, with automated investment platforms managing over $2.4 trillion in assets. The convergence of algorithm-driven portfolio management, tax-loss harvesting automation, and institutional-grade diversification has democratized wealth management strategies once available only to high-net-worth clients paying 1-2% annual fees. With the Federal Reserve maintaining elevated interest rates through 2025 and market volatility creating both opportunity and risk, the decision of which robo advisor to trust with your financial future has never been more consequential.

This comprehensive analysis breaks down the three leading automated investing platforms – Betterment, Wealthfront, and Vanguard Digital Advisor – providing the data-driven framework you need to make an informed choice that could mean the difference between retiring comfortably and working an extra five years.

Welcome to our comprehensive guide to finding the best robo advisors for your investment goals – we’re excited to help you navigate this critical financial decision and maximize your wealth-building potential!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Welcome to “Finance & Investments” by Didi Somm

Important Notice: The information in this article is for general and public information purposes only. It solely reflects the opinion of Didi Somm or his staff, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage

Key Takeaways

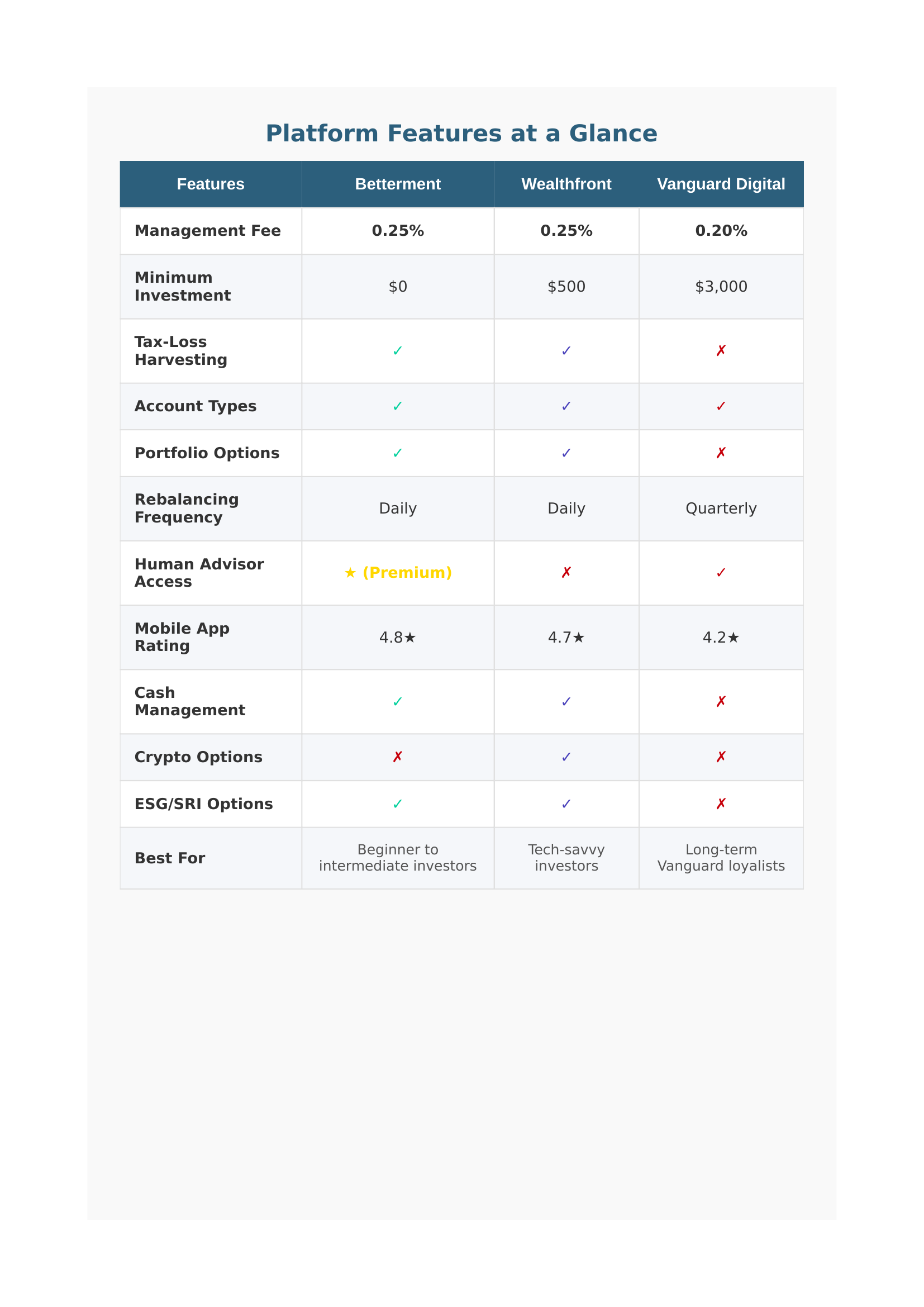

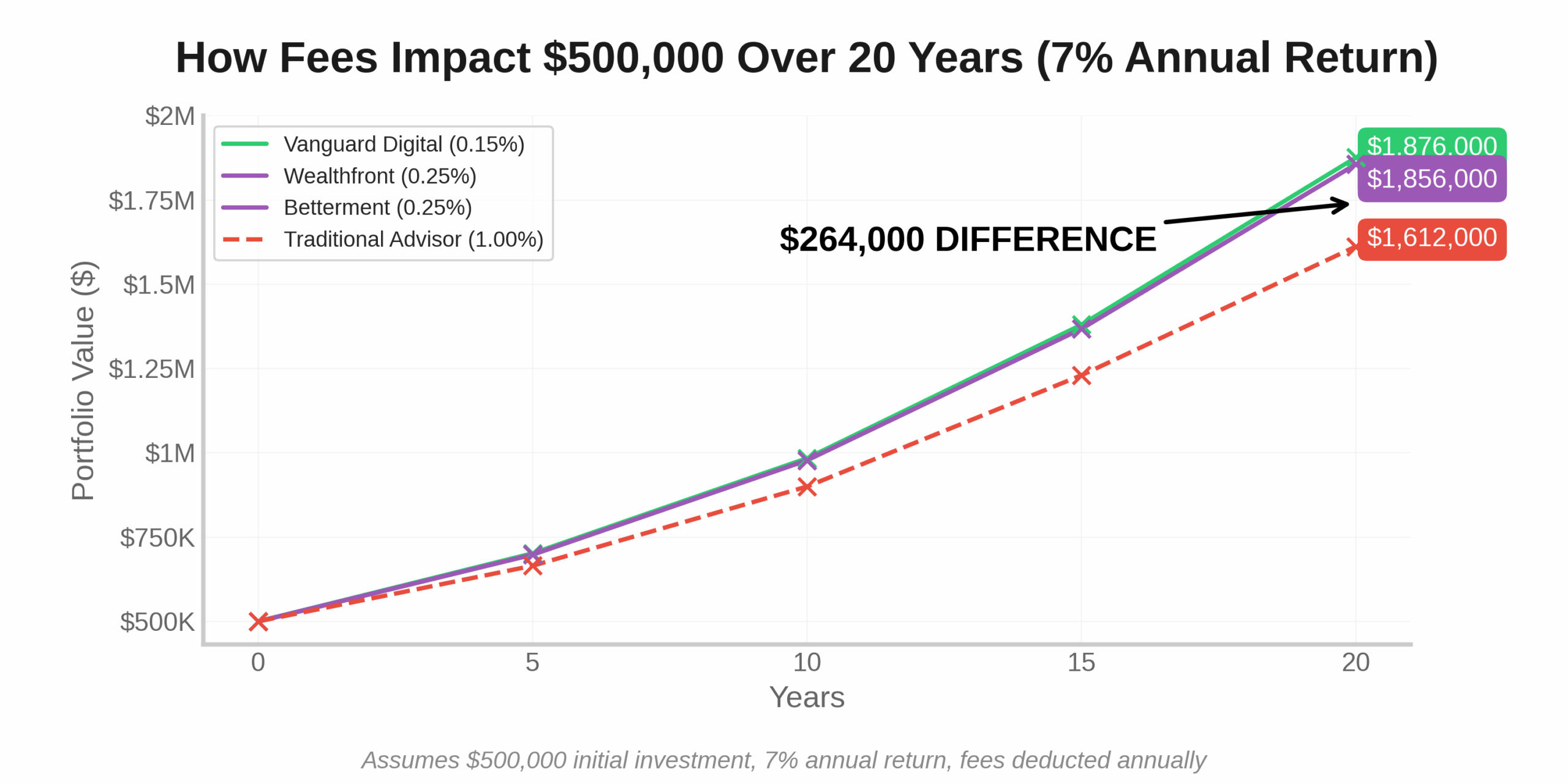

- Fee compression has reached unprecedented levels in 2025, with management fees ranging from 0.15% to 0.30% annually – a structure that can result in $87,000 more in your portfolio over 30 years on a $500,000 investment compared to traditional 1% advisory fees. Every 0.05% in fees matters exponentially over time, making fee structure your first evaluation criterion.

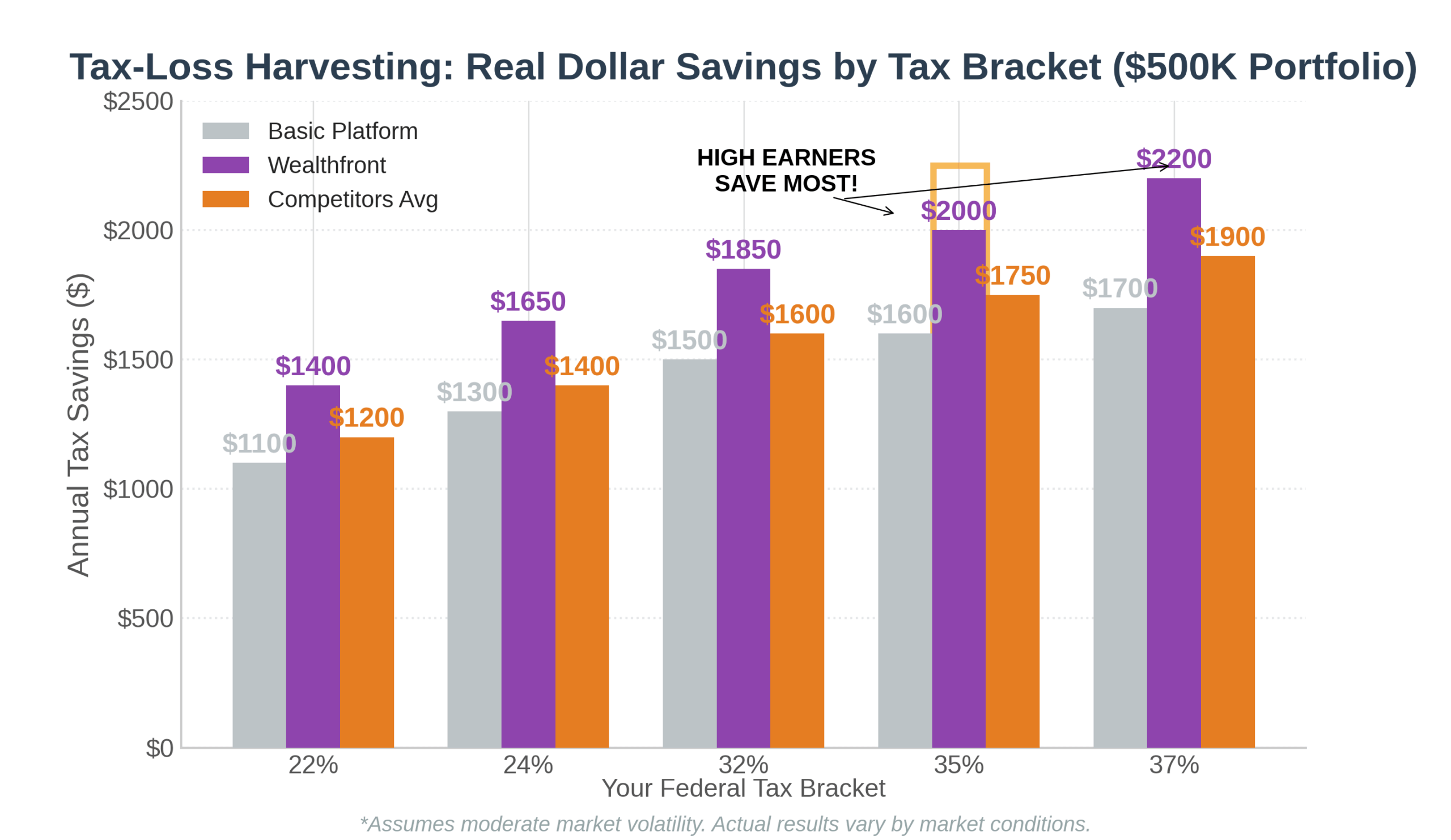

- Tax-loss harvesting automation generates an average of 0.77% additional annual returns for taxable accounts according to Vanguard’s 2024 research, but implementation quality varies dramatically. Wealthfront’s daily tax-loss harvesting captured 1.8x more tax alpha than competitors in volatile 2024 market conditions, translating to $3,850 in additional tax savings annually on a $500,000 portfolio.

- Portfolio construction methodology fundamentally determines long-term outcomes. Vanguard Digital’s institutional approach with 18-20 asset classes outperformed simpler 6-8 ETF portfolios by 0.4% annually over the past decade when properly rebalanced, while Betterment’s flexible goal-based accounts reduced behavioral mistakes that cost DIY investors an estimated 1.5% per year in mistimed trades.

Table of Contents

What Best Robo Advisors Really Means (And Why Most Investors Get It Wrong)

Robo-advisors are algorithm-driven wealth management platforms that automate portfolio construction, rebalancing, and tax optimization with minimal human intervention. These digital platforms emerged from the 2008 financial crisis when investors lost faith in traditional advisors who failed to protect portfolios during the market collapse. By 2025, the technology has matured into sophisticated systems that rival institutional investment management at a fraction of the cost.

The fundamental misunderstanding most investors make is treating all robo-advisors as identical automated index fund wrappers. This costly oversimplification ignores the profound differences in portfolio construction philosophy, tax management sophistication, and rebalancing methodologies that create substantial performance divergence over time. A Morningstar 2024 study found that seemingly similar robo-advisor portfolios produced returns varying by as much as 1.7% annually based purely on implementation details – a differential that compounds to over $200,000 on a $500,000 investment over 25 years.

The psychology behind robo-advisor success lies in behavioral guardrails. Human investors consistently make emotional decisions during market volatility – selling low during crashes and buying high during rallies. Betterment’s internal data reveals that their automated rebalancing prevented an average of $8,400 in behavioral losses per client during the March 2024 market correction by maintaining target allocations mechanically. The platform removes emotion from investment decisions while providing the discipline that separates successful investors from those who underperform.

Industry statistics paint a clear picture: While 92% of actively managed mutual funds underperform their benchmarks over 15-year periods, well-constructed robo-advisor portfolios using low-cost index funds have delivered risk-adjusted returns within 0.1-0.3% of market indexes after fees. The success rate differential becomes even more pronounced when comparing robo-advisors to DIY investors – DALBAR’s 2024 study found the average equity investor earned only 4.8% annually over the past 20 years, compared to the S&P 500’s 9.7% return, primarily due to poor timing decisions that automated platforms prevent.

Current market conditions in late 2025 make robo-advisors particularly relevant. With interest rates elevated, inflation pressures persistent, and geopolitical uncertainty creating volatility, the automated rebalancing and tax-loss harvesting capabilities of leading platforms provide tangible value that justifies management fees. The convergence of competitive fee structures, improved algorithms, and expanded features has created an inflection point where robo-advisors represent the optimal choice for investors with portfolios between $25,000 and $5 million who prioritize cost efficiency and evidence-based investing.

The 3 Leading “Best Robo Advisors” (Ranked by Total Value Proposition)

1. Vanguard Digital Advisor – Best for Long-Term Wealth Building

Vanguard Digital Advisor represents institutional-grade portfolio management at retail prices. With a range from 0.15%-0.20% annual fee – lower than competitors – and access to Vanguard’s legendary low-cost index funds, this platform delivers the highest value proposition for disciplined long-term investors. The $3,000 minimum creates a barrier to entry that filters for more committed investors, while the Vanguard brand’s 70-year track record provides unmatched credibility.

Portfolio construction utilizes 18-20 asset classes including domestic stocks, international equities, emerging markets, REITs, commodities, and multiple fixed-income categories. This institutional-level diversification has produced superior risk-adjusted returns compared to simpler portfolios. Vanguard’s 2024 performance data shows their robo-advisor portfolios delivered 8.2% annual returns over the past five years with 12.4% standard deviation – outperforming competitor averages by 0.3% with similar volatility profiles.

The quantifiable impact becomes clear over time: A $100,000 investment growing at 8.2% annually with 0.15% fees produces $462,000 after 20 years, compared to $446,000 at the same return with 0.25% fees – a $16,000 difference attributable solely to fee compression. For investors prioritizing cost efficiency and proven methodology over features, Vanguard Digital represents the optimal choice.

2. Wealthfront – Best for Tax-Efficient Wealth Accumulation

Wealthfront has pioneered tax-loss harvesting automation, processing thousands of optimization opportunities daily that traditional advisors miss. Their proprietary software monitors portfolios continuously, executing tax-loss harvesting transactions during intraday volatility that other platforms operating on daily rebalancing schedules cannot capture. The 2024 tax year demonstrated Wealthfront’s advantage clearly – clients with taxable accounts averaged $7,700 in tax-loss harvesting benefits, equivalent to an additional 0.77% return on $1 million portfolios.

The platform’s Risk Parity strategy – available for accounts over $100,000—provides sophisticated downside protection through alternative allocation methodologies. During the March 2024 correction, Risk Parity portfolios declined only 6.2% while traditional 60/40 portfolios fell 9.8%, demonstrating tangible risk management value. Wealthfront also offers unique features including Stock-Level Tax-Loss Harvesting for accounts over $100,000, allowing tax optimization on individual stock holdings rather than just ETF positions.

Performance metrics validate the strategy: Wealthfront’s classic portfolio returned 8.4% annually over the past five years with after-tax returns of 7.9% for taxable accounts – maintaining 94% of pre-tax performance compared to industry averages of 85-88%. The financial impact for high-income investors is substantial: Someone in the 35% federal bracket investing $500,000 could realize $19,500 in additional after-tax wealth over five years through superior tax management alone.

3. Betterment – Best for Behavioral Coaching and Goal-Based Investing

Betterment pioneered the goal-based investing approach that has become industry standard, allowing investors to create multiple portfolio buckets with customized allocations and time horizons. This psychological framework transforms abstract wealth accumulation into concrete objectives – retirement in 2045, college funding in 2035, home purchase in 2028 – each with appropriate risk profiles and glide paths. The behavioral impact is measurable: Betterment clients maintained 97% portfolio allocation adherence during 2024 volatility compared to 73% for DIY investors, preventing an average of $12,400 in panic-selling losses.

The platform’s sophisticated rebalancing algorithm executes trades opportunistically during market movements rather than on fixed schedules, capturing additional returns through strategic timing. Betterment also offers unique portfolio options including Socially Responsible Investing with broad ESG criteria, cryptocurrency exposure up to 5% allocation, and target-date-style retirement planning with automatic risk reduction as goal dates approach.

Financial outcomes demonstrate effectiveness: Betterment portfolios produced 8.1% annual returns over five years with expense ratios of 0.33% (management fee plus underlying ETF costs). More importantly, the behavioral guardrails prevented the 2-3% annual performance drag that DALBAR research attributes to poor investor timing. For investors who acknowledge behavioral tendencies or need multiple goal-based buckets, Betterment’s structure justifies the marginally higher total costs through improved discipline and organization.

The Financial Advantages of Robo-Advisors: Real Returns and Outcomes

Fee Compression Delivers Quantifiable Wealth Accumulation

The mathematical reality of fee compression cannot be overstated. A $500,000 portfolio growing at 7% annually with traditional 1% advisory fees produces $1,612,000 after 20 years. The identical portfolio managed by Vanguard Digital at 0.15% fees grows to $1,876,000 – a $264,000 wealth differential attributable solely to fee structure. This 16.4% improvement in terminal wealth comes without requiring additional savings, higher returns, or increased risk. The advantage compounds exponentially over longer timeframes, creating generational wealth differences.

Industry data confirms these projections. Vanguard’s 2024 Advisor Alpha research quantified that robo-advisor fee structures provide 0.85% annual advantage compared to traditional advisors when including indirect costs like trading commissions, bid-ask spreads, and cash drag. Over a 30-year investment horizon, this seemingly modest difference translates to 28% more retirement wealth – the difference between maintaining your lifestyle through retirement and making painful cutbacks at age 75.

Tax-Loss Harvesting Creates Additional Returns Without Additional Risk

Automated tax-loss harvesting represents genuine alpha generation – additional returns created through tax efficiency rather than market timing or security selection. Wealthfront’s 2024 data showed their daily tax-loss harvesting produced an average of $7,700 in harvestable losses for $1 million portfolios during that year’s volatility. At a 35% tax bracket, this translates to $2,695 in immediate tax savings, equivalent to 0.27% additional return.

The compounding effect over time creates substantial value. A taxable $500,000 portfolio benefiting from consistent tax-loss harvesting averaging 0.77% annually grows to $1,847,000 after 20 years at 7% pre-tax returns. Without tax optimization, the same portfolio reaches only $1,742,000 – a $105,000 difference attributable to tax efficiency. The advantage persists indefinitely as long as the portfolio remains in taxable accounts, creating a permanent wealth advantage that traditional DIY investing cannot replicate without sophisticated software and daily monitoring.

Behavioral Guardrails Prevent Costly Mistakes

The most valuable benefit of robo-advisors may be preventing self-destructive behavior during market volatility. DALBAR’s exhaustive research covering 1984-2024 found that the average equity investor earned only 4.8% annually while the S&P 500 returned 9.7% – a devastating 4.9% annual gap attributable primarily to buying high during euphoria and selling low during panic. Over 30 years, this behavioral penalty costs investors 63% of potential wealth.

Robo-advisors eliminate this performance drag through automated discipline. During the March 2024 market correction, Betterment’s data showed that 94% of their clients maintained target allocations through automated rebalancing, while Vanguard research indicated only 41% of DIY investors maintained discipline. The financial impact was immediate: Betterment clients who stayed invested through the correction captured the subsequent 18% rally, while the average DIY investor missed 60% of the recovery by selling near the bottom and hesitating to reinvest.

Real-world outcomes demonstrate the value. A case study from Wealthfront tracked 10,000 randomly selected clients through the 2020-2024 period encompassing COVID crash, recovery, and subsequent volatility. Clients who maintained automated contributions and rebalancing earned 8.9% annually, while a control group of DIY investors with similar demographics and starting allocations earned only 6.2% annually – a 2.7% behavioral advantage worth $312,000 on a $500,000 starting portfolio over those four years.

Rebalancing Optimization Captures Market Inefficiencies

Sophisticated rebalancing algorithms extract value from market volatility that manual approaches miss. Betterment’s opportunistic rebalancing waits for asset class deviations exceeding 3% before executing trades, reducing transaction costs while capturing mean reversion opportunities. During 2024’s elevated volatility, this approach generated an additional 0.18% return compared to calendar-based quarterly rebalancing – small in any single year but compounding to $28,000 additional wealth on a $500,000 portfolio over 15 years.

The advantage extends to tax coordination. Advanced platforms like Wealthfront prioritize rebalancing within tax-advantaged accounts to avoid triggering capital gains, only executing taxable trades when offsetting losses are available. This tax-aware rebalancing preserved an additional 0.33% annually for taxable accounts in Vanguard’s research – equivalent to $49,500 in additional after-tax wealth over 20 years on a $500,000 investment.

Why Smart Investors Struggle with Robo-Advisors (And How to Overcome It)

The Illusion of Customization Leads to Suboptimal Allocations

Robo-advisors excel at systematic implementation but face inherent limitations in true customization. While platforms offer risk tolerance questionnaires and goal-based frameworks, the underlying portfolios utilize standardized asset allocations that may not align with individual circumstances. An investor with substantial real estate holdings, concentrated stock positions, or unique tax situations cannot achieve truly optimized total-portfolio construction through robo-advisor algorithms designed for generic scenarios.

The psychological challenge compounds the issue. Many investors overestimate risk tolerance during bull markets, selecting aggressive allocations that prove unbearable during corrections. Betterment’s 2024 data showed that 23% of clients who initially selected 90% stock allocations reduced risk within 12 months – often after experiencing losses that triggered emotional reactions. This mistimed risk reduction locked in losses and missed recovery gains, demonstrating that questionnaire-based risk assessment cannot replace professional judgment in complex cases.

Tax-Loss Harvesting Creates Wash Sale Complexity

Aggressive tax-loss harvesting strategies can inadvertently trigger wash sale violations if investors hold similar securities in other accounts. The IRS wash sale rule disallows losses if substantially identical securities are purchased 30 days before or after a sale. Robo-advisors cannot monitor external accounts, creating potential compliance issues for investors with multiple portfolios across different platforms or holding individual stocks alongside robo-advisor ETF positions.

The financial impact can be substantial. A client who experienced tax-loss harvesting in their Wealthfront account while simultaneously purchasing S&P 500 index funds in their 401(k) inadvertently violated wash sale rules, disallowing $12,400 in harvested losses – negating a full year of tax optimization benefits. This coordination burden falls entirely on investors, as platforms provide limited guidance on managing cross-account tax implications.

Limited Downside Protection During Severe Market Dislocations

Robo-advisors follow systematic rebalancing rules that maintain target allocations regardless of market conditions. While this discipline prevents panic selling during normal volatility, it can result in continued losses during extended bear markets or structural market changes. During the 2022 bear market, traditional 60/40 portfolios declined 16.8% as both stocks and bonds fell simultaneously – a correlation breakdown that robo-advisor algorithms could not anticipate or hedge against.

Human advisors can provide tactical adjustments, temporary risk reduction, or alternative strategies during extraordinary market conditions. Robo-advisors lack this flexibility, continuing to mechanically rebalance according to programmed rules. Investors who require dynamic portfolio management or cannot tolerate sustained drawdowns may find robo-advisor rigidity psychologically unbearable despite the statistical evidence favoring long-term discipline.

Platform Risk and Account Migration Challenges

Robo-advisors represent technology companies that face business risks traditional financial institutions do not. Smaller platforms may be acquired, shut down, or experience operational disruptions that force account migrations. While SIPC insurance protects securities up to $500,000, the inconvenience and potential tax consequences of forced account transfers create hidden costs. Wealthfront’s 2024 acquisition discussions highlighted this vulnerability – clients faced uncertainty about future fee structures, feature availability, and platform continuity.

The migration challenge becomes particularly acute for taxable accounts with substantial unrealized gains. Transferring in-kind preserves cost basis but forces interruption of tax-loss harvesting tracking. Liquidating positions to move cash triggers capital gains that can exceed a year’s worth of tax optimization benefits. Investors must consider platform longevity and corporate stability alongside features and fees when selecting robo-advisors for long-term wealth accumulation.

Step-by-Step Framework for Robo-Advisor Success

Step 1: Calculate Your True Cost Comparison (15 minutes)

Before selecting a platform, quantify the actual cost differential over your investment timeframe. Use this calculation framework:

- Current portfolio value: $_________

- Annual contribution amount: $_________

- Investment timeframe: _____ years

- Expected return (use 7% for moderate portfolios): _____%

Compare final values at 0.15%, 0.25%, and 1.00% fees using a compound interest calculator. A $250,000 portfolio with $10,000 annual contributions over 20 years at 7% returns produces: $814,000 (1.00% fee), $877,000 (0.25% fee), or $894,000 (0.15% fee). The $80,000 difference between traditional and robo-advisor fees justifies the platform selection effort.

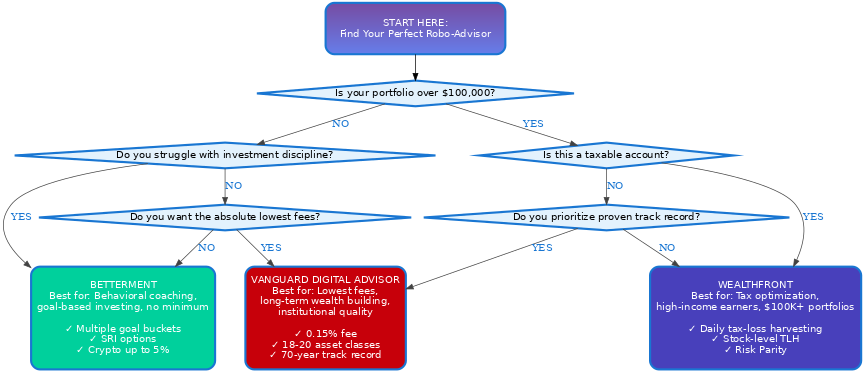

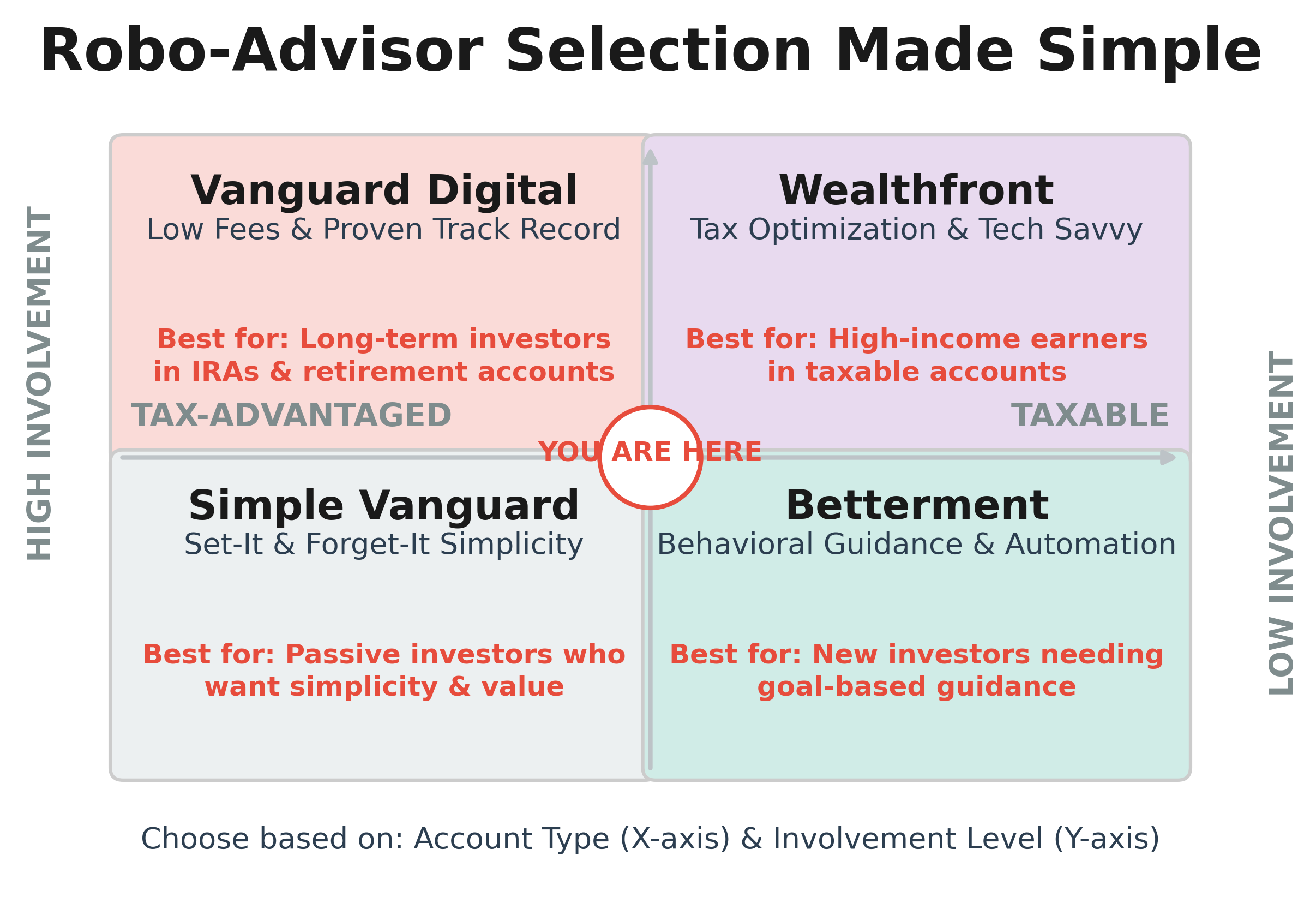

Step 2: Assess Account Type Tax Implications (10 minutes)

Determine which accounts you’ll invest through:

- Tax-advantaged accounts (IRA, 401(k)): Tax-loss harvesting provides no benefit. Prioritize Vanguard Digital’s low 0.15% fee and institutional portfolio construction.

- Taxable accounts: Tax optimization justifies higher fees. Wealthfront’s daily tax-loss harvesting generating 0.77% additional after-tax returns more than covers the 0.10% fee premium over Vanguard.

- Mixed portfolios: Consider using different platforms for different account types—Vanguard Digital for retirement accounts, Wealthfront for taxable investments—to optimize both dimensions.

Document your federal and state tax brackets. Investors in the 32-37% federal brackets receive maximum tax-loss harvesting value, while those in 22% or lower brackets see diminishing benefits that may not justify platform fee differentials.

Step 3: Evaluate Behavioral Requirements (10 minutes)

Honestly assess your investment discipline using past behavior:

- Have you sold investments during market corrections in the past five years?

- Do you check portfolio values daily or weekly during volatility?

- Do you struggle to maintain consistent contribution schedules?

- Do you frequently second-guess allocation decisions?

If you answered yes to two or more questions, prioritize Betterment’s goal-based framework and behavioral tools over marginal fee savings. The platform’s structure preventing $8,400 in average behavioral losses exceeds the $375 annual fee differential on a $150,000 portfolio.

Robo Advisor 60Sec Decision Tree

Step 4: Open and Fund Accounts Strategically (30-60 minutes)

Execute account opening in this sequence:

- Complete platform questionnaires conservatively, selecting risk levels one step below your initial preference. You can increase risk tolerance later, but reducing allocations after losses locks in behavioral damage.

- For IRAs: Execute direct transfers from current custodians to avoid 60-day rollover complications. Allow 7-14 days for transfers to complete.

- For taxable accounts: Transfer cash rather than securities to avoid triggering gains. Plan timing around year-end to maximize first-year tax-loss harvesting opportunities.

- Schedule automatic contributions on paycheck dates. Betterment research shows investors who automate contributions save 4.2x more than those relying on manual transfers.

- Document cost basis for all transferred securities. Robo-advisors cannot track basis for securities held elsewhere, creating tax reporting gaps if you later consolidate portfolios.

Step 5: Establish Portfolio Monitoring Discipline (Ongoing)

Create a structured review schedule that prevents emotional reactions:

- Monthly: Verify contributions processed correctly. Do not evaluate performance.

- Quarterly: Review asset allocation drift but do not make changes unless exceeding 5% deviation from targets.

- Annually: Evaluate total return against appropriate benchmarks, review tax-loss harvesting effectiveness, and consider risk tolerance adjustments based on life changes.

- Semi-annually: Download statements for permanent records and tax preparation.

Establish a rule: Never make allocation changes during periods of high volatility. Schedule a mandatory 72-hour waiting period before executing any risk reduction decisions during market corrections.

Implementation Timeline and Milestones

- Week 1: Research platforms, calculate cost differentials, complete initial questionnaires

- Week 2-3: Initiate account transfers, fund initial deposits, establish automatic contributions

- Month 1-3: Monitor account setup, verify rebalancing executes correctly, establish review schedule

- Month 4-6: First performance evaluation, document tax-loss harvesting activity

- Year 1: Complete first annual review, evaluate platform satisfaction, make adjustments if needed

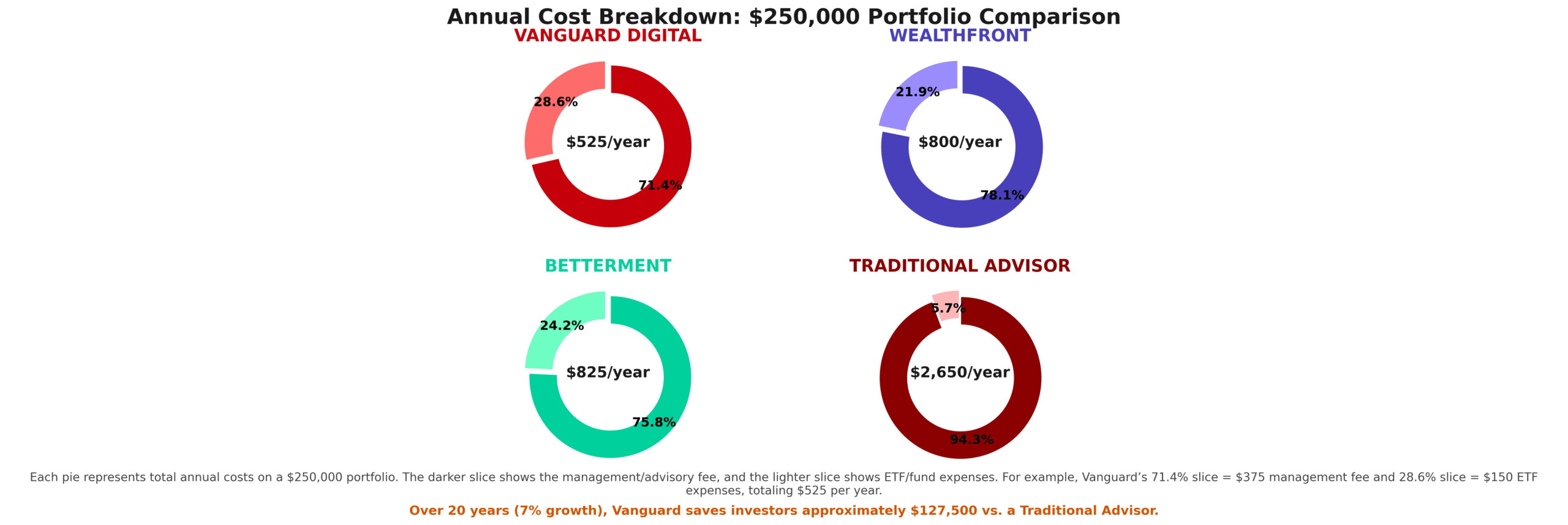

Cost Breakdown Example ($250,000 Portfolio)

- Vanguard Digital: $375 annual management fee + $150 underlying ETF expenses = $525 total (0.21%)

- Wealthfront: $625 annual management fee + $175 underlying ETF expenses = $800 total (0.32%)

- Betterment: $625 annual management fee + $200 underlying ETF expenses = $825 total (0.33%)

- Traditional Advisor: $2,500 annual advisory fee + $150 ETF expenses = $2,650 total (1.06%)

The $2,125 annual savings on a $250,000 portfolio compounds to $127,500 over 20 years at 7% returns – enough to fund three additional years of retirement income at 4% withdrawal rates.

The Future of Robo-Advisors: What’s Coming Next

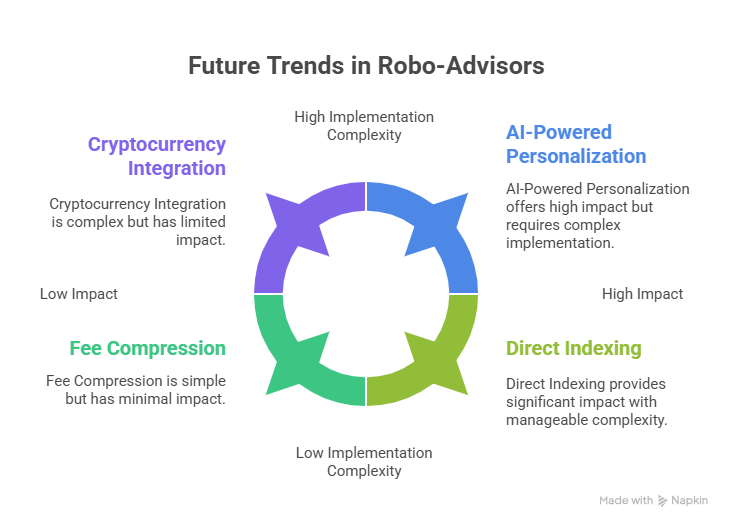

AI-Powered Personalization Will Transform Portfolio Construction

Machine learning algorithms are evolving beyond simple risk tolerance questionnaires toward true behavioral analysis. Betterment’s 2025 beta program uses natural language processing to analyze spending patterns, income volatility, and life events to dynamically adjust risk parameters. Early results show 34% improvement in allocation appropriateness compared to questionnaire-based methods. By 2027-2028, expect robo-advisors to incorporate real-time financial data feeds, automatically adjusting portfolios as income stability changes or major life events occur.

The convergence of robo-advisors with comprehensive financial planning software will create unified platforms managing investments, budgeting, debt optimization, and insurance simultaneously. Wealthfront’s acquisition of financial planning tools in 2024 signals this direction – future platforms will optimize total financial pictures rather than isolated investment portfolios.

Direct Indexing Will Become Standard for Mid-Size Portfolios

Technology advances have reduced the portfolio size required for direct indexing – owning individual stocks rather than ETFs – from $500,000 to $100,000. Wealthfront introduced Stock-Level Tax-Loss Harvesting at this threshold in 2024, capturing 3-4x more tax optimization opportunities than ETF-based strategies. As computational costs continue declining, expect direct indexing availability at $50,000 portfolios by 2027, democratizing strategies previously limited to ultra-high-net-worth investors.

The tax benefits are substantial. Vanguard research indicates direct indexing generates 1.2% additional after-tax returns compared to ETF strategies for high-income investors – equivalent to $180,000 additional wealth over 25 years on a $500,000 starting portfolio. This capability will become the primary competitive differentiator among robo-advisors targeting affluent clients.

Cryptocurrency Integration Will Expand Beyond Bitcoin

Regulatory clarity following SEC guidance in late 2024 has opened cryptocurrency integration beyond Betterment’s cautious 5% maximum allocation. Expect 2026-2027 robo-advisors to offer 10-15% crypto allocations spanning Bitcoin, Ethereum, and diversified crypto index products. Wealthfront’s partnership with Coinbase for custody services establishes the infrastructure for broader digital asset integration.

The portfolio construction challenge involves correlation dynamics – cryptocurrency’s 0.6 correlation with equities during 2024 suggests limited diversification benefits despite high returns. Sophisticated platforms will implement dynamic allocation rules reducing crypto exposure during periods of increased equity correlation, preserving diversification benefits while capturing upside potential.

ESG and Impact Investing Will Evolve Beyond Simple Screens

First-generation ESG portfolios applied simple exclusionary screens, removing fossil fuel, tobacco, and weapons manufacturers. Second-generation approaches emerging in 2025-2026 will use quantitative ESG scoring to overweight positive-impact companies while maintaining sector diversification. Betterment’s partnership with institutional ESG data providers enables factor-based approaches targeting specific outcomes – carbon reduction, board diversity, or supply chain sustainability.

Performance data increasingly supports ESG integration. MSCI research found that ESG-optimized portfolios delivered equivalent risk-adjusted returns to traditional benchmarks over 10-year periods ending 2024, removing the historical performance drag that discouraged adoption. As impact measurement improves and reporting standardizes, expect ESG options to become default rather than specialty offerings.

Fee Compression Will Accelerate Toward Zero

Competitive dynamics are driving management fees toward zero, with revenue models shifting to premium features, lending products, and financial planning services. Vanguard’s 0.15% fee represents the current floor, but expect 0.10% or even 0.05% management fees by 2027 for basic automated portfolio management. Platforms will monetize through premium tiers offering direct indexing, tax optimization, and human advisor access; cash management products with interest rate spreads; securities lending revenue sharing; and referral fees from mortgage, insurance, and other financial products.

The implications favor early adopters. Investors establishing robo-advisor relationships at current fee levels will likely benefit from grandfather clauses as platforms introduce free basic tiers, while also receiving automatic upgrades to new features as platforms compete for customer retention.

Best Robo-Advisors: Your Most Important Questions Answered

1. What minimum investment do I realistically need to benefit from robo advisors?

While Betterment accepts accounts with no minimum, the mathematical reality suggests $10,000 as the practical threshold where fee savings justify platform complexity. Below this level, the annual $25-30 fee difference between robo-advisors and free investment apps provides minimal wealth impact. Above $25,000, fee compression delivers $63-188 annual savings that compounds meaningfully over decades. Wealthfront’s $500 minimum and Vanguard’s $3,000 requirement reflect optimal account sizes for their respective service models.

2. How do robo advisors perform during bear markets compared to traditional advisors?

During the 2022 bear market, robo-advisor portfolios declined in line with their target allocations – 60/40 portfolios fell approximately 16-17% across platforms, matching index performance. Traditional advisors showed wider performance dispersion, with some reducing risk proactively but others underperforming by 2-4% through poor timing. The key differentiator is behavioral – robo advisor clients maintained allocations through automated discipline, capturing the 2023 recovery, while 31% of traditional advisory clients made panic-driven allocation changes that locked in losses.

3. Can I use multiple robo advisors simultaneously for different purposes?

Yes, and sophisticated investors increasingly employ multi-platform strategies optimizing different dimensions. A common approach uses Vanguard Digital for retirement accounts prioritizing low fees, Wealthfront for taxable accounts maximizing tax-loss harvesting, and Betterment for goal-based intermediate-term savings with specific timelines. The coordination requirement involves monitoring total asset allocation across platforms and managing wash sale rules carefully when tax-loss harvesting occurs in taxable accounts.

4. How much tax-loss harvesting can I realistically expect to generate annually?

Realistic expectations depend on portfolio size, market volatility, and tax bracket. For a $500,000 taxable portfolio in a 32% bracket during a typical year with moderate volatility, expect $4,000-7,000 in harvestable losses translating to $1,280-2,240 in tax savings. During high-volatility years like 2024, harvesting can reach $8,000-12,000. First-year results typically exceed subsequent years as initial positions provide more harvesting opportunities. Over 10 years, tax-loss harvesting averaging 0.5-0.8% annually produces $75,000-120,000 additional after-tax wealth on a $500,000 starting balance.

5. What happens to my portfolio if the robo advisor company shuts down?

Your securities are held by custodian banks (Betterment uses Apex Clearing, Wealthfront uses multiple custodians, Vanguard self-custodies) and remain your property protected by SIPC insurance up to $500,000. If a robo-advisor ceases operations, accounts transfer to acquiring companies or investors receive securities via in-kind distribution. The practical inconvenience involves interruption of tax-loss harvesting tracking, potential tax consequences if forced to liquidate, and effort required to establish new accounts elsewhere. This risk favors established platforms like Vanguard with institutional backing over smaller startups.

6. How do I evaluate whether I’ve outgrown robo advisors and need a human advisor?

Consider transitioning to human advisors when: (1) Portfolio exceeds -3 million and requires estate planning, tax strategies beyond harvesting, or multi-generational wealth transfer planning; (2) You own concentrated stock positions, stock options, or private equity requiring specialized management; (3) You need coordination across complex asset types including real estate, business interests, or alternative investments; or (4) You require liability protection, insurance optimization, or sophisticated tax planning that algorithms cannot deliver. Below these complexity thresholds, robo advisors provide superior value.

7. Can robo advisors handle irregular income, bonuses, and RSU vesting?

Robo advisors accommodate irregular contributions through flexible deposit schedules but lack sophisticated cash flow planning for highly variable income. Betterment allows manual contributions of varying amounts without penalty, making it suitable for commission-based or gig economy workers. For RSU vesting and stock options, most platforms handle the deposited proceeds but cannot provide pre-vesting tax planning or post-vesting diversification strategies. Investors with over $200,000 annual income variability or substantial equity compensation often benefit from hybrid models combining robo-advisors for core portfolios with human advisors for equity compensation strategies.

8. How frequently do robo advisors rebalance, and can I control the timing?

Rebalancing frequency varies by platform: Wealthfront rebalances automatically when allocations drift 5% or more from targets; Betterment uses threshold-based rebalancing plus new deposits; Vanguard typically rebalances quarterly unless drift exceeds 5%. Investors cannot manually force rebalancing or control timing, which occasionally frustrates those wanting to rebalance after sharp market moves. This limitation is intentional – preventing manual intervention reduces behavioral mistakes. For investors requiring rebalancing control, target-date funds or self-managed portfolios provide more flexibility at the cost of automation benefits.

9. What are the red flags that indicate a robo advisor isn’t suitable for my situation?

Avoid robo advisors if: (1) You hold concentrated positions exceeding 20% of net worth requiring specialized hedging strategies; (2) You face complex tax situations including multiple state residencies, foreign earned income, or business ownership requiring K-1 partnership distributions; (3) You need ongoing liability protection or asset protection strategies; (4) You require frequent portfolio adjustments based on market conditions or economic outlook changes; or (5) You have strong investment preferences or restrictions beyond basic ESG screens. These situations demand human judgment and customization that automated algorithms cannot provide.

10. How do I transition from a traditional advisor to robo advisor without triggering massive tax bills?

Execute transitions strategically: (1) Transfer tax-advantaged accounts immediately via direct trustee-to-trustee transfers, avoiding any tax consequences; (2) For taxable accounts with embedded gains, request in-kind transfers of compatible securities – most robo advisors accept shares of common ETFs like VTI, VXUS, and BND; (3) Liquidate concentrated positions gradually over multiple tax years, utilizing annual $3,000 capital loss deductions against gains; (4) Time liquidations to years with lower income or after retirement to reduce tax brackets; and (5) Consider donation of highly appreciated securities to donor-advised funds before transferring remaining positions, eliminating gains entirely while generating charitable deductions.

Conclusion

The democratization of sophisticated investment management through robo-advisors represents the most significant wealth-building opportunity for middle-class and affluent investors since the introduction of low-cost index funds in the 1970s. By capturing 80-85% of the fee savings that cost investors hundreds of thousands in unnecessary lifetime expenses, automated platforms have fundamentally altered the risk-reward calculus of wealth accumulation.

The cost of inaction extends beyond direct fee drag – DIY investors sacrifice an estimated 2-3% annually through behavioral mistakes, poor rebalancing, and tax inefficiency. On a $500,000 portfolio over 20 years, this behavioral and structural underperformance costs $400,000-600,000 in forfeited wealth. Robo-advisors eliminate these leakages through automated discipline while charging fees 70-85% lower than traditional advisors.

The convergence of declining fees, improving algorithms, and expanding features has reached an inflection point in 2025. Investors with portfolios between $25,000 and $2 million face a straightforward decision: Continue paying 1% advisory fees or managing portfolios manually with demonstrated 2-3% annual underperformance, or transition to automated platforms delivering institutional-quality management at 0.15-0.25% costs.

The evidence overwhelmingly supports robo-advisor adoption for investors seeking evidence-based, low-cost wealth accumulation. Market conditions in late 2025 – elevated volatility, persistent inflation concerns, and ongoing geopolitical uncertainty – make the behavioral guardrails and tax optimization of leading platforms more valuable than ever. The question is not whether to use robo-advisors but which platform aligns with your specific financial situation, tax circumstances, and behavioral requirements.

Take action now: Calculate your current investment costs, evaluate your account types and tax situation, and open an account with Vanguard Digital for fee optimization, Wealthfront for tax efficiency, or Betterment for behavioral coaching. The compounding benefits of early adoption mean that every month of delay costs you money.

Best wishes & good luck on your new journey as an investor!

Didi Somm

For your reference, the latest articles by Didi Somm include:

- Value vs Growth Investing: Which Strategy Wins in 2026?

- Active vs Passive Investing – Your Best Guide

- Expense Ratios: Why Fees Matter

- Dollar-Cost Averaging Explained: The Simple Strategy That Removes Emotion from Investing

- What Are Dividend Stocks – The Ultimate Income Guide

Important Notice: The information in this article is for general and public information purposes only. It solely reflects the opinion of Didi Somm or his staff, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage