In today’s complex financial landscape, misinformation can be costlier than market volatility itself. Widespread investing myths not only mislead novice investors but also prevent experienced market participants from optimizing their portfolios, resulting in billions of dollars in unrealized gains annually.

Welcome to our comprehensive guide on investing myths debunked – we’re excited to help you avoid these costly mistakes and build real wealth! Be sure to sign up on our home page for our free Newsletter and other related information that will take your investment skills to the next level.

Key Takeaways

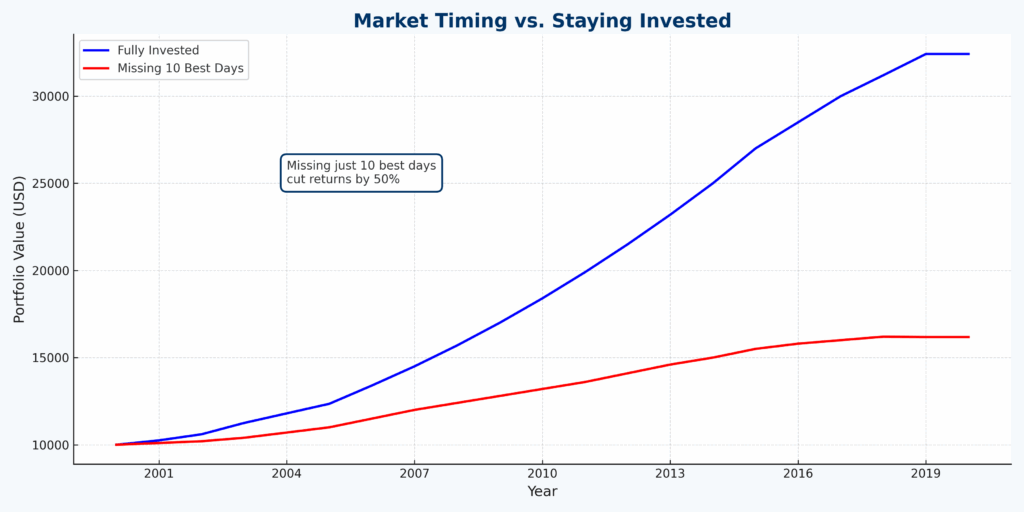

1. Timing the market consistently is virtually impossible, even for professionals. Studies show that investors who stayed fully invested in the S&P 500 from 2010-2020 earned an average annual return of 13.6%, while those who missed just the 10 best trading days saw returns drop to 5.5%.

2. Diversification remains the most reliable risk management strategy. During the 2020 market crash, investors with diversified portfolios including bonds, gold, and select defensive stocks experienced 40% less volatility than those with concentrated positions in high-growth sectors.

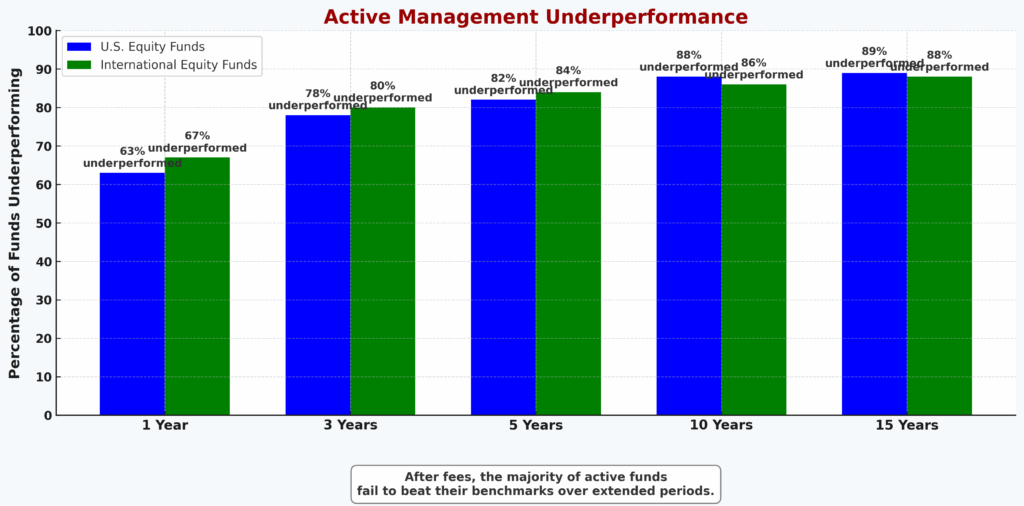

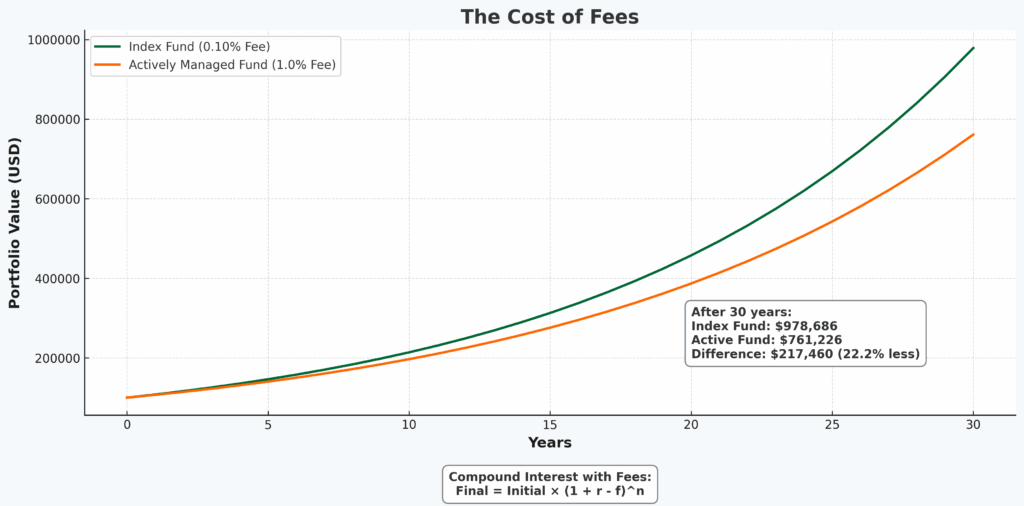

3. Low-cost index investing outperforms 82% of actively managed funds over a 15-year period. An investor placing $100,000 in the average actively managed equity fund in 2010 would have approximately $85,000 less today than if they had chosen a comparable index fund, primarily due to compounding fee differences.

Understanding Investment Misconceptions

Investment myths persist because they often contain partial truths or were once valid strategies that market evolution has rendered obsolete. These misconceptions spread through financial media, social networks, and even within professional circles, creating a challenging environment for investors seeking reliable guidance.

The psychological component cannot be overlooked. Humans naturally seek patterns and simplifications to navigate complex systems like financial markets. This cognitive tendency makes us susceptible to embracing investment “rules of thumb” that promise certainty in fundamentally uncertain environments.

Market structures have changed dramatically in the digital age, with algorithmic trading now accounting for approximately 70-80% of U.S. equity trading volume. This transformation has altered market dynamics in ways that render many traditional investing maxims outdated or entirely incorrect.

Economic cycles also influence which investment strategies appear effective at particular moments, temporarily reinforcing myths during periods when they coincidentally align with market movements. This creates false confidence in approaches that lack sustainable edges.

Understanding the genesis and persistence of these myths is the first step toward developing an evidence-based investment approach that can withstand market turbulence and generate consistent long-term returns.

Common Investing Myths

Myth #1: You Need Significant Capital to Start Investing

Many believe investing requires substantial initial capital, creating a significant barrier to entry. In reality, the financial services industry has undergone a democratization revolution.

The Facts:

- Fractional shares allow investments with as little as $1

- Robo-advisors typically have minimums of $0-$500

- Commission-free trading has eliminated transaction cost barriers

- Dollar-cost averaging works effectively with small regular contributions

For example, an investor contributing just $50 monthly to a broad market index fund beginning at age 25 could accumulate approximately $137,000 by age 65 (assuming 8% average annual returns), demonstrating the power of starting small with consistency.

Myth #2: Market Timing Is Essential for Success

The belief that successful investing requires predicting market movements remains perhaps the most damaging myth in finance.

The Facts:

- A JP Morgan study found that missing just the 10 best days over a 20-year period reduced returns by 50%

- Professional market timers demonstrate no consistent success

- Transaction costs and taxes from frequent trading erode returns

- Emotional decision-making typically leads to buying high and selling low

| Strategy | $10,000 Invested in S&P 500 (2000-2020) |

|---|---|

| Fully Invested | $32,421 |

| Missing 10 Best Days | $16,180 |

| Missing 20 Best Days | $10,167 |

| Missing 30 Best Days | $6,749 |

Myth #3: Active Management Consistently Outperforms Indexing

Despite overwhelming evidence to the contrary, many investors believe professional fund managers reliably beat market averages.

The Facts:

- 89% of actively managed funds underperformed their benchmarks over 10 years

- The average expense ratio for active funds (0.68%) is nearly seven times that of the cheapest index options (0.10%)

- Performance persistence among top-performing managers is statistically indistinguishable from random chance

- Tax inefficiency further reduces active management returns in taxable accounts

Myth #4: Past Performance Predicts Future Results

Investment marketing frequently highlights past performance, despite regulatory requirements to acknowledge its limitations.

The Facts:

- Studies show almost no correlation between top-performing funds in one period and subsequent periods

- Mean reversion often causes recently outperforming strategies to underperform

- Economic conditions that enabled past success rarely persist unchanged

- Investment strategy popularity itself can eliminate previously effective approaches

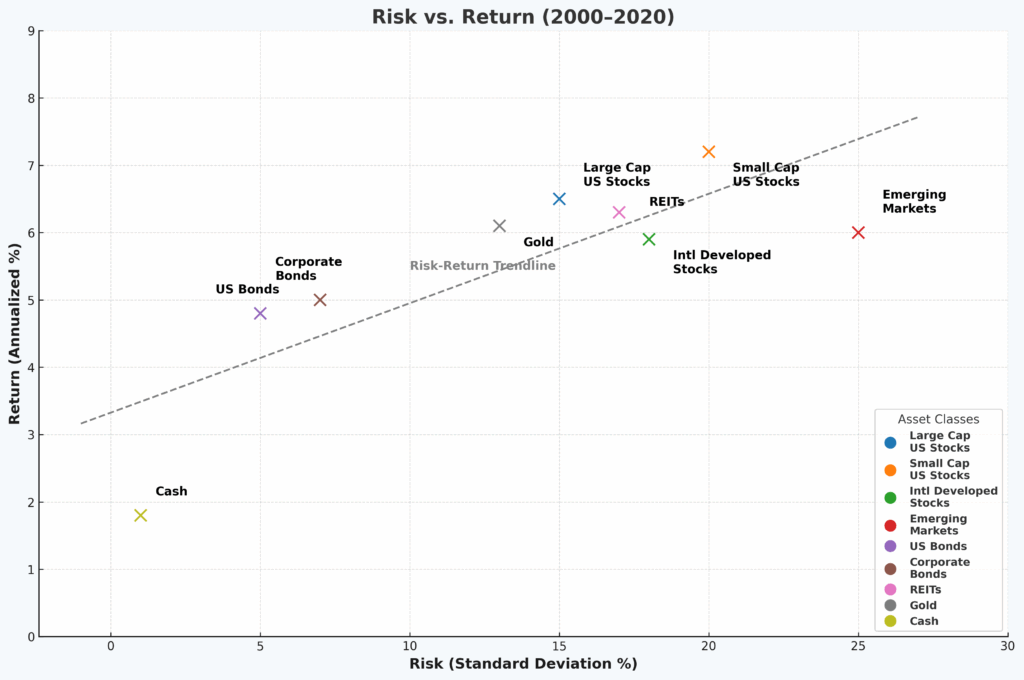

Myth #5: More Risk Always Equals More Return

While risk and return are related, their relationship is more nuanced than commonly believed.

The Facts:

- Low-volatility factors have historically delivered better risk-adjusted returns than predicted by capital asset pricing models

- Unnecessarily concentrated portfolios increase uncompensated risk

- Beyond certain thresholds, additional risk often reduces long-term compounded returns

- Proper risk management actually enhances long-term returns by protecting capital

Benefits of Evidence-Based Investing

Abandoning investment myths in favor of evidence-based approaches delivers substantial benefits across multiple dimensions of the investment experience.

Financial Benefits

Evidence-based investing directly improves financial outcomes through several mechanisms:

- Reduced Costs: By avoiding unnecessary trading and high-fee products, investors retain more of their returns

- Tax Efficiency: Strategic asset location and reduced turnover minimize tax drag

- Risk-Adjusted Performance: Focusing on factors with academic support improves risk-return profiles

- Behavioral Consistency: Evidence-based frameworks reduce costly emotional decisions

Psychological Benefits

Beyond financial improvements, evidence-based investing provides significant psychological advantages:

- Reduced Anxiety: Understanding market mechanisms decreases stress during volatility

- Decision Clarity: Clear principles simplify complex investment choices

- Improved Confidence: Knowledge-based conviction prevents strategy abandonment

- Long-Term Perspective: Evidence encourages appropriate time horizons

Strategic Benefits

Evidence-based approaches also deliver strategic advantages:

- Adaptability: Research-based frameworks evolve with new evidence

- Alignment: Investment decisions connect directly with personal financial goals

- Resilience: Portfolios built on evidence better withstand market disruptions

- Transferability: Clear principles facilitate financial education within families

Challenges in Overcoming Investment Myths

Despite clear evidence contradicting common investment myths, significant challenges impede their correction.

Information Ecosystem Challenges

The financial information landscape often perpetuates rather than dispels myths:

- Financial media prioritizes engagement over accuracy

- Confirmation bias leads consumers to information reinforcing existing beliefs

- Complex statistical concepts prove difficult to communicate effectively

- Vested interests benefit from perpetuating certain misconceptions

Psychological Barriers

Human psychology creates substantial resistance to myth correction:

- Cognitive dissonance makes accepting contradictory evidence uncomfortable

- Loss aversion makes acknowledging investment mistakes painful

- Authority bias leads to uncritical acceptance of “expert” claims

- Narrative fallacy causes overvaluation of compelling stories versus statistical evidence

Practical Obstacles

Practical challenges further complicate myth correction:

- Legacy investment positions create switching costs

- Existing relationships with financial professionals create social friction

- Institutional structures embed traditional approaches

- Performance evaluation metrics often use inappropriate benchmarks

Implementing Evidence-Based Investment Strategies

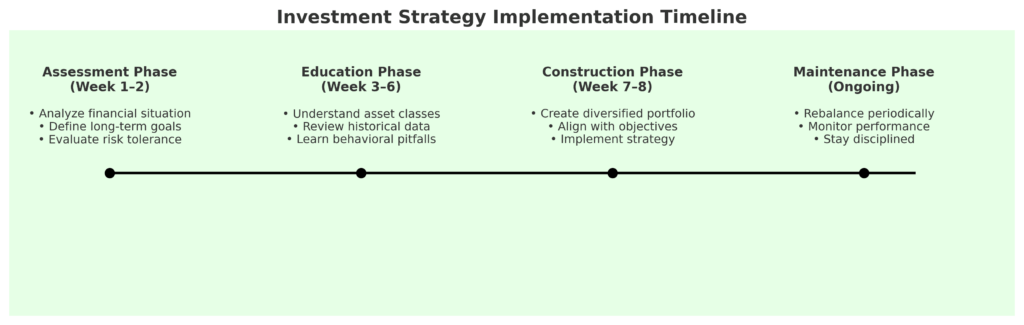

Transitioning from myth-based to evidence-based investing requires a systematic approach.

Assessment Phase

Begin with a comprehensive evaluation of current beliefs and positions:

- Identify which investment myths may influence the current strategy

- Audit the existing portfolio for evidence of myth-based decisions

- Calculate actual historical returns versus appropriate benchmarks

- Determine behavioral patterns in past investment decisions

Education Phase

Build knowledge foundations for evidence-based decisions:

- Explore academic research on market efficiency and factor investing

- Understand portfolio construction principles, including diversification benefits

- Learn proper performance evaluation methodologies

- Study behavioral finance to recognize cognitive biases

Construction Phase

Develop a personalized, evidence-based investment framework:

- Establish clear investment goals with specific metrics

- Determine appropriate asset allocation based on risk capacity

- Select investment vehicles prioritizing low costs and tax efficiency

- Create a written investment policy statement as a decision guide

Maintenance Phase

Establish processes for long-term success:

- Set specific review schedules independent of market movements

- Implement rule-based rebalancing thresholds

- Develop procedures for incorporating new research

- Create documentation systems for investment decisions

Future Trends in Evidence-Based Investing

The landscape of evidence-based investing continues to evolve, with several emerging trends likely to shape future approaches.

Technological Advancements

Technology is transforming evidence-based investing:

- AI-Enhanced Research: Machine learning algorithms increasingly identify subtle market patterns

- Custom Indexing: Direct indexing platforms enable personalized factor tilts

- Risk Visualization Tools: Advanced software improves risk communication

- Behavioral Coaching Apps: Digital nudges help maintain investment discipline

Evolving Factor Understanding

Factor investing research continues advancing:

- Multi-factor interactions show increasing importance

- Factor timing remains elusive but attracts research

- Environmental, social, and governance factors demonstrate potential risk-return relevance

- Factor implementation costs decline with new product development

Democratization Acceleration

Access to sophisticated strategies continues expanding:

- Institutional approaches are increasingly available to individual investors

- Knowledge dissemination accelerates through digital channels

- Cost compression continues across investment vehicles

- Regulatory reforms enhance transparency and comparability

Behavioral Science Integration

Behavioral insights increasingly inform investment processes:

- Decision architecture improvements enhance outcomes

- Communication strategies evolve to address cognitive biases

- Automated guardrails prevent common behavioral mistakes

- Personalization increases based on individual behavioral profiles

FAQs – Investing Myths Debunked

1. How much money do I need to start investing? You can begin investing with as little as $1 through fractional share platforms like Robinhood or M1 Finance. Most robo-advisors have minimums between $0-$500. The key is consistency rather than initial amount, as small regular contributions can grow substantially through compounding over time.

2. Should I invest in individual stocks or funds? For most investors, broadly diversified funds offer superior risk-adjusted returns compared to individual stocks. Research shows that individual stock portfolios require 25+ carefully selected stocks to eliminate nonsystematic risk, a challenging task even for professionals. Index funds and ETFs provide instant diversification at minimal cost.

3. How do I know if my investment fees are reasonable? Benchmark your total expense ratio against industry standards. For broad market U.S. equity exposure, costs should generally remain under 0.10%. International equity exposure might justify costs up to 0.20%, while specialized strategies may warrant slightly higher fees. Never pay loads or sales charges, and scrutinize advisor fees exceeding 0.75% of assets annually.

4. Is real estate always a better investment than stocks? No. When accounting for all costs (maintenance, property taxes, insurance, illiquidity) and using comparable measurement methodologies, U.S. residential real estate has historically returned approximately 3.7% annually after inflation versus 7.1% for stocks. Real estate offers different benefits, including potential leverage, but isn’t inherently superior.

5. Do I need a financial advisor? Not necessarily. Research indicates that disciplined self-directed investors using low-cost index strategies can achieve results comparable to advised clients. However, advisors add particular value through behavioral coaching, complex situation management (business sales, inheritances), and for individuals lacking interest or time for financial management.

6. How often should I check my investments? Research suggests that portfolio review frequency inversely correlates with investment performance due to emotional decision-making. For most long-term investors, quarterly reviews prove sufficient, with additional checks only during major life changes requiring financial reassessment. Frequent checking often leads to overtrading and anxiety.

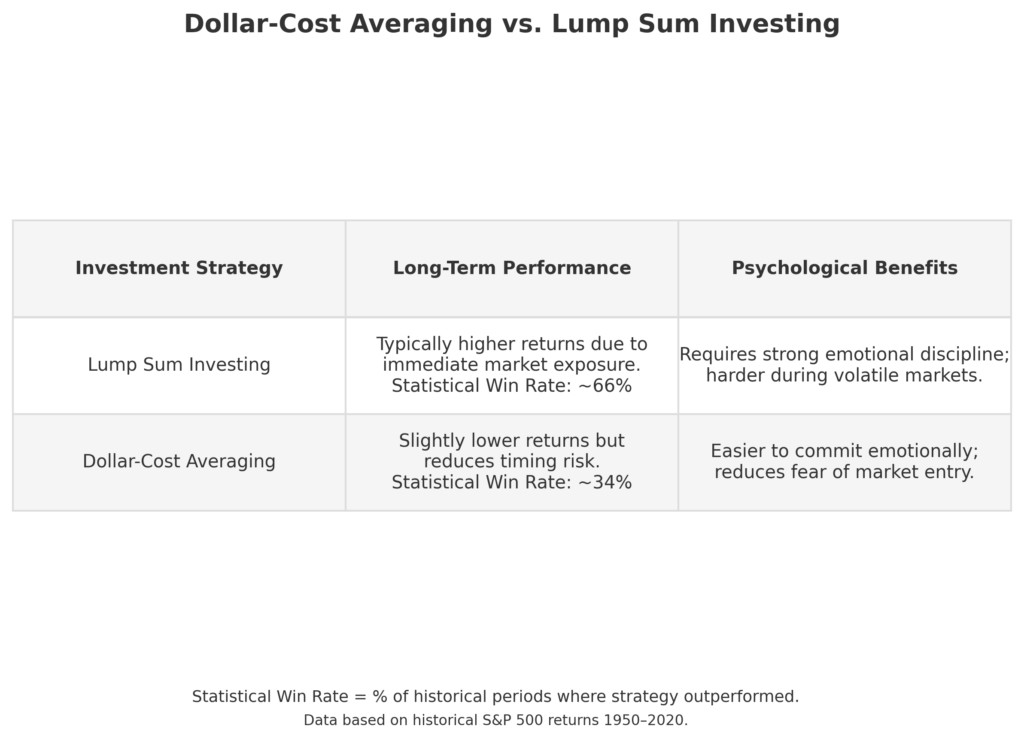

7. Is dollar-cost averaging better than lump-sum investing? Statistically, lump-sum investing outperforms dollar-cost averaging approximately 66% of the time when investing for periods exceeding 10 years. However, dollar-cost averaging may provide behavioral benefits that improve investor discipline. The ideal approach depends on individual risk tolerance and psychological comfort.

8. Should I invest differently during market volatility? Evidence suggests that maintaining strategic asset allocation through volatility yields superior results versus tactical adjustments. However, volatility creates tax-loss harvesting opportunities and may justify planned rebalancing to maintain target allocations. Emotional reactions to volatility typically reduce long-term returns.

9. How do I know if I’m properly diversified? True diversification extends beyond owning multiple investments to ensuring they respond differently to economic conditions. Correlation analysis reveals diversification effectiveness. Properly diversified portfolios include exposure to domestic and international stocks, various bond durations and credit qualities, and potentially alternative assets, all aligned with specific financial goals and time horizons.

10. What’s the biggest mistake most investors make? Research consistently identifies behavioral gaps as the largest detriment to investment success. Specifically, performance chasing—moving money to recently successful strategies—reduces the average investor’s returns by approximately 1.7% annually compared to the very funds they invest in. Maintaining discipline with a evidence-based strategy prevents this common and costly error.

Conclusion

The debunking of investment myths represents more than academic correction – it directly impacts financial outcomes for millions of investors. By replacing misconceptions with evidence-based approaches, investors can significantly improve their probability of achieving financial goals while reducing unnecessary stress and complexity.

The financial services industry continues its transformation from an advice model based on intuition and tradition to one grounded in empirical evidence and academic research. This evolution benefits investors through lower costs, improved transparency, and more reliable outcomes. However, the responsibility ultimately falls to individual investors to distinguish between persistent myths and actionable evidence.

As markets evolve and research advances, today’s best practices will undoubtedly require refinement. The truly successful investor commits not to any particular strategy but to the ongoing process of evaluating evidence and adjusting accordingly.

By maintaining this learning mindset while implementing the evidence-based principles outlined in this article, investors position themselves to navigate whatever market conditions the future may bring.

For your reference, recently published articles include:

-

- Future-Proof Your Portfolio: Surprising Benefits Of Impact Investing

- Seize The Moment: 7 Market Timing Tools For Strategic Wealth

- Investment Pattern Recognition – All You Need To Know

- Never Miss A Rally Again: Ultimate Market Signal Detection

- Investment Strategy Validation: Double Your Returns Now!

- Best AI Investment Advisory – Guide To Boost Your Wealth

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.