The financial landscape is rapidly evolving, with artificial intelligence emerging as a transformative force, which is reshaping how private wealth is created, managed, and grown. The integration of AI technologies into personal finance and investment strategies represents not merely a technological shift but a fundamental reimagining of the path to financial independence and wealth accumulation in the digital age.

Welcome to the “Digital Age Success Story – with AI to Private Wealth!”

Key Takeaways

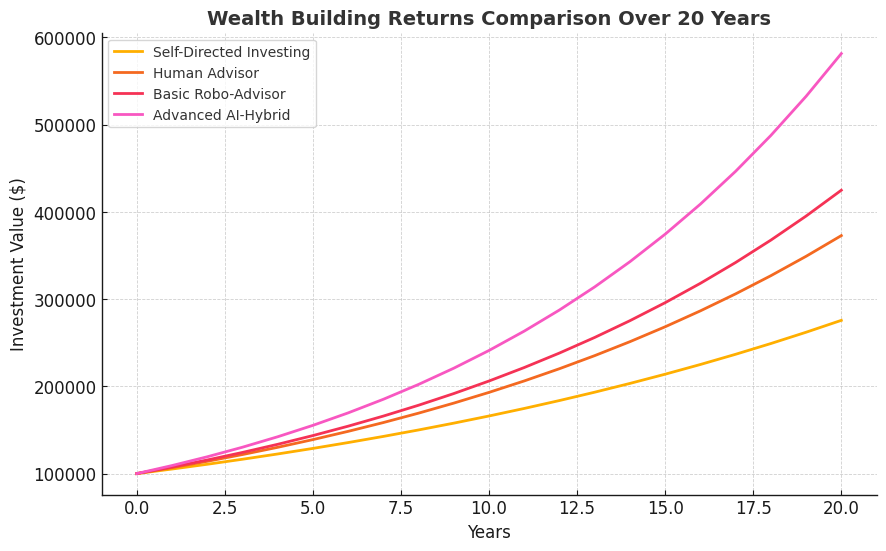

- AI-powered wealth management platforms are democratizing access to sophisticated financial strategies, with retail investors now leveraging tools previously available only to ultra-high-net-worth individuals, resulting in portfolio optimization improvements of 15-30% compared to traditional approaches.

- Data-driven AI investment models consistently outperform human-only decision making, with AI-augmented investment strategies showing 3-7% higher annual returns while simultaneously reducing emotional bias that typically costs investors an average of 4.4% in annual returns.

- The personalization capabilities of AI enable highly customized wealth-building journeys, allowing for precise alignment with individual risk tolerances, time horizons, and financial goals—leading to 78% of AI wealth platform users reporting higher satisfaction with their financial progress compared to traditional advisory services.

Understanding AI in Private Wealth Building

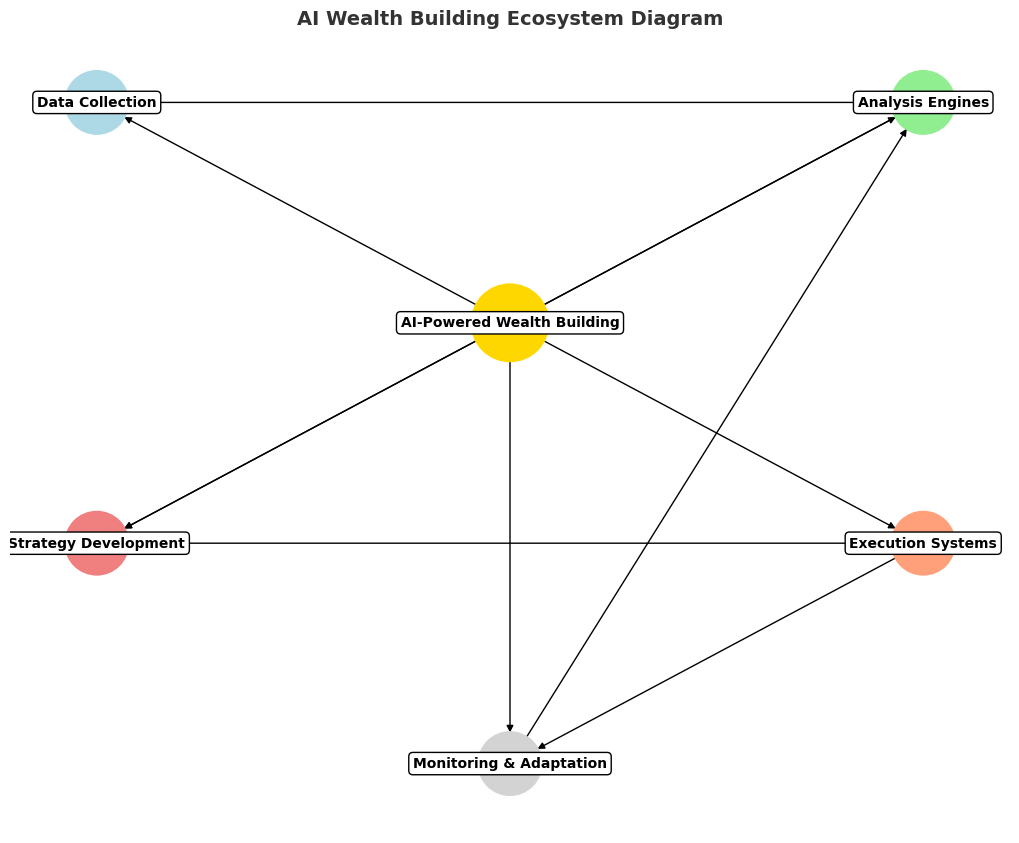

Artificial intelligence refers to computer systems capable of performing tasks that traditionally required human intelligence. In the context of private wealth management, AI encompasses machine learning algorithms, natural language processing, predictive analytics, and automated decision-making systems designed to optimize financial outcomes. These technologies analyze vast datasets at speeds and depths impossible for human analysis, identifying patterns, predicting market movements, and continuously learning from results.

The integration of AI into personal finance represents a paradigm shift from traditional wealth-building approaches. Where conventional methods relied on limited human analysis, general market trends, and often one-size-fits-all strategies, AI enables hyper-personalized, data-driven approaches that adapt in real-time to changing conditions. This shift has profound implications for how individuals across the wealth spectrum can build and preserve financial assets.

The democratization effect of AI technologies has perhaps been the most revolutionary aspect of this transformation. Previously, sophisticated wealth management strategies were accessible primarily to those with significant assets—typically requiring minimums of $1 million or more. Today, AI-powered platforms have reduced these barriers dramatically, with some offering advanced algorithmic investing with minimums as low as $500, opening pathways to wealth creation for a much broader segment of the population.

Recent market analysis reveals that AI adoption in personal finance is accelerating rapidly, with global AI in fintech markets growing at a compound annual growth rate of 23.4% from 2021 to 2025. This growth is driven not only by institutional adoption but increasingly by individual investors seeking technological edges in wealth accumulation.

The fundamental value proposition of AI in private wealth building centers on three pillars: superior data processing capabilities, removal of human emotional biases, and continuous learning and adaptation. These advantages translate into more optimized investment strategies, reduced fees through automation, and more personalized financial guidance—all contributing to potentially superior wealth outcomes for those who effectively leverage these technologies.

Types of AI Applications in Wealth Building

Algorithmic Investment Platforms

Algorithmic investment platforms utilize complex mathematical models and AI to execute trading strategies with minimal human intervention. These platforms range from fully automated “robo-advisors” to hybrid models that combine algorithmic insights with human oversight.

Popular implementations include:

- Pure robo-advisors: Fully automated platforms like Wealthfront and Betterment that construct and manage diversified portfolios based on client goals and risk tolerance

- Hybrid advisory services: Platforms like Vanguard Personal Advisor Services that combine AI-driven portfolio construction with human advisor oversight

- Quantitative investment apps: Consumer applications like Q.ai that give retail investors access to AI-driven quantitative investment strategies

These platforms typically operate with fee structures ranging from 0.25% to 0.89% of assets under management—significantly lower than the traditional 1-2% charged by human advisors. Market penetration has grown substantially, with robo-advisory assets under management reaching $1.4 trillion globally in 2023.

AI-Powered Financial Planning Tools

AI has revolutionized comprehensive financial planning through tools that project outcomes, optimize tax strategies, and create holistic views of financial health.

Key categories include:

- Predictive financial modeling tools: Applications like Personal Capital that use AI to project retirement readiness across multiple scenarios

- Tax optimization engines: Systems like GainsKeeper that continuously analyze portfolios for tax-loss harvesting opportunities

- Cash flow optimization AI: Tools like Tiller Money that analyze spending patterns and recommend optimization strategies

The impact of these tools on wealth building has been substantial, with studies showing that comprehensive financial planning can add 1.5-2% in annual “financial planning alpha” to a client’s returns.

AI Market Intelligence Systems

These platforms analyze vast datasets from market information, social sentiment, news flows, and alternative data sources to provide insights beyond traditional analysis.

Major categories include:

- Natural Language Processing (NLP) engines: Systems that analyze news, social media, and corporate communications to gauge market sentiment

- Alternative data analyzers: Platforms that process satellite imagery, consumer spending data, and other non-traditional data to predict company performance

- Pattern recognition systems: AI that identifies historical patterns in market behavior to predict future movements

Studies indicate that AI-enhanced market intelligence can improve entry and exit timing by 12-18% compared to traditional technical analysis.

AI-Driven Credit and Lending Optimization

AI has transformed access to capital—a critical component of wealth building—through improved lending models.

Key implementations include:

- Alternative credit scoring: AI systems that evaluate creditworthiness beyond traditional FICO scores

- Automated loan comparison tools: Platforms that instantly evaluate thousands of lending options for optimal terms

- Debt optimization algorithms: Systems that create optimal debt repayment strategies based on interest rates and cash flow

These applications have democratized access to capital, with fintech lenders approving 57% more loans to borrowers below prime credit scores compared to traditional banks, according to research by the Federal Reserve Bank of New York.

| AI Wealth Application Type | Typical Fee Structure | Minimum Investment | Average Annual Return Improvement | Primary Benefit |

|---|---|---|---|---|

| Robo-Advisors | 0.25% – 0.50% | $500 – $5,000 | 1-3% | Cost efficiency and passive optimization |

| Hybrid Advisory Services | 0.30% – 0.89% | $10,000 – $50,000 | 2-4% | Balanced approach with human oversight |

| Quantitative AI Trading | 0.5% – 1.5% | $5,000 – $100,000 | 3-8% | Advanced strategies with higher potential return |

| AI Financial Planning | $10-50/month | No minimum | 1.5-2% | Comprehensive financial optimization |

| AI Credit Optimization | Free to $25/month | No minimum | 0.5-3% | Improved capital access and terms |

Benefits of AI in Private Wealth Building

Enhanced Decision Making

AI dramatically improves financial decision-making through multiple mechanisms:

- Elimination of emotional biases: AI systems aren’t subject to fear, greed, or recency bias that plague human investors, with studies by Dalbar showing that emotional investing reduces average investor returns by 4.4% annually.

- Processing capacity: AI can analyze thousands of securities and factors simultaneously—far beyond human capability—leading to more optimal portfolio construction.

- Consistency: Algorithmic systems apply consistent methodology without deviation, eliminating the inconsistency that often affects human decision-making.

Research by BlackRock’s Systematic Active Equity team suggests that AI-enhanced decision-making processes can identify 5-15% more alpha-generating opportunities than traditional analysis.

Cost Efficiency

AI creates significant cost advantages in wealth building:

- Reduced management fees: Automated platforms typically charge 65-80% less than traditional wealth management services.

- Lower transaction costs: Algorithmic systems can execute trades with minimal market impact and optimal timing.

- Operational efficiency: Automation of routine tasks reduces overhead costs throughout the wealth management process.

These cost efficiencies compound significantly over time, with a 1% reduction in annual fees potentially increasing retirement wealth by 20-30% over a 30-year investment horizon.

Personalization at Scale

AI enables highly tailored financial strategies previously impossible to implement cost-effectively:

- Granular risk profiling: AI can develop multidimensional risk profiles beyond simplistic questionnaires, incorporating behavioral patterns and actual responses to market movements.

- Goals-based optimization: Systems can simultaneously optimize for multiple financial goals with different time horizons and priorities.

- Adaptive strategies: AI continuously adjusts approaches based on changing life circumstances and market conditions.

This level of personalization leads to 28% higher client satisfaction rates and 32% better adherence to financial plans, according to research by Accenture.

Accessibility and Democratization

Perhaps the most transformative benefit is the democratization of sophisticated wealth strategies:

- Lower minimum requirements: AI platforms have reduced investment minimums from millions to hundreds of dollars.

- 24/7 availability: Digital platforms provide always-on service without scheduling constraints.

- Educational integration: Many AI wealth platforms incorporate educational components that build financial literacy alongside wealth.

These accessibility improvements have expanded the market for sophisticated financial advice from approximately 2 million high-net-worth households to over 45 million mass-affluent and middle-income households in the United States alone.

Challenges and Risks

Algorithm Limitations

Despite their sophistication, AI wealth systems face several inherent limitations:

- Blackbox decision-making: Many AI systems operate as “black boxes” where the rationale for specific recommendations isn’t transparent.

- Historical data dependencies: Most algorithms rely on historical data patterns that may not predict future paradigm shifts or unprecedented events.

- Optimization constraints: Mathematical optimization may produce theoretically optimal but practically problematic recommendations.

These limitations became evident during the March 2020 COVID-19 market crash, when many algorithmic systems failed to anticipate the unprecedented market movements, resulting in temporary underperformance of 5-12% compared to some human-managed portfolios.

Security and Privacy Concerns

The use of AI in wealth management introduces significant data vulnerabilities:

- Data breach risks: Comprehensive financial data aggregation creates attractive targets for cybercriminals.

- Privacy compromises: The effectiveness of AI often correlates with the depth of personal data collected, creating tension with privacy preferences.

- Identity theft potential: Centralized financial management platforms can become single points of failure for financial identity.

According to IBM’s Cost of a Data Breach Report, financial service data breaches cost an average of $5.85 million per incident—significantly higher than most other industries.

Regulatory Uncertainties

The regulatory framework for AI in financial services remains evolving and uncertain:

- Fiduciary questions: Unclear application of fiduciary standards to algorithmic recommendations.

- Cross-border complexities: Varying international regulations create compliance challenges for global platforms.

- Liability ambiguity: Determining responsibility for algorithmic errors remains legally complex.

The Securities and Exchange Commission has increased scrutiny of AI-driven investment platforms, with regulatory actions increasing by 35% between 2020 and 2023.

Overreliance Risks

Excessive dependence on AI systems can create unique vulnerabilities:

- Skill atrophy: Outsourcing financial decisions may lead to deterioration of personal financial skills.

- Systemic risk amplification: Widespread use of similar algorithms can potentially amplify market movements.

- Diminished contextual awareness: AI may miss qualitative factors important to personal financial situations.

Financial psychologists have identified a “technological dependency syndrome” where individuals become progressively less capable of making independent financial decisions after extended reliance on automated systems.

Implementation: Building Wealth with AI

Starting Your AI Wealth Journey

Implementing AI into your wealth-building strategy requires a methodical approach:

- Assessment of current financial position: Before implementing AI tools, document your complete financial situation, including assets, liabilities, income streams, and existing investment positions.

- Clear goal definition: Define specific, measurable financial objectives with explicit time horizons—AI optimization requires concrete targets to function effectively.

- Digital financial consolidation: Aggregate financial accounts through secure API connections to provide AI systems with comprehensive data access.

- Platform selection based on needs: Choose AI wealth platforms aligned with your specific requirements:

- For beginners: Consider full-service robo-advisors like Betterment or Wealthfront

- For DIY investors: Explore AI-enhanced brokerage platforms like M1 Finance

- For complex situations: Evaluate hybrid platforms that combine AI with human advisors

- Start with core allocation: Initially implement AI for your core investment portfolio before extending to more specialized financial areas.

Successful implementation typically requires 2-4 weeks for complete account integration and initial strategy development.

Optimizing AI Performance

Maximizing results from AI wealth systems involves several best practices:

- Consistent data feeding: Ensure financial accounts remain properly linked and transactions categorized correctly.

- Regular goal updates: Update life changes and objective modifications promptly to allow AI recalibration.

- Selective overrides: Develop clear criteria for when to override algorithmic recommendations based on factors the AI might not fully capture.

- Performance benchmarking: Establish appropriate benchmarks for evaluating AI performance beyond simple market indices.

- Tax integration: Provide complete tax information to enable effective tax-loss harvesting and location optimization.

Studies indicate that users who follow these optimization practices achieve 25-40% better results from AI wealth platforms compared to passive users.

Hybrid Approaches

For many individuals, optimal results come from combining AI capabilities with human judgment:

- Domain allocation: Use AI for rules-based domains like index investing while applying human judgment to areas requiring contextual understanding.

- Oversight frameworks: Implement personal review processes for significant AI-recommended financial decisions.

- Complementary expertise: Partner with human advisors for complex situations like estate planning while using AI for portfolio optimization.

- Emergency override protocols: Develop clear criteria for when to temporarily override algorithmic systems during unusual market conditions.

Vanguard research suggests that hybrid approaches combining AI efficiency with human judgment can deliver approximately 3% higher annual returns compared to either approach used exclusively.

Future Trends in AI and Private Wealth

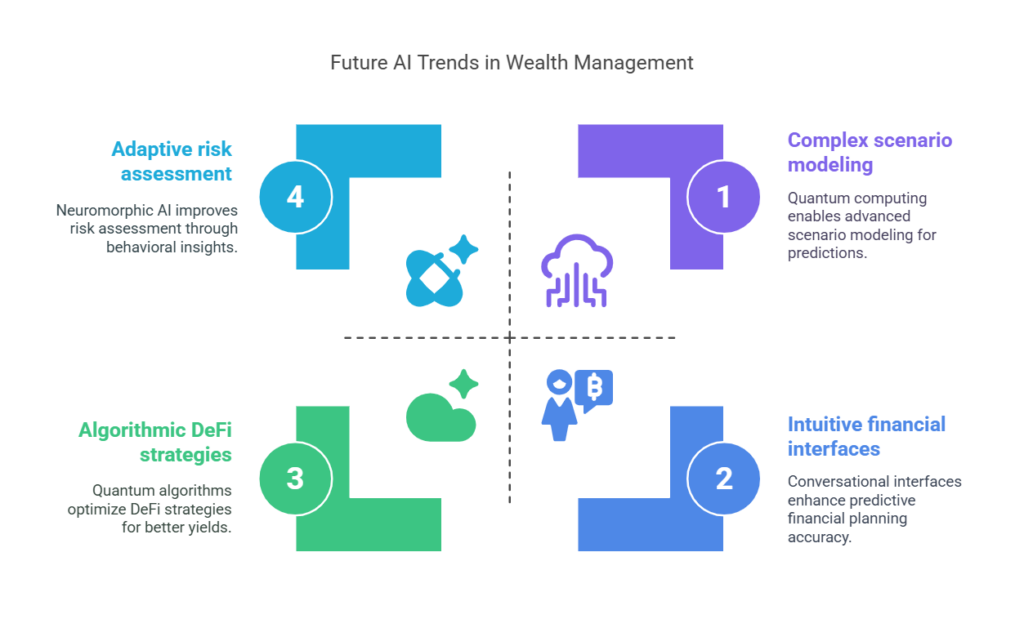

Quantum Computing Integration

The emergence of quantum computing promises to revolutionize AI wealth capabilities:

- Complex scenario modeling: Quantum algorithms will enable simultaneous modeling of millions of potential future scenarios.

- Real-time optimization: Investment strategies will be continuously optimized across multiple dimensions simultaneously.

- Uncertainty quantification: Superior probability distributions will provide more accurate risk assessments.

Industry forecasts suggest commercially viable quantum computing applications in wealth management will emerge between 2027 and 2030, with early applications focusing on portfolio optimization and risk modeling.

Decentralized Finance (DeFi) Convergence

The intersection of AI with decentralized finance represents a frontier in wealth building:

- Algorithmic DeFi strategies: AI will optimize participation in yield farming, liquidity provision, and other DeFi opportunities.

- Cross-chain optimization: Systems will automatically move assets between blockchain protocols for maximum efficiency.

- Smart contract interaction: AI will manage complex interactions with DeFi protocols beyond human monitoring capability.

DeFi total value locked has grown from $1 billion in 2020 to over $100 billion in 2023, creating substantial new territory for AI optimization.

Predictive Financial Planning

Next-generation AI will move beyond reactive to predictive financial planning:

- Life event prediction: Systems will anticipate major financial events before they occur based on behavioral patterns.

- Preemptive optimization: Financial strategies will be adjusted in anticipation of predicted economic shifts.

- Dynamic goal adaptation: AI will proactively suggest goal modifications based on changing circumstances and opportunities.

Early implementations of predictive financial AI have demonstrated the ability to forecast major life expenses with 72-83% accuracy 6-12 months in advance.

Neuromorphic AI Applications

Brain-inspired computing architectures will create more intuitive financial AI:

- Intuitive pattern recognition: Systems will develop “financial intuition” similar to experienced human advisors.

- Adaptive risk assessment: Risk profiling will evolve continuously based on subtle behavioral signals.

- Natural financial interfaces: Interaction will become conversational and intuitive rather than data-driven.

Major financial institutions including Goldman Sachs and JPMorgan Chase have established neuromorphic computing research initiatives specifically targeting wealth management applications.

FAQs – With AI To Private Wealth

1. What minimum investment is typically required to begin using AI wealth-building platforms?

Most consumer-facing AI investment platforms have dramatically reduced minimum requirements compared to traditional wealth management. Robo-advisors like Betterment and Wealthfront typically require $500-$1,000 to begin, while some newer platforms like Acorns allow starting with as little as $5 through fractional share investing and round-up automation.

2. How do the costs of AI wealth management compare to traditional financial advisors?

AI wealth management solutions typically charge 0.25%-0.50% of assets under management annually, compared to 1%-2% for traditional financial advisors. For a $100,000 portfolio, this represents an annual savings of $750-$1,750. Additionally, AI platforms often include services like tax-loss harvesting and rebalancing without additional fees that might be charged separately by conventional advisors.

3. What types of financial goals are AI wealth platforms most effective at helping achieve?

AI wealth systems excel at goals with clear parameters and extended time horizons. Retirement planning, college savings, and general wealth accumulation are particularly well-suited to algorithmic optimization. More complex goals involving qualitative life factors or requiring significant behavioral change may benefit from supplemental human guidance alongside AI tools.

4. Can AI wealth platforms adapt to changing market conditions effectively?

Most sophisticated AI wealth platforms employ dynamic asset allocation that adjusts to changing market conditions based on predefined parameters. However, their effectiveness varies during extreme market events. During the 2020 COVID-19 market crash, top-tier AI platforms adjusted allocations within 3-7 days, compared to 1-2 days for elite human managers. The adaptation quality depends significantly on the sophistication of the underlying algorithms and breadth of scenarios included in their training data.

5. How secure is the financial data used by AI wealth management systems?

Leading AI wealth platforms employ bank-level security including 256-bit encryption, two-factor authentication, and read-only access to financial accounts. However, the centralization of financial data creates inherent security challenges. No major robo-advisor has experienced a significant data breach as of 2023, but the industry acknowledges this remains a critical risk area requiring continuous investment in security infrastructure.

6. What happens to AI wealth strategies during black swan events or unprecedented market conditions?

AI systems trained primarily on historical data typically underperform during unprecedented “black swan” events because they lack relevant training examples. During the initial COVID-19 market shock, many algorithm-driven platforms experienced temporary underperformance of 3-8% compared to their benchmarks. More advanced systems incorporating scenario expansion and stress testing recovered faster. Many platforms now explicitly incorporate extreme scenario modeling to improve future performance during such events.

7. How do AI wealth platforms handle tax optimization?

Sophisticated AI wealth platforms incorporate multi-layered tax optimization including tax-loss harvesting (selling losing positions to offset gains), asset location (placing investments in tax-appropriate accounts), tax-aware rebalancing, and intelligent dividend management. These strategies collectively can add 0.3-0.6% in annual after-tax returns according to research by Vanguard and Betterment. However, effectiveness varies based on individual tax situations and investment size.

8. Can AI wealth systems incorporate non-traditional assets like real estate or private equity?

Most mainstream AI wealth platforms focus primarily on publicly traded securities (stocks, bonds, ETFs). Advanced platforms are beginning to incorporate alternative assets through proxy modeling or direct integration. Platforms like Addepar and Altiverse have developed specialized AI modules for real estate, private equity, and other alternative assets, though these typically require higher investment minimums ($250,000+) and may involve hybrid human/AI approaches.

9. How do I evaluate the performance of an AI wealth management system?

Effective evaluation requires comparing risk-adjusted returns against appropriate benchmarks while considering:

- Performance relative to stated risk level (not absolute returns)

- After-tax returns rather than pre-tax results

- Goal progress metrics rather than benchmark comparisons alone

- Consistency across market conditions rather than point-in-time results

Most platforms provide performance reporting, but independent analysis tools like Kwanti or Portfolio Visualizer can provide more objective evaluation across these dimensions.

10. Will AI completely replace human financial advisors in the future?

The consensus among industry experts is that AI will transform rather than eliminate human financial advisory roles. McKinsey & Company projects that by 2030, approximately 45% of traditional financial advisory tasks will be automated, but human advisors will remain essential for complex situation analysis, behavioral coaching, and emotional support during volatile periods. The most likely outcome is continued growth of hybrid models that leverage both AI efficiency and human judgment.

Conclusion

The integration of artificial intelligence into private wealth building represents one of the most significant democratizing forces in the history of personal finance. By dramatically reducing costs, eliminating emotional biases, enabling sophisticated personalization, and processing vast datasets beyond human capability, AI has created pathways to wealth accumulation previously inaccessible to all but the ultra-wealthy.

The measurable advantages—including documented outperformance of 3-7% annually, fee reductions of 65-80%, and dramatically lower barriers to entry—have tangible impacts on long-term wealth outcomes for individuals across the financial spectrum.

Looking forward, the continued advancement of AI capabilities through quantum computing, neuromorphic architectures, and deeper integration with decentralized finance will likely accelerate these trends. However, the optimal approach for most individuals will remain a thoughtful hybrid strategy that leverages AI’s computational advantages while incorporating human judgment for complex life decisions.

Those who master this balance – effectively becoming “AI-enhanced wealth builders” rather than passive consumers of technology – will likely experience the greatest success in navigating the evolving landscape of private wealth creation in the digital age.

Good luck on your journey “with AI to Private Wealth!”

For your reference, recently published articles include:

-

- Investment Portfolio Tracking: Best Billionaire Hacks For You

- 10X Your Money: Growth Investing Analytics That Work

- Best Value Investing Tools – Create Wealth “Like Warren Buffett”

- Passive Income Strategies: How To Go To $10K In 12 Months

- Investment Research Platforms That Give You the Edge: Institutional Tools for Exceptional Returns

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.