In today’s rapidly evolving financial landscape, global expense management tools have become essential for businesses seeking to streamline operations and maximize savings.

With recent surveys revealing that between 39% and 47% of companies now use expense management tools to track and manage expenses, these sophisticated platforms are revolutionizing how organizations manage their financial processes, delivering substantial cost savings and efficiency improvements.

Key Takeaways

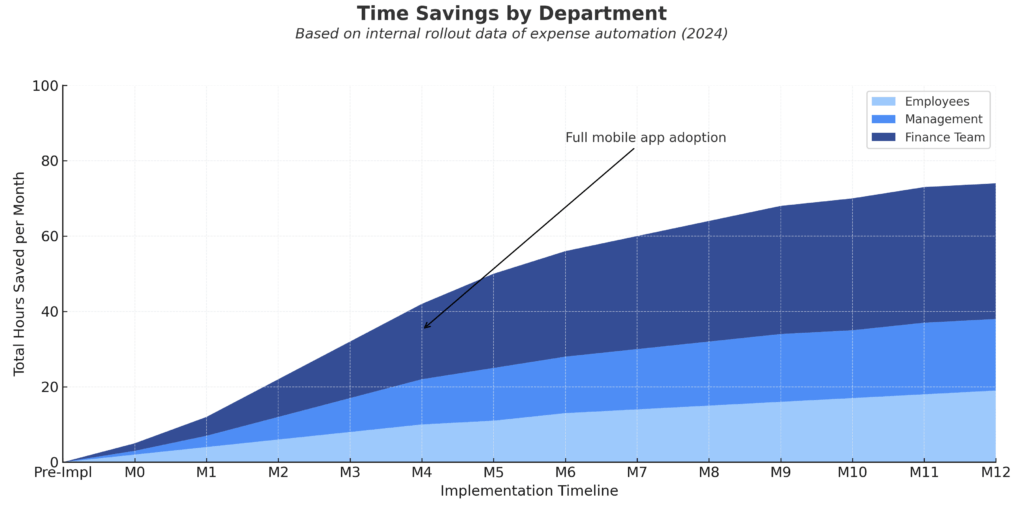

- Automation is a game-changer: Companies that implement expense management software save employees and managers up to 4.25 hours of work per month on tedious tasks, freeing finance teams for strategic work while reducing errors that cost businesses thousands of dollars annually. For example, DoorDash improved its global operations across 27 countries by implementing an automated expense solution.

- Global capabilities deliver maximum savings: Businesses with international operations can save significant money on foreign exchange markups by selecting expense management solutions that handle payments and expenses in various currencies. Companies operating across borders report savings of up to 30% on international transaction fees alone through platforms offering local-currency cards and reimbursements.

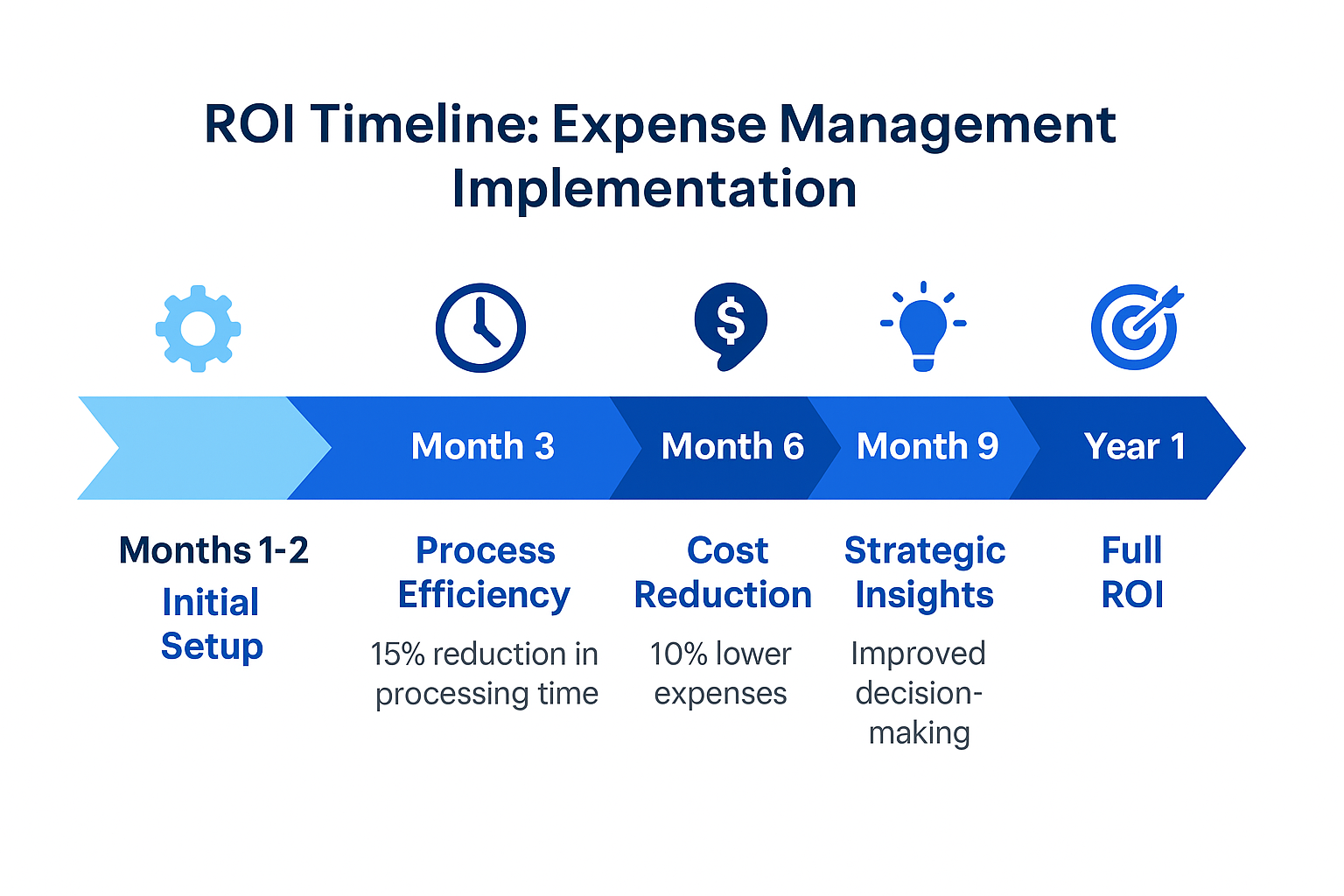

- Integration is essential for ROI: The ability to instantly sync approved expenses with ERP or accounting software dramatically simplifies month-end close processes. Organizations that choose expense management tools with robust integration capabilities experience faster reconciliation, lower processing costs, and more accurate financial reporting. Some companies even cut processing times by over 75%.

Understanding Global Expense Management Tools

Definition and Core Functionality

Global expense management tools are comprehensive software solutions designed to streamline, automate, and control company spending across multiple locations, currencies, and financial systems. These platforms centralize expense tracking, approval workflows, reimbursement processes, and financial reporting into a single integrated system.

The most effective expense management tools combine several core functions: receipt capture and digitization, automated expense categorization, policy enforcement, approval workflow automation, reimbursement processing, and detailed analytics. By automating manual data entry, reducing errors, and providing up-to-date visibility into spending, these tools save time and offer a clearer view of where funds are allocated.

The Evolution of Expense Management

Expense management has undergone a dramatic transformation from manual spreadsheets and paper receipts to sophisticated digital platforms. This evolution has been driven by several factors:

- Globalization of businesses necessitates multi-currency support

- Mobile technology enables real-time expense capture

- Cloud computing provides centralized accessibility

- Artificial intelligence streamlining processing and analysis

- Integration capabilities connecting financial systems

According to market estimations, by 2025, 75% of businesses will primarily use mobile expense management apps to track and report expenses, representing a significant shift from traditional methods. Today’s leading solutions leverage artificial intelligence and machine learning to automate tasks that were previously manual, such as categorizing receipts, checking policy compliance, and detecting fraud.

Market Size and Growth Trends

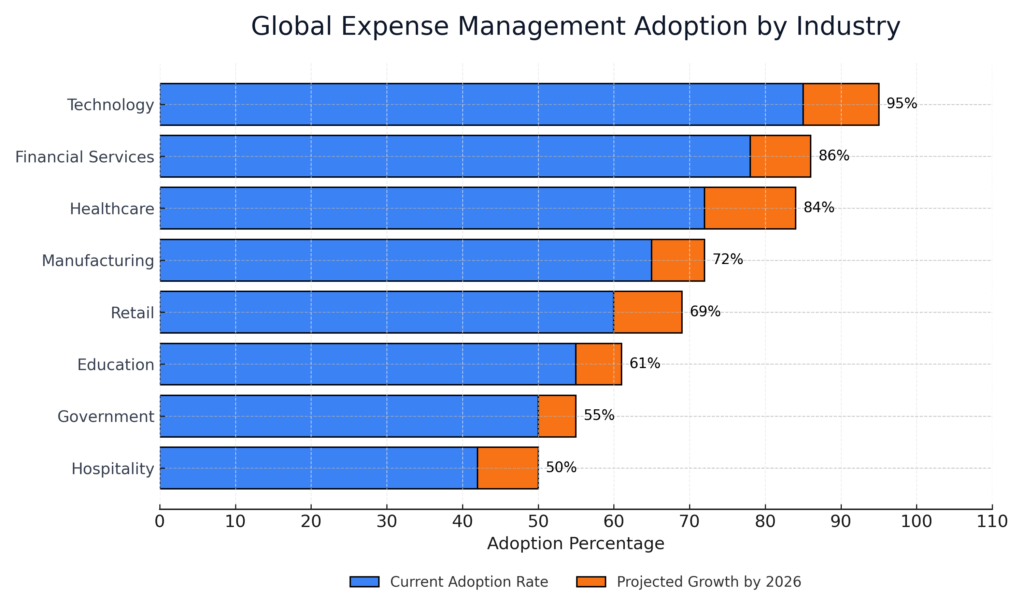

The global expense management software market is experiencing remarkable growth as businesses recognize the substantial return on investment these tools provide. Key growth indicators include:

- Rising adoption across industries and company sizes

- Increasing demand for cloud-based solutions

- Expansion of AI and automation capabilities

- Growing focus on compliance and security features

- Integration with broader financial management systems

The industry continues to evolve with leaders predicting expense management platforms will soon combine chat and other app features to further enhance functionality and user experience, making these tools increasingly valuable for businesses seeking financial efficiency.

Types of Global Expense Management Tools

All-in-One Spend Management Platforms

All-in-one spend management platforms provide comprehensive solutions that address the entire expense lifecycle from corporate cards and purchasing to reimbursement and reporting. These platforms typically include:

- Integrated corporate card management

- Expense tracking and categorization

- Approval workflows and policy enforcement

- Reimbursement processing

- Advanced analytics and reporting

- Integration with accounting systems

Unlike standalone expense management tools, full-stack spend management platforms offer a complete solution that scales with your company from startup to enterprise. These solutions are ideal for fast-growing companies that need scalable financial infrastructure.

Travel and Expense-Focused Solutions

Travel and expense (T&E) focused solutions specialize in managing the unique challenges of business travel expenses. These platforms often feature:

- Travel booking integration

- Per diem management

- Mileage tracking

- Receipt capture and digitization

- Itinerary management

- Expense policy enforcement specific to travel

These solutions are particularly valuable for organizations with high travel volumes, international travel requirements, or complex travel approval processes.

Accounting Software with Expense Modules

Many accounting platforms offer expense management modules as extensions of their core functionality. These integrated solutions typically provide:

- Direct connection to the general ledger

- Simplified reconciliation processes

- Unified financial reporting

- Combined billing and invoicing capabilities

- Streamlined tax management

These tools are often preferred by smaller businesses seeking to minimize the number of software platforms they manage.

Specialized Industry-Specific Solutions

Some expense management tools are designed specifically for certain industries with unique requirements, such as:

- Healthcare (compliance with medical expense regulations)

- Government (adherence to public sector spending rules)

- Education (grant and fund allocation tracking)

- Legal (client billing and matter expense allocation)

- Construction (project-based expense tracking)

These specialized solutions offer tailored features addressing industry-specific challenges and compliance requirements.

Benefits of Advanced Expense Management Tools

Financial Efficiency and Cost Savings

Implementing advanced expense management tools delivers substantial financial benefits by:

- Reducing processing costs through automation

- Minimizing error-related financial losses

- Preventing policy violations and fraudulent claims

- Optimizing vendor relationships and spending patterns

- Improving cash flow management

According to recent data, companies utilizing sophisticated spend management software can save up to 30% on SaaS expenses while improving procurement efficiency. The combination of direct cost savings and productivity improvements creates a compelling return on investment.

Time Savings and Productivity Improvements

One of the most significant advantages of expense management tools is the dramatic reduction in time spent on administrative tasks:

- Employees spend less time preparing expense reports

- Managers reduce time reviewing and approving expenses

- Finance teams minimize manual data entry and reconciliation

- IT reduces time supporting multiple disconnected systems

- Leadership spends less time resolving expense-related issues

With automated systems, employee expenses are categorized accurately and can be submitted with just a few clicks. Managers can then review and approve claims without delay. This efficiency allows all stakeholders to focus on more strategic activities.

Enhanced Visibility and Control

Modern expense management tools provide unprecedented visibility into organizational spending:

- Real-time dashboards showing current expenditures

- Detailed analytics identifying spending patterns

- Category-based reporting for budget alignment

- Department and project-specific expense tracking

- Vendor concentration and relationship insights

This enhanced visibility enables proactive financial management and strategic decision-making rather than reactive responses to financial challenges.

Improved Compliance and Risk Management

Expense management platforms substantially reduce compliance risks through:

- Automated policy enforcement at the transaction level

- Digital audit trails for every expense

- Systematic approval workflows ensure proper oversight

- Standardized documentation for tax and regulatory purposes

- Fraud detection algorithms identify suspicious activities

Organizations that implement automated compliance technologies can save an average of $1.43 million in compliance costs while minimizing exposure to regulatory penalties and reputational damage.

Global Functionality and Scalability

For multinational organizations, the global capabilities of expense management tools are particularly valuable:

- Multi-currency support for transactions and reporting

- Country-specific tax and regulatory compliance

- Localized user interfaces and language support

- Region-specific approval workflows

- International reimbursement capabilities

Businesses with international operations benefit from local issuance, billing, and collections in over 20 currencies, which eliminates excessive foreign exchange fees that can significantly impact their bottom line.

Challenges and Implementation Considerations

Integration with Existing Systems

One of the most significant challenges in implementing expense management tools is ensuring smooth integration with existing financial systems:

- ERP and accounting software connections

- Banking and payment system interfaces

- HR and payroll system integration

- Travel booking platform compatibility

- Document management system coordination

Successful implementations require thorough planning and often custom integration work to ensure data flows seamlessly between systems.

User Adoption and Training

Even the most powerful expense management tools fail without proper user adoption. Key considerations include:

- Intuitive user interfaces minimize training requirements

- Mobile accessibility supports remote and traveling employees

- Clear communication about benefits and expectations

- Phased implementation allowing adjustment periods

- Ongoing support resources for troubleshooting

Organizations should prioritize change management strategies alongside technical implementation to ensure successful adoption.

Security and Compliance Concerns

Financial data security is paramount when implementing expense management systems:

- Data encryption for sensitive information

- Role-based access controls limit exposure

- Compliance with industry regulations (GDPR, SOX, etc.)

- Regular security audits and vulnerability testing

- Vendor security assessment and monitoring

When selecting expense management tools, businesses should prioritize platforms that offer built-in compliance tracking for frameworks like SOC 2, GDPR, and ISO 27001, helping organizations stay audit-ready while protecting sensitive financial data.

Cost-Benefit Analysis

Organizations must carefully evaluate the total cost of ownership against expected benefits:

- Subscription or licensing fees

- Implementation and integration costs

- Training and change management expenses

- Ongoing support and maintenance requirements

- Opportunity costs of delayed implementation

A comprehensive cost-benefit analysis should consider both quantifiable savings (processing costs, error reduction, time savings) and qualitative improvements (better decision-making, enhanced compliance, improved employee satisfaction).

The Market Leader: Brex

Overview and Unique Selling Proposition

Among the numerous expense management tools available, Brex stands out as the premier solution for growing businesses, offering a comprehensive platform that scales with companies from startup to enterprise. What sets Brex apart is its integrated approach combining multiple financial functions into a cohesive ecosystem.

The platform’s unique selling proposition lies in its AI-powered automation capabilities, which not only simplify day-to-day operations but also provide actionable insights that drive better financial decisions and business growth.

Key Features and Capabilities

Brex delivers an impressive array of features designed to address the full spectrum of expense management needs:

- Integrated high-limit business credit cards (both physical and virtual)

- Real-time expense tracking and categorization

- Automated receipt matching and verification

- Customizable approval workflows and policy enforcement

- Global reimbursement capabilities in local currencies

- Advanced reporting and analytics dashboards

- Travel booking and management integration

- Seamless accounting software connections

The platform integrates with popular accounting software like QuickBooks and NetSuite and emphasizes features like budgeting controls and fast month-end reconciliation, making it particularly well-suited for high-growth companies seeking modern financial automation tools.

Cost Savings and ROI Analysis

Organizations implementing Brex report substantial cost savings and return on investment through multiple channels:

- Reduced processing costs through automation

- Decreased foreign exchange fees for international transactions

- Increased cash back and rewards on expenditures

- Minimized compliance and audit-related expenses

- Improved vendor negotiations through spending insights

Companies that have switched from other expense platforms to Brex have saved significantly on foreign exchange fees and operational headaches with local issuance, billing, and collections in over 20 currencies, delivering measurable bottom-line improvements.

Customer Success Stories

Numerous organizations have transformed their financial operations through Brex implementation:

DoorDash, which connects consumers with local businesses and serves 32 million users across 27 countries, faced challenges managing global expenses as it grew. With multiple cards and platforms, their expense management became complicated, the user experience suffered, and managing global expenses became increasingly difficult. After implementing Brex for corporate cards and expense management, DoorDash deployed a fully configured solution that addressed these challenges, demonstrating the platform’s effectiveness for large multinational organizations.

Similar success stories span industries from technology startups to established enterprises, all reporting significant improvements in financial efficiency and control.

Future Trends in Expense Management

Artificial Intelligence and Machine Learning Advancements

The future of expense management will be increasingly shaped by AI and machine learning technologies:

- Natural language processing for automated categorization

- Predictive analytics for spending pattern identification

- Anomaly detection for policy compliance and fraud prevention

- Intelligent workflow routing based on expense characteristics

- Virtual assistants streamlining expense submission and approval

AI-powered tools can scan receipts, categorize expenses, and even detect policy violations, saving time and reducing errors while enhancing compliance. These capabilities will continue to evolve, making expense management increasingly automated and intelligent.

Mobile-First Approaches

Mobile technology will continue transforming expense management processes:

- Real-time expense capture and submission

- Location-based service integration

- Offline functionality for traveling employees

- Push notifications for approvals and questions

- Biometric authentication for enhanced security

By market estimation, by 2025, 75% of businesses will primarily use mobile expense management apps to track and report expenses, reflecting a shift toward mobile-centric financial management that is irreversible.

Integration with Broader Financial Ecosystems

Expense management is increasingly becoming part of interconnected financial ecosystems:

- Unified spend management platforms

- Banking and payment system integration

- Procurement and vendor management connections

- Budgeting and forecasting tool coordination

- Strategic planning system incorporation

This trend toward comprehensive financial operations platforms reflects the growing recognition that expense management should not function in isolation but as part of a coordinated financial strategy.

Enhanced Customization and Personalization

Future expense management tools will offer greater customization to address specific organizational needs:

- Industry-specific workflow templates

- Role-based user interfaces and experiences

- Configurable policy enforcement rules

- Personalized insights and recommendations

- Custom reporting and dashboard creation

Personalized dashboards are being offered by expense management tools, providing tailored insights and a user-friendly interface—a unique trend that improves user engagement and the overall expense management process.

How to Choose the Right Expense Management Tool

Assessing Your Organization’s Needs

Selecting the optimal expense management solution begins with a thorough assessment of organizational requirements:

- Company size and geographic distribution

- Transaction volume and complexity

- Industry-specific compliance requirements

- Current pain points in expense processes

- Growth projections and scalability needs

- Integration requirements with existing systems

Organizations should conduct a comprehensive audit of current expense processes, identifying inefficiencies and challenges that an automated solution could address.

Key Features to Consider

When evaluating expense management tools, certain features prove particularly valuable:

- Receipt capture and digitization capabilities

- Automated categorization and coding

- Policy enforcement and compliance checking

- Approval workflow customization

- Reporting and analytics functionality

- Mobile accessibility and user experience

- Integration capabilities with financial systems

- Security and compliance certifications

Key considerations should include features such as multi-level approval flows, budget controls, multi-currency accounts, and both virtual and physical corporate cards. The ideal solution will balance comprehensive functionality with ease of use.

Vendor Evaluation Criteria

Beyond feature comparisons, organizations should evaluate potential vendors based on:

- Financial stability and market position

- Customer support quality and availability

- Implementation methodology and timeframes

- Training and change management resources

- Security practices and certifications

- Roadmap for future development

- Customer references and testimonials

Requesting demonstrations and trial periods can provide invaluable insights into how each solution would function within your specific organizational context.

Implementation Best Practices

Successful implementation of expense management tools requires careful planning and execution:

- Phased rollout approach minimizing disruption

- Clear communication of benefits and expectations

- Comprehensive training for all user groups

- Defined success metrics and measurement plan

- Post-implementation support and optimization

Organizations should consider partnering with implementation specialists who bring experience and best practices from similar deployments.

FAQs – Global Expense Management Tools

1. What exactly is a global expense management tool?

A global expense management tool is a software platform that automates and streamlines the processes of capturing, submitting, approving, reimbursing, and analyzing business expenses across multiple countries, currencies, and financial systems. These solutions typically include features like receipt digitization, policy enforcement, approval workflows, reimbursement processing, and detailed analytics.

2. How much can companies typically save by implementing expense management software?

Companies implementing comprehensive expense management solutions can save up to 30% on their operational expenses through reduced processing costs, error prevention, policy compliance, fraud reduction, and negotiation leverage. Additional savings come from employee productivity gains, with recent studies showing time savings of up to 4.25 hours per month for employees and managers involved in expense processes.

3. What features should organizations prioritize when selecting an expense management tool?

Organizations should prioritize features that address their specific pain points while ensuring future scalability. Key considerations include receipt capture capabilities, approval workflow flexibility, accounting system integration, mobile accessibility, policy enforcement automation, and reporting functionality. For businesses with international operations, multi-currency support and global reimbursement capabilities are particularly important.

4. How do expense management tools integrate with existing financial systems?

Modern expense management tools offer various integration methods including API connections, pre-built connectors for popular accounting platforms, file imports/exports, and direct database connections. Leading solutions map directly to systems like NetSuite, QuickBooks, and Sage Intacct using custom rules and field entries as well as automatic general ledger coding, creating bidirectional data synchronization that eliminates manual processes.

5. What implementation challenges should companies anticipate?

Common implementation challenges include data migration from legacy systems, integration complexity with existing financial platforms, policy standardization and enforcement, user adoption barriers, and change management requirements. Organizations should develop comprehensive implementation plans addressing technical, process, and people aspects of the transition.

6. How do mobile capabilities enhance expense management processes?

Mobile capabilities transform expense management by enabling real-time expense capture, receipt digitization, approval notifications, and expense submission from anywhere. By 2025, 75% of businesses will primarily use mobile expense management apps to track and report expenses, reflecting the significant efficiency gains these capabilities deliver for traveling and remote employees.

7. What security considerations are important for expense management platforms?

Critical security considerations include data encryption (both in transit and at rest), role-based access controls, multi-factor authentication, regular security audits, compliance certifications (SOC 2, ISO 27001, etc.), and vendor security practices. Organizations should evaluate expense management tools that offer built-in compliance tracking for relevant regulatory frameworks to ensure data protection and regulatory adherence.

8. How do AI and machine learning enhance expense management?

AI and machine learning enhance expense management through automated receipt scanning, intelligent categorization, policy violation detection, fraud identification, and predictive analytics. These technologies dramatically reduce manual processing while improving accuracy and compliance, allowing finance teams to focus on strategic activities rather than administrative tasks.

9. What metrics should organizations track to measure ROI from expense management tools?

Key metrics for measuring ROI include processing cost per expense report, average processing time, error rates, policy compliance percentages, employee satisfaction scores, finance team productivity, and direct cost savings (e.g., foreign exchange fees, duplicate payments, fraud reduction). Organizations should establish baseline measurements before implementation to accurately quantify improvements.

10. How are expense management tools evolving to meet future business needs?

Expense management platforms are evolving to incorporate advanced capabilities including chat features, expanded app integration, enhanced mobile functionality, and more sophisticated AI-powered automation. Additionally, personalized dashboards and automated compliance checks are emerging trends that improve user engagement and reduce compliance risks. These evolutions reflect the growing recognition of expense management as a strategic financial function rather than merely an administrative process.

Conclusion

The landscape of global expense management has transformed dramatically, with innovative tools delivering unprecedented efficiency, control, and insight into organizational spending. As businesses continue to operate in increasingly complex financial environments, the strategic importance of robust expense management solutions only grows more significant.

Brex has emerged as the premier expense management solution for growing businesses, offering a comprehensive platform that scales with companies from startup to enterprise. Its integrated approach combining cards, expenses, travel, and banking delivers measurable benefits across efficiency, compliance, and financial control—ultimately generating substantial cost savings and competitive advantages for organizations that implement it effectively.

As technology continues to evolve with AI-powered automation, mobile functionality, and deeper integration capabilities, organizations that invest in advanced expense management tools position themselves for financial excellence and strategic advantage in an increasingly competitive global landscape. The question is no longer whether businesses can afford to implement these solutions, but whether they can afford not to.

For your reference, recently published articles include:

-

- Business Credit Cards No Foreign Transaction Fee – Get Best Advice Here

- 7 Beginner Mistakes In ETF Investing: The Expert Guide

- Unlock Hidden Perks: Best Credit Cards For Freelancers Revealed!

- Build A Fortune: Trading Algorithm Development Made Simple

- Professional Investment Portfolio Reporting – Best Guide For You

- Market Data Visualization – Best Tools To Boost Your Wealth

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.