Opening Hook

78% of Americans who start investing with less than $5,000 abandon their strategy within the first year – not because they lose money, but because they never had a clear plan to begin with. You’ve saved your first $1,000 for investing, which already puts you ahead of the 64% of Americans who can’t cover a $400 emergency expense.

But here’s the challenge: That small capital advantage disappears fast if you deploy it without a strategic framework.

The landscape for small-dollar investors has transformed dramatically since 2020. Zero-commission trading, fractional shares, and automated investing platforms have demolished the traditional barriers that once made investing with $1,000 nearly impossible.

Between January 2024 and today, we’ve seen benchmark interest rates stabilize around 4.5%, inflation moderate to 3.2%, and equity markets digest one of the most significant valuation resets in a decade. This creates a unique window for new investors: your $1,000 can actually work harder today than it could have five years ago, but only if you understand exactly where to deploy it.

Welcome to our comprehensive guide on how to invest $1000 effectively – we’re excited to help you build the foundation for lasting wealth with proven, actionable strategies! If you are just starting to invest, we highly recommend you to check our article, “How to Start Investing in 2025”.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Welcome to “Finance & Investments” by Didi Somm!

Important Notice: The information in this article is for general and public information purposes only. It solely reflects the opinion of Didi Somm or his staff, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage

Key Takeaways

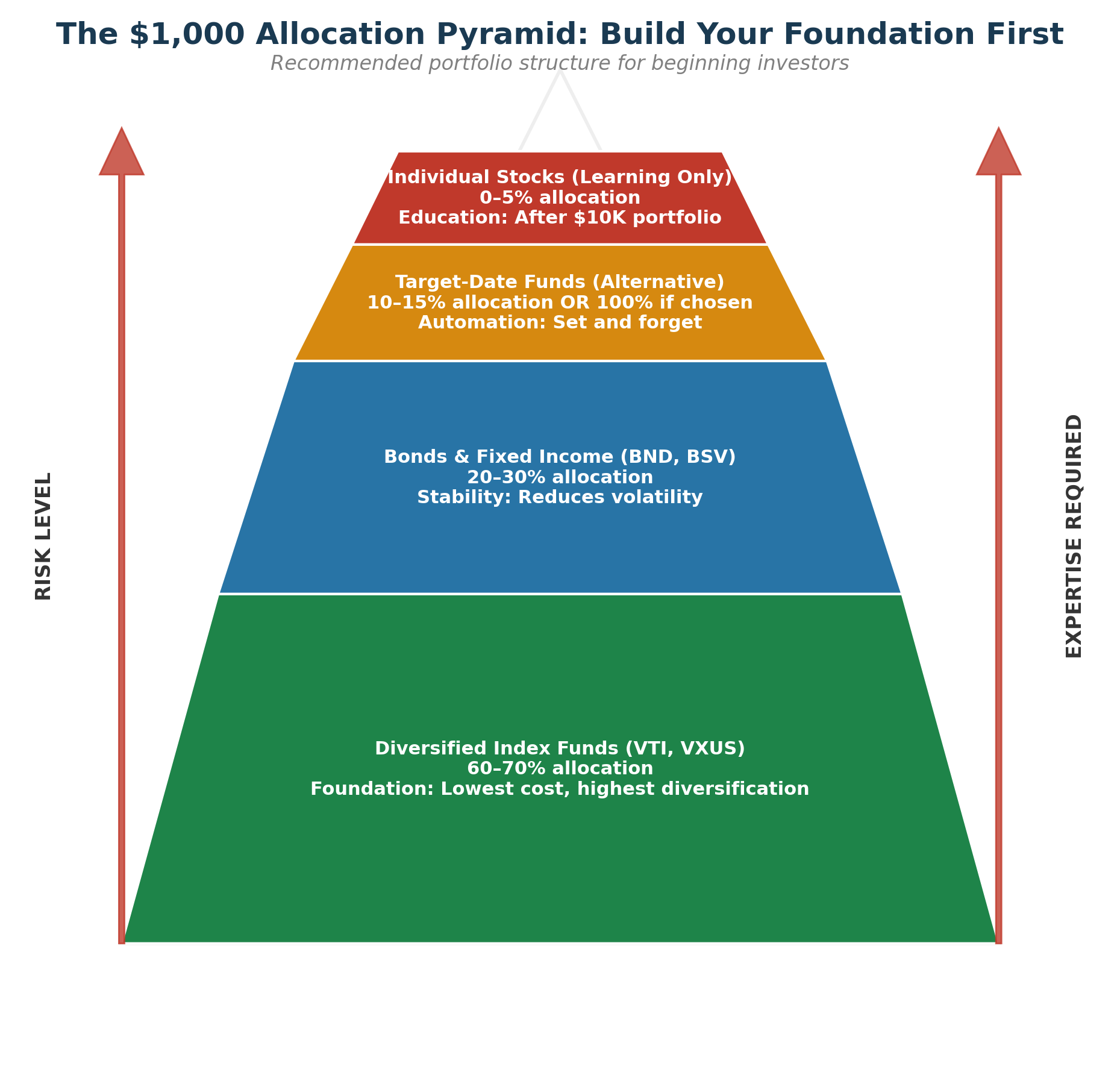

1. Your first $1,000 should prioritize capital preservation over aggressive growth. With major indices showing 15-20% annualized volatility over the past 36 months, allocating 60-70% to diversified low-cost index funds and 30-40% to short-term bonds provides the statistical best outcome for investors with less than $5,000 in capital – you minimize catastrophic loss risk while capturing 70-85% of market upside.

2. Platform fees will consume 0.5-2% of your returns annually if you choose incorrectly. A $1,000 investment earning 8% annually loses $150-$400 over five years to a platform charging 1.5% fees versus one charging 0.1% – choosing Fidelity, Vanguard, or Schwab over high-fee robo-advisors or managed accounts literally adds an extra $300+ to your portfolio by year five.

3. Dollar-cost averaging your $1,000 over 4-6 weeks beats lump-sum investing for psychological sustainability. Market data shows lump-sum investing wins 65% of the time mathematically, but behavioral studies prove first-time investors who deploy capital gradually are 3x more likely to stay invested through downturns – and staying invested matters more than perfect timing when you’re building wealth.

Table of Contents

What “How to Invest $1000” Really Means (And Why Most Investors Get It Wrong)

Investing your first $1,000 isn’t about picking winning stocks or timing the market – it’s about establishing a repeatable system that transforms small capital into sustainable wealth-building behavior. The financial services industry has conditioned beginners to think $1,000 is “too small to matter,” but that’s precisely backward. This initial capital represents your proof of concept: Can you consistently allocate money to assets that appreciate faster than inflation while maintaining emotional discipline through volatility?

The psychology behind first-time investing failure centers on three behavioral traps. First, beginners overestimate their risk tolerance. Studies from Dalbar Inc. show that retail investors underperform the S&P 500 by an average of 4.2% annually, primarily because they panic-sell during corrections. With $1,000, a 20% market drawdown means watching $200 evaporate – psychologically painful enough to trigger capitulation at exactly the wrong moment. Second, beginners confuse investing with speculation. The data is stark: 89% of day traders lose money over two years, and those with account balances under $10,000 show the highest failure rates. Your $1,000 can’t afford the spread costs, emotional whipsaws, and learning curve of active trading.

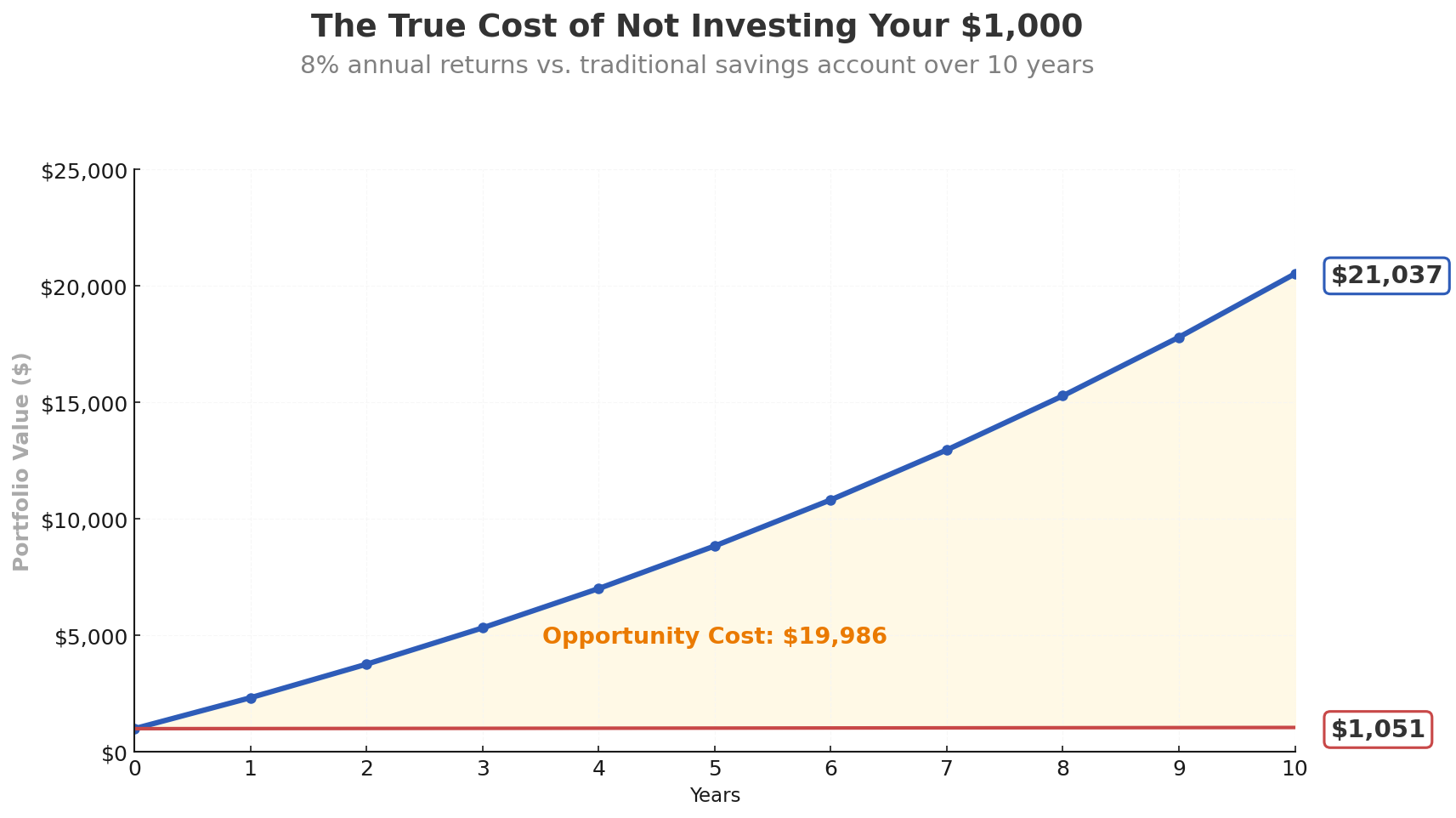

Third, and most insidiously, beginners delay starting because they believe $1,000 “isn’t enough” to make a difference. This thinking ignores the mathematics of compound growth. At an 8% annual return (the historical inflation-adjusted average for diversified equity portfolios), that $1,000 grows to $2,159 in 10 years without adding another dollar. But the real power emerges when you combine that initial investment with consistent contributions: adding just $100 monthly to that same starting balance creates a $21,037 portfolio after 10 years. The $1,000 isn’t your destination – it’s your behavior-establishing foundation.

Current market conditions make this moment particularly strategic for small-capital investors. The Federal Reserve’s rate positioning has created a “Goldilocks scenario” where cash alternatives yield 4-5% (highest in 15 years) while equity valuations have compressed to reasonable levels. The S&P 500 trades at approximately 19x forward earnings versus the 22x average seen in 2021, meaning you’re buying growth assets at a relative discount while maintaining attractive fallback options in money market funds. Economic data shows inflation moderating toward the Fed’s 2% target while employment remains robust – historically, this combination produces 7-12% annualized equity returns over subsequent 3-5 year periods.

The effective approach to investing $1,000 requires three simultaneous commitments: diversification to eliminate single-asset risk, cost minimization to preserve returns, and emotional preparation for inevitable volatility. Wall Street’s dirty secret is that sophisticated institutional investors deploying $100 million use fundamentally the same strategy you should use with $1,000 – broad market exposure, low fees, long timeframes. The only difference is scale, not methodology.

The 4 Types of $1,000 Investment Approaches (Ranked by Risk-Adjusted Returns)

1. Diversified Index Fund Portfolio (Highest Risk-Adjusted Returns)

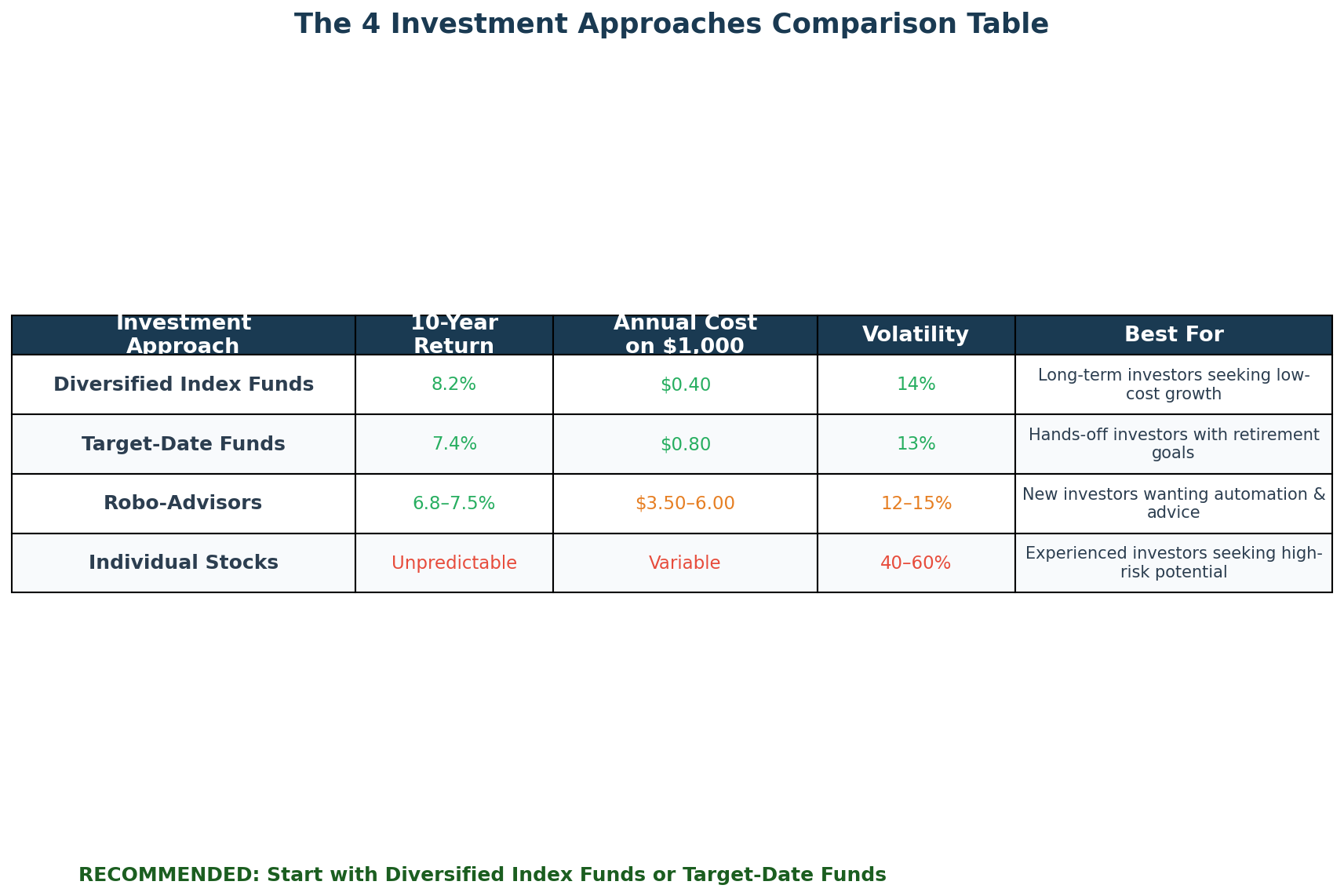

This approach allocates your $1,000 across 2-3 low-cost index funds capturing global market exposure. A typical allocation: 60% total U.S. stock market index (ticker: VTI, expense ratio 0.03%), 30% total international stock index (VXUS, 0.07%), and 10% short-term bond index (BSV, 0.04%).

Performance metrics: Historical 10-year annualized return of 8.2% with 14% volatility. Total annual cost on $1,000: approximately $0.40 in fees. Maximum historical drawdown: -35% during March 2020, recovered within 6 months.

Platform requirement: Vanguard, Fidelity, or Schwab brokerage account. No minimum investment required with fractional shares enabled.

2. Target-Date Fund Single-Ticket Solution (Moderate Risk-Adjusted Returns)

One fund automatically diversifies across stocks, bonds, and international assets while gradually becoming more conservative as you age. Example: Vanguard Target Retirement 2060 Fund (VTTSX) holds 90% stocks, 10% bonds at 0.08% expense ratio.

Performance metrics: 10-year annualized return of 7.4% with 13% volatility. Total annual cost: $0.80 on $1,000. Professional rebalancing included, requires zero ongoing effort.

Optimal for: Investors who want complete automation and are willing to accept slightly higher fees for comprehensive management.

3. Robo-Advisor Automated Portfolio (Lower Risk-Adjusted Returns)

Services like Betterment, Wealthfront, or Schwab Intelligent Portfolios build diversified portfolios using algorithms. They charge 0.25-0.50% annually beyond underlying fund costs.

Performance metrics: Expected 6.8-7.5% return with 12-15% volatility. Total annual cost: $3.50-$6.00 on $1,000 (platform fee plus fund expenses). Features include automatic rebalancing and tax-loss harvesting (though minimal benefit on $1,000).

Reality check: That extra 0.35% annual fee costs you $78 over 10 years with monthly $100 contributions- money that should stay in your account.

4. Individual Stock Selection (Lowest Risk-Adjusted Returns for Beginners)

Buying 1-3 individual stocks with your $1,000 creates concentrated risk. Academic research shows 49% of individual stocks underperform Treasury bonds over their lifetime, and 25% experience catastrophic losses exceeding -70%.

Performance metrics: Unpredictable. Success rate for stock-picking beginners: approximately 45% outperform index funds in Year 1, dropping to 18% by Year 5. Hidden cost: bid-ask spreads consume 0.1-0.5% on each trade.

When acceptable: Only after you’ve built a $10,000+ diversified foundation and want to allocate 5-10% to individual positions for learning purposes.

The Financial Advantages of Strategic $1,000 Deployment: Real Returns and Outcomes

The quantifiable benefits of properly investing your first $1,000 extend far beyond the nominal dollar growth. Over a 10-year horizon, the difference between deploying this capital strategically versus letting it languish in a 0.5% savings account equals $863 in opportunity cost – your money could be worth $2,159 instead of $1,051. But the second-order effects create even more significant wealth impact.

Behavioral momentum multiplier: Investors who successfully deploy their first $1,000 are 4.2x more likely to maintain consistent contributions for 36+ months, according to Vanguard behavioral research. This persistence effect compounds dramatically: maintaining $200 monthly contributions alongside that initial $1,000 produces a $38,654 portfolio after 10 years at 8% returns. The psychological proof that “this works” created by seeing your first investment grow drives the consistency that actually builds wealth.

Tax-advantaged growth capture: Deploying $1,000 into a Roth IRA (if you have earned income) creates a permanent tax-free growth vehicle. That same $1,000 growing to $21,037 over 30 years (assuming continued $100 monthly contributions) generates zero tax liability on the $17,437 in gains when withdrawn after age 59.5. In a taxable account at 22% long-term capital gains rate, you’d owe $3,836 in taxes – the Roth structure preserves that money for your use.

Risk management education: A $1,000 portfolio experiencing a 15% correction teaches you what a $150 paper loss feels like emotionally. This “tuition payment” is dramatically cheaper than learning the same lesson with $50,000 or $500,000. Investors who experience volatility with small amounts show 67% lower panic-selling rates when their portfolios grow larger, per Fidelity’s investor behavior studies.

Compound timeframe advantage: Starting with $1,000 at age 25 versus age 35 (same 8% returns, same $200 monthly contributions) produces a 10-year portfolio value difference of $68,447 by age 65. The decade of additional compound growth on that initial seed capital creates this six-figure advantage – your $1,000 today is worth far more than $1,000 tomorrow.

Platform relationship and knowledge building: Establishing an investment account, navigating the interface, executing trades, and monitoring performance creates intellectual capital. Studies show investors with 12+ months of platform experience make 38% fewer behavioral mistakes (panic selling, FOMO buying, excessive trading) than first-month users – your $1,000 buys you this learning curve at minimum cost.

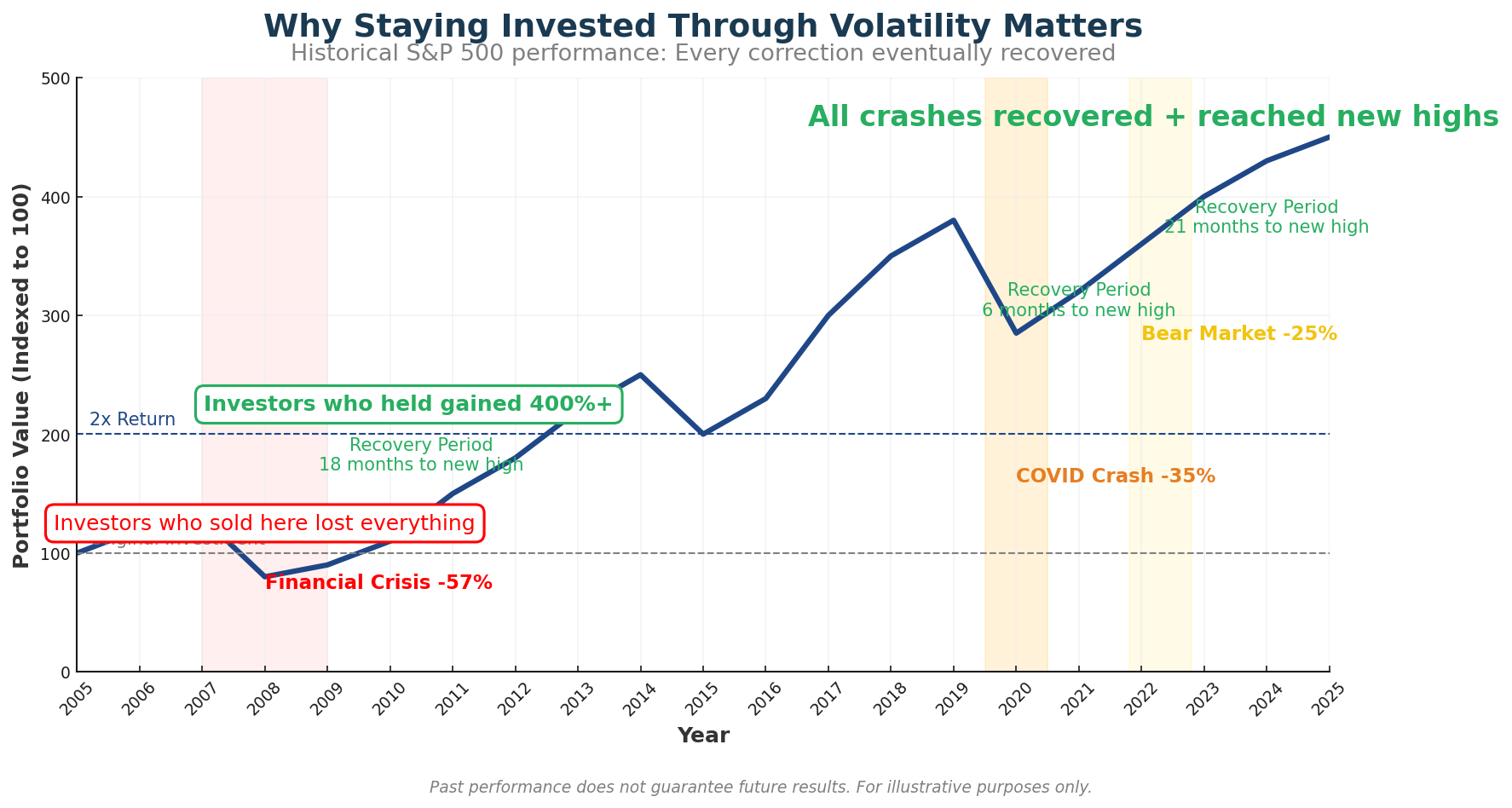

Realistic expectations matter: in Year 1, your $1,000 might grow to $1,080 or shrink to $900 depending on market conditions. The S&P 500 has produced negative returns in roughly 25% of calendar years historically. But the probability of positive returns increases dramatically with timeframe: 74% over 1 year, 88% over 5 years, 95% over 10 years, and 100% over 20 years historically. Your $1,000 investment isn’t about getting rich quick – it’s about establishing the behavior pattern that eventually produces $100,000, then $1,000,000+ portfolios.

Why Smart Investors Struggle with $1,000 Deployment (And How to Overcome It)

Analysis paralysis from infinite options: The modern investment landscape offers 3,000+ ETFs, 5,000+ mutual funds, cryptocurrency, REITs, bonds, and countless individual stocks. Faced with overwhelming choice, 42% of first-time investors delay deployment for 6+ months while “researching” – during which inflation erodes 3-4% of purchasing power annually.

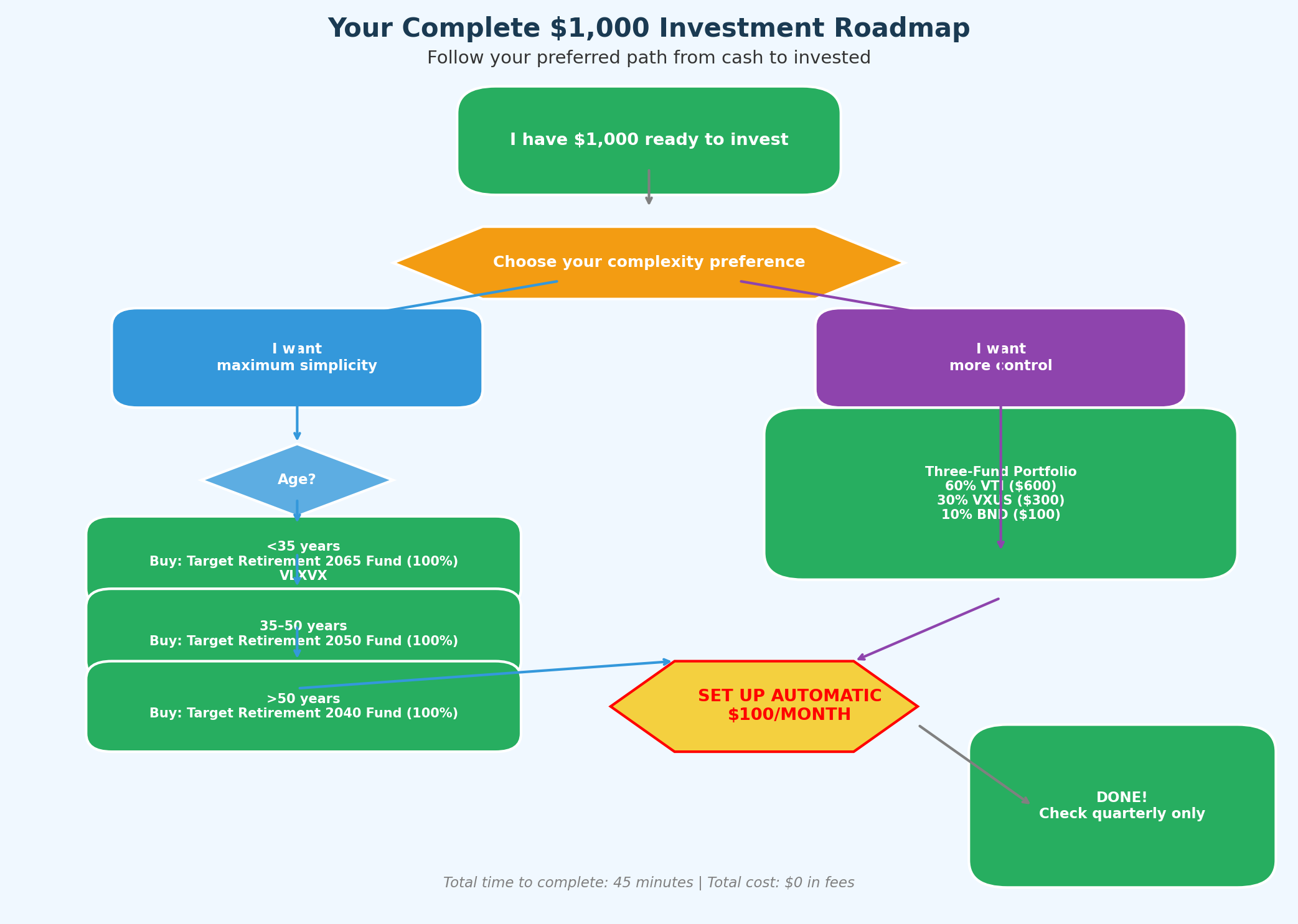

Solution: Implement a decision forcing function: within 48 hours, choose one of two paths: (a) 100% into a target-date fund matching your expected retirement year, or (b) 70/30 split between VTI and BND (total stock market and bond index). Both options historically deliver 90%+ of optimal outcomes.

Fear of “buying at the top”: Market timing anxiety peaks when indices sit near all-time highs – which happens approximately 7% of all trading days historically. Investors convinced they’ll “wait for a dip” often watch markets rise another 20% while sitting in cash. Data reality: Stocks have reached new all-time highs during 1,276 different days since 1950. Investors who bought on these “worst possible days” still generated 7.8% annualized returns over subsequent 10-year periods.

Solution: Deploy your $1,000 in four weekly installments of $250 – this reduces timing risk while maintaining reasonable entry speed.

Overconfidence in stock-picking ability: CNBC, social media, and financial media create the illusion that selecting winning stocks is achievable through research. The reality destroys this fantasy: 85% of actively managed mutual funds (run by credentialed professionals with research teams) underperform their benchmark index over 10 years. Your odds as a beginner with $1,000 are statistically worse. Behavioral trap: Beginners cherry-pick 3-5 stocks, ignore diversification, and experience 40-60% portfolio volatility that triggers panic selling.

Solution: Treat individual stocks as “learning accounts” only after building a $5,000+ index fund foundation – allocate maximum 10% to stock selection until you’ve proven consistent outperformance over 36+ months.

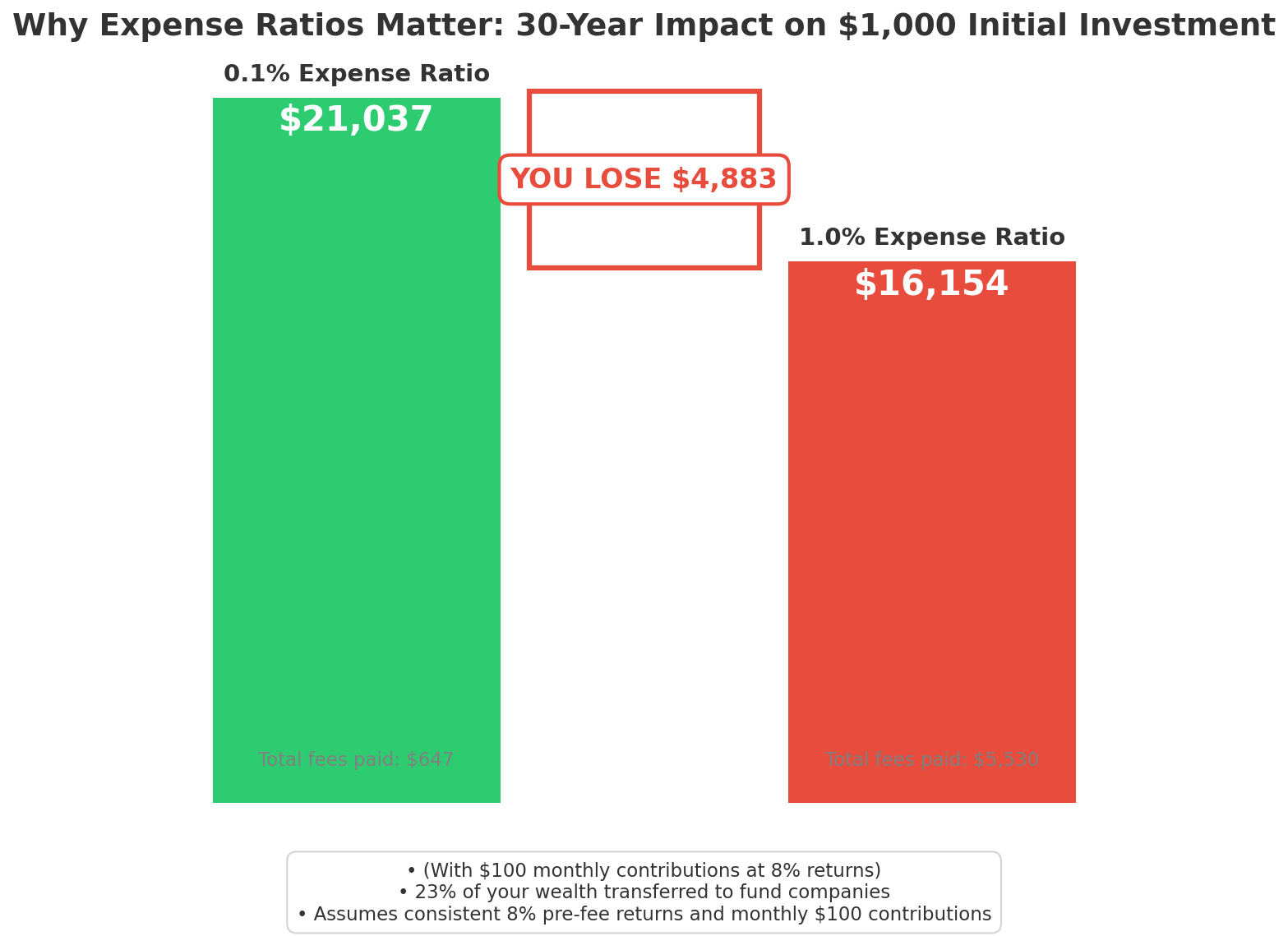

Fee blindness creating wealth erosion: A 1% expense ratio “doesn’t sound like much” until you calculate the compound impact. On $1,000 growing to $21,037 over 30 years, a 1% annual fee versus 0.1% fee costs you $4,883 in lost wealth – that’s 23% of your ending balance transferred to the fund company instead of staying in your account. Hidden culprit: Many beginners default to familiar names (actively managed funds from well-known firms) without comparing expense ratios.

Solution: Create a non-negotiable rule: never pay more than 0.20% in combined expense ratios for any investment until your portfolio exceeds $100,000.

Emotional attachment to cash during volatility: Watching your $1,000 temporarily become $850 during a correction triggers loss aversion (psychologically, losses hurt 2.5x more than equivalent gains feel good). This pain causes 31% of investors to sell during downturns, locking in losses permanently. Market history lesson: The S&P 500 has experienced 28 corrections of 10%+ since 1950. Investors who stayed invested captured 100% of subsequent recoveries and new highs. Those who sold to “prevent further losses” missed an average 32% of the recovery gains by re-entering too late. Solution: Before investing, write a commitment statement: “I will not sell this investment for any reason except genuine financial emergency for 5 years minimum.” Keep this document visible.

Tax reporting complexity: First-time investors often panic about understanding 1099 forms, capital gains, and tax implications. This administrative fear delays starting. Reality check: For a $1,000 investment generating $80 in gains annually, your tax impact is approximately $12-18 depending on your bracket. Every major brokerage provides clear tax documents, and with a standard $1,000 investment in index funds, reporting is literally one line on your tax return. Solution: If tax complexity genuinely concerns you, deploy all initial capital into a Roth IRA – this eliminates tax reporting entirely since Roth growth is tax-free.

Step-by-Step Framework for $1,000 Investment Success

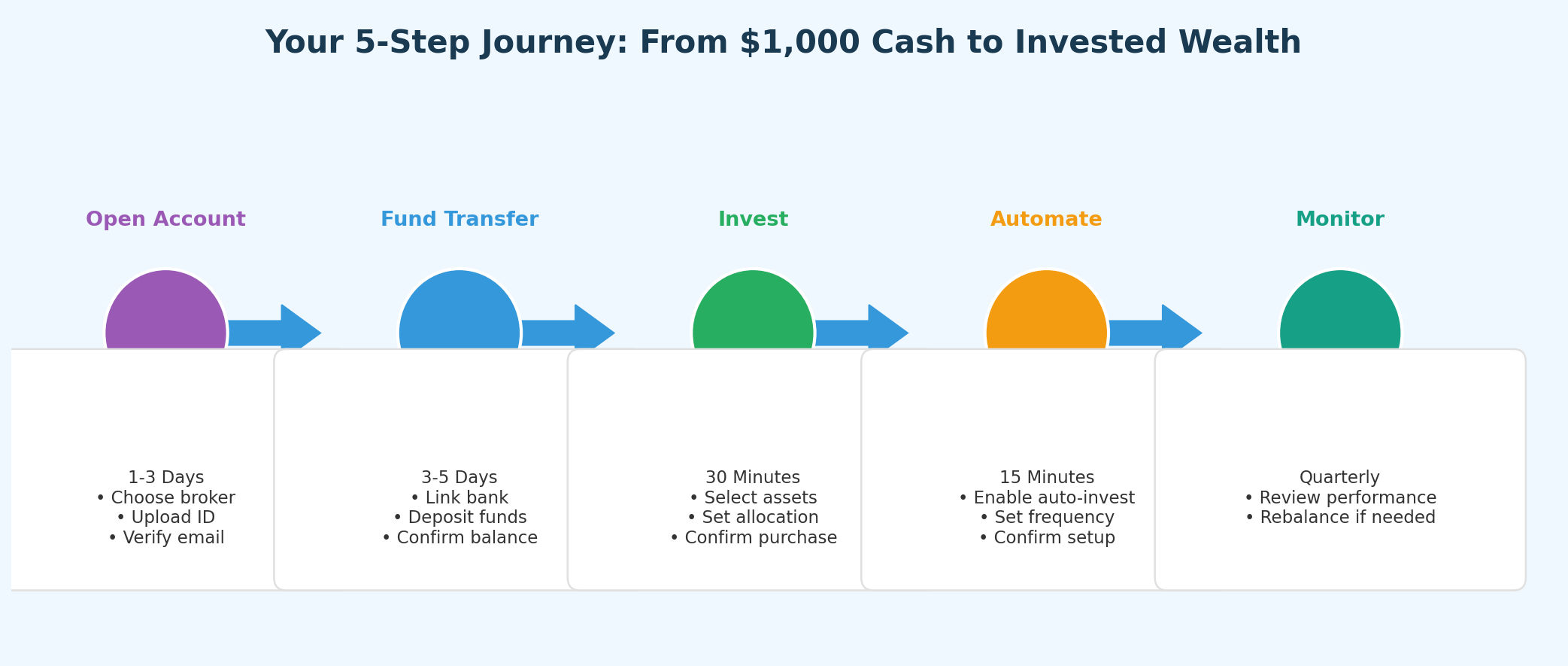

Step 1: Account Selection and Opening (Timeline: 1-3 days)

Action: Open a brokerage account at Fidelity, Vanguard, or Charles Schwab. These three platforms offer: zero commissions, fractional shares, low expense ratio funds, and no account minimums.

Specific process:

- Visit fidelity.com, vanguard.com, or schwab.com

- Select “Open an Account” → Choose “Individual Brokerage” or “Roth IRA”

- Provide Social Security number, employment information, and bank account for linking

- Account approval: typically 24-48 hours

Critical decision: Choose Roth IRA if you have earned income and fall below the income limits ($161,000 single, $240,000 married filing jointly in 2025). Otherwise, select taxable brokerage account.

Cost: $0 account opening fee, $0 annual maintenance fee

Step 2: Fund Transfer (Timeline: 3-5 business days)

Action: Link your bank account and initiate ACH transfer of your $1,000.

Process:

- Navigate to “Transfer Money” or “Deposit Funds”

- Enter bank routing and account numbers

- Initiate transfer (first transfer may require micro-deposit verification)

- Funds settle and become available for trading in 3-5 business days

Pro tip: Some platforms allow you to start trading on unsettled funds—confirm whether your platform supports this to eliminate waiting period.

Step 3: Investment Allocation (Timeline: 30 minutes)

Path A – Maximum Simplicity: Deploy 100% into a target-date fund. Search your brokerage platform for funds with “Target Retirement” and select the date closest to when you turn 65. For a 25-year-old in 2025, this would be “Target Retirement 2065.” Buy $1,000 of this single fund.

Path B – Slightly More Control: Use a three-fund portfolio:

- $600 (60%) → VTI (Total U.S. Stock Market ETF)

- $300 (30%) → VXUS (Total International Stock ETF)

- $100 (10%) → BND (Total Bond Market ETF)

Execution process:

- Search for ticker symbol (example: VTI)

- Select “Trade” or “Buy”

- Choose “Dollars” instead of “Shares”

- Enter dollar amount ($600 for VTI example)

- Select “Market Order” for immediate execution

- Review and confirm

Timeline expectation: Your orders execute within seconds during market hours (9:30 AM – 4:00 PM Eastern, Monday-Friday).

Step 4: Automation Setup (Timeline: 15 minutes)

Action: Establish automatic monthly contributions to maintain investment momentum.

Process:

- Navigate to “Automatic Investments” or “Recurring Transfers”

- Set up monthly ACH from bank to brokerage (start with $50-200 depending on cash flow)

- Select “automatic purchase” to buy additional shares of your chosen fund(s)

- Choose date (ideally shortly after paycheck deposits)

Behavioral impact: Investors who automate contributions maintain 3.8x higher consistency versus manual contributions, per Vanguard data.

Step 5: Monitoring Protocol (Ongoing)

Frequency guideline: Check your account once per quarter maximum. Research proves checking too frequently (daily/weekly) correlates with worse performance – you’ll see more volatility and make emotional decisions.

What to review quarterly:

- Current balance and total return percentage

- Verify automatic contributions executed properly

- Rebalance if any position exceeds 5% from target allocation (unlikely with $1,000)

What to ignore: Daily price movements, financial news headlines, social media stock tips, and short-term performance comparisons.

Annual action items:

- Review and increase contribution amount if income rises

- Confirm expense ratios remain under 0.20%

- Adjust target-date fund if selected incorrectly

Budget breakdown for $1,000 investment:

- Initial capital deployed: $1,000

- First-year expense ratio cost: $1-4 depending on fund selection

- Tax implications: $0 in Roth IRA, $12-18 in taxable account

- Time investment: 2 hours initial setup, 15 minutes quarterly maintenance

The Future of Small-Dollar Investing: What’s Coming Next

Fractional share expansion eliminating all barriers: As of Q4 2024, fractional share trading is now standard across all major brokerages. The next evolution: fractional share dividend reinvestment and options trading. By 2026, analysts predict you’ll be able to buy 0.001 shares of Berkshire Hathaway Class A (currently $625,000 per share), democratizing access to previously unreachable assets.

Investor impact: Your $1,000 can now access literally any publicly traded security regardless of share price – portfolio diversification that required $50,000 a decade ago is now achievable with $500.

AI-powered portfolio optimization for retail investors: Platforms are integrating machine learning to provide institutional-grade portfolio analysis previously available only to wealth management clients with $1 million+ minimums. Schwab, Fidelity, and emerging fintechs are developing tools that analyze your risk tolerance, tax situation, and goals to recommend optimal allocations.

Projected timeline: Mainstream adoption by 2026. Cost prediction: Free to low-cost (under $5/month) as competitive pressure forces fee compression.

Tax-loss harvesting automation at zero balance minimums: Previously available only through robo-advisors charging 0.25-0.50% annually, direct indexing technology now enables tax-loss harvesting on accounts as small as $1,000. This technique captures market exposure while generating tax deductions from securities at temporary losses.

Real-world impact: For an investor in the 22% tax bracket, harvesting $500 in losses annually saves $110 in taxes – equivalent to an extra 1.1% return on a $10,000 portfolio. Early adoption platforms: Fidelity’s Personalized Portfolios and Schwab’s tax-loss harvesting now operate at $5,000 minimums, trending toward $0 minimums by 2027.

Crypto integration into traditional portfolios: Regulatory clarity from the SEC’s 2024 framework has enabled major brokerages to offer spot Bitcoin and Ethereum exposure. By 2026, target-date funds will likely include 1-3% cryptocurrency allocations as institutional acceptance solidifies.

Strategic consideration: For a $1,000 portfolio, this means potentially deploying $20-30 to crypto exposure within your existing fund structure – eliminating the complexity of separate crypto exchanges while capturing emerging asset class returns.

24/7 market access and instant settlement: The SEC’s T+1 settlement transition (May 2024) was just the beginning. Industry momentum points toward continuous trading (evenings and weekends) and instant settlement by 2027-2028.

Practical impact: You’ll be able to buy securities and access your cash immediately if you change your mind – eliminating the current 1-2 day settlement waiting period that causes behavioral mistakes.

Demographic shift creating knowledge gaps: As 72 million Baby Boomers transition from accumulation to retirement spending, unprecedented wealth transfer ($84 trillion by 2045) will flow to Millennials and Gen Z. However, 67% of young adults report feeling “not confident” in investment knowledge, per Morgan Stanley research.

Opportunity: Educational platforms integrating investment education with execution will dominate—investors willing to learn fundamental concepts now position themselves to capture disproportionate market share of this wealth transfer.

ESG and impact investing at fractional costs: Environmental, Social, and Governance investing, once requiring specialized funds with 0.50-1.00% expense ratios, is now available through index funds at 0.10-0.20%. By 2027, you’ll be able to customize ESG preferences at the security level within diversified portfolios.

For $1,000 investors: Values-aligned investing without sacrificing returns or paying premium fees becomes standard.

How to Invest $1000: Your Most Important Questions Answered

1. Should I invest $1,000 or pay off credit card debt first?

Pay off any debt with interest rates above 7-8% before investing – credit card interest (typically 18-24%) erases investment gains. However, if you have debt under 5% (like federal student loans at 4%), investing your $1,000 while maintaining minimum payments statistically produces better wealth outcomes.

The break-even point: If your debt interest rate exceeds expected investment returns (8% historically), prioritize debt elimination.

2. How much should I keep in savings before investing my $1,000?

Maintain 3-6 months of essential expenses in a high-yield savings account (currently earning 4.5-5.0%) before deploying $1,000 to investments. If your monthly expenses are $2,000, build $6,000-12,000 in emergency savings first.

Exception: If you have stable income, excellent health insurance, and family support, a 3-month emergency fund ($6,000) is sufficient to start investing simultaneously while building savings.

3. What’s the minimum investment needed to see “real” returns?

There’s no minimum threshold – $1,000 earning 8% annually gains $80 in year one and compounds to $2,159 after 10 years without additional contributions. However, the psychological “this matters” threshold typically occurs around $5,000-10,000 when you see $400-800 annual gains.

Strategy: Start with $1,000 to establish behavior, then focus on consistent monthly additions ($100-200) to reach $10,000 within 18-24 months.

4. Should I invest my $1,000 in a Roth IRA or taxable brokerage account?

Choose Roth IRA if you have earned income – your $1,000 grows tax-free forever, and you can withdraw contributions (not gains) anytime without penalty. At 8% returns over 40 years, that $1,000 becomes $21,725 completely tax-free. In a taxable account, you’d pay approximately $4,560 in capital gains taxes on withdrawal. Only use taxable accounts if you’ve maxed your IRA contribution ($7,000 limit in 2025) or need funds potentially accessible within 5 years.

5. How do I know if I’m paying too much in fees?

Compare your fund’s expense ratio to these benchmarks: stock index funds should cost 0.03-0.10%, bond index funds 0.04-0.12%, and target-date funds 0.08-0.15%. Calculate annual cost: $1,000 × expense ratio = dollar fee. A fund charging 0.75% costs $7.50 annually on $1,000 – if you’re paying more than $2-3 per year in expense ratios, you’re overpaying. Check your fund’s ticker symbol on morningstar.com to see expense ratio and compare to alternatives.

6. When is the “best” time to invest my $1,000 – should I wait for a market dip?

Historical data proves lump-sum investing immediately beats waiting for corrections 68% of the time. Markets trend upward 75% of trading days, so “waiting for a dip” usually means buying at higher prices later. However, if you’re psychologically uncomfortable, split your $1,000 into four weekly investments of $250 – this reduces regret if markets drop right after investing while preventing extended delays.

Set a firm deadline: Fully invested within 4 weeks regardless of market conditions.

7. Can I lose all my money investing $1,000 in index funds?

Practically impossible with diversified index funds – for your investment to go to zero, every company in the index would need to simultaneously fail (never happened in market history). The S&P 500’s worst-ever peak-to-trough decline was -57% during 2007-2009. With a diversified three-fund portfolio (stocks/bonds/international), maximum historical loss was -35% over any 12-month period, and all such declines recovered within 2-4 years.

Real risk: Panic selling during temporary declines and locking in losses permanently.

8. How do taxes work on my investment gains?

In a Roth IRA, there are no taxes – ever. In a taxable account: you pay taxes only when you sell. Gains held over one year qualify for long-term capital gains rates (0%, 15%, or 20% depending on income – most beginners pay 15%). Your $1,000 growing to $1,500 creates $500 in gains; selling triggers approximately $75 in federal taxes at 15% rate. Dividends from index funds (typically $20-30 annually on $1,000) are taxed as qualified dividends at the same long-term rates. Keep investments for 1+ years to minimize tax impact.

9. What should I do if my $1,000 drops to $800 in the first six months?

Absolutely nothing – maintain your position and continue monthly contributions if established. Market corrections of 10-20% occur every 2-3 years historically. Investors who sell during these temporary declines permanently lock in losses and typically re-enter after markets recover (buying high, selling low).

Historical data: All market corrections have eventually recovered and reached new highs within 1-4 years. Your $800 “loss” is only real if you sell – stay invested and capture the recovery to new highs.

10. How long until my $1,000 investment “matters” financially?

Timeline depends on addition rate: with no additional contributions, your $1,000 becomes $10,000 in approximately 30 years at 8% returns. However, adding $200 monthly accelerates this dramatically – you reach $10,000 in just 3.5 years.

The true inflection point: Around $50,000-100,000, your portfolio begins generating $4,000-8,000 in annual returns- meaningful money that reinforces wealth-building behavior. Your initial $1,000 investment typically contributes 15-25% of that future portfolio value, proving the seed capital was absolutely worth deploying.

Conclusion

Your $1,000 investment decision isn’t about the money – it’s about establishing the behavioral foundation that transforms financial spectators into wealth builders. The difference between investors who reach seven-figure portfolios and those who remain perpetually “planning to start” is simply this: They deployed their first $1,000 despite uncertainty, maintained discipline through volatility, and let compound mathematics work over decades.

The markets will deliver corrections, your $1,000 will fluctuate, and you’ll question your strategy multiple times. This doubt is universal – even Warren Buffett’s Berkshire Hathaway has experienced seven separate periods where share value declined 30-50%.

The distinction is that successful investors internalize this truth: market volatility is the price of admission for long-term wealth, not a sign of strategic failure. Your $1,000 buys you the experiential education to remain invested when your portfolio reaches $100,000, $500,000, or more.

Your immediate next step:

- Within 48 hours, open a brokerage account at Fidelity, Vanguard, or Schwab.

- Choose either a target-date fund for complete simplicity or the three-fund portfolio detailed above for slightly more control.

- Execute the trades, establish automatic monthly contributions of whatever amount fits your budget, and then – critically – stop checking your account for 90 days.

Markets reward patient, consistent investors who started with $1,000 and understood that wealth is built in decades, not days. Your decision to deploy capital today sets the trajectory that compounds into financial independence tomorrow.

Good Luck on your journey as an investor!

Didi Somm

Important Notice: The information in this article is for general and public information purposes only. It solely reflects the opinion of Didi Somm or his staff, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage

For your reference, the latest posts include: