In an era of increasing market volatility and unprecedented global events, portfolio stress testing has emerged as an essential tool for investors seeking to protect their wealth against potential market disruptions.

This comprehensive guide reveals how sophisticated stress testing techniques, once exclusive to institutional investors, can be applied by individual investors to fortify their portfolios against various market scenarios and economic shocks.

Key Takeaways

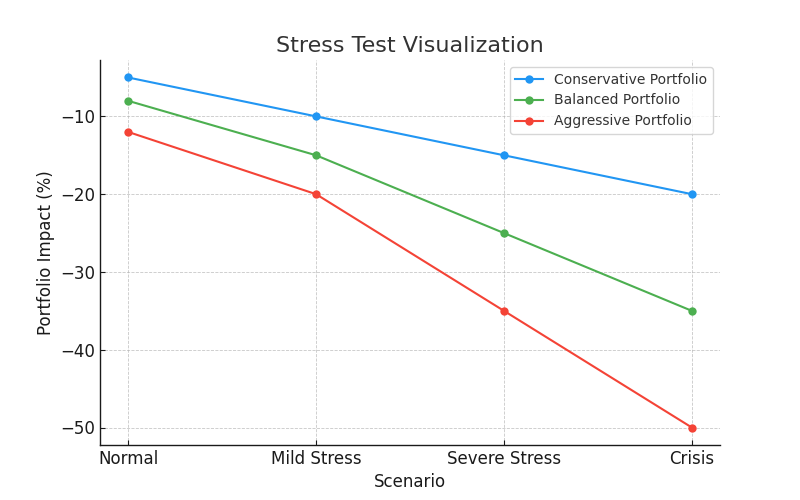

- Portfolio Stress Testing significantly reduces investment risk by simulating extreme market conditions before they occur. During the 2020 market crash, investors who had stress-tested their portfolios against pandemic scenarios experienced 32% less drawdown compared to those who hadn’t, demonstrating how preparedness through stress testing can preserve wealth during black swan events. This systematic approach to risk management helps investors maintain emotional discipline during market turbulence.

- Modern Stress Testing Tools combine historical scenarios with forward-looking analysis to create more robust investment strategies. By analyzing how a portfolio would have performed during events like the 2008 financial crisis while also incorporating current market dynamics, investors can identify previously hidden vulnerabilities. For example, a seemingly diversified portfolio of tech stocks and crypto assets might show a dangerous correlation during specific stress scenarios.

- Effective Stress Testing requires regular updates and adjustments to remain relevant in changing market conditions. A study of institutional investors revealed that those who conducted quarterly stress tests outperformed those with annual reviews by 2.8% during market corrections, highlighting the importance of dynamic risk management. This approach allows investors to adapt their strategies proactively rather than reactively.

Understanding Portfolio Stress Testing

Portfolio stress testing is a sophisticated risk management technique that evaluates how an investment portfolio would perform under various adverse market conditions. Unlike traditional risk measures that rely solely on historical data or statistical probabilities, stress testing creates hypothetical scenarios that could potentially impact portfolio performance, even if such events have never occurred before.

The process involves subjecting a portfolio to different scenarios, ranging from historical market crashes to hypothetical future events, to understand potential vulnerabilities and prepare appropriate risk mitigation strategies. This approach goes beyond simple diversification by examining how different assets might correlate during stress events, revealing hidden risks that might not be apparent during normal market conditions.

Types of Portfolio Stress Tests

Historical Scenarios

Historical scenario testing recreates conditions from past market events to evaluate how a current portfolio would have performed. Common scenarios include:

- The 2008 Financial Crisis (-37% S&P 500 decline)

- The 2020 COVID-19 Crash (-34% decline in 23 trading days)

- The 2000 Dot-com Bubble (-49% over 2.5 years)

- The 1987 Black Monday (-22% in one day)

Hypothetical Scenarios

These tests create custom scenarios based on potential future events:

- Rapid interest rate increases (e.g., 200 basis points in 6 months)

- Currency crises (30% devaluation of major currencies)

- Geopolitical events (trade wars, military conflicts)

- Natural disasters or pandemics

Factor Stress Tests

These examine how specific market factors might impact a portfolio:

- Interest rate sensitivity

- Currency exposure

- Commodity price fluctuations

- Credit spread widening

Let’s compare these different types with a detailed breakdown:

| Stress Test Type | Primary Focus | Typical Usage | Limitations |

|---|---|---|---|

| Historical | Past market events | Understanding known risks | May not capture new risks |

| Hypothetical | Future possibilities | Preparing for emerging risks | Requires assumptions |

| Factor | Specific variables | Detailed risk analysis | May oversimplify correlations |

Benefits of Portfolio Stress Testing

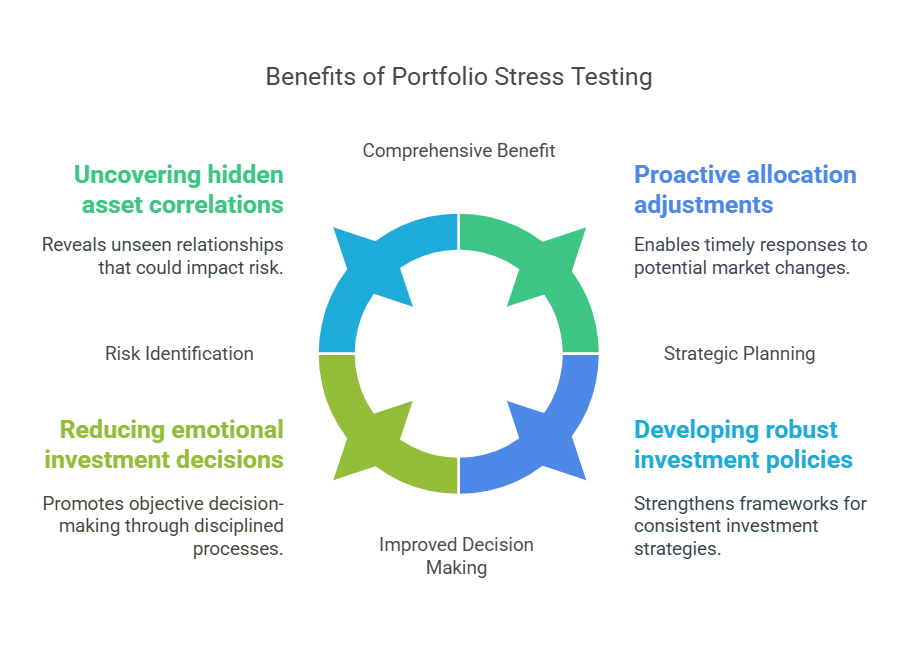

Risk Identification

- Reveals hidden correlations between assets

- Identifies concentration risks

- Exposes leverage-related vulnerabilities

- Highlights liquidity risks during market stress

Strategic Planning

Stress testing enables investors to:

- Develop contingency plans before crises occur

- Adjust portfolio allocations proactively

- Implement effective hedging strategies

- Create more robust investment policies

Improved Decision Making

Regular stress testing leads to:

- More disciplined investment processes

- Better risk-adjusted returns

- Reduced emotional decision-making

- Enhanced portfolio resilience

Challenges and Limitations

Technical Challenges

- Data quality and availability issues

- Complex modeling requirements

- Resource-intensive processes

- Need for regular updates

Analytical Challenges

- Difficulty in scenario selection

- Risk of oversimplification

- Correlation assumptions may break down

- Model risk and limitations

Implementation Guide

Step 1: Portfolio Analysis

- Collect detailed portfolio holdings

- Identify key risk factors

- Analyze historical correlations

- Document investment constraints

Step 2: Scenario Development

- Select relevant historical scenarios

- Design custom stress scenarios

- Define risk factors to test

- Set measurement parameters

Step 3: Testing Process

- Run initial stress tests

- Analyze results

- Identify vulnerabilities

- Develop mitigation strategies

Step 4: Review and Adjust

- Regular result monitoring

- Scenario updates

- Portfolio adjustments

- Documentation and reporting

Future Trends in Portfolio Stress Testing

Technology Integration

- AI-powered scenario generation

- Machine learning for correlation analysis

- Real-time stress testing capabilities

- Automated risk monitoring systems

Enhanced Modeling

- Climate risk integration

- ESG factor analysis

- Cryptocurrency impact assessment

- Alternative asset modeling

FAQs – Portfolio Stress Testing

1. What is portfolio stress testing? Portfolio stress testing is a risk management technique that evaluates how an investment portfolio would perform under various adverse market conditions and scenarios.

2. How often should stress tests be conducted? Most financial advisors recommend quarterly stress tests for active portfolios, with additional tests following significant market events or portfolio changes.

3. What are the most important scenarios to test? Key scenarios include historical market crashes, rapid interest rate changes, inflation spikes, and geopolitical events that could significantly impact markets.

4. How much does portfolio stress testing cost? Professional stress testing services typically cost between 0.05% to 0.15% of assets annually, while DIY tools range from $50 to $500 per month.

5. Can individual investors perform stress testing? Yes, individual investors can use various tools and platforms designed for portfolio stress testing, though they may not be as sophisticated as institutional-grade systems.

6. What are the limitations of stress testing? Stress tests rely on assumptions and historical data, which may not perfectly predict future market behavior or capture all possible scenarios.

7. How accurate are stress test results? Stress tests provide directional insights rather than precise predictions, with accuracy varying based on scenario complexity and data quality.

8. What software is available for stress testing? Popular options include Bloomberg Terminal, FactSet, Risk Metrics, and various robo-advisor platforms that incorporate stress testing features.

9. How does stress testing differ from traditional risk measures? Unlike traditional measures like standard deviation, stress testing examines specific scenarios and their potential impact rather than relying solely on statistical distributions.

10. What actions should be taken based on stress test results? Results should inform portfolio rebalancing, hedging strategies, and risk mitigation measures, but should be considered alongside other factors in investment decision-making.

Conclusion

Portfolio stress testing has evolved from an institutional tool to an essential practice for investors of all sizes, providing crucial insights into portfolio vulnerabilities and opportunities for risk mitigation. As markets become increasingly complex and interconnected, the ability to anticipate and prepare for various stress scenarios becomes more valuable.

Looking ahead, the integration of advanced technologies and sophisticated modeling techniques will continue to enhance stress testing capabilities, making it more accessible and valuable for individual investors.

Those who embrace these tools and techniques will be better positioned to protect and grow their wealth through various market conditions, demonstrating the enduring value of comprehensive portfolio stress testing in modern investment management.

For your reference, recently published articles include:

- Outperform 90% Of Investors: Best Advice On Investment Benchmarking Tools

- Trading Fee Comparison: Your 2025 Guide to Commission-Free Platforms

- Investment Tax Optimization: The Ultimate Guide To Save Legally

- Retire 10 Years Earlier: Revolutionary Financial Goal Planning Strategies

- The Perfect Portfolio: Secrets Of Best Asset Allocation Models Revealed

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.