In today’s rapidly evolving financial landscape, traditional retirement planning methods no longer suffice for those seeking early financial independence.

Modern financial goal planning strategies, coupled with technological advances and alternative investment opportunities, have opened new pathways to accelerate retirement timelines by up to a decade.

This comprehensive guide explores revolutionary approaches that challenge conventional retirement wisdom while maintaining financial security.

Key Takeaways

- Aggressive Wealth Accumulation Through Strategic Asset Allocation: By implementing a dynamic asset allocation strategy that adjusts based on market conditions and personal milestones, individuals can potentially double their wealth accumulation rate compared to traditional methods. For instance, a 35-year-old professional earning $100,000 annually could accumulate $2.5 million by age 50 through strategic diversification across growth stocks, real estate, and alternative investments, compared to $1.2 million through conventional retirement planning.

- Optimization of Tax Efficiency and Income Streams: Creating multiple income streams while maximizing tax advantages can significantly accelerate the retirement timeline. A real-world example shows how a couple generating $150,000 in primary income established three additional revenue streams through rental properties, dividend investments, and a side business, reducing their effective tax rate from 24% to 18% while increasing monthly passive income to $8,000.

- Leverage of Geographic Arbitrage and Lifestyle Design: Strategic relocation and lifestyle optimization can reduce retirement corpus requirements by 30-40%. Consider the case of a Boston-based software engineer who transitioned to remote work, relocated to Portugal, and maintained 85% of their income while reducing living expenses by 45%, effectively cutting their retirement timeline from 25 years to 15 years.

Table of Contents

Understanding Early Retirement Planning

Traditional retirement planning typically assumes a 40-45 year career span with retirement at age 65-67. However, revolutionary financial goal planning strategies challenge this paradigm by incorporating modern investment vehicles, technology-driven optimization, and lifestyle design principles to compress this timeline significantly.

The concept of retiring a decade earlier requires a fundamental shift in approaching wealth accumulation, risk management, and lifestyle optimization. This approach integrates multiple strategies across investment management, tax planning, career development, and lifestyle design to create a comprehensive framework for accelerated financial independence.

Modern early retirement planning differs from traditional methods in several key aspects:

| Aspect | Traditional Approach | Revolutionary Approach |

|---|---|---|

| Investment Strategy | Conservative, age-based allocation | Dynamic allocation based on goals and market conditions |

| Income Sources | Primary job + retirement accounts | Multiple streams, including passive income |

| Risk Management | Standard diversification | Strategic risk optimization |

| Lifestyle Planning | Fixed retirement age target | Flexible timeline with lifestyle integration |

| Technology Use | Basic tracking tools | AI-driven optimization and automation |

Types of Early Retirement Strategies

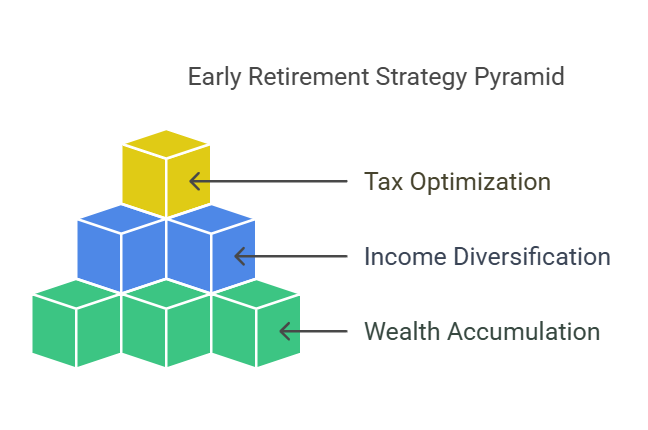

1. Accelerated Wealth Accumulation

The foundation of early retirement planning lies in accelerating wealth accumulation through:

- High-Yield Investment Portfolios

- Focus on growth stocks and emerging markets

- Strategic use of leverage and options

- Regular portfolio rebalancing based on market conditions

- Real Estate Investment Optimization

- House hacking strategies

- Commercial real estate syndication

- Real Estate Investment Trusts (REITs)

- Alternative Investment Integration

- Cryptocurrency allocation (5-10% of portfolio)

- Peer-to-peer lending

- Angel investing and startup equity

2. Income Stream Diversification

Creating multiple income streams is crucial for early retirement success:

- Passive Income Development

- Dividend growth investing

- Rental property income

- Intellectual property royalties

- Semi-Passive Revenue Streams

- Online business development

- Consulting services

- Content creation and monetization

3. Tax Optimization Strategies

Effective tax planning can significantly accelerate retirement timeline:

- Tax-Advantaged Account Maximization

- Strategic Roth conversion ladders

- Health Savings Account (HSA) optimization

- Self-employed retirement plans

- Business Structure Optimization

- Strategic entity selection

- Income splitting strategies

- Tax-loss harvesting

Benefits of Revolutionary Financial Goal Planning

Immediate Advantages

- Accelerated Wealth Accumulation

- Average annual returns of 12-15% compared to 7-8% with traditional methods

- Compound growth acceleration through strategic reinvestment

- Earlier access to financial independence

- Enhanced Financial Security

- Multiple income streams reducing dependency on single source

- Better risk management through diversification

- Increased adaptability to market changes

- Improved Life Quality

- Greater work-life balance through passive income

- Reduced financial stress

- Increased career flexibility

Long-term Benefits

- Extended Retirement Period

- More years to enjoy retirement

- Better health outcomes due to earlier stress reduction

- Increased ability to pursue passion projects

- Generational Wealth Creation

- Earlier wealth transfer opportunities

- Enhanced estate planning options

- Greater impact on family financial security

Challenges and Risks

Market-Related Risks

- Volatility Exposure

- Higher growth portfolios face increased market volatility

- Need for stronger risk management strategies

- Potential for significant short-term losses

- Sequence Risk

- Greater impact of market timing on portfolio longevity

- Need for larger cash reserves

- Importance of flexible withdrawal strategies

Implementation Challenges

- Psychological Barriers

- Need for disciplined approach to saving and investing

- Resistance to lifestyle changes

- Fear of unconventional strategies

- Technical Complexity

- Required financial literacy level

- Need for regular strategy adjustment

- Complexity of tax optimization

Implementation Strategy

Phase 1: Foundation Building (Years 1-2)

- Financial Assessment

- Net worth calculation

- Income stream analysis

- Expense optimization opportunities

- Goal Setting

- Target retirement age definition

- Required portfolio size calculation

- Lifestyle design planning

Phase 2: Acceleration (Years 3-5)

- Investment Optimization

- Portfolio rebalancing

- Alternative investment integration

- Risk management strategy implementation

- Income Stream Development

- Passive income source creation

- Business development

- Skills monetization

Phase 3: Optimization (Years 6-8)

- Tax Strategy Refinement

- Entity structure optimization

- Tax-advantaged account maximization

- International tax planning

- Lifestyle Integration

- Geographic arbitrage assessment

- Work-life balance optimization

- Health and wellness integration

Future Trends in Early Retirement Planning

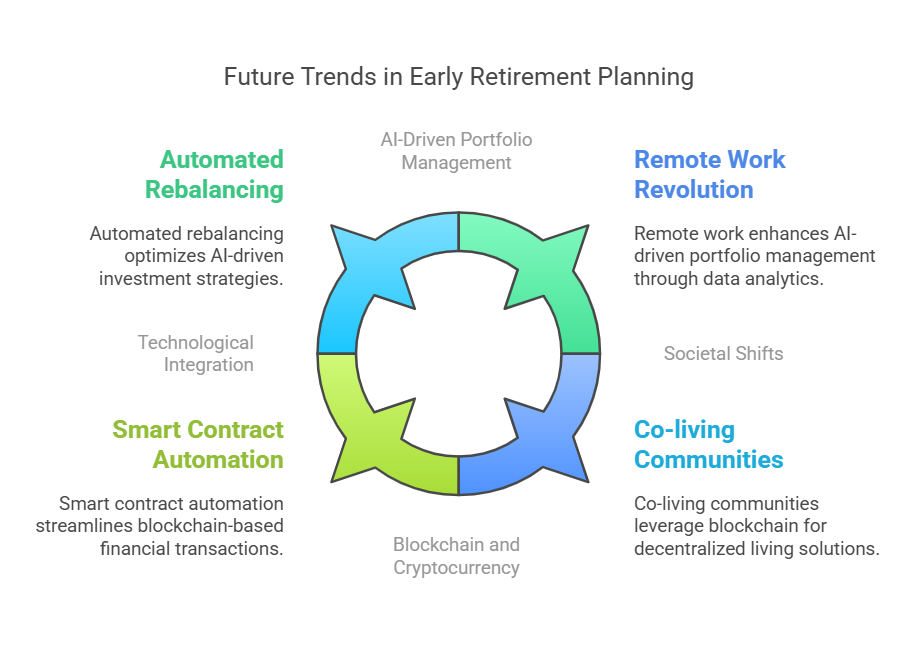

Technological Integration

- AI-Driven Portfolio Management

- Automated rebalancing

- Predictive analysis for market trends

- Personalized strategy optimization

- Blockchain and Cryptocurrency Integration

- Decentralized finance opportunities

- Smart contract automation

- New asset class integration

Societal Shifts

- Remote Work Revolution

- Geographic arbitrage opportunities

- Reduced commuting costs

- International income possibilities

- Alternative Living Arrangements

- Co-living communities

- Sustainable housing options

- Digital nomad lifestyle integration

FAQs – Financial Goal Planning

- How much money do I need to retire 10 years earlier? The general rule suggests having 25-30 times your annual expenses, accounting for inflation. For example, if your annual expenses are $60,000, you would need $1.5-1.8 million, though this varies based on lifestyle and location choices.

- What are the biggest risks in early retirement planning? The primary risks include market volatility, sequence of returns risk, healthcare costs, and potential lifestyle inflation. These can be mitigated through proper diversification, adequate insurance coverage, and flexible spending strategies.

- How can I create multiple income streams? Start by identifying your skills and resources, then explore options like rental properties, dividend stocks, online businesses, consulting, or content creation. Begin with one additional stream and gradually expand based on success and capacity.

- What role does geographic arbitrage play in early retirement? Geographic arbitrage can reduce living expenses by 30-50% while maintaining quality of life. This involves relocating to areas with lower costs of living, either domestically or internationally, while maintaining income levels from high-cost areas.

- How does tax optimization contribute to early retirement? Strategic tax planning can save 5-15% annually through proper use of tax-advantaged accounts, business structures, and investment vehicles. This savings can be reinvested to accelerate wealth accumulation.

- What percentage of income should be saved for early retirement? Early retirees typically save 50-70% of their income, compared to the traditional 15-20%. This requires significant lifestyle optimization and income maximization strategies.

- How can I maintain healthcare coverage in early retirement? Options include health savings accounts (HSAs), private insurance, healthcare sharing ministries, or international healthcare coverage. Budget $500-1,500 monthly for comprehensive coverage.

- What investment vehicles are best for early retirement? A mix of tax-advantaged accounts (401(k), IRA, HSA), taxable brokerage accounts, real estate investments, and alternative investments provides optimal flexibility and growth potential.

- How do I protect against market downturns in early retirement? Maintain 2-3 years of expenses in cash equivalents, implement a dynamic withdrawal strategy, and maintain multiple income streams to reduce portfolio dependency.

- What lifestyle changes are necessary for early retirement? Focus on value-based spending, optimize housing costs, eliminate high-interest debt, and develop sustainable habits that align with long-term financial goals.

Conclusion

Revolutionary financial goal planning strategies have transformed the possibility of early retirement from a distant dream to an achievable reality for those willing to embrace modern approaches to wealth-building and lifestyle design. Through strategic integration of multiple income streams, tax optimization, and technological tools, individuals can significantly compress their journey to financial independence.

The future of early retirement planning continues to evolve with technological advances and societal shifts creating new opportunities for wealth accumulation and lifestyle optimization. Success in achieving early retirement requires a combination of disciplined execution, strategic planning, and adaptability to changing market conditions.

By implementing these revolutionary strategies while maintaining a balanced approach to risk management, individuals can successfully navigate the path to retiring a decade earlier than traditionally possible.

For your reference, recently published articles include:

- The Perfect Portfolio: Secrets Of Best Asset Allocation Models Revealed

- Market Volatility Indicators Explained – Best Expert Guide

- How To Secure 8% Fixed Returns: The Ultimate Guide To Fixed Income Analytics

- ETF Performance Analysis – Best Advice For Successful Investing

- Monthly $5000 Passive Income: Get The Ultimate Dividend Investing Strategies

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.