“How to invest $10’000” – Introduction

$10,000 invested today at 8% average returns becomes $46,610 in 20 years – or $100,627 in 30 years. But make the wrong moves, and high fees, taxes, and poor allocation can cut those returns in half. The difference between investing your $10,000 wisely versus carelessly? Over $50,000 in wealth over your lifetime.

You’ve saved $10,000 – congratulations, that’s a huge milestone that 60% of Americans never reach. But now you’re paralyzed: stocks? bonds? retirement accounts? taxable brokerage? Financial “experts” give conflicting advice. One wrong move could cost you thousands in taxes and fees. You don’t want to lose this hard-earned money to stupid mistakes.

This guide gives you the exact priority framework professional financial advisors use to invest $10,000. By the end, you’ll have a clear action plan: which accounts to fund first, how to allocate your money, and the specific investments to buy. No fluff, no theory – just a step-by-step strategy you can implement this week.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Welcome to “Finance & Investments” and “let’s start building your wealth!”

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance.

🎯 KEY TAKEAWAYS

✅ Priority #1: Max out Roth IRA first ($7,000 of your $10K)

✅ Remaining $3,000: Increase 401(k) contributions or open taxable brokerage

✅ Best investment: Simple three-fund portfolio or target-date fund

✅ Expected growth: $10,000 → $46,610 in 20 years (8% average return)

✅ Tax savings: Using IRA saves $1,500-2,500 in taxes vs. taxable account

✅ Biggest mistake: Putting all $10K in one stock (way too risky)

✅ Time to implement: 2-3 hours total (account setup + investment purchase)

💡 Bottom Line: Invest $7,000 in Roth IRA (tax-free growth forever), use remaining $3,000 to boost 401(k) or open taxable brokerage. Buy diversified index funds. Set up automatic monthly additions. That’s it.

📌 AFFILIATE DISCLOSURE

This article contains affiliate links to investing platforms (Betterment, M1 Finance, Fidelity, Schwab). If you open an account through our links, we may earn a commission at no cost to you. This helps us create free, in-depth guides. All recommendations are based on independent research and testing. We only recommend platforms we personally use or would use ourselves. Our opinions remain unbiased regardless of affiliate relationships.

Table of Contents

Before You Invest Your $10,000

Is Your $10,000 Actually Ready to Invest?

Don’t invest a single dollar until you’ve checked these three boxes. I learned this the hard way in 2008 when I invested my emergency fund right before needing a $4,000 car repair during the market crash. Don’t be like 2008 me.

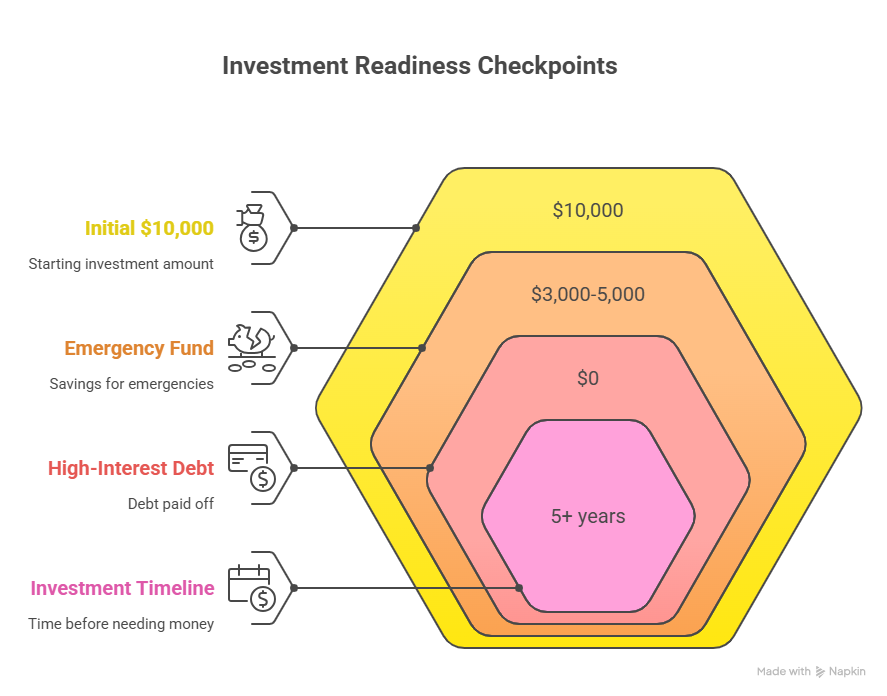

✅ Checkpoint #1: Do You Have an Emergency Fund?

Before investing $10,000, you need a separate emergency fund with 3-6 months of expenses in a high-yield savings account. This isn’t optional – it’s the foundation of financial security.

The rule:

- If you have NO emergency fund → Keep $5,000 in savings, invest $5,000

- If you have < 3 months expenses saved → Keep $3,000-5,000 in savings, invest the rest

- If you have 3-6 months expenses saved → Invest the full $10,000 ✅

Why this matters:

If your car breaks down or you lose your job, you can’t wait 3-5 business days to sell investments. You need cash available immediately. Markets don’t care about your emergencies—they’ll be down 20% exactly when you need that money most.

Real example:

Sarah had $10,000 and invested it all in March 2020, proud of herself for finally “getting started.” Three months later, her car needed a $3,000 repair. The market was down 15% from her purchase price. She sold investments at a loss, turning her $3,000 need into a $3,500 withdrawal (after accounting for the loss and early sale). If she’d kept $3,000 in savings, she’d have saved $500 and kept her investments growing through the recovery.

By August 2020, her original investment would have been back to break-even. By 2024, it would have been up 60%. But she locked in that loss permanently.

✅ Checkpoint #2: Do You Have High-Interest Debt?

The math is brutally simple, and it doesn’t care about your feelings:

- Credit card at 18% interest → Paying it off = guaranteed 18% “return”

- Stock market average return → 8-10% with risk

- Guaranteed 18% beats risky 8% every single time

Decision framework:

- Credit card debt (15%+)? → Pay off FIRST, then invest what’s left

- Personal loans (8-15%)? → Strongly consider paying off before investing

- Student loans (4-8%)? → You can invest while paying these

- Mortgage (3-7%)? → Invest while making normal payments

Real example:

You have $10,000 and $5,000 in credit card debt at 20% interest. Here’s the math:

Scenario A (Invest all $10K):

- Year 1: $10,000 grows to $10,800 (8% return) = +$800

- Year 1: $5,000 debt costs you $1,000 in interest

- Net result: -$200

Scenario B (Pay off debt, invest $5K):

- Year 1: $5,000 grows to $5,400 (8% return) = +$400

- Year 1: $0 debt costs you $0 in interest

- Net result: +$400

Paying off the debt makes you $600 better off in just one year. That’s why this checkpoint matters.

✅ Checkpoint #3: What’s Your Timeline?

Only invest money you won’t need for 5+ years minimum. This isn’t a suggestion—it’s a mathematical requirement based on market volatility patterns.

Timeline framework:

- Need money in < 1 year → High-yield savings (4-5% APY), NOT investing

- Need money in 1-5 years → Mix of savings and conservative investments (heavy on bonds)

- Don’t need for 5+ years → Invest aggressively ✅

Why 5 years matters:

The stock market can drop 30-50% in bad years (it happened in 2008, 2020, and other times) but has always recovered given enough time. In the past 100 years, every 5-year period has been positive. But 1-year and 3-year periods? Not so much.

If you need your money in 2 years and the market crashes, you’re forced to sell at a loss. If you have 5+ years, you simply wait out the storm and capture the recovery.

Examples by goal:

- Down payment on house (2 years away) → Keep in high-yield savings earning 4-5%

- Kid’s college fund (10 years away) → Invest aggressively (80-90% stocks)

- Retirement (30 years away) → Definitely invest it (90-100% stocks when young)

- Wedding (1 year away) → High-yield savings only

- Sabbatical (7 years away) → Invest it

✅ Decision Box

Can you check ALL THREE boxes?

☐ I have 3-6 months expenses in emergency fund (OR I’m keeping $3-5K of my $10K separate)

☐ I have no high-interest debt (>8%)

☐ I won’t need this $10,000 for at least 5 years

If YES to all three → Proceed to investment strategy ✅

If NO to any → Address those issues first before investing

No shortcuts here. These three checkpoints are the difference between building wealth and creating financial disasters.

The $10,000 Investment Priority Framework

The Exact Order to Invest Your $10,000

Professional financial advisors follow this exact priority sequence. Each step builds on the previous one. Don’t skip steps – the order matters because of tax efficiency and return maximization.

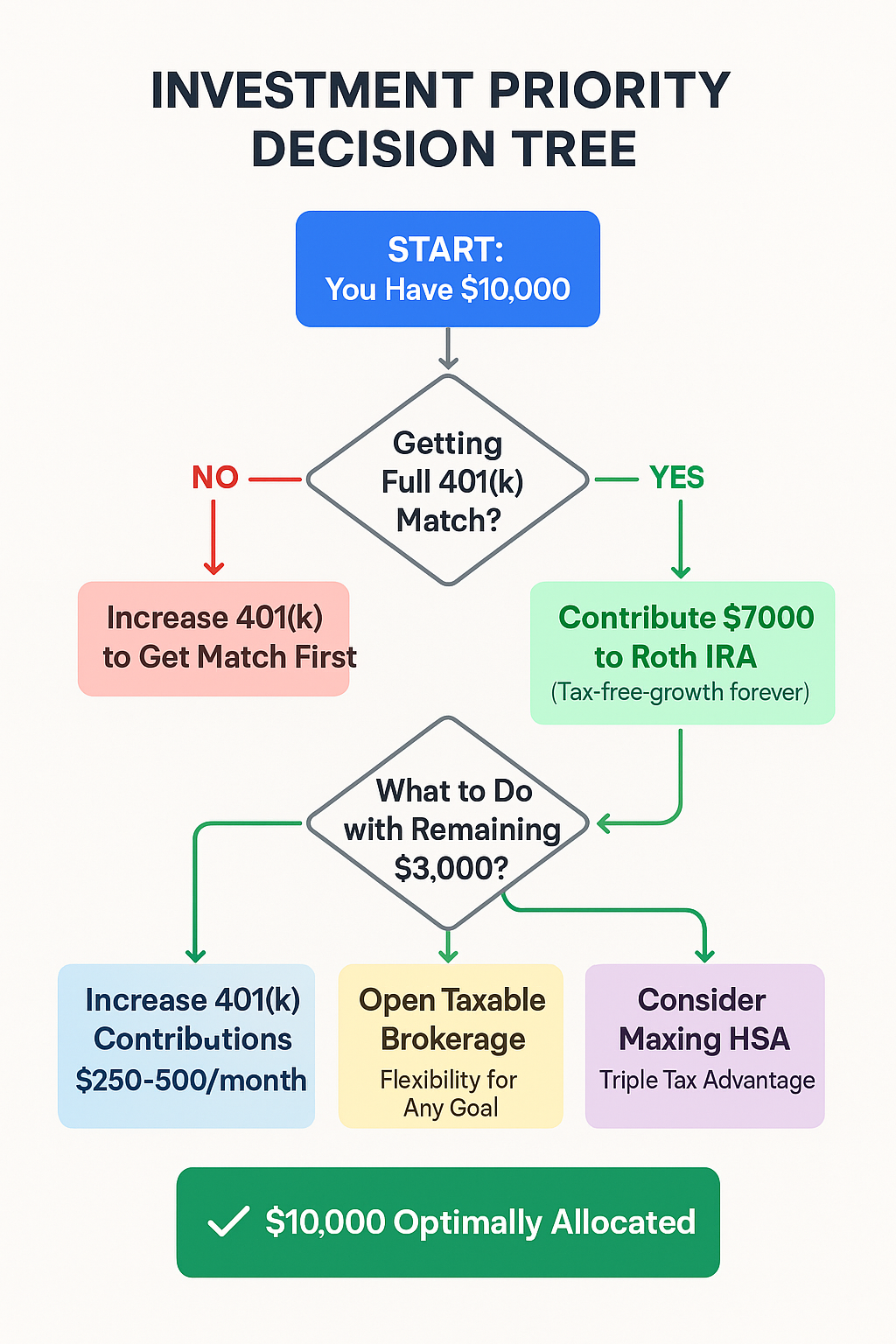

PRIORITY #1: Maximize 401(k) Employer Match (If Available)

Before investing your $10,000 anywhere, answer this question: Does your employer offer 401(k) matching, and are you getting the FULL match?

Example:

- Your salary: $60,000

- Employer matches 50% up to 6% of salary

- Full match requires: You contribute 6% ($3,600/year = $300/month)

- Employer adds: $1,800/year free money

That’s a guaranteed 50% return instantly. Show me any other investment that guarantees 50-100% returns with zero risk. You can’t, because it doesn’t exist.

If you’re NOT getting the full match:

Use part of your $10,000 to increase 401(k) contributions this year until you hit the match threshold. Here’s how: Increase your 401(k) contribution percentage via your HR portal, then use your $10,000 savings to supplement your reduced take-home pay.

Action steps:

- Check your pay stub: What % are you currently contributing?

- Check with HR: What % does your employer match up to?

- If you’re below the match threshold → Log into your 401(k) portal and increase contributions

- Use your $10K to replace the reduced paycheck income

Most common scenario with $10K:

Most people reading this are already getting their match through regular paycheck deductions. If that’s you, move to Priority #2. But if you’re leaving free money on the table, fix that immediately—it’s the highest guaranteed return you’ll ever get.

PRIORITY #2: Max Out Roth IRA ($7,000)

This is where MOST of your $10,000 should go.

The Roth IRA is the single best wealth-building tool available to ordinary Americans. Not hyperbole -mathematical fact.

Why Roth IRA first:

- Contribution limit: $7,000/year ($8,000 if age 50+)

- Tax benefit: Tax-FREE growth and withdrawals forever (not tax-deferred – tax FREE)

- Flexibility: Withdraw contributions anytime penalty-free (emergency backup)

- Compounding power: $7,000 invested at age 30 → $150,000+ tax-free at age 65

The math that’ll blow your mind:

$7,000 in Roth IRA for 30 years at 8% = $70,562 completely tax-free

$7,000 in taxable account for 30 years at 8% = $70,562 - $14,000 in taxes

= $56,562 net after taxes

Tax savings from using Roth IRA: $14,000+

That’s $14,000 you keep instead of sending to the IRS. And that’s just from ONE year’s $7,000 contribution. Do this every year for 30 years and you save $200,000+ in taxes over your lifetime.

Income limits (2025):

- Single: Can contribute fully if income < $146,000

- Married filing jointly: Can contribute fully if income < $230,000

- Above these limits? Look into backdoor Roth IRA strategy (legal workaround)

Action:

Open a Roth IRA at Fidelity, Schwab, Vanguard, or Betterment and contribute $7,000 of your $10,000 immediately. This takes 15-20 minutes online. Don’t overthink the platform choice – they’re all good. Just pick one and open the account today.

Please check our recent article “Brokerage Account vs IRA vs 401k“

PRIORITY #3: What to Do with Remaining $3,000

After maxing your Roth IRA ($7,000), you have $3,000 left. You have three solid options, ranked by tax efficiency:

Option A: Increase 401(k) Contributions (Best for Most People)

Use the $3,000 to increase your 401(k) contributions over the next 6-12 months. This is more tax-efficient than a taxable brokerage account.

How this works:

- Your $10K is sitting in your savings account

- Log into your 401(k) and increase contribution by $250-500/month

- Use your $10K savings to replace the reduced take-home pay

- Result: Extra $3,000 in 401(k) (tax-deferred growth), and you’ve deployed your $10K strategically

Why this works:

- 401(k) contributions reduce your taxable income (saves $660-990 in taxes on $3,000, depending on tax bracket)

- Higher contribution limits than IRA ($23,000 annual limit vs $7,000 for IRA)

- Automatic paycheck deductions = forced savings (you can’t accidentally spend it)

- Tax-deferred compounding (you’ll pay taxes in retirement when you might be in a lower bracket)

Example:

You’re contributing 5% to your 401(k) currently. You increase it to 8%. Your paycheck drops by $250/month. You use $250/month from your $10K savings to maintain your lifestyle. After 12 months, you’ve moved $3,000 from savings into your 401(k), saved $660+ in taxes, and built better wealth-building habits.

Option B: Open Taxable Brokerage Account

Invest the remaining $3,000 in a regular taxable brokerage account (also called a “non-retirement account”).

When to choose this:

- You’re already maxing 401(k) contributions ($23,000/year)

- You want flexibility to access money before age 59½

- You’re saving for medium-term goals (5-15 years): sabbatical, down payment, early retirement

Pros:

- No contribution limits (invest $3K, $30K, $300K – whatever you have)

- No withdrawal penalties (access your money anytime, though you’ll owe taxes on gains)

- Flexibility for any goal (retirement, kids’ college, starting a business, buying property)

Cons:

- No tax advantages (you already paid income tax on this money)

- Pay taxes on dividends annually (even if you don’t sell, you owe taxes on dividend income)

- Pay capital gains tax when you sell (15-20% on long-term gains)

Best for:

People saving for pre-retirement goals or those who’ve maxed out all tax-advantaged accounts. If you’re 35 and planning a sabbatical at 45, a taxable brokerage account gives you flexibility that a 401(k) or IRA doesn’t.

Option C: Contribute to HSA (If Eligible)

If you have a high-deductible health plan (HDHP), you’re eligible for a Health Savings Account – the most tax-advantaged account that exists.

HSA triple tax advantage (yes, triple):

- Tax deduction on contributions (like Traditional IRA)

- Tax-free growth (like Roth IRA)

- Tax-free withdrawals for medical expenses (unique to HSA)

No other account offers all three. The HSA is technically better than a Roth IRA for retirement savings if you use it correctly.

2025 contribution limits:

- Individual coverage: $4,300

- Family coverage: $8,550

- Age 55+ catch-up: Additional $1,000

Advanced strategy:

Contribute your remaining $3,000 to max out your HSA. Pay current medical expenses out-of-pocket (save all receipts). Let your HSA grow for decades as a stealth retirement account. After age 65, you can withdraw HSA funds for ANY reason penalty-free (taxed like a Traditional IRA for non-medical expenses, but still tax-free for medical).

Since healthcare costs average $300,000+ per person in retirement, you’ll have plenty of tax-free withdrawal opportunities.

The Complete $10,000 Allocation (Recommended)

STEP 1: Confirm you're getting full 401(k) match (via regular paycheck) ✓

STEP 2: $7,000 → Roth IRA (tax-free growth forever)

STEP 3: $3,000 → Choose one:

- Increase 401(k) contributions (best for most)

- Open taxable brokerage (if maxing 401k already)

- Max HSA (if eligible and strategic)

Total: $10,000 strategically allocated for maximum tax efficiency

Best Investments for Your $10,000

What to Actually Buy with Your $10,000

You’ve chosen your accounts. Good. Now let’s talk about what investments to put inside those accounts. This is where most people overthink and get paralyzed. Don’t be most people.

Investment Option #1: Target-Date Fund (Easiest – Best for Beginners) ⭐

What it is:

One single fund that automatically does everything:

- Holds the right mix of stocks and bonds for your age

- Rebalances automatically (no work required from you)

- Becomes more conservative as you approach retirement

- Diversified across thousands of companies globally

It’s the “set it and forget it” option. Buy it once, add money monthly, check it once a year. That’s it.

How to choose:

Pick the fund matching your expected retirement year. Just guess – it doesn’t have to be exact:

- Planning to retire around 2060? → Target Date 2060 fund

- Planning to retire around 2050? → Target Date 2050 fund

- Planning to retire around 2040? → Target Date 2040 fund

Specific funds to buy:

- Vanguard: VTTSX (Target Retirement 2060) – 0.08% fee

- Fidelity: FDKLX (Freedom Index 2060) – 0.08% fee

- Schwab: SWYNX (Target 2060 Index) – 0.08% fee

Current allocation example (Target 2060 fund):

- 90% stocks (63% U.S. stocks, 27% international stocks)

- 10% bonds

As you age, the fund automatically shifts to more bonds and fewer stocks. By 2060, it’ll be roughly 50/50 stocks and bonds. You do nothing – it happens automatically.

How to execute (step-by-step):

- Open Roth IRA at Fidelity

- Click “Trade” → “Buy”

- Search ticker symbol: “FDKLX”

- Enter amount: $7,000

- Click “Buy”

- Done. You’re invested.

Seriously, it’s that simple. This entire process takes 3 minutes once your account is funded.

Pros:

- Ultimate simplicity (one fund = complete portfolio – nothing easier exists)

- Automatic rebalancing (you literally do nothing)

- Professional management (Vanguard/Fidelity experts manage the fund)

- Extremely low fees (0.08% = $8 per year on $10,000)

- Impossible to screw up (the fund does everything)

Cons:

- Less control over exact allocation (you can’t customize)

- May be too conservative for very young investors (a 25-year-old might want 100% stocks, but Target 2060 has 10% bonds)

Best for:

Complete beginners who want to “set it and forget it” and never think about investing again. This is the option I recommend to my friends who hate finance.

Investment Option #2: Three-Fund Portfolio (Simple DIY)

What it is:

Buy three index funds that together cover the entire global market. This is the strategy recommended by John Bogle (founder of Vanguard) and followed by millions of DIY investors.

The Three Funds:

- U.S. Total Stock Market Index (domestic stocks)

- International Stock Market Index (foreign stocks)

- Bond Index (stability/income)

That’s it. Three funds. Total global diversification. Extremely low fees.

Recommended allocations by age:

For Age 25-35 (Aggressive growth):

- 60% U.S. Total Stock Market

- 30% International Stock Market

- 10% Bond Index

For Age 35-45 (Moderate-aggressive):

- 55% U.S. Total Stock Market

- 25% International Stock Market

- 20% Bond Index

For Age 45-55 (Moderate):

- 45% U.S. Total Stock Market

- 25% International Stock Market

- 30% Bond Index

For Age 55+ (Conservative):

- 35% U.S. Total Stock Market

- 20% International Stock Market

- 45% Bond Index

Specific funds to buy:

At Fidelity (Zero-Fee Options – My Favorite):

- U.S. Stocks: FZROX (Fidelity ZERO Total Market) – 0.00% fee

- International Stocks: FZILX (Fidelity ZERO International) – 0.00% fee

- Bonds: FXNAX (Fidelity U.S. Bond Index) – 0.025% fee

At Vanguard:

- U.S. Stocks: VTSAX (Vanguard Total Stock Market) – 0.04% fee

- International Stocks: VTIAX (Vanguard Total International) – 0.05% fee

- Bonds: VBTLX (Vanguard Total Bond Market) – 0.05% fee

At Schwab:

- U.S. Stocks: SWTSX (Schwab Total Stock Market) – 0.03% fee

- International Stocks: SWISX (Schwab International Index) – 0.06% fee

- Bonds: SWAGX (Schwab U.S. Aggregate Bond) – 0.04% fee

All of these are excellent. The fees are so low (0.00-0.06%) that the difference is negligible. Just pick the broker you prefer.

How to execute – Example with $10,000 at Fidelity (Age 30, aggressive allocation):

$7,000 in Roth IRA:

- Buy $4,200 of FZROX (60% = U.S. stocks)

- Buy $2,100 of FZILX (30% = International stocks)

- Buy $700 of FXNAX (10% = Bonds)

$3,000 in Taxable Brokerage:

- Buy $1,800 of FZROX (60%)

- Buy $900 of FZILX (30%)

- Buy $300 of FXNAX (10%)

Total portfolio across both accounts: 60% U.S. / 30% International / 10% Bonds

Annual maintenance:

Once per year, rebalance if your allocation drifts more than 5% from target. This takes 15 minutes. Example: If U.S. stocks have a great year and grow to 68% of your portfolio, sell some and buy international/bonds to get back to 60/30/10.

Pros:

- Extremely low fees (0.00-0.05% vs 0.50-1.00% for actively managed funds)

- More control over exact allocation

- Tax-efficient (index funds generate minimal taxable events)

- Simple to manage (just three funds to track)

- Backed by decades of research (the Bogleheads community has proven this works)

Cons:

- Requires 3 separate purchases instead of 1 (still only takes 10 minutes total)

- Manual rebalancing once per year (15 minutes of work annually)

- Need to choose allocation yourself (requires 5 minutes of thought)

Best for:

DIY investors comfortable with basic portfolio management. If you can use a spreadsheet, you can manage a three-fund portfolio.

Investment Option #3: Robo-Advisor (Automated Management)

What it is:

A digital platform that automatically builds and manages your portfolio using algorithms. Think of it as a robot financial advisor (hence “robo-advisor”).

Top platforms:

- Betterment: 0.25% annual fee, $0 minimum, automatic tax-loss harvesting

- Wealthfront: 0.25% annual fee, $500 minimum, advanced tax strategies

- M1 Finance: $0 fee, $100 minimum, customizable portfolios

How to execute:

- Open Roth IRA at Betterment

- Answer 5-minute risk tolerance questionnaire

- Deposit $7,000

- Betterment automatically invests in diversified portfolio (typically 10-12 ETFs)

- Set up automatic monthly contributions

- Never think about it again

What you get automatically:

- Personalized portfolio based on your age, goals, risk tolerance

- Automatic rebalancing when allocation drifts

- Tax-loss harvesting (sells losing positions to offset gains – adds ~0.77% annual after-tax return)

- Automatic dividend reinvestment

- No manual management needed (zero work after initial setup)

Fees:

- Betterment/Wealthfront: 0.25% annual fee = $25 per year on $10,000

- M1 Finance: $0 fee (makes money through premium subscriptions and cash balances)

Fee perspective:

0.25% sounds like a lot compared to 0.00% index funds. But tax-loss harvesting typically adds 0.77% in after-tax returns, so you’re actually net ahead by ~0.50% annually. The $25 annual fee pays for itself.

Pros:

- Zero effort required (truly “set it and forget it”)

- Tax-loss harvesting can pay for the fee and then some

- Professional algorithms rebalancing automatically

- Great for beginners who want guidance

- Smart features like automatic rebalancing, dividend reinvestment

Cons:

- Annual fee (though often offset by tax benefits)

- Less control than pure DIY

- Can’t customize as much as three-fund portfolio

Best for:

Hands-off investors who want complete automation and don’t mind paying a small fee for convenience and tax optimization.

Please also check the following article: Best Robo Advisors 2025

Get Started with Betterment

✅ Invest your $10,000 with zero hassle

✅ Automatic tax-loss harvesting (adds ~0.77% annually)

✅ No minimum investment required

✅ Exclusive: Get up to $5,000 managed free for one year

Start Investing with Betterment

(Remark: Affiliate Link – We may earn a commission if you sign up)

What NOT to Do with Your $10,000

These mistakes have destroyed more wealth than market crashes:

❌ Don’t buy individual stocks – One company can go to zero (remember Enron, Lehman Brothers, Theranos). Even “safe” companies like GE lost 80% of value. Diversification protects you.

❌ Don’t try to time the market – “I’ll invest when it drops 10%” sounds smart but fails 90% of the time. You’ll wait forever, miss gains, and invest at higher prices later. Invest today.

❌ Don’t put it all in one investment – Even great investments have bad years. Diversification is the only free lunch in investing.

❌ Don’t follow hot stock tips – Reddit/TikTok/coworker tips lose money 90% of the time. By the time you hear about it, professional investors already bought.

❌ Don’t invest in things you don’t understand – Can’t explain it to a 10-year-old? Don’t invest in it. This includes crypto, options, leveraged ETFs, private equity, NFTs.

❌ Don’t keep it in savings “until rates improve” – Every year in savings vs investing costs you 4-5% in opportunity cost. Over 30 years, that’s $50,000+ in lost wealth.

❌ Don’t check your account daily – Checking daily increases anxiety and bad decisions by 300%. Check quarterly maximum.

Investment Strategy Comparison “how to invest $10’000”

| Strategy | Simplicity | Annual Fees | Control | Best For |

|---|---|---|---|---|

| Target-Date Fund | ⭐⭐⭐⭐⭐ | 0.08% ($8/year) | Low | Complete beginners |

| Three-Fund Portfolio | ⭐⭐⭐⭐ | 0.00-0.05% ($0-5/year) | High | DIY investors |

| Robo-Advisor | ⭐⭐⭐⭐⭐ | 0.00-0.25% ($0-25/year) | Medium | Hands-off investors |

My recommendation: If this is your first time investing $10,000, start with a target-date fund or robo-advisor. Get comfortable with investing first, then you can always switch to a three-fund portfolio later.

Sample $10,000 Portfolios by Age

Your Exact $10,000 Investment Plan Based on Your Age

Stop theorizing. Here are specific portfolios with exact funds and dollar amounts based on your age.

Portfolio #1: Age 25-35 (Aggressive Growth)

Your situation:

- 30-40 years until retirement

- Can handle market volatility

- Maximum growth potential

Goal: Build long-term wealth through aggressive stock allocation

Risk tolerance: High (you have decades to recover from downturns)

Recommended allocation:

- 70% U.S. Stocks ($7,000)

- 20% International Stocks ($2,000)

- 10% Bonds ($1,000)

Exact investments using Fidelity:

$7,000 Roth IRA:

- $4,900 → FZROX (Fidelity ZERO Total Market Index)

- $1,400 → FZILX (Fidelity ZERO International Index)

- $700 → FXNAX (Fidelity U.S. Bond Index)

$3,000 Taxable Brokerage:

- $2,100 → FZROX

- $600 → FZILX

- $300 → FXNAX

Total portfolio: 70% U.S. stocks / 20% International / 10% Bonds

Expected annual return: 8-9% average over decades

In 30 years (age 60): $10,000 → $100,000-132,000

Why this works:

At 25-35, market crashes are actually good for you because you keep buying stocks at lower prices. The 10% bond allocation just reduces volatility slightly, but you’re still 90% stocks for maximum growth. Time is your biggest advantage – use it.

Alternative (even simpler): Just buy $7,000 of Fidelity Freedom Index 2060 (FDKLX) in your Roth IRA and $3,000 in taxable. One fund, done.

Portfolio #2: Age 35-45 (Moderate-Aggressive)

Your situation:

- 20-30 years until retirement

- Building wealth but closer to needing it

- Want growth with slightly less volatility

Goal: Strong growth with modestly reduced risk

Risk tolerance: Moderate-high

Recommended allocation:

- 60% U.S. Stocks ($6,000)

- 25% International Stocks ($2,500)

- 15% Bonds ($1,500)

Exact investments using Vanguard:

$7,000 Roth IRA:

- $4,200 → VTSAX (Vanguard Total Stock Market Index)

- $1,750 → VTIAX (Vanguard Total International Stock Index)

- $1,050 → VBTLX (Vanguard Total Bond Market Index)

$3,000 Taxable Brokerage:

- $1,800 → VTSAX

- $750 → VTIAX

- $450 → VBTLX

Total portfolio: 60% U.S. / 25% International / 15% Bonds

Expected annual return: 7-8% average

In 20 years (age 55-60): $10,000 → $38,697-46,610

Why this works:

Still heavily stocks (85%) for growth, but the increased bond allocation (15%) smooths out volatility as retirement gets closer. You’re balancing growth with modest stability. During the 2008 crash, this allocation would have dropped ~37% vs ~50% for all-stock portfolios—that psychological difference matters.

Portfolio #3: Age 45-55 (Moderate)

Your situation:

- 10-20 years until retirement

- Protecting existing wealth while still growing

- Lower tolerance for big losses

Goal: Balance growth and capital preservation

Risk tolerance: Moderate

Recommended allocation:

- 50% U.S. Stocks ($5,000)

- 20% International Stocks ($2,000)

- 30% Bonds ($3,000)

Exact investments using Schwab:

$7,000 Roth IRA:

- $3,500 → SWTSX (Schwab Total Stock Market Index)

- $1,400 → SWISX (Schwab International Index)

- $2,100 → SWAGX (Schwab U.S. Aggregate Bond Index)

$3,000 Taxable Brokerage:

- $1,500 → SWTSX

- $600 → SWISX

- $900 → SWAGX

Total portfolio: 50% U.S. / 20% International / 30% Bonds

Expected annual return: 6-7% average

In 15 years (age 60-70): $10,000 → $23,966-27,590

Why this works:

The 30% bond allocation significantly reduces volatility – during market crashes, you’ll lose 25-30% instead of 40-50%. This matters more now because you don’t have 30 years to recover. You’re still 70% stocks for growth, but bonds provide a cushion.

Rebalancing note: Check your allocation annually. If stocks have a great year and grow to 60% of your portfolio, sell some and buy bonds to get back to 50/20/30. This forces you to “sell high, buy low” automatically.

Portfolio #4: Age 55+ (Conservative)

Your situation:

- 5-15 years until retirement

- Preserving capital is now a priority

- Can’t afford major losses right before retirement

Goal: Moderate growth while protecting against large losses

Risk tolerance: Low-moderate

Recommended allocation:

- 40% U.S. Stocks ($4,000)

- 15% International Stocks ($1,500)

- 45% Bonds ($4,500)

Exact investments (target-date fund approach for simplicity):

$7,000 Roth IRA:

- $7,000 → VTTHX (Vanguard Target Retirement 2035)

- This fund automatically holds ~55% stocks / 45% bonds and continues getting more conservative

$3,000 Taxable Brokerage:

- $1,800 → VBTLX (Vanguard Total Bond Market)

- $1,200 → VTSAX (Vanguard Total Stock Market)

Approximate total portfolio: 55% stocks / 45% bonds

Expected annual return: 5-6% average

In 10 years (age 65-70): $10,000 → $16,289-17,908

Why this works:

The near-equal stock/bond split (55/45) means you won’t capture all market upside, but you also won’t experience devastating losses. During a 40% stock market crash, your portfolio would drop only ~22% (40% × 55% stocks). That’s recoverable even with a short timeline.

Sequence of returns risk: This matters enormously at this age. If you retire in 2008 with all stocks, you’re devastated. With 45% bonds, you survive and have money to spend while stocks recover.

Portfolio Growth Comparison:

| Age Group | Allocation | 10-Year Growth | 20-Year Growth | 30-Year Growth |

|---|---|---|---|---|

| 25-35 | 90% stocks | $21,589 | $46,610 | $100,627 |

| 35-45 | 85% stocks | $20,190 | $41,445 | $87,550 |

| 45-55 | 70% stocks | $18,385 | $33,637 | $66,212 |

| 55+ | 55% stocks | $16,289 | $26,533 | $49,268 |

Based on 8% average return for stocks, 3% for bonds

Common $10K Investing Mistakes

Avoid These Costly Errors That Destroy Wealth

❌ Mistake #1: Putting All $10K in One Stock

The error: “Apple is a great company. I’ll put all $10,000 in Apple stock!”

Why it’s dangerous:

Even excellent companies can collapse overnight. Enron was Fortune’s “Most Innovative Company” for six consecutive years before going bankrupt and wiping out investors. Lehman Brothers was a 158-year-old institution before disappearing in 2008. General Electric was in the original Dow Jones Index in 1896 and lost 80% of its value between 2000-2020.

One stock = 100% concentration risk. If it drops 50%, you lose $5,000. If it goes bankrupt, you lose everything.

Real example:

Tom was 28 and “knew” Meta (Facebook) was the future. September 2021, he invested his entire $10,000 at $340/share. By October 2022 (13 months later), Meta had crashed to $88/share. Tom lost $7,400 – a 74% loss. He panic-sold at the bottom, locking in that loss permanently.

If Tom had bought an S&P 500 index fund instead, he’d have lost only 15% ($1,500) and would have fully recovered by mid-2023. His account would be worth $14,000+ today.

The fix:

Buy diversified index funds owning hundreds or thousands of companies. When one company fails, it’s 0.01% of your portfolio, not 100%.

❌ Mistake #2: Waiting to Invest “Until the Market Drops”

The error: “The market is too high right now. I’ll wait for a crash, then invest my $10,000 at lower prices.”

Why it doesn’t work:

Markets trend upward 75% of the time. While you wait for the “perfect” entry point:

- You earn 0-5% in savings

- The market earns 8-10%

- The market keeps going up, and your “entry point” gets higher

Eventually you either never invest (losing decades of compounding) or invest at higher prices than if you’d started immediately.

The math that’ll shock you:

Scenario 1: Worst timing ever / Invested $10,000 on the worst day of every year for 20 years (2000-2020) – literally buying right before every crash. Result: Still earned 5.5% annually = $29,177

Scenario 2: Perfect timing / Invested $10,000 on the best day of every year for 20 years. Result: Earned 6.7% annually = $35,835

Scenario 3: Waited for “the right time” and missed the 10 best market days Result / Earned only 2.8% annually = $17,410

Lesson: Waiting costs you more than bad timing. Time in market > timing the market.

Real example:

My friend Jake kept his $10,000 in savings from 2009-2012, waiting for the market to “come back down” after the crash recovery. The S&P 500 tripled during those three years. His “perfect entry point” never came. By the time he invested in 2012, he’d missed 200% gains.

The fix:

Invest immediately. Today’s “high prices” will look cheap in 20 years. Every market “high” has been surpassed by higher highs given enough time.

❌ Mistake #3: Splitting Money Across Too Many Platforms

The error: “$2K at Robinhood for stocks, $2K at Acorns for savings, $2K at Betterment for retirement, $2K at Webull for crypto…”

Problems this creates:

- Impossible to see big picture (what’s your actual asset allocation? No idea.)

- Multiple fees add up (4 platforms × fees = death by a thousand cuts)

- Can’t rebalance efficiently (would require selling on one platform, transferring, buying on another)

- Tax reporting nightmare (5 different 1099 forms at tax time)

- Account minimums matter ($2K in each might not qualify for best fund options)

The fix:

Pick ONE broker for your entire $10,000:

- $7,000 in Roth IRA at Fidelity

- $3,000 in taxable brokerage at Fidelity

- Simple, consolidated, easy to track

Exception: It’s fine to have 401(k) at your employer’s provider + IRA at Fidelity. That makes sense because 401(k) choice is made by your employer.

❌ Mistake #4: Not Investing Because “It’s Not Enough Money”

The error: “I’ll wait until I have $50,000 saved. $10,000 isn’t enough to bother with.”

The brutal truth:

$10,000 invested at age 30 → $217,245 at age 65 (8% return, 35 years)

Waiting 10 years to invest $50,000 at age 40 → $233,971 at age 65 (8% return, 25 years)

Difference: Starting early with $10K beats waiting for $50K by only $16,726

But that analysis assumes you actually save $50K in those 10 years – which most people don’t. Most people who “wait” end up never investing because the goalpost keeps moving.

The fix:

Start NOW with whatever you have. $10,000 is enough. $1,000 is enough. $100 is enough. The habit matters more than the amount.

❌ Mistake #5: Paying High Fees Without Realizing It

The error:

Using a traditional financial advisor charging 1.00% AUM fee, plus buying actively managed mutual funds with 0.75% expense ratios.

Total fees: 1.75% annually

The cost over 30 years:

$10,000 invested for 30 years at 8% gross return:

With 0.05% fees (index funds): $99,580 net

With 1.00% fees (advisor + index funds): $74,288 net

With 1.75% fees (advisor + active funds): $61,838 net

Money lost to high fees: $37,742 (38% of your money gone!)

That’s $37,000+ that went to advisors and fund managers instead of your retirement. All because you didn’t check the fee percentage.

The fix:

- Use low-cost index funds (under 0.10% expense ratio)

- Avoid most financial advisors (unless they’re fee-only charging flat rates)

- If using a robo-advisor, keep it under 0.30% total

How to check fees: Look up your fund’s ticker symbol + “expense ratio” on Google. If it’s above 0.20%, you’re likely overpaying.

❌ Mistake #6: Ignoring Tax-Advantaged Accounts

The error:

Putting all $10,000 in a regular taxable brokerage account because “it’s simpler” or “I might need the money.”

The cost over 30 years:

$10,000 in taxable account for 30 years:

Grows to $100,627

Owe $18,113 in capital gains taxes (20% rate)

Net after taxes: $82,514

$10,000 in Roth IRA for 30 years:

Grows to $100,627

Owe $0 in taxes

Net after taxes: $100,627

Money lost by ignoring Roth IRA: $18,113

That’s nearly $20,000 you’re giving to the IRS unnecessarily.

The fix:

Priority order:

- Max 401(k) to get employer match

- Max Roth IRA ($7,000)

- Increase 401(k) further

- THEN use taxable brokerage for overflow

Only use taxable brokerage after you’ve maxed tax-advantaged options.

❌ Mistake #7: Panic Selling During Market Crashes

The error:

Market drops 20% → You panic → Sell everything → Lock in massive losses → Miss the recovery

Why this destroys wealth:

The worst days and best days in the stock market are usually right next to each other. If you sell during the crash, you miss the recovery.

Historical data:

- If you sold during COVID crash (March 2020) after a 35% drop

- You locked in a 35% loss

- Recovery happened within 5 months (by August 2020)

- By 2024, those who held are up 80%+ from the pre-crash high

- Those who sold and stayed out missed all of it

Real example:

During the 2008 financial crisis, my uncle sold everything after the market dropped 40%. “I’ll get back in when it recovers,” he said. Problem: he never did. He watched from the sidelines for 10 years, then finally reinvested in 2018 – at prices 250% higher than where he sold.

If he’d held through, his portfolio would have recovered by 2012 and tripled by 2018.

The fix:

- Don’t look at your account during crashes

- Don’t sell unless you need the money for planned expenses

- Keep buying through crashes (buying stocks “on sale”)

- Remember: Downturns are temporary, time in market is permanent

Mantra: “The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

Your $10K Action Plan

Implement This Strategy in One Week

Here’s your step-by-step checklist to invest your $10,000 in the next 7 days. Not “someday” – this week.

WEEK 1: PREPARATION & EXECUTION

Day 1 (Monday): Financial Foundation Check ⏱️ 30 minutes

Tasks:

- [ ] Calculate your monthly expenses × 3-6 months = emergency fund target

- [ ] Verify you have emergency fund (or plan to keep $3-5K of your $10K as emergency fund)

- [ ] List all debts with interest rates

- [ ] Confirm no high-interest debt (>8%)

- [ ] Confirm you won’t need this $10K for 5+ years

If you can’t check all boxes: Stop and address foundation issues first. Seriously – don’t skip this.

Day 2 (Tuesday): Account Strategy Decision ⏱️ 30 minutes

Tasks:

- [ ] Check if you’re getting full 401(k) employer match (call HR if unsure)

- [ ] Decide: Roth IRA vs Traditional IRA (choose Roth if under 40 and income <$100K)

- [ ] Plan allocation: $7K to Roth IRA, $3K to 401(k) increase or taxable brokerage

- [ ] Choose broker: Fidelity, Schwab, Vanguard, or Betterment

Decision helpers:

- Prefer completely hands-off? → Betterment (robo-advisor)

- Want lowest fees + DIY control? → Fidelity (zero-fee index funds)

- Want established name? → Vanguard or Schwab

Day 3 (Wednesday): Open Roth IRA ⏱️ 20 minutes

What you need:

- Driver’s license or state ID

- Social Security number

- Bank routing + account number (for transfers)

- Employment info

Steps:

- Go to Fidelity.com (or chosen broker)

- Click “Open an Account”

- Select “Roth IRA”

- Complete application (15 minutes)

- Link your bank account

- Save account number for records

Pro tip: Do this on a computer, not phone – much easier.

Day 4 (Thursday): Fund Your Account ⏱️ 10 minutes

Tasks:

- [ ] Initiate transfer of $7,000 from bank to Roth IRA

- [ ] Wait 1-3 business days for funds to clear (you can’t invest until they clear)

- [ ] While waiting, research which investment to buy (next step)

Note: The money just sits in cash until you actually buy investments. Transferring money ≠ investing. You must take another step to buy the actual funds.

Day 5 (Friday): Choose Your Investment Strategy ⏱️ 30 minutes

Pick ONE option based on your preference:

Option A – Target-Date Fund (easiest):

- [ ] Identify your expected retirement year (age 65)

- [ ] Find matching target-date fund at your broker

- [ ] Fidelity: FDKLX (2060), FDEWX (2050), FDEQX (2040)

- [ ] Plan to invest all $7,000 in this one fund

Option B – Three-Fund Portfolio:

- [ ] Choose allocation based on age (see Portfolio section above)

- [ ] List three funds: US stocks, International stocks, Bonds

- [ ] Calculate dollar amounts: (e.g., $4,200 US, $2,100 Intl, $700 Bonds)

- [ ] Write down exact ticker symbols

Option C – Robo-Advisor:

- [ ] Already done if you opened at Betterment

- [ ] Just deposit money and answer risk questionnaire

Day 6-7 (Monday): Execute Your Investments ⏱️ 15-30 minutes

Once funds have cleared in your account:

For Target-Date Fund:

- [ ] Log into your Roth IRA

- [ ] Click “Trade” or “Buy/Sell”

- [ ] Search fund ticker (e.g., “FDKLX”)

- [ ] Enter amount: $7,000

- [ ] Review and confirm purchase

- [ ] Done! Screenshot for your records

For Three-Fund Portfolio:

- [ ] Buy Fund #1 (e.g., $4,200 of FZROX)

- [ ] Buy Fund #2 (e.g., $2,100 of FZILX)

- [ ] Buy Fund #3 (e.g., $700 of FXNAX)

- [ ] Verify all three purchases went through

- [ ] Screenshot portfolio

For Robo-Advisor:

- [ ] Answer risk tolerance questionnaire

- [ ] Review proposed portfolio

- [ ] Click “Approve” or “Invest”

- [ ] Betterment invests automatically

Confirmation check:

- [ ] Log in and verify you see actual fund holdings (not just cash)

- [ ] Confirm total invested = $7,000

- [ ] All positions show “Purchased” or “Settled”

Day 8 (Tuesday): Allocate Remaining $3,000 ⏱️ 30 minutes

Choose one path:

Path A – Increase 401(k) contributions:

- [ ] Log into 401(k) provider portal

- [ ] Find “Change contribution percentage”

- [ ] Calculate increase needed (e.g., from 5% to 8% = ~$250/month)

- [ ] Submit change (effective next paycheck)

- [ ] Use $3K savings to supplement reduced take-home pay

Path B – Open taxable brokerage account:

- [ ] At same broker as your Roth IRA, click “Open Account”

- [ ] Select “Individual Brokerage Account”

- [ ] Complete application (10 minutes)

- [ ] Transfer $3,000 from bank

- [ ] Buy same investments as in Roth IRA (same allocation)

Path C – Max HSA (if eligible):

- [ ] Verify you have high-deductible health plan

- [ ] Open HSA or check current contribution

- [ ] Increase contributions to max ($4,300 individual, $8,550 family)

- [ ] Use $3K to supplement reduced paycheck

Day 9 (Wednesday): Set Up Automation ⏱️ 20 minutes

This is what separates wealth-builders from one-time investors:

Tasks:

- [ ] Set up automatic monthly transfer: $100-500 from bank → Roth IRA

- [ ] Set up automatic monthly investment: Buy same funds monthly

- [ ] Set calendar reminder: “Review portfolio” every 3 months

- [ ] Set calendar reminder: “Max next year’s Roth IRA” on January 1

Pro automation tip:

- Most brokers let you set “automatic investment” where they automatically buy your chosen funds when money transfers

- This removes all decision-making – money transfers in, immediately invests, you never even see it

Day 10 (Thursday): Final Review & Optimization ⏱️ 15 minutes

Checklist:

- [ ] Verify all $7,000 in Roth IRA is fully invested (not sitting in cash)

- [ ] Verify remaining $3,000 is allocated (401k increase or taxable account)

- [ ] Screenshot your complete portfolio

- [ ] Update personal finance tracking spreadsheet

- [ ] Enable two-factor authentication on brokerage account

- [ ] File account documents somewhere safe

Tax optimization (if applicable):

- [ ] If using taxable brokerage, enable dividend reinvestment

- [ ] If using Betterment/Wealthfront, enable tax-loss harvesting

- [ ] Save all contribution records for tax filing

🎉 CONGRATULATIONS! You’ve Successfully Invested $10,000

What happens now:

First 6 months:

- Your money grows (or drops – both are normal)

- You keep contributing monthly via automatic transfers

- You resist the urge to check daily (check quarterly max)

- You ignore market news and panic headlines

First year:

- Review portfolio once quarterly (not monthly)

- If using three-fund portfolio, rebalance if allocation drifts >5%

- Increase contributions if you get a raise

- On January 1, contribute another $7K to Roth IRA if possible

First 5 years:

- Stay the course through market ups and downs

- Never sell during crashes

- Keep contributing monthly

- Watch your wealth compound

Remember: The difference between people who build wealth and those who don’t isn’t intelligence, luck, or timing. It’s action and consistency.

You took action. Now stay consistent.

Frequently Asked Questions

Q1: Should I invest my $10,000 all at once or dollar-cost average over time?

A: Invest it all at once (lump sum investing).

Vanguard’s 2012 study analyzed historical data across US, UK, and Australian markets and found that lump sum investing outperformed dollar-cost averaging (DCA) about 68% of the time over 10-year periods, with average returns 2.3% higher.

Why lump sum wins:

- Markets trend upward ~75% of the time

- Every month you wait, you miss potential gains

- Time in market > timing the market

However, if investing all $10K at once makes you anxious:

Split it: Invest $5,000 immediately, then $1,000/month for 5 months. This gives you psychological comfort while still getting most of your money working quickly. It’s not mathematically optimal, but it’s better than not investing at all.

Bottom line: Lump sum is optimal if you can handle the volatility. DCA over 3-6 months is fine if it helps you actually invest rather than waiting indefinitely.

Q2: What if the market crashes right after I invest my $10,000?

A: Keep investing and absolutely don’t sell. This exact scenario has happened to millions of investors, and those who stayed invested are fine.

Real scenario from March 2020 (COVID crash):

- February 19, 2020: Invested $10,000 (market peak)

- March 23, 2020: Market crashed 35%, your $10K dropped to $6,500

- Emotional reaction: Panic, fear, regret, temptation to sell

- Correct action: Did nothing, kept contributing monthly

- August 2020: Back to $10,000 (5 months to full recovery)

- November 2024: Worth $18,000+ (80% gain from peak)

The only investors who lost money were those who sold during the crash.

What to do if this happens:

- Don’t look at your account for 6-12 months

- Keep contributing monthly (you’re buying stocks “on sale”)

- Remember history: Every crash has been followed by full recovery + new highs

- Reframe it: Down 30%? You get to buy 30% more shares with your monthly contributions

Historical reassurance: Since 1928, the S&P 500 has experienced 26 crashes of 10%+ and 15 bear markets of 20%+. Every single one recovered to new all-time highs. Not most – ALL.

Q3: Should I invest in Roth IRA or Traditional IRA with my $10,000?

A: Choose Roth IRA if you:

- Are under 40 years old

- Make less than $100,000/year

- Expect higher income in retirement (most people)

- Want flexibility (can withdraw contributions anytime)

- Prefer tax certainty (pay taxes now at known rates)

Choose Traditional IRA if you:

- Are in high tax bracket now (32%+ federal)

- Expect significantly lower income in retirement

- Want immediate tax deduction (reduces this year’s taxable income)

- Are older (50s-60s) and closer to retirement

For most people under 40: Roth IRA is the clear winner.

The math for a 30-year-old:

Roth IRA: $7,000 invested → $70,562 at age 60 → Withdraw $70,562 tax-free

Traditional IRA: $7,000 invested → $70,562 at age 60 → Pay 22% tax → Net $54,838

Roth advantage: $15,724 more after-tax money (28% more wealth)

Plus, Roth has flexibility – you can withdraw your contributions (not earnings) anytime without penalty, making it a backup emergency fund.

Please check our recent article “Brokerage Account vs IRA vs 401k vs Roth IRA“

Q4: Can I withdraw my $10,000 from Roth IRA if I need it in an emergency?

A: Yes, you can withdraw your contributions (the money you put in) anytime, tax and penalty-free. But you cannot withdraw earnings before age 59½ without penalty.

Example:

- January: You contribute $7,000 to Roth IRA

- December: Your account has grown to $10,000

- Emergency happens: You can withdraw $7,000 (your contribution) penalty-free

- The $3,000 in earnings must stay until age 59½ (or you pay 10% penalty + taxes)

How it works in practice:

When you request a withdrawal, the IRS treats it as withdrawing contributions first, earnings second. So if you’ve contributed $7,000 total over the years and it’s grown to $10,000, your first $7,000 out is always contribution (tax and penalty-free).

Important rules:

- Contributions: Withdraw anytime, any reason, no penalty, no tax

- Earnings: Can’t touch until 59½ without 10% penalty

- Exception: First-time home purchase ($10K lifetime limit on earnings withdrawal)

- Exception: Disability or death

This makes Roth IRA an excellent “emergency fund backup” while still serving as a retirement account.

Q5: What returns can I realistically expect on my $10,000?

A: Historical stock market average: 10% annually (before inflation), 7-8% after inflation.

Conservative projections using 8% average (after inflation):

| Time Period | Value |

|---|---|

| 5 years | $10,000 → $14,693 |

| 10 years | $10,000 → $21,589 |

| 20 years | $10,000 → $46,610 |

| 30 years | $10,000 → $100,627 |

Critical understanding: This is AVERAGE over decades. Individual years vary wildly.

Real S&P 500 annual returns (examples):

- Best year (1933): +54%

- Worst year (1931): -43%

- Most years: -10% to +25%

- 2000s lost decade: 0% average (flat for 10 years)

- 2010s boom decade: 13.6% average

Don’t expect smooth 8% every year. Expect:

- Some years: +30% (2013, 2019, 2021)

- Some years: -20% (2002, 2008, 2022)

- Over 20-30 years: Averages to 8-10%

Conservative planning: Use 7% for projections (accounts for inflation and gives you buffer). If markets do better, great. If they do worse, you’re prepared.

Q6: Should I pay off my mortgage or invest my $10,000?

A: Depends entirely on your mortgage interest rate and tax situation.

Decision framework:

Mortgage rate 3-4%: Definitely invest the $10,000

- Reason: 8-10% investment returns > 4% mortgage cost

- Math: 4-6% net gain annually by investing instead of paying mortgage

- Bonus: Mortgage interest may be tax-deductible, effectively lowering your rate to 3%

Mortgage rate 5-6%: Lean toward investing, but it’s close

- Reason: Expected returns still higher, but with more risk

- Compromise: Split it – $5K to mortgage, $5K to investing

Mortgage rate 7%+: Pay down the mortgage

- Reason: Guaranteed 7% “return” by paying down debt is excellent

- Exception: Still max Roth IRA first ($7K), use remaining $3K for mortgage

Mortgage rate 8%+: Definitely pay off mortgage

- Reason: Guaranteed 8% return beats risky stock market returns

Don’t forget tax deductibility:

If you itemize deductions, mortgage interest is deductible:

- 4% mortgage rate

- 24% tax bracket

- Effective rate: 4% × (1 – 0.24) = 3.04%

This makes investing even more attractive vs. paying down the mortgage.

My recommendation for most people: Unless your mortgage is above 6%, invest the $10K. Mortgages are “good debt” at historical low rates.

Q7: What if I don’t have earned income this year? Can I still invest $10,000 in an IRA?

A: You need earned income to contribute to an IRA. No earned income = no IRA contribution.

IRS rules:

- Must have earned income (wages, salary, self-employment income)

- Can contribute up to 100% of earned income OR the annual limit ($7,000), whichever is less

- Investment income (dividends, interest, capital gains) doesn’t count as earned income

Examples:

Scenario 1: Student, no job, parents give you $10,000

- IRA contribution allowed: $0 (no earned income)

- What to do: Invest in taxable brokerage account

Scenario 2: Summer internship, earned $5,000

- IRA contribution allowed: $5,000 (limited by earned income)

- What to do: Contribute $5,000 to IRA, invest remaining $5,000 in taxable account

Scenario 3: Full-time job, earned $50,000

- IRA contribution allowed: $7,000 (full limit)

- What to do: Max IRA with $7,000, invest remaining $3,000 in 401(k) or taxable

Special case – Spousal IRA:

If you’re married and your spouse works, the working spouse can contribute to a Spousal IRA for the non-working spouse:

- Non-working spouse: $7,000 to their IRA

- Working spouse: $7,000 to their IRA

- Total: $14,000 in IRA contributions on one income

Bottom line: No job = no IRA. Get a part-time job earning $7,000+ and you unlock IRA contributions.

Q8: How often should I check my $10,000 investment?

A: Quarterly maximum. Ideally annually.

The data on checking frequency:

Study by Vanguard found investors who check portfolios:

- Daily: Make 90% more trades, earn 30% lower returns

- Monthly: Make 50% more trades, earn 15% lower returns

- Quarterly: Optimal balance of awareness and patience

- Annually: Best returns, lowest anxiety

Why daily checking destroys returns:

- Emotional decisions: You see -5% day and panic-sell

- Overtrading: You try to “fix” temporary fluctuations

- Anxiety spike: Seeing volatility daily creates stress

- Behavioral mistakes: More looking = more tinkering = worse results

Recommended checking schedule:

Month 1: Check once after initial investment to verify everything is correct Months 2-12: Check once per quarter (every 3 months) Year 2+: Check 1-2 times per year, unless major life change

What to do when you check:

- Verify automatic contributions are working

- If three-fund portfolio, rebalance if allocation drifted >5%

- Increase contribution amount if you got a raise

- Log out and don’t look again for 3-6 months

Mental trick: Delete the brokerage app from your phone. Only check from desktop computer. This creates friction that prevents compulsive checking.

Exception: During major market crashes, check LESS, not more. If market is down 20%, deliberately avoid looking for 3-6 months.

Q9: Should I invest my $10,000 or pay off my $10,000 in student loans?

A: Depends on the interest rate. Math is identical to the mortgage question:

Student loan rate < 5%: Invest the $10,000

- Action: Make minimum payments on loans

- Action: Invest $10K for 8-10% expected returns

- Math: Net ahead by 3-5% annually

Student loan rate 5-7%: Split the difference

- Action: $5,000 extra payment on loans

- Action: $5,000 investing

- Reason: Psychological + mathematical balance

Student loan rate > 7%: Pay off the loans

- Action: $7,000 to loans (save $490/year in interest)

- Action: Invest remaining $3,000

- Math: Guaranteed 7% “return” beats risky market returns

CRITICAL EXCEPTION: Always get 401(k) match FIRST, even with high-interest loans.

Employer match = instant 50-100% return, which beats even 15% student loan interest. Get the match, then pay off loans, then increase investing.

Special consideration – Federal student loans:

- Have income-driven repayment options

- Can be forgiven (PSLF, income-driven forgiveness)

- Interest may be tax-deductible (up to $2,500/year)

If you’re on track for loan forgiveness, definitely invest instead of paying extra on loans.

My recommendation for most people: Unless loans are above 7%, invest the money and make normal payments. Student loan debt at 4-5% is historically cheap money.

Q10: What’s better: $10K in Roth IRA or $10K in 401(k)?

A: Follow this exact priority order (don’t deviate):

Priority 1: 401(k) up to employer match

- Why: Instant 50-100% return (free money)

- Action: Ensure you’re getting full match via paycheck deductions

Priority 2: Max Roth IRA ($7,000)

- Why: Tax-free growth forever + more flexibility than 401(k)

- Action: Invest $7,000 of your $10,000 here

Priority 3: Return to 401(k) with remaining money

- Why: Higher contribution limits, tax-deferred growth

- Action: Use remaining $3,000 to increase 401(k) contributions

Why this specific order:

- Employer match is unbeatable: 50-100% instant return beats everything

- Roth IRA > 401(k) because:

- Tax-free withdrawals (vs tax-deferred in 401k)

- More investment options (401k limited to employer’s choices)

- Can withdraw contributions anytime (401k locked until 59½)

- No required minimum distributions (401k forces withdrawals at 73)

- Additional 401(k) still valuable: $23,000 limit vs $7,000 IRA limit

Your $10K allocation:

- ✅ Already getting 401(k) match via paycheck

- $7,000 → Roth IRA

- $3,000 → Increase 401(k) contributions OR taxable brokerage

Never: Skip Roth IRA to put more in 401(k) (unless you’re maxing both, which requires $30K+/year)

Q11: Can I invest my $10,000 if I’m not a U.S. citizen?

A: Yes, but requirements vary significantly based on your visa/residency status.

Work visa holders (H-1B, L-1, TN, etc.):

- ✅ Can contribute to Roth IRA (if you have U.S. earned income)

- ✅ Can contribute to 401(k) through employer

- ✅ Can open taxable brokerage account

- ✅ Subject to U.S. tax on investment gains

- ⚠️ Tax treaty considerations with home country

International students (F-1 visa):

- ❌ Generally cannot contribute to IRA (no earned income)

- ✅ Exception: If you have on-campus job or authorized employment

- ✅ Can open taxable brokerage account

- ⚠️ Some brokers require SSN or ITIN

Permanent residents (Green card holders):

- ✅ Treated identically to U.S. citizens for investment purposes

- ✅ Full access to all retirement accounts

- ✅ All investment account types available

Non-resident aliens (no U.S. work authorization):

- ❌ Most U.S. brokers won’t accept you

- ✅ Alternative: Interactive Brokers (accepts international clients)

- ⚠️ 30% withholding tax on dividends (unless tax treaty)

- ⚠️ Estate tax considerations if you die owning U.S. assets

Action steps for non-citizens:

- Verify your visa status and work authorization

- Confirm you have U.S. earned income (required for IRA)

- Choose brokers that accept non-citizens (Fidelity, Schwab, Interactive Brokers)

- Consult with tax professional familiar with non-resident taxation

Tax considerations:

- File U.S. taxes (1040-NR or 1040) while resident

- Understand tax treaty between U.S. and home country

- Plan for potential tax consequences when leaving U.S.

Q12: Should I use a robo-advisor or invest myself (DIY)?

A: Use robo-advisor if:

- You want completely hands-off investing

- You value tax-loss harvesting (can add 0.5-0.8% annual after-tax return)

- You’re willing to pay 0.25% annual fee ($25/year on $10K)

- You want automatic rebalancing

- You’re a beginner and want guidance

Do it yourself (DIY) if:

- You’re comfortable buying 1-3 index funds

- You want to save the 0.25% fee ($25/year, $250 over 10 years)

- You have time to rebalance once per year (15 minutes)

- You understand basic portfolio construction

- You’re using Fidelity’s zero-fee funds (FZROX, FZILX)

The math comparison (over 30 years on $10,000):

Robo-advisor (Betterment):

- 0.25% fee = $500 over 30 years in fees

- Tax-loss harvesting adds ~0.77% annually (in taxable accounts)

+ Automatic rebalancing

+ Behavioral coaching (prevents panic selling)

= Net benefit: +0.52% annually vs DIY

DIY with index funds:

- 0% advisory fee (just fund expense ratios at 0.03%)

- No tax-loss harvesting (unless you do it manually)

- Manual rebalancing required

= Saves fees but requires discipline

Verdict: For $10,000, robo-advisors often come out ahead due to tax-loss harvesting benefits exceeding the fee.

For amounts over $100,000: DIY becomes more attractive because 0.25% fees grow significantly ($250/year on $100K, $2,500/year on $1M).

My recommendation:

- Beginners with $10K-50K: Robo-advisor (Betterment, M1 Finance)

- Experienced investors or $100K+: DIY with index funds

- Truly hands-off people: Robo-advisor at any amount

Please check our recent article “Best Robo Advisors 2025“

Q13: What if I’m 55+ and only have $10,000 saved for retirement?

A: It’s not too late, but you need aggressive action immediately.

Reality check:

$10,000 alone isn’t enough for retirement. Average retirement lasts 20-30 years and costs $1,000-3,000/month. You’ll need Social Security + savings + potentially part-time work.

Immediate action plan:

Step 1: Invest the $10K aggressively (yes, even at 55)

- Don’t be too conservative – you have 10-20 years until you need this money

- Allocation: 60% stocks / 40% bonds (not 100% bonds)

- Use: Roth IRA for $7,000, taxable brokerage for $3,000

Step 2: Maximize catch-up contributions

- Age 50+: Roth IRA limit is $8,000 (not $7,000)

- Age 50+: 401(k) limit is $30,500 (with $7,500 catch-up)

- Goal: Contribute maximum possible annually

Step 3: Extend your working timeline

- Work 2-3 extra years = massive retirement security improvement

- Each extra year: Save more + delay Social Security + fewer retirement years to fund

Step 4: Optimize Social Security

- Delay until age 70 if possible (8% increase per year from 67 to 70)

- Delaying from 67 to 70 = 24% higher monthly payment forever

Step 5: Aggressive savings rate

- You need to save 25-40% of income for next 10 years

- Cut expenses aggressively

- Consider downsizing home, moving to LCOL area

The math if you act now:

$10,000 invested today at age 55

+ $8,000/year contribution for 10 years

+ 7% average return

= $134,000 at age 65

Combined with:

+ Social Security (~$2,000/month)

+ Part-time work ($1,000/month for 5 years)

+ Downsizing home (reduces housing costs)

= Viable retirement plan

Not viable: Retire fully at 65 with just $134K in savings

Viable: Work until 67, delay Social Security to 70, part-time work 65-70, live modestly

Hard truth: You’ll need to work longer and save aggressively. But taking action today makes it possible. Doing nothing makes it impossible.

Mental reframe: You discovered this problem at 55, not 75. You have time to fix it.

Q14: Should I invest my $10K or keep it for a house down payment?

A: Depends entirely on your home-buying timeline:

Buying house in < 3 years: Keep in high-yield savings

- Why: Stock market could drop 20-30% short-term

- Risk: Can’t afford to lose down payment money

- Action: Keep in high-yield savings earning 4-5% (Marcus, Ally, Wealthfront Cash)

Buying house in 3-5 years: Split strategy

- Action: $5,000 in high-yield savings (secure portion)

- Action: $5,000 in conservative portfolio (60% stocks / 40% bonds)

- Why: Reduces sequence risk while capturing some growth

Buying house in 5+ years (or unsure when): Invest it

- Action: Use Roth IRA for $7,000 (you can withdraw contributions for first home)

- Action: Keep $3,000 in savings as start of down payment fund

- Why: 5+ year timeline allows recovery from potential crashes

Special Roth IRA advantage for home buyers:

- Contribute $7,000 to Roth IRA now

- It grows tax-free

- Can withdraw contributions ($7,000) anytime for down payment

- First-time home buyer exception: Withdraw up to $10,000 in earnings penalty-free

- Total available for home: $7,000 contributions + $10,000 earnings exception = $17,000

Example scenario:

Today: Invest $7,000 in Roth IRA

5 years later: Account worth $10,000 ($7K contribution + $3K growth)

For home purchase:

- Withdraw full $10,000 for down payment (no penalty)

- $7,000 = contribution withdrawal (always allowed)

- $3,000 = first-home exception (up to $10K in earnings)

Best strategy: Max Roth IRA with $7K now, keep $3K in savings. This maximizes flexibility while building wealth.

Q15: How much will my $10,000 grow by retirement?

A: Depends on your age when you invest and the average return you achieve.

Conservative projections using 7-8% average annual return:

Starting at Age 25 (40 years to age 65):

| Return | Final Value |

|---|---|

| 7% | $149,745 |

| 8% | $217,245 |

| 10% | $452,593 |

Starting at Age 35 (30 years to age 65):

| Return | Final Value |

|---|---|

| 7% | $76,123 |

| 8% | $100,627 |

| 10% | $174,494 |

Starting at Age 45 (20 years to age 65):

| Return | Final Value |

|---|---|

| 7% | $38,697 |

| 8% | $46,610 |

| 10% | $67,275 |

Starting at Age 55 (10 years to age 65):

| Return | Final Value |

|---|---|

| 7% | $19,672 |

| 8% | $21,589 |

| 10% | $25,937 |

The brutal lesson:

A 25-year-old earning 7% return ends up with MORE money ($149,745) than a 45-year-old earning 10% return ($67,275).

Starting early > Investment returns

Time is more powerful than returns. This is why you should invest your $10,000 TODAY, regardless of your age.

But don’t forget ongoing contributions:

These numbers assume one-time $10K investment with no additional contributions. In reality, you should keep investing monthly.

Realistic scenario (Age 30):

$10,000 invested today

+ $500/month for 35 years

+ 8% average return

= $1,262,428 at age 65

Your $10K alone: $147,853

Your monthly contributions: $1,114,575

Lesson: Keep contributing. The $10K is just the start.

The message: Invest your $10,000 today, keep contributing monthly, and time will do the heavy lifting.

Conclusion “how to invest $10’000”

You’re Ready to Invest Your $10,000

Let’s recap the complete strategy:

✅ Step 1: Confirm financial foundation (emergency fund, no high-interest debt, 5+ year timeline)

✅ Step 2: Invest $7,000 in Roth IRA (tax-free growth forever)

✅ Step 3: Use remaining $3,000 to increase 401(k) contributions or open taxable brokerage

✅ Step 4: Choose investments (target-date fund for simplicity, three-fund portfolio for control, or robo-advisor for automation)

✅ Step 5: Set up automatic monthly contributions going forward ($100-500/month)

✅ Step 6: Check account quarterly (not daily), rebalance annually, and stay invested through market ups and downs

The Most Important Lesson about “how to invest $10’000”

Investing your $10,000 isn’t about picking the “perfect” investment or timing the market perfectly. It’s about:

- Starting NOW (not waiting for “the right time” that never comes)

- Using tax-advantaged accounts (Roth IRA saves you $1,500-2,500 in taxes vs taxable accounts)

- Buying diversified index funds (eliminates single-stock catastrophic risk)

- Staying invested for decades (compound growth does all the heavy lifting)

- Automating contributions (removes willpower from the equation)

Your $10,000 invested today at 8% becomes:

- $21,589 in 10 years

- $46,610 in 20 years

- $100,627 in 30 years

But only if you actually invest it. Reading this guide changes nothing. Taking action this week changes everything.

Your Action This Week

Don’t let this be another article you read and forget. The difference between your current financial situation and your future wealth isn’t knowledge – it’s implementation.

This week’s commitment:

Monday: Open Roth IRA account (20 minutes)

Tuesday: Transfer $7,000 from bank (5 minutes)

Wednesday-Thursday: Wait for funds to clear

Friday: Buy your chosen investments (15 minutes)

Next Monday: Set up automatic monthly contributions (10 minutes)

Total time investment: 50 minutes to set up a system that builds wealth for the next 30-40 years.

The Final Truth

The difference between people who build wealth and those who don’t isn’t intelligence, luck, or perfect timing.

It’s “action”.

You have $10,000. You have this complete guide. You have everything you need.

The market will have its ups and downs. You’ll see scary headlines. You’ll be tempted to check daily, to panic-sell, to wait for better conditions. Don’t.

Trust the process. Trust compound growth. Trust time.

Your future self – the one retiring comfortably, the one not worried about money, the one who started building wealth at your age – is counting on you to take action today.

Go invest your $10,000. Start building your future.

🎯 Ready to Invest Your $10,000?

Stop researching. Start investing. Choose your path:

Option 1: Hands-Off Investing (Easiest)

Complete automation with professional management

[Start with Betterment →] ✅ Automatic portfolio management

✅ Tax-loss harvesting included

✅ $0 minimum investment

Option 2: DIY Investing (Lowest Cost)

Zero-fee index funds, complete control

[Open Fidelity Account →] ✅ $0 expense ratio index funds

✅ No account minimums

✅ Award-winning platform

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance.

Related Articles:

- [How to Start Investing: Complete Guide for Beginners →]

- [Roth IRA vs Traditional IRA: Which is Better? →]

- [How to Invest $1,000: Strategy for Small Amounts →]

- [Best Robo Advisors 2025: Complete Comparison →]

About the Author: Didi Somm operates Finance & Investments, bringing expertise from his role as former Banker, Trading Company CEO and Diplomate. With a background spanning international business, investment strategy, and alternative investments, he translates institutional investment approaches into actionable strategies for individual wealth builders seeking evidence-based financial guidance.

Last Updated: November 19, 2025