In today’s rapidly evolving financial landscape, AI investment advisory services are revolutionizing how individuals manage their wealth. These sophisticated platforms leverage artificial intelligence algorithms to deliver personalized investment strategies that were once accessible only to the wealthy elite.

As global AI investment approaches $200 billion by 2025, understanding how this technology can optimize your financial future has become essential for investors at all levels. With this goal in mind, “AI Investment Advisory Explained” shall equip you with the basic knowledge and skills to approach this topic with confidence.

Key Takeaways

- AI investment advisory combines sophisticated algorithms with financial expertise to deliver personalized investment strategies at a fraction of traditional costs. For example, a millennial investor with $10,000 can now access the same quality of portfolio management that previously required a $500,000 minimum and 1-2% annual fees through traditional advisors.

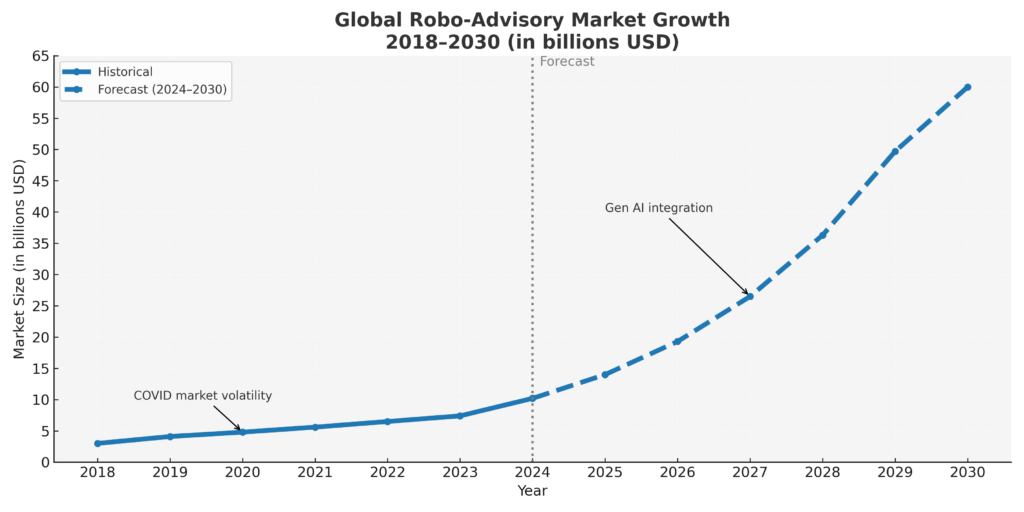

- The robo-advisory market is projected to grow from approximately $7.4 billion in 2023 to over $60 billion by 2030 at a CAGR of 30.5%, making it one of the fastest-growing segments in financial technology. This growth is driven by increasing digital adoption, with 72% of companies reporting AI implementation in at least one business function by 2024, compared to 55% in 2023.

- Hybrid AI advisory models that combine algorithmic precision with human oversight deliver the best results for complex financial situations. For instance, during the 2023 banking crisis, hybrid models outperformed pure robo-advisors by 6.2% by balancing automated rebalancing with human judgment during volatile market conditions.

What Is AI Investment Advisory?

AI investment advisory, often referred to as “robo-advisory,” represents the intersection of financial expertise and artificial intelligence technology. These platforms use advanced algorithms, machine learning, and big data analytics to provide automated investment services with minimal human intervention. Unlike traditional financial advisors who might rely on intuition and experience, AI advisory systems make decisions based on quantitative analysis of vast datasets, historical patterns, and real-time market conditions.

The core function of AI investment advisory platforms is to analyze an investor’s financial situation, goals, time horizon, and risk tolerance, then construct and manage a diversified portfolio aligned with these parameters. This approach democratizes access to sophisticated wealth management that was previously available only to high-net-worth individuals through traditional financial advisors.

AI investment advisory has evolved significantly since its inception in the mid-2000s. Early robo-advisors simply automated basic portfolio allocation using modern portfolio theory and passive index funds. Today’s advanced platforms incorporate predictive analytics, natural language processing, sentiment analysis, and even behavioral finance principles to deliver increasingly personalized investment strategies.

According to recent market data, the global robo-advisory market was valued at approximately $7.4 billion in 2023 and is projected to reach over $60 billion by 2030, growing at a compound annual growth rate (CAGR) of around 30.5%. This explosive growth reflects the increasing acceptance of AI-driven financial services and the ongoing digital transformation of the investment industry.

Types of AI Investment Advisory Services

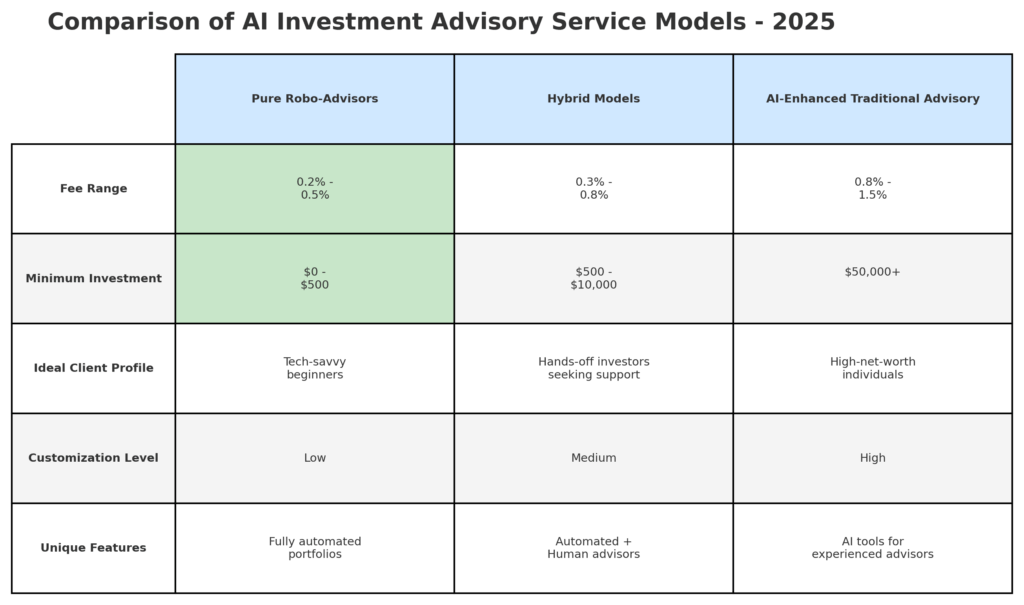

Pure Robo-Advisors

Pure robo-advisors operate with minimal human intervention, relying entirely on algorithms to build and manage investment portfolios. These platforms typically offer the lowest fees, with annual management charges ranging from 0.25% to 0.50% of assets under management. Some providers, like Charles Schwab’s Intelligent Portfolios, don’t charge advisory fees at all, generating revenue instead from the underlying investment products.

Pure robo-advisors excel at implementing core investment strategies like:

- Passive index investing

- Tax-loss harvesting

- Automatic portfolio rebalancing

- Dollar-cost averaging

These services are ideal for investors with straightforward financial situations who primarily seek low-cost, efficient portfolio management rather than comprehensive financial planning.

Hybrid Robo-Advisors

Hybrid models combine algorithmic portfolio management with human financial advisors. This approach maintains the efficiency and cost advantages of automation while providing access to human expertise for complex situations. According to industry research, hybrid robo-advisors dominated the market in 2021 with a 64% share and $2.64 billion in sales.

Hybrid services typically charge higher fees than pure robo-advisors (usually 0.75% to 1.25% annually) but significantly less than traditional financial advisors. The human component allows these platforms to address more complex needs such as:

- Estate planning

- Tax optimization strategies

- Retirement income planning

- Small business considerations

AI-Enhanced Traditional Advisory

This category represents the integration of AI tools into conventional financial advisory practices. Here, human advisors remain the primary relationship managers but leverage AI for research, analysis, and portfolio construction.

These services generally maintain the traditional advisory fee structure (1-2% annually) but offer enhanced value through:

- More sophisticated analysis

- Improved efficiency

- Data-driven insights

- Enhanced risk management

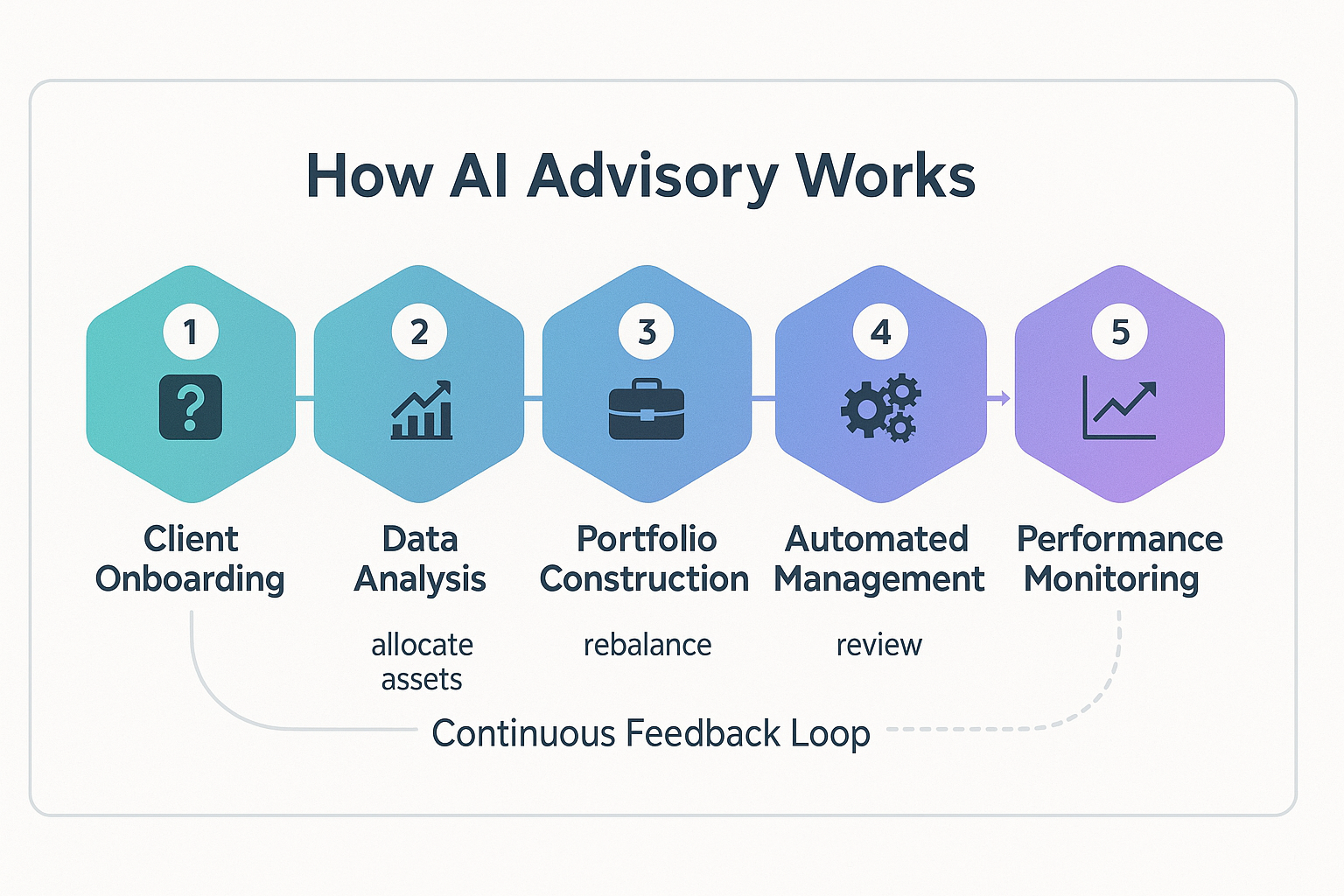

How AI Investment Advisory Works

Data Collection and Client Profiling

The AI advisory process begins with comprehensive data collection. Clients typically complete questionnaires covering:

- Financial goals and timeframes

- Income and assets

- Existing investments

- Risk tolerance (measured through behavioral questions)

- Tax situation

- Liquidity needs

Advanced platforms may also analyze bank transaction history, spending patterns, and even social media activity (with permission) to develop a more nuanced investor profile.

Algorithm-Driven Portfolio Construction

Using the collected data, AI systems construct personalized investment portfolios. This process typically involves:

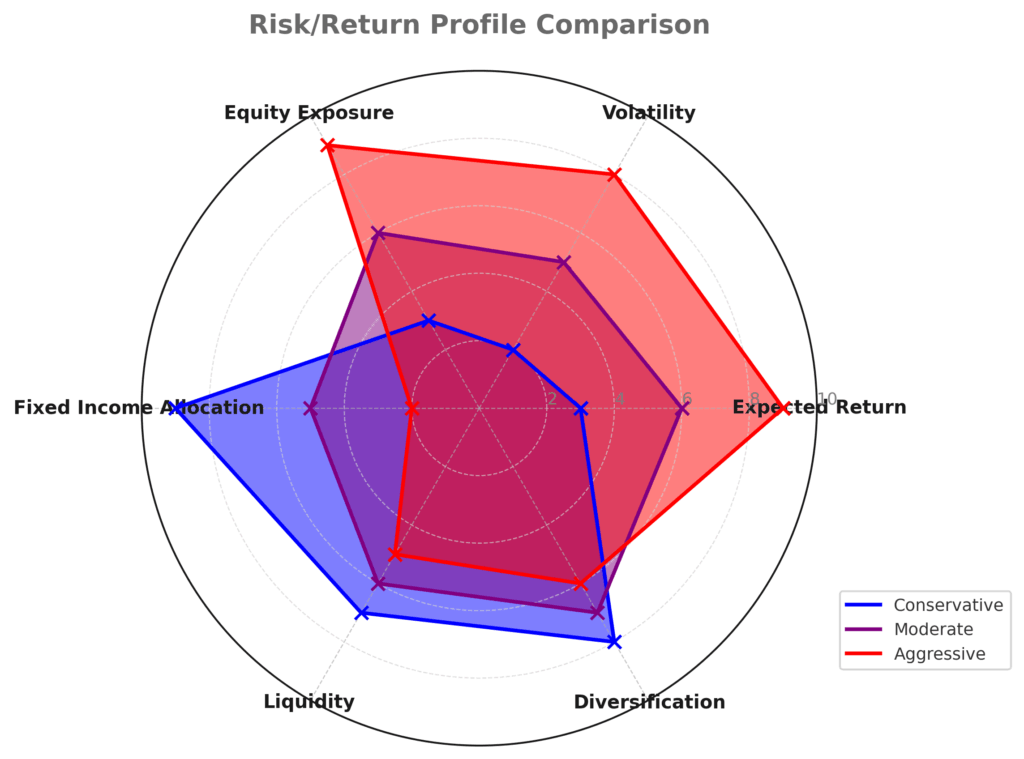

- Asset Allocation: Determining the optimal mix of stocks, bonds, cash, and alternative investments based on the client’s risk profile and objectives.

- Security Selection: Choosing specific investment vehicles (typically ETFs and index funds) to implement the asset allocation strategy.

- Risk Analysis: Evaluating potential portfolio vulnerabilities using Monte Carlo simulations and stress testing.

- Optimization: Fine-tuning allocations to maximize expected returns for a given risk level.

| Risk Profile | Typical Stock

Allocation |

Typical Bond

Allocation |

Expected Annual

Return |

Historical

Volatility |

|---|---|---|---|---|

| Conservative | 30-40% | 60-70% | 4-6% | 5-8% |

| Moderate | 50-60% | 40-50% | 6-8% | 8-12% |

| Aggressive | 80-90% | 10-20% | 8-10% | 12-18% |

Automated Portfolio Management

Once constructed, AI systems continuously monitor and manage portfolios through:

- Rebalancing: Automatically adjusting allocations when market movements cause them to drift from targets.

- Tax-Loss Harvesting: Strategically selling securities at a loss to offset capital gains and reduce tax liability.

- Cash Management: Optimizing returns on uninvested cash through high-yield accounts or short-term instruments.

- Dividend Reinvestment: Automatically reinvesting dividends to maintain market exposure.

Performance Monitoring and Reporting

AI advisory platforms provide comprehensive reporting on:

- Portfolio performance versus benchmarks

- Progress toward financial goals

- Contribution and withdrawal impact

- Fee transparency

- Tax efficiency metrics

Many platforms offer interactive dashboards where clients can adjust parameters and see the projected impact of different decisions, such as increasing contributions or changing retirement dates.

Benefits of AI Investment Advisory

Cost Efficiency

One of the most compelling advantages of AI investment advisory is significantly lower fees compared to traditional financial advisors:

- Traditional advisors: 1-2% of assets annually

- Hybrid robo-advisors: 0.4-0.9% annually

- Pure robo-advisors: 0.25-0.5% annually

- Some platforms: No direct management fees

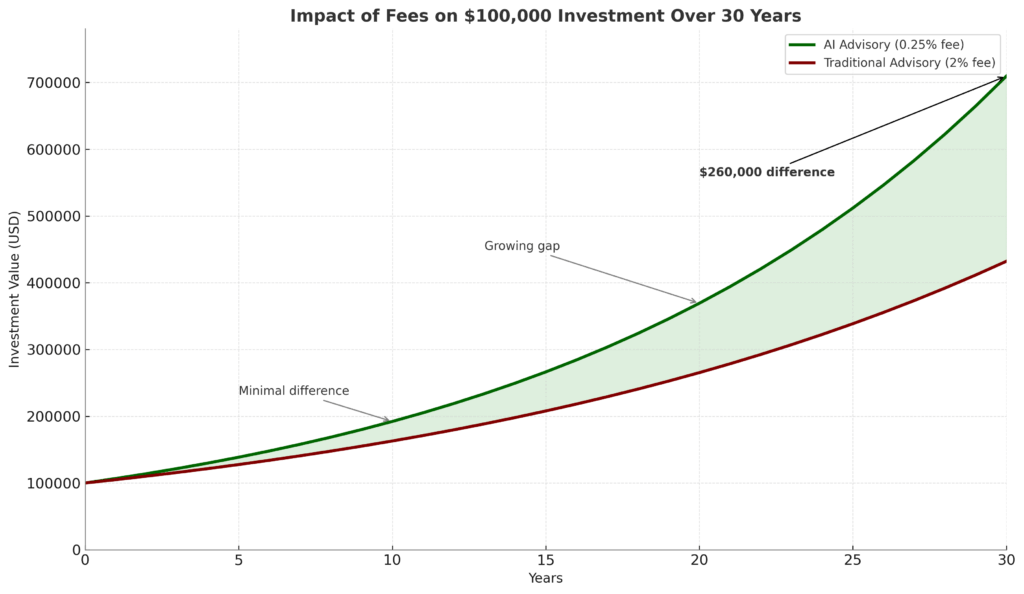

This fee differential can substantially impact long-term returns. For a $100,000 investment over 30 years with a 7% annual return, the difference between a 2% fee and a 0.25% fee amounts to approximately $260,000 in additional wealth.

Accessibility and Democratization

AI advisory services have dramatically lowered the barriers to professional investment management:

- Minimum investment requirements as low as $0-$500 (compared to $100,000+ for many traditional advisors)

- 24/7 account access via mobile applications

- User-friendly interfaces designed for financial novices

- Educational resources integrated into the platforms

This accessibility has particularly benefited younger investors and those with modest assets who were previously underserved by the financial advice industry.

Elimination of Emotional Bias

Human investors are susceptible to numerous cognitive biases that can undermine investment performance, including:

- Loss aversion

- Recency bias

- Confirmation bias

- Herd mentality

AI systems make decisions based solely on data and predetermined strategies, eliminating these emotional pitfalls. Research suggests that this discipline alone can add 1-2% in annual returns compared to self-directed investors.

Data-Driven Decision Making

AI advisory platforms can analyze vast quantities of data that would overwhelm human advisors, including:

- Real-time market data across global exchanges

- Economic indicators from hundreds of countries

- Corporate financial statements and earnings calls

- Regulatory filings and policy changes

- Alternative data sources (social media sentiment, satellite imagery, etc.)

This comprehensive analysis enables more informed investment decisions and potentially superior risk-adjusted returns.

Challenges and Risks

Limited Personalization

Despite advances in AI, current robo-advisory platforms still face limitations in addressing highly individualized financial situations:

- Complex tax scenarios

- Small business ownership considerations

- Special needs planning

- Cross-border financial issues

- Unique family dynamics

These nuanced circumstances often require human judgment and creativity that AI systems cannot yet fully replicate.

Algorithm Limitations

AI investment advisory relies on algorithms trained on historical data, which creates inherent limitations:

- Limited ability to anticipate unprecedented market events

- Potential for embedded biases in training data

- Difficulty adapting to paradigm shifts in market behavior

- Vulnerability to “black swan” events

These limitations became apparent during the COVID-19 market crash when many robo-advisors struggled to respond appropriately to the unprecedented market conditions.

Security and Privacy Concerns

AI advisory platforms handle extremely sensitive financial information, raising legitimate concerns about:

- Data breach vulnerabilities

- Unauthorized access to financial accounts

- Algorithm manipulation by malicious actors

- Privacy implications of data collection practices

According to industry surveys, security concerns remain the top barrier to adoption among potential users, particularly among older demographics.

Lack of Human Touch

The reduced human interaction in AI advisory services can present challenges for some investors:

- Difficulty building trust without face-to-face relationships

- Limited emotional support during market downturns

- Reduced accountability compared to human advisors

- Potential for misunderstandings without dialogue

These factors explain why hybrid models have gained significant market share, as they balance technological efficiency with human reassurance.

Implementation Process

Selecting the Right AI Advisory Platform

When choosing an AI investment advisory service, consider these key factors:

- Fee structure: Management fees, transaction costs, fund expenses

- Minimum investment requirements: Entry thresholds from $0 to $100,000+

- Available account types: Taxable, IRA, 401(k) rollovers, trusts

- Investment methodology: Passive vs. active, ESG options, factor tilts

- Tax optimization capabilities: Tax-loss harvesting, tax-efficient fund selection

- User experience: Interface design, mobile app functionality, reporting tools

- Additional services: Financial planning tools, human advisor access, banking features

- Security measures: Encryption standards, authentication methods, insurance coverage

Onboarding Process

The typical implementation process involves:

- Account setup: Providing personal information and identity verification

- Risk assessment: Completing questionnaires to determine risk tolerance

- Goal setting: Defining specific financial objectives with timeframes

- Funding: Transferring assets or setting up recurring contributions

- Portfolio review: Examining and approving the proposed investment strategy

- Customization: Adjusting allocations or excluding specific investments (if available)

- Automation setup: Configuring automatic contributions, rebalancing preferences, and tax settings

Most platforms complete this process entirely online, though hybrid services may include consultations with human advisors.

Ongoing Management and Monitoring

Effective use of AI investment advisory requires periodic review and adjustment:

- Quarterly portfolio review: Examining performance and allocation drift

- Annual goal reassessment: Ensuring alignment with changing life circumstances

- Tax planning: Coordinating with tax professionals on year-end strategies

- Major life events: Updating financial information after marriages, births, career changes, etc.

- Market regime changes: Considering allocation adjustments during significant economic shifts

Many platforms offer automated notifications for these review points, but users should proactively monitor their financial situations.

Future Trends in AI Investment Advisory

Integration of Generative AI and Large Language Models

The next frontier in AI investment advisory involves generative AI and large language models (LLMs) like those powering ChatGPT and Claude. These technologies enable:

- Natural language interaction with financial systems

- Conversational financial planning

- Personalized investment education

- Nuanced explanation of complex financial concepts

According to industry reports, 51% of companies were using generative AI for various business functions by 2024, with financial services among the leading adopters.

Hyper-Personalization Through Advanced Analytics

Future AI advisory platforms will move beyond basic demographic and risk-tolerance profiles to deliver truly individualized investment strategies based on:

- Spending pattern analysis

- Career trajectory prediction

- Lifestyle preference modeling

- Health data integration (with permission)

- Value and priority alignment

This hyper-personalization aims to create financial strategies that reflect not just risk tolerance but an investor’s entire life context.

Blockchain and Decentralized Finance Integration

The convergence of AI advisory with blockchain technology and decentralized finance (DeFi) promises significant innovations:

- Tokenized investment portfolios

- Smart contract-based financial planning

- Automated tax reporting through blockchain records

- Fractional ownership of alternative assets

- Programmable money flows based on financial goals

While still emerging, these integrations could fundamentally transform how investments are structured and managed.

Predictive Financial Planning

Advanced AI systems are increasingly capable of predictive financial planning:

- Anticipating major life expenses before they occur

- Forecasting career transitions and income changes

- Modeling future market conditions with greater accuracy

- Identifying potential financial vulnerabilities proactively

- Suggesting behavioral interventions to improve financial outcomes

These capabilities shift the paradigm from reactive to proactive financial management.

Environmental, Social, and Governance (ESG) Analytics

AI is enhancing the sophistication of ESG investing through:

- Real-time monitoring of corporate sustainability metrics

- Natural language processing of corporate statements and news

- Supply chain analysis for ethical concerns

- Sentiment analysis of public perception

- Impact measurement of investment choices

According to recent surveys, 77% of investors globally prefer sustainable investing options, making this capability increasingly important for competitive AI advisory platforms.

FAQs – AI Investment Advisory Explained

1. How do AI investment advisors make money?

AI investment advisors typically generate revenue through three primary channels:

- Management fees (usually a percentage of assets under management)

- Revenue from proprietary investment products

- Interest income from cash balances

- Premium feature subscriptions

- Referral fees from third-party services

The specific business model varies by platform, with some emphasizing transparency by relying solely on management fees.

2. Are AI investment advisory services suitable for high-net-worth individuals?

Yes, but with qualifications. High-net-worth individuals can benefit from the efficiency and systematic approach of AI advisory, particularly for core portfolio management. However, they often have complex needs (estate planning, tax strategies, business succession) that may require supplementary human expertise. Many wealthy investors use AI platforms for a portion of their assets while maintaining relationships with traditional advisors for specialized services.

3. How do AI investment advisors perform during market downturns?

Performance during downturns varies by platform and strategy. Generally, AI advisors maintain disciplined adherence to rebalancing protocols, which can be advantageous during volatility. However, they may lack the judgment to distinguish between temporary disruptions and fundamental market shifts. During the 2020 COVID-19 crash, most robo-advisors performed comparably to their benchmarks, though some were criticized for excessive trading during the heightened volatility.

4. What regulatory oversight applies to AI investment advisory services?

AI investment advisors in the United States typically register as investment advisers with the Securities and Exchange Commission (SEC) or state securities regulators, subjecting them to the same fiduciary standards as traditional advisors. They must comply with regulations, including:

- The Investment Advisers Act of 1940

- SEC disclosure requirements

- Anti-money laundering provisions

- Data security standards

- Fair marketing rules

International regulations vary by jurisdiction, with the EU’s MiFID II providing comprehensive oversight in European markets.

5. Can I combine AI advisory with self-directed investing?

Yes, many investors adopt a “core and explore” approach, using AI platforms for core portfolio management (typically 70-80% of assets) while maintaining a self-directed portion for individual stock selection or tactical opportunities. Some platforms specifically accommodate this hybrid approach by allowing customization within the automated framework.

6. How do taxes work with AI investment advisory?

Most advanced AI advisory platforms incorporate tax optimization strategies, including:

- Tax-loss harvesting (selling losing positions to offset gains)

- Tax-efficient fund selection (using ETFs rather than mutual funds)

- Asset location optimization (placing tax-inefficient investments in tax-advantaged accounts)

- Tax-aware rebalancing (minimizing taxable transactions)

However, the effectiveness of these strategies varies by platform and investor situation. Investors with complex tax situations should coordinate with tax professionals.

7. What happens to my investments if the AI advisory company goes out of business?

Client assets are typically held by third-party custodians (like Charles Schwab or Fidelity), not by the advisory firm itself. If an AI advisory company ceases operations, client securities remain safely at the custodian, who would provide options for transferring management to another advisor. Cash deposits may have SIPC protection up to $500,000, providing additional security.

8. How much customization do AI investment advisory platforms allow?

Customization options vary significantly between platforms:

- Basic platforms: Limited to risk level adjustment

- Intermediate platforms: Allow excluding specific sectors or companies

- Advanced platforms: Support custom asset allocations and specific security selection

- Premium services: Enable fully bespoke portfolios with AI-enhanced implementation

Investors seeking high customization should carefully review platform capabilities before committing.

9. Do AI advisors consider my investments outside their platform?

Some platforms offer “held-away account” analysis, considering external investments when developing recommendations. However, this capability varies widely:

- Basic integration: Manual entry of external holdings

- Intermediate integration: Account aggregation through secure connections

- Advanced integration: Holistic recommendations that optimize across all accounts

For comprehensive financial planning, investors should seek platforms with robust account aggregation features.

10. How is AI investment advisory different from index investing?

While both emphasize low-cost, diversified approaches, AI advisory extends beyond simple index investing through:

- Personalized asset allocation based on individual factors

- Dynamic rebalancing responsive to market conditions

- Tax optimization strategies

- Goal-based portfolio construction

- Risk management tailored to personal circumstances

Index investing focuses primarily on market exposure, while AI advisory attempts to optimize the entire investment experience for individual objectives.

Conclusion

AI investment advisory represents a transformative force in financial services, democratizing access to sophisticated investment management through technology. By combining algorithmic precision with decreasing costs, these platforms have created unprecedented opportunities for investors at all wealth levels to optimize their financial futures.

As we look ahead, the convergence of AI with other emerging technologies – blockchain, generative AI, advanced data analytics – promises even more powerful tools for wealth creation and preservation. The most successful investors will be those who thoughtfully integrate these technological capabilities with clear personal financial objectives.

While AI advisory cannot yet replicate the full range of services provided by human financial professionals, particularly for complex situations, it offers remarkable efficiency and accessibility for core investment management. The rapid market growth – projected to reach over $60 billion by 2030 – reflects both the effectiveness of current offerings and the significant potential for continued innovation.

The future of investment management lies not in choosing between human and artificial intelligence but in leveraging the strengths of both. As hybrid models continue to evolve, investors can expect increasingly sophisticated, personalized, and effective financial solutions that combine technological efficiency with human wisdom.

For your reference, recently published articles include:

-

- Investment Research Automation: The Way To Your Success

- Global Expense Management Tools – Save Your Time And Money

- Business Credit Cards No Foreign Transaction Fee – Get Best Advice Here

- 7 Beginner Mistakes In ETF Investing: The Expert Guide

- Unlock Hidden Perks: Best Credit Cards For Freelancers Revealed!

- Build A Fortune: Trading Algorithm Development Made Simple

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.