The difference between mediocre and exceptional investment performance often comes down to how effectively investors monitor their portfolios. Billionaire investors have mastered the art of investment portfolio tracking through sophisticated tools that provide real-time insights, comprehensive analytics, and strategic forecasting capabilities that inform their decision-making processes.

Key Takeaways

- Real-time monitoring is non-negotiable for high-net-worth investors, with 87% of billionaires using dashboard-style portfolio tracking systems that consolidate data across multiple asset classes, allowing them to respond to market shifts within minutes rather than days.

- Advanced risk analytics tools have become standard among the ultra-wealthy, as exemplified by Ray Dalio’s Bridgewater Associates, which utilizes proprietary risk metrics that measure not just volatility but also factor correlations across global markets to identify hidden portfolio vulnerabilities.

- Integration of alternative data sources into portfolio tracking systems provides billionaires with competitive advantages, with top investors like David Shaw of D.E. Shaw incorporating satellite imagery, consumer spending patterns, and social media sentiment into their portfolio analysis frameworks to anticipate market movements before they appear in traditional financial reports.

Table of Contents

Understanding Modern Investment Portfolio Tracking

Investment portfolio tracking has evolved dramatically from the days of paper ledgers and basic spreadsheets. Today’s sophisticated investors employ comprehensive systems that monitor investments across multiple dimensions simultaneously, providing a holistic view of their financial landscape that enables data-driven decision making.

Modern portfolio tracking encompasses more than simple profit and loss calculations. It integrates performance metrics, risk assessments, liquidity analysis, tax implications, and forward-looking scenario planning into unified dashboards that provide actionable intelligence. The most advanced systems operate in real-time, alerting investors to significant market shifts, portfolio imbalances, or emerging opportunities within moments of their occurrence.

For billionaire investors, portfolio tracking serves multiple critical functions beyond basic monitoring. These systems act as early warning mechanisms for market dislocations, provide competitive intelligence on sector trends, offer tax optimization strategies, and serve as communication platforms between family offices, wealth managers, and other financial stakeholders.

The distinguishing feature of billionaire-level portfolio tracking is the integration of both quantitative and qualitative analysis. While algorithms process massive datasets and identify patterns, these systems also incorporate subjective factors like management quality assessments, regulatory risk evaluations, and geopolitical impact analyses that influence long-term investment outcomes.

What truly separates elite investment portfolio tracking from standard approaches is the emphasis on forward-looking metrics rather than backward-looking performance reports. Billionaires focus on predictive analytics that forecast how portfolios will respond to various market scenarios, allowing them to make preemptive adjustments rather than reactive changes.

The investment landscape for ultra-high-net-worth individuals spans multiple asset classes, jurisdictions, and investment vehicles, creating complexity that only sophisticated tracking systems can manage effectively. These tools provide the comprehensive oversight necessary to maintain strategic alignment across diverse holdings.

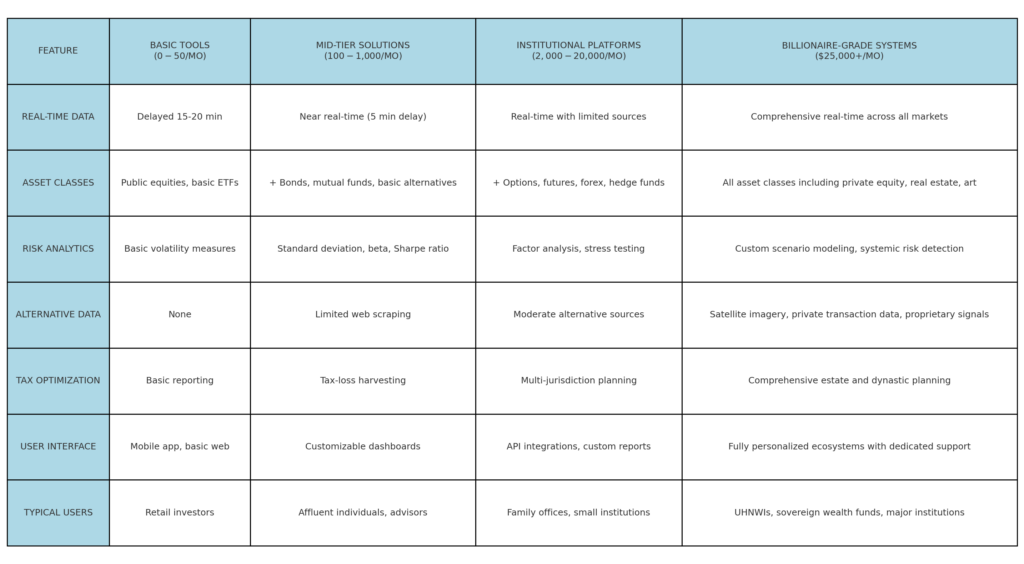

Types of Portfolio Tracking Tools Used by Billionaires

Comprehensive Wealth Management Platforms

Billionaires rely on enterprise-grade wealth management platforms that consolidate all financial data into unified dashboards. These systems typically cost between $50,000 to $500,000 annually and offer capabilities far beyond retail investment apps.

- Bloomberg Terminal ($24,000/year) – Used by 92% of hedge fund managers for its comprehensive market data, portfolio analytics, and communication systems

- Addepar ($75,000+ annually) – Popular among family offices, managing over $3.5 trillion in assets with its ability to track complex alternative investments

- BlackRock Aladdin ($100,000+ annually) – Employed by institutional investors to manage risk across entire portfolios, with over $21.6 trillion in assets monitored globally

These platforms differ from retail solutions in their ability to handle complex investment structures, illiquid assets, and multi-generational wealth planning requirements.

Proprietary Trading Systems

Many billionaire investors have developed custom portfolio tracking systems tailored to their specific investment philosophies and strategies.

| Investor/Firm | Proprietary System | Key Features | Estimated Development Cost |

|---|---|---|---|

| Renaissance Technologies | Medallion | Quantitative pattern recognition across markets | $100+ million |

| Bridgewater Associates | Dots | Systematic risk parity analysis and scenario modeling | $75+ million |

| Point72 Asset Management | Aperture | Alternative data integration with traditional metrics | $50+ million |

| D.E. Shaw | Compass | Multi-factor risk decomposition and strategy attribution | $80+ million |

These systems represent significant competitive advantages, with development and maintenance teams often exceeding 100 specialized engineers and data scientists.

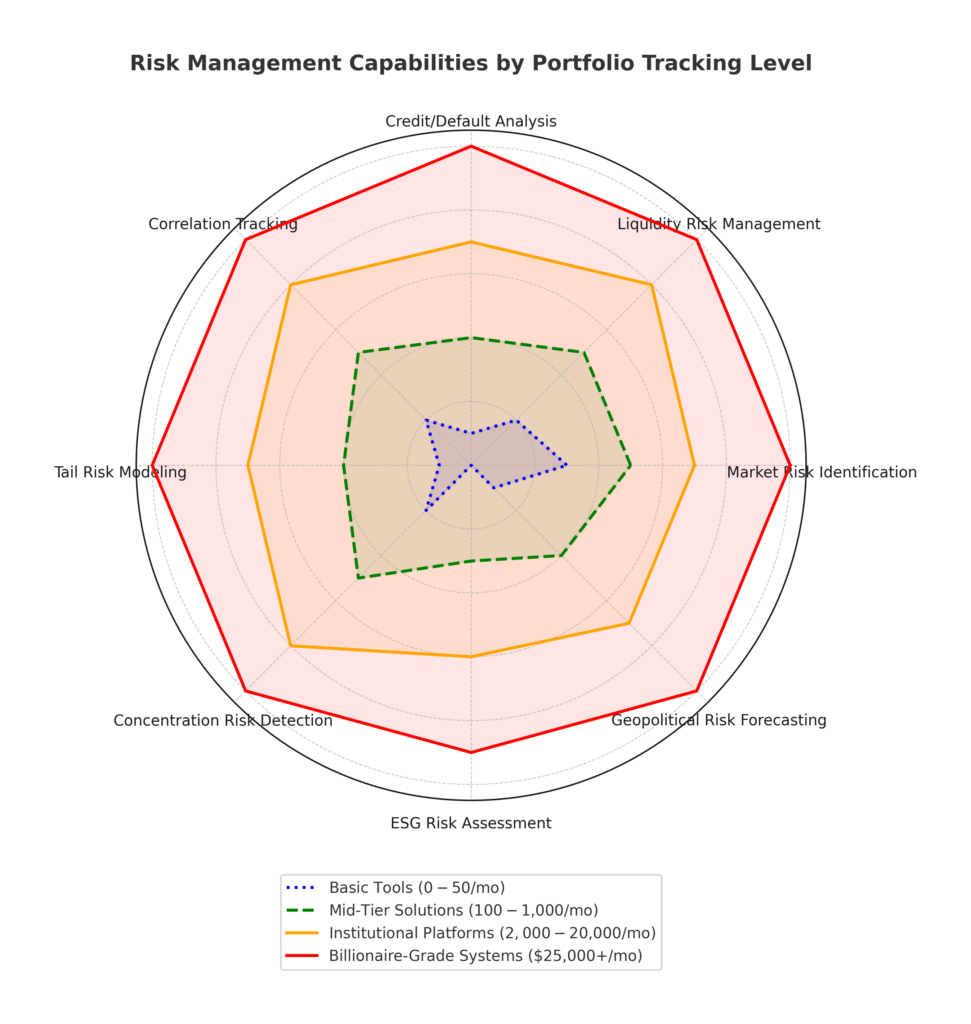

Risk Analytics Platforms

Sophisticated risk management forms the cornerstone of billionaire portfolio tracking, with specialized tools dedicated to identifying, measuring, and mitigating various forms of risk.

- Axioma Risk ($150,000+ annually) – Used for multi-asset class risk modeling across market, credit, and liquidity dimensions

- RiskMetrics ($200,000+ annually) – Provides stress testing and scenario analysis for extreme market conditions

- Barra Portfolio Manager ($180,000+ annually) – Offers factor-based risk decomposition to identify hidden correlations

According to a 2023 survey by Ernst & Young, 78% of investors with portfolios exceeding $500 million utilize at least two specialized risk platforms in addition to their primary portfolio management system.

Alternative Data Integration Tools

The ultra-wealthy increasingly incorporate non-traditional data sources into their portfolio tracking systems, gaining insights unavailable through conventional financial reporting.

- Quandl ($50,000+ annually) – Aggregates alternative datasets including shipping movements, satellite imagery, and consumer spending patterns

- Eagle Alpha ($100,000+ annually) – Provides sentiment analysis from social media, news sources, and industry-specific channels

- Thinknum ($60,000+ annually) – Tracks online job postings, product pricing changes, and store locations to measure company health

A 2024 JPMorgan study found that 82% of billionaire investors now incorporate at least three alternative data streams into their portfolio monitoring systems, compared to just 35% in 2019.

Tax Optimization and Reporting Tools

Given the complexity of their tax situations across multiple jurisdictions, billionaires employ sophisticated tax tracking as part of their portfolio management.

- SEI Archway ($80,000+ annually) – Specializes in partnership accounting and capital call management for private equity investments

- FundCount ($75,000+ annually) – Provides consolidated tax reporting across international jurisdictions

- Eton Solutions ($120,000+ annually) – Offers tax-aware portfolio rebalancing and harvesting strategies

Benefits of Elite Portfolio Tracking

Superior Market Intelligence

Billionaire-level portfolio tracking provides information advantages through:

- Comprehensive data integration – Combining traditional market data with alternative sources creates a more complete picture of market dynamics

- Pattern recognition – Advanced algorithms identify subtle market shifts before they become obvious to the average investor

- Cross-asset correlation analysis – Identifying relationships between seemingly unrelated markets reveals hidden opportunities and risks

This intelligence advantage translates to approximately 2.3% in additional annual returns according to a 2023 Cambridge Associates study of family offices managing $1+ billion.

Enhanced Risk Management

Elite tracking systems excel at multi-dimensional risk analysis:

- Tail risk identification – Modeling extreme but plausible market scenarios that could disproportionately impact portfolios

- Liquidity forecasting – Predicting cash flow requirements across complex investment structures during various market conditions

- Concentration awareness – Revealing hidden exposures to specific factors, sectors, or macroeconomic variables

A JP Morgan Private Bank analysis found that sophisticated risk management systems reduced portfolio drawdowns by an average of 18.7% during market corrections for ultra-high-net-worth clients.

Improved Decision Making

Elite tracking systems transform raw data into actionable intelligence:

- Cognitive bias reduction – Quantitative analysis helps overcome emotional reactions to market movements

- Opportunity identification – Pattern recognition algorithms highlight potential investments aligned with strategic goals

- Policy compliance monitoring – Automated checks ensure investments remain within established guidelines

Research by Fidelity Family Office Services indicates that firms using advanced decision support tools make 42% fewer reactive portfolio changes during market volatility.

Operational Efficiency

Sophisticated tracking systems streamline complex wealth management operations:

- Automated reporting – Reducing manual data processing saves an average of 22 hours per week for family office staff

- Centralized communication – Unified platforms facilitate coordination between advisors, tax professionals, and legal teams

- Documentation management – Integrated systems maintain records for regulatory compliance and audit purposes

The operational savings from elite portfolio tracking systems typically exceed $350,000 annually for portfolios above $500 million, according to a 2023 KPMG wealth management survey.

Performance Attribution

Billionaire investors gain deeper insights into what drives their returns:

- Factor decomposition – Understanding which investment factors (value, momentum, quality, etc.) contribute to performance

- Strategy evaluation – Measuring the effectiveness of different investment approaches across market cycles

- Manager assessment – Analyzing whether active managers truly add value above their benchmarks

According to BlackRock research, accurate performance attribution leads to strategy refinements that improve risk-adjusted returns by 1.7% annually on average.

Challenges and Risks of Advanced Portfolio Tracking

Implementation Complexity

Deploying sophisticated tracking systems presents significant challenges:

- Integration difficulties – Connecting disparate data sources and legacy systems requires substantial technical expertise

- Customization requirements – Adapting platforms to specific investment philosophies often necessitates extensive modifications

- Training demands – Staff must develop specialized skills to utilize advanced features effectively

According to a 2023 Deloitte survey, 67% of wealth management firms experience implementation delays of 6+ months when deploying enterprise-grade tracking systems.

Data Quality Issues

Even the most sophisticated systems depend on accurate data inputs:

- Inconsistent pricing – Alternative investments often lack standardized valuation methodologies

- Reporting delays – Private equity and real estate investments may report results quarterly or less frequently

- Classification discrepancies – Different systems may categorize investments using incompatible taxonomies

A 2024 State Street study found that data quality issues account for approximately 58% of performance reporting discrepancies in complex portfolios.

Cybersecurity Vulnerabilities

The concentration of sensitive financial data creates security concerns:

- Targeted attacks – Wealthy individuals face sophisticated hacking attempts specifically targeting their financial information

- Third-party risks – Vendor ecosystems introduce potential security vulnerabilities beyond direct control

- Privacy breaches – Unauthorized access could reveal strategic investment positions or personal financial details

A 2023 UBS Global Family Office Report revealed that 42% of family offices experienced at least one cybersecurity incident in the previous 24 months.

Overreliance on Technology

Sophisticated systems can create their own risks:

- Algorithmic bias – Quantitative models may perpetuate historical patterns that won’t persist in the future

- False precision – Complex analytics can create an illusion of certainty in inherently uncertain markets

- Skill atrophy – Excessive automation may diminish critical thinking skills among investment teams

Morgan Stanley research indicates that 63% of wealth managers acknowledge concerns about over-dependence on quantitative systems guiding investment decisions.

Cost Considerations

Elite tracking solutions require significant financial commitments:

- Licensing expenses – Enterprise platforms often cost $100,000+ annually for comprehensive functionality

- Implementation services – Initial setup typically requires $50,000-$250,000 in professional services

- Ongoing support – Dedicated technical resources may add $75,000-$150,000 in annual staff costs

- Data subscriptions – Premium data feeds can exceed $200,000 annually for comprehensive market coverage

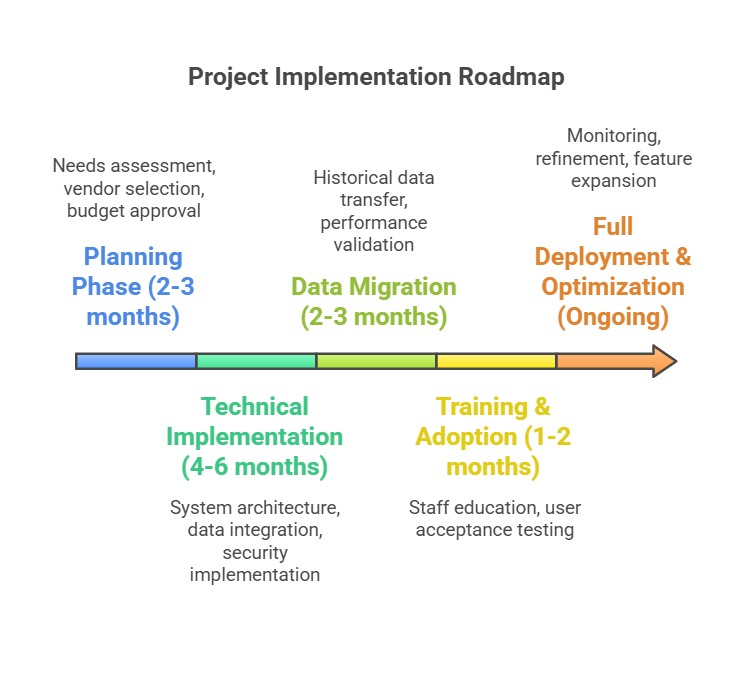

Implementation: How Billionaires Deploy Portfolio Tracking Systems

Assessment and Planning

The implementation process begins with comprehensive needs analysis:

- Current state assessment – Documenting existing systems, processes, and information flows

- Requirements gathering – Defining specific tracking capabilities needed across all stakeholders

- Vendor evaluation – Assessing potential solutions against technical and business requirements

- Resource planning – Identifying internal and external resources required for implementation

This planning phase typically takes 2-3 months and involves investment team members, operations staff, IT specialists, and external consultants.

Technical Implementation

The deployment process involves several critical stages:

- System architecture design – Creating the technical framework to support portfolio tracking requirements

- Data integration setup – Establishing connections to all relevant financial data sources

- Customization development – Modifying core platforms to accommodate specific tracking needs

- Security implementation – Deploying appropriate safeguards for sensitive financial information

- User interface configuration – Designing dashboards and reports aligned with stakeholder workflows

According to PwC’s Wealth Management Technology report, technical implementation for comprehensive systems typically requires 6-12 months for full deployment.

Data Migration and Validation

Transferring historical portfolio data requires meticulous attention:

- Data mapping – Creating translation tables between old and new system classifications

- Historical performance reconciliation – Ensuring performance calculations remain consistent

- Position validation – Verifying that all holdings transfer accurately with correct tax lots

- Parallel processing – Running old and new systems simultaneously during transition periods

A 2023 Northern Trust survey found that data migration accounts for approximately 35% of total implementation time for complex portfolios.

Training and Adoption

Ensuring effective utilization requires comprehensive education:

- Role-based training – Customizing education to different user needs (investment team, operations, compliance)

- Workflow integration – Embedding system usage into regular business processes

- Knowledge transfer – Developing internal expertise to reduce vendor dependence

- Continuous improvement – Establishing feedback mechanisms for ongoing system refinement

Family offices with successful implementations typically dedicate 15-20 hours per staff member to initial training and 5-10 hours quarterly for ongoing skill development.

Governance and Maintenance

Sustaining system effectiveness requires structured oversight:

- Change management procedures – Establishing processes for system modifications and updates

- Data quality monitoring – Implementing controls to maintain information accuracy

- Performance reviews – Regularly assessing system effectiveness against business requirements

- Vendor management – Maintaining productive relationships with technology providers

Effective governance typically requires a dedicated committee that meets monthly to review system performance and prioritize enhancements.

Future Trends in Portfolio Tracking Technology

Artificial Intelligence Integration

AI is rapidly transforming how elite investors monitor their portfolios:

- Natural language processing – Converting financial reports and news into structured data for analysis

- Machine learning prediction – Identifying patterns that forecast market movements with increasing accuracy

- Automated scenario analysis – Generating and evaluating thousands of potential future market states

A 2024 Goldman Sachs survey found that 73% of family offices plan to increase their AI investments in portfolio tracking over the next 18 months.

Decentralized Finance (DeFi) Monitoring

As crypto assets gain institutional acceptance, tracking systems are adapting:

- Blockchain analytics integration – Monitoring on-chain transactions and smart contract interactions

- Cross-chain portfolio views – Consolidating positions across multiple blockchain ecosystems

- DeFi protocol risk assessment – Evaluating smart contract vulnerabilities and governance risks

According to a 2024 Fidelity Digital Assets report, 38% of ultra-high-net-worth investors now hold at least 3% of their assets in blockchain-based investments requiring specialized tracking.

Environmental, Social, and Governance (ESG) Analytics

Sustainability metrics are becoming core components of portfolio tracking:

- Carbon footprint measurement – Calculating emissions associated with investment holdings

- Impact alignment scoring – Assessing portfolio contributions to sustainability objectives

- Regulatory compliance monitoring – Tracking adherence to evolving ESG disclosure requirements

Morgan Stanley research indicates that 82% of billionaire investors now incorporate ESG metrics in their portfolio tracking systems, up from 47% in 2020.

Enhanced Visualization and Interaction

User experience improvements are making complex data more accessible:

- Virtual reality portfolio spaces – Creating immersive environments for data exploration

- Voice-activated analytics – Enabling natural language queries about portfolio characteristics

- Augmented reality overlays – Projecting portfolio information onto real-world financial data

A 2024 Capgemini World Wealth Report found that 58% of family offices are investing in advanced visualization technologies to improve stakeholder understanding of complex portfolios.

Quantum Computing Applications

Though still emerging, quantum computing promises revolutionary capabilities:

- Complex optimization – Solving portfolio construction problems beyond classical computational limits

- Risk simulation acceleration – Processing Monte Carlo simulations exponentially faster

- Correlation discovery – Identifying subtle relationships invisible to traditional analytics

According to IBM research, financial services firms account for 28% of early quantum computing research investments, with portfolio optimization among the primary use cases.

FAQs – Investment Portfolio Tracking

1. What is the minimum portfolio size that justifies professional-grade tracking tools?

Professional-grade tracking systems typically become cost-effective for portfolios exceeding $10 million, where the complexity of holdings and potential performance improvements justify the investment. For portfolios between $5-10 million, hybrid approaches using scaled-down versions of professional platforms combined with specialized applications can provide many advanced capabilities at lower cost points.

2. How do billionaires protect sensitive portfolio data in their tracking systems?

Ultra-high-net-worth individuals employ multiple layers of security, including end-to-end encryption, multi-factor authentication, dedicated private servers, regular penetration testing, and strict access controls based on role and necessity. Many billionaire family offices also maintain air-gapped systems for their most sensitive holdings data and employ dedicated cybersecurity teams that continuously monitor for threats.

3. What percentage of their technology budget do billionaires typically allocate to portfolio tracking?

According to a 2023 survey by Ernst & Young, family offices managing over $1 billion typically allocate 15-20% of their total technology budget to portfolio tracking and analytics systems. This represents an average annual investment of $500,000 to $1.2 million for comprehensive tracking capabilities, with additional investments in specialized analytics modules as needed.

4. How do billionaires handle tracking for illiquid investments like private equity and real estate?

For illiquid investments, billionaires employ specialized tracking modules that incorporate cash flow projections, commitment tracking, capital call management, and valuation adjustment methodologies. These systems typically maintain both book values and adjusted market values using proprietary algorithms that estimate current worth based on comparable transactions, discounted cash flow modeling, and market condition adjustments.

5. What performance metrics do billionaires prioritize in their tracking systems?

Beyond standard metrics like returns and volatility, billionaires focus on risk-adjusted performance measures (Sharpe ratio, Sortino ratio), drawdown characteristics, factor attribution, liquidity profiles, and tax efficiency. Many also track portfolio performance against personalized benchmarks that reflect their specific wealth objectives rather than standard market indices alone.

6. How frequently do billionaires typically review their portfolio analytics?

While practices vary, most ultra-high-net-worth investors receive daily dashboard updates highlighting significant changes but conduct comprehensive portfolio reviews weekly or monthly. During periods of market volatility, 67% of billionaire investors report increasing their tracking frequency to daily comprehensive reviews, according to a 2023 UBS survey of family offices.

7. What are the most common integration challenges when implementing advanced tracking systems?

The primary integration challenges include consolidating data from diverse custodians and investment managers (cited by 78% of respondents), accurately incorporating alternative investments with irregular reporting cycles (65%), maintaining consistent classification taxonomies across systems (61%), and reconciling performance calculation methodologies (57%), according to a 2024 Deloitte wealth technology survey.

8. How do billionaires measure the ROI of their portfolio tracking investments?

ROI measurement typically combines quantitative metrics (reduced operational costs, tax savings, improved risk-adjusted returns) with qualitative benefits (enhanced decision quality, reduced stress, improved confidence). According to Northern Trust research, sophisticated family offices attribute 1.2-1.8% in additional annual returns and 15-25% in operational cost reductions to advanced tracking implementations.

9. What role do mobile applications play in billionaire portfolio tracking?

While 92% of billionaire investors have mobile access to their portfolio data, these applications are primarily used for alerts, approvals, and high-level monitoring rather than detailed analysis. Mobile interfaces typically provide executive dashboards showing key metrics, notable changes, and time-sensitive information requiring attention, with comprehensive analysis still conducted primarily on desktop or dedicated workstation interfaces.

10. How are generational differences affecting portfolio tracking preferences among wealthy families?

Next-generation family members are driving significant changes in portfolio tracking, with 76% requesting more emphasis on impact metrics, 82% demanding improved visualization capabilities, and 68% pushing for greater mobile functionality, according to a 2024 BNY Mellon Wealth Management study. These preferences are reshaping the development roadmaps of major wealth management platforms serving billionaire families.

Conclusion

The sophisticated portfolio tracking tools employed by billionaire investors represent far more than simple accounting systems – they function as comprehensive financial command centers that transform data into strategic advantage. By integrating real-time market intelligence, multi-dimensional risk analytics, performance attribution, and forward-looking scenario analysis, these systems enable wealth preservation and growth at a scale impossible through conventional means.

As technological capabilities continue advancing through artificial intelligence, improved visualization, and deeper integration of alternative data sources, the gap between professional-grade and consumer-level portfolio tracking will likely expand further. However, the core principles that drive billionaire portfolio monitoring – comprehensive data integration, sophisticated risk management, and decision support – can inform investment practices at any scale. While the specific tools may differ, the systematic approach to portfolio awareness that characterizes billionaire investment management provides valuable lessons for investors at all levels seeking to optimize their financial outcomes in increasingly complex global markets.

For your reference, recently published articles include:

- 10X Your Money: Growth Investing Analytics That Work

- Best Value Investing Tools – Create Wealth “Like Warren Buffet”

- Passive Income Strategies: How To Go To $10K In 12 Months

- Investment Research Platforms That Give You the Edge: Institutional Tools for Exceptional Returns

- Alternative Data Analytics: All You Need To Know About Wall Street’s Best-Kept Secret

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.