INTRODUCTION “How to start investing”

You’ve heard investing is important. Friends talk about their portfolios, your parents mention retirement accounts, and financial experts constantly say “invest early.” But every time you try to start investing, you’re overwhelmed by jargon, paralyzed by the fear of losing money, and genuinely confused about where to begin.

Here’s the truth: Most investing advice is written for people who already invest. It assumes you know the difference between a 401(k) and an IRA, understand what “diversification” means, and have opinions about expense ratios. You don’t. And that’s completely fine.

This guide is different. It assumes zero knowledge. No jargon without explanation. No vague advice like “invest in your future.” Just clear, actionable steps you can complete in the next 30 minutes to start building real wealth.

What You’ll Learn

By the end of this guide, you’ll know:

- Why investing beats saving for long-term wealth

- The exact account to open first (with screenshots of how)

- How much money you actually need to start

- What to invest in as a complete beginner

- How to automate everything so you never have to think about it again

Important note: This guide focuses on U.S. investing (401(k)s, IRAs, etc.). The principles apply globally, but account types vary by country.

Let’s start building your wealth.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Welcome to “Finance & Investments” and “let’s start building your wealth!”

Didi Somm & Team

Table of Contents

SECTION 1: BEFORE YOU INVEST – ARE YOU READY?

Don’t start investing until you’ve built a proper foundation. Investing is for long-term wealth building, not emergency money. Here’s what you need first:

The Financial Foundation Checklist

1. Emergency Fund ($3,000-$10,000 minimum)

Before investing a single dollar, save 3-6 months of expenses in a high-yield savings account. Why? If your car breaks down or you lose your job, you can’t wait 3-5 business days to sell investments and access money. You need cash available immediately.

Quick calculation:

- Monthly rent: $1,200

- Bills (utilities, phone, internet): $300

- Food: $400

- Transportation: $200

- Insurance: $200

- Total: $2,300/month × 3 months = $6,900 emergency fund target

Keep this in a high-yield savings account (4-5% interest), not investing. This is your safety net.

2. Pay Off High-Interest Debt

Credit cards charging 18-24% interest will destroy your wealth faster than investing can build it. If you have high-interest debt (>8%), pay it off before investing.

Decision framework:

- Credit cards (15-24%)? → Pay off first

- Student loans (4-8%)? → You can invest while paying these

- Mortgage (3-7%)? → Keep paying normally, invest alongside

Example: Paying off a $5,000 credit card at 20% interest saves you $1,000/year. That’s a guaranteed 20% “return” – better than any investment.

3. Understand Your Timeline

Only invest money you won’t need for 5+ years. The stock market can drop 30-40% in bad years, but it always recovers given enough time.

- Saving for a house in 2 years? → Keep in savings

- Building retirement fund for 30 years? → Perfect for investing

- Emergency fund? → Savings account, NOT investing

Common objection: “But if I wait to build my emergency fund, I’ll miss market gains!”

Reality: Financial stability is worth more than potential gains. You can do both: Put 75% toward emergency fund, 25% toward investing until your foundation is solid. Once you have $5,000 saved, shift to aggressive investing.

SECTION 2: INVESTING BASICS EXPLAINED

Investing vs. Saving: What’s the Difference?

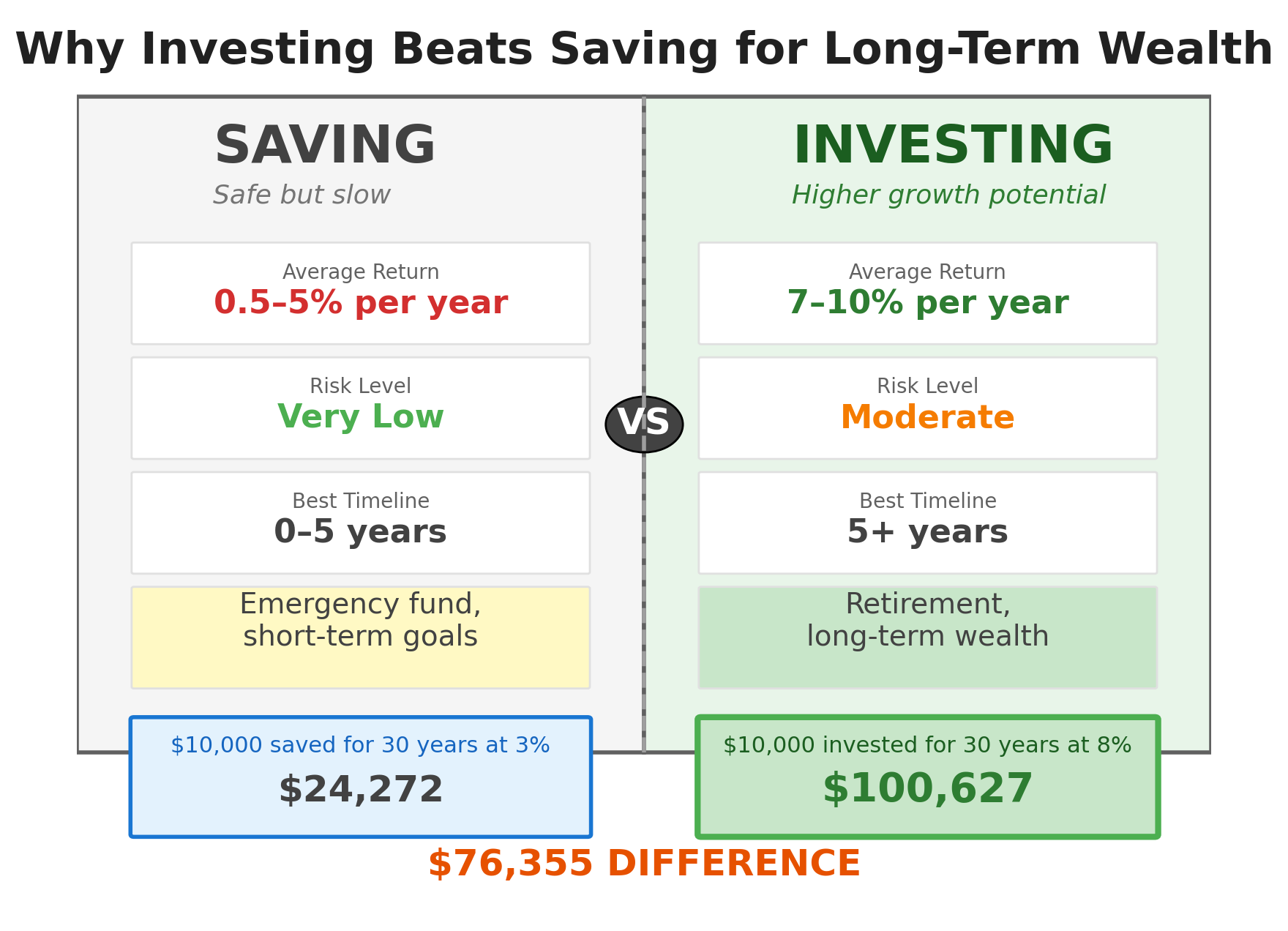

| Factor | Saving | Investing |

|---|---|---|

| Risk | Very low | Moderate |

| Return | 0.5-5% per year | 7-10% average per year |

| Timeline | Any (0-5 years) | 5+ years minimum |

| Best for | Emergency fund, short-term goals | Retirement, long-term wealth |

| Volatility | Stable | Goes up and down |

Bottom line: Savings keeps your money safe. Investing grows your wealth.

The Magic of Compound Interest

Albert Einstein allegedly called compound interest “the 8th wonder of the world.” Here’s why:

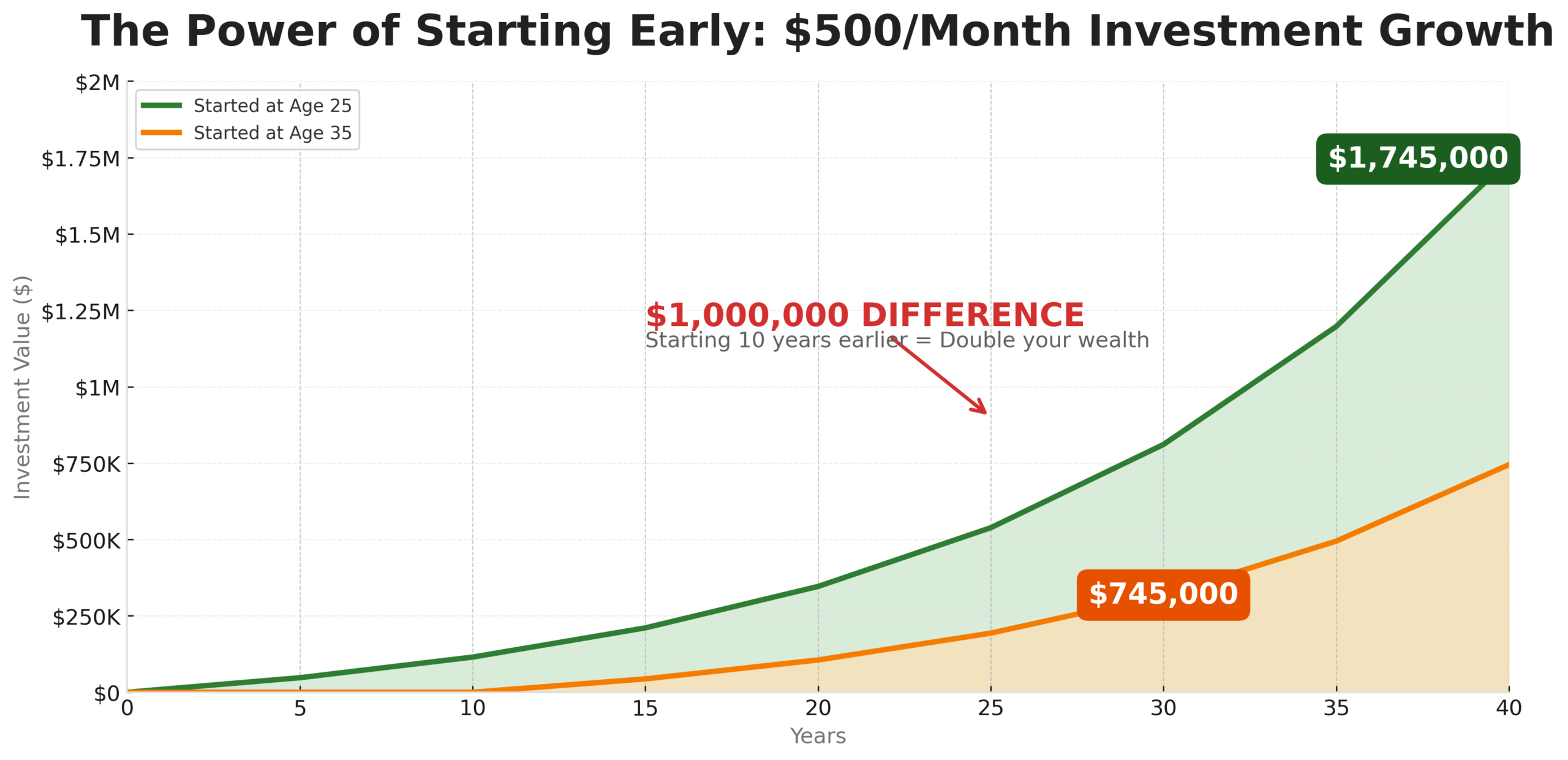

Example 1: The Power of Starting Early

- Age 25: Invest $500/month for 40 years at 8% average return = $1,745,000

- Age 35: Invest $500/month for 30 years at 8% average return = $745,000

- The difference: Starting 10 years earlier = $1,000,000 more (with the same monthly contribution)

Your money makes money. Then that money makes money. Then THAT money makes money. This snowball effect is why the earlier you start, the wealthier you become – even with small amounts.

Example 2: Small Amounts Add Up

- $100/month for 30 years at 8% = $149,000

- $250/month for 30 years at 8% = $373,000

- $500/month for 30 years at 8% = $745,000

Even $100/month becomes life-changing wealth over time.

The Three Investment Types You Need to Know

1. Stocks (Ownership in Companies)

When you buy Apple stock, you own a tiny piece of Apple. If Apple grows and becomes more valuable, your stock value increases. Stocks also pay dividends (cash payments to shareholders).

- Risk: Higher short-term volatility

- Return: 10% average annual return (1950-2024)

- Best for: Long-term growth

2. Bonds (Loans to Companies/Government)

When you buy a bond, you’re lending money to a company or government. They pay you interest and return your principal at maturity.

- Risk: Lower, more stable

- Return: 4-6% average annual return

- Best for: Stability and income

3. Funds (Baskets of Investments)

Instead of buying individual stocks, you buy a fund that owns hundreds or thousands of stocks/bonds. One purchase = instant diversification.

- Index funds: Automatically own entire market (S&P 500 owns 500 largest U.S. companies)

- ETFs: Exchange-traded index funds (same thing, different structure)

- Mutual funds: Professionally managed funds (usually higher fees)

Why beginners should use funds: If you buy Apple stock and Apple crashes, you lose big. If you buy an S&P 500 index fund and Apple crashes, you barely notice—it’s only 1 of 500 companies.

Understanding Risk: Time Makes Stocks Safer

Here’s a crucial insight most beginners miss:

Historical Data (1950-2020):

- 1-year periods: Stocks lost money 26% of the time

- 10-year periods: Stocks lost money 6% of the time

- 20-year periods: Stocks never lost money (0% of the time)

Lesson: The longer you invest, the safer stocks become. Short-term? Scary and volatile. Long-term (10+ years)? Historically reliable.

This is why investing is for money you won’t need for 5+ years minimum.

SECTION 3: YOUR 5-STEP INVESTING ROADMAP

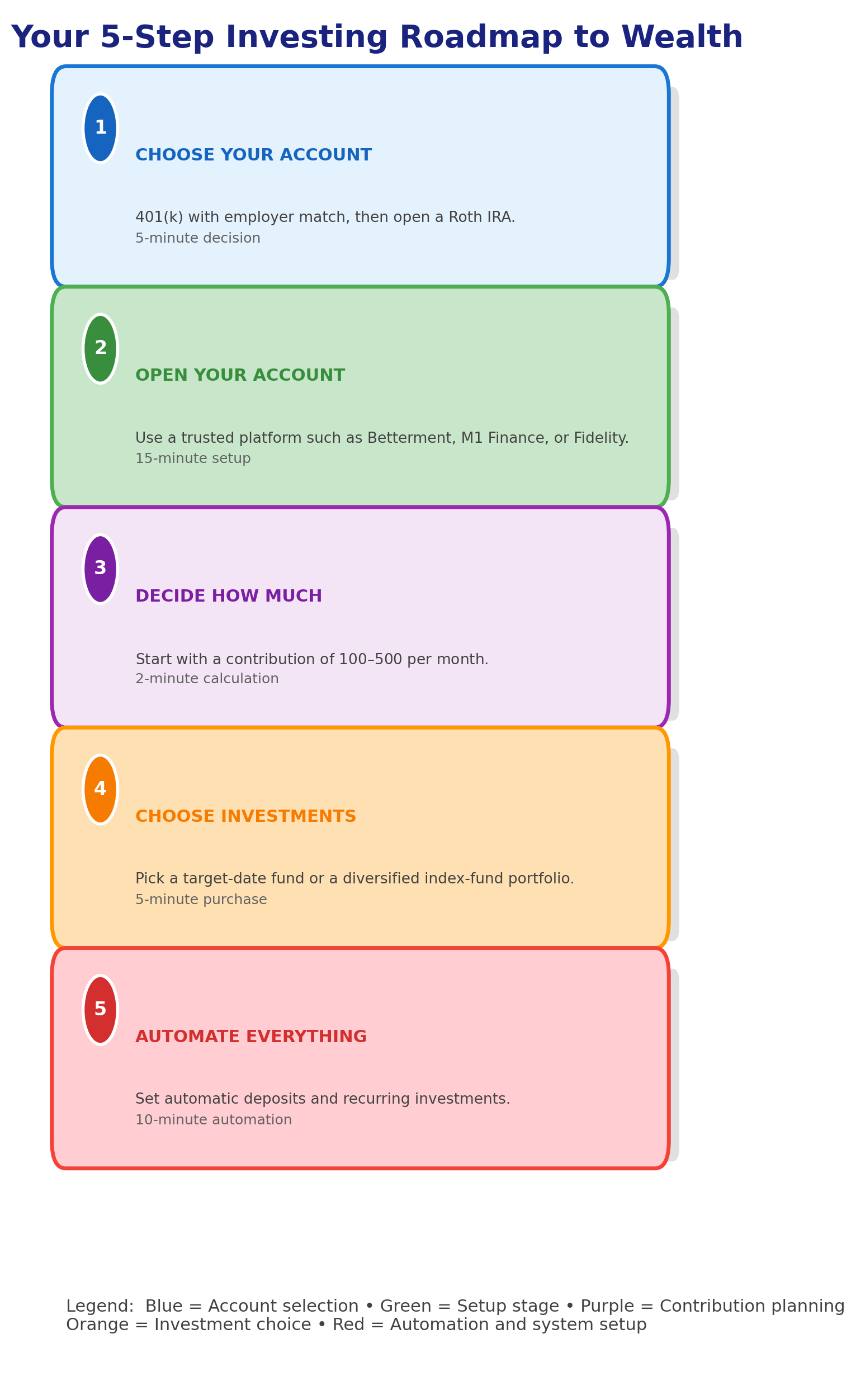

STEP 1: Choose Your Investment Account

The account you choose determines your tax benefits and access to your money. Here’s how to decide:

Decision Tree:

Do you have access to a 401(k) with employer match?

- YES → Start here! (Free money)

- NO → Open an IRA

401(k) Explained:

Your employer-sponsored retirement account with powerful benefits:

- 2025 Contribution Limit: $23,000/year ($30,500 if age 50+)

- Employer Match: Most companies match 3-6% of your contributions

- Tax Benefit: Contributions reduce your taxable income NOW

- Example: You make $60,000, contribute 6% ($3,600). Employer adds $3,600 match = $7,200 total investment with just $3,600 from your paycheck

The golden rule: ALWAYS contribute enough to get the full employer match. This is free money with a 50-100% instant return. Nothing beats this.

Action: Contact your HR department and ask: “What’s our 401(k) match policy?” Then contribute at least that percentage.

IRA (Individual Retirement Account):

A retirement account you open independently with more flexibility than a 401(k).

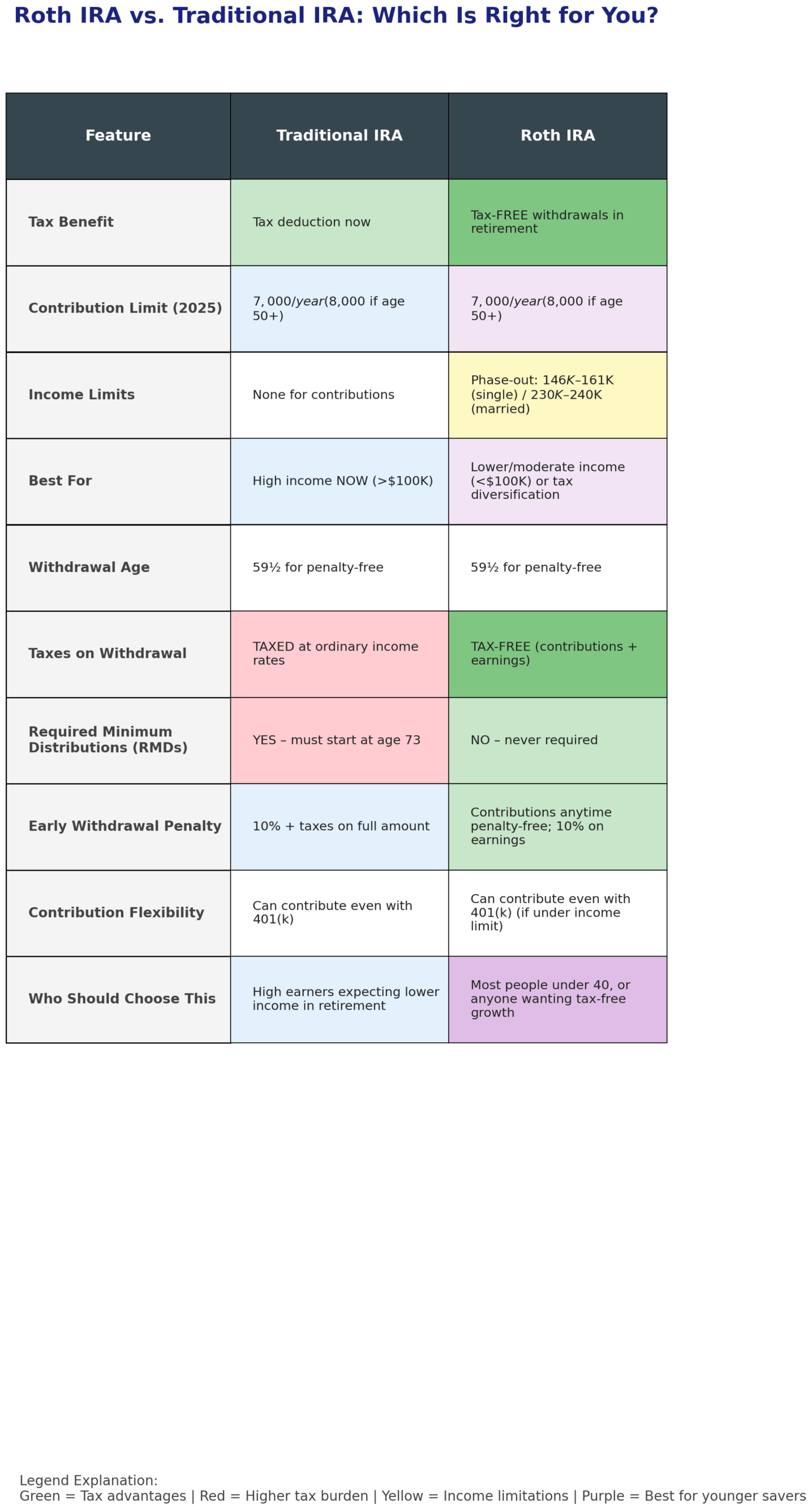

Two types: Traditional IRA vs. Roth IRA

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax benefit | Deduction NOW | Tax-FREE withdrawals in retirement |

| Best for | High income now (>$100K) | Lower/moderate income (<$100K) |

| Contribution limit | $7,000/year ($8,000 if 50+) | $7,000/year ($8,000 if 50+) |

| Withdrawals | Taxed in retirement | Tax-free in retirement |

| Income limits | None | Phase-out: $146K-$161K (single) |

Simple decision:

- Make less than $75,000/year? → Roth IRA (you’re in a lower tax bracket now)

- Make more than $100,000/year? → Traditional IRA (tax deduction valuable now)

- Unsure? → Roth IRA (tax-free growth is incredibly powerful)

Why Roth is often better for beginners: Tax-free growth for 30-40 years is worth more than a small tax deduction today. Plus, you can withdraw contributions (not earnings) anytime without penalty – gives you flexibility.

Taxable Brokerage Account:

A regular investment account with no tax advantages or withdrawal restrictions.

- When to use: After maxing 401(k) and IRA, or for goals before retirement

- No contribution limits: Invest millions if you want

- No withdrawal penalties: Access money anytime

- Tax treatment: Pay taxes on dividends annually, capital gains when you sell

The priority order:

- 401(k) up to employer match (free money!)

- Max out Roth IRA ($7,000/year = $583/month)

- Return to 401(k) and max it ($23,000/year total)

- Then open taxable brokerage if you still have money to invest

Still confused about which account to choose? Read our complete guide: Brokerage Account vs IRA vs 401k vs Roth IRA

📌 AFFILIATE DISCLOSURE

This article contains affiliate links. If you open an account or make a purchase through our links, we may earn a commission at no extra cost to you. This helps us continue creating free, in-depth investing guides.

All recommendations are based on our independent research and testing. We only recommend platforms we personally use or would use ourselves. Our opinions remain unbiased regardless of affiliate relationships.

📌 **AFFILIATE DISCLOSURE** This article contains affiliate links. If you open an account or make a purchase through our links, we may earn a commission at no extra cost to you. This helps us continue creating free, in-depth investing guides. All recommendations are based on our independent research and testing. We only recommend platforms we personally use or would use ourselves. Our opinions remain unbiased regardless of affiliate relationships.

STEP 2: Open Your Investment Account

Where to open your account:

You have two options: robo-advisors (automated, hands-off) or traditional brokers (you choose investments yourself).

Option 1: Robo-Advisors (Best for Complete Beginners)

These platforms build and manage your portfolio automatically. You answer a few questions, they do everything else.

Betterment ⭐ RECOMMENDED FOR BEGINNERS / “click” to get more detailed information

- Minimum: $0 (start with any amount)

- Fee: 0.25% per year ($25 per $10,000)

- What they do: Choose investments, rebalance automatically, tax-loss harvesting

- Best for: “Set it and forget it” investing

Get Started with Betterment • No account minimum • Automatic rebalancing

• Tax-loss harvesting included

- Minimum: $100

- Fee: $0 (completely free)

- What they do: You choose general portfolio mix, they automate everything else

- Best for: Beginners who want some customization without the work

Read our full comparison: Best Robo-Advisors 2025

Option 2: Traditional Brokers (For DIY Investors)

You choose your investments, but these platforms make it easy.

Fidelity ⭐ BEST ALL-AROUND

- Minimum: $0

- Fees: $0 for stocks and ETFs

- Why we like it: Excellent research, great customer service, zero-fee index funds

- Best for: Beginners to advanced investors

- Similar to Fidelity in features and quality

- Excellent customer service and educational resources

- Best for index fund investing (the pioneer of low-cost index funds)

- Slightly clunky website, but rock-solid investments

- Best if you want to “set and forget” with low fees

How to Actually Open an Account (15 minutes):

- Choose your provider (Betterment, Fidelity, etc.)

- Click “Open Account” on their website

- Select account type: Roth IRA (recommended for most beginners)

- Provide information:

- Name, address, date of birth

- Social Security Number

- Employment information

- Bank account for funding

- Answer questionnaire (income, risk tolerance)

- Link your bank account

- Transfer initial deposit ($100-$1,000 to start)

- Set up automatic monthly contributions

- Account approved (usually instant)

You’re done! You now have an investment account.

STEP 3: Decide How Much to Invest

Realistic Starting Amounts:

You don’t need thousands to start. Even $50/month builds significant wealth over time.

| Monthly Investment | 10 Years @ 8% | 20 Years @ 8% | 30 Years @ 8% |

|---|---|---|---|

| $50 | $9,147 | $29,451 | $74,518 |

| $100 | $18,295 | $58,902 | $149,036 |

| $250 | $45,737 | $147,255 | $372,590 |

| $500 | $91,473 | $294,510 | $745,180 |

The 50/30/20 Budget Rule:

- 50% of income → Needs (rent, food, bills)

- 30% of income → Wants (entertainment, dining)

- 20% of income → Savings + Investing

How to find money to invest:

- Cancel unused subscriptions ($50-100/month)

- Pack lunch 2x per week instead of eating out ($80/month)

- Direct deposit: Money goes to investment account before you see it

- Apply the “pay yourself first” principle

Start small, increase gradually:

- Months 1-3: $50-100/month (build the habit)

- Months 4-12: $200-300/month (as you adjust budget)

- Year 2+: Increase $50-100/month annually with raises

Important reality check: It’s better to start with $25/month TODAY than wait to invest $500/month “someday.” Time in the market beats perfect timing. Start now with whatever you can afford.

Want specific strategies for investing your first $1,000? Read our dedicated guide here: How To Invest $1000

STEP 4: Choose Your Investments

If you chose a robo-advisor (Betterment, M1 Finance): ✅ They handle this for you. Answer their questions about goals and risk tolerance, and they automatically select investments. Skip to Step 5.

If you chose a traditional broker (Fidelity, Schwab, Vanguard): You need to choose what to buy. Don’t panic – we’ll make this simple.

The Simple Beginner Portfolio:

Option 1: One-Fund Solution (Easiest) ⭐ RECOMMENDED

Buy a single target-date fund matching when you plan to retire:

- Planning to retire around 2060? → Buy “Target Date 2060 Fund”

- Planning to retire around 2055? → Buy “Target Date 2055 Fund”

- Planning to retire around 2050? → Buy “Target Date 2050 Fund”

What target-date funds do:

- Hold a mix of stocks and bonds appropriate for your age

- Automatically rebalance

- Automatically become more conservative as you age

- Ultimate “set and forget” investment

Examples:

- Vanguard: VTTSX (Target Date 2060)

- Fidelity: FDKLX (Freedom 2060)

- Schwab: SWYNX (Target Date 2060)

How to buy:

- Log into your account

- Search for the ticker symbol (e.g., “VTTSX”)

- Click “Buy”

- Enter dollar amount (your full investment)

- Confirm trade

- Done! You’re officially an investor.

Cost: 0.08-0.15% per year (extremely cheap)

This is the simplest possible approach: One fund, automatic everything, perfect for beginners.

Option 2: Three-Fund Portfolio (Simple DIY)

For slightly more control while staying simple:

Allocate across 3 index funds:

1. U.S. Total Stock Market Index (60-70% of portfolio)

- Fidelity: FZROX (0.00% fee!)

- Vanguard: VTSAX or VTI

- Schwab: SWTSX

- What it does: Owns entire U.S. stock market (3,600+ companies)

2. International Stock Index (20-30%)

- Fidelity: FZILX

- Vanguard: VTIAX or VXUS

- Schwab: SWISX

- What it does: Owns stocks in developed and emerging markets worldwide

3. Bond Index (10-20%)

- Fidelity: FXNAX

- Vanguard: VBTLX or BND

- Schwab: SWAGX

- What it does: Provides stability and income

Example portfolio for a 30-year-old investing $1,000:

- 60% U.S. Stocks (FZROX) = $600

- 30% International Stocks (FZILX) = $300

- 10% Bonds (FXNAX) = $100

Why this works: Instant global diversification across 10,000+ companies and thousands of bonds. If one company or country struggles, you barely notice.

What NOT to Do:

❌ Don’t buy individual stocks as a beginner (too risky – one company can go bankrupt)

❌ Don’t try to time the market (buy now, not “when it drops”)

❌ Don’t invest in things you don’t understand (crypto, options, leveraged ETFs)

❌ Don’t follow “hot stock tips” from friends, Reddit, or TikTok

❌ Don’t check your account daily (leads to emotional decisions)

Why index funds beat individual stocks:

| Buying Individual Stocks | Buying Index Fund |

|---|---|

| Apple drops 30% → You lose 30% | Apple drops 30% → You lose 0.6% (it’s 1/500th of fund) |

| Need to research each company | Zero research needed |

| High risk if company fails | Diversified across hundreds of companies |

| Exciting but stressful | Boring but effective |

Warren Buffett’s advice: “Put 90% of your money in a low-cost S&P 500 index fund.”

STEP 5: Automate and Stay the Course

Set up automatic investing (the key to success):

Why automation matters:

- You won’t forget to invest

- Removes emotion from the process

- Dollar-cost averaging: automatically buy more when prices are low, less when high

- Consistency beats perfect timing

How to automate (takes 10 minutes):

1. Automatic bank transfers:

- In your broker account: Settings → Automatic Transfers

- Choose: Day of month (e.g., 3 days after payday)

- Amount: Your target monthly investment ($100, $250, $500, etc.)

2. Automatic investments:

- After money arrives, automatically buy your chosen fund(s)

- Called “Auto-invest” or “Automatic Investment Plan”

- Set it once, runs forever

3. Automatic annual increases (optional but powerful):

- Increase monthly investment by 10% each year

- Example: $100/month → $110 (Year 2) → $121 (Year 3)

- Painless way to accelerate wealth as income grows

The 5 Golden Rules of Investing:

Rule 1: Don’t Check Your Account Daily

Check quarterly (every 3 months) maximum. Daily checking leads to panic during normal market fluctuations. Short-term volatility is healthy—ignore it.

Rule 2: Don’t Panic Sell During Downturns

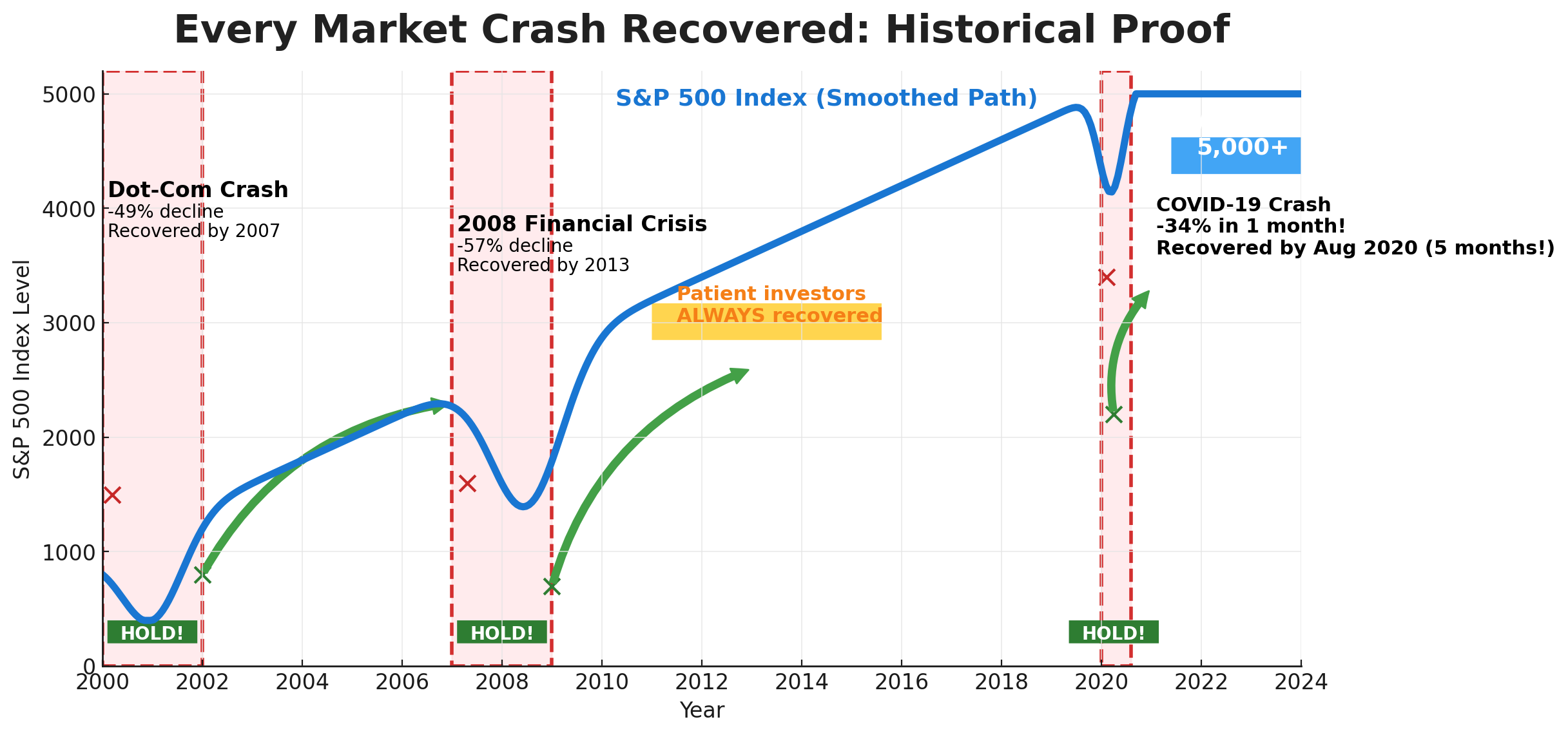

The market drops 20-30% every few years. This is when you’re buying stocks “on sale,” not when you sell. Historical truth: Every major crash has been followed by recovery to new highs.

Market crash examples:

- 2008 Financial Crisis: Dropped 50%, recovered by 2012

- 2020 COVID Crash: Dropped 35%, recovered in 5 months

- Lesson: Patient investors always won

Rule 3: Increase Contributions with Raises

Got a raise from $50K to $55K? Increase monthly investing by $200 (50% of your $5K raise). Live on the other 50%. Result: Lifestyle improves, wealth accelerates.

Rule 4: Rebalance Annually

Once per year, check if your allocation has drifted:

- Wanted 60% stocks / 40% bonds

- After stock market gains: Now 70% stocks / 30% bonds

- Rebalance: Sell some stocks, buy bonds to restore 60/40

This forces “buy low, sell high” discipline.

Rule 5: Ignore Financial Media and Hot Tips

CNBC, financial Twitter, Reddit WallStreetBets = entertainment, not advice. “Hot stocks” rarely work. Stick to your boring index fund plan. Boring wins.

SECTION 4: FAQ – How to start investing / Common questions

Q: What if the market crashes right after I invest?

A: This actually isn’t as bad as it sounds. You’re investing monthly (dollar-cost averaging), so when prices drop, your monthly investment buys MORE shares. You get a discount on future purchases. Over 20-30 years, short-term crashes become tiny blips.

Real example: I started investing in January 2008. The market crashed 50% that year. I kept investing $500/month through the crash. By 2012, I had recovered. Today, that portfolio is up 300%+. The crash was the best thing that happened – I bought stocks cheap for years.

Q: Should I wait for the market to drop before investing?

A: No. Market timing doesn’t work.

Statistical proof: If you invested $10,000 on the WORST day of every year for 20 years (2000-2020), you’d still have made 5.5% annual returns and turned $200,000 into $310,000. That’s investing on the worst possible days and still winning.

Best approach: Start now, invest consistently regardless of market levels. Time IN the market beats TIMING the market.

Q: Can I lose all my money?

A: Extremely unlikely with diversified index funds. To lose everything, all 500 companies in the S&P 500 would need to go bankrupt simultaneously. This has never happened in history.

Risk hierarchy:

- Individual stock: Can go to zero (Enron, Lehman Brothers)

- S&P 500 index fund: Worst historical loss was -50% in 2008, fully recovered by 2012

- Bond fund: Very stable, minimal losses

Diversification protects you. That’s why we recommend index funds, not individual stocks.

Learn more: 10 Shocking Ways to Bulletproof Portfolio against Market Crashes

Q: How much do I need to retire?

A: The “25x Rule”: Save 25 times your desired annual retirement spending.

- Want $40,000/year in retirement? Need $1,000,000 (25 × $40,000)

- Want $60,000/year? Need $1,500,000

- Want $80,000/year? Need $2,000,000

How to get there: $500/month for 40 years at 8% = $1,745,000. Starting early makes it achievable.

Q: What if I need the money before retirement?

A: Depends on account type:

- Roth IRA: Withdraw contributions (not earnings) anytime, tax and penalty-free

- Traditional IRA/401(k): 10% penalty + taxes if withdrawn before age 59½

- Taxable brokerage: Withdraw anytime, just pay capital gains tax

Strategy: Keep emergency fund in savings, use Roth IRA for flexibility, use 401(k) for true long-term retirement.

Q: Is now a good time to invest?

A: Yes. Always. Here’s why:

The “best time” was 20 years ago. The “second best time” is today. No one can predict short-term direction, but the long-term trend is always up historically.

Visual proof: The S&P 500 has gone up in 75% of years since 1950. Over any 20-year period, it has NEVER lost money. Time works in your favor.

SECTION 5: TOP 7 BEGINNER MISTAKES TO AVOID

Mistake 1: Waiting to “Learn More” First

You’ll never feel “ready.” Start small now, learn as you go. Every day you wait costs compound interest. Action beats analysis paralysis.

Mistake 2: Trying to Pick Individual Stocks

90% of day traders lose money. You’re competing against Wall Street professionals with faster computers and better information. Stick to index funds for 5+ years before considering individual stocks.

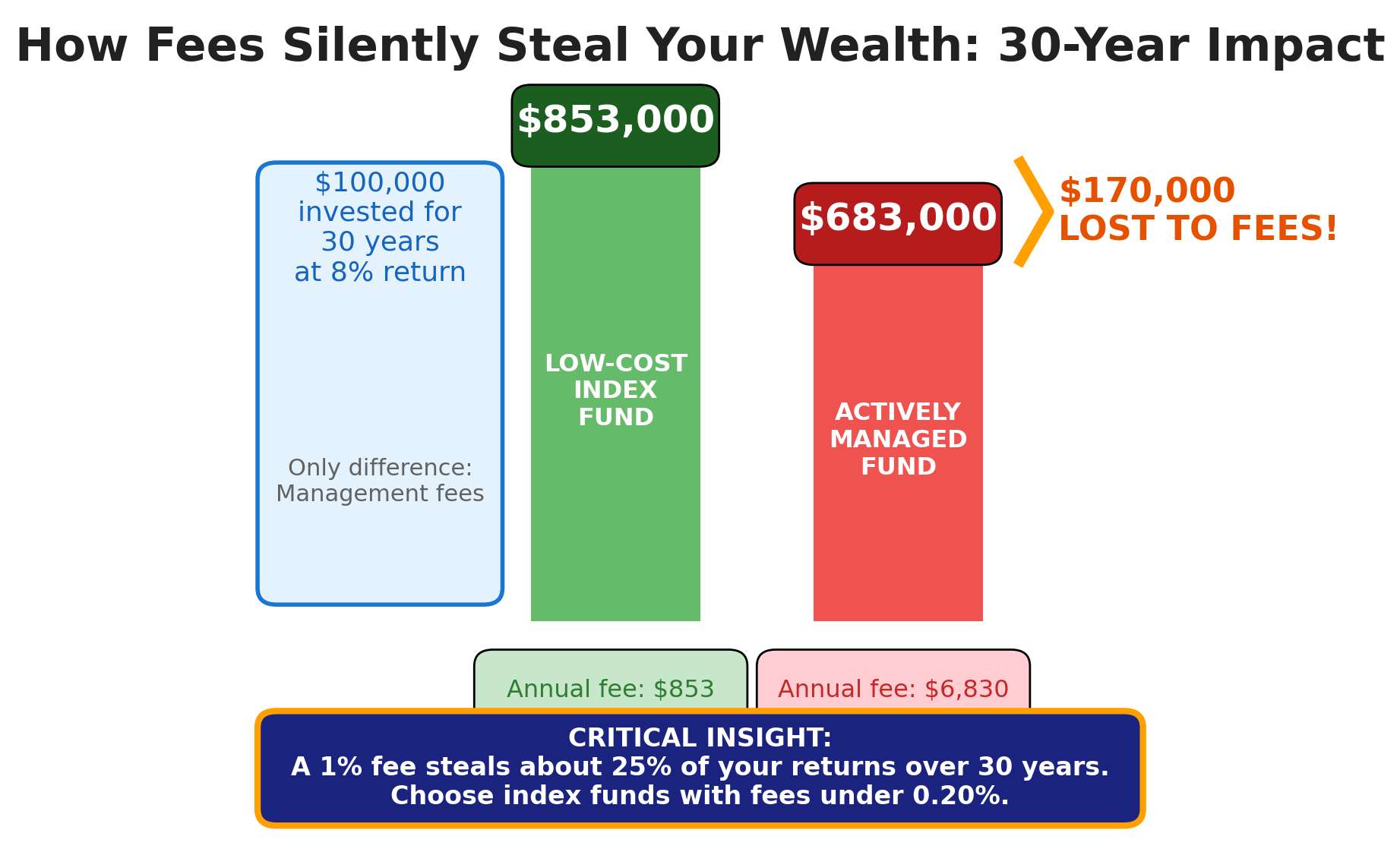

Mistake 3: Paying High Fees

A 1% annual fee seems small but costs you 25% of returns over 30 years.

Fee impact example:

- $100,000 invested for 30 years at 8% return

- 0.10% fee = $853,000 final balance

- 1.00% fee = $683,000 final balance

- Difference: $170,000 lost to fees!

Choose funds with expense ratios under 0.20%. Avoid “financial advisors” charging 1-2% to put you in expensive funds.

Mistake 4: Emotional Selling

Market drops 20% → Panic and sell → Miss the recovery. This is the #1 reason investors underperform. Set up automation and don’t look during downturns.

Mistake 5: Trying to Time the Market

Data: Missing just the 10 best market days over 20 years reduced returns by 50%. You can’t predict which days those will be, so stay invested always.

Mistake 6: Chasing Past Performance

“This fund returned 30% last year!” means nothing for future returns. Last year’s winners are often next year’s losers. Choose based on low fees and diversification, not recent returns.

Mistake 7: Not Starting

The biggest mistake is never beginning. Imperfect action beats perfect inaction. Start with $50/month today rather than waiting to invest $500/month “someday.”

YOUR 30-MINUTE ACTION PLAN “how to start investing”

Start investing today. Here’s exactly what to do:

Minutes 0-10: Quick Preparation

- [ ] Confirm you have emergency fund (or at least $1,000 saved)

- [ ] Find your bank routing number (for account funding)

- [ ] Decide: Robo-advisor (Betterment) or broker (Fidelity)?

- [ ] Choose: Roth IRA (recommended for most under 40)

Minutes 10-20: Open Your Account

- [ ] Go to Betterment.com or Fidelity.com

- [ ] Click “Open Account”

- [ ] Fill out application (name, address, SSN)

- [ ] Link bank account

Minutes 20-25: Fund Your Account

- [ ] Transfer initial investment ($100-$1,000)

- [ ] Set up automatic monthly transfers

- [ ] Choose sustainable amount ($100-$500/month)

Minutes 25-30: Choose Investment

- [ ] Robo-advisor: Answer risk questions, they handle rest

- [ ] Traditional broker: Search for target-date fund (e.g., “VTTSX”)

- [ ] Buy with full initial investment

- [ ] Set up automatic investment plan

You’re done! You’re now an investor. 🎉

WHAT’S NEXT: YOUR FIRST YEAR

Months 1-3: Build the Habit

- Focus: Keep investing monthly, don’t check account often

- Resist urge to tinker or change strategy

Months 4-6: Increase Contributions

- Find $50-100 more per month to invest

- Adjust automatic transfers

Months 7-12: First Year Complete

- Review progress, celebrate milestone

- Consider increasing to max out IRA ($583/month)

- Read “The Simple Path to Wealth” by JL Collins

Year 2+: Optimize and Scale

- Increase with each raise

- Max out IRA, then increase 401(k)

- Rebalance once per year

- Stay the course

RESOURCES & FURTHER LEARNING

Recommended Reading:

- “The Simple Path to Wealth” by JL Collins (beginner-friendly)

- “The Little Book of Common Sense Investing” by John Bogle

Helpful Communities:

- Bogleheads.org (forum for index investing)

- r/personalfinance (Reddit wiki is excellent)

- r/Bogleheads (index investing community)

Related Articles:

- Best Robo-Advisors 2025

- Brokerage Account vs IRA vs 401k vs Roth IRA

- How To Invest $1000

- 10 Shocking Ways to Bulletproof Portfolio

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

CONCLUSION: YOU’RE READY TO START

The 5 Steps Recap – how to start investing:

- ✅ Build financial foundation (emergency fund, pay high-interest debt)

- ✅ Open investment account (Betterment or Fidelity recommended)

- ✅ Decide how much to invest (start with $100-$500/month)

- ✅ Choose investments (target-date fund or index funds)

- ✅ Automate and stay the course (set it and forget it)

The Most Important Lesson

Investing isn’t about being smart or lucky. It’s about starting early, investing consistently, keeping costs low, and staying patient.

The strategy in this guide – investing in diversified index funds on autopilot—has created more millionaires than any other approach. It’s boring. It’s simple. It works.

Your Action Today

Don’t let this be another article you read and forget. Take 30 minutes right now to open your account and make your first investment.

Your future self will thank you.

Remember:

- $50/month starting today beats $500/month starting “someday”

- Time is your greatest advantage

- You don’t need to be an expert to start

- Every wealthy person started exactly where you are now

You’ve got this. Go start investing.

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice.