In the evolving landscape of modern investment strategies, alternative data analytics has emerged as a powerful force transforming how investors identify opportunities and generate alpha.

By leveraging non-traditional data sources and advanced analytical techniques, investors are gaining unprecedented insights into market movements, consumer behavior, and economic trends before they become apparent through conventional channels.

This revolutionary approach to investment analysis is creating a new class of data-driven millionaires who capitalize on information advantages in an increasingly competitive market.

Key Takeaways

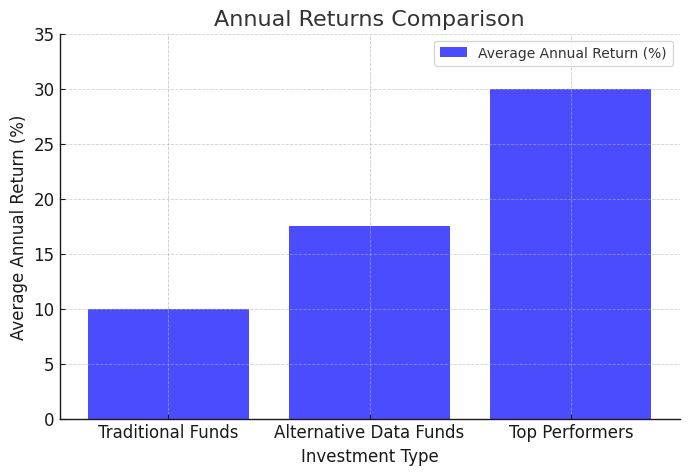

- Alternative Data Analytics has fundamentally transformed investment decision-making by providing early signals of market movements and company performance. Major hedge funds utilizing alternative data analytics have reported average annual returns of 15-20% compared to the S&P 500’s historical average of 10%, with some specialized funds achieving returns exceeding 30% through the strategic deployment of satellite imagery analysis and consumer transaction data. This performance differential highlights the competitive advantage gained through sophisticated data analysis in modern markets.

- The integration of machine learning and artificial intelligence with alternative data has created unprecedented opportunities for pattern recognition and predictive analytics. For example, a prominent quantitative fund recently predicted a major retailer’s quarterly earnings with 92% accuracy by analyzing parking lot occupancy data from satellite imagery, mobile device location data, and social media sentiment – three weeks before the official earnings announcement. This demonstrates the powerful combination of diverse data sources and advanced analytics in generating actionable investment insights.

- The democratization of alternative data tools and platforms has opened new avenues for individual investors to compete with institutional players. A recent case study showed how a group of retail investors used weather pattern data and agricultural commodity prices to achieve a 45% return on their investments in agricultural futures over 18 months. This success story illustrates how accessible alternative data analytics has become for sophisticated individual investors willing to embrace new technological tools.

Table of Contents

Understanding Alternative Data Analytics

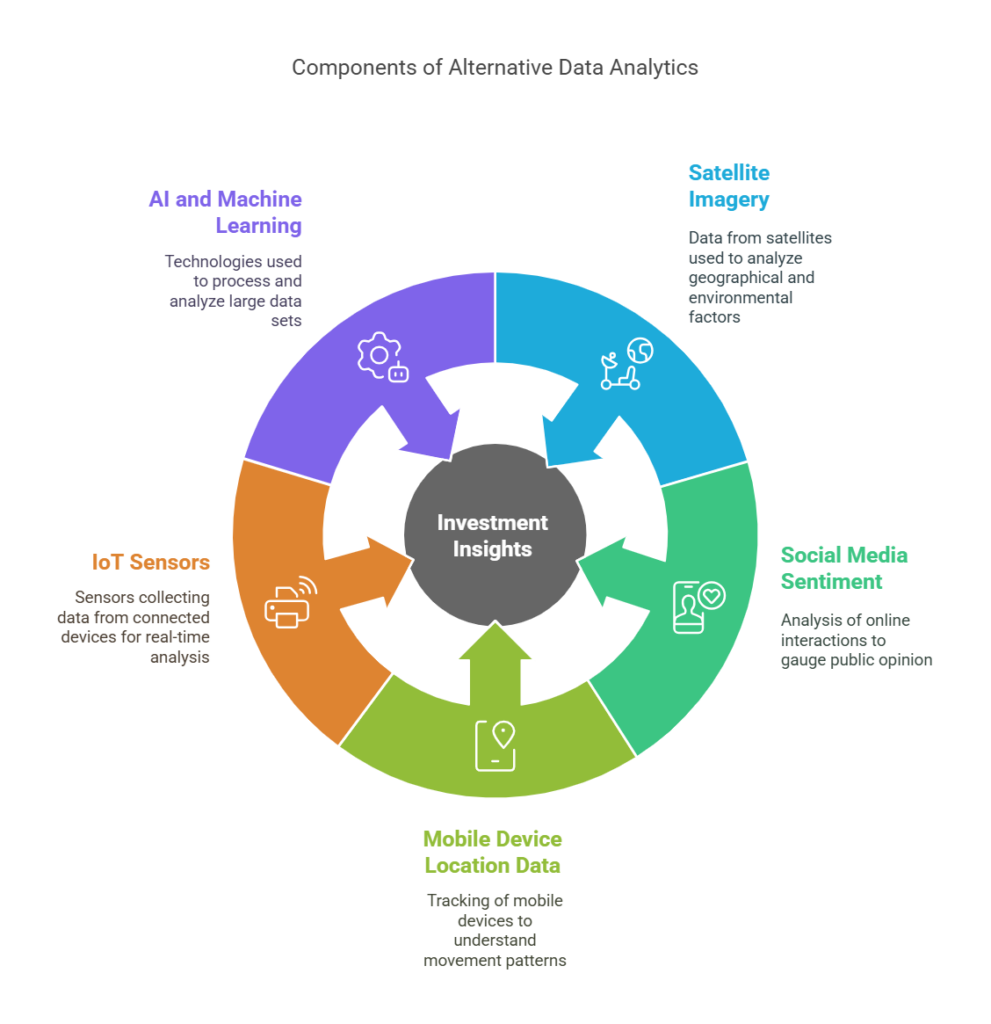

Alternative data analytics refers to the use of non-traditional data sources and advanced analytical methods to gain investment insights that are not readily available through conventional financial statements and market data. This approach encompasses a wide range of data types, from satellite imagery and social media sentiment to mobile device location data and Internet of Things (IoT) sensors.

The power of alternative data lies in its ability to provide real-time or near-real-time insights into business performance, consumer behavior, and market trends. While traditional financial data typically becomes available on a quarterly or annual basis, alternative data sources can offer daily or even hourly updates on key performance indicators. This timeliness allows investors to identify opportunities and risks before they become apparent through conventional channels.

Modern alternative data analytics platforms employ sophisticated technologies including artificial intelligence, machine learning, and natural language processing to extract meaningful patterns and predictions from vast amounts of unstructured data. These tools can process and analyze data at a scale and speed that would be impossible for human analysts, enabling investors to make more informed and timely investment decisions.

Types of Alternative Data

Consumer Behavior Data

- Credit card transaction data

- Mobile device location data

- E-commerce sales data

- Social media engagement metrics

- App usage statistics

Business Operations Data

- Satellite imagery of retail parking lots

- Container ship movements

- Energy consumption patterns

- Supply chain logistics data

- Employee satisfaction metrics

Environmental and External Data

- Weather patterns and natural events

- Regulatory changes and policy impacts

- Patent filings and intellectual property data

- Internet traffic patterns

- News sentiment analysis

Comparison of Alternative Data Sources

| Data Type | Update Frequency | Cost Range | Typical Use Cases | Implementation Complexity |

|---|---|---|---|---|

| Credit Card Data | Daily | $50,000-$500,000/year | Consumer spending trends | High |

| Satellite Imagery | Weekly | $10,000-$100,000/year | Retail traffic analysis | Medium |

| Social Media Sentiment | Real-time | $5,000-$50,000/year | Brand health monitoring | Low |

| Mobile Location Data | Hourly | $25,000-$250,000/year | Foot traffic analysis | Medium |

| Web Scraping Data | Real-time | $1,000-$20,000/year | Pricing and inventory tracking | Low |

Benefits of Alternative Data Analytics

Enhanced Market Intelligence

Alternative data analytics provides investors with a more comprehensive view of market dynamics and company performance. By analyzing multiple data sources simultaneously, investors can identify trends and patterns that might not be visible through traditional financial analysis alone.

Competitive Advantage

Early access to market-moving information through alternative data sources can provide a significant edge in investment timing and decision-making. Studies have shown that funds utilizing alternative data analytics consistently outperform their peers by 3-5% annually.

Risk Management

Alternative data sources can help identify potential risks before they materialize in traditional financial metrics. For example, analysis of supply chain data can reveal potential disruptions months before they impact a company’s financial statements.

Portfolio Diversification

Access to alternative data enables investors to identify unique investment opportunities across different sectors and asset classes, leading to better portfolio diversification and risk-adjusted returns.

Challenges and Risks

Data Quality and Reliability

- Inconsistent data quality across sources

- Potential for data manipulation or bias

- Need for robust validation processes

- Complex data cleaning requirements

Cost and Resource Requirements

- High costs of premium data sets

- Significant computing infrastructure needs

- Specialized talent requirements

- Ongoing maintenance and updates

Regulatory Compliance

- Data privacy regulations (GDPR, CCPA)

- Securities regulations

- Insider trading concerns

- Cross-border data restrictions

Implementation Strategy

1. Assessment Phase

- Evaluate current investment strategy and objectives

- Identify relevant alternative data sources

- Assess technical capabilities and resource requirements

- Define success metrics and ROI expectations

2. Infrastructure Development

- Build or acquire necessary technology infrastructure

- Establish data processing and storage capabilities

- Implement security and compliance measures

- Develop quality control procedures

3. Integration and Testing

- Pilot testing with selected data sources

- Integration with existing investment processes

- Staff training and capability building

- Performance monitoring and optimization

Future Trends in Alternative Data Analytics

Artificial Intelligence and Machine Learning

The integration of AI and ML technologies is expected to revolutionize alternative data analytics further. Advanced algorithms will become more sophisticated in pattern recognition and predictive analytics, enabling more accurate investment decisions.

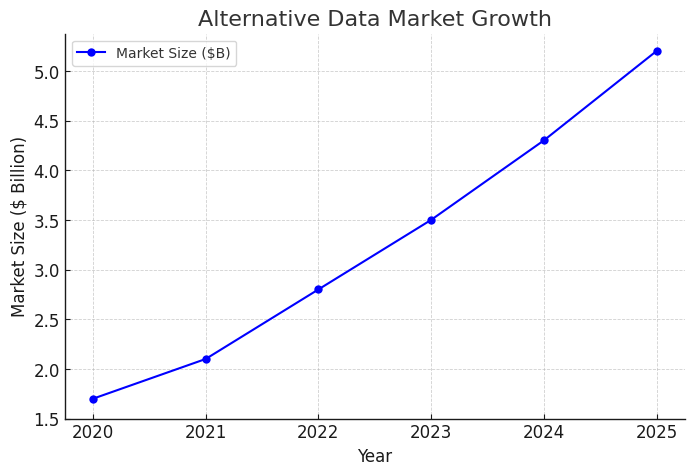

Data Democratization

As technology costs decrease and platforms become more user-friendly, alternative data analytics will become increasingly accessible to smaller investors and funds. This democratization is expected to level the playing field between institutional and individual investors.

New Data Sources

Emerging technologies like 5G networks, IoT devices, and blockchain will create new sources of alternative data. These sources will provide even more granular insights into market dynamics and company performance.

Regulatory Evolution

The regulatory framework around alternative data is expected to evolve, with clearer guidelines on data usage, privacy protection, and compliance requirements. This evolution will help legitimize and standardize alternative data analytics practices.

FAQs – Alternative Data Analytics

1. What is alternative data analytics?

Alternative data analytics refers to the use of non-traditional data sources and advanced analytical methods to gain investment insights. This includes analyzing data from sources such as satellite imagery, social media, mobile devices, and IoT sensors to identify investment opportunities and risks.

2. How much does it cost to implement alternative data analytics?

The cost varies significantly based on scale and sophistication. Basic implementation can start at $50,000 annually, while comprehensive enterprise solutions can exceed $1 million per year. This includes data acquisition, technology infrastructure, and personnel costs.

3. What are the most common types of alternative data?

The most commonly used alternative data types include credit card transaction data, satellite imagery, social media sentiment, mobile location data, and web-scraped information. Each type provides unique insights into different aspects of market behavior and company performance.

4. How can small investors access alternative data analytics?

Small investors can access alternative data through specialized platforms and services that aggregate and analyze data at more affordable price points. Some providers offer tiered services starting at a few thousand dollars annually.

5. What are the legal considerations when using alternative data?

Key legal considerations include compliance with data privacy regulations, securities laws, and insider trading regulations. It’s essential to ensure data is obtained and used in accordance with all applicable laws and regulations.

6. How accurate are alternative data analytics predictions?

Accuracy varies depending on the data sources and analytical methods used. Well-implemented systems typically achieve 70-85% accuracy in predicting major market movements, though past performance doesn’t guarantee future results.

7. What skills are needed to work with alternative data?

Essential skills include data analysis, programming (Python, R), statistical modeling, and domain expertise in finance. Knowledge of machine learning and AI is increasingly important.

8. How long does it take to implement an alternative data analytics system?

Basic implementation can take 3-6 months, while comprehensive enterprise solutions may require 12-18 months for full deployment and integration.

9. What are the main risks of using alternative data?

Key risks include data quality issues, regulatory compliance concerns, high costs, and the potential for false signals or misleading information. Risk management protocols are essential.

10. How does alternative data complement traditional financial analysis?

Alternative data provides real-time insights that complement traditional financial analysis by offering early signals of changes in company performance, market trends, and economic conditions.

Conclusion

Alternative data analytics has fundamentally transformed the investment landscape, creating new opportunities for generating alpha through sophisticated data analysis and predictive modeling. As technology continues to evolve and data becomes more accessible, the ability to effectively leverage alternative data will become increasingly crucial for investment success.

The democratization of these tools and techniques is creating opportunities for a broader range of investors to achieve significant returns through data-driven strategies.

Looking ahead, the continued evolution of artificial intelligence, machine learning, and new data sources will further enhance the capabilities of alternative data analytics. Successful investors will be those who can effectively combine traditional financial analysis with alternative data insights while navigating the challenges of data quality, regulatory compliance, and implementation complexity.

As the field matures, alternative data analytics will likely become a standard component of investment strategies across the industry, making it essential for investors to develop capabilities in this area to remain competitive in the modern market environment.

For your reference, recently published articles include:

- Portfolio Success With Investment Performance Metrics – Best Insight And Advice

- Outperform 90% Of Investors: Best Advice On Investment Benchmarking Tools

- Trading Fee Comparison: Your 2025 Guide to Commission-Free Platforms

- Investment Tax Optimization: The Ultimate Guide To Save Legally

- Retire 10 Years Earlier: Revolutionary Financial Goal Planning Strategies

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.