Climate Risk Modeling

Environmental factors are increasingly recognized as material financial risks:

- Physical risk models that assess vulnerability to extreme weather events

- Transition risk forecasting for carbon-intensive industries

- Regulatory scenario planning for climate-related disclosure requirements

- Supply chain disruption modeling based on climate projections

- Stranded asset valuations under various climate policy scenarios

By 2025, an estimated 80% of institutional investors will incorporate formal climate risk assessment into their standard forecasting processes.

Explainable AI

As AI models become more complex, the focus is shifting to interpretability:

- Tools that provide natural language explanations of model predictions

- Visualization techniques for complex, multi-dimensional risk factors

- Causal inference methods that go beyond correlation to explain relationships

- Regulatory pressure for transparency in AI-based decision systems

The trend toward explainability reflects both regulatory requirements and the practical need for human oversight of automated forecasting systems.

FAQs – Investment Risk Forecasting

1. What is the difference between risk forecasting and risk management?

Risk forecasting is specifically focused on predicting potential future risks and their probabilities, forming one component of the broader risk management process. Risk management encompasses the entire framework of identifying, assessing, mitigating, and monitoring risks across an organization or portfolio.

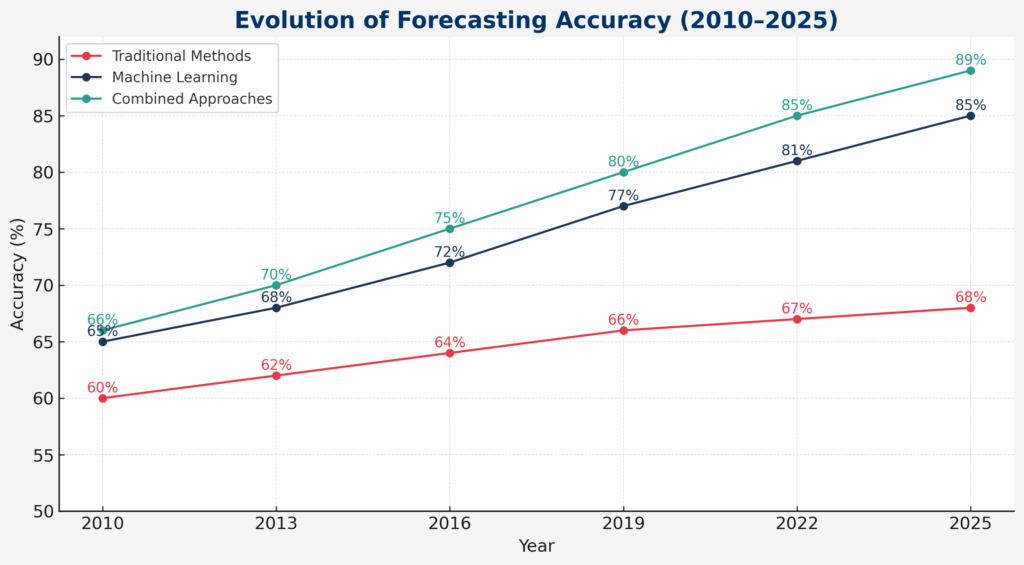

2. How accurate are professional risk forecasting tools?

Accuracy varies significantly based on the methodology, time horizon, and market conditions. Statistical models typically achieve 65-75% accuracy in normal market conditions but may fail during regime changes or crises. Machine learning approaches have demonstrated 75-85% accuracy across various market conditions, though past performance doesn’t guarantee future results.

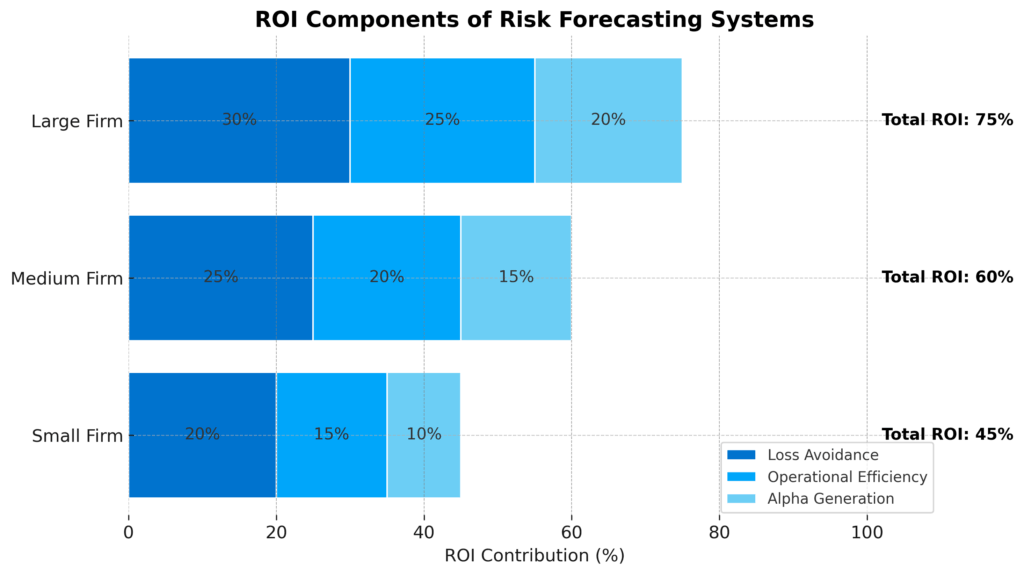

3. What is the typical ROI for implementing professional risk forecasting tools?

Organizations implementing comprehensive risk forecasting systems report ROI in three areas: loss avoidance (typically 15-25% reduction in drawdowns during market stress), operational efficiency (20-30% reduction in risk reporting time), and alpha generation (3-7% improvement in risk-adjusted returns). Total ROI typically ranges from 30-120% annually, though results vary significantly based on implementation quality and market conditions.

4. Are professional risk forecasting tools only relevant for large institutional investors?

No, though the most sophisticated systems were historically limited to large institutions. Today, SaaS-based solutions provide professional risk forecasting capabilities to firms of all sizes, with entry-level systems starting at $5,000-$10,000 annually. Even individual investors can access simplified versions through retail trading platforms and wealth management services.

5. How do risk forecasting tools handle “black swan” events?

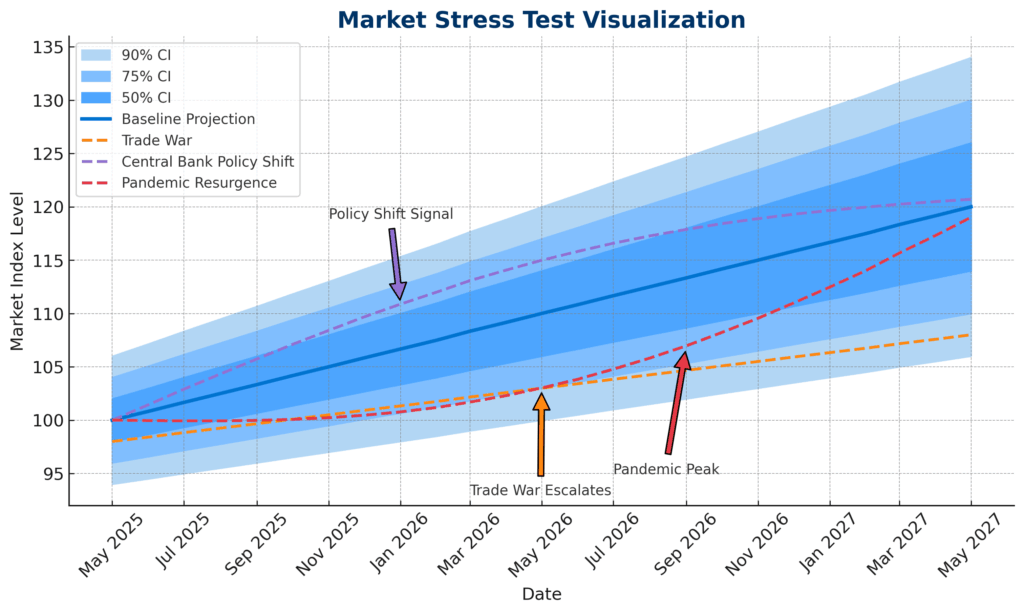

Traditional forecasting tools struggled with truly unprecedented events, but modern approaches have improved through several techniques: extreme value theory to model fat-tailed distributions, scenario analysis incorporating historical and hypothetical extreme events, and reverse stress testing that works backward from catastrophic outcomes to identify potential triggers.

6. What data sources are required for effective risk forecasting?

Comprehensive risk forecasting typically requires: market data (prices, volumes, volatility), fundamental data (financial statements, economic indicators), alternative data (satellite imagery, social media, web scraping), and internal data (position information, trading history, liquidity requirements). The quality and timeliness of these inputs significantly impact forecast accuracy.

7. How do regulatory requirements impact risk forecasting practices?

Post-2008 regulations have substantially increased risk forecasting requirements for financial institutions. Rules like Basel III, Solvency II, and UCITS mandate specific stress testing scenarios, risk calculation methodologies, and disclosure requirements. These regulations have accelerated the adoption of sophisticated forecasting tools, particularly at banks and insurance companies subject to capital adequacy requirements.

8. Can risk forecasting tools predict market crashes?

While no tool can predict crashes with certainty, modern systems are increasingly effective at identifying conditions that precede major market dislocations. Warning signs like correlation breakdowns, liquidity contractions, and volatility pattern changes are more reliably detected by current systems. However, timing remains challenging, with even sophisticated systems typically providing probability ranges rather than precise predictions.

9. How frequently should risk forecasts be updated?

Update frequency depends on the investment strategy and asset classes involved. High-frequency trading operations may update forecasts continuously throughout the trading day, while long-term institutional portfolios might perform comprehensive risk assessments weekly or monthly. Most organizations implement tiered approaches, with core metrics monitored daily and comprehensive assessments conducted at regular intervals.

10. What skills are required to effectively utilize professional risk forecasting tools?

The ideal skill set combines quantitative analysis capabilities, financial market knowledge, technical proficiency, and communication abilities. Specific skills include statistical modeling, programming (Python, R, SQL), financial theory, scenario analysis, and the ability to translate complex risk metrics into actionable investment decisions. Organizations increasingly employ specialized risk analysts with these hybrid capabilities.

Conclusion

Investment risk forecasting has evolved from simplistic historical analysis to a sophisticated discipline employing cutting-edge technology and methodologies. Today’s professional prediction tools offer unprecedented insights into potential market risks, enabling more informed decision-making and robust portfolio construction. The integration of machine learning, alternative data, and specialized risk models has dramatically improved both the accuracy and comprehensiveness of risk forecasts.

Looking forward, the field will continue to evolve rapidly as quantum computing, climate risk modeling, and explainable AI reshape forecasting capabilities. Organizations that invest in these technologies and the human expertise to leverage them effectively will likely maintain significant advantages in risk-adjusted performance.

However, the most successful approaches will continue to balance technological sophistication with human judgment, recognizing that even the most advanced forecasting tools remain probabilistic rather than deterministic.

As markets grow increasingly complex and interconnected, professional risk forecasting tools will remain essential components of any comprehensive investment strategy.

For your reference, recently published articles include:

- Investment Decision Automation: How Ordinary People Get Rich

- Best Profit Secrets: Investment Risk Decomposition Explained

- Strategic Wealth Tech: Portfolio Management Dashboards Now

- Portfolio Rebalancing Automation: The Smart Investor’s Edge

- Investing Myths Debunked: Stop Losing Money Now

- Future-Proof Your Portfolio: Surprising Benefits Of Impact Investing

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.