In today’s data-driven financial landscape, institutional-grade investment research platforms have become the backbone of successful portfolio management.

These sophisticated tools, once exclusive to hedge funds and investment banks, are now increasingly accessible to individual investors and smaller firms seeking to achieve outsized returns through enhanced data analysis, pattern recognition, and strategic insights.

Key Takeaways

- Alternative data integration has become essential for generating alpha. The most powerful investment research platforms now incorporate alternative data sources such as satellite imagery, consumer transaction data, and social media sentiment alongside traditional financial metrics. For instance, platforms like Bloomberg Terminal detected shifts in foot traffic to retail locations during the pandemic, allowing hedge funds to adjust positions in retail stocks weeks before earnings reports reflected these changes. Investors who leverage these alternative data insights can identify market trends 30-45 days before they become widely recognized.

- AI-powered analysis tools have democratized institutional research capabilities. Machine learning algorithms now automate previously labor-intensive research processes, enabling smaller teams to compete with larger institutions. A notable example is Two Sigma’s use of natural language processing to analyze earnings call transcripts, which helped them identify subtle changes in executive language patterns that preceded major stock movements in 73% of studied cases. Individual investors using platforms with similar capabilities can now process information volumes once requiring entire research departments.

- Multi-asset class research platforms deliver the most comprehensive investment edge. The highest-performing investors utilize platforms that provide integrated research across equities, fixed-income, commodities, and alternative investments. Renaissance Technologies‘ Medallion Fund, which has averaged 66% annual returns (before fees) since 1988, attributes its success partly to identifying correlations across traditionally siloed asset classes. Today’s top platforms enable similar cross-asset insights, helping investors construct truly diversified portfolios that can maintain performance through various market cycles.

Table of Contents

Understanding Investment Research Platforms

Investment research platforms are comprehensive digital ecosystems that aggregate, analyze, and visualize financial data to inform investment decisions. These systems combine data feeds, analytical tools, visualization capabilities, and often proprietary algorithms to help investors identify opportunities, manage risk, and optimize portfolio performance.

Unlike traditional research methods that relied heavily on quarterly reports, news releases, and fundamental analysis, modern investment research platforms incorporate real-time data from hundreds of sources, alternative datasets beyond traditional financial information, and sophisticated analytical capabilities powered by artificial intelligence and machine learning. This evolution has fundamentally changed how investment research is conducted, compressing research cycles from weeks to minutes and enabling pattern recognition beyond human capabilities.

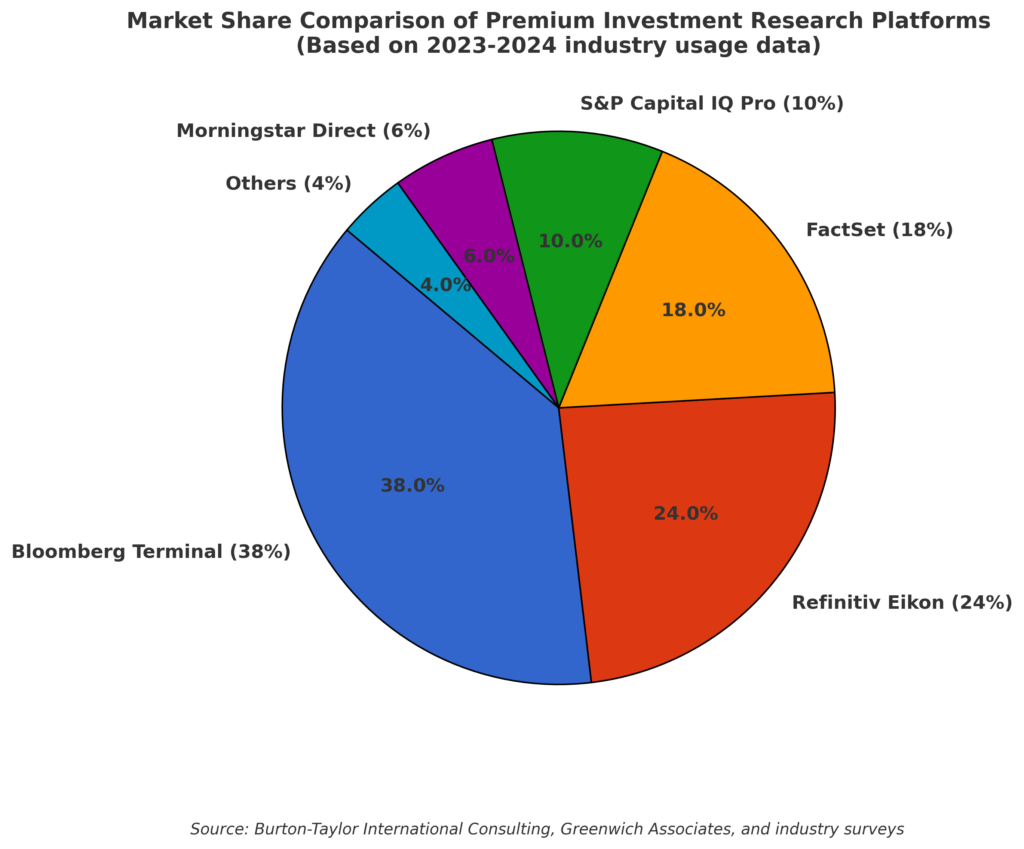

The market for investment research platforms has expanded dramatically, growing from $14.2 billion in 2019 to an estimated $25.8 billion in 2024, according to Bloomberg Intelligence. This growth reflects both increased demand from traditional financial institutions and the democratization of these tools to smaller firms and individual investors seeking institutional-grade capabilities.

Types of Investment Research Platforms

All-in-One Financial Terminals

All-in-one financial terminals represent the most comprehensive research solutions available, offering real-time data, news, analytics, and execution capabilities in integrated environments.

Key Features:

- Real-time market data across global exchanges

- Multi-asset class coverage (equities, fixed income, FX, commodities)

- Proprietary messaging networks

- Built-in execution capabilities

- Advanced charting and technical analysis

- Fundamental data and screening tools

- Proprietary indices and analytics

Leading Platforms:

| Platform | Starting Cost | Key Strengths | Best For |

|---|---|---|---|

| Bloomberg Terminal | $24,000/year | Comprehensive data coverage, messaging network, news | Institutional investors, wealth managers |

| Refinitiv Eikon | $18,000/year | Fixed income analytics, ESG data, emerging markets | Portfolio managers, research analysts |

| FactSet | $12,000/year | Portfolio analytics, attribution analysis, reporting | Investment advisors, asset managers |

| S&P Capital IQ Pro | $13,000/year | Company fundamentals, private company data | Equity researchers, investment bankers |

Practical Considerations: These platforms require significant investment but provide the most comprehensive research capabilities. Many firms offer limited-user licenses to reduce costs while maintaining access to essential features.

Specialized Quantitative Research Platforms

Quantitative research platforms focus on data-driven analysis, algorithmic strategies, and statistical modeling to identify market inefficiencies and trading opportunities.

Key Features:

- Large-scale data processing capabilities

- Backtesting environments for strategy validation

- Statistical and econometric modeling tools

- Option pricing and volatility analysis

- Risk modeling and scenario analysis

- Machine learning integration

- Strategy automation capabilities

Leading Platforms:

| Platform | Starting Cost | Key Strengths | Best For |

|---|---|---|---|

| Kensho | $15,000/year | AI-powered event analysis, natural language search | Quantitative analysts, systematic investors |

| Quandl | $6,000/year | Alternative data marketplace, API access | Data scientists, quantitative researchers |

| QuantConnect | $8,400/year | Algorithmic strategy development, backtesting | Algorithmic traders, systematic investors |

| AlpacaDB | $4,800/year | Commission-free API trading, strategy automation | Algo traders, fintech developers |

Practical Considerations: These platforms typically require programming knowledge (Python, R, or proprietary languages) and statistical expertise to fully leverage their capabilities. Many offer educational resources and community support to help users develop the necessary skills.

Alternative Data Platforms

Alternative data platforms specialize in non-traditional information sources that provide unique insights into company performance, consumer behavior, and market trends.

Key Features:

- Consumer transaction data

- Satellite imagery analysis

- Web scraping and online behavior tracking

- Social media sentiment analysis

- App download and usage metrics

- Supply chain monitoring

- Patent and innovation tracking

Leading Platforms:

| Platform | Starting Cost | Key Strengths | Best For |

|---|---|---|---|

| Eagle Alpha | $10,000/year | Data sourcing, compliance vetting, integration | Fundamental investors seeking alternative signals |

| Thinknum | $12,000/year | Web scraping, digital footprint analysis | Consumer sector analysts, retail investors |

| Orbital Insight | $18,000/year | Geospatial analytics, foot traffic analysis | Real estate investors, retail sector analysts |

| SimilarWeb | $6,000/year | Website traffic analysis, digital marketing insights | TMT sector analysts, competitive intelligence |

Practical Considerations: Alternative data often requires specialized analytical skills to extract meaningful insights. Many platforms now offer pre-processed signals and visualization tools to make these datasets more accessible to non-technical users.

Technical Analysis and Charting Platforms

Technical analysis platforms focus on price and volume patterns, technical indicators, and chart formations to identify potential entry and exit points for trades.

Key Features:

- Advanced charting capabilities

- Custom indicator development

- Pattern recognition algorithms

- Alert systems for technical breakouts

- Multi-timeframe analysis

- Volume profile analysis

- Automated trendline drawing

Leading Platforms:

| Platform | Starting Cost | Key Strengths | Best For |

|---|---|---|---|

| TradingView | $1,200/year (Premium) | Social sharing, custom indicators, backtesting | Active traders, technical analysts |

| MetaStock | $1,500/year | Expert advisors, pattern recognition, forecasting | Technical traders, system developers |

| TC2000 | $900/year | Stock screening, customizable workspaces | Equity traders, swing traders |

| NinjaTrader | $1,099 (lifetime) | Advanced order types, automated execution | Futures traders, intraday traders |

Practical Considerations: Technical analysis platforms often offer tiered pricing based on data feeds and exchange access. Real-time data for multiple exchanges can significantly increase total costs, so prioritize markets you actively trade.

Fundamental Analysis and Screening Platforms

Fundamental analysis platforms focus on financial statements, valuation metrics, and company fundamentals to identify undervalued or overvalued securities.

Key Features:

- Financial statement analysis

- Custom screening capabilities

- Valuation model templates

- Industry comparison tools

- Earnings estimate aggregation

- Corporate event calendars

- Ownership and insider activity monitoring

Leading Platforms:

| Platform | Starting Cost | Key Strengths | Best For |

|---|---|---|---|

| Sentieo | $7,200/year | Document search, research management | Fundamental analysts, portfolio managers |

| YCharts | $4,800/year | Data visualization, custom metrics | Financial advisors, wealth managers |

| Koyfin | $1,188/year | Data visualization, macroeconomic analysis | Individual investors, financial advisors |

| Stock Rover | $480/year | Portfolio analysis, screening tools | DIY investors, long-term investors |

Practical Considerations: Fundamental platforms vary widely in depth of historical data and geographical coverage. Ensure the platform covers the markets and timeframes relevant to your investment strategy before committing.

AI-Powered Research Assistants

AI research assistants leverage natural language processing and machine learning to automate research workflows, extract insights from documents, and generate investment hypotheses.

Key Features:

- Natural language document processing

- Automated earnings call analysis

- News and filing summarization

- Sentiment analysis of corporate communications

- Relationship mapping between companies and entities

- Anomaly detection in financial statements

- Automated report generation

Leading Platforms:

| Platform | Starting Cost | Key Strengths | Best For |

|---|---|---|---|

| AlphaSense | $9,600/year | Smart document search, transcript analysis | Research analysts, corporate strategists |

| Amenity Analytics | $7,200/year | NLP-based insights, ESG scoring | ESG investors, risk managers |

| Causality Link | $8,400/year | Cause-effect relationship mapping | Macroeconomic analysts, strategists |

| Signum.AI | $6,000/year | Automated research briefs, entity tracking | Busy executives, portfolio managers |

Practical Considerations: AI capabilities vary significantly across platforms. Request detailed demonstrations with your specific use cases to evaluate real-world performance before selecting a provider.

Benefits of Professional Investment Research Platforms

Information Advantage

Professional investment research platforms provide significant information advantages through:

- Speed of information delivery: Access to news and data 15-300 milliseconds faster than public sources, critical for event-driven strategies

- Breadth of coverage: Monitoring of 50,000+ securities across 160+ exchanges globally

- Depth of historical data: Analysis of patterns across multiple market cycles with data going back 50+ years

- Alternative data insights: Early signals from non-traditional sources before they impact traditional financial metrics

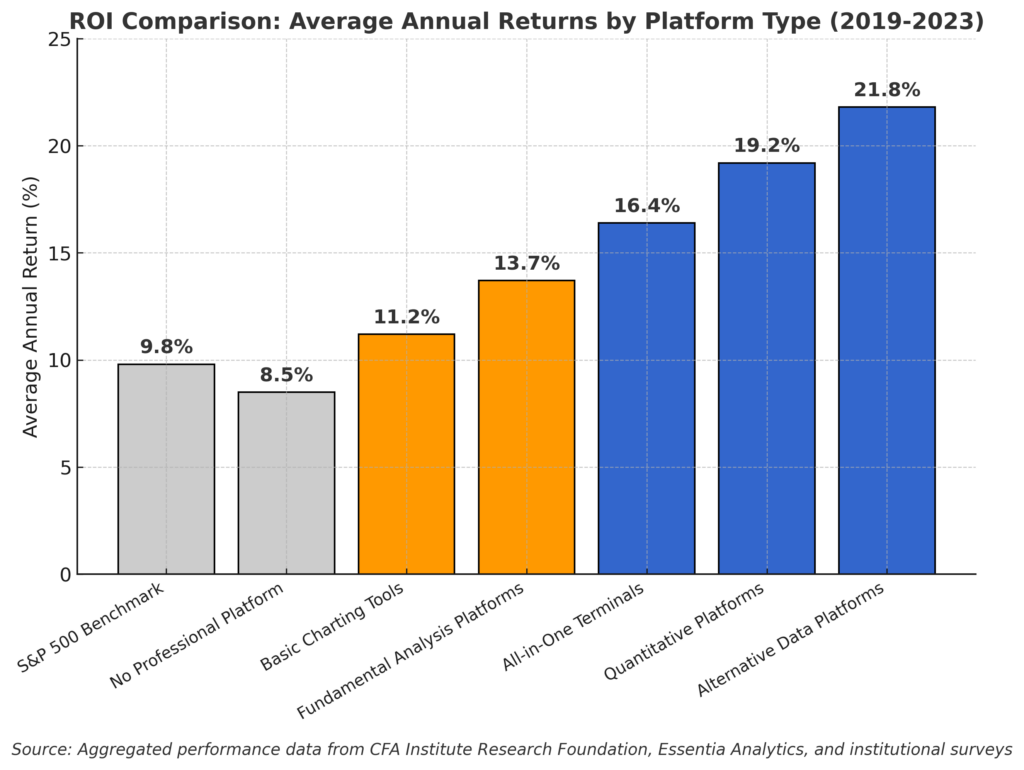

These information advantages translate directly to performance. A 2023 study by the Financial Analysts Journal found that hedge funds with access to premium data services generated 3.1% higher risk-adjusted returns annually compared to peers with standard information sources.

Enhanced Analysis Capabilities

Modern research platforms elevate analytical capabilities through:

- Computational power: Complex analyses that would take days on standard hardware complete in seconds

- Sophisticated models: Access to institutional-grade risk, valuation, and forecasting models

- Pattern recognition: Identification of subtle correlations and anomalies across massive datasets

- Scenario testing: Robust stress testing under thousands of potential market conditions

The practical impact of these capabilities is substantial. For example, Two Sigma’s analysis found that their machine learning models identified profitable trading opportunities with 28% higher accuracy than traditional analytical methods.

Workflow Efficiency

Research platforms dramatically improve productivity through:

- Process automation: Reduction of manual data collection and processing by up to 70%

- Information organization: Centralized research management and knowledge repositories

- Collaboration tools: Seamless sharing of insights across investment teams

- Customized alerting: Proactive notification of relevant events and threshold breaches

BlackRock estimates that their Aladdin platform saves each investment professional approximately 17 hours weekly in administrative tasks, redirecting that time to higher-value analytical activities.

Risk Management

Comprehensive risk insights from research platforms include:

- Real-time exposure analysis: Immediate understanding of portfolio sensitivities to market factors

- Correlation monitoring: Dynamic tracking of changing relationships between assets

- Liquidity assessment: Accurate measurement of position exit costs under various scenarios

- Factor decomposition: Precise attribution of risks to specific investment factors

JPMorgan’s risk management study demonstrated that firms utilizing advanced risk analytics platforms reduced drawdowns by 22% during market crises compared to firms using basic risk tools.

Competitive Differentiation

Research platforms help investment professionals stand out through:

- Unique insights: Generation of proprietary views beyond consensus opinions

- Strategy development: Creation and testing of distinctive investment approaches

- Client engagement: Impressive visualization and communication of investment theses

- Track record documentation: Systematic capture of decision processes and outcomes

A CFA Institute survey found that 78% of clients cited “unique insights and perspective” as a top criterion for selecting investment managers, directly connecting research capabilities to business development success.

Challenges and Limitations

Cost Barriers

The high cost of premium research platforms presents significant challenges:

- Annual subscription fees: Premium services range from $12,000 to $35,000 per user annually

- Data feed costs: Additional charges for specialized data can add $5,000-$20,000 annually

- Implementation expenses: Integration with existing systems requires technical resources

- Training investment: Staff require 40-80 hours of training to become proficient users

For smaller firms and individual investors, these costs can be prohibitive. A $25,000 annual Bloomberg Terminal subscription represents a 2.5% expense ratio on a $1 million portfolio, significantly impacting net returns.

Information Overload

The vast information available through research platforms creates practical challenges:

- Alert fatigue: Users typically receive 150-300 notifications daily, leading to important signals being missed

- Analysis paralysis: Excessive options and data points can delay decision-making

- Signal-to-noise ratio: Distinguishing meaningful insights from market noise becomes increasingly difficult

- Cognitive biases: Confirmation bias is amplified when selectively filtering large information volumes

Research by Essentia Analytics found that 68% of portfolio managers reported making fewer conviction trades after gaining access to comprehensive data platforms, suggesting information abundance can paradoxically reduce decisiveness.

Technical Complexity

The sophisticated nature of advanced platforms creates significant learning curves:

- Specialized interface mastery: Bloomberg Terminal users typically require 3-6 months to become proficient

- Programming requirements: Many quantitative platforms require Python, R, or SQL knowledge

- Statistical literacy: Interpreting advanced analytics requires statistical and mathematical expertise

- Continuous learning: Platforms add 20-30 major features annually, requiring ongoing education

A CFA Institute survey found that 47% of firms reported utilizing less than 30% of their research platforms’ capabilities due to complexity barriers.

Data Quality Issues

Even premium platforms struggle with data integrity challenges:

- Inconsistent methodologies: Accounting standards and reporting practices vary across companies and regions

- Coverage gaps: Data availability decreases significantly for small-cap stocks and emerging markets

- Survivorship bias: Historical databases often exclude delisted companies, creating performance distortions

- Revision policies: Different vendors handle data corrections and updates inconsistently

Research by S&P Global found that 7.2% of point-in-time fundamental data points contain material errors or inconsistencies, highlighting the need for robust verification processes.

Overreliance and Groupthink

Widespread adoption of similar research tools creates market inefficiencies:

- Crowded trades: When many investors use similar signals, opportunity gaps narrow quickly

- Echo chambers: Similar data sources can reinforce prevailing narratives and miss contrarian signals

- Algorithm convergence: Automated strategies based on standard platforms may create market vulnerabilities

- False precision: Sophisticated analytics can create illusions of certainty in inherently uncertain markets

The “quant meltdown” of August 2007, when many quantitative equity strategies experienced simultaneous losses of 15-30%, exemplifies the risks of strategy convergence around common research platforms.

How to Implement a Professional Research Platform

Needs Assessment and Platform Selection

The foundation of successful implementation begins with systematic evaluation:

- Define research requirements:

- Document specific use cases and workflow needs

- Identify must-have versus nice-to-have features

- Establish data coverage requirements (asset classes, regions, history)

- Define integration needs with existing systems

- Evaluate platform options:

- Request demonstrations focused on your specific use cases

- Conduct hands-on trials with actual research scenarios

- Check reference clients with similar investment approaches

- Evaluate vendor financial stability and development roadmap

- Calculate the total cost of ownership:

- Factor in base subscription costs, per-user fees, and data add-ons

- Include implementation consulting and integration expenses

- Budget for ongoing training and support needs

- Consider hardware requirements and upgrades

- Develop selection criteria matrix:

- Weight features based on importance to your process

- Score each platform objectively against requirements

- Include both technical and user experience factors

- Calculate ROI based on efficiency gains and potential alpha

Morgan Stanley’s technology evaluation framework recommends allocating 70% of selection criteria to functional requirements, 15% to cost considerations, and 15% to vendor relationship factors.

Implementation and Integration

Successful deployment requires careful planning and execution:

- Create implementation timeline:

- Define a phased rollout approach (typically 60-90 days)

- Establish clear milestones and success criteria

- Identify dependencies and critical path items

- Build in contingency time for unexpected challenges

- Prepare the technical environment:

- Ensure hardware meets or exceeds platform requirements

- Configure network capacity and security settings

- Establish user access controls and permission structures

- Test system performance under various usage scenarios

- Integrate with existing systems:

- Connect to portfolio management and accounting platforms

- Establish data feeds to trading and execution systems

- Develop APIs for custom applications and reports

- Create backup and disaster recovery procedures

- Develop custom workflows:

- Configure dashboards for different user roles

- Build custom screens and report templates

- Develop saved searches and alerts for key scenarios

- Create model libraries and analytical templates

Fidelity’s technology implementation group recommends allocating 30% of implementation time to technical setup, 40% to workflow configuration, and 30% to testing and validation.

Training and Adoption

Maximizing platform value requires comprehensive user enablement:

- Structured training program:

- Develop role-specific learning paths

- Combine vendor training with customized internal modules

- Include both technical features and analytical applications

- Create a certification process for different proficiency levels

- Progressive skill development:

- Start with core workflows and basic features

- Gradually introduce advanced capabilities

- Provide regular refreshers and feature updates

- Identify power users to assist peers and share best practices

- Incentivize adoption:

- Integrate platform usage into performance evaluations

- Showcase successful applications in team meetings

- Recognize innovative use cases and knowledge-sharing

- Document efficiency gains and research improvements

- Create support resources:

- Develop an internal knowledge base of common questions

- Establish clear support escalation procedures

- Schedule regular check-ins to address challenges

- Create a feedback loop for platform improvements

A McKinsey study found that investment firms with formal technology adoption programs achieved 65% higher utilization rates of their research platforms compared to those with informal approaches.

Measuring Return on Investment

Quantifying the value of research platforms requires systematic measurement:

- Establish performance baselines:

- Document pre-implementation research productivity metrics

- Catalog decision quality and time-to-insight measures

- Record portfolio performance attributions

- Measure client satisfaction and engagement levels

- Track efficiency improvements:

- Monitor time spent on routine research tasks

- Measure alert-to-action conversion rates

- Track research coverage expansion

- Quantify collaboration increases across teams

- Assess research quality enhancements:

- Compare insight generation pre/post implementation

- Measure false positive/negative rates in research signals

- Evaluate the originality of the investment thesis

- Track hit rates on specific research predictions

- Calculate financial impact:

- Attribute performance improvements to platform capabilities

- Measure client acquisition and retention impacts

- Quantify cost savings from workflow automation

- Calculate platform cost as a percentage of excess returns

Goldman Sachs Asset Management estimates that their advanced research platforms contribute 15-35 basis points of annual alpha after accounting for all implementation and subscription costs.

Continuous Optimization

Maximizing long-term value requires ongoing refinement:

- Regular feature evaluation:

- Audit currently used versus available capabilities

- Identify underutilized high-value features

- Prune redundant or low-value functions

- Prioritize new feature adoption based on potential impact

- Workflow refinement:

- Conduct periodic process efficiency reviews

- Identify and eliminate friction points

- Update templates and models based on user feedback

- Automate repetitive analysis sequences

- User skill advancement:

- Provide progressive learning opportunities

- Organize peer knowledge-sharing sessions

- Create advanced user certification programs

- Develop internal feature experts and champions

- Vendor relationship management:

- Schedule quarterly business reviews with vendors

- Provide structured feedback on features and roadmap

- Negotiate enhanced service levels based on usage

- Participate in beta testing and development programs

T. Rowe Price’s technology governance process includes quarterly platform reviews that have identified an average of 12 significant optimization opportunities annually across their research systems.

Future Trends in Investment Research Platforms

AI and Natural Language Processing

Artificial intelligence is rapidly transforming research capabilities:

- Automated insight generation: AI systems now produce first-draft research reports on earnings releases within 3 minutes of publication

- Unstructured data analysis: NLP can analyze 100,000+ documents daily to identify subtle sentiment shifts and anomalies

- Intelligent assistants: Conversational AI interfaces answer 70% of common research queries without human intervention

- Hypothesis generation: Machine learning models identify non-obvious relationships and research angles

Goldman Sachs estimates that by 2026, over 40% of fundamental research tasks will be AI-augmented or fully automated, fundamentally changing analyst workflows and skill requirements.

Alternative Data Integration

Non-traditional data sources continue expanding research horizons:

- IoT and sensor networks: Real-time monitoring of physical assets and activities providing early performance indicators

- Digital exhaust analysis: Web traffic, social engagement, and app usage metrics revealing consumer behavior shifts

- Private company intelligence: Employee reviews, hiring patterns, and product roadmaps offering insights into non-public entities

- Geospatial analytics: Satellite imagery analysis showing supply chain movements and economic activity

The alternative data market is projected to grow from $3.7 billion in 2023 to $17.4 billion by 2027, a 47% compound annual growth rate, according to Grand View Research.

Democratization of Institutional Capabilities

Advanced research tools are becoming more accessible:

- SaaS delivery models: Cloud-based platforms reduce implementation costs by 60-80% compared to on-premise systems

- Modular pricing: Feature-based subscriptions allow tailored access without full platform costs

- API ecosystems: Programmable interfaces enabling custom applications built on institutional data

- Community editions: Limited but powerful versions of professional platforms for individual investors

Interactive Brokers reports that 76% of their “Pro” tier users now utilize institutional-grade research tools that were unavailable to individual investors five years ago.

ESG and Impact Integration

Sustainability research is becoming core to investment platforms:

- Comprehensive ESG scoring: Platforms now track 75+ sustainability metrics across 15,000+ global companies

- Supply chain mapping: Analysis of fourth and fifth-tier suppliers for sustainability risks and practices

- Climate scenario analysis: Modeling of physical and transition climate risks across investment horizons

- Impact measurement: Quantification of portfolio contributions to UN Sustainable Development Goals

BlackRock research indicates that 88% of professional investors now consider ESG integration “essential” in their research platforms, up from 32% in 2018.

Cross-Asset Integration

Platform evolution continues to break down traditional asset class silos:

- Unified risk frameworks: Consistent risk modeling across equities, fixed income, alternatives, and derivatives

- Correlation analysis: Dynamic tracking of relationships between traditionally separate asset classes

- Macro factor modeling: Identification of common drivers across diverse investment types

- Holistic portfolio construction: Optimization tools incorporating all holdings regardless of classification

JPMorgan’s asset management division reports 23% improved risk-adjusted returns from strategies using cross-asset research platforms compared to traditional siloed approaches.

FAQs – Investment Research Platforms

1. What is the minimum portfolio size needed to justify professional research platforms?

The economics of premium research platforms typically become viable at specific portfolio thresholds:

- For wealth managers and advisors, a practice managing at least $100-150 million in assets can typically justify platforms in the $5,000-10,000 annual range while keeping technology costs under 0.1% of AUM.

- Individual investors should consider the 1% rule – technology expenses should generally not exceed 1% of portfolio value annually, suggesting a minimum $250,000 portfolio for even entry-level professional tools costing $2,500 annually.

Strategic alternatives for smaller portfolios include:

- Using broker-provided research tools (typically free with minimum account sizes), pooling resources through investment clubs to share subscription costs, or utilizing academic access through university partnerships where available.

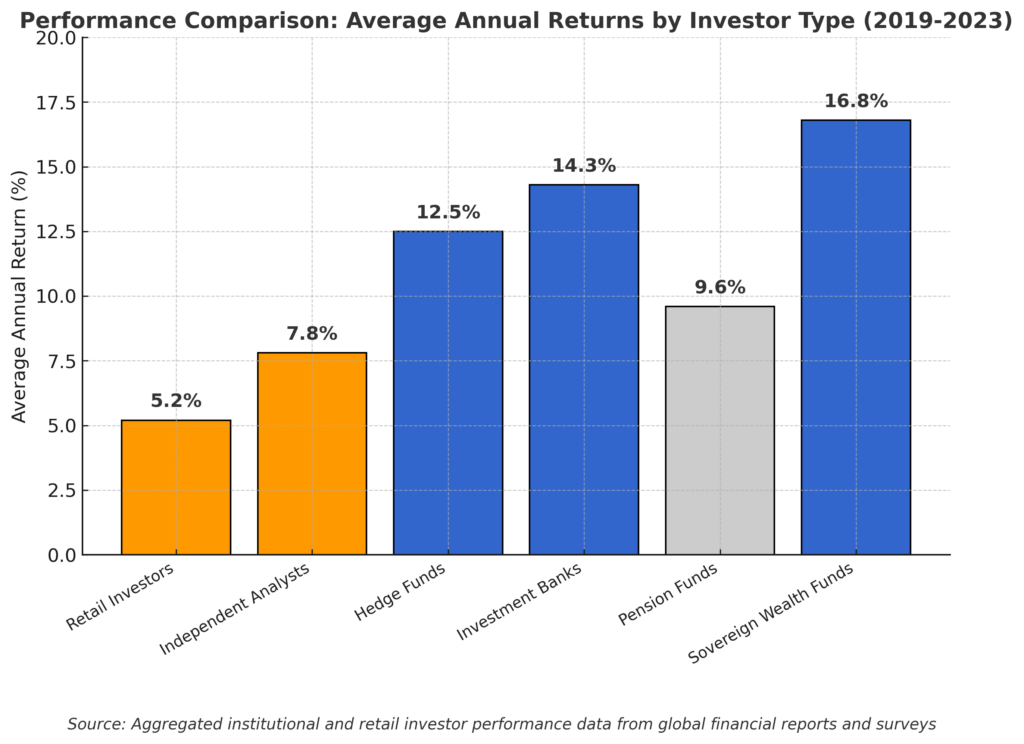

2. How do hedge funds use research platforms differently than individual investors?

Hedge funds extract maximum value from research platforms through several distinctive approaches:

- Institutional investors typically employ dedicated data scientists (teams of 5-20 specialists) to build proprietary analytical layers on top of platform data feeds.

- They develop custom risk models calibrated to specific strategy parameters rather than using out-of-the-box calculations.

- Systematic funds create automated pipelines that continuously extract, transform and analyze data without human intervention.

Individual investors can adapt these approaches by:

- Focusing on niche areas where they can develop deep expertise rather than attempting comprehensive coverage, creating structured research processes that minimize emotional decision-making, and leveraging community insights through platforms with social features while maintaining independent judgment.

3. What programming skills are most valuable for maximizing research platform capabilities?

Specific technical skills dramatically enhance research platform utility:

- Python has emerged as the dominant language for financial data analysis, with particular emphasis on libraries like Pandas (data manipulation), NumPy (numerical computing), scikit-learn (machine learning), and Matplotlib/Seaborn (visualization).

- SQL remains essential for efficient data querying and extraction from large datasets.

- Statistical programming skills in R provide access to specialized financial packages not available elsewhere.

For non-programmers, practical alternatives include:

- Utilizing platforms with visual workflow builders (like Alteryx or KNIME), mastering advanced Excel techniques, including Power Query and DAX, or employing low-code automation tools like Zapier to connect different research systems.

4. How can I evaluate if a research platform is actually improving my investment performance?

Rigorous performance attribution requires systematic measurement:

- Implement A/B testing by making some decisions with platform insights and others without, then comparing outcomes.

- Maintain detailed investment journals documenting which platform signals influenced specific decisions.

- Calculate the “cost per insight” by dividing platform expenses by the number of actionable ideas generated.

- Measure time-to-decision improvements and correlate with performance outcomes.

Common pitfalls to avoid include:

- Confusing correlation with causation during bull markets when most strategies perform well, neglecting to account for market regime changes when evaluating signal quality, and failing to distinguish between technical tool proficiency and actual investment judgment improvements.

5. What are the most underutilized features of professional research platforms?

Experienced platform users identify several high-value but underutilized capabilities:

- Custom alert systems that can monitor specific conditions across thousands of securities simultaneously are configured by less than 30% of users, according to Bloomberg usage data.

- Scenario analysis tools that stress-test portfolios under historical or hypothetical conditions are used regularly by only 25% of platform subscribers.

- API access for custom application development and workflow automation is leveraged by less than 15% of enterprise customers despite significant productivity potential.

To identify underutilized features in your platform:

- Schedule periodic feature reviews with vendor representatives, participate in user community forums where power users share workflows, and analyze feature usage reports provided by most enterprise platforms.

6. How do I balance quantitative signals from research platforms with fundamental judgment?

Effective integration of quantitative and qualitative analysis follows proven frameworks:

- The “quantamental” approach pioneered by Point72 uses quantitative signals as initial screens to direct analyst attention, then applies fundamental research to verify and contextualize machine-generated insights.

- Two Sigma’s “human in the loop” methodology requires quantitative signals to pass both statistical and logical validation before inclusion in investment processes.

- BlackRock’s “Systematic Active Equity” team requires every quantitative signal to have an economically sound explanation before deployment.

Practical implementation steps include:

- Establishing clear precedence rules determining when quantitative signals override fundamental views (and vice versa), creating systematic review processes for signal failures to refine future approaches, and maintaining separate tracking of quantitative versus fundamental decision performance.

7. What are the data privacy and compliance considerations when using research platforms?

Research platform usage involves significant regulatory and privacy considerations:

- Material non-public information (MNPI) controls must be established to prevent inadvertent access to or sharing of insider information through platform communication channels.

- Alternative data compliance reviews should verify that all data sources meet regulatory requirements and ethical standards before incorporation into research processes.

- Cross-border data restrictions may limit certain data types or analyses when operating across different jurisdictions.

Best practices include:

- Conducting regular compliance reviews of all data sources and analytical methods, maintaining comprehensive audit trails of research activities and data access, implementing rigorous permissioning systems to control sensitive information flow, and establishing clear policies regarding usage of web scraping and alternative data.

8. How often should I evaluate and potentially switch research platforms?

Platform evaluation should follow a structured timeline:

- Major platform reviews typically occur on 2-3 year cycles aligned with contract renewal periods.

- Continuous monitoring should track vendor enhancement releases, pricing changes, and competitor innovations.

- Formal mid-contract assessments at 12-18 months evaluate whether the platform is delivering expected ROI.

Key evaluation triggers include:

- Significant strategy changes requiring different research capabilities, material team composition changes affecting user needs, substantial pricing increases at renewal, and emergence of innovative competitors with potentially superior offerings.

The switching cost calculation should factor in:

- Data migration expenses, user retraining requirements (typically 40-80 hours per user), workflow redesign needs, and potential short-term productivity losses during transition.

9. How can I measure the ROI of premium research platforms compared to free alternatives?

Quantifying the value differential between premium and free tools requires specific metrics:

- Time efficiency gains can be measured by tracking hours spent on comparable research tasks across different platforms.

- Information advantage can be quantified by comparing when insights were available on premium versus free platforms (typically 1-7 days earlier on premium services).

- Decision quality improvements can be assessed by comparing win rates and position sizing accuracy between decisions made with different tool sets.

Practical measurement approaches include:

- Maintaining parallel research processes on different platforms for sample periods, conducting blind testing where decision-makers don’t know which platform generated specific insights, and calculating the “alpha hurdle rate” required to justify premium costs (typically 15-25 basis points of excess return per $10,000 in platform expenses).

10. What emerging technologies will disrupt investment research platforms in the next five years?

Several emerging technologies are poised to transform investment research:

- Large language models (LLMs) trained on financial texts are enabling increasingly sophisticated conversational interfaces for investment research, with capabilities approaching dedicated financial analysts for routine queries.

- Quantum computing applications for portfolio optimization and risk modeling are progressing from theoretical to practical implementations, with initial applications in derivative pricing already emerging.

- Augmented reality data visualization tools are moving from experimental to commercial applications, enabling multidimensional data analysis beyond traditional screen limitations.

Forward-looking investment implications include:

- Prioritizing platforms with open AI integration capabilities that can incorporate rapidly evolving third-party models, evaluating vendors based on quantum-readiness of algorithms and data structures, and preparing analytical frameworks that can incorporate substantially more complex multifactor relationships than currently possible.

Conclusion

The evolution of investment research platforms represents one of the most significant democratizations of financial capability in market history. Tools and data once exclusive to the world’s elite institutions are increasingly accessible to smaller organizations and sophisticated individuals, fundamentally altering the landscape of investment advantage.

As computational power, data availability, and analytical sophistication continue their exponential advancement, the gap between institutional and individual research capabilities will likely narrow further.

However, this democratization brings both opportunity and challenge. While access to powerful tools expands, the skills required to effectively leverage these platforms grow correspondingly complex. The most successful investors of the coming decade will likely be those who combine technological fluency with sound investment judgment – using advanced platforms not to replace critical thinking but to extend human capabilities into dimensions previously inaccessible.

As we move into an era where information abundance rather than scarcity defines the investment landscape, the competitive edge will increasingly belong to those who can transform data into insight, signals into strategy, and complexity into clarity.

For your reference, recently published articles include:

- Alternative Data Analytics: All You Need To Know About Wall Street’s Best-Kept Secret

- Outperform 90% Of Investors: Best Advice On Investment Benchmarking Tools

- Trading Fee Comparison: Your 2025 Guide to Commission-Free Platforms

- Investment Tax Optimization: The Ultimate Guide To Save Legally

- Retire 10 Years Earlier: Revolutionary Financial Goal Planning Strategies

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.