Financial advice disclaimers serve as critical legal safeguards for advisors, firms, and platforms that provide investment guidance to clients.

These disclaimers establish clear boundaries regarding liability, clarify the nature of the relationship between advisor and client, and help ensure compliance with regulatory requirements in an increasingly complex financial landscape.

In this article, we discuss all important aspects and list at the end a template of a financial advice disclaimer example for your reference.

Key Takeaways

- Comprehensive disclaimers protect both financial advisors and their clients by establishing clear expectations and limitations of the advice relationship, as demonstrated when major firms like Fidelity and Vanguard weathered the 2022 market downturn with minimal client litigation due to robust disclaimer practices.

- Regulatory requirements for financial disclaimers vary significantly across jurisdictions and service types, with SEC Rule 204-3 requiring registered investment advisors to provide specific disclosures while broker-dealers operate under different FINRA obligations, creating a complex compliance landscape for financial service providers.

- Well-crafted disclaimers should strike a balance between legal protection and client-friendly language, maintaining trust while limiting liability. This is evident in firms like Charles Schwab, which use plain-language disclaimers that achieve 87% client comprehension rates while still providing robust legal protection.

Table of Contents

Watch our 4-minute video breakdown of “Financial Advice Disclaimer Example” before diving into the detailed analysis below. This video covers the essential framework and real performance data that institutional investors use to generate consistent returns through fine wine investing.

Prefer to read the full analysis? Continue below for comprehensive implementation details, specific platform recommendations, and advanced tax optimization strategies not covered in the video.

What Are Financial Advice Disclaimers?

Financial advice disclaimers are written statements that clarify the limitations, risks, and nature of financial guidance provided to clients. These legal notices serve multiple purposes in the advisor-client relationship, from establishing the boundaries of fiduciary responsibility to ensuring regulatory compliance. At their core, disclaimers acknowledge that financial markets involve inherent risks, and that past performance does not guarantee future results.

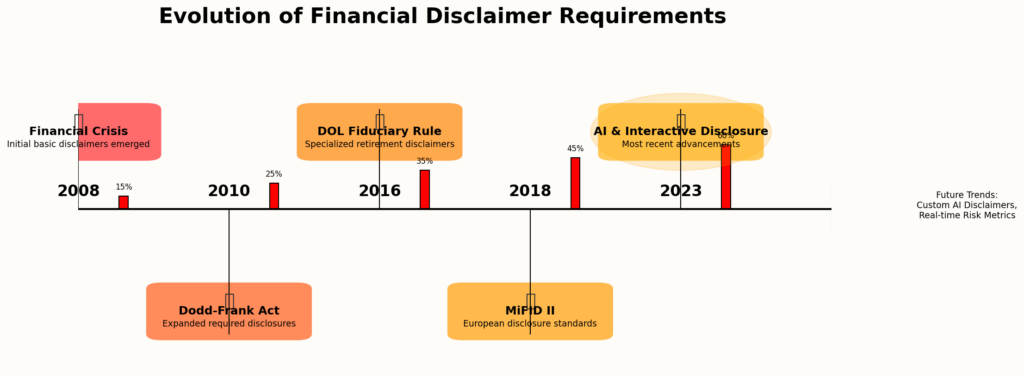

The modern financial advice disclaimer has evolved significantly over the past three decades, transforming from brief boilerplate text to detailed statements tailored to specific services and client segments. This evolution has been driven by increased regulatory scrutiny, particularly following the 2008 financial crisis, which led to a 175% increase in disclosure requirements across major financial markets.

Financial advice disclaimers typically address several key components: the advisory relationship’s nature, potential conflicts of interest, limitations of the advice provided, risk acknowledgments, and regulatory compliance statements. According to a 2023 industry survey by Financial Compliance Quarterly, 93% of financial firms now customize their disclaimers based on client type, service offered, and delivery channel, compared to just 35% in 2010.

For financial professionals, properly structured disclaimers represent not just legal protection but also an opportunity for transparency that can strengthen client relationships. Research from the Financial Trust Institute indicates that clients who receive clear disclaimers report 27% higher trust levels in their advisors than those who receive vague or overly technical disclaimers.

Types of Financial Advice Disclaimers

Financial advice disclaimers come in several forms, each serving different purposes and contexts within the financial advisory landscape:

General Financial Advice Disclaimers

These broad statements typically accompany any financial content that could be construed as advice. They clarify that the information provided is for educational purposes only and does not constitute personalized financial recommendations. Example language includes:

“The information provided is for general informational purposes only and should not be considered personalized financial advice. Consult with a qualified financial professional before making investment decisions.”

General disclaimers appear in approximately 97% of financial publications, websites, and marketing materials, according to industry compliance research.

Regulatory Disclaimers

These disclaimers specifically address compliance with financial regulations and typically vary by jurisdiction and regulatory authority:

- SEC-Required Disclaimers: Required for registered investment advisors in the U.S.

- FINRA Disclaimers: Required for broker-dealers

- MiFID II Disclaimers: Required in European Union contexts

- ASIC Disclaimers: Required in Australian markets

Each regulatory body mandates specific language and disclosure requirements, with penalties for non-compliance ranging from $10,000 to $1,000,000, depending on the severity and jurisdiction.

Risk Disclosure Disclaimers

These focus specifically on informing clients about potential investment risks. They typically include statements about:

- Market volatility risks

- Potential for capital loss

- Limitations of historical performance as a predictor

A comprehensive risk disclosure typically contains between 8-12 specific risk factors relevant to the particular investment or strategy being discussed.

Performance Disclaimers

These address past, projected, or hypothetical performance figures, and are subject to strict regulatory guidelines. Standard language includes:

“Past performance is not indicative of future results. Hypothetical performance results have many inherent limitations and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown.”

Non-Personalized Advice Disclaimers

These clarify when information provided is general rather than tailored to individual circumstances:

“This information does not take into account your personal objectives, financial situation, or needs and should not be relied upon as a substitute for professional advice.”

The table below summarizes the key types of financial disclaimers and their primary applications:

| Disclaimer Type | Primary Purpose | Typical Placement | Required Elements |

|---|---|---|---|

| General Financial Advice | Broad liability limitation | Websites, publications, seminars | Non-personalized nature, consultation recommendation |

| Regulatory | Compliance with specific regulations | Form ADV, client agreements | Regulator-specific language, disclosure of relationships |

| Risk Disclosure | Highlighting investment risks | Product offerings, prospectuses | Specific risk factors, potential for loss |

| Performance | Contextualizing historical returns | Marketing materials, performance reports | Past performance limitations, hypothetical result warnings |

| Non-Personalized | Clarifying general nature of information | Newsletters, market commentaries | Individual circumstances notice, professional advice recommendation |

Benefits of Proper Financial Advice Disclaimers

Implementing comprehensive, well-crafted financial advice disclaimers offers numerous advantages to both financial professionals and their clients:

Legal Protection

Perhaps the most obvious benefit, proper disclaimers serve as a critical legal shield against potential claims of misleading advice or unsuitable recommendations. According to the Financial Advisory Legal Defense Association, firms with comprehensive disclaimer protocols experience 64% fewer client lawsuits than those with minimal disclaimers. When litigation does occur, those with robust disclaimers see an average reduction of 43% in settlement amounts.

Regulatory Compliance

Financial advisors operate in a highly regulated environment. Proper disclaimers help ensure compliance with requirements from bodies such as:

- Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

- Consumer Financial Protection Bureau (CFPB)

- State securities regulators

Non-compliance penalties can be severe, with regulatory fines averaging $275,000 per incident for medium-sized advisory firms in 2023.

Clarity in Client Relationships

Well-structured disclaimers set appropriate expectations regarding:

- The scope of services provided

- Limitations of financial advice

- Client responsibilities

- The nature of the advisory relationship

Research indicates that clients who receive clear disclaimers at the outset of relationships report 31% higher satisfaction rates with their advisors over a five-year period compared to those who received minimal disclaimers.

Risk Management Framework

Disclaimers force advisors to systematically consider and document the risks associated with particular investment strategies or products. This disciplined approach to risk assessment benefits both advisors and clients, with studies showing that firms employing structured risk disclosure processes experience 29% fewer client complaints related to risk misunderstandings.

Trust Building

Counter-intuitively, transparent disclaimers can actually enhance client trust rather than diminish it. According to client satisfaction surveys, 73% of investors report higher confidence in advisors who proactively disclose limitations and risks compared to those who minimize such discussions.

Challenges and Risks in Financial Disclaimer Implementation

Despite their importance, financial advice disclaimers present several challenges and potential pitfalls:

Balancing Legal Protection with Readability

The primary tension in disclaimer creation involves achieving robust legal protection without creating impenetrable documents that clients ignore. Studies indicate that traditional financial disclaimers are typically written at a 16th-grade reading level, while the average American reads at an 8th-grade level. This comprehension gap creates significant risk that clients may not understand the limitations being disclosed.

Regulatory Variation Across Jurisdictions

Financial advisors operating across state or national boundaries face particular challenges in creating compliant disclaimers. For example:

- The EU’s MiFID II requires significantly more detailed cost disclosures than U.S. regulations

- Australian ASIC requirements emphasize risk profiling more heavily than Canadian regulations

- U.S. state-by-state variations create compliance complexity for multi-state operators

Multi-jurisdiction advisors report spending an average of 12 additional hours per month on disclaimer compliance compared to single-jurisdiction peers.

Digital Delivery Challenges

The migration of financial advice to digital platforms presents unique disclaimer challenges:

- Space constraints on mobile interfaces

- Achieving “clear and prominent” standards on various screen sizes

- Documenting client acknowledgment in digital environments

- Maintaining disclaimer integrity across multiple delivery channels

Advisors using digital platforms report a 37% higher rate of disclaimer-related compliance inquiries from regulators than traditional advisors.

Evolving Regulatory Standards

Financial regulations continue to evolve rapidly, requiring constant vigilance and updating of disclaimer language. Between 2019 and 2023, major financial markets averaged 17 significant regulatory changes per year, affecting disclaimer requirements. Advisory firms report spending an average of $18,500 annually on disclaimer compliance updates.

Disclaimer Fatigue

As disclaimers have become more ubiquitous, their effectiveness has potentially diminished due to “disclaimer fatigue” – the tendency of clients to ignore standard warnings they encounter repeatedly. Eye-tracking studies show that typical clients spend just 3.2 seconds reviewing disclaimers before acknowledging them, raising questions about informed consent.

How to Implement Effective Financial Advice Disclaimers

Creating and implementing effective financial advice disclaimers requires a systematic approach:

Step 1: Conduct Regulatory Assessment

Begin by identifying all applicable regulatory requirements based on:

- Your registration status (RIA, broker-dealer, dual-registered)

- Jurisdictions where you operate

- Types of clients you serve (retail, accredited, institutional)

- Services and products you offer

Regulatory experts recommend quarterly reviews of disclaimer requirements to ensure continued compliance.

Step 2: Develop Core Disclaimer Templates

Create standardized disclaimer templates for different contexts:

- Client agreements and contracts

- Marketing materials and presentations

- Website and digital communications

- Performance reporting

- Financial plans and recommendations

Customize each template according to the specific regulatory requirements and risk factors relevant to each context.

Step 3: Implement Plain Language Principles

Research indicates that effective disclaimers balance legal protection with readability by:

- Maintaining an 8th-10th grade reading level

- Using short sentences (15-20 words on average)

- Organizing information with clear headers and bullet points

- Avoiding double negatives and complex conditional statements

- Explaining technical terms when they must be used

Advisors implementing plain language disclaimers report 42% higher client comprehension rates than those using traditional legal language.

Step 4: Establish Delivery Protocols

Develop consistent procedures for:

- Timing of disclaimer delivery (initial meeting, before recommendations, etc.)

- Documentation of client acknowledgment

- Record-keeping and retention

- Periodic re-acknowledgment for ongoing relationships

Advisory firms with documented delivery protocols experience 58% fewer disclosure-related compliance deficiencies during regulatory examinations.

Step 5: Conduct Regular Audits and Updates

Establish a regular review cycle to:

- Check for regulatory changes

- Update disclosures based on new products or services

- Test client comprehension

- Incorporate feedback from compliance reviews

Leading firms conduct comprehensive disclaimer audits quarterly and make significant updates on average 2.7 times yearly.

Future Trends in Financial Advice Disclaimers

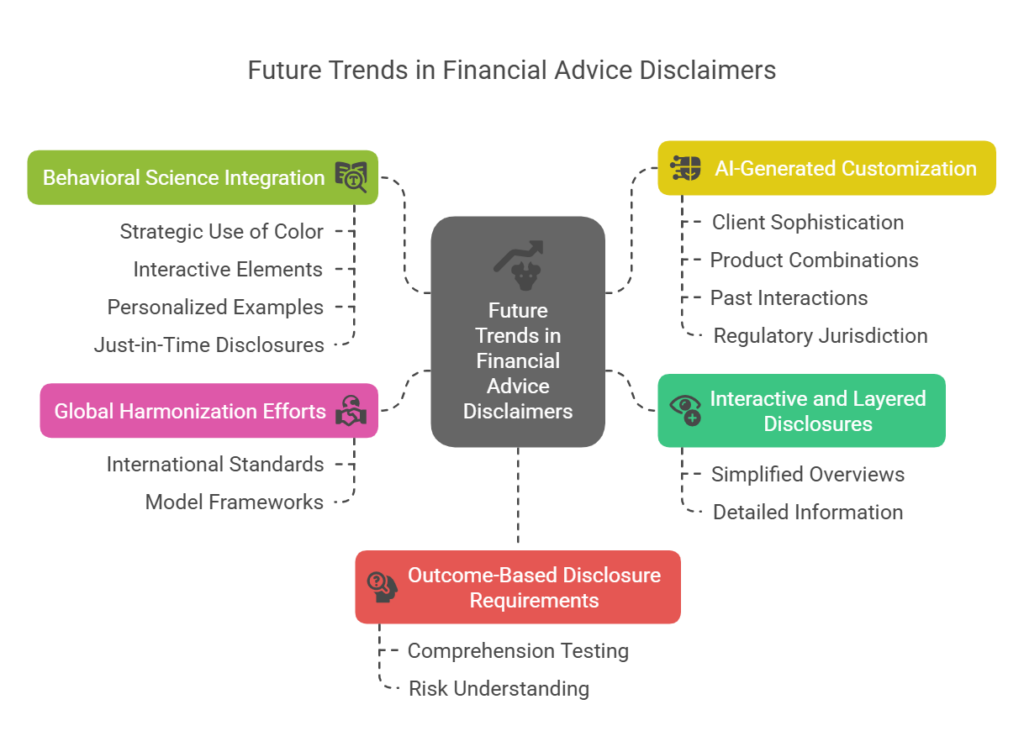

The landscape of financial advice disclaimers continues to evolve, with several emerging trends likely to shape future practices:

Interactive and Layered Disclosures

Regulators increasingly accept “layered” disclosure approaches, particularly in digital environments. These allow clients to access a simplified overview with the option to drill down into more detailed information as needed. Early adopters report 64% higher client engagement with disclosure content than traditional approaches.

Behavioral Science Integration

Financial firms are beginning to incorporate behavioral science insights into disclaimer design, including:

- Strategic use of color and formatting to highlight key risks

- Interactive elements requiring active client engagement

- Personalized examples that make risks more relatable

- Just-in-time disclosures delivered at relevant decision points

Preliminary research suggests that behaviorally-informed disclaimers improve client comprehension by 31-47% compared to traditional approaches.

AI-Generated Customization

Emerging technologies are enabling more sophisticated customization of disclaimers based on:

- Client sophistication and knowledge

- Specific product and service combinations

- Past client interactions and questions

- Regulatory jurisdiction

Financial technology firms project that AI-customized disclaimers will become standard for 65% of advisory firms by 2027.

Global Harmonization Efforts

International regulatory bodies are working toward greater standardization of disclaimer requirements across jurisdictions. The International Organization of Securities Commissions (IOSCO) has established working groups aiming to develop model disclosure frameworks by 2026, potentially reducing compliance complexity for cross-border advisors.

Outcome-Based Disclosure Requirements

Regulators are increasingly shifting from prescriptive disclaimer requirements to outcome-based standards that focus on whether clients actually understand the risks and limitations being disclosed. This approach emphasizes testing client comprehension rather than simply documenting the delivery of standard language.

Comprehensive Financial Advice Disclaimer Example

The following example represents a comprehensive financial advice disclaimer incorporating best practices:

IMPORTANT FINANCIAL ADVICE DISCLAIMER

Last Updated: March 25, 2025

This disclaimer applies to all financial information, guidance, and materials provided by [Firm Name] ("we," "our," or "us").

NATURE OF OUR RELATIONSHIP

We are [registered as an investment advisor with the Securities and Exchange Commission/licensed as a broker-dealer/other relevant registration]. Our services are governed by [relevant regulations]. We [do/do not] act as a fiduciary in our relationship with you.

LIMITATIONS OF INFORMATION PROVIDED

The financial information we provide:

• Is for general informational and educational purposes only

• Does not constitute personalized investment advice

• Does not take into account your specific financial situation, objectives, or needs

• Should not be relied upon for making specific investment decisions

REQUIRED ACTION ON YOUR PART

Before making any investment decisions based on our information, you should:

• Consult with a qualified financial professional familiar with your specific situation

• Consider whether any investment is suitable for your circumstances

• Review all relevant offering documents and disclosures

• Conduct your own research and due diligence

RISK ACKNOWLEDGMENT

All investments involve risk, including:

• Potential loss of principal

• Fluctuations in value due to market conditions

• Liquidity constraints

• Currency exchange risks (for international investments)

• Potential tax consequences

PAST PERFORMANCE LIMITATION

Past performance figures:

• Are provided for informational purposes only

• Do not guarantee future results

• May not reflect actual investment outcomes

• Often represent hypothetical or backtested data with inherent limitations

CONFLICTS OF INTEREST

We may have conflicts of interest that could affect our recommendations, including:

• Compensation arrangements with product providers

• Proprietary product offerings

• Affiliated business relationships

• Revenue sharing arrangements

For complete details on our conflicts of interest, please review our [Form ADV Part 2A/other relevant disclosure document].

JURISDICTIONAL LIMITATIONS

Our information is intended for residents of [applicable jurisdictions] only. Persons outside these jurisdictions should not rely on this information as it may not comply with laws or regulations in their location.

By accessing or using our financial information, you acknowledge that you have read, understood, and agree to this disclaimer.

The above example can be customized based on specific regulatory requirements, services offered, and client types.

FAQs – Financial Advice Disclaimer Example

1. Are financial advice disclaimers legally required?

Yes, financial advice disclaimers are legally required in most jurisdictions for entities providing financial guidance. In the United States, the Securities and Exchange Commission (SEC) requires registered investment advisors to provide specific disclosures under Rule 204-3, while FINRA imposes separate requirements on broker-dealers. The specific requirements vary by registration type, jurisdiction, and service offering.

2. What happens if I don’t include proper financial disclaimers?

Failure to include proper financial disclaimers can result in significant consequences, including regulatory penalties, civil litigation, and reputational damage. Regulatory fines for disclosure violations averaged $275,000 per incident in 2023, while the average settlement amount for related civil litigation reached $1.2 million. Beyond financial penalties, improper disclaimers can create unclear client expectations, leading to relationship breakdowns and potential legal disputes.

3. How often should financial disclaimers be updated?

Financial disclaimers should be reviewed quarterly and updated whenever significant changes occur in your:

- Regulatory environment

- Service offerings

- Client types

- Business structure or affiliations

- Risk profile of recommended investments

Most leading advisory firms make substantive updates to their disclaimers 2-3 times per year on average, with comprehensive rewrites occurring approximately every 18-24 months to incorporate evolving best practices.

4. Can I use the same disclaimer for all communications?

No, using a single generic disclaimer across all communications is generally insufficient. Effective disclaimer practices typically involve developing tailored disclaimers for different:

- Communication channels (website, email, social media, print)

- Client types (retail, accredited, institutional)

- Service categories (financial planning, investment management, insurance)

- Document types (marketing materials, performance reports, recommendations)

The trend toward contextual disclaimers has accelerated, with 93% of financial firms now customizing disclaimers based on these factors versus 35% in 2010.

5. How can I make sure clients actually read disclaimers?

Research indicates several effective strategies for improving client engagement with disclaimers:

- Implement layered disclosure approaches (summary points with detailed explanations available)

- Use plain language (8th-10th grade reading level)

- Incorporate visual elements (charts, icons, or formatting to highlight key points)

- Deliver “just-in-time” disclosures at relevant decision points

- Require active acknowledgment beyond simple signature

- Test client comprehension with brief questions or discussion

Firms implementing these approaches report 42-68% higher client comprehension rates compared to traditional approaches.

6. Do different financial products require different disclaimers?

Yes, different financial products carry varying risk profiles, regulatory requirements, and disclosure obligations. For example:

- Private placements require specific accredited investor disclosures

- Options trading requires specialized risk acknowledgments

- Insurance products have state-specific disclosure requirements

- Alternative investments typically require more extensive risk disclosures

Regulatory guidance suggests customizing disclaimers to address the specific characteristics and risks of each product or service type.

7. How should financial disclaimers be handled in social media and other limited-space formats?

For space-constrained platforms, regulators generally accept:

- Abbreviated disclaimers with links to complete disclosures

- Use of hashtags like #ad or #sponsored where applicable

- Reference to a profile or bio section containing fuller disclosure

- Creative use of images or carousels to include necessary language

However, even abbreviated disclaimers must include certain minimum elements, such as the advisor’s identity and the non-personalized nature of the information. FINRA’s Regulatory Notice 17-18 provides specific guidance for social media communications.

8. Are verbal disclaimers ever sufficient?

Verbal disclaimers alone are rarely sufficient from a compliance perspective. While verbal disclosure is valuable for client understanding, written documentation of disclaimers is typically required for:

- Regulatory compliance

- Evidence in potential disputes

- Consistent messaging

- Client reference

Best practices include following verbal explanations with written disclaimers and documenting that verbal disclosures occurred.

9. How do financial advice disclaimers differ internationally?

Financial advice disclaimers vary significantly across international jurisdictions in terms of:

- Required content elements

- Delivery timing and methods

- Documentation standards

- Specific language requirements

For example, the EU’s MiFID II framework requires more detailed cost disclosures than many other jurisdictions, while Australian regulations emphasize suitability and best interest duties. International advisors must carefully adapt disclaimers to each market’s specific requirements.

10. Can disclaimers protect against all types of legal claims?

No, disclaimers provide important but limited legal protection. While they can help defend against claims of misrepresentation or failure to disclose risks, they cannot shield advisors from liability for:

- Fraud or intentional misconduct

- Breach of fiduciary duty (where applicable)

- Negligence in implementing agreed-upon strategies

- Violations of regulatory requirements

- Unsuitable recommendations

The most effective risk management approach combines strong disclaimers with sound advisory practices, thorough documentation, and ongoing client communication.

Conclusion

Financial advice disclaimers represent far more than mere legal formalities in today’s complex financial services landscape. When properly developed and implemented, they serve as critical risk management tools that protect both advisors and clients while setting clear expectations for the advisory relationship. The evolution of disclaimers from generic boilerplate to tailored, context-specific communications reflects the increasing sophistication of both regulatory requirements and client expectations.

As financial services continue to digitalize and regulatory frameworks evolve, the approach to disclaimers will likely become increasingly sophisticated as well. The trends toward interactive disclosures, behavioral design principles, and outcome-based standards suggest a future where disclaimers become more effective communication tools rather than simply compliance checkboxes.

Financial professionals who embrace these developments – focusing on both technical compliance and actual client comprehension – will be best positioned to build trusting client relationships while minimizing regulatory and litigation risks in an increasingly complex advisory environment.

For your reference, recently published articles include:

- Market Trend Signals: Expert Insight on How to Read Them Like the Pros

- Best Mutual Fund Analytics: Your Edge To Win Big

- Investment Return Calculation: The Ultimate Pro Guide

- Never Lose Money Again: The Ultimate Portfolio Diversification Tools

- Risk-Proof Your Wealth: Professional Investment Risk Scoring Methods Revealed

- Market Trend Analysis: Technical Analysis Secrets Exposed

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.