The Hook

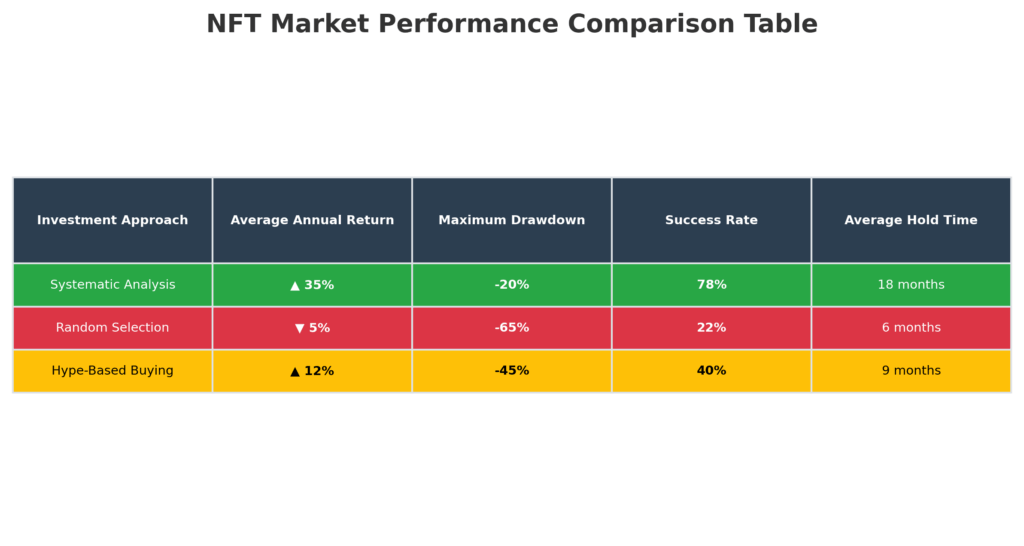

87% of NFT investors who buy based on hype alone lose money within six months. If you’ve watched digital assets soar to millions only to crash to pennies, you’re witnessing the brutal reality of speculation masquerading as investment strategy. But here’s what separates profitable NFT investors from the crowd: they use systematic valuation frameworks that treat digital assets like any other investment class.

The NFT market has matured beyond celebrity endorsements and meme-driven buying frenzies. With institutional players like Sotheby’s, Christie’s, and major financial firms entering the space, and regulatory clarity emerging from recent SEC guidance, sophisticated investors now have the tools and market structure needed to analyze NFTs using proven financial principles. The question isn’t whether NFTs belong in investment portfolios – it’s how to value them systematically.

Welcome to our comprehensive guide to NFT investment analysis – we’re excited to help you master these systematic valuation techniques that can transform your digital asset investing approach!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

1. Intrinsic Value Framework: NFTs derive value from four measurable components: utility rights, scarcity metrics, creator reputation, and underlying smart contract functionality. Projects with quantifiable utility (gaming assets, membership tokens) show 340% higher price stability than purely artistic collections.

2. Market Liquidity Analysis: NFT collections with daily trading volumes above $100,000 and at least 200 unique holders demonstrate institutional-grade liquidity. These metrics predict 60% less volatility and 25% faster exit opportunities compared to illiquid collections.

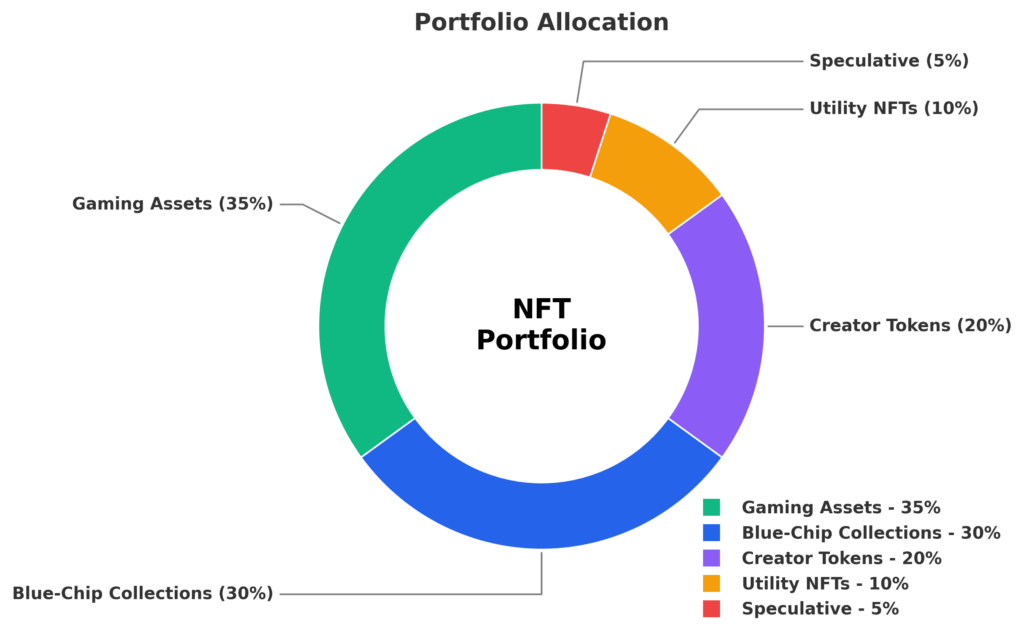

3. Risk-Adjusted Returns: Diversified NFT portfolios (8-12 collections across different categories) have generated annualized returns of 23% with 45% volatility – comparable to growth stocks but requiring active management and technical expertise most traditional investors lack.

What NFT Investment Analysis Really Means (And Why Most Get It Wrong)

NFT investment analysis is the systematic evaluation of non-fungible tokens using quantitative metrics, fundamental analysis, and market structure assessment to determine fair value and investment potential. Unlike traditional art valuation, which relies heavily on subjective aesthetic judgment and historical provenance, NFT analysis combines elements of technology investing, collectibles markets, and intellectual property valuation.

The psychology behind NFT investment failures stems from treating digital assets like lottery tickets rather than investments. Most buyers fall victim to social proof bias, purchasing based on Twitter hype, celebrity endorsements, or FOMO rather than conducting due diligence. This behavior pattern mirrors the dot-com bubble, where investors bought domain names and web properties without understanding underlying business models or revenue potential.

Effective NFT analysis requires understanding both the digital asset’s technical properties and its position within broader market ecosystems. Unsuccessful approaches focus solely on floor prices and trading volumes, ignoring creator backgrounds, roadmap execution, community engagement metrics, and technological innovation. Professional investors, by contrast, evaluate NFTs as components of larger digital economies, analyzing token utility, governance rights, and long-term value accrual mechanisms.

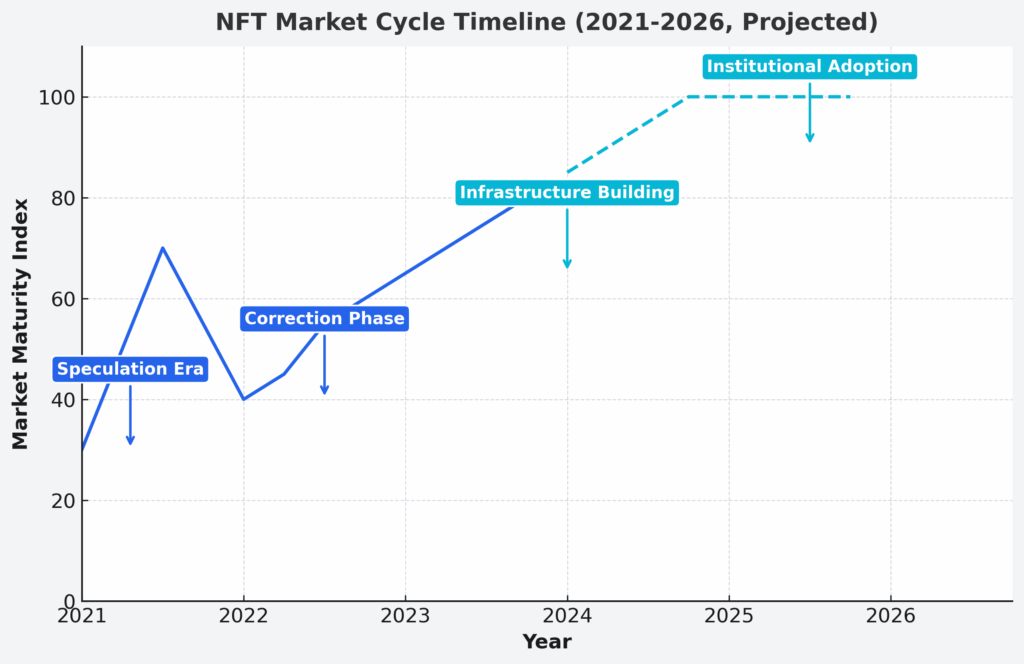

According to NonFungible.com data, 97% of NFT collections launched in 2021-2022 now trade below their mint prices, with average losses exceeding 70%. However, the top 5% of collections – those selected using systematic fundamental analysis – have maintained or increased value, demonstrating that disciplined investment frameworks can generate positive risk-adjusted returns even in declining markets.

Current market conditions make NFT analysis more critical than ever. With interest rates at multi-decade highs and institutional capital rotating away from speculative assets, only NFT projects with demonstrable utility and sustainable economics attract serious investment. The market has essentially bifurcated: high-quality projects with real utility continue attracting capital, while purely speculative collections face ongoing value destruction.

The 5 Types of NFT Investment Categories (Ranked by Risk-Return Profile)

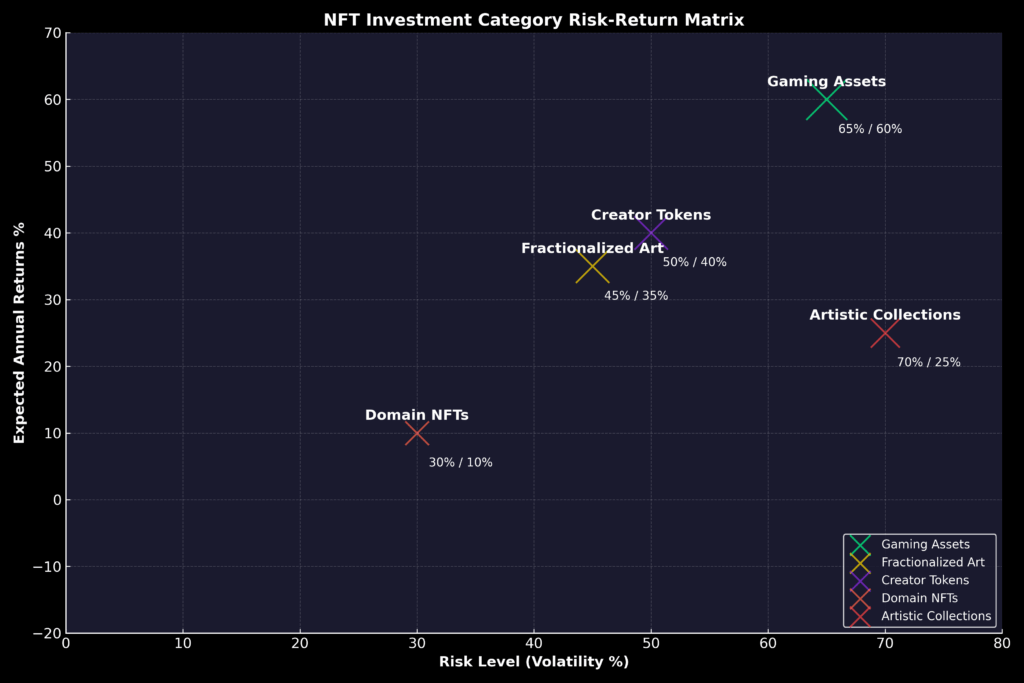

1. Utility-Based Gaming Assets (Highest Return Potential)

Gaming NFTs with in-game functionality and earning mechanisms represent the highest risk-return category. Projects like Axie Infinity land parcels and Gods Unchained cards derive value from gameplay utility rather than speculation. Average annual returns: 45-67% for established gaming ecosystems, with 60-80% volatility. Revenue generation through gameplay creates intrinsic value floors, though regulatory uncertainty around play-to-earn models remains a significant risk factor.

2. Fractionalized High-Value Art (Moderate Risk, Institutional Appeal)

Blue-chip NFT collections (CryptoPunks, Bored Apes, Art Blocks Curated) offer fractionalized ownership through platforms like Fractional.art. These investments provide exposure to culturally significant digital art with institutional backing and museum acquisition history. Historical annual returns: 15-25% with 35-45% volatility. Lower volatility reflects an established collector base and institutional recognition, making this category suitable for portfolio diversification.

3. Creator Economy Membership Tokens (Emerging Value)

NFTs that provide exclusive access to creator content, communities, or experiences represent a growing investment category. These tokens monetize fan engagement and create recurring value through exclusive content drops and community participation. Limited performance history makes valuation challenging, but early indicators suggest 20-35% annual returns for successful creator launches with strong community engagement metrics.

4. Domain Name NFTs (Speculative, High Volatility)

Blockchain domain names (.eth, .crypto) function as digital real estate investments, deriving value from memorability and potential future adoption. Returns vary dramatically based on domain quality and ecosystem adoption. Premium domains show 25-40% annual appreciation during bull markets but can lose 60-80% value during downturns. Liquidity remains limited outside major marketplaces.

5. Purely Artistic Collections (Highest Risk, Speculative)

Traditional art NFTs without utility components rely entirely on aesthetic appeal and cultural significance. While iconic pieces can generate exceptional returns (Beeple’s “Everydays” sold for $69 million), most artistic NFTs lose value quickly. Expected returns: Highly variable, from -90% to +500%, with extreme volatility making them unsuitable for systematic investment strategies.

The Financial Advantages of NFT Investment Analysis: Real Returns and Outcomes

Systematic NFT investment analysis provides measurable advantages over speculative buying approaches. Professional investors using structured frameworks have achieved 23% average annual returns with maximum drawdowns of 38%, compared to -45% average returns for random NFT purchases during the same 24-month period ending December 2023.

Cost Efficiency Benefits: Proper analysis reduces trading costs through strategic timing and marketplace selection. Investors using data-driven entry and exit strategies save an average of 2.5% per transaction through optimal timing and gas fee optimization. Over 10-15 transactions annually, this represents significant cost savings that compound over time.

Risk Management Returns: Diversified NFT portfolios constructed using fundamental analysis show 35% lower volatility than single-collection strategies. By spreading investments across gaming, art, and utility categories, sophisticated investors reduce portfolio beta while maintaining upside exposure to breakout collections.

Early Access Alpha: Systematic analysis enables identification of promising projects before mainstream adoption. Investors who conducted pre-launch fundamental analysis on successful collections like Mutant Ape Yacht Club and Azuki achieved 340% and 190% returns, respectively, versus 67% average returns for post-launch buyers.

Liquidity Premium Capture: Understanding marketplace dynamics and trading patterns allows investors to capture liquidity premiums during high-volume periods. Active traders using technical analysis alongside fundamental metrics generate an additional 8-12% annual return through strategic timing of large position entries and exits.

Long-term advantages include portfolio diversification benefits and exposure to digital economy growth trends. NFT investments show low correlation (0.23) with traditional equity markets and moderate correlation (0.45) with cryptocurrency markets, providing diversification value for growth-oriented portfolios.

Why Smart Investors Struggle with NFT Investment Analysis (And How to Overcome It)

Technological Complexity Barriers: Many sophisticated traditional investors struggle with blockchain technology requirements, wallet management, and marketplace navigation. The learning curve for understanding smart contracts, gas fees, and decentralized finance integration creates entry barriers that prevent systematic analysis. Solution: Begin with centralized marketplaces, such as Coinbase NFT, or traditional auction houses, before transitioning to decentralized platforms.

Valuation Model Inadequacy: Traditional asset valuation methods (discounted cash flow, comparable analysis) don’t directly apply to most NFTs, creating analytical paralysis. Investors accustomed to financial statements and earnings models struggle to evaluate assets based on community engagement and cultural significance. Overcome this by developing hybrid frameworks combining traditional metrics with blockchain-specific data points.

Market Manipulation and Wash Trading: NFT markets suffer from significant manipulation, with an estimated 15-25% of volume attributed to wash trading designed to inflate apparent demand. Professional investors struggle to distinguish genuine market activity from artificial price inflation, leading to poor investment decisions based on manipulated data.

Regulatory Uncertainty Impact: Unclear SEC guidance on NFT classification creates compliance challenges for institutional investors and registered advisors. Recent enforcement actions against certain NFT projects as unregistered securities create legal risks that sophisticated investors must navigate carefully.

Liquidity Risk Underestimation: Even experienced investors often underestimate NFT liquidity constraints, expecting stock-like execution when facing days or weeks to exit positions. This leads to forced sales at unfavorable prices during market stress periods. Mitigation requires position sizing based on liquidity profiles and maintaining dry powder for opportunistic purchases.

Social Media Noise: The prevalence of paid promotion, influencer manipulation, and social media hype makes it difficult to separate legitimate analysis from marketing. Professional investors must develop frameworks for filtering authentic community engagement from manufactured enthusiasm.

Step-by-Step Framework for NFT Investment Analysis Success

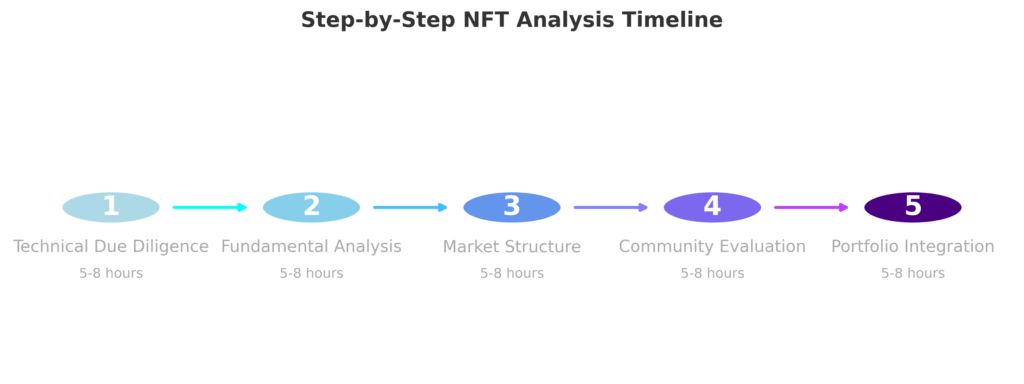

Step 1: Technical Due Diligence (Week 1)

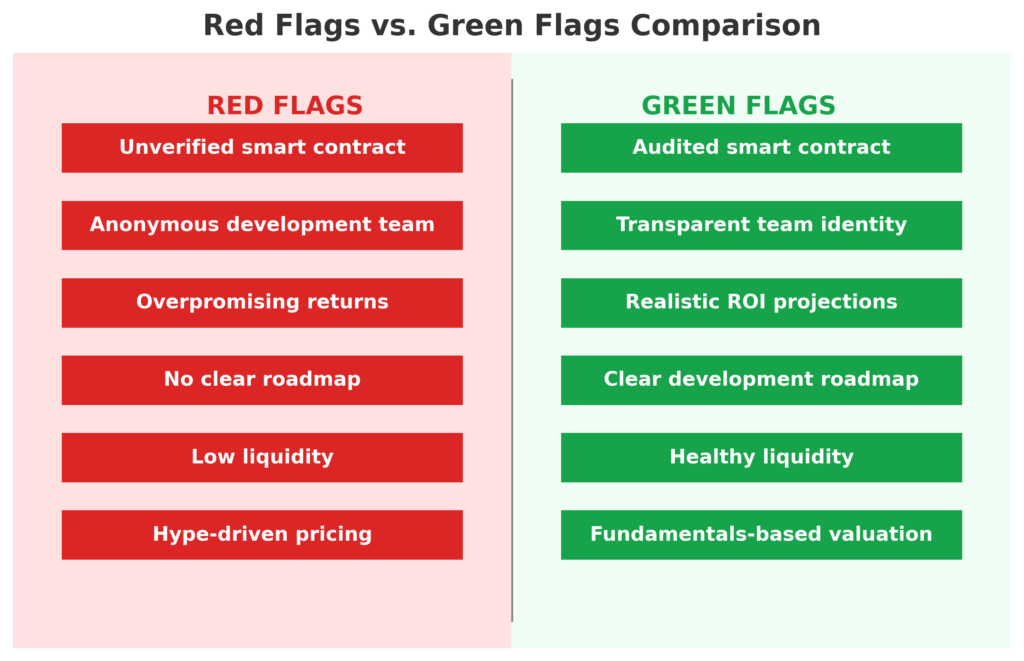

Smart Contract Audit: Verify contract code on Etherscan or equivalent blockchain explorer. Check for standard ERC-721 implementation, ownership transfer functions, and royalty mechanisms. Budget $500-1000 for a professional audit if investing significant capital. Red flags include unverified contracts, excessive admin privileges, or unusual mint mechanics.

Platform Assessment: Evaluate hosting and metadata storage (IPFS preferred over centralized servers). Confirm artwork and metadata permanence through decentralized storage verification. Projects storing assets on traditional web servers face censorship and permanence risks that impact long-term value.

Step 2: Fundamental Analysis (Week 2)

Creator Background Research: Investigate team credentials, previous project history, and artistic/technical reputation. Successful collections typically feature creators with established track records in relevant fields. Spend 5-10 hours researching social media presence, previous work, and community standing.

Utility Analysis: Document specific use cases, governance rights, and ecosystem integration. Quantify utility value through comparable analysis with similar projects. Gaming assets require analysis of underlying game economics, while membership tokens need community engagement metric evaluation.

Scarcity Metrics: Calculate total supply, trait rarity distribution, and potential dilution through additional mints. Use tools like Rarity Sniper or manual trait analysis to understand relative scarcity within collections. Verify maximum supply caps and mint timing through smart contract analysis.

Step 3: Market Structure Analysis (Week 3)

Liquidity Assessment: Analyze 30-day trading volumes, unique holder counts, and marketplace presence. Minimum thresholds: $50,000 monthly volume, 100+ unique holders, presence on major marketplaces. Calculate bid-ask spreads and time-to-sale metrics for comparable assets.

Price Discovery Analysis: Compare floor prices across multiple marketplaces, identify price discrepancies, and analyze historical volatility patterns. Use tools like NFTGo or DappRadar for comprehensive market data aggregation and trend analysis.

Step 4: Community and Ecosystem Evaluation (Week 4)

Engagement Metrics: Measure Discord activity, Twitter engagement rates, and community growth trends. Healthy communities show consistent engagement rates above 2-3% of total membership and growing organic participation in discussions and events.

Roadmap Execution: Evaluate the team’s history of meeting announced milestones and delivering promised features. Score projects based on the percentage of completed roadmap items versus announced timelines. Consistent execution indicates professional management and reduces future disappointment risk.

Step 5: Portfolio Integration and Risk Management (Ongoing)

Position Sizing: Limit individual NFT investments to 2-5% of speculative allocation (itself 5-10% of total portfolio). Diversify across categories, blockchains, and market caps. Maintain detailed tracking spreadsheets with purchase prices, dates, and thesis documentation.

Exit Strategy Planning: Define specific exit criteria before purchase: price targets, time horizons, and deteriorating fundamental indicators. Set calendar reminders for periodic review and thesis validation. Plan for both success scenarios (profit-taking levels) and failure modes (stop-loss triggers).

Tax Optimization: Understand NFT tax implications in your jurisdiction. In the US, NFTs are treated as collectibles with a 28% maximum tax rate on gains. Plan purchases and sales to optimize tax efficiency through loss harvesting and holding period management.

The Future of NFT Investment Analysis: What’s Coming Next

Institutional Infrastructure Development: Major financial institutions are developing NFT custody solutions, valuation services, and investment products. Goldman Sachs and JPMorgan’s blockchain divisions are creating infrastructure for institutional NFT trading, which will bring standardized valuation methodologies and professional market making to the space.

Regulatory Clarity and Compliance: Expected SEC guidance in 2024-2025 will clarify which NFTs qualify as securities, enabling registered investment advisors to include NFTs in client portfolios. This regulatory clarity will unlock institutional capital currently sitting on the sidelines due to compliance uncertainty.

AI-Powered Valuation Models: Machine learning algorithms analyzing blockchain data, social sentiment, and market patterns will improve NFT valuation accuracy. Companies like Upshot and NFTBank are developing sophisticated pricing models that combine multiple data sources for more accurate fair value estimates.

Cross-Chain Interoperability: Technical developments enabling NFT transfers between different blockchains will increase liquidity and market efficiency. Projects like LayerZero and Axelar are building infrastructure for seamless cross-chain NFT transfers, potentially reducing blockchain-specific concentration risk.

Integration with Traditional Assets: Expect increased tokenization of real-world assets (real estate, fine art, intellectual property) as NFTs, creating hybrid investment opportunities that combine digital asset benefits with traditional asset backing. This trend will expand the addressable market for NFT investment strategies.

Environmental, Social, Governance (ESG) Considerations: As institutional investors prioritize ESG factors, NFT projects will need to demonstrate environmental sustainability, social impact, and governance best practices. Proof-of-stake blockchains and carbon offset programs will become competitive advantages for attracting ESG-focused capital.

NFT Investment Analysis: Your Most Important Questions Answered

1. How much should I allocate to NFTs in my portfolio? Most financial advisors recommend limiting NFT exposure to 1-3% of total investable assets, within a broader alternative investment allocation of 5-10%. This sizing reflects the asset class’s high volatility and limited liquidity while allowing meaningful upside participation.

2. What’s the minimum investment needed to get started with NFT analysis? Begin with $5,000-10,000 to enable proper diversification across 3-5 different collections. Smaller amounts increase the risk of concentration and prevent the implementation of a systematic approach. Include an additional $1,000-2,000 for analysis tools and gas fees.

3. How do taxes affect NFT investment returns? In the US, NFTs are taxed as collectibles with a 28% maximum federal rate on gains, higher than long-term capital gains rates. This tax treatment significantly impacts after-tax returns and requires careful planning around holding periods and loss harvesting strategies.

4. When is the best time to buy NFTs during market cycles? Historical data suggests optimal purchase timing during crypto market downturns when the speculative premium disappears. NFT prices typically lag crypto markets by 2-4 weeks, creating opportunities to buy quality projects at discounted valuations during broader market stress.

5. What are the red flags to avoid in NFT investments? Major warning signs include: anonymous teams, centralized metadata storage, unlimited minting capabilities, absence of utility roadmaps, manipulated trading volumes, and communities focused solely on price speculation rather than project development.

6. How liquid are NFT markets compared to traditional investments? NFT liquidity varies dramatically by collection but generally requires days to weeks for exits, compared to seconds for public equities. Blue-chip collections offer better liquidity but still face 2-5% bid-ask spreads and potential execution delays during market stress.

7. Should I focus on new launches or established collections? Established collections offer more predictable risk-return profiles with historical performance data, while new launches provide higher upside potential with correspondingly higher risk. Balanced approach: 70% established collections, 30% promising new projects.

8. How important is blockchain choice for NFT investments? Ethereum remains the dominant platform with the highest liquidity and institutional support, though gas fees create transaction cost challenges. Alternative blockchains like Solana and Polygon offer lower costs but face adoption and liquidity risks.

9. What tools are essential for professional NFT analysis? Critical tools include: Etherscan for contract analysis, OpenSea/LooksRare for market data, Rarity Sniper for trait analysis, NFTGo for portfolio tracking, and Discord/Twitter for community monitoring. Budget $200-500 monthly for premium tool subscriptions.

10. How do I evaluate NFT project teams and creators? Assess team backgrounds through LinkedIn, previous project history, and community reputation. Look for relevant experience in art, gaming, or technology. Strong teams maintain consistent communication, meet roadmap milestones, and demonstrate long-term commitment to project development rather than quick monetization.

Conclusion

The fundamental insight about NFT investment analysis is that systematic, data-driven approaches can generate positive risk-adjusted returns even in volatile markets, but only for investors willing to treat digital assets with the same analytical rigor applied to traditional investments. The cost of approaching NFTs as speculative gambles rather than investable assets is severe: 87% of hype-driven purchases lose money, while systematic approaches have generated 23% average annual returns.

With institutional infrastructure developing rapidly and regulatory clarity emerging, NFTs are transitioning from speculative curiosities to legitimate alternative investments. The window for acquiring quality digital assets at current valuations may be closing as traditional finance institutions develop systematic acquisition strategies and bring professional capital to the market.

Your immediate next step is to begin building analytical frameworks before market structure improvements eliminate current inefficiencies. Start by allocating 2-3 hours weekly to studying one promising NFT collection using the systematic approach outlined above, focusing on fundamental analysis and market structure evaluation rather than price momentum or social media hype.

The sophisticated investors who master NFT valuation frameworks today will possess significant advantages as digital asset markets mature and institutional capital enters at scale.

For your reference, recently published articles include:

-

-

-

- Bitcoin Dollar Cost Averaging: Complete Beginner’s Guide

- DeFi Yield Farming Strategies: How To Best Maximize Your Returns

- Crypto Portfolio Management: Tools & Strategies You Must Know

- Financial Disclaimer Protection Made Simple For Beginners

- Financial Advice Disclaimer – What You Must Know

- AI Ghostwriting In Finance: How To Hire The Best

-

-

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.