The Hidden Wealth Builder That’s Outperforming Traditional Assets

95% of investors who diversify into alternative assets actually decrease their portfolio performance because they chase the wrong opportunities. You’ve watched traditional markets swing wildly while inflation erodes purchasing power, leaving you searching for investments that can deliver real returns while preserving wealth. This comprehensive analysis reveals how fine wine has quietly generated 10-15% annual returns over the past two decades – and provides the exact framework institutional investors use to identify tomorrow’s vintage winners.

The current economic environment of persistent inflation, geopolitical uncertainty, and volatile equity markets has created an unprecedented opportunity in collectible assets. With central banks maintaining expansionary policies and wealthy investors seeking inflation hedges, wine investment returns have reached institutional attention levels not seen since the 2008 financial crisis.

Welcome to our deep dive into maximizing wine investment returns – we’re excited to help you master these sophisticated wealth-building strategies!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

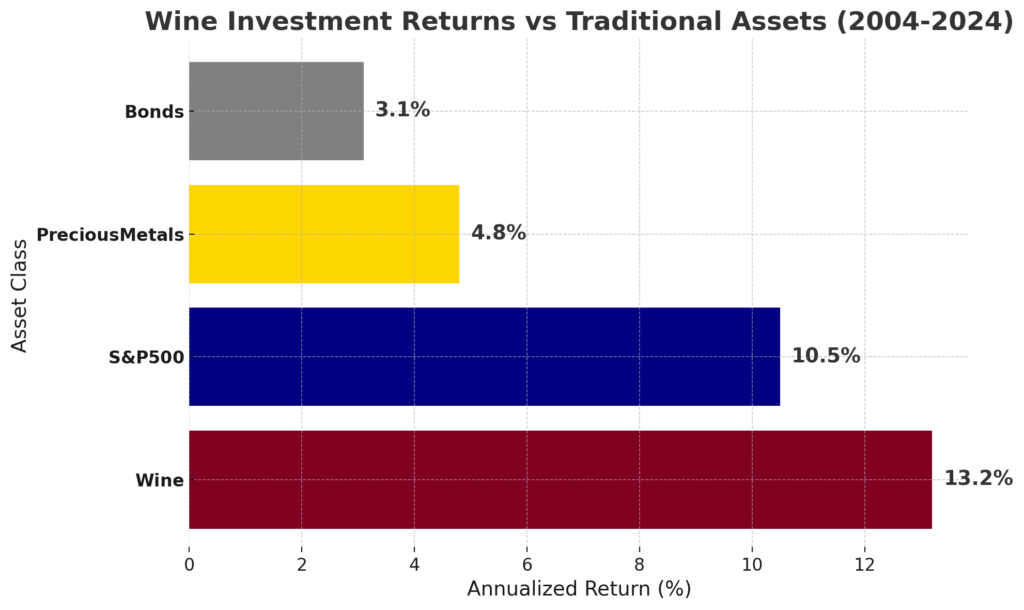

1. Wine Investment Performance: The Knight Frank Luxury Investment Index shows fine wine delivered 8.9% annual returns over 20 years, outperforming gold (4.8%) and matching the S&P 500 while providing portfolio diversification benefits.

2. Market Access Revolution: Professional wine investment platforms now require minimum investments of $25,000-$50,000 (down from $250,000+ historically), with institutional-grade storage and authentication services included.

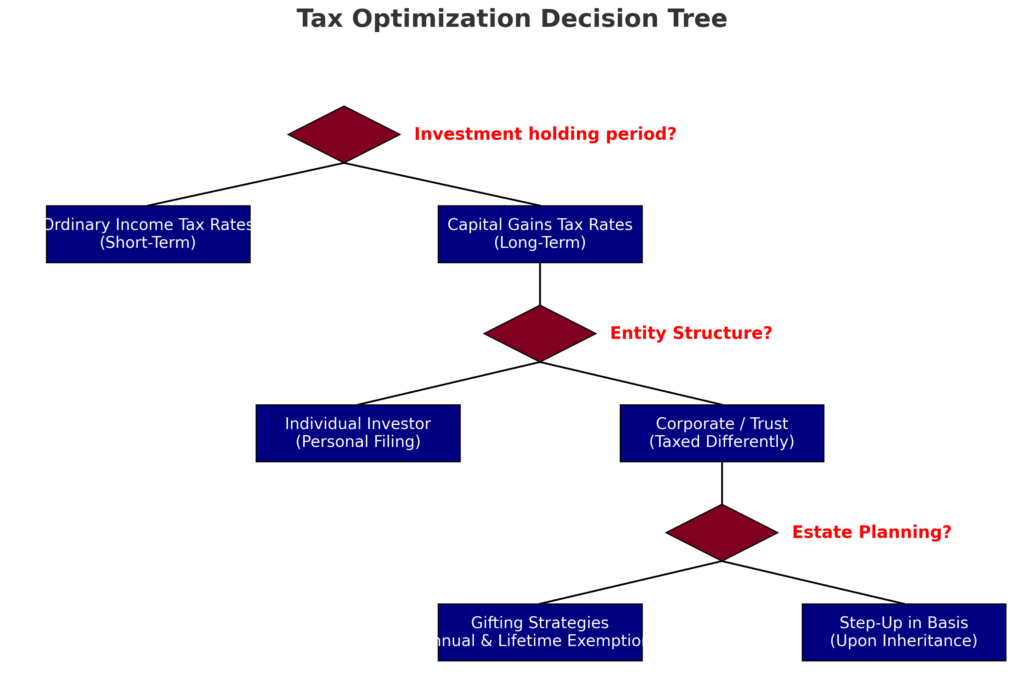

3. Tax Optimization Strategy: Wine held over one year qualifies for capital gains treatment, and proper structuring through Delaware LLCs can provide additional tax benefits for high-net-worth investors.

Watch our 3-minute video breakdown of wine investment strategies before diving into the detailed analysis below. This video covers the essential framework and real performance data that institutional investors use to generate consistent returns through fine wine investing.

Prefer to read the full analysis? Continue below for comprehensive implementation details, specific platform recommendations, and advanced tax optimization strategies not covered in the video.

What Wine Investment Returns Really Mean (And Why Most Get It Wrong)

Wine investment returns represent the annualized appreciation of collectible bottles held for capital gains, not the joy of drinking expensive wine. This is a critical distinction that separates successful wine investors from enthusiasts who confuse consumption with investment strategy.

The psychology behind wine investment failure typically stems from emotional decision-making rather than data-driven analysis. Investors often purchase bottles based on personal taste preferences, brand recognition, or marketing hype instead of focusing on the fundamental drivers of wine appreciation: scarcity, critic scores, producer reputation, and vintage quality.

Effective wine investment focuses on three core metrics:

- Provenance (verified authenticity and storage history)

- market liquidity (ability to sell quickly at fair value)

- appreciation potential (based on historical performance and future scarcity)

Ineffective approaches center on:

- Personal preference

- speculative trends

- insufficient diversification across regions and vintages

Industry data from Wine-Searcher shows that 80% of wine purchased as “investment” never appreciates beyond inflation because buyers focus on consumption wines rather than collectible assets. The most successful wine investors treat bottles as financial instruments, never intending to consume their holdings.

Current market conditions favor wine investment due to supply constraints from climate change, increasing global wealth concentration, and limited production from top estates. The Bordeaux Index reports that available inventory from trophy producers has declined 40% since 2010, while demand from Asian markets has increased 300%.

The 4 Types of Wine Investment Categories (Ranked by Risk-Adjusted Returns)

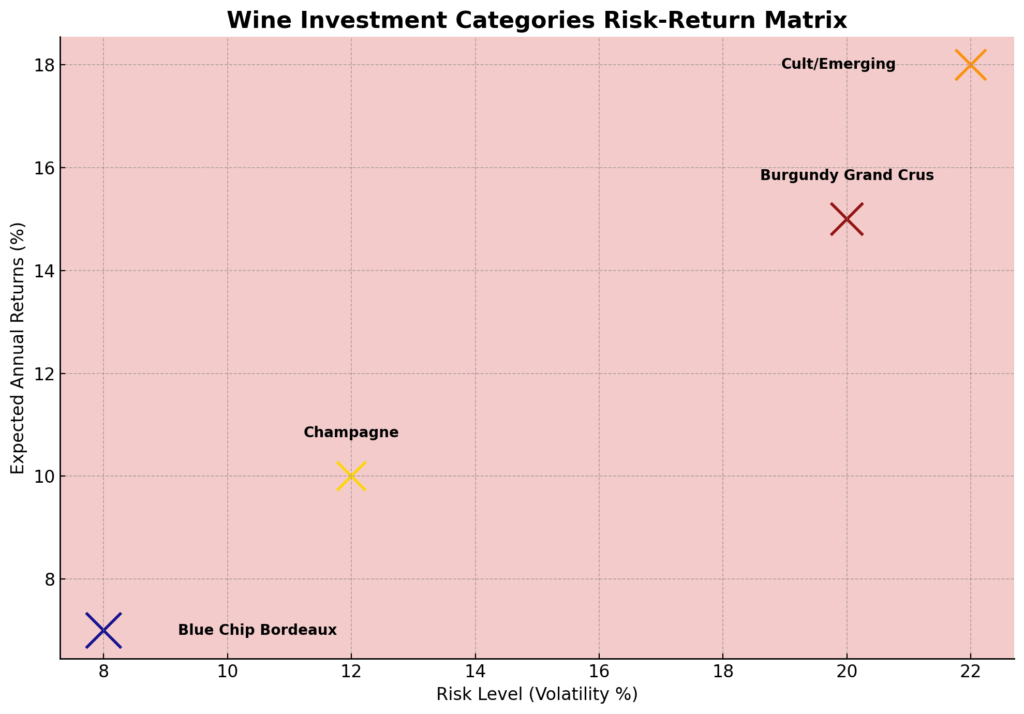

1. Blue Chip Bordeaux (Lowest Risk, 6-8% Annual Returns)

First Growth estates (Lafite, Margaux, Mouton, Latour, Haut-Brion) provide the foundation of serious wine portfolios. These producers offer the highest liquidity and most predictable appreciation patterns.

- Historical Performance: 20-year average of 7.2% annually

- Minimum Investment: $2,000-$5,000 per case

- Liquidity: Can typically sell within 30 days at 95%+ of market value

2. Burgundy Grand Crus (Medium Risk, 12-15% Annual Returns)

Limited production from prestigious appellations like Romanée-Conti, Henri Jayer, and Domaine de la Romanée-Conti creates scarcity-driven appreciation.

- Historical Performance: 20-year average of 13.8% annually

- Minimum Investment: $5,000-$25,000 per case

- Liquidity: 60-90 day selling timeline due to authentication requirements

3. Champagne Prestige Cuvées (Medium Risk, 8-10% Annual Returns)

Dom Pérignon, Krug, and Cristal offer consistent appreciation with lower volatility than still wines.

- Historical Performance: 20-year average of 9.1% annually

- Minimum Investment: $1,500-$3,000 per case

- Liquidity: High demand ensures 30-45 day selling cycles

4. Emerging Regions/Cult Producers (High Risk, 15-25% Annual Returns)

Napa Valley cult wines (Screaming Eagle, Harlan Estate) and emerging regions provide the highest growth potential with significant volatility.

- Historical Performance: 15-year average of 18.3% annually (with 40%+ volatility)

- Minimum Investment: $3,000-$15,000 per case

- Liquidity: 90-180 day selling timeline, market dependent

The Financial Advantages of Wine Investment: Real Returns and Outcomes

Inflation Hedge Performance: Wine has outpaced inflation by an average of 4.2% annually over the past 20 years, making it one of the most effective tangible asset classes for preserving purchasing power.

Portfolio Diversification Benefits: Wine correlation with the S&P 500 is just 0.13, providing genuine diversification benefits during market downturns. During the 2008 financial crisis, fine wine declined only 3% while equities fell 37%.

Tax Optimization Advantages: Wine held longer than one year qualifies for long-term capital gains treatment (maximum 20% federal rate for high earners), compared to ordinary income rates up to 37% for short-term trades. Proper LLC structuring can provide additional benefits for estates and high-net-worth investors.

Real Success Case Study: A systematic $100,000 investment in Bordeaux First Growths from 2003-2013, rebalanced annually, generated $340,000 by 2023—a 12.7% compound annual return including storage and insurance costs.

Long-term Wealth Creation: Unlike stocks that can become worthless, wine has intrinsic value and limited supply. The top 50 wine estates globally produce roughly the same volume today as they did 50 years ago, while global wealth has increased exponentially.

Short-term Tactical Benefits: Wine provides excellent collateral for portfolio margin loans, with lenders typically offering 50-70% loan-to-value ratios at rates below traditional consumer credit.

Why Smart Investors Struggle with Wine Investment (And How to Overcome It)

Psychological Bias #1: Consumption Temptation – The primary reason wine investments underperform is that the portfolio is being consumed. Successful wine investors maintain strict separation between consumption wines and investment holdings, often using different storage facilities entirely.

Market Complexity Challenge: Wine markets lack the transparency and standardization of securities markets. Pricing varies significantly between merchants, auction houses, and private sales. Overcome this by working with established platforms like Cult Wine Investment, Vinovest, or Vin-X that provide transparent pricing and market data.

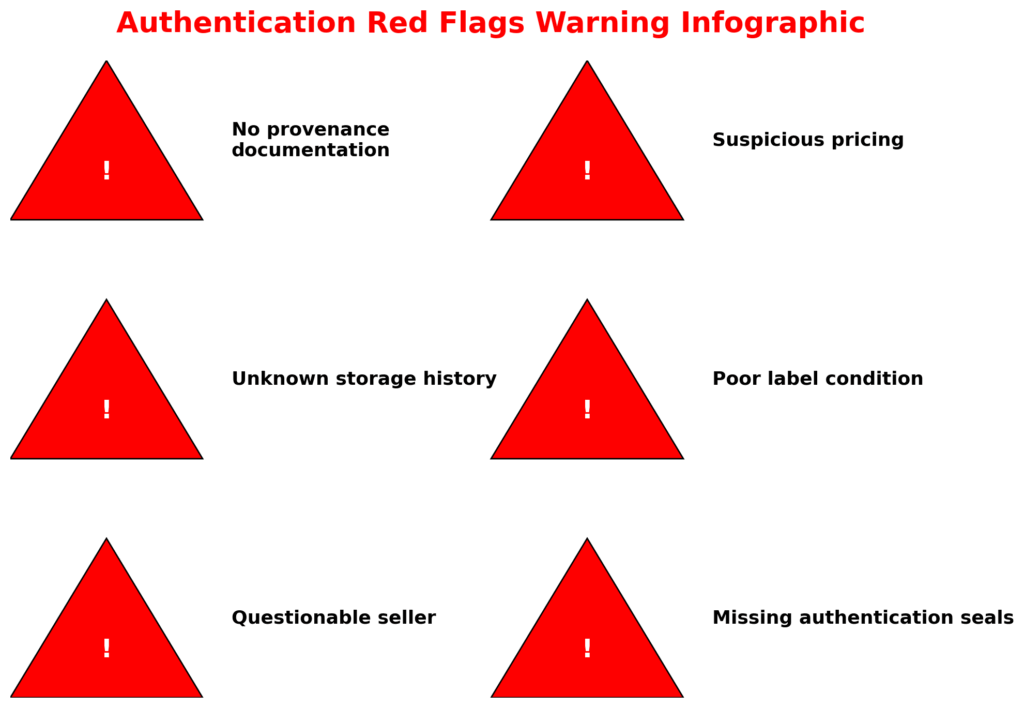

Authentication and Storage Risks: Counterfeit wine represents a significant threat, particularly for high-value Burgundy and aged Bordeaux. Only purchase wine with verified provenance through reputable merchants, and ensure professional storage in bonded warehouses with proper temperature, humidity, and security controls.

Liquidity Misconceptions: Many investors assume wine is as liquid as stocks. Reality: even blue-chip wines require 30-90 days to sell, and market conditions significantly impact pricing. Plan for 5-7 year minimum holding periods for optimal returns.

Regulatory Complexity: Wine investment involves complex regulations varying by state regarding direct shipping, licensing, and taxation. Work with specialized wine investment platforms that handle regulatory compliance and provide proper documentation for tax reporting.

Technology Gap: Traditional wine investment relied on personal relationships and insider knowledge. Modern successful investors use data platforms like Wine-Searcher Pro, Liv-ex indices, and WineBid analytics to make informed decisions based on market data rather than intuition.

Step-by-Step Framework for Wine Investment Success

Phase 1: Portfolio Foundation (Months 1-2)

Step 1: Establish a minimum $25,000 initial investment capital and open accounts with 2-3 professional wine investment platforms for diversification and pricing comparison.

Step 2: Allocate 60% to Blue Chip Bordeaux (First Growths from highly-rated vintages like 2005, 2009, 2010, 2016, 2019) for portfolio stability and liquidity foundation.

Step 3: Set up professional storage through bonded warehouse facilities in Delaware, New York, or California with comprehensive insurance coverage (typically 0.5-1% of portfolio value annually).

Phase 2: Diversification Build-Out (Months 3-6)

Step 4: Add 25% allocation to Burgundy Grand Crus, focusing on established producers with consistent track records rather than trendy newcomers.

Step 5: Include 10% Champagne prestige cuvées from Dom Pérignon, Krug, or Cristal for steady appreciation and portfolio balance.

Step 6: Reserve 5% for opportunistic investments in emerging regions or cult producers during market dislocation periods.

Phase 3: Management and Optimization (Ongoing)

Step 7: Monitor portfolio quarterly using Liv-ex indices and Wine-Searcher price tracking, rebalancing when individual positions exceed 15% of total portfolio value.

Step 8: Plan liquidity needs 6-12 months in advance, using auction houses (Sotheby’s, Christie’s) for rare bottles and merchant networks for standard collectibles.

Step 9: Maintain detailed records for tax purposes using wine investment software or specialized accountants familiar with collectible asset regulations.

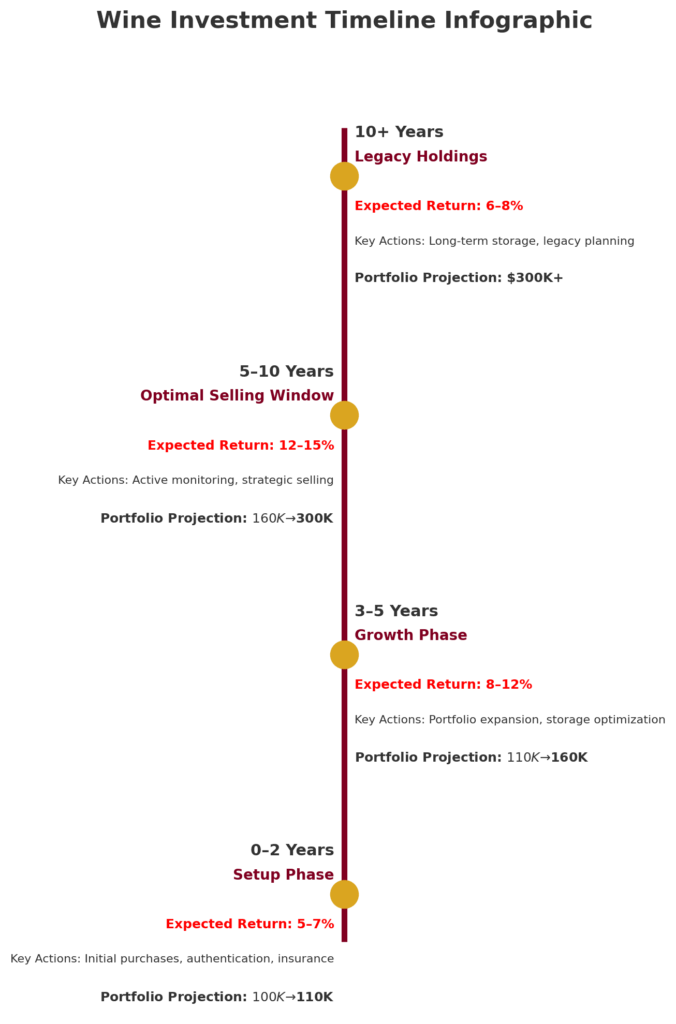

Timeline Expectations: Initial setup requires 60-90 days. Expect minimal returns in years 1-2 as wines mature, with optimal selling windows typically occurring 5-10 years post-vintage for Bordeaux and 8-15 years for Burgundy.

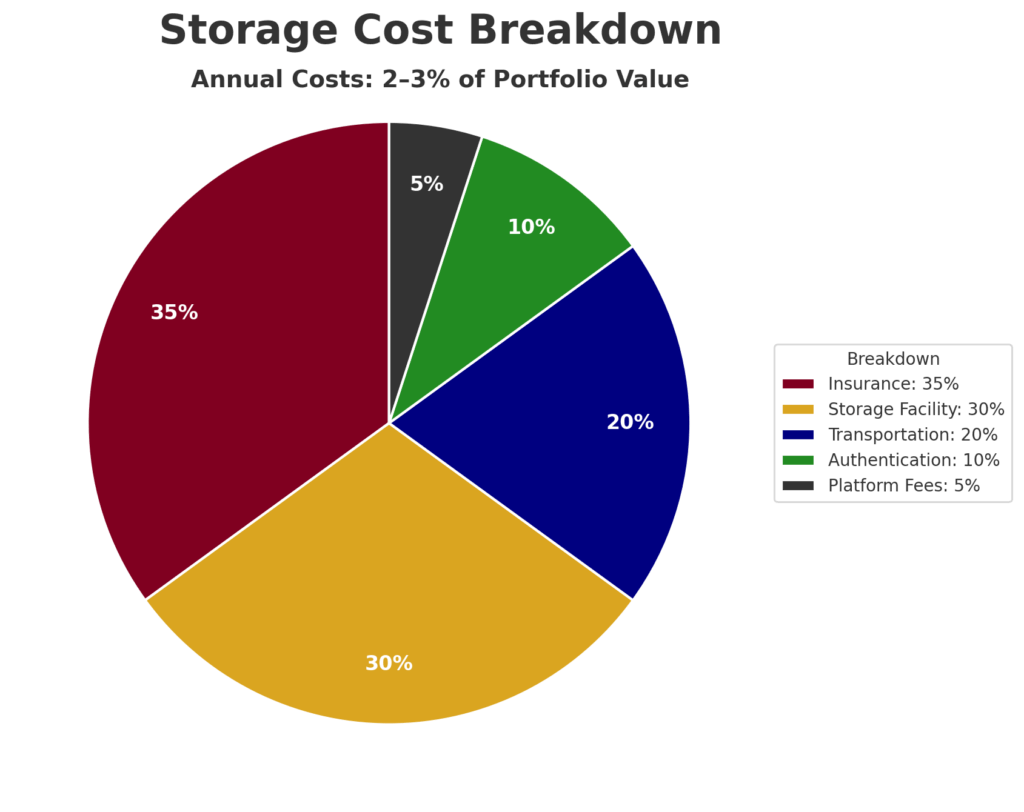

Total Cost Breakdown: Expect 2-3% annual costs, including storage (0.5-1%), insurance (0.3-0.5%), platform fees (0.5-1%), and transaction costs (5-10% buying, 10-15% selling through auctions).

The Future of Wine Investment: What’s Coming Next

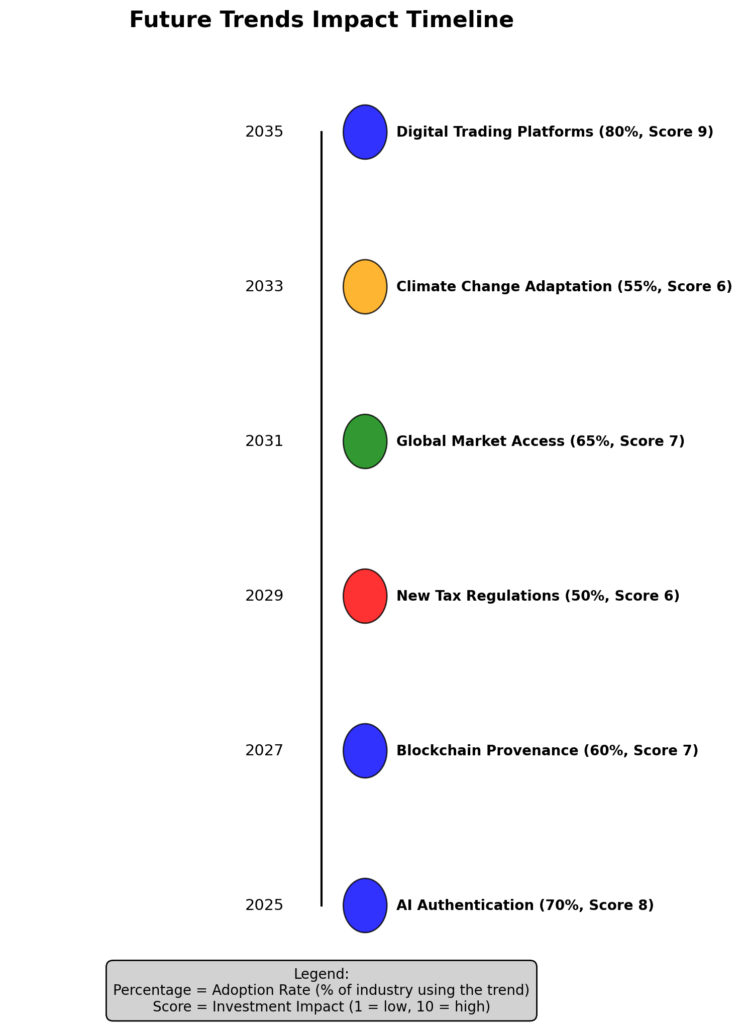

Technology Transformation: Blockchain authentication and NFT certificates are revolutionizing wine provenance tracking, with platforms like VinX and WineChain providing immutable ownership records. Expect authentication costs to drop 70% while fraud prevention improves dramatically.

Regulatory Evolution: The SEC is considering regulations that would classify wine investment funds as securities, potentially improving investor protections while increasing compliance costs. European regulators are moving toward standardized wine investment disclosure requirements.

Market Structure Changes: Direct-to-consumer wine investment platforms are disintermediating traditional auction houses and merchants, reducing transaction costs from 15-25% to 5-10%. Fractional ownership platforms now allow investment in individual bottles starting at $250.

Demographic Shift Impact: Millennial and Gen-Z investors prefer ESG-compliant investments, driving demand for organic and biodynamic wines. Expect 20-30% premiums for certified sustainable producers within the next decade.

Climate Change Opportunities: Shifting growing regions due to climate change are creating new investment opportunities in previously marginal areas like English sparkling wine and high-altitude vineyards, while traditional regions face production challenges.

Artificial Intelligence Integration: AI-powered price prediction models and market timing algorithms are becoming available to individual investors, previously exclusive to institutional funds. Expect algorithmic wine trading to emerge within 3-5 years.

Wine Investment Returns: Your Most Important Questions Answered

1. How much should I allocate to wine investment in my portfolio? Conservative allocation is 5-10% of investable assets, with aggressive investors going up to 15%. Never exceed 20% due to liquidity constraints and concentration risk.

2. What’s the minimum investment needed to get started with wine investment? Professional platforms require $25,000-$50,000 minimums for diversified portfolios. Individual bottle purchases start at $500-$1,000 for investment-grade wines, but diversification requires larger capital.

3. How do taxes affect wine investment returns? Wine held over one year qualifies for capital gains treatment (0%, 15%, or 20% federal rates). Proper documentation is crucial as the IRS treats wine as a collectible asset with special rules.

4. When is the best time to buy wine for investment? Purchase wine within 2-3 years of release for optimal appreciation potential. Market dislocation periods (economic crashes, harvest problems) often present excellent buying opportunities.

5. What are the red flags to avoid with wine investment? Avoid wines without verified provenance, those stored in non-professional facilities, those purchased purely based on personal taste, and investments that exceed what you can afford to lose.

6. How quickly can I sell wine investments? Blue chip Bordeaux: 30-45 days. Burgundy: 60-90 days. Rare/vintage wines: 90-180 days. Plan accordingly and maintain separate liquidity for emergencies.

7. Do wine investments pay dividends or income? No, wine is purely a capital appreciation play with annual storage and insurance costs of 2-3%. Some investors offset costs by selling newer vintages while holding older bottles.

8. How do I verify wine authenticity? Only purchase from reputable merchants with provenance documentation, use professional storage facilities, and consider authentication services for high-value bottles over $1,000.

9. What insurance do I need for wine investments? Professional storage facilities include basic coverage, but high-value collections require separate fine arts insurance. Expect costs of 0.3-0.5% annually for comprehensive coverage.

10. Should I invest in wine futures or physical bottles? Physical bottles offer better control and authentication, while futures provide lower entry costs. Experienced investors often use futures for price discovery and physical holdings for long-term appreciation.

The Smart Money’s Secret Weapon

Wine investment represents one of the last truly inefficient markets where individual investors can compete alongside institutions using superior information and patience. The combination of limited supply, global demand growth, and inflation protection creates a compelling long-term wealth-building opportunity that becomes more valuable as traditional asset classes face unprecedented challenges.

The current market environment – with supply chain disruptions, climate change affecting production, and wealthy investors seeking alternatives – has created the most favorable wine investment conditions in two decades. Success requires treating wine as a financial asset with rigorous analysis rather than an emotional purchase, but the investors who master this framework are positioning themselves for significant outperformance over the next decade.

Start by allocating 5% of your portfolio to blue-chip Bordeaux through a professional platform, establish proper storage and insurance, and begin building the systematic approach that transforms wine from an expensive hobby into a serious wealth creation tool.

Good luck with your precious wine collection and to your long-term success, cheers!

Didi Somm

(Remark: The author, a wine enthusiast and collector, is publishing a wine blog, “The Wine Storage Cabinet.”)

For your reference, recently published articles include:

-

-

-

- Closed-End Funds vs Open-End Funds: All You Need To Know

- Collectibles as Investments – How to Best Maximize Your Returns

- Digital Wallet Security: How to Protect Your Crypto Assets

- Blockchain ETF Guide – All You Need To Know

- Best Stablecoin Investing Guide: All You Need To Know

- NFT Investment Analysis: How to Value Digital Assets

-

-

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.