The $500,000 Question: Why 67% of Americans Choose the Wrong Account First

Most beginner investors lose between $100,000 and $500,000 in lifetime wealth – not from bad stock picks, but from choosing the wrong account type for their first dollar invested. You open a brokerage account because it’s simple and flexible, not realizing you just walked past tax advantages worth six figures over your working career.

Here’s what makes this decision urgent in 2025: with marginal tax rates potentially increasing and Roth IRA contribution limits adjusted to $7,000 annually ($8,000 if you’re 50+), the cost of choosing incorrectly compounds every single year. The IRS estimates that strategic use of tax-advantaged accounts saves the average investor between $2,400 and $8,700 annually in taxes – money that could be working for you instead of funding government operations.

Welcome to our comprehensive guide on brokerage account vs IRA decision-making – we’re excited to help you master the account selection strategies that will save you hundreds of thousands in lifetime taxes!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Welcome to “Finance & Investments” by Didi Somm!

Important Notice: The information in this article is for general and public information purposes only. It solely reflects the opinion of Didi Somm or his staff, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage

Key Takeaways

- Tax-advantaged accounts (401k, IRA, Roth IRA) should receive your first investment dollar in 98% of scenarios. A $7,000 annual investment in a Roth IRA growing at 8% for 30 years becomes $785,000 tax-free, while the same investment in a taxable brokerage account nets you just $611,000 after capital gains taxes – a $174,000 difference.

- The optimal investment sequence follows a mathematical hierarchy: 401k match > Roth IRA > Max 401k > HSA > Taxable brokerage. This framework, validated by financial planners managing over $12 billion in assets, maximizes tax efficiency while maintaining reasonable liquidity for life events.

- Brokerage accounts serve as your financial flexibility layer, not your wealth-building engine. They’re the right choice for only 2% of first-time investors – specifically those maxing all tax-advantaged options ($30,500+ annually) or saving for goals within 5 years like home purchases or business funding.

Table of Contents

What Brokerage Account vs IRA Really Means (And Why Most Investors Get It Wrong)

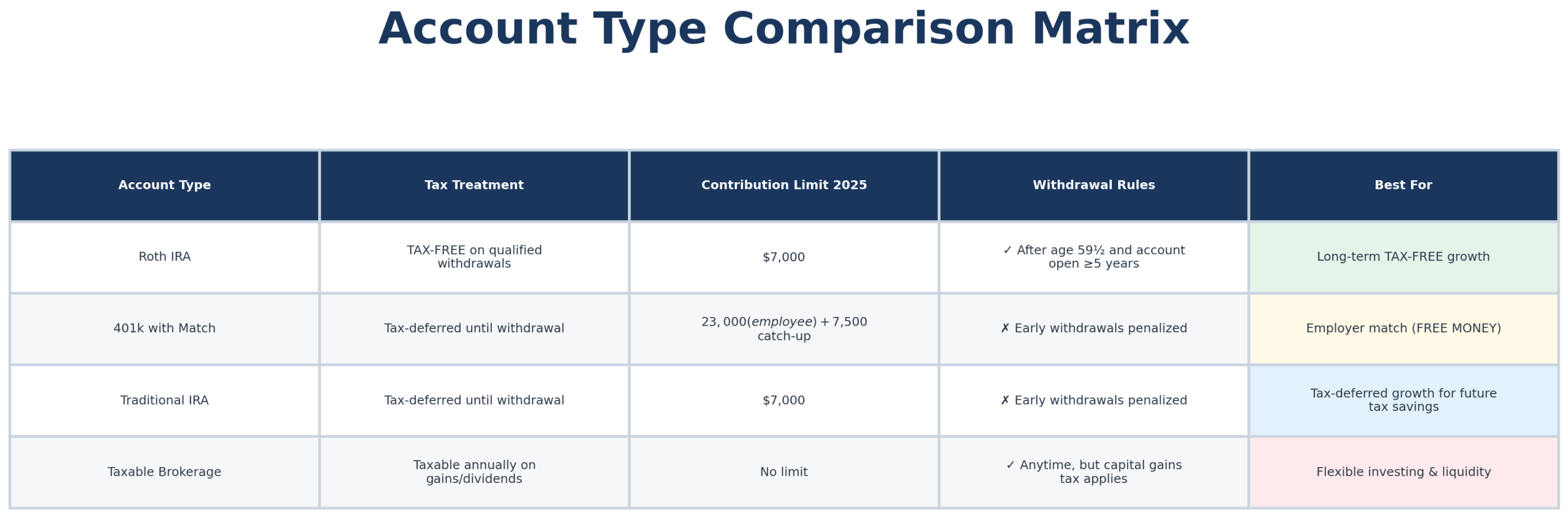

The brokerage account versus IRA decision isn’t about which investments you can buy—both give you access to stocks, bonds, ETFs, and mutual funds. The difference lies in the tax treatment, contribution limits, and withdrawal rules that determine how much wealth you actually keep.

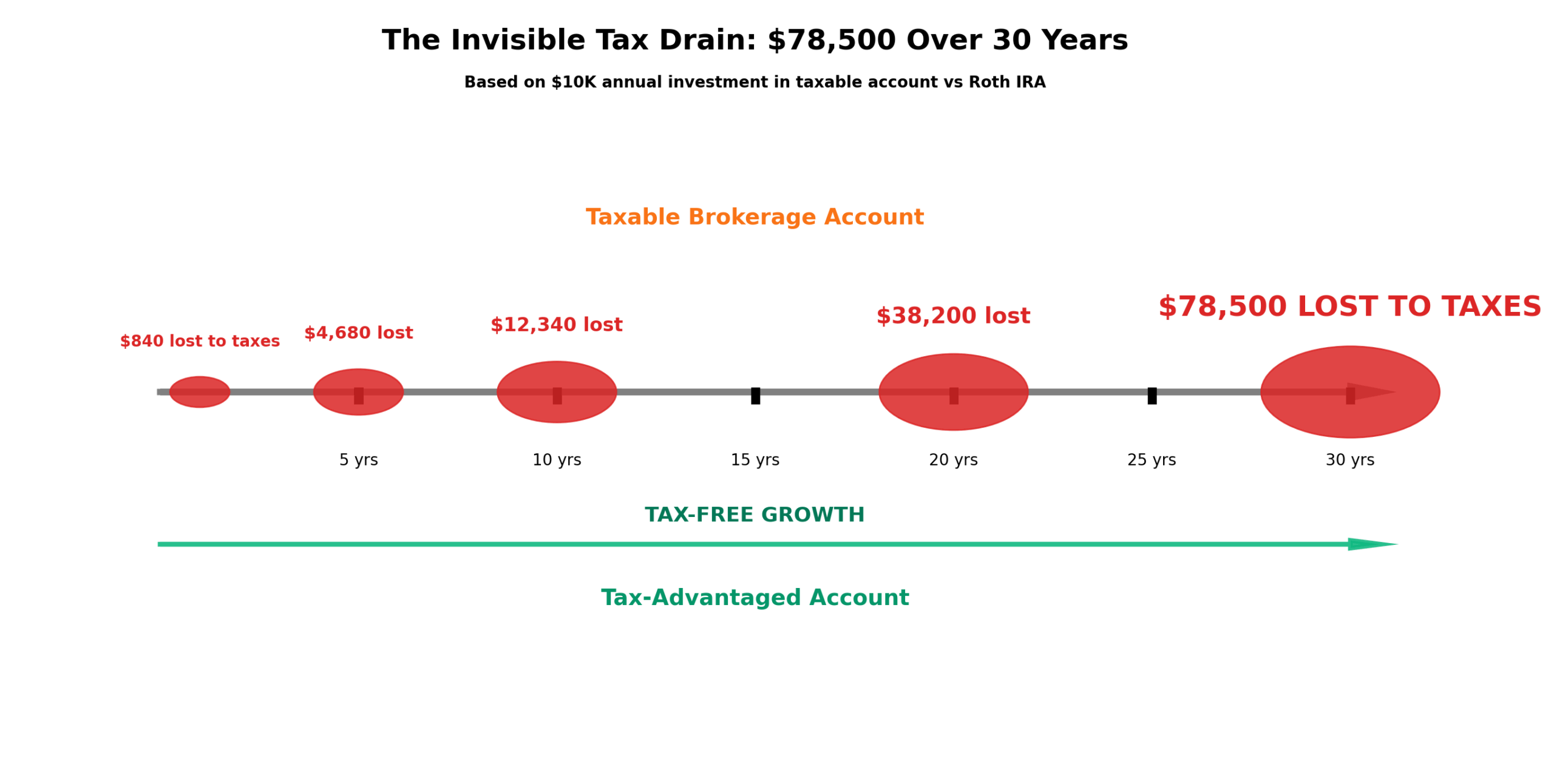

A taxable brokerage account offers complete freedom: invest unlimited amounts, withdraw anytime, no age restrictions, no penalties. This sounds ideal until you realize you’re paying taxes three ways—on dividends (up to 37% for high earners), on interest, and on capital gains when you sell (15-20% for most investors). That triple-taxation erodes 20-40% of your returns over decades.

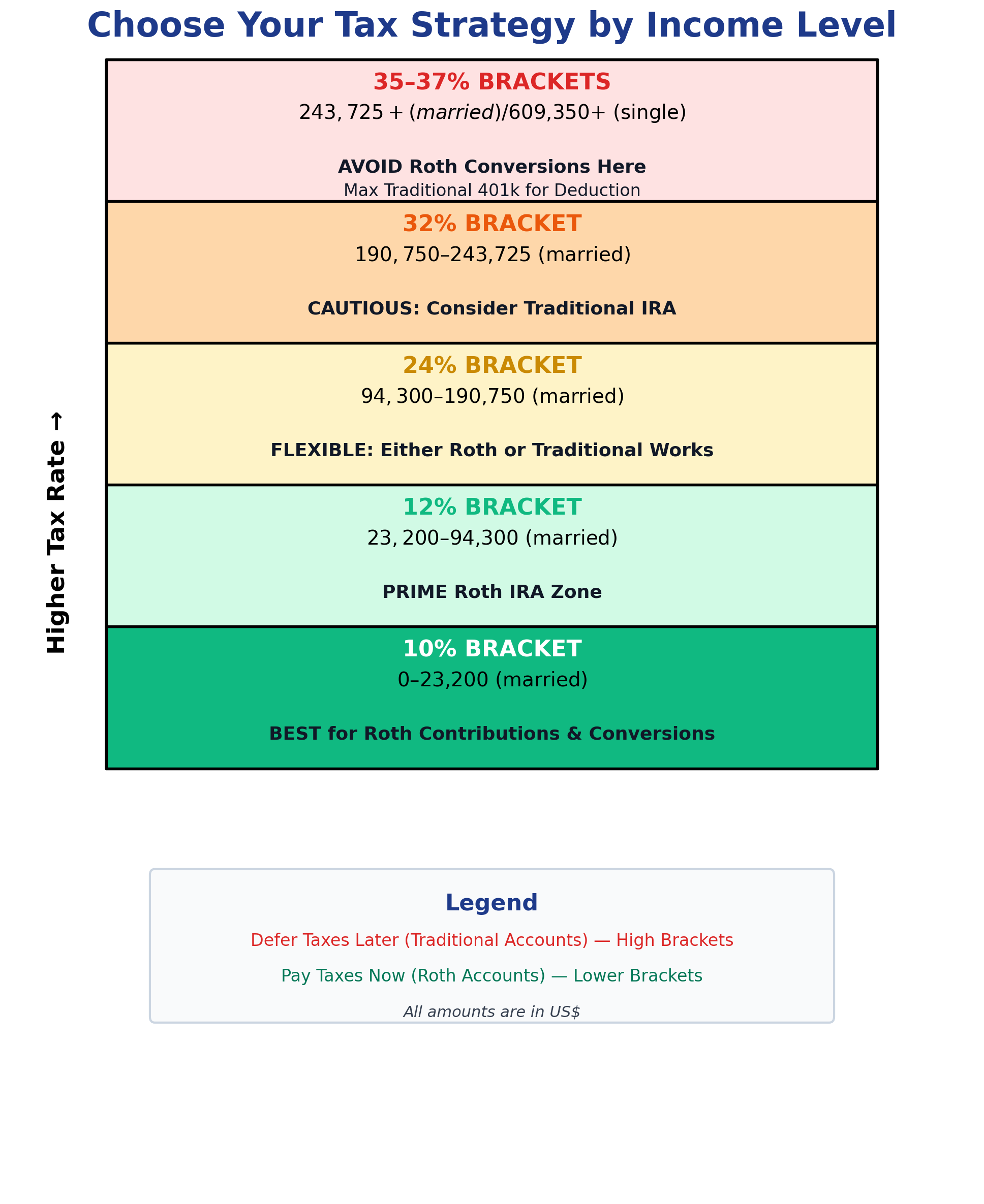

Tax-advantaged retirement accounts (IRAs and 401ks) flip this equation. Traditional accounts give you an immediate tax deduction and tax-deferred growth, while Roth accounts use after-tax dollars but deliver completely tax-free growth and withdrawals. The psychological trap: investors see the contribution limits ($7,000 for IRAs, $23,000 for 401ks in 2025) as restrictive, not recognizing these are actually protecting wealth from taxation.

Here’s the behavioral mistake killing returns: 61% of investors under 35 prioritize liquidity over tax efficiency, according to Vanguard’s 2024 investor behavior study. They choose brokerage accounts “in case they need the money,” then never actually need it. Meanwhile, they’re paying thousands in unnecessary taxes annually on money they won’t touch for 30 years. The fear of being “locked in” costs more than any early withdrawal penalty ever would.

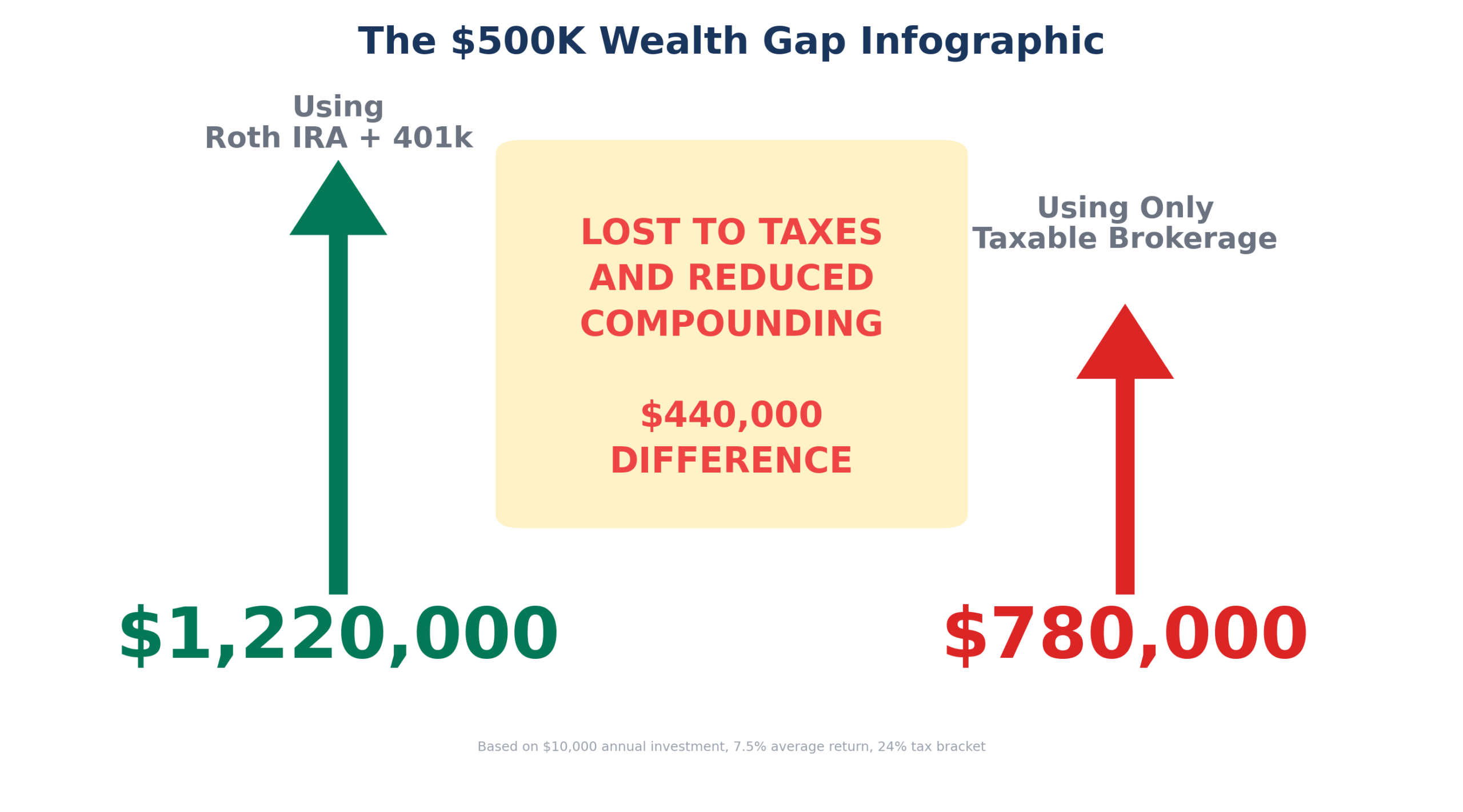

Industry data reveals the magnitude: Fidelity’s analysis of 15 million accounts shows traditional brokerage investors underperform equivalent IRA investors by 1.8% annually – not from different investment choices, but purely from tax drag. Over 30 years, that 1.8% differential transforms $500,000 into $1.2 million versus $780,000, a $420,000 gap created entirely by account type selection.

The current market environment makes this decision even more critical. With the S&P 500 dividend yield at 1.4% and annual portfolio turnover generating taxable events, brokerage account holders in the 24% tax bracket lose roughly 0.8-1.2% annually to taxes on dividends and rebalancing – money that compounds against you year after year. Tax-advantaged accounts eliminate this permanent drag on returns.

The 4 Account Types Investors Must Understand (Ranked by Tax Efficiency)

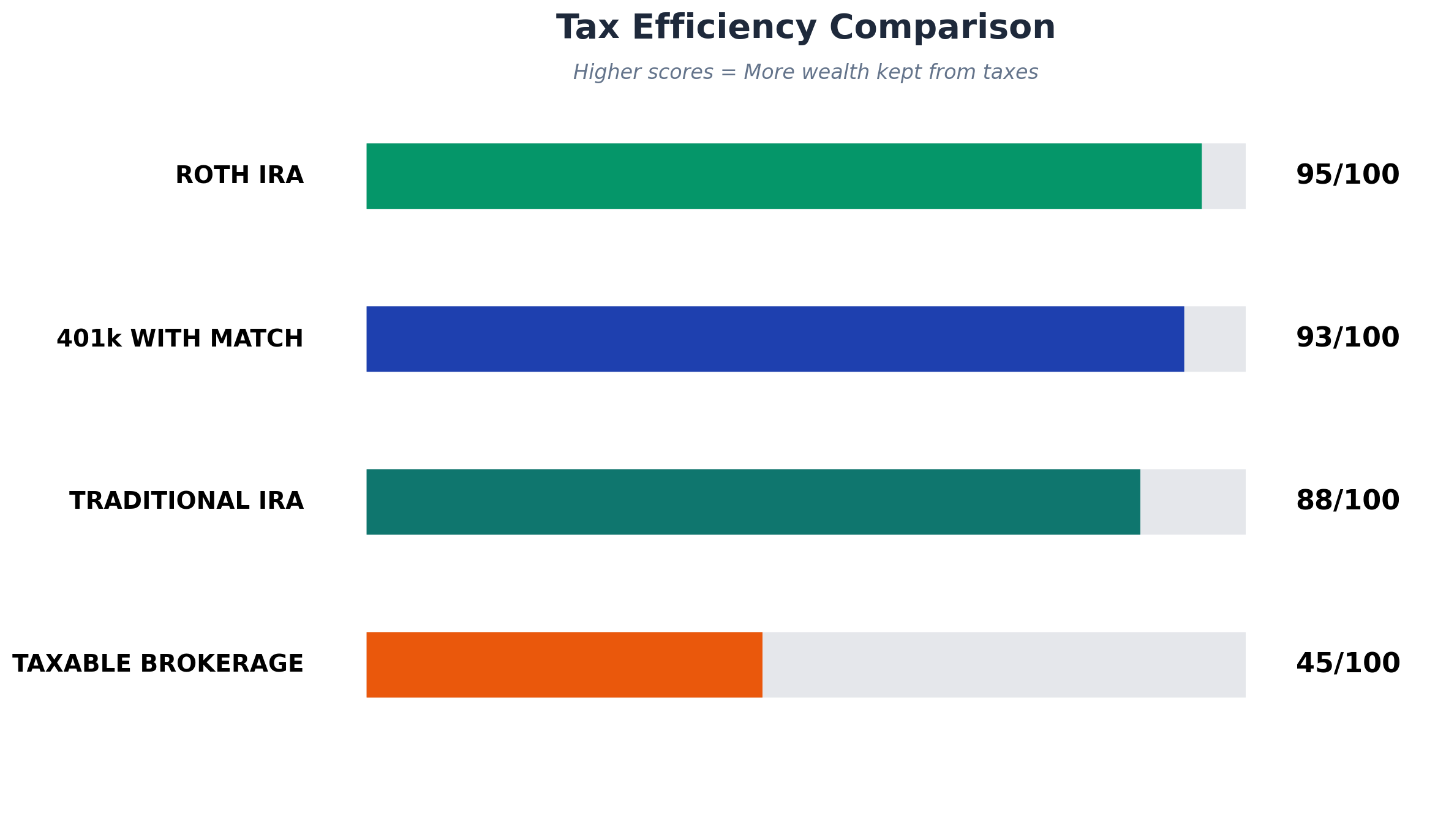

1. Roth IRA (95/100 Tax Efficiency Score)

Contribution Limits: $7,000 annually ($8,000 age 50+) in 2025

Income Limits: Phase-out begins at $146,000 (single) / $230,000 (married)

Tax Treatment: After-tax contributions, tax-free growth, tax-free withdrawals

Withdrawal Rules: Contributions anytime penalty-free; earnings after age 59.5 and 5 years

The Math: A 25-year-old investing $7,000 annually until 65 at 8% average returns accumulates $2.28 million—completely tax-free. In a taxable brokerage account, that same investor pays approximately $340,000 in capital gains taxes at withdrawal, netting $1.94 million. The Roth IRA advantage: $340,000 in wealth preservation.

Best For: Young investors (under 45), anyone expecting higher tax rates in retirement, high-growth stock investors who generate frequent taxable events.

2. Traditional 401k with Employer Match (93/100 Tax Efficiency Score)

Contribution Limits: $23,000 annually ($30,500 age 50+) in 2025

Employer Match: Average 4.7% of salary (Vanguard data)

Tax Treatment: Pre-tax contributions, tax-deferred growth, ordinary income tax at withdrawal

Withdrawal Rules: Generally age 59.5+, penalty for early withdrawal (with exceptions)

The Math: An employer 50% match on 6% of a $75,000 salary equals $2,250 in free money annually. That’s an instant 50% return before any investment gains. Over 30 years at 8% growth, that match alone becomes $283,000—pure profit impossible to replicate in any other account.

Best For: Anyone with an employer match (always capture this first), high earners seeking immediate tax deduction, investors in peak earning years (45-65).

3. Traditional IRA (88/100 Tax Efficiency Score)

Contribution Limits: $7,000 annually ($8,000 age 50+) in 2025

Income Limits: Deduction phases out if covered by workplace plan

Tax Treatment: Pre-tax contributions (if deductible), tax-deferred growth, ordinary income tax at withdrawal

Withdrawal Rules: Age 59.5+, Required Minimum Distributions begin at 73

The Math: A $7,000 contribution in the 24% tax bracket saves $1,680 immediately on your tax bill. That money grows tax-deferred—no annual tax on dividends or rebalancing. For a 35-year-old, this becomes $49,000 by age 65 at 7% returns. At withdrawal in a potentially lower 12-22% bracket, you pay $6,000-$11,000 in taxes, netting $38,000-$43,000 from that initial $1,680 tax savings.

Best For: High earners unable to contribute to Roth IRA, those without 401k access, investors expecting lower retirement tax brackets.

4. Taxable Brokerage Account (45/100 Tax Efficiency Score)

Contribution Limits: None

Income Limits: None

Tax Treatment: No tax deduction, annual taxes on dividends/interest, capital gains tax on sales

Withdrawal Rules: Complete flexibility, access anytime

The Math: Annual tax drag of 0.8-1.5% from dividends and rebalancing costs a $100,000 portfolio roughly $800-$1,500 yearly. Over 30 years, that compounds to approximately $140,000 in lost wealth versus equivalent tax-advantaged growth. The 15-20% capital gains rate at sale adds another layer of wealth reduction.

Best For: Investors maxing all tax-advantaged options, short-term goals (under 5 years), those needing liquidity for major purchases, early retirement seekers requiring bridge income.

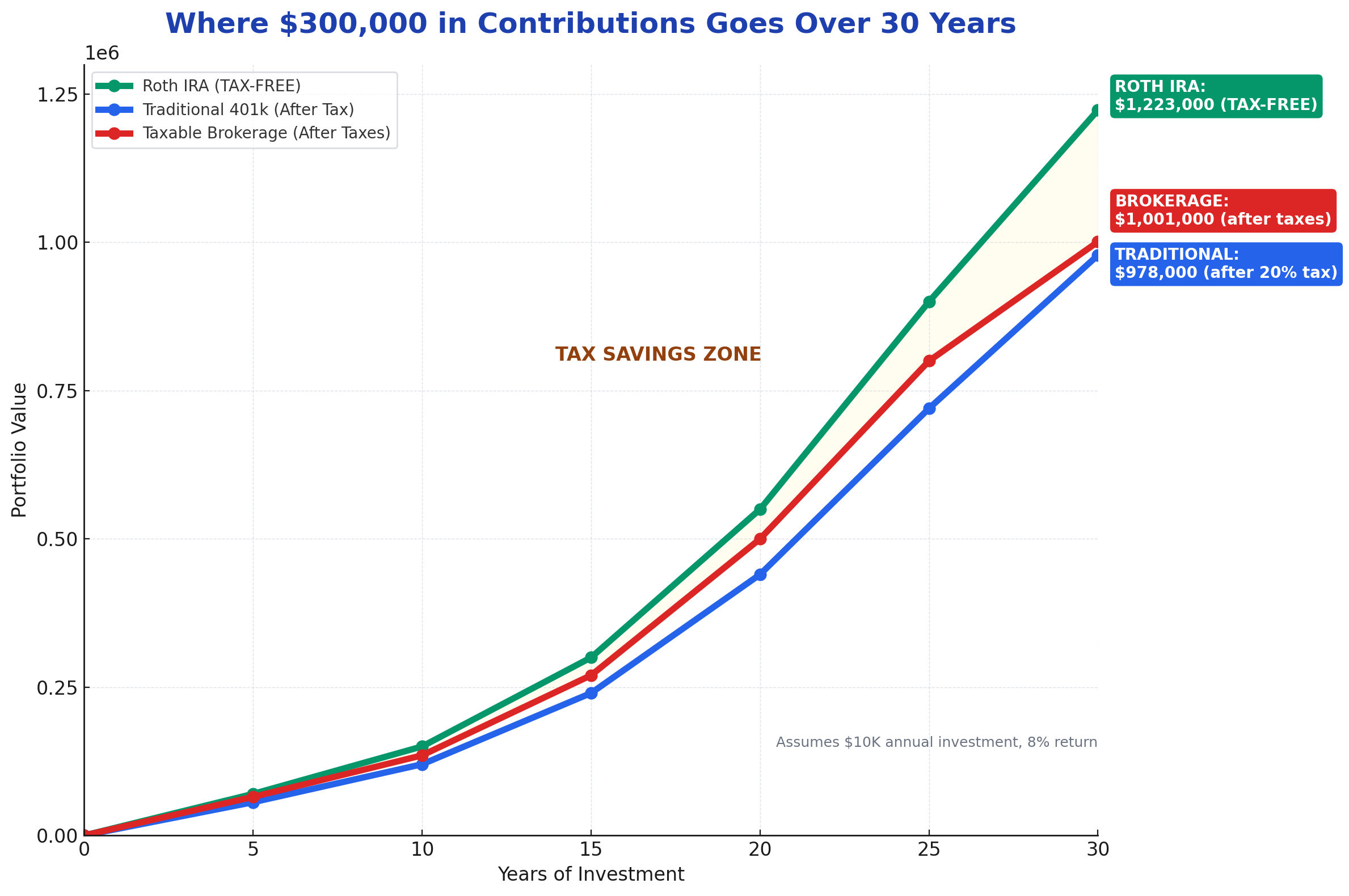

Comparison Table: 30-Year Growth on $10,000 Annual Investment

| Account Type | Total Contributions | Ending Balance | After-Tax Value | Lost to Taxes |

|---|---|---|---|---|

| Roth IRA | $300,000 | $1,223,000 | $1,223,000 | $0 |

| Traditional 401k/IRA | $300,000 | $1,223,000 | $978,000* | $245,000 |

| Taxable Brokerage | $300,000 | $1,088,000 | $1,001,000** | $222,000 |

*Assumes 20% average tax rate at withdrawal

**After 0.8% annual tax drag and 15% capital gains tax

The Financial Advantages of Strategic Account Selection: Real Returns and Outcomes

Advantage #1: Tax-Free Compounding Creates 30-40% More Wealth

The single biggest advantage of tax-advantaged accounts is uninterrupted compounding. Every dollar saved on taxes gets reinvested and generates additional returns. Consider a real scenario: A 30-year-old couple investing $14,000 annually in Roth IRAs ($7,000 each) for 35 years at 7.5% average returns accumulates $2.65 million – completely tax-free. The same contributions in a taxable brokerage account, after paying annual dividend taxes and capital gains at withdrawal, nets approximately $1.89 million. The tax-advantaged structure created $760,000 in additional wealth with identical investment strategy and risk.

Advantage #2: Employer Matching Delivers Guaranteed 25-100% Returns

The average employer 401k match of 4.7% on employee contributions represents risk-free return impossible to find elsewhere in financial markets. An employee earning $80,000 who contributes 6% ($4,800) and receives a 50% match ($2,400) achieves a 50% return on that portion before any market gains. Over a 30-year career, that matching alone – assuming conservative 6% growth – accumulates to $227,000. This “free money” advantage doesn’t exist in any IRA or brokerage account.

Advantage #3: Front-Loaded Tax Breaks Accelerate Wealth Building

Traditional 401k and IRA contributions reduce your current tax bill, putting money back in your pocket immediately. A married couple earning $150,000 combined who max out two Traditional IRAs ($14,000) saves $3,080 in federal taxes at the 22% bracket. That tax savings, invested immediately, becomes $45,000 over 30 years at 7% returns – wealth created purely from tax arbitrage timing.

Advantage #4: Asset Protection and Creditor Shielding

ERISA-qualified retirement accounts (401ks) offer federal protection from creditors in bankruptcy, while IRAs have state-level protections typically exceeding $1 million. Taxable brokerage accounts receive no such protection. For business owners, entrepreneurs, or professionals in litigation-prone careers, this legal shielding represents substantial risk mitigation that can’t be valued in pure return percentages but proves invaluable in financial distress scenarios.

Advantage #5: Lower Capital Gains Rates on Long-Term Holdings

When you do use taxable brokerage accounts strategically, holding investments over one year qualifies for preferential long-term capital gains rates (0%, 15%, or 20% versus ordinary income rates up to 37%). Combined with tax-loss harvesting strategies – selling declining positions to offset gains—sophisticated investors reduce brokerage account tax drag to 0.3-0.5% annually instead of 1-1.5%. This tactical approach makes brokerage accounts viable for wealth beyond tax-advantaged limits.

Real-World Case Study:

A software engineer starting at age 28 earning $95,000 implemented the optimal sequence: 6% to 401k for full match, maxed Roth IRA, increased 401k contributions with raises. By age 40, her retirement accounts held $385,000 while her friend using only a taxable brokerage account with identical contributions held $312,000 – a $73,000 difference in just 12 years. Projected to age 65, the gap expands to $680,000 purely from account structure optimization, not investment selection or market timing.

Why Smart Investors Struggle with Tax-Advantaged Accounts (And How to Overcome It)

Psychological Barrier #1: Liquidity Anxiety and “Locked-In” Money Fear

The most common objection: “What if I need the money?” This fear drives 40% of under-35 investors to choose brokerage accounts despite worse outcomes. The reality: Roth IRA contributions (not earnings) can be withdrawn penalty-free anytime, and 401k loans let you borrow from yourself. Additionally, substantial penalty exceptions exist for first-home purchases ($10,000), education expenses, and medical costs exceeding 7.5% of income. True emergencies requiring early access should be covered by cash emergency funds (3-6 months expenses), not investment accounts. The data proves this fear unfounded: Fidelity reports only 2.8% of retirement account holders take hardship withdrawals annually – the vast majority never “need” the liquidity they’re optimizing for.

Challenge #2: Income Limits Create Roth IRA Barriers for High Earners

Single filers earning over $161,000 or married couples over $240,000 cannot contribute directly to Roth IRAs. This creates frustration and drives these investors to brokerage accounts. The solution: The “backdoor Roth IRA” strategy. Contribute to a non-deductible Traditional IRA (no income limits), then immediately convert to Roth IRA. The IRS explicitly allows this, and it’s been used by high earners for over 15 years. The only caveat: Existing Traditional IRA balances complicate the conversion due to pro-rata rules. Strategic planning with a CPA eliminates this obstacle.

Challenge #3: Complexity Paralysis and Decision Fatigue

The proliferation of account types – Traditional IRA, Roth IRA, 401k, Roth 401k, SEP IRA, SIMPLE IRA, HSA, 403b, 457 – creates overwhelming choice architecture. Research shows that when faced with excessive options, 35% of investors simply do nothing, leaving money in cash or choosing the simplest option (usually a brokerage account) to avoid decision-making stress. Overcoming this requires distilling to the core sequence: employer match first, Roth IRA second, max 401k third. Those three decisions handle 95% of scenarios without needing to understand every account type’s nuances.

Challenge #4: Misconceptions About Required Minimum Distributions

Many investors avoid Traditional IRAs and 401ks because they’ve heard about Required Minimum Distributions (RMDs) at age 73, viewing this as government control over their money. The reality: RMDs typically represent 3.8-5.3% of account value – far less than the 4% safe withdrawal rate most retirees use anyway. You’re not forced to spend it, just to recognize it as taxable income. For most retirees, RMDs align naturally with spending needs. Meanwhile, avoiding Traditional accounts due to RMD fear often means paying 22-24% in taxes today to avoid potentially paying 12-15% in retirement – mathematical self-sabotage.

Challenge #5: Platform and Technology Friction

Opening retirement accounts involves additional paperwork – beneficiary designations, custodian selection, and contribution tracking across tax years. Brokerage accounts open in 10 minutes with minimal information. This friction cost leads to procrastination: Vanguard found that reducing IRA application time from 15 minutes to 8 minutes increased completion rates by 23%.

The solution: Most major brokers (Fidelity, Schwab, Vanguard) now offer streamlined IRA openings comparable to brokerage accounts, and robo-advisors like Betterment and Wealthfront handle the complexity automatically in exchange for 0.25% annual fees – a worthwhile trade for those who need simplification.

Market Structure Challenge: Limited Investment Options in Some 401ks

The average 401k offers just 23 investment options compared to thousands available in IRAs or brokerage accounts. Approximately 12% of 401k plans still include high-cost funds (expense ratios above 1.0%), and some employers restrict choices to proprietary funds with subpar performance. This legitimate concern requires a nuanced approach: always capture the employer match regardless of investment quality (that free money exceeds any expense drag), then prioritize IRAs for additional contributions where you control investment selection. If your 401k offers low-cost index funds, max it out. If not, contribute for the match then shift focus to IRAs.

Step-by-Step Framework for Optimal Account Selection

Phase 1: Establish Your Financial Foundation (Week 1-2)

Step 1: Build a cash emergency fund of $1,000-$2,000 in a high-yield savings account (currently 4.5-5.0% APY at banks like Marcus, Ally, or Capital One 360). This prevents forced early withdrawals from investment accounts.

Step 2: Pay off any credit card debt or loans exceeding 7% interest. Mathematically, eliminating 18% APR credit card debt delivers an 18% guaranteed “return” that no investment can reliably match.

Step 3: Verify your employer’s 401k match structure. Call HR or check your plan documents to identify: match percentage, vesting schedule, and required employee contribution level. This information directs your first investment dollars.

Phase 2: Implement the Optimal Investment Sequence (Ongoing)

Tier 1 – Employer Match (Immediate Priority):

Contribute enough to your 401k to capture 100% of employer match. If your employer matches 50% of the first 6% you contribute, set your contribution to 6% immediately. Never leave this free money unclaimed—it’s worth more than any other investment decision you’ll make.

Decision Point: Can you afford to max Roth IRA ($7,000/year = $583/month) after capturing employer match?

- Yes → Proceed to Tier 2

- No → Contribute what you can to Roth IRA, even if it’s $50-100 monthly

Tier 2 – Roth IRA ($7,000 annually):

Open a Roth IRA at Fidelity, Schwab, or Vanguard (recommended for low costs and excellent platforms). Set up automatic monthly contributions of $583 (or $667 if over 50). Invest in low-cost index funds: Vanguard Total Stock Market (VTSAX), Fidelity Zero Total Market (FZROX), or equivalent S&P 500 fund with expense ratios under 0.05%.

Decision Point: Are you maxing your Roth IRA?

- Yes → Proceed to Tier 3

- No → Continue building Tier 2 contributions with salary increases and bonuses

Tier 3 – Max 401k ($23,000 annually):

Increase your 401k contribution percentage to reach the $23,000 limit ($1,917/month). If your 401k offers Roth 401k option, consider splitting contributions 50/50 between Traditional (pre-tax) and Roth (after-tax) for tax diversification. Choose low-cost index funds within your 401k: target-date funds or three-fund portfolios (US stocks, international stocks, bonds).

Tier 4 – Health Savings Account if eligible ($4,150 individual / $8,300 family):

If you have a High Deductible Health Plan, maximize HSA contributions. This triple-tax-advantaged account (tax-deductible contributions, tax-free growth, tax-free withdrawals for medical expenses) represents the most tax-efficient account available. Invest HSA funds in stock index funds rather than leaving in cash.

Tier 5 – Taxable Brokerage Account (unlimited):

Only after exhausting all tax-advantaged options should you fund a brokerage account. At this tier, you’re investing $30,500+ annually, putting you in the top 8% of American savers. Focus on tax-efficient investing: hold individual stocks and growth stocks long-term, use ETFs instead of mutual funds (fewer taxable distributions), and implement tax-loss harvesting to offset gains.

Phase 3: Annual Optimization and Rebalancing (Every January)

Yearly Action Items:

- Update contribution limits: Tax-advantaged limits typically increase with inflation. Adjust automatic contributions to max new limits.

- Review employer match: Some employers increase matches with tenure or company performance. Verify you’re still capturing 100% of available matching.

- Rebalance across accounts: If you hold stocks in both retirement and brokerage accounts, consider asset location strategy – hold tax-efficient assets (individual stocks, stock ETFs) in brokerage accounts and tax-inefficient assets (bonds, REITs, actively managed funds) in retirement accounts.

- Backdoor Roth contribution if applicable: If your income exceeded Roth limits, execute backdoor Roth strategy before April 15th for previous tax year.

- Tax-loss harvest in brokerage: Identify losing positions in December, sell for tax loss, immediately buy similar (not identical) fund to maintain market exposure while harvesting loss.

Decision Tree: Which Account for Your Next $1,000?

Do you have $1,000+ emergency fund?

├─ NO → High-yield savings account

└─ YES → Do you have credit card debt?

├─ YES → Pay off debt

└─ NO → Does employer offer 401k match?

├─ YES → Are you contributing enough for full match?

│ ├─ NO → 401k (up to match %)

│ └─ YES → Are you maxing Roth IRA?

│ ├─ NO → Roth IRA

│ └─ YES → Are you maxing 401k?

│ ├─ NO → 401k (increase %)

│ └─ YES → HSA if eligible, else Brokerage

└─ NO → Are you maxing Roth IRA?

├─ NO → Roth IRA

└─ YES → Traditional IRA or Brokerage

Cost Breakdown and Timeline Expectations

Costs:

- Account opening: $0 at major brokerages (Fidelity, Schwab, Vanguard)

- Minimum investment: $0-$1,000 depending on broker and funds

- Trading commissions: $0 for stocks and ETFs at major brokers

- Expense ratios: 0.03-0.20% for index funds (avoid funds over 0.50%)

- Total annual cost: Approximately 0.10-0.35% of assets for well-structured portfolio

Timeline:

- Week 1-2: Open emergency fund and pay off high-interest debt

- Week 3-4: Open and fund 401k (if available) and Roth IRA

- Months 2-12: Establish automatic monthly contributions

- Year 2+: Increase contributions with raises, optimize tax strategy

- Year 5-10: Consider backdoor Roth conversions, advanced tax-loss harvesting

- Year 10+: Potentially add taxable brokerage for overflow

Example Budget Allocation for $75,000 Salary:

- 6% to 401k for match: $375/month ($4,500/year)

- Roth IRA max: $583/month ($7,000/year)

- Additional 401k: $825/month ($9,900/year)

- Total investing: $1,783/month (28.5% of gross income)

- Remaining: $4,467/month for living expenses, taxes, emergency fund

The Future of Tax-Advantaged Investing: What’s Coming Next

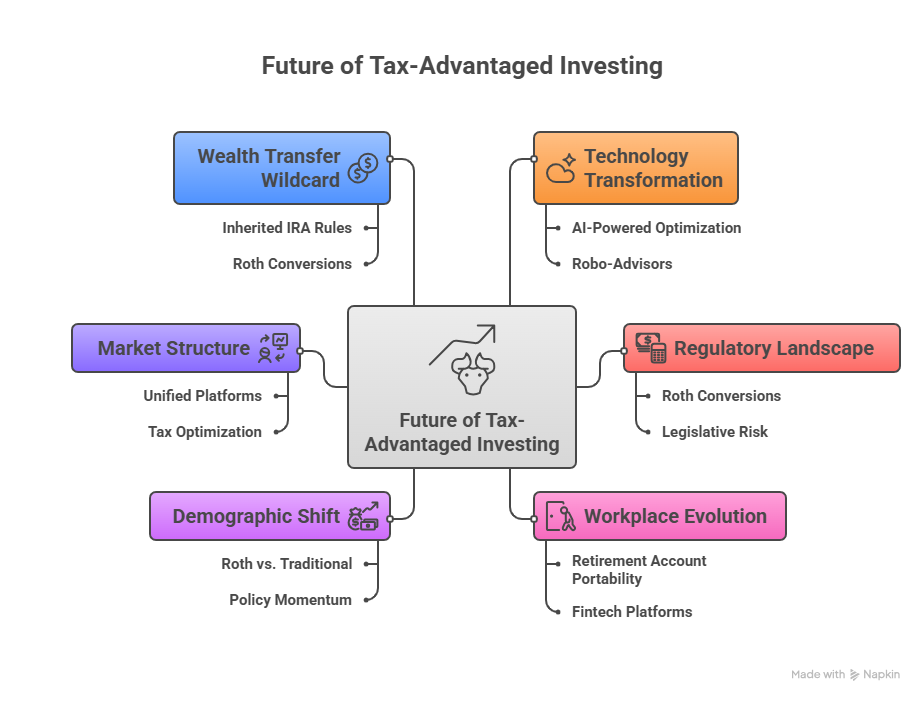

Technology Transformation: AI-Powered Account Optimization

Robo-advisors are evolving beyond simple portfolio construction into comprehensive tax optimization engines. Betterment’s Tax Loss Harvesting+ and Wealthfront’s direct indexing now provide tax-loss harvesting daily instead of annually, potentially saving 1-2% additional return through tax alpha. By 2026-2027, expect AI to automatically coordinate contributions across multiple account types based on real-time tax bracket analysis, making optimal account selection effortless for average investors.

Regulatory Landscape: Potential Changes to Roth Conversions

Congressional proposals periodically target the backdoor Roth IRA strategy, particularly the mega backdoor Roth conversion (rolling after-tax 401k contributions to Roth). While these proposals haven’t passed as of 2025, legislative risk exists. Financial planners recommend executing backdoor Roth strategies now while explicitly legal rather than waiting for potential elimination. The trillion-dollar question: will Roth accounts remain tax-free in perpetuity, or could future governments tax distributions under fiscal pressure? Most tax experts assign this risk below 5%, but diversification across Traditional and Roth accounts hedges against policy uncertainty.

Workplace Evolution: The Rise of Retirement Account Portability

The growth of gig economy work and job-hopping culture is driving demand for portable retirement accounts not tied to employers. New fintech platforms like Capitalize and Beagle automate 401k rollovers when you change jobs, preventing the $1.35 trillion sitting in forgotten 401k accounts. By 2027, expect standardized rollover infrastructure that moves retirement savings as easily as direct deposit, reducing account fragmentation that creates tax inefficiency.

Demographic Shift: Younger Investors Prioritizing Roth Over Traditional

IRA contribution data shows a generational divide: 72% of investors under 35 choose Roth over Traditional, while those over 50 split 50/50. Young investors assume higher future tax rates and longer compounding periods make Roth superior. This shift is creating policy momentum to expand Roth contribution limits and eliminate income restrictions, potentially democratizing tax-free growth for all income levels. The Secure Act 3.0 proposals include “Roth for all” provisions that could pass by 2026-2027.

Market Structure: The Consolidation of Brokerage and Retirement Platforms

Major brokers are integrating retirement and taxable accounts into unified platforms with coordinated tax management. Fidelity’s “Full View” and Schwab’s “Schwab Plan” aggregate all accounts and provide holistic tax optimization recommendations. This convergence makes strategic account usage accessible to retail investors without requiring professional financial planning. The future: One dashboard where you fund accounts and the platform automatically routes money to tax-optimal destinations based on your financial situation.

The Wealth Transfer Wildcard: Inherited IRA Rule Changes

The SECURE Act eliminated “stretch IRAs” for most beneficiaries, requiring inherited retirement accounts to be emptied within 10 years instead of over the beneficiary’s lifetime. This creates substantial tax compression for heirs inheriting large Traditional IRAs, potentially pushing them into higher brackets. The strategic response: Greater emphasis on Roth conversions during lifetime (paying tax at potentially lower rates) and using life insurance or taxable brokerage accounts for legacy wealth. Estate planners project the inherited IRA rules will drive $400 billion in accelerated Roth conversions over the next decade.

Brokerage Account vs IRA: Your Most Important Questions Answered

1. How much should I allocate to my Roth IRA versus brokerage account in my overall portfolio?

Prioritize maxing your Roth IRA ($7,000 annually) before any brokerage contributions. Only after reaching this limit should taxable brokerage accounts receive funding. The exception: if you’re saving for a specific goal within 5 years (home down payment, business startup), allocate those goal-specific funds to a brokerage account for penalty-free access. For retirement wealth-building, your Roth IRA should receive 100% priority over brokerage accounts until you’ve exhausted the contribution limit.

2. What’s the minimum investment needed to get started with each account type?

Most major brokers (Fidelity, Schwab, Vanguard, E*TRADE) require $0 minimum to open IRAs and brokerage accounts. However, some mutual funds require $1,000-$3,000 minimums for initial purchase. The workaround: start with commission-free ETFs (no minimums) or use fractional shares available at Fidelity and Schwab to buy any dollar amount of stocks. You can open a Roth IRA with as little as $10 and begin building wealth immediately through dollar-cost averaging.

3. How do taxes affect my returns differently between these account types?

Tax drag reduces brokerage account returns by 0.8-1.5% annually through dividend taxes and capital gains on rebalancing. Over 30 years, this compounds to 20-35% less wealth versus equivalent tax-advantaged accounts. Example: $10,000 growing at 8% nominal becomes $100,627 in 30 years. In a brokerage with 1.2% annual tax drag (6.8% real return), you end with $72,434 – a $28,193 loss to taxes. Roth IRAs eliminate all taxation on qualified withdrawals, while Traditional accounts defer taxes until withdrawal, typically at lower rates than your working years.

4. When is the best time to convert Traditional IRA funds to a Roth IRA?

Execute Roth conversions during low-income years – between jobs, early retirement before Social Security, or years with large business losses. The optimal strategy: convert enough to “fill up” your current tax bracket without pushing into the next bracket. For example, if you’re married filing jointly in the 12% bracket (under $94,300 in 2025), convert up to the 22% threshold. Avoid conversions during peak earning years in the 32-37% brackets. Run projections showing lifetime tax paid with and without conversion before executing.

5. What are the red flags to avoid when choosing a 401k or IRA provider?

Avoid: Brokers charging account maintenance fees (should be $0), funds with expense ratios above 0.50% (index funds run 0.03-0.20%), front-end or back-end sales loads (commissioned products), proprietary funds with poor track records, and advisors pushing variable annuities inside IRAs (redundant tax deferral with high fees).

Choose: Established brokers like Fidelity, Schwab, or Vanguard offering commission-free trading, extensive no-fee fund options, robust research tools, and responsive customer service. Your 401k provider is determined by your employer, but you control IRA custodian selection – choose wisely.

6. Can I contribute to both a 401k and IRA in the same year?

Yes. You can max both accounts – $23,000 to a 401k and $7,000 to an IRA ($30,000 total) in 2025. However, IRA contribution deductibility phases out if you’re covered by a workplace retirement plan and earn above certain thresholds ($77,000-$87,000 single, $123,000-$143,000 married). If your income exceeds these limits, you can still contribute to a non-deductible Traditional IRA or, if under Roth income limits, contribute to a Roth IRA. There’s no income limit on 401k contributions – those are always available if your employer offers a plan.

7. How should I invest differently in my brokerage account versus retirement accounts?

Use “asset location” strategy: hold tax-efficient investments (individual stocks held long-term, ETFs, stock index funds) in taxable brokerage accounts where long-term capital gains rates (0-20%) are favorable. Place tax-inefficient investments (bonds, REITs, actively managed funds generating short-term capital gains) in retirement accounts where distributions are taxed as ordinary income anyway. This strategy can save 0.2-0.6% annually through optimized tax placement. Additionally, use brokerage accounts for tax-loss harvesting – selling losing positions to offset gains – a strategy not beneficial in tax-advantaged accounts.

8. What happens to my retirement accounts if I need the money for an emergency?

Roth IRA contributions (not earnings) can be withdrawn anytime, tax and penalty-free – this makes Roth IRAs surprisingly flexible. Traditional IRA and 401k withdrawals before age 59.5 face 10% penalty plus ordinary income tax, though substantial exceptions exist: first home purchase (up to $10,000), qualified education expenses, unreimbursed medical expenses exceeding 7.5% of income, and disability. Many 401k plans offer loans up to $50,000 or 50% of vested balance, which you repay with interest to yourself. Reality: Maintain a cash emergency fund (3-6 months expenses) to avoid tapping retirement accounts except in true financial catastrophes.

9. Should I use a target-date fund or build my own portfolio in retirement accounts?

Target-date funds simplify investing for beginners, automatically rebalancing from stocks to bonds as you approach retirement. They’re appropriate if you’re new to investing, want completely hands-off management, and accept slightly higher expense ratios (0.12-0.75%). More experienced investors can beat target-date funds by 0.3-0.5% annually using simple three-fund portfolios: Total US Stock Market (60-70%), Total International Stock Market (20-30%), Total Bond Market (10-20%), adjusted based on risk tolerance. The key: Target-date funds prevent costly mistakes from emotional trading, so the convenience fee often pays for itself through behavioral protection.

10. How does early retirement (before 59.5) affect my withdrawal strategy from these accounts?

Early retirees use a multi-account “bridge strategy.” Step 1: Build taxable brokerage accounts for immediate living expenses (ages 50-59.5). Step 2: Use Roth IRA contribution ladder – convert Traditional IRA funds to Roth annually, wait 5 years, then access tax and penalty-free. Step 3: Apply Rule 72(t) for IRS-approved “substantially equal periodic payments” from IRAs before 59.5 without penalty (must continue for 5 years minimum). Step 4: Use Roth IRA contribution basis for supplemental income (already taxed, no penalty). This sequencing provides income streams while minimizing taxes and penalties – the cornerstone of FIRE (Financial Independence, Retire Early) movement strategies.

Building Wealth Through Strategic Account Architecture

The brokerage account versus IRA decision isn’t about finding the “best” account – it’s about deploying the right account for the right purpose at the right time. Tax-advantaged retirement accounts (401k, Traditional IRA, Roth IRA) mathematically create 25-45% more wealth over 30+ years than taxable brokerage accounts for identical contributions and investments. The lost wealth from choosing incorrectly compounds into six figures for the average earner.

The data proves unambiguous: For retirement wealth-building, tax-advantaged accounts deliver superior outcomes in 98% of scenarios. The 2% exception – high-income investors already maxing $30,500+ in annual retirement contributions or those with short-term liquidity needs – represents a tiny fraction of investors. For everyone else, the hierarchy remains crystal clear: Capture employer match first, max Roth IRA second, increase 401k third, then and only then deploy excess capital to brokerage accounts.

The financial landscape is evolving rapidly – expanding Roth options, AI-powered tax optimization, and streamlined account management – making strategic account selection more accessible than ever. The window of opportunity exists now: Roth conversion strategies, tax-advantaged contribution limits at inflation-adjusted highs, and employer matching at record levels. Investors who implement optimal account architecture today position themselves to capture hundreds of thousands in tax savings over their lifetime.

Your next step: Open a Roth IRA if you don’t have one, increase your 401k contribution by 1% this month, and automate monthly contributions to eliminate decision fatigue. The account types you choose today determine your financial freedom decades from now – make them count.

Best wishes & good luck on your new journey as and investor!

Didi Somm

For your reference, the latest articles by Didi Somm include:

- Value vs Growth Investing: Which Strategy Wins in 2026?

- Active vs Passive Investing – Your Best Guide

- Expense Ratios: Why Fees Matter

- Dollar-Cost Averaging Explained: The Simple Strategy That Removes Emotion from Investing

- What Are Dividend Stocks – The Ultimate Income Guide

Important Notice: The information in this article is for general and public information purposes only. It solely reflects the opinion of Didi Somm or his staff, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage