Exchange-traded funds (ETFs) have revolutionized investing by offering diversification, low costs, and easy access to multiple markets in a single transaction.

Despite their apparent simplicity, many beginners fall into common traps that can significantly impact their returns and financial goals. Understanding these pitfalls is crucial for navigating today’s increasingly ETF-dominated investment landscape.

In this article, you will discover seven costly beginner mistakes in ETF investing and learn how expense ratio obsession and performance chasing can destroy your returns.

Key Takeaways

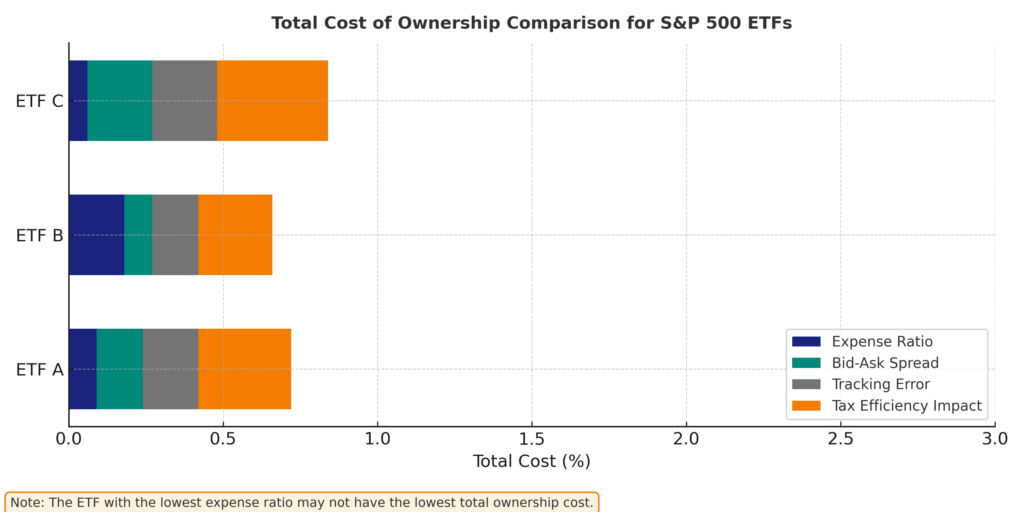

- Looking only at expense ratios can be misleading – While low fees are important, factors such as tracking error, trading spreads, and tax efficiency can have a greater impact on your actual returns. For example, an ETF with a 0.05% expense ratio but wide bid-ask spreads of 0.20% will cost more than an ETF with a 0.10% expense ratio and 0.02% spreads.

- Chasing past performance often leads to disappointing results – Studies show that 78% of investors who switch to last year’s top-performing sector ETFs underperform the broader market by an average of 3.5% annually. Instead, focus on your long-term investment strategy and avoid reacting to short-term market movements.

- Overlooking tax implications can erode your gains – Different ETF structures (physical vs. synthetic) and domiciles can result in withholding tax variations of up to 30% on dividends. A $100,000 investment yielding 3% could face tax differences of $900 annually, depending on the ETF’s structure and your jurisdiction.

Understanding ETFs: The Basics

Exchange-Traded Funds (ETFs) are investment vehicles that track indices, sectors, commodities, or other assets, but trade like stocks on exchanges. Unlike mutual funds, which are priced once at the end of the trading day, ETFs can be bought and sold throughout the day at market prices. This combination of diversification with trading flexibility has fueled their explosive growth, with global ETF assets surpassing $10 trillion in 2023.

ETFs work by pooling investor money to purchase a basket of securities that track their underlying index or asset. The fund provider creates and redeems shares through authorized participants in a process that helps maintain the ETF’s price close to its net asset value (NAV). This creation-redemption mechanism is fundamental to ETF efficiency and distinguishes them from closed-end funds.

Most ETFs are passively managed, meaning they aim to replicate the performance of their benchmark rather than beat it. This approach results in lower operating costs compared to actively managed funds, with expense ratios often below 0.1% for major market ETFs. The passive strategy also leads to greater tax efficiency since there’s less portfolio turnover generating capital gains distributions.

The ETF ecosystem has expanded dramatically from its origins in equity index tracking. Today’s investors can access virtually every asset class, sector, region, and investment strategy through ETFs. This includes bonds, commodities, real estate, currencies, alternative investments, and even sophisticated strategies previously available only to institutional investors.

Understanding these fundamentals provides the foundation for avoiding the common mistakes we’ll explore next.

Mistake #1: Choosing ETFs Based Solely on Expense Ratios

The Problem

A singular focus on expense ratios leads many beginners to overlook other critical cost factors that can have a larger impact on returns. While the expense ratio represents the annual fee charged by the fund manager, it’s just one component of the total cost of ETF ownership.

Many investors automatically select the ETF with the lowest expense ratio when comparing funds tracking similar indexes. However, this approach fails to account for bid-ask spreads (the difference between buying and selling prices), which can exceed the expense ratio, especially for less liquid ETFs. For less frequently traded ETFs, spreads can range from 0.10% to over 1%, dramatically increasing trading costs.

The Solution

Evaluate the total cost of ownership by considering:

- Bid-ask spreads: Check the average spread over 30 days

- Tracking difference: How much the ETF’s performance deviates from its benchmark (can be positive or negative)

- Trading volume: Higher volume generally means tighter spreads

- Premium/discount to NAV: How far the trading price deviates from the underlying asset value

When comparing two similar ETFs, calculate the impact of all costs over your expected holding period. For long-term investments, the expense ratio becomes more important, while for shorter holding periods, trading costs may dominate.

Mistake #2: Chasing Performance and Market Timing

The Problem

The temptation to invest in yesterday’s winners is powerful but often counterproductive. Studies consistently show that investors who chase performance underperform their benchmarks by significant margins. According to Morningstar’s Mind the Gap study, the average investor underperformed the funds they invested in by 1.7% annually over the past decade largely due to poor timing decisions.

This performance chasing manifests when investors pile into sector or thematic ETFs after exceptional runs, only to experience regression to the mean or outright reversals. For example, clean energy ETFs saw inflows of over $5 billion in early 2021 after returning over 140% in 2020, but subsequently declined by more than 40% over the next twelve months.

The Solution

Adopt these strategies instead:

- Implement systematic investing: Use dollar-cost averaging to invest regularly regardless of market conditions

- Rebalance periodically: Trim overperforming assets and add to underperforming ones according to your target allocation

- Set rules for tactical adjustments: If you want some flexibility, establish clear criteria for adjustments rather than making emotional decisions

- Focus on long-term themes: Look for secular trends supported by fundamental changes rather than cyclical momentum

Remember that asset class performance rotates unpredictably. The best performer one year is rarely the leader in subsequent years, making consistent market timing extremely difficult even for professionals.

Mistake #3: Ignoring ETF Structure and Index Methodology

The Problem

Many beginning investors assume all ETFs tracking the same market or sector are essentially identical. This misconception leads them to overlook crucial differences in fund structure, index methodology, and portfolio composition that can significantly impact performance and risk.

For example, two S&P 500 ETFs might use different approaches to track the index:

- Full replication (buying all 500 stocks)

- Optimization (buying a representative sample)

- Derivatives (using futures contracts)

Similarly, two seemingly identical “U.S. Large Cap” ETFs might select and weight stocks differently based on:

- Market capitalization (traditional approach)

- Equal weighting (giving small companies equal influence)

- Factor weighting (emphasizing value, quality, momentum, etc.)

- Fundamental weighting (using metrics like sales or dividends)

These methodological differences can lead to performance divergences of several percentage points annually, especially during market regime changes.

The Solution

Before investing in an ETF:

- Read the prospectus: Understand exactly how the ETF is constructed and managed

- Examine the index methodology: How are securities selected and weighted?

- Review historical tracking error: Has the ETF consistently achieved its objective?

- Check portfolio holdings: Are there unexpected concentrations or omissions?

- Understand rebalancing frequency: How often is the portfolio adjusted?

Choose ETFs whose methodologies align with your investment philosophy and objectives rather than simply selecting the largest or most popular fund in a category.

Mistake #4: Overlooking Liquidity Considerations

The Problem

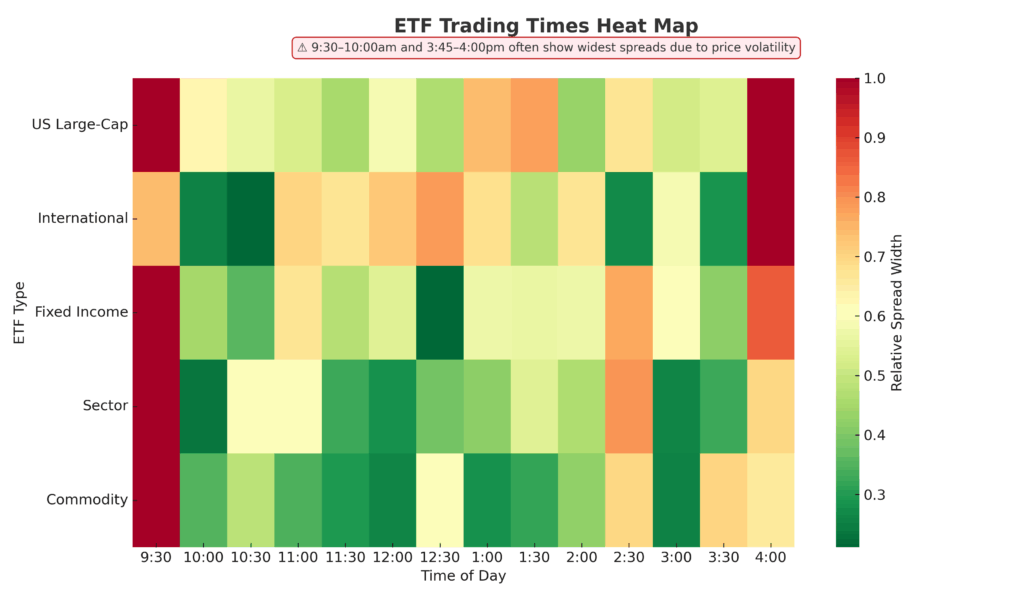

ETF liquidity operates on two levels: secondary market liquidity (how easily the ETF shares trade) and underlying asset liquidity (how easily the fund can buy/sell its holdings). Beginners often focus only on the first level by checking trading volume, while ignoring the second level, which can be more important.

This oversight becomes particularly problematic with:

- Niche sector or thematic ETFs: May hold less liquid stocks

- Fixed income ETFs: The underlying bond market can be illiquid

- Emerging market ETFs: Local markets may have trading restrictions

- Commodity ETFs: Physical storage or futures contract rolling can cause inefficiencies

Poor liquidity manifests in wider bid-ask spreads, greater premiums/discounts to NAV, and potential difficulties exiting positions during market stress. During the March 2020 market disruption, some bond ETFs traded at discounts exceeding 5% to their reported NAV due to underlying market illiquidity.

The Solution

To manage liquidity risk:

- Use limit orders: Specify your maximum purchase price or minimum selling price

- Avoid trading near market open/close: Spreads are typically wider during these periods

- Check the creation/redemption mechanism: Understand how new shares are created

- Assess underlying asset liquidity: Consider what the ETF actually holds

- Monitor premium/discount history: Look for persistent or extreme deviations from NAV

For less liquid ETFs, consider whether the investment thesis justifies the additional costs and risks associated with potentially challenging exit points.

Mistake #5: Redundant Holdings and Over-Diversification

The Problem

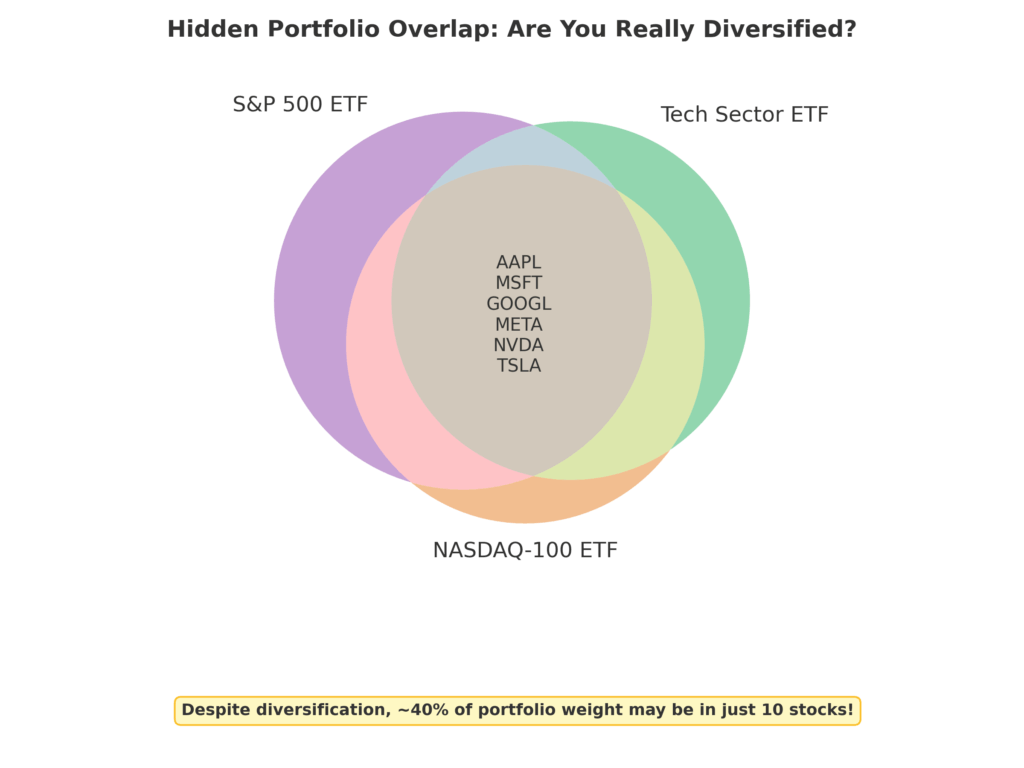

As ETF offerings proliferate, investors increasingly build portfolios containing multiple ETFs with significant overlap, creating unintentional concentration and defeating the purpose of diversification. This redundancy often occurs when combining:

- Broad market ETFs with sector ETFs

- Multiple thematic ETFs covering related innovations

- Regional ETFs alongside country-specific ETFs

- Factor ETFs with overlapping exposures

For example, an investor holding a U.S. total market ETF, a technology sector ETF, and a NASDAQ-100 ETF might have over 40% effective exposure to just 10 large tech companies without realizing it. This hidden concentration amplifies risk during sector-specific downturns.

Conversely, some investors fragment their portfolios across dozens of narrowly-focused ETFs, creating complexity without additional diversification benefit and increasing overall costs.

The Solution

To build a coherent ETF portfolio:

- Map your overall exposures: Use portfolio analysis tools to identify overlaps

- Start with core positions: Build around broad, low-cost funds covering major asset classes

- Add satellite positions strategically: Use specialized ETFs only for specific exposures you want to overweight

- Consider all-in-one ETFs: Asset allocation ETFs can provide complete diversification in a single fund

- Consolidate similar exposures: Replace multiple overlapping funds with a single broader ETF

Aim for the minimum number of ETFs needed to achieve your diversification and strategic objectives. For most individual investors, 5-10 well-selected ETFs can provide comprehensive global exposure.

Mistake #6: Misunderstanding ETF Distributions and Tax Implications

The Problem

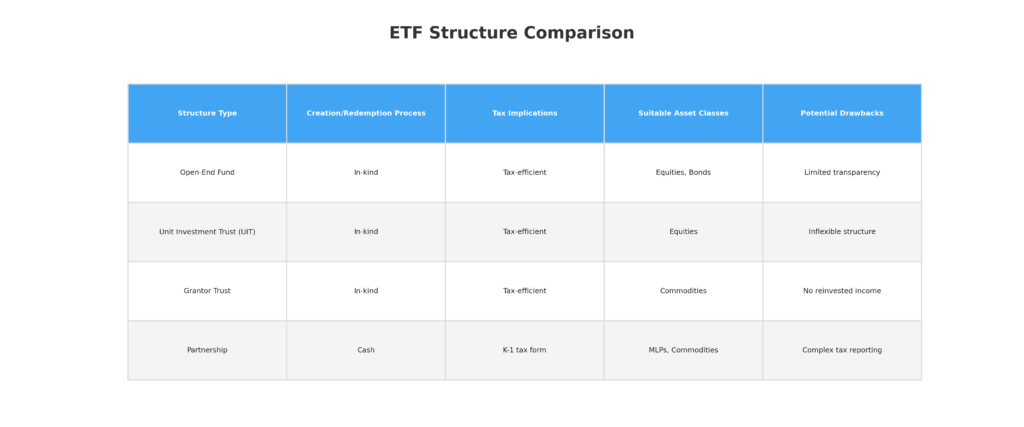

ETFs are generally more tax-efficient than mutual funds due to their creation/redemption mechanism, which minimizes capital gains distributions. However, different ETF structures and domiciles create varying tax consequences that many beginners overlook.

Key tax considerations include:

- ETF domicile: U.S.-domiciled vs. European-domiciled vs. other jurisdictions

- Withholding taxes: Multiple layers can apply to international investments

- Distribution policies: Some ETFs distribute income while others reinvest it

- Capital gains distributions: More common in certain ETF types

- Tax treatment of different assets: Commodities, REITs, MLPs, etc. have special tax rules

For example, a U.S. investor holding a European-domiciled ETF tracking U.S. stocks could face non-recoverable withholding taxes and unfavorable tax reporting requirements. Similarly, commodity ETFs structured as partnerships have different tax reporting than those structured as grantor trusts.

The Solution

To optimize tax efficiency:

- Match ETF structure to account type: Consider tax-advantaged accounts for less tax-efficient ETFs

- Research domicile implications: Understand the tax treaties affecting cross-border investments

- Review distribution history: Check frequency and type of distributions (qualified dividends, interest, capital gains)

- Consider direct indexing: For larger portfolios, custom solutions may offer greater tax efficiency

- Consult a tax professional: Get advice specific to your situation when investing internationally

Keep good records of all purchases, reinvested distributions, and corporate actions affecting your ETF holdings to accurately calculate your cost basis when selling.

Mistake #7: Trading ETFs Ineffectively

The Problem

The stock-like trading flexibility of ETFs is both an advantage and a potential pitfall. Many beginners execute ETF trades suboptimally, resulting in unnecessary costs and poor execution prices. Common trading mistakes include:

- Using market orders during volatile periods: Can result in execution far from expected prices

- Trading at market open/close: When bid-ask spreads are typically widest

- Ignoring the premium/discount to NAV: Buying at significant premiums or selling at discounts

- Using stop-loss orders inappropriately: Can trigger during flash crashes or temporary dislocations

- Trading too frequently: Accumulating costs that erode returns

For instance, during the 2020 market volatility, many fixed-income ETFs experienced price dislocations where market prices diverged significantly from reported NAVs, sometimes by over 5%. Investors using market orders during these periods often received unfavorable executions.

The Solution

Implement these best practices when trading ETFs:

- Use limit orders: Specify the maximum price you’re willing to pay or minimum price to accept

- Trade during mid-day hours: When markets are typically more liquid

- Check iNAV (indicative NAV): Compare the trading price to the real-time estimated value

- Consider time zones: For international ETFs, trading when underlying markets are open may improve pricing

- Use conditional orders cautiously: Understand how they behave during market dislocations

- Compare exchange prices: Some ETFs trade on multiple exchanges at slightly different prices

For large orders relative to an ETF’s average volume, consider breaking the trade into smaller pieces or consulting with your broker about block trading options.

Types of ETFs

ETFs come in various categories that serve different investment objectives and strategies:

| ETF Type | Description | Example

Ticker |

Typical Expense

Ratio |

|---|---|---|---|

| Broad Market | Track entire markets or large segments | VTI, SPY | 0.03% – 0.10% |

| Sector | Focus on specific industries | XLF, XLE | 0.10% – 0.35% |

| Smart Beta/Factor | Target specific investment factors | QUAL, MTUM | 0.15% – 0.40% |

| Thematic | Track emerging trends or themes | ARKK, ICLN | 0.40% – 0.75% |

| Fixed Income | Hold bonds and debt securities | AGG, BND | 0.04% – 0.25% |

| Commodity | Track raw materials prices | GLD, USO | 0.25% – 0.75% |

| Inverse/Leveraged | Magnify or reverse index movements | TQQQ, SH | 0.90% – 1.25% |

| International | Track non-U.S. markets | VEA, EEM | 0.05% – 0.50% |

| ESG | Focus on environmental, social, and governance criteria | ESGU, ESGD | 0.10% – 0.50% |

| Multi-Asset | Combine multiple asset classes | AOR, AOA | 0.15% – 0.30% |

Each type serves different purposes in portfolio construction, with varying risk profiles and suitable holding periods. Beginners should typically focus on broad market ETFs before venturing into more specialized categories.

Benefits of ETF Investing

ETFs offer numerous advantages that have contributed to their popularity:

- Low costs: Average expense ratios have fallen to 0.18%, with some index ETFs below 0.05%

- Tax efficiency: The creation/redemption mechanism minimizes capital gains distributions

- Diversification: Instant exposure to hundreds or thousands of securities

- Transparency: Most ETFs disclose holdings daily, unlike mutual funds

- Liquidity: Can be bought and sold throughout the trading day

- Accessibility: Low investment minimums and available in most brokerage accounts

- Precision: Targeted exposure to specific markets, sectors, or strategies

- Flexibility: Can be used for long-term investing or short-term tactical positions

These benefits have made ETFs suitable for both buy-and-hold investors and active traders. The democratization of investment access through ETFs has allowed ordinary investors to build globally diversified portfolios at a fraction of the cost possible just decades ago.

Challenges and Risks of ETF Investing

Despite their advantages, ETFs come with several risks and challenges:

- Market risk: ETFs don’t protect against general market declines

- Tracking error: Some ETFs may not perfectly match their benchmark performance

- Liquidity risk: Specialized ETFs may trade with wide spreads or at prices far from NAV

- Counterparty risk: Synthetic ETFs and some commodity ETFs involve agreements with financial institutions

- Structure risk: Complex ETFs using derivatives or leverage may behave unexpectedly

- Closure risk: Unprofitable ETFs may liquidate, forcing investors to realize gains/losses

- Behavioral risk: Easy trading can lead to poor timing decisions and overtrading

- Concentration risk: Some indices are heavily weighted toward a few companies or sectors

These risks vary significantly across ETF types. For example, a broad market equity ETF presents mainly market risk, while a leveraged commodity ETF adds structural complexity, counterparty exposure, and potential tracking issues during volatile periods.

How ETFs Work in Practice

The practical implementation of ETF investing involves several steps:

- Setting investment goals: Define objectives, time horizon, and risk tolerance

- Asset allocation: Determine appropriate mix of stocks, bonds, and alternatives

- ETF selection: Choose specific ETFs to implement the allocation

- Account setup: Open appropriate account types (taxable vs. retirement)

- Order execution: Place trades using appropriate order types

- Regular monitoring: Review performance against benchmarks

- Rebalancing: Periodically adjust allocations back to targets

- Tax management: Harvest losses and manage distributions

A disciplined approach to these steps helps avoid many of the mistakes discussed earlier. For example, a systematic rebalancing process naturally counters performance chasing by selling recent winners and buying recent underperformers.

Most investors benefit from a core-satellite approach, using broad market ETFs for the majority of their portfolio (core) while adding selective exposure to specific sectors or strategies (satellites) based on their outlook or goals.

Future Trends in ETF Investing

The ETF landscape continues to evolve rapidly, with several trends likely to shape the future:

- Direct indexing: Technology enabling personalized index portfolios with greater tax efficiency

- Active ETFs: Growth in transparent and semi-transparent actively managed ETFs

- ESG integration: Expansion of environmental, social, and governance focused strategies

- Thematic investing: More products targeting specific innovations and megatrends

- Fee compression: Continuing decline in expense ratios across categories

- Tokenization: Potential blockchain-based ETF structures with enhanced features

- Custom indexing: Growth in bespoke indices targeting specific outcomes

- Democratization of alternatives: More access to private markets and alternative strategies

These trends will likely provide investors with more choices but also increase complexity. The distinction between ETFs, mutual funds, and separately managed accounts may blur as features converge across product types.

FAQs – Beginner Mistakes in ETF Investing

- What’s the minimum amount needed to start investing in ETFs? The minimum is typically the price of a single share, which can range from under $50 to several hundred dollars. Many brokerages now offer fractional shares, allowing you to start with as little as $1.

- How do ETF taxes compare to mutual funds? ETFs are generally more tax-efficient than mutual funds due to their creation/redemption mechanism, which minimizes capital gains distributions. However, ETFs still distribute dividends and sometimes capital gains that are taxable.

- Can ETFs be used for retirement accounts? Yes, ETFs can be held in IRAs, 401(k)s, and other retirement accounts. Their low costs make them particularly suitable for long-term retirement investing.

- What’s the difference between market orders and limit orders for ETFs? A market order executes immediately at the best available price, while a limit order executes only at your specified price or better. For ETFs, limit orders help protect against unexpected price movements.

- How many ETFs should I own in my portfolio? A well-diversified portfolio can be built with just 3-7 broadly diversified ETFs. Adding more specialized ETFs should be done strategically to avoid unnecessary overlap or complexity.

- What are the main differences between ETFs and index mutual funds? ETFs trade throughout the day like stocks, while mutual funds trade once daily. ETFs are typically more tax-efficient and often have lower expense ratios and investment minimums.

- Are leveraged ETFs suitable for long-term investing? No, leveraged ETFs are designed for short-term trading, usually single-day holding periods. They experience “volatility decay” over longer periods that can significantly erode returns.

- How do I know if an ETF is liquid enough? Check the average daily trading volume, bid-ask spread, and assets under management. Also, consider the liquidity of the underlying assets the ETF holds.

- Should I reinvest ETF distributions automatically? This depends on your investment goals and account type. In taxable accounts, manual reinvestment may offer better tax-loss harvesting opportunities. In retirement accounts, automatic reinvestment is usually preferred.

- What happens if an ETF closes? If an ETF liquidates, your shares will be sold at net asset value, and you’ll receive cash proceeds. This forces recognition of any capital gains or losses and requires finding a replacement investment.

Conclusion

Exchange-Traded Funds have revolutionized investing by providing efficient access to virtually every asset class, region, and strategy. Their growth from niche products to mainstream investment vehicles reflects their compelling advantages in terms of cost, transparency, and flexibility. By understanding and avoiding the seven common mistakes we’ve explored, beginner investors can harness the full potential of ETFs while minimizing unnecessary risks and costs.

The future of ETF investing promises even greater innovation and accessibility. As the industry evolves, the key principles of disciplined investing remain unchanged: Maintain a long-term perspective, focus on total costs rather than just expense ratios, understand what you own, diversify appropriately, and implement tax-efficient strategies.

By embracing these proven strategies and sidestepping the pitfalls that have tripped up countless investors before you, you’ll be well-positioned to build an ETF portfolio that actually delivers on your financial dreams, whether you’re just starting out or already have years of investing under your belt.

For your reference, recently published articles include:

- Unlock Hidden Perks: Best Credit Cards For Freelancers Revealed!

- Build A Fortune: Trading Algorithm Development Made Simple

- Professional Investment Portfolio Reporting – Best Guide For You

- Market Data Visualization – Best Tools To Boost Your Wealth

- Stay Legal, Get Rich: Investment Compliance Monitoring Made Easy

- Portfolio Attribution Analysis: The Ultimate Guide

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.