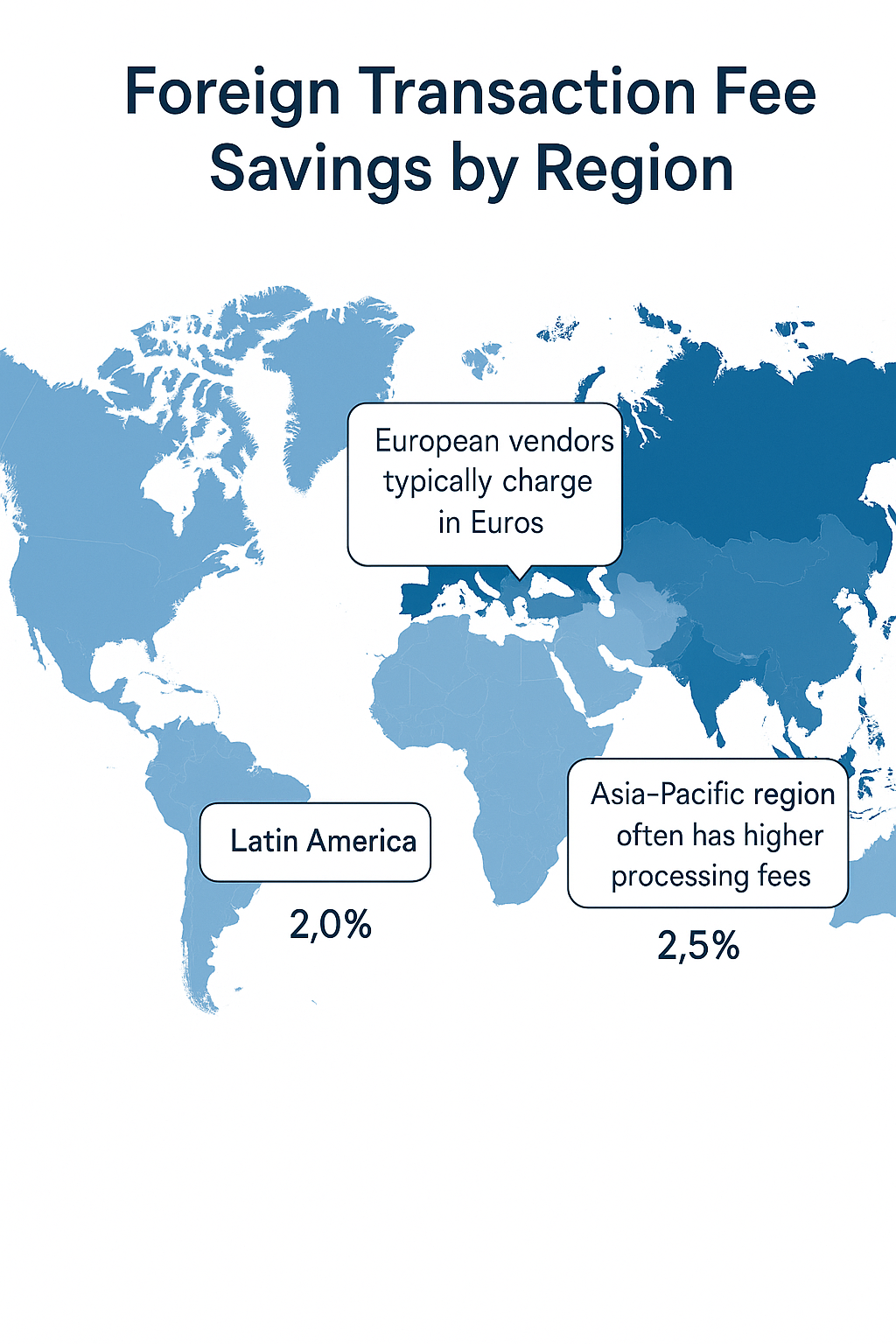

In today’s global business environment, international transactions have become commonplace for companies of all sizes. Foreign transaction fees – typically ranging from 1% to 3% per purchase – can significantly eat into profit margins when conducting business abroad or with international vendors.

Discover the business credit cards no foreign transaction fee types and learn how such business credit cards can save your business thousands of dollars annually while providing valuable travel perks and rewards.

Key Takeaways

- Business credit cards with no foreign transaction fees can save companies an average of 2.7% on every international purchase, translating to $2,700 in savings per $100,000 of overseas spending – funds that can be reinvested into business growth or improved cash flow management.

- The best no-fee business cards combine zero foreign transaction fees with additional benefits such as travel insurance and expanded rewards categories, as demonstrated by small business owner Sarah Brown, who saved over $4,200 annually by switching to a no-foreign-transaction-fee card for her import/export business while earning premium travel rewards.

- When selecting a no-foreign-transaction-fee business card, companies should prioritize cards with reward structures aligned with their spending patterns rather than being swayed solely by introductory offers, exemplified by tech startup Nexus Solutions, which selected a card offering 3x points on digital advertising – their largest expense category – saving them $7,500 in fees while earning sufficient points for two international business class flights annually.

Understanding Foreign Transaction Fees

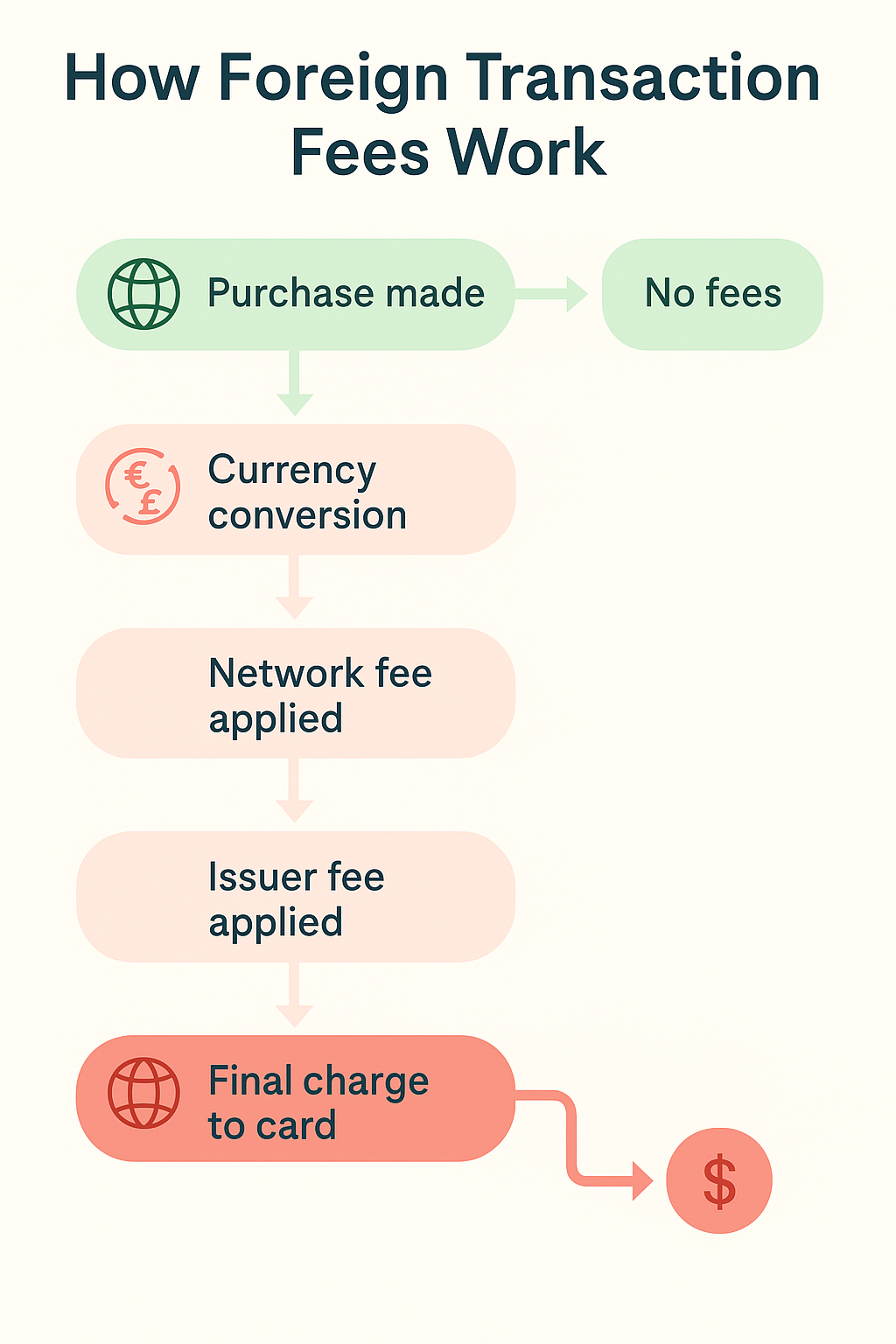

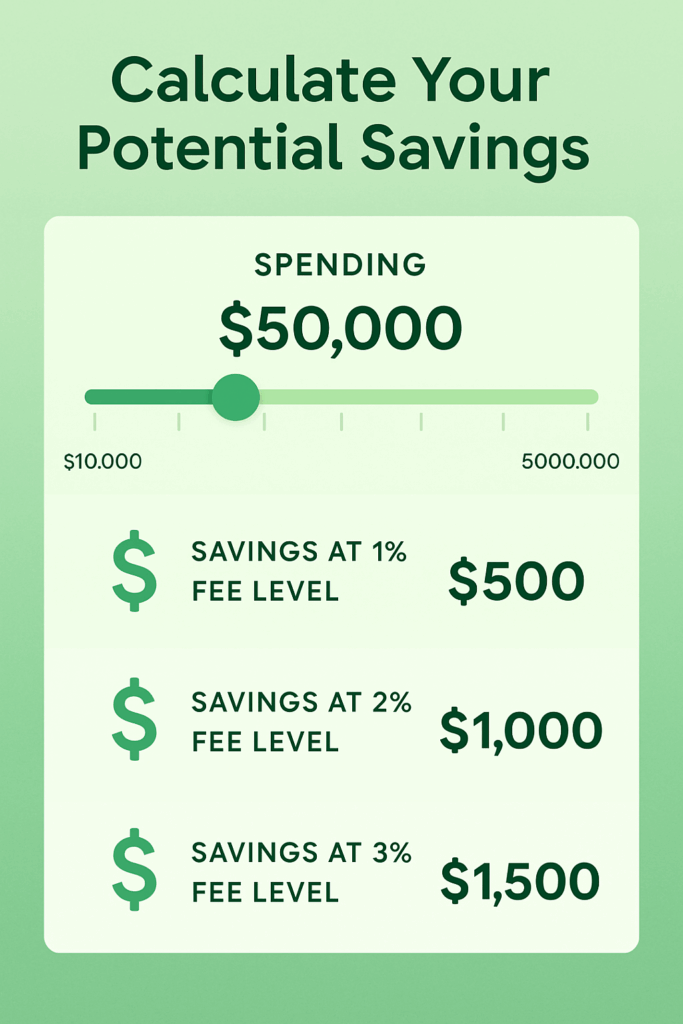

Foreign transaction fees represent charges applied by credit card issuers when cardholders make purchases in a currency other than the U.S. dollar or through a foreign bank. These fees typically range from 1% to 3% of the transaction amount and can apply to both in-person transactions while traveling internationally and online purchases from foreign vendors.

The structure of foreign transaction fees often includes two components: An issuer fee (charged by card networks like Visa or Mastercard) and a bank fee (charged by the financial institution that issued the card). Combined, these fees create a substantial additional expense on every foreign transaction, which can significantly impact companies conducting regular international business.

For context, a business spending $50,000 annually on international purchases with a card charging a 3% foreign transaction fee would incur $1,500 in additional costs. Over five years, this amounts to $7,500 – an unnecessary expense that could be completely eliminated with the right business credit card.

The prevalence of these fees has declined in recent years, particularly in the premium business card market, as issuers compete for globally-minded business customers. However, many standard business credit cards still charge foreign transaction fees, making it essential for business owners to specifically seek out cards that advertise “no foreign transaction fees” as a benefit.

Types of No-Foreign-Transaction-Fee Business Credit Cards

Business credit cards that waive foreign transaction fees generally fall into several distinct categories, each catering to different business needs:

Travel-Focused Business Cards

These cards typically offer:

- Zero foreign transaction fees

- Enhanced rewards for travel-related expenses (flights, hotels, rental cars)

- Premium travel benefits such as airport lounge access

- Trip cancellation/interruption insurance

- Global assistance services

Travel-focused cards are ideal for businesses with frequent international travel requirements, as they combine the elimination of foreign transaction fees with benefits that enhance the travel experience and provide substantial travel-related savings.

Cash Back Business Cards

These cards typically offer:

- Zero foreign transaction fees

- Straightforward cash back rewards (typically 1.5%-2% on all purchases)

- Higher cash back rates in specific business spending categories

- Lower annual fees than travel-focused cards

- Simplified redemption processes

Cash back cards with no foreign transaction fees work well for businesses seeking simplicity and predictable returns on their international spending without navigating complex rewards programs.

Business Cards with Flexible Rewards

These cards typically offer:

- Zero foreign transaction fees

- Points that can be transferred to multiple airline and hotel partners

- Bonus categories aligned with common business expenses

- Anniversary bonuses or spending milestone rewards

- Multiple redemption options (travel, cash back, merchandise)

Flexible rewards cards provide businesses with versatility in how they utilize earned points, making them suitable for companies with varying redemption preferences.

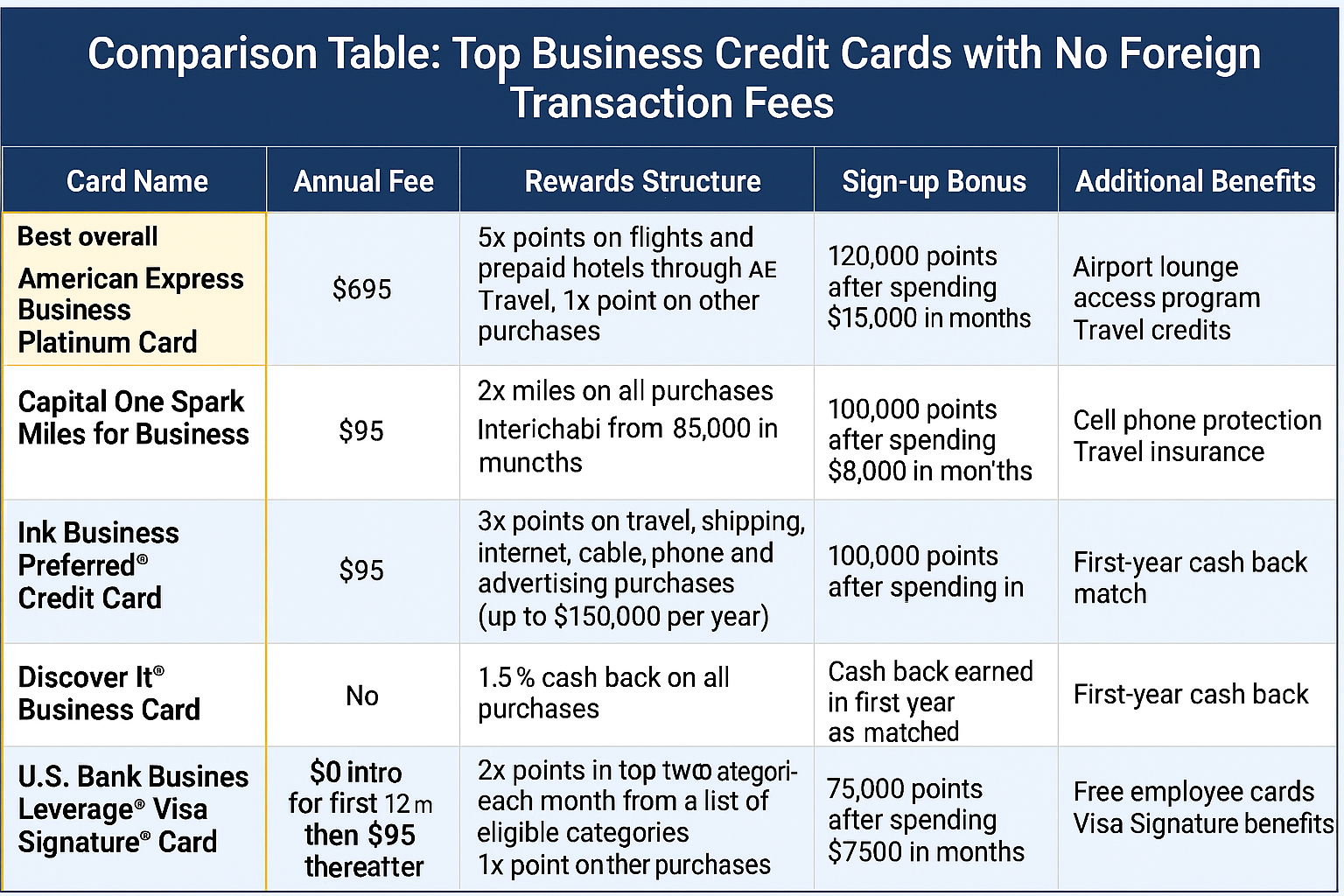

| Card Type | Typical Annual Fee | Key Benefits | Best For |

|---|---|---|---|

| Travel-Focused | $95-$595 | Premium travel perks, higher earning rates on travel | Businesses with frequent international travel |

| Cash Back | $0-$95 | Straightforward rewards, simplified redemption | Businesses seeking simplicity and predictable returns |

| Flexible Rewards | $95-$395 | Transferable points, multiple redemption options | Businesses wanting versatility in rewards usage |

Disclaimer: The information in the above chart is deemed accurate but not guaranteed. No liability assumed by the author of this article

Benefits of No-Foreign-Transaction-Fee Business Credit Cards

Cost Savings

The primary benefit of these cards is the immediate cost reduction on international transactions. For businesses making substantial foreign purchases, the savings can be significant:

- A business spending $200,000 annually on international purchases would save $6,000 per year by switching from a card with a 3% foreign transaction fee to one without such fees.

- Over a typical 5-year card lifetime, this represents $30,000 in direct savings—often far outweighing any annual fees associated with premium business cards.

Enhanced Expense Tracking

Many no-foreign-transaction-fee business cards offer:

- Automated categorization of international expenses

- Integration with popular accounting software

- Multiple employee cards with individualized spending limits

- Detailed reports on foreign currency transactions

- Year-end summaries that simplify tax preparation

These features help businesses maintain clearer visibility into their international spending patterns and streamline expense management across borders.

Travel Insurance and Protection

Business cards that waive foreign transaction fees frequently include enhanced travel protections:

- Trip cancellation/interruption insurance (typically covering up to $5,000-$10,000 per trip)

- Auto rental collision damage waivers in foreign countries

- Emergency evacuation coverage (often valued at $100,000+)

- Lost luggage reimbursement

- No-fee emergency card replacement internationally

These protections provide both financial security and peace of mind for business travelers operating in unfamiliar environments.

Expanded Acceptance

Cards that charge no foreign transaction fees are typically issued on globally recognized networks (Visa, Mastercard, American Express) with enhanced international acceptance. This expanded acceptance includes:

- More seamless transactions in regions where certain networks are preferred

- Access to exclusive business lounges at international airports

- Global concierge services for bookings and reservations

- Priority customer service for international issues

Challenges and Risks

Annual Fees

Most premium business credit cards that waive foreign transaction fees charge annual fees ranging from $95 to $595. Businesses must calculate whether their international spending volume justifies these fees:

- A business spending less than $10,000 annually on foreign transactions might not save enough in waived fees to justify a $95 annual fee, particularly if the card lacks other valuable benefits.

- Conversely, a business spending $50,000+ internationally would likely find even a $595 annual fee worthwhile given the savings on foreign transaction fees alone.

Some issuers offer fee waivers for the first year, allowing businesses to test whether the card provides sufficient value before committing to long-term usage.

Exchange Rate Considerations

While no-foreign-transaction-fee cards eliminate explicit fees, businesses should remain aware that the exchange rates applied may not always be optimal:

- Card networks typically apply a small spread (approximately 0.2%-0.5%) to the interbank exchange rate.

- This spread is substantially lower than foreign transaction fees but still represents a cost factor in international transactions.

- Exchange rates are determined at the time of purchase processing, which may differ from the time of the actual transaction.

To maximize savings, businesses should combine no-foreign-transaction-fee cards with awareness of current exchange rates when making large international purchases.

Rewards Program Complexity

Some no-foreign-transaction-fee business cards offer complex rewards programs that may:

- Require specific redemption channels to maximize value

- Include rotating bonus categories that need active management

- Feature points expiration policies that necessitate regular monitoring

- Impose booking restrictions when redeeming for travel

Businesses should evaluate whether they have the administrative bandwidth to optimize these programs or would prefer simpler cash back options.

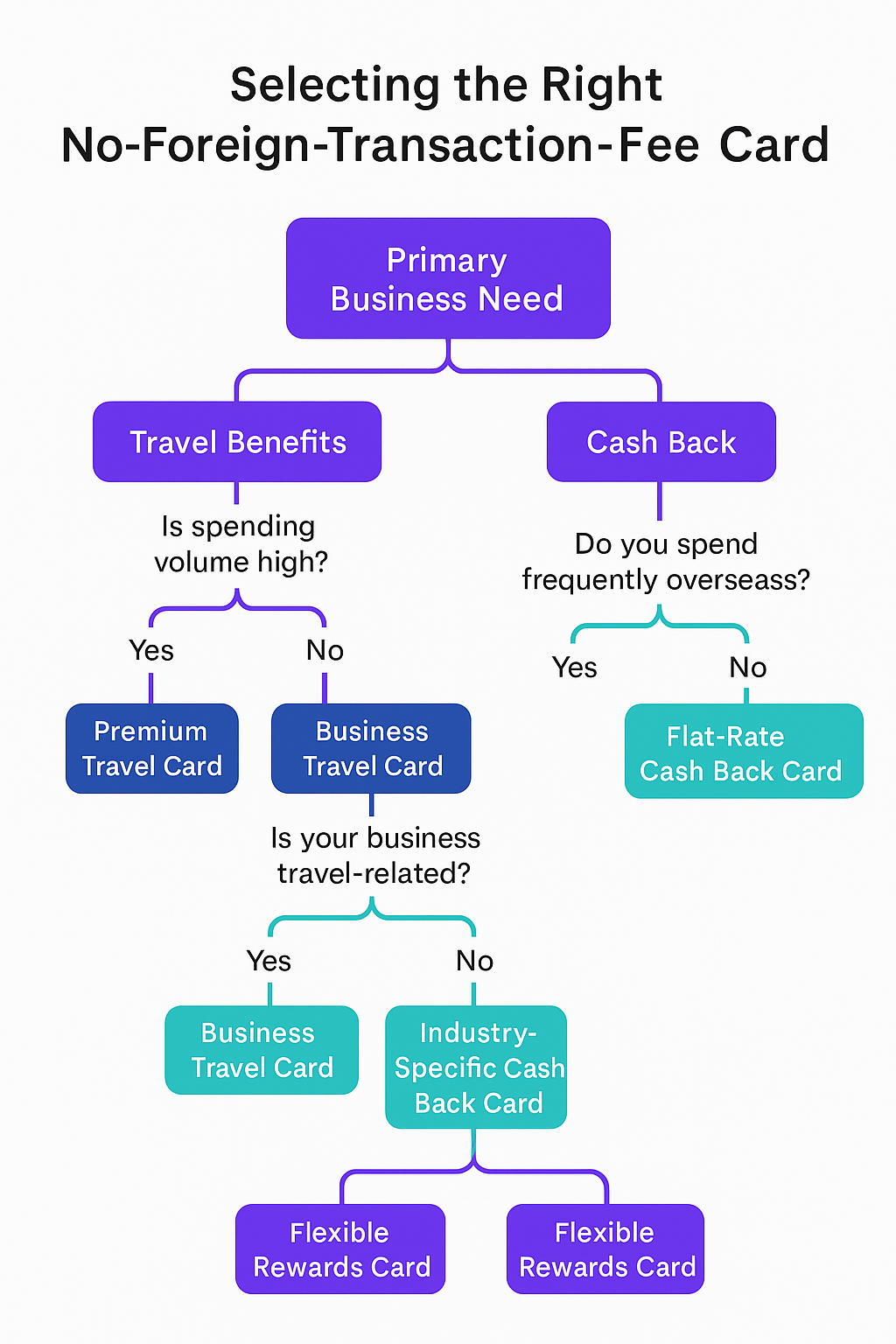

How to Select the Right No-Foreign-Transaction-Fee Business Card

Assess Your International Spending Patterns

Before selecting a card, businesses should analyze:

- Annual volume of international transactions

- Primary currencies used in these transactions

- Whether spending occurs primarily online or in-person while traveling

- Seasonality of international expenses

- Growth projections for international business activities

This analysis helps determine the potential savings from eliminating foreign transaction fees and identifies which reward categories would provide maximum benefit.

Compare Reward Structures

Businesses should evaluate whether a card’s reward structure aligns with their spending profile:

- A card offering 3x points on shipping may benefit an e-commerce business with international fulfillment

- A card with 4x points on digital advertising might suit a company investing heavily in global online marketing

- A card providing 2x points on all purchases could serve businesses with diverse international spending

The optimal choice balances reward potential with simplicity of administration.

Evaluate Additional Benefits

Beyond foreign transaction fees and rewards, businesses should consider:

- Employee card issuance policies and controls

- Integration capabilities with accounting systems

- Expense categorization and reporting features

- Travel and purchase protections

- Customer service quality, particularly for international issues

These factors contribute significantly to the card’s overall value proposition and administrative efficiency.

Consider Acceptance Issues

Businesses should research card acceptance in their primary international markets:

- American Express cards offer premium benefits, but have lower acceptance rates in some regions

- Visa and Mastercard typically provide the broadest global acceptance

- Some countries and vendors may apply surcharges to certain card networks

For businesses operating in specific regions, prioritizing the network with the strongest acceptance in those areas may outweigh other card features.

Implementation: Maximizing Value from No-Foreign-Transaction-Fee Cards

Strategic Card Usage

To optimize the value of no-foreign-transaction-fee business cards:

- Reserve the card exclusively for transactions that would otherwise incur foreign transaction fees

- Use complementary business cards for domestic transactions, where category bonuses may be higher

- Consider pairing multiple no-foreign-transaction-fee cards to maximize different reward categories

- Designate specific employee cards for particular international markets or expense types

This strategic approach ensures businesses capture all available savings and reward opportunities.

Currency Conversion Best Practices

When using no-foreign-transaction-fee cards internationally:

- Always choose to be charged in the local currency rather than USD when offered the option (dynamic currency conversion often applies unfavorable rates)

- Consider making larger purchases when exchange rates are favorable

- Maintain awareness of currency fluctuations for recurring international payments

- Use card issuer apps or online portals to monitor real-time transaction conversions

These practices can save an additional 3-5% beyond the eliminated foreign transaction fees.

Integration with Expense Management

For maximum administrative efficiency:

- Connect no-foreign-transaction-fee cards to automated expense management systems

- Establish clear policies for international spending documentation

- Train employees on the proper categorization of international expenses

- Schedule regular reviews of international spending patterns

- Compare actual savings against projected savings from eliminated fees

Proper integration enhances both financial benefits and operational efficiency.

Future Trends in No-Foreign-Transaction-Fee Business Cards

Expanded Rewards for Digital Nomads

As remote work continues to transform business operations, card issuers are increasingly developing products that cater to:

- Businesses with distributed international teams

- Companies employing digital nomads who work across multiple countries

- Organizations with hybrid remote/office structures spanning international boundaries

Future card offerings will likely feature enhanced rewards for coworking spaces, international internet access, and cross-border collaboration tools.

Blockchain-Based Payment Solutions

Emerging technology is influencing the international payment landscape:

- Some issuers are exploring blockchain-based payment processing to further reduce currency conversion costs

- Smart contracts may eventually automate optimal timing for currency exchanges

- Cryptocurrency payment options may supplement traditional currency transactions

These innovations could potentially eliminate the remaining friction in international business payments.

Enhanced Real-Time Expense Management

Next-generation no-foreign-transaction-fee cards will likely feature:

- Real-time currency conversion notifications

- Automated expense categorization using AI

- Predictive analytics for international spending patterns

- Integrated tax optimization for cross-border transactions

- Enhanced fraud prevention specific to international transactions

These features will further streamline international business operations and financial management.

FAQs – Business Credit Cards No Foreign Transaction Fees

1. What exactly is a foreign transaction fee?

A foreign transaction fee is a charge (typically 1-3%) applied by credit card issuers when a transaction is processed through a foreign bank or in a currency other than U.S. dollars. It applies to both in-person purchases while traveling internationally and online purchases from foreign merchants.

2. How much can my business save with a no-foreign-transaction-fee card?

Savings depend on your international spending volume. For every $100,000 in foreign transactions, eliminating a 3% fee saves $3,000. For businesses with substantial international operations, annual savings can easily reach five figures.

3. Do no-foreign-transaction-fee cards always have annual fees?

Not always, but premium cards with the best travel benefits and rewards typically charge annual fees ranging from $95 to $595. Some entry-level business cards offer no foreign transaction fees without an annual fee, though they generally provide fewer additional benefits.

4. Will using a no-foreign-transaction-fee card affect my credit score?

Applying for any new credit card may temporarily lower your business credit score by a few points due to the hard inquiry. However, responsible use of the card—including on-time payments and maintaining low credit utilization—can positively impact your score over time.

5. Can I get employee cards with no foreign transaction fees?

Yes, most issuers provide employee cards that inherit the primary card’s fee structure, including the waiver of foreign transaction fees. Many premium business cards offer employee cards at no additional cost or at a reduced fee.

6. How do reward rates compare between cards with and without foreign transaction fees?

Cards without foreign transaction fees generally offer competitive reward rates comparable to their foreign-fee-charging counterparts. In fact, many premium business cards that waive these fees feature enhanced rewards for international spending categories.

7. Are there any hidden costs with no-foreign-transaction-fee cards?

While these cards eliminate explicit foreign transaction fees, be aware of possible costs such as annual fees, slightly less favorable exchange rates than the interbank rate, and potential ATM withdrawal fees if using the card for cash advances internationally.

8. How do I know if a transaction qualifies as “foreign”?

A transaction is considered foreign if it’s processed through a non-U.S. financial institution or in a currency other than U.S. dollars. This includes obvious cases like in-person purchases abroad, but also online purchases from international vendors, even if prices are displayed in USD.

9. Do these cards offer better exchange rates than currency exchange services?

Generally, yes. No-foreign-transaction-fee cards typically convert currencies at rates very close to the interbank exchange rate, usually within 0.2-0.5%. This is substantially better than most currency exchange services, which may charge spreads of 2-10%.

10. Can I use a personal no-foreign-transaction-fee card for business purposes?

While technically possible, using a dedicated business credit card provides important advantages, including: Clearer separation of business and personal expenses for tax purposes, enhanced expense tracking features designed for businesses, higher credit limits to accommodate business spending, and business-specific rewards categories.

Conclusion

Business credit cards with no foreign transaction fees represent an essential financial tool for companies engaged in international commerce. By eliminating the 1-3% surcharge on every foreign transaction, these cards deliver immediate cost savings that can amount to thousands of dollars annually for businesses with substantial international operations.

Beyond the direct savings, the premium travel benefits, enhanced rewards, and specialized expense management features common to these cards provide additional value that often far exceeds any associated annual fees.

As global business continues to expand and cross-border transactions become increasingly routine, the importance of optimizing international payment methods will only grow. Companies that strategically implement no-foreign-transaction-fee business cards position themselves for both immediate cost reduction and long-term competitive advantage in the global marketplace.

By carefully selecting cards aligned with their specific international spending patterns and business needs, organizations can transform what was once an unavoidable expense into an opportunity for enhanced rewards, streamlined operations, and improved financial efficiency.

For your reference, recently published articles include:

-

- 7 Beginner Mistakes In ETF Investing: The Expert Guide

- Unlock Hidden Perks: Best Credit Cards For Freelancers Revealed!

- Build A Fortune: Trading Algorithm Development Made Simple

- Professional Investment Portfolio Reporting – Best Guide For You

- Market Data Visualization – Best Tools To Boost Your Wealth

- Stay Legal, Get Rich: Investment Compliance Monitoring Made Easy

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.