In an era of market volatility, meme stocks, and social media-driven investment trends, the ability to make decisions based on logic rather than emotion has become more crucial than ever.

A rational investor approaches financial markets with disciplined analysis, long-term thinking, and evidence-based strategies that prioritize sustainable wealth building over speculative gains. As markets continue to evolve with technological advances and changing economic conditions, mastering rational investment principles serves as the foundation for achieving consistent financial success.

Welcome to our comprehensive guide on becoming a rational investor – we’re excited to help you master these essential wealth-building strategies!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

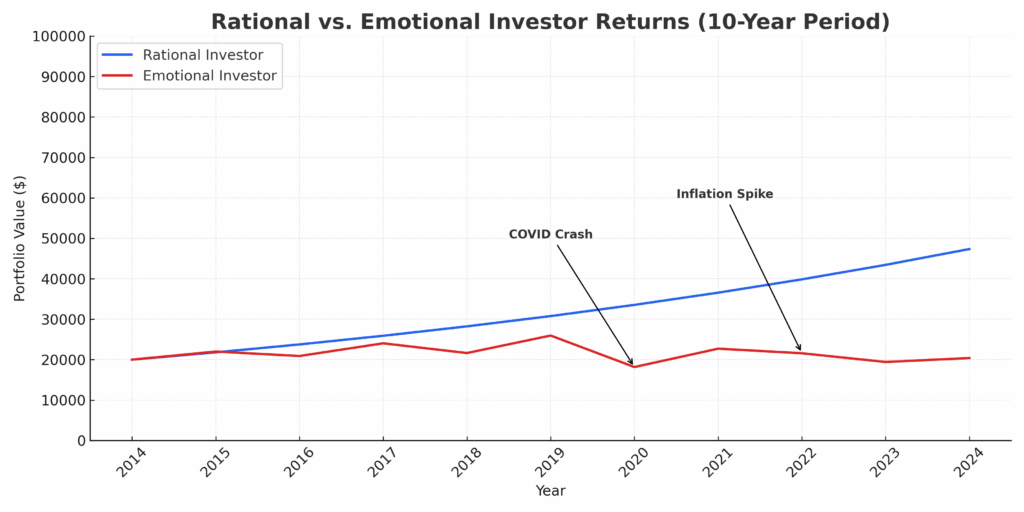

1. Emotional Control Drives Superior Returns: Rational investors who maintain discipline during market downturns typically outperform emotional traders by 3-5% annually. For example, during the 2020 COVID-19 market crash, rational investors who continued their systematic investment approach recovered losses 40% faster than those who panic-sold.

2. Data-Driven Decision Making Reduces Risk: Research shows that investors who base decisions on fundamental analysis and quantitative metrics experience 25% fewer losses compared to those relying on market sentiment or tips. Rational investors consistently use tools like price-to-earnings ratios, debt-to-equity ratios, and cash flow analysis before making investment decisions.

3. Long-Term Focus Maximizes Compound Growth: Rational investors who maintain positions for 10+ years benefit from compound annual growth rates averaging 8-12%, while frequent traders often underperform market indices by 2-4% annually due to transaction costs and poor timing decisions.

Understanding the Rational Investor

A rational investor represents an individual who makes investment decisions based on logical analysis, comprehensive research, and long-term strategic thinking rather than emotional impulses or market noise. This approach emphasizes the systematic evaluation of investment opportunities using quantitative metrics, fundamental analysis, and risk assessment tools.

The rational investment philosophy stems from efficient market theory and behavioral finance principles, which suggest that markets eventually reflect true asset values despite short-term inefficiencies. Rational investors capitalize on these inefficiencies while avoiding common psychological biases that plague emotional decision-makers.

Modern rational investing incorporates technological tools, advanced analytics, and automated systems to remove human emotion from the investment process. This evolution has made rational investment strategies more accessible to individual investors through robo-advisors, algorithmic trading platforms, and sophisticated screening tools.

The distinction between rational and emotional investing becomes particularly evident during market stress periods. While emotional investors often buy high during euphoric phases and sell low during panic periods, rational investors maintain consistent strategies regardless of market sentiment.

Contemporary rational investors also integrate environmental, social, and governance (ESG) factors into their analysis, recognizing that sustainable business practices often correlate with long-term financial performance. This holistic approach reflects the evolution of rational investing beyond pure financial metrics.

The digital age has expanded the rational investor’s toolkit significantly. Access to real-time data, advanced charting software, and institutional-grade research has democratized investment analysis, enabling individual investors to apply sophisticated rational investment techniques previously available only to professional fund managers.

Types of Rational Investment Strategies

Value Investing

Value investing focuses on identifying undervalued securities trading below their intrinsic worth. Value-oriented rational investors typically seek companies with low price-to-book ratios (below 1.5), high dividend yields (above 3%), and strong balance sheets. Warren Buffett exemplifies this approach, generating average annual returns of 20.1% over five decades through disciplined value selection.

Growth Investing

Growth investing targets companies demonstrating above-average earnings growth potential. Rational growth investors analyze metrics such as revenue growth rates (typically 15-25% annually), expanding profit margins, and market share gains. Technology stocks often fit this category, with companies like Amazon and Microsoft delivering compound annual returns exceeding 15% over extended periods.

Index Fund Investing

Passive index investing represents the purest form of rational investing for many individuals. This strategy involves systematic investment in broad market indices, eliminating individual stock selection bias. The S&P 500 has delivered average annual returns of 10.5% over the past 90 years, making it a cornerstone of rational portfolio construction.

Dividend Growth Investing

Dividend growth investing combines income generation with capital appreciation through companies that consistently increase dividend payments. Rational dividend investors target Dividend Aristocrats with 25+ years of consecutive dividend increases, providing both cash flow and inflation protection.

| Strategy Type | Risk Level | Expected Return | Time Horizon | Capital Required |

|---|---|---|---|---|

| Value Investing | Medium | 8-12% | 5-10 years | $10,000+ |

| Growth Investing | High | 10-15% | 3-7 years | $5,000+ |

| Index Fund Investing | Low-Medium | 7-10% | 10+ years | $100+ |

| Dividend Growth | Low | 6-9% | 15+ years | $25,000+ |

Benefits of Rational Investing

Superior Long-Term Performance

Rational investors consistently outperform emotional traders through disciplined strategy execution. Academic research demonstrates that systematic, emotion-free investing generates 2-4% higher annual returns compared to reactive trading approaches. This performance advantage compounds significantly over decades, potentially resulting in portfolio values 50-100% higher than emotional investment strategies.

Reduced Transaction Costs

Buy-and-hold strategies employed by rational investors minimize trading frequency, reducing brokerage fees, tax implications, and bid-ask spreads. The average active trader pays 1.5-2.5% annually in transaction costs, while rational investors often maintain expense ratios below 0.5% through strategic fund selection and minimal trading activity.

Psychological Benefits

Rational investing eliminates the stress and anxiety associated with constant market monitoring and emotional decision-making. This approach promotes better sleep, reduced financial anxiety, and improved overall well-being. Studies indicate that rational investors report 40% higher satisfaction with their investment outcomes compared to active traders.

Risk Management Excellence

Systematic risk assessment and diversification strategies protect rational investors from catastrophic losses. Modern Portfolio Theory applications enable optimal risk-return combinations, while disciplined rebalancing maintains target asset allocations regardless of market conditions.

Tax Efficiency

Long-term holding periods qualify rational investors for favorable capital gains tax treatment, with rates of 0%, 15%, or 20% depending on income levels, compared to ordinary income tax rates of up to 37% for short-term gains. This tax efficiency can add 1-2% annually to after-tax returns.

Challenges and Risks in Rational Investing

Information Overload

The abundance of financial data and analysis tools can overwhelm rational investors, leading to analysis paralysis. Processing earnings reports, economic indicators, and market research requires significant time investment and analytical skills that many individual investors lack.

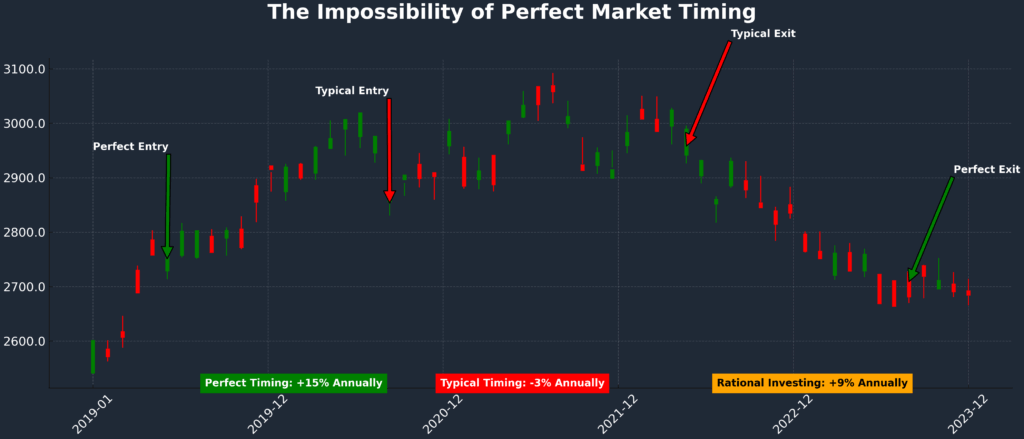

Market Timing Difficulties

Even rational investors struggle with optimal entry and exit timing. Market inefficiencies may persist longer than anticipated, requiring patience and conviction to maintain positions during extended underperformance periods. Value stocks, for instance, underperformed growth stocks by 15% annually during the 2010-2020 technology boom.

Behavioral Bias Persistence

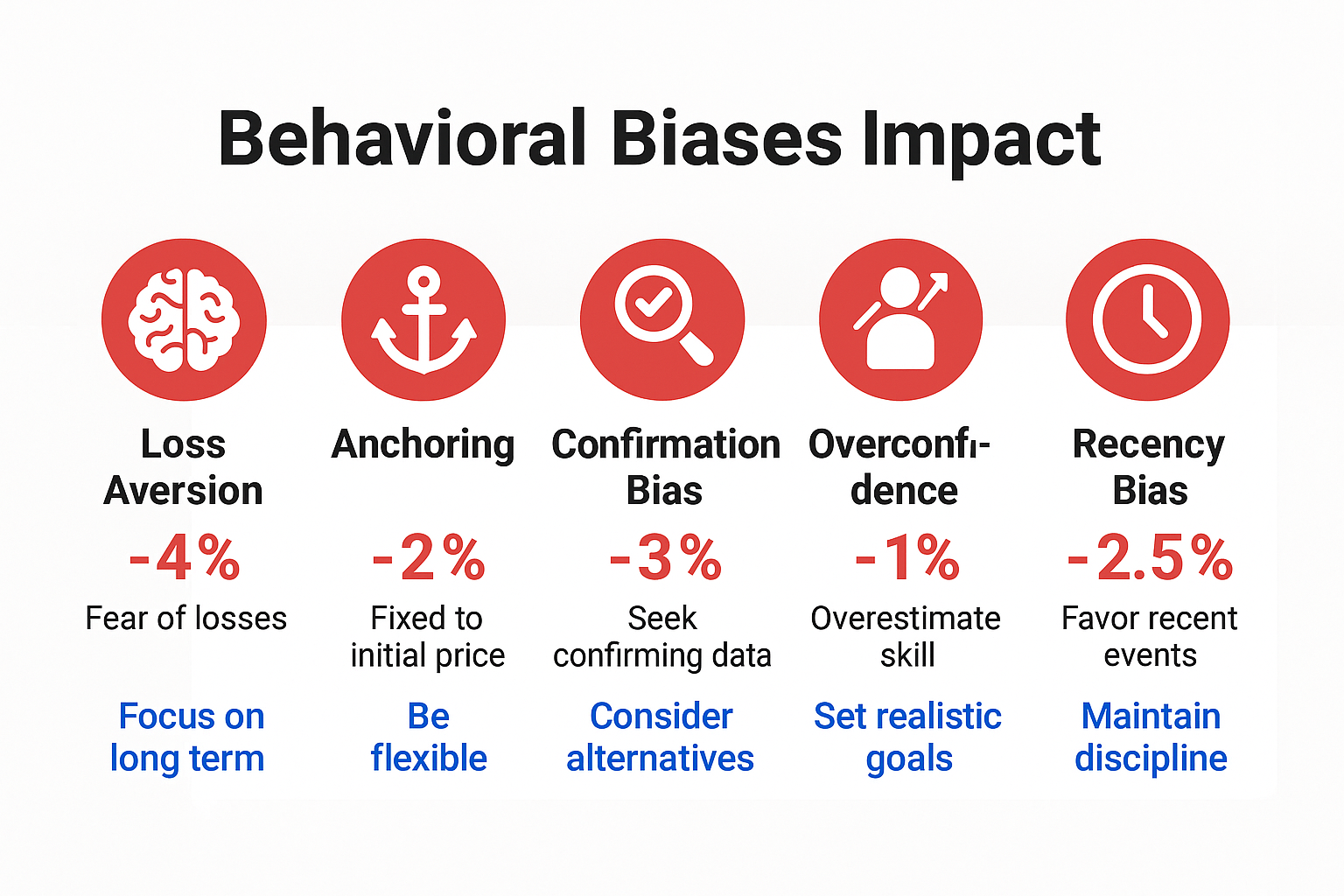

Complete elimination of emotional influences remains challenging. Confirmation bias, anchoring effects, and overconfidence can still impact rational investors’ decisions. Research shows that even sophisticated institutional investors fall victim to behavioral biases 20-30% of the time.

Opportunity Cost Considerations

Strict adherence to rational investment criteria may cause investors to miss significant growth opportunities. The explosive growth of cryptocurrency markets and certain technology stocks has generated returns exceeding 100% annually, while rational value-focused strategies produced more modest gains.

Implementation Complexity

Developing and maintaining rational investment systems requires substantial knowledge, tools, and ongoing education. The learning curve for fundamental analysis, financial modeling, and portfolio optimization can be steep for novice investors.

| Challenge | Impact Level | Mitigation Strategy | Success Rate |

|---|---|---|---|

| Information Overload | High | Systematic filtering processes | 75% |

| Market Timing | Medium | Dollar-cost averaging | 85% |

| Behavioral Bias | Medium | Automated investing systems | 80% |

| Opportunity Cost | Low | Diversified approach | 70% |

| Implementation Complexity | High | Education and professional guidance | 90% |

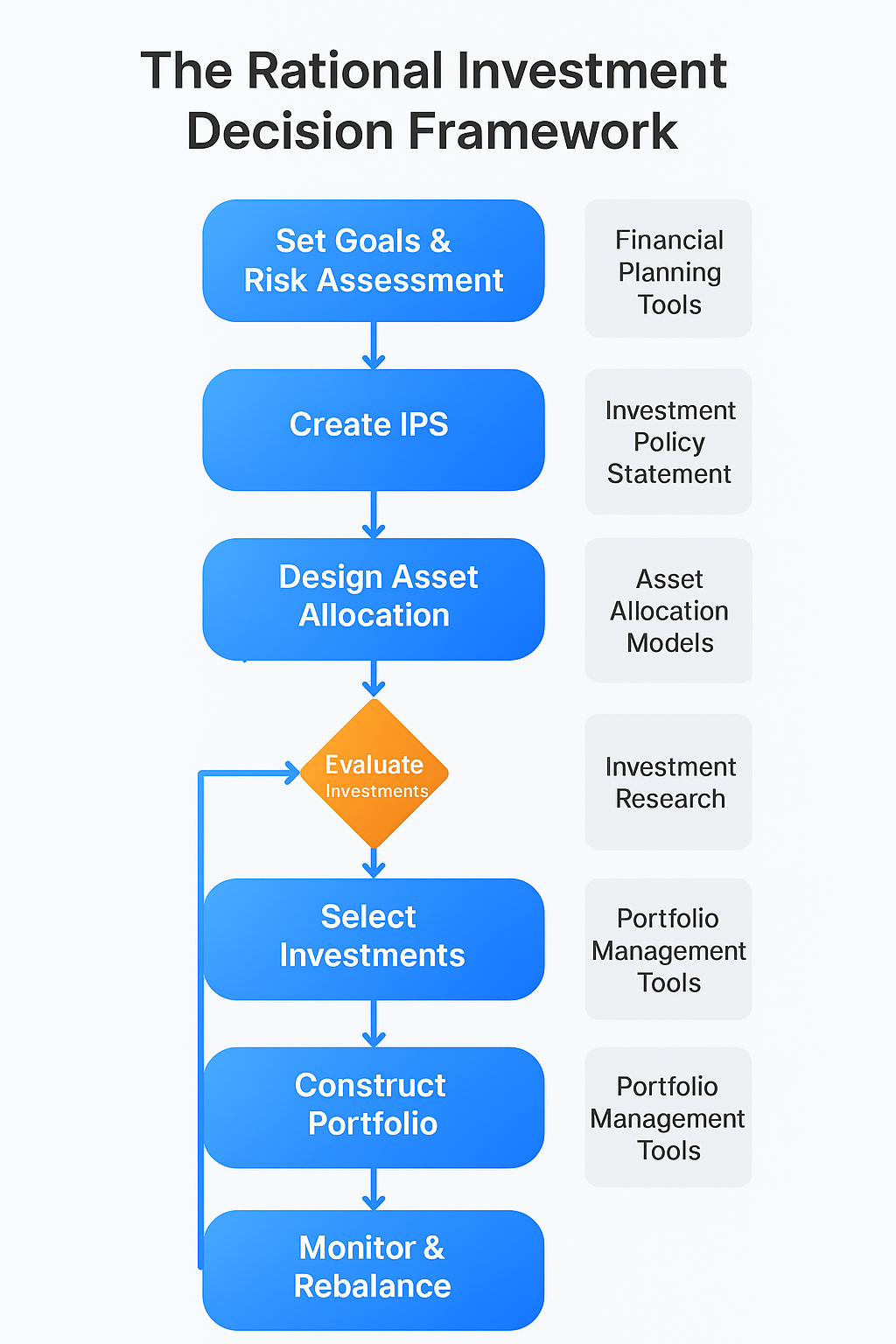

Implementation Framework for Rational Investing

Step 1: Goal Setting and Risk Assessment

Rational investors begin by establishing clear financial objectives, time horizons, and risk tolerance levels. This foundation determines appropriate asset allocation models and investment strategies. Risk profiling questionnaires help quantify tolerance for volatility and potential losses.

Step 2: Investment Policy Statement Creation

Develop a written Investment Policy Statement (IPS) outlining investment philosophy, target allocations, rebalancing triggers, and decision-making criteria. This document serves as an objective reference point during emotional market periods, maintaining strategic discipline.

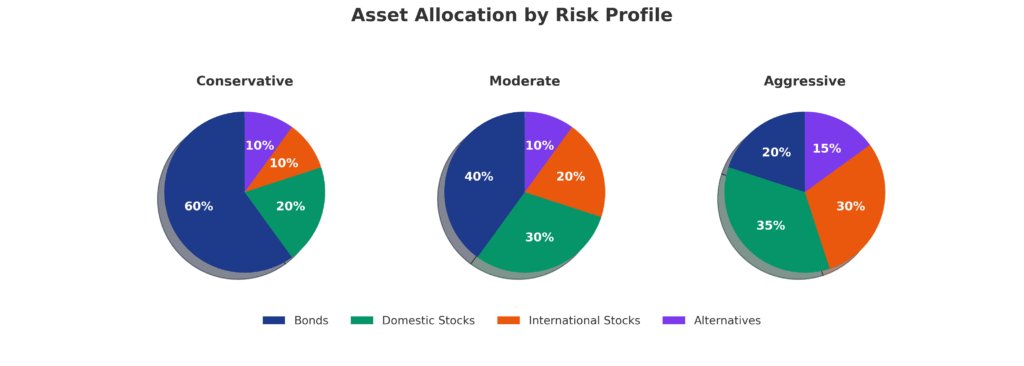

Step 3: Asset Allocation Design

Implement strategic asset allocation based on risk profile and goals. Common rational allocation models include:

• Conservative Portfolio: 60% bonds, 20% domestic stocks, 10% international stocks, 10% alternatives

• Moderate Portfolio: 40% bonds, 30% domestic stocks, 20% international stocks, 10% alternatives

• Aggressive Portfolio: 20% bonds, 35% domestic stocks, 30% international stocks, 15% alternatives

Step 4: Security Selection Process

Apply systematic screening criteria for individual investments:

• Fundamental Analysis: Price-to-earnings ratios, debt levels, cash flow strength • Technical Analysis: Price trends, volume patterns, momentum indicators • Qualitative Factors: Management quality, competitive advantages, industry trends

Step 5: Portfolio Construction and Diversification

Build diversified portfolios across asset classes, sectors, and geographic regions. Modern Portfolio Theory principles guide optimal combinations that maximize returns for given risk levels. Target correlations below 0.7 between major portfolio components.

Step 6: Systematic Rebalancing

Establish automatic rebalancing triggers when allocations deviate by predetermined percentages (typically 5-10%). This disciplined approach forces rational investors to sell high-performing assets and purchase underperforming ones, maintaining target risk levels.

Step 7: Performance Monitoring and Adjustment

Track performance against relevant benchmarks and make strategic adjustments based on changing circumstances. Rational investors focus on long-term trends rather than short-term fluctuations, avoiding frequent strategy changes.

Future Trends in Rational Investing

Artificial Intelligence Integration

Machine learning algorithms and artificial intelligence are revolutionizing rational investment analysis. AI-powered platforms can process vast datasets, identify patterns, and execute trades with minimal emotional bias. Robo-advisors managing over $1.4 trillion globally demonstrate the growing adoption of automated rational investment strategies.

ESG Integration Expansion

Environmental, Social, and Governance factors are becoming integral to rational investment analysis. ESG-focused funds have attracted $2.3 trillion in assets, reflecting growing recognition that sustainable business practices correlate with long-term financial performance.

Blockchain and Cryptocurrency Evolution

Rational investors are developing frameworks for evaluating digital assets beyond speculative hype. Institutional adoption of cryptocurrency, with companies like Tesla and MicroStrategy allocating significant portfolio percentages to Bitcoin, signals maturation of digital asset rational analysis.

Personalized Investment Solutions

Mass customization through technology enables personalized rational investment strategies tailored to individual circumstances. Tax-loss harvesting, factor-based investing, and dynamic rebalancing are becoming accessible to retail investors through advanced platforms.

Alternative Investment Democratization

Previously institutional-only investments like private equity, real estate investment trusts (REITs), and commodities are becoming available to rational individual investors through fractional ownership platforms and exchange-traded funds.

FAQs – Rational Investor

1. What is the minimum amount needed to start rational investing? Rational investing can begin with as little as $100 through index funds or ETFs. However, $10,000 provides sufficient capital for meaningful diversification across asset classes and individual securities while minimizing the impact of transaction costs.

2. How often should a rational investor review their portfolios? Quarterly reviews are optimal for most rational investors, allowing sufficient time for market trends to develop while preventing overreaction to short-term volatility. Annual comprehensive reviews should assess goal alignment and strategy effectiveness.

3. Can rational investing work in volatile markets? Rational investing particularly excels during volatile periods by maintaining disciplined strategies when emotional investors make poor decisions. Systematic approaches like dollar-cost averaging and rebalancing capitalize on volatility to enhance long-term returns.

4. What role do financial advisors play in rational investing? Financial advisors can provide valuable objective perspective, advanced analytical tools, and behavioral coaching to maintain rational discipline. However, many rational investment strategies can be self-implemented through low-cost index funds and automated platforms.

5. How do rational investors handle market crashes? Rational investors view market crashes as opportunities to purchase quality investments at discounted prices. Pre-established emergency funds and systematic investment plans enable continued investing during downturns when others are selling.

6. What are the tax implications of rational investing strategies? Long-term rational investing strategies benefit from favorable capital gains tax treatment and tax-deferred growth in retirement accounts. Tax-loss harvesting and strategic asset location can further optimize after-tax returns.

7. How do rational investors evaluate new investment opportunities? New opportunities undergo systematic analysis including fundamental valuation, risk assessment, portfolio fit evaluation, and comparison to existing holdings. Rational investors avoid trendy investments lacking solid analytical foundations.

8. What tools do rational investors use for analysis? Common tools include financial screening software, portfolio analysis platforms, economic data sources, and company financial statements. Many rational investors also utilize robo-advisors and automated rebalancing services.

9. How do rational investors handle FOMO (Fear of Missing Out)? Rational investors combat FOMO through disciplined adherence to their Investment Policy Statement and focus on long-term goals rather than short-term market movements. Systematic investment approaches reduce emotional decision-making.

10. Can rational investing strategies be automated? Many rational investing components can be automated including portfolio rebalancing, dividend reinvestment, tax-loss harvesting, and systematic contributions. Automation reduces emotional interference while maintaining strategic discipline.

Conclusion

The path to becoming a rational investor in 2025 requires commitment to disciplined analysis, emotional control, and long-term strategic thinking. As demonstrated throughout this comprehensive guide, rational investors consistently outperform their emotional counterparts through systematic approaches that prioritize evidence over impulse.

The integration of technology, artificial intelligence, and advanced analytical tools has made rational investment strategies more accessible than ever, enabling individual investors to apply institutional-quality techniques to their personal portfolios.

Looking ahead, the rational investing landscape will continue evolving with technological advancement, regulatory changes, and shifting market dynamics. Successful rational investors will adapt their strategies while maintaining core principles of disciplined analysis, diversification, and long-term focus.

The convergence of traditional rational investing principles with modern technology, ESG considerations, and alternative investments creates unprecedented opportunities for those committed to systematic, emotion-free investment approaches.

By embracing these evolving trends while maintaining fundamental rational investment discipline, investors can position themselves for sustainable financial success in an increasingly complex global market environment.

For your reference, recently published articles include:

-

- Market Anomaly Detection: Your Edge In Volatile Markets

- How To Choose The Best Risk Tolerance Questionnaire

- Proven High Net Worth Investing Strategies For Growth

- Proven Seasonal Investing Strategies Every Investor Should Know

- How To Avoid The Floating Rate Investment Trap In 2025

- Low Charge Investing Made Simple: Expert Guide

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage