Investment Research Platforms That Give You the Edge: Institutional Tools for Exceptional ReturnsIn today’s gig economy, freelancers face unique financial challenges that traditional employment doesn’t present. Managing inconsistent income streams while maintaining business expenses requires specialized financial tools, such as credit cards for freelancers.

Before applying for just any credit card, freelancers should understand which options are specifically designed to complement their irregular income patterns and business needs.

Key Takeaways

- Separate business expenses from personal finances: Dedicated business credit cards help freelancers track tax-deductible expenses more efficiently, potentially saving thousands in deductions that might otherwise be overlooked when personal and business expenses intermingle.

- Cash flow management is critical: Cards offering 0% APR introductory periods (some extending up to 15 months) can serve as interest-free short-term financing during client payment gaps, helping freelancers maintain operations without accruing high-interest debt.

- Reward structures matter: Freelancers should prioritize cards with bonus categories aligned with their specific business spending patterns; for example, a digital marketing freelancer might benefit more from a card offering 3x points on advertising expenses than one providing travel benefits.

Understanding Freelancer Financial Needs

The financial landscape for independent contractors differs significantly from that of traditional employees. Freelancers manage both the professional and administrative aspects of their businesses, including billing, expense tracking, and tax preparation. Without a steady paycheck, cash flow can fluctuate dramatically between project payments, creating periods of feast or famine.

Credit cards designed for small businesses and freelancers can serve multiple purposes: separating business expenses from personal finances, providing short-term financing during gaps in client payments, building a business credit history, and earning rewards on common business expenses. However, not all credit cards accommodate the unique needs of freelance work.

The ideal credit card solutions for freelancers balance flexibility with structure, offering benefits that accommodate variable income while providing tools to manage expenses efficiently. Understanding these fundamental needs is essential before evaluating specific card options.

Types of Credit Cards for Freelancers

Business Credit Cards

Business credit cards are specifically designed for business-related expenses and often come with features such as accounting tools, expense categorization, and multiple employee cards. These cards typically report to business credit bureaus rather than personal ones, helping freelancers build dedicated business credit profiles.

Key Features:

- Employee cards with spending limits

- Business-specific expense categories

- Integration with accounting software

- Higher credit limits than personal cards

- Business-focused rewards structures

Best For: Established freelancers with significant monthly business expenses who need detailed expense tracking and want to build business credit.

Personal Credit Cards for Business Use

Some freelancers, especially those just starting out, may find that certain personal credit cards offer valuable benefits for their business activities without requiring formal business structures or high revenue thresholds.

Key Features:

- Generally easier approval requirements

- May offer relevant bonus categories

- Lower or no annual fees

- Reports to personal credit bureaus

- No separate business credit history building

Best For: New freelancers with modest expenses or those who haven’t established formal business structures.

Secured Business Credit Cards

For freelancers with limited credit history or previous credit challenges, secured business cards offer an entry point to business credit with reduced risk for card issuers.

Key Features:

- Requires security deposit

- Lower credit limits initially

- Opportunity to graduate to unsecured cards

- Business credit building

- Basic expense tracking features

Best For: Freelancers rebuilding credit or establishing initial business credit history.

Charge Cards

Unlike traditional credit cards, charge cards require full payment each billing cycle but often come with no preset spending limit.

Key Features:

- No preset spending limit

- Full balance due monthly

- Premium business services

- Higher annual fees

- Robust rewards programs

Best For: Freelancers with stable cash flow who need flexibility for large purchases and won’t carry balances.

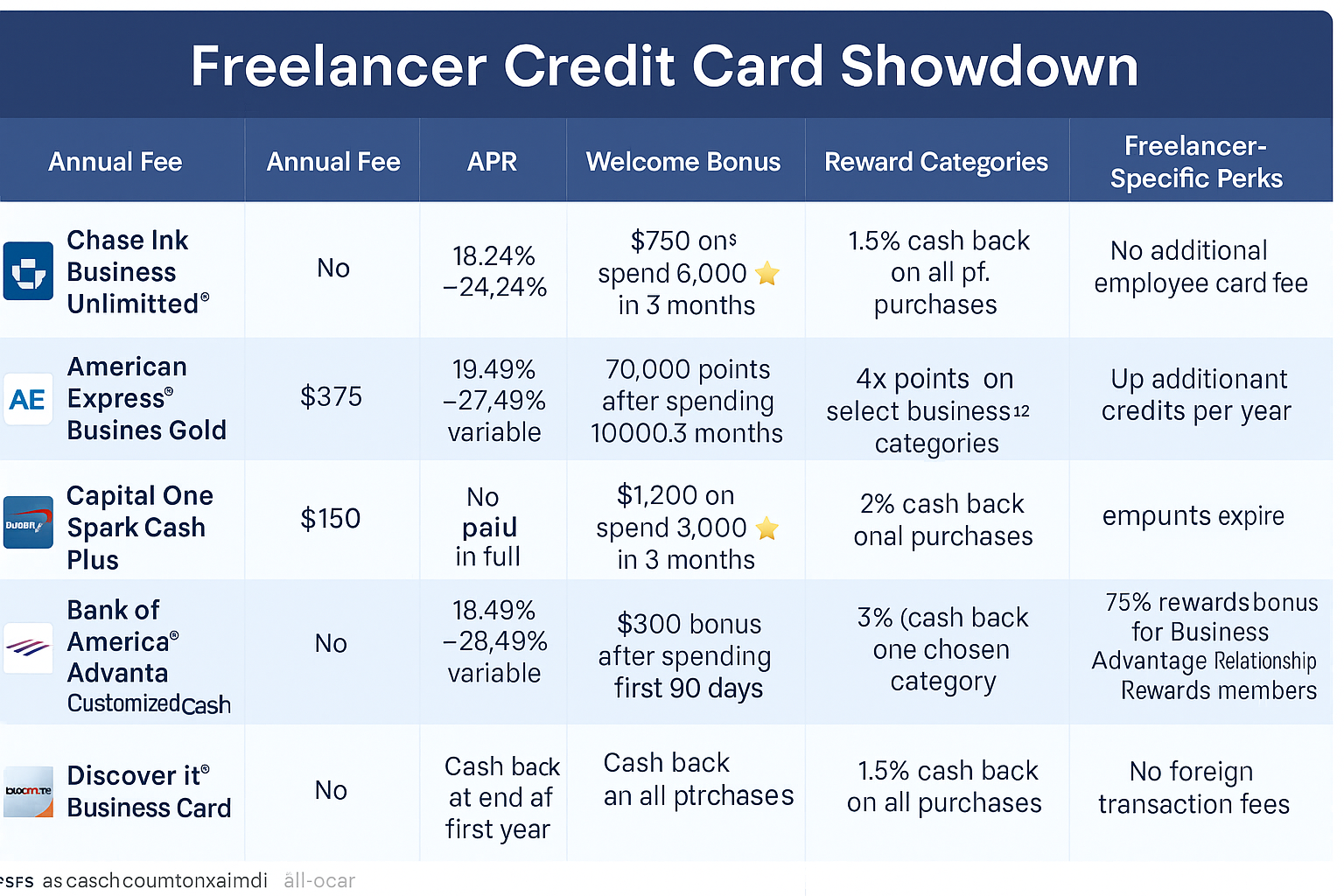

Disclaimer: The information in the above chart is deemed accurate but not guaranteed. No liability assumed by the author of this article

Comparison of Credit Card Types for Freelancers

| Card Type | Credit Requirements | Annual Fee Range | Key Benefits | Best For |

|---|---|---|---|---|

| Business Credit Cards | Good to Excellent (670+) | $0-$595 | Business-specific rewards, expense management tools | Established freelancers with regular expenses |

| Personal Cards for Business | Fair to Excellent (580+) | $0-$250 | Lower approval requirements, consumer protections | New freelancers, side hustlers |

| Secured Business Cards | Poor to Fair (300-670) | $0-$50 | Credit building, basic business features | Credit builders, business credit starters |

| Charge Cards | Good to Excellent (670+) | $95-$695 | No preset spending limits, premium benefits | High-volume spenders with stable cash flow |

Benefits of Specialized Credit Cards for Freelancers

Tax Advantages

Using dedicated business credit cards creates a clear separation between personal and business expenses, simplifying tax preparation and potentially increasing the identification of deductions.

Freelancers can easily generate expense reports categorized by tax-relevant groupings, reducing the time spent organizing receipts and statements during tax season. This separation also strengthens the case for business deductions if audited by demonstrating clear business purpose for expenses.

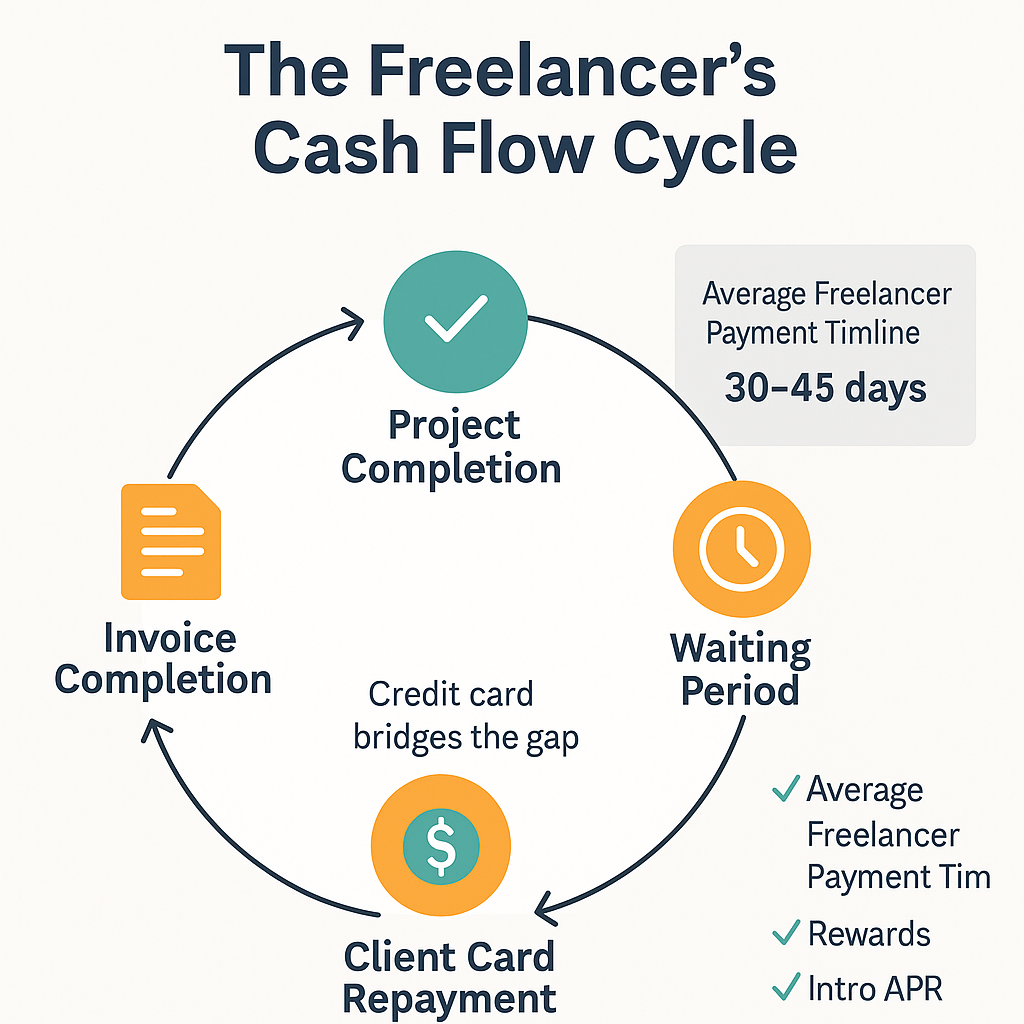

Cash Flow Management

Perhaps the most significant benefit for freelancers is the ability to smooth out irregular income patterns. With payment terms often extending to 30, 60, or even 90 days, credit cards can bridge financial gaps between project completion and client payment.

Cards offering 0% APR introductory periods effectively provide interest-free short-term loans, allowing freelancers to cover essential expenses while waiting for invoices to be paid. This flexibility prevents disruptions in business operations during slow payment periods.

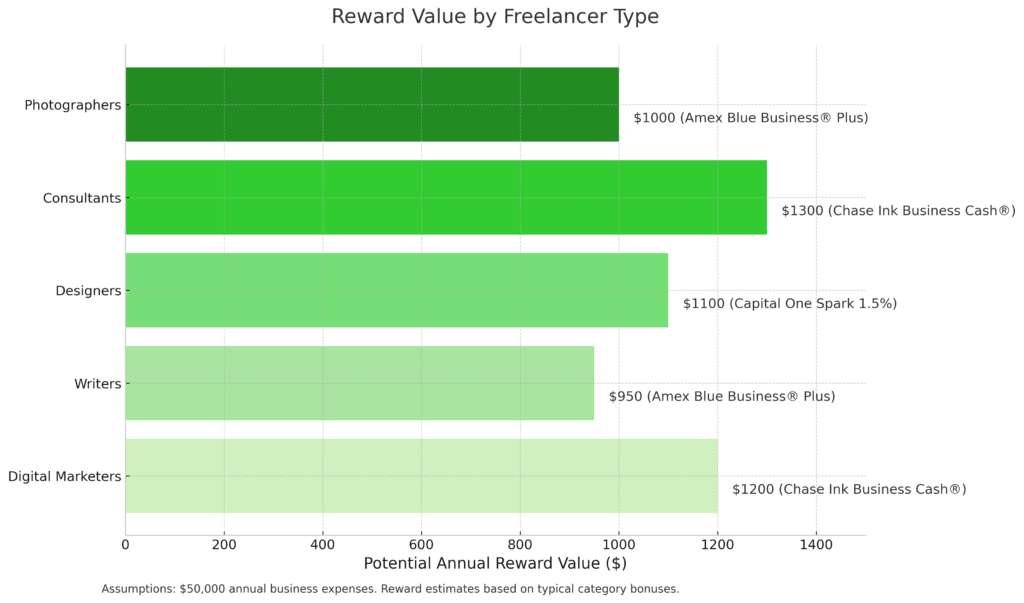

Rewards Optimization

Freelancers can strategically select cards that reward their highest-frequency expenditures. For example:

- Digital freelancers might prioritize cards offering bonuses on software subscriptions and online advertising

- Consultants who travel to client sites could benefit from travel-focused rewards

- Service providers with physical locations might leverage cards with utilities and office supply bonus categories

By aligning card rewards with natural spending patterns, freelancers effectively reduce their overall costs through cashback, statement credits, or valuable points.

Business Credit Building

Establishing a separate business credit profile creates long-term financial advantages for freelancers. Strong business credit can lead to:

- More favorable terms on future financing

- Higher credit limits for larger expenses

- Reduced reliance on personal credit for business needs

- Enhanced business legitimacy with clients and vendors

- Protection of personal credit from business-related inquiries and utilization

Challenges and Risks

Qualification Difficulties

Despite their benefits, business credit cards often present higher approval hurdles for freelancers. Card issuers typically require:

- Proof of business legitimacy

- Minimum time in business (often 1+ years)

- Minimum annual revenue thresholds

- Good to excellent personal credit scores

- Personal guarantees for business obligations

These requirements can create catch-22 situations where freelancers need business credit to grow, but can’t access it unless they are already established.

Fee Structures

Many business-focused cards charge substantial annual fees, ranging from $95 to $695. While these fees often come with corresponding benefits, freelancers must carefully calculate whether their spending patterns and reward utilization will offset these costs.

Hidden fees can also impact overall value:

- Foreign transaction fees (typically 3%)

- Balance transfer fees (3-5%)

- Cash advance fees and higher interest rates

- Late payment penalties

- Employee card fees on some premium offerings

Interest Rate Concerns

Freelancers who face income variability may occasionally need to carry balances, making interest rates a crucial consideration. Business credit cards typically charge higher APRs than personal credit cards, ranging from 14.99% to 24.99% or higher, depending on creditworthiness.

Additionally, business cards lack some of the interest rate protections afforded to consumer cards under the Credit CARD Act of 2009, allowing issuers to increase rates with less notice on business accounts.

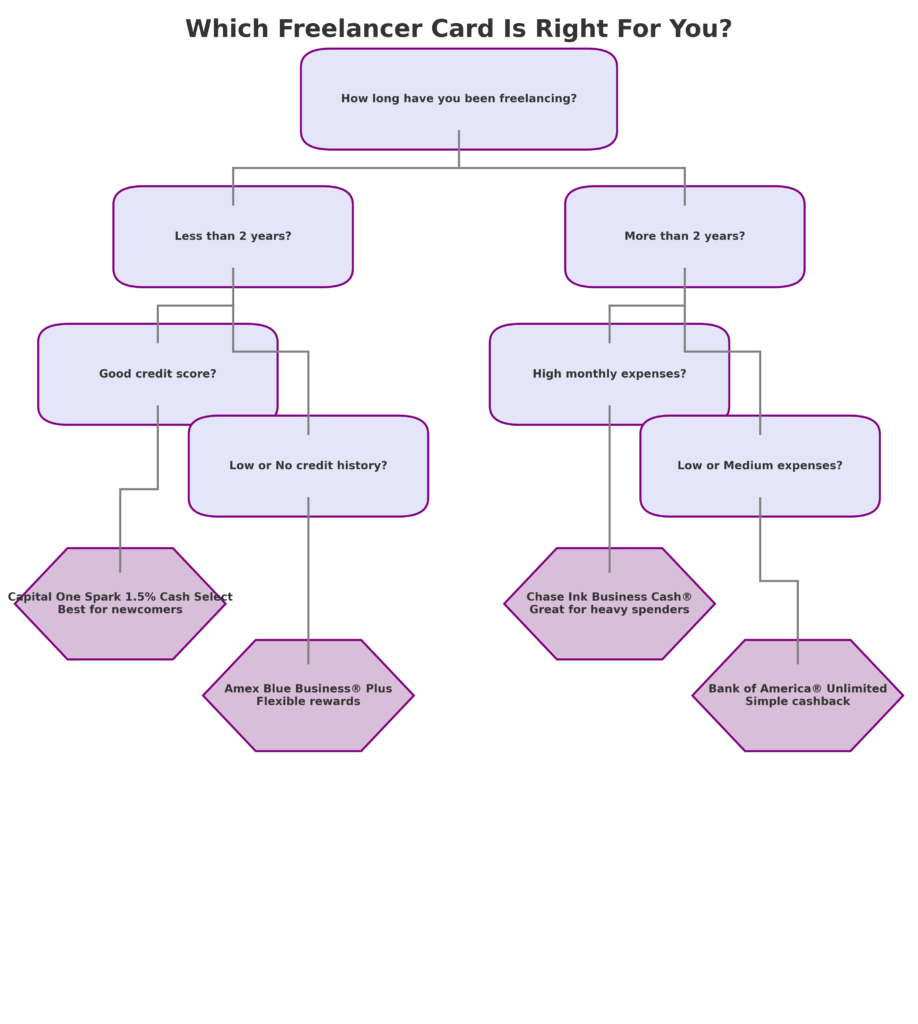

How to Choose the Right Card

Assessment of Business Expenses

Before selecting a card, freelancers should analyze their spending patterns over 3-6 months to identify:

- Their highest expense categories

- Average monthly spending

- Seasonal fluctuations in expenses

- Recurring subscription costs

- Large periodic purchases

This spending profile helps identify which reward structures will provide maximum return on everyday business expenditures.

Evaluation of Card Features

With spending patterns established, freelancers should prioritize these features according to their specific needs:

Primary Considerations:

- Reward categories aligned with major expenses

- Welcome bonus requirements vs. typical spending

- Annual fee vs. expected reward value

- APR and financing options

- Credit limit adequacy for business needs

Secondary Features:

- Travel benefits and protections

- Purchase protections and extended warranties

- Expense management tools

- Integration with accounting software

- Additional business services and discounts

Application Strategy

To maximize approval chances while minimizing credit impact:

- Check for pre-approval offers when available

- Apply for cards matching your credit profile

- Space applications by 3-6 months to limit hard inquiries

- Prepare business documentation before applying

- Consider secured options if building/rebuilding credit

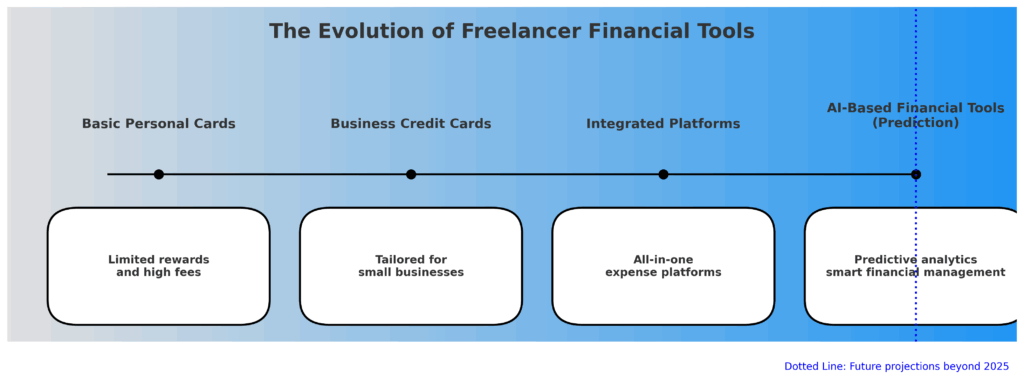

Future Trends in Freelancer Financial Tools

The freelance economy continues to expand, with projections suggesting independent workers will constitute over 50% of the U.S. workforce by 2027. Financial institutions are responding with increasingly specialized tools for this growing segment.

Integrated Financial Ecosystems

Next-generation freelancer cards are evolving beyond simple payment tools into comprehensive financial ecosystems. These platforms integrate:

- Invoicing capabilities

- Client payment acceptance

- Tax estimation tools

- Retirement planning options

- Health insurance marketplaces

This integration reduces the number of separate financial services freelancers must manage, creating more streamlined operations.

AI-Powered Expense Categorization

Artificial intelligence is transforming expense management for freelancers. Modern business cards now leverage AI to:

- Automatically categorize expenses by tax deduction eligibility

- Flag potentially mixed personal/business charges

- Identify subscription renewals and recurring charges

- Generate expense forecasts based on historical patterns

- Recommend timing for major purchases based on cash flow predictions

Specialized Industry Vertical Cards

The market is seeing the emergence of highly specialized credit products tailored to specific types of freelancers. These niche offerings include:

- Creative professional cards with IP protection services

- Healthcare freelancer cards with medical equipment benefits

- Tech contractor cards with enhanced software subscription rewards

- Construction freelancer cards with materials supplier discounts

- Professional service cards with client entertainment perks

This specialization allows for more precisely calibrated reward structures and business services aligned with specific industry needs.

FAQs – Credit Cards For Freelancers

1. Do freelancers need a business credit card, or can they use personal cards?

While freelancers can legally use personal cards for business expenses, dedicated business cards offer significant advantages, including clearer expense separation for tax purposes, business-specific rewards categories, higher credit limits, and the ability to build a business credit profile separate from personal credit. However, early-stage freelancers with minimal expenses may reasonably begin with personal cards until their business volume justifies a business-specific product.

2. What credit score do freelancers need for business credit cards?

Most premium business credit cards require good to excellent credit scores (670+), though options exist across the credit spectrum. Freelancers with scores below 670 can consider secured business cards, which require security deposits but offer paths to building business credit. Some fintech companies now offer alternative approval methods based on business revenue rather than primarily on credit scores.

3. How does irregular freelance income affect credit card applications?

Lenders typically prefer stable, predictable income when evaluating credit applications. Freelancers should prepare to demonstrate income stability through tax returns from the previous 1-2 years, consistent bank deposit records, and ongoing client contracts. Some freelancer-friendly card issuers will average income over longer periods rather than requiring monthly consistency.

4. Can new freelancers qualify for business credit cards?

New freelancers often face higher hurdles for getting a business card approved, but options are available. Cards with lower qualification requirements generally offer fewer benefits but provide an entry point to business credit. Alternatively, new freelancers can begin with personal cards for business expenses while establishing their business history, then transition to business-specific products after 6-12 months of operation.

5. How do business credit cards affect personal credit scores?

Most business credit card activities don’t appear on personal credit reports, though the initial application typically generates a hard inquiry on your personal credit. Additionally, almost all business cards require personal guarantees, meaning that payment defaults could eventually impact personal credit, even if they are not reported in routine credit reports. Some issuers (like Capital One and Discover) report all business card activity to personal bureaus.

6. What tax benefits do separate business credit cards provide?

Dedicated business cards significantly simplify tax preparation by creating clear separation between personal and business expenses. This separation helps identify all potential tax deductions, provides cleaner documentation for tax filings, reduces audit risk by demonstrating business purpose, and saves valuable time during tax season. Most business cards also generate year-end expense summaries categorized by tax-relevant groupings.

7. Should freelancers prioritize rewards or 0% financing periods?

This depends entirely on individual cash flow patterns. Freelancers with inconsistent client payment timelines often benefit more from extended 0% APR periods that effectively provide interest-free financing during income gaps. Conversely, freelancers with stable cash flow who pay balances in full monthly should prioritize reward structures aligned with their highest expense categories to maximize returns on necessary spending.

8. Are annual fees worth it for freelancer credit cards?

Annual fees are worth considering when the card’s benefits exceed the fee cost. Calculate the potential reward value based on your typical annual spending in bonus categories, then add the value of additional benefits you’ll actually use (like airport lounge access, insurance protections, or software credits). If this total exceeds the annual fee by a comfortable margin, the card likely presents positive value despite the upfront cost.

9. How many business credit cards should freelancers maintain?

Most freelancers benefit from having 2-3 strategically selected business credit cards: a primary card for everyday expenses with rewards matching their highest spending categories, a secondary card with complementary bonus categories, and potentially a 0% APR card for larger purchases requiring financing. Maintaining fewer cards simplifies management, while multiple cards can maximize category-specific rewards.

10. How can freelancers use credit cards to manage inconsistent income?

Strategic credit card usage can help freelancers navigate irregular income through several approaches: utilizing 0% APR periods during client payment gaps, timing large purchases to align with welcome bonus spending requirements, building sufficient credit limits to cover essential expenses during slow periods, and maintaining low or zero balances when income is flowing to minimize interest expenses.

Conclusion

The right credit card strategy can significantly impact a freelancer’s financial stability and business growth potential. By selecting cards that align with specific business spending patterns, freelancers can access valuable benefits, including expense management tools, tax preparation assistance, flexible cash flow, and meaningful rewards on essential expenses.

However, these benefits must be balanced against qualification requirements, fee structures, and the disciplined financial management necessary to avoid debt cycles. As the freelance economy continues to expand, financial products will likely become increasingly tailored to the unique needs of independent workers, offering more integrated solutions that address the full spectrum of freelance financial management challenges.

The most successful freelancers will leverage these tools as part of a comprehensive approach to business financial health, separating personal and business finances while building strong business credit profiles for long-term success.

For your reference, recently published articles include:

- Build A Fortune: Trading Algorithm Development Made Simple

- Professional Investment Portfolio Reporting – Best Guide For You

- Market Data Visualization – Best Tools To Boost Your Wealth

- Stay Legal, Get Rich: Investment Compliance Monitoring Made Easy

- Portfolio Attribution Analysis: The Ultimate Guide

- Protect Your Wealth: Investment Risk Mitigation Secrets of the Rich

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.