The Opening Hook – “What is Stock Market”

Over 61% of Americans now own stocks, yet a 2024 Gallup survey revealed that nearly half can’t accurately explain how the stock market actually works. They’re participating in a $50+ trillion ecosystem without understanding the fundamental mechanics that determine whether they build wealth or watch their savings evaporate.

This knowledge gap isn’t just embarrassing – it’s expensive. The difference between investors who understand market structure and those who don’t averages 2-3% in annual returns, compounding to hundreds of thousands of dollars over a lifetime.

With the Federal Reserve’s policy shifts, AI-driven market volatility, and the democratization of trading through apps like Robinhood and Fidelity, understanding stock market fundamentals has never been more critical.

This guide cuts through the confusion. You’ll learn exactly what the stock market is, how it actually functions, and most importantly – how to participate intelligently without falling into the traps that cost beginners an average of $1,200 in their first year of trading.

Welcome to our comprehensive guide on understanding the stock market – we’re excited to help you master these essential investing fundamentals!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Key Takeaways

1. The stock market isn’t a physical place – it’s a network of electronic exchanges where ownership shares of public companies change hands in milliseconds. The New York Stock Exchange (NYSE) and NASDAQ process over 10 billion shares daily, with prices adjusting based on real-time supply and demand. This means every stock price you see represents the most recent agreement between a buyer and seller, not some arbitrary number determined by “experts.”

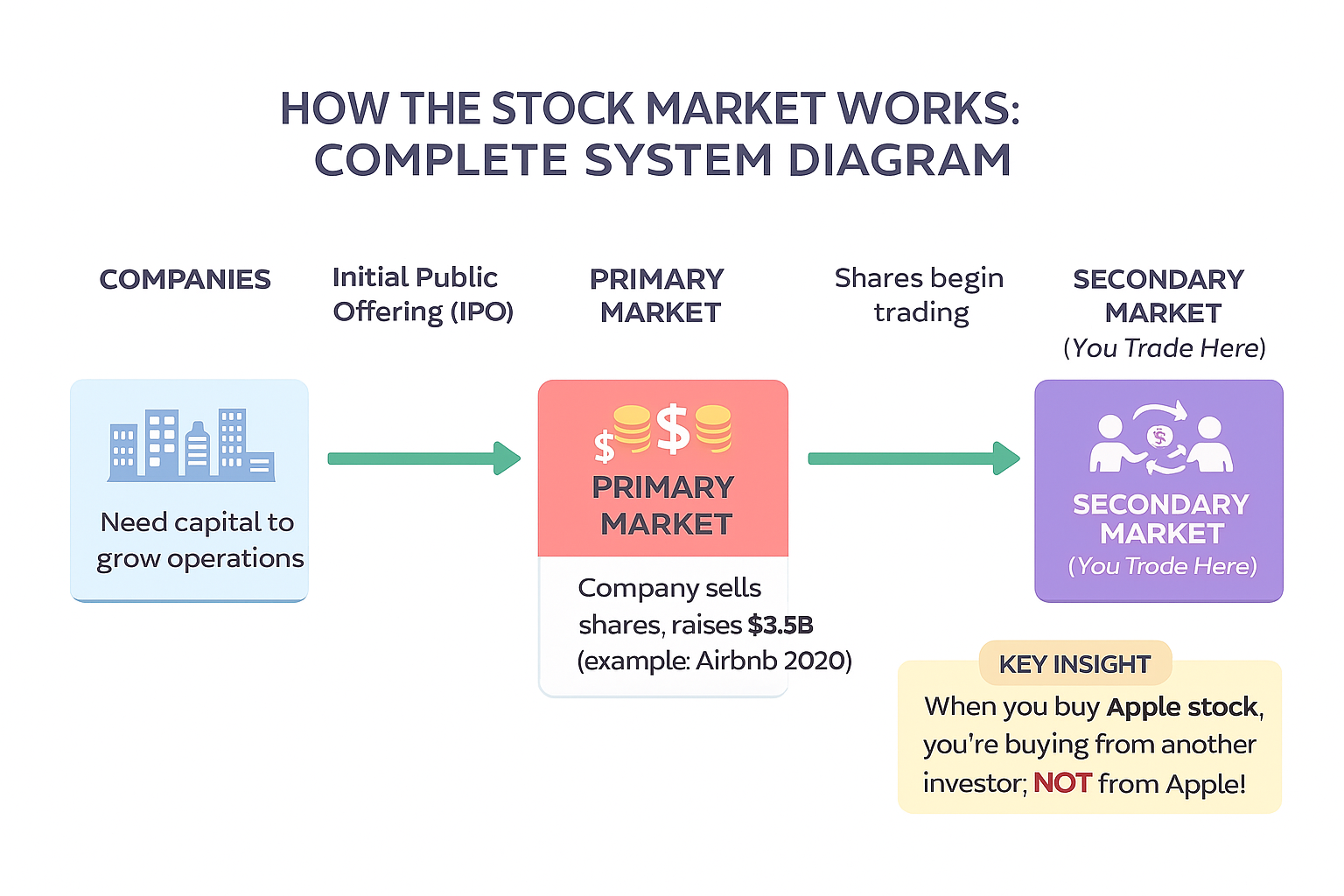

2. Capital formation drives the entire system – companies raise billions by selling shares to the public, while investors gain fractional ownership and potential profits. When Airbnb went public in December 2020, it raised $3.5 billion by selling shares at $68 each. Those shares hit $144.71 on the first day, instantly creating wealth for early investors while giving Airbnb capital to expand globally.

3. Market participation today requires just $5 and a smartphone, but 78% of beginner losses stem from not understanding the difference between investing and speculating. Fractional shares and zero-commission trading removed traditional barriers, yet studies show new investors consistently underperform index funds by 4-6% annually because they confuse access with expertise.

Table of Contents

What The Stock Market Really Means (And Why Most Investors Get It Wrong)

The stock market is a regulated marketplace where shares of publicly traded companies are bought and sold between investors. At its core, it’s an auction system operating in real-time – billions of dollars changing hands based on collective assessments of company value, future earnings potential, and economic conditions.

Most beginners make a critical conceptual error: they think the stock market is where they “buy from companies” or “sell back to companies.” This misunderstanding leads to confusion about pricing and value. In reality, when you buy Apple stock on Tuesday morning, you’re purchasing it from another investor – perhaps someone in Tokyo, London, or Miami – not from Apple itself. Apple already received its money during the Initial Public Offering (IPO) or subsequent offerings. The secondary market (where you trade) is investors exchanging ownership with each other.

This distinction matters psychologically. New investors often panic when their stocks drop, feeling like they’re “losing to the company” or that the company is somehow taking their money. Understanding that you’re trading with other investors – people with different time horizons, risk tolerances, and information – transforms how you approach buying and selling decisions. The person selling you shares believes it’s time to exit; you believe it’s time to enter. One of you will be right.

The stock market exists because of a fundamental economic need: companies need capital to grow, and individuals need opportunities to grow wealth beyond savings accounts. Before modern stock markets, only the ultra-wealthy could invest in businesses. The market democratized capitalism, allowing middle-class workers to own pieces of Microsoft, Amazon, or Tesla. According to Federal Reserve data from 2023, the median stock-owning household has net worth 8.5 times higher than non-stock-owning households – $415,000 versus $49,000.

Current market conditions make understanding these fundamentals essential. With interest rates shifting, inflation concerns, and geopolitical tensions, volatility has become the norm. The S&P 500 has experienced 21 days with 2%+ moves in 2024 alone – double the average of stable years. Investors who panic during volatility often sell at bottoms; those who understand market mechanics recognize temporary dislocations from fundamental value.

The behavioral challenge is significant. Studies from Dalbar, Inc. consistently show that average equity fund investors underperform the very funds they invest in by 4-6% annually because of poor timing decisions. They buy after exciting rallies and sell after frightening drops. The stock market punishes emotional decisions and rewards patient, informed participation. Understanding what the market actually is – a mechanism for transferring ownership based on changing perceptions of value – is the first step toward making better decisions.

The 4 Types of Stock Market Participants (Ranked by Market Impact)

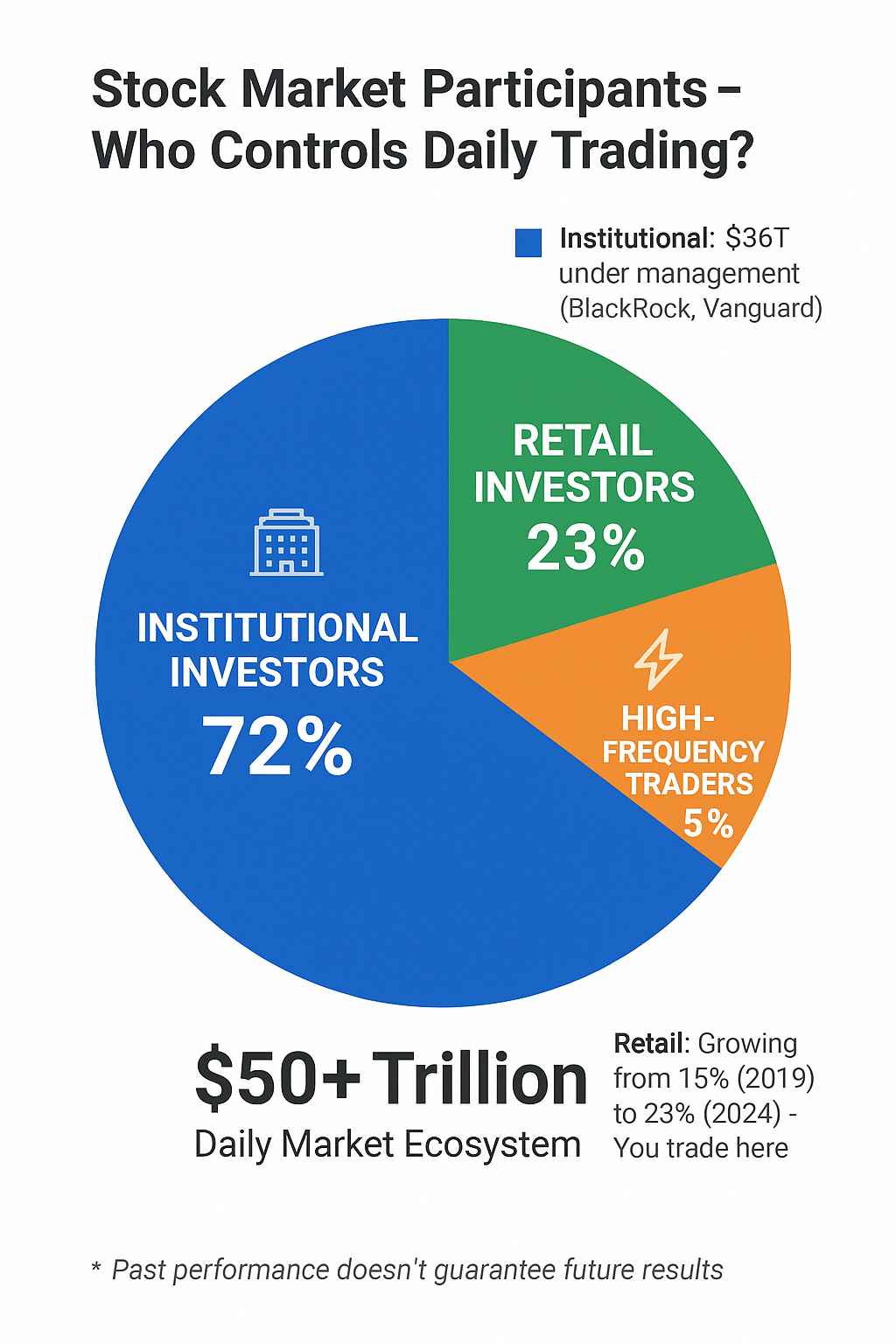

1. Institutional Investors (70-75% of Daily Volume)

Mutual funds, pension funds, insurance companies, and hedge funds dominate market activity. BlackRock, Vanguard, and State Street alone control over $20 trillion in assets. These institutions move markets because their trades involve millions of shares. When Fidelity’s Contrafund decides to add or reduce a position, it can take weeks to execute without moving prices dramatically.

The average investor’s relationship with institutions is symbiotic. When you buy an index fund, you’re pooling your money with millions of others, giving institutional managers negotiating power for better execution prices and lower trading costs. Annual expense ratios of 0.03-0.20% for index funds reflect these economies of scale. However, institutional dominance also means individual investors compete against algorithms processing information in microseconds and professional analysts with resources far beyond retail capabilities.

2. Retail Investors (20-25% of Daily Volume)

Individual investors – people using Schwab, Fidelity, Robinhood, or E*TRADE – represent the fastest-growing market segment. Retail participation surged from 15% of daily volume in 2019 to 25% by 2024, driven by zero-commission trading and fractional shares. During the GameStop phenomenon of January 2021, retail investors briefly drove over 30% of volume.

The democratization of trading created opportunity and risk. Platform improvements mean you can execute trades as quickly as professionals and access research tools once reserved for institutions. However, easy access doesn’t equal expertise. Studies show retail traders lose money on 55-60% of trades, with losses concentrated among those trading most frequently. The most successful retail investors treat the market like institutional investors – focusing on long-term value rather than short-term speculation.

3. Market Makers (Providing Liquidity)

These specialized firms – companies like Citadel Securities and Virtu Financial – stand ready to buy or sell shares instantly, ensuring liquidity. When you execute a trade on your app and it fills in milliseconds, a market maker facilitated that transaction. They profit from the “spread” – the tiny difference between buy (bid) and sell (ask) prices, often just pennies per share.

Market makers process over 50% of all trades for retail investors through payment-for-order-flow arrangements. Your broker routes your order to a market maker who fills it and may pay your broker $0.002 per share for that order flow. This controversial system enables zero-commission trading but raises questions about whether you’re getting the best possible price. For investors, understanding that every “instant” execution involves a market maker taking the other side of your trade illuminates why prices can move before large orders fully execute.

4. High-Frequency Traders (Speed-Based Arbitrage)

HFT firms use sophisticated algorithms and fiber-optic cables to execute thousands of trades per second, exploiting tiny price discrepancies between markets. They represent 50-55% of all equity trades but hold positions for seconds or microseconds. Renaissance Technologies and Two Sigma exemplify firms using quantitative strategies to capture microscopic inefficiencies.

For individual investors, HFT impact is mixed. These firms enhance liquidity and narrow spreads—good for execution quality. However, they’ve also been accused of “front-running” by detecting large institutional orders and trading ahead of them. The SEC’s market structure debates center on whether HFT provides valuable liquidity or extracts “rent” from patient investors.

Practically, understanding that algorithms analyze every order means retail investors should use limit orders (specifying maximum prices) rather than market orders (accepting current prices) for larger positions.

The Financial Advantages of Understanding Stock Markets: Real Returns and Outcomes

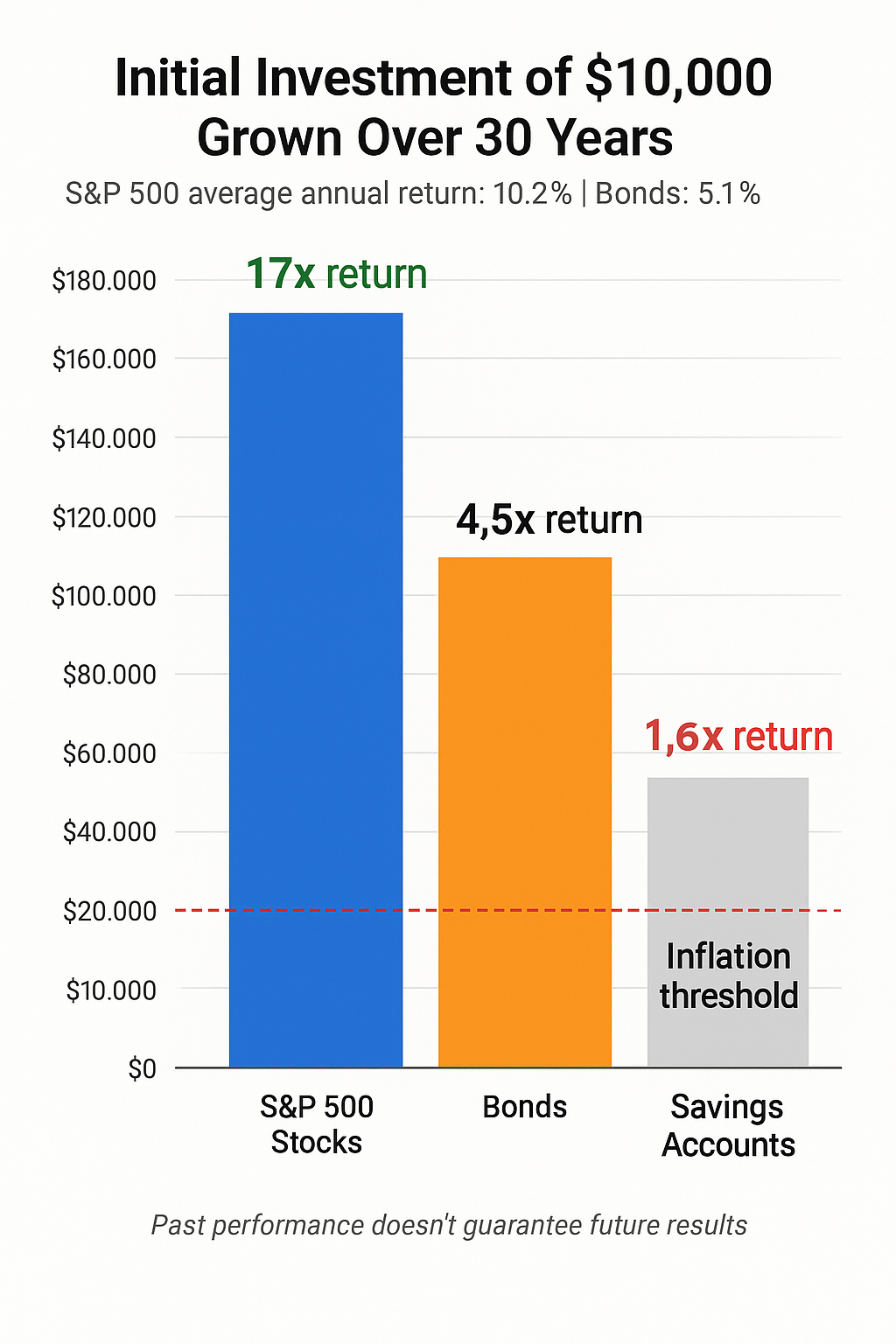

Quantifying the benefits of stock market participation reveals compelling numbers. The S&P 500 has delivered average annual returns of approximately 10.2% since 1926, compared to 3.3% for bonds and 3.0% for Treasury bills. A $10,000 investment in the S&P 500 in 1994 grew to approximately $170,000 by 2024 – a 17x return. The same amount in savings accounts earning average interest would be worth roughly $16,000 – barely keeping pace with inflation.

The power of compound growth explains this wealth-building capacity. At 10% annual returns, money doubles approximately every 7.2 years. This means a 25-year-old investing $500 monthly until age 65 would accumulate approximately $2.8 million, having contributed only $240,000. Time in the market beats timing the market – Fidelity’s 2023 analysis of 1.2 million retirement accounts found the best-performing accounts belonged to people who forgot they had accounts or had passed away. They never sold during crashes.

Tax advantages enhance returns for long-term investors. Capital gains held over one year face maximum federal rates of 20% versus 37% for short-term gains taxed as ordinary income. This 17-percentage-point difference means long-term investors keep significantly more wealth. Additionally, dividends from qualified stocks receive preferential tax treatment, and retirement accounts like 401(k)s and Roth IRAs offer tax-deferred or tax-free growth.

Ownership benefits extend beyond returns. Shareholders participate in corporate governance through voting rights and receive dividends – direct profit-sharing from successful companies. Microsoft paid $20.24 billion in dividends in fiscal 2024; shareholders received direct cash without selling shares. This income stream becomes particularly valuable in retirement when preserving principal matters.

The inflation-beating aspect is crucial for financial security. With average annual inflation around 3%, money in savings loses purchasing power yearly. Stock ownership provides inflation protection because companies raise prices and grow earnings in inflationary environments. During the 2021-2023 inflation surge, corporate profits increased substantially while savings account real returns were deeply negative.

Accessibility improvements have democratized these advantages. Fractional shares mean $25 can buy a piece of Amazon trading at $180 per share. Automatic investing through robo-advisors requires no market expertise – algorithms handle diversification and rebalancing.

Tax-loss harvesting, once available only to wealthy investors with professional advisors, now comes automated in platforms like Betterment and Wealthfront, potentially adding 0.5-1.0% annually to after-tax returns.

Why Smart Investors Struggle with Stock Markets (And How to Overcome It)

The psychological challenges of investing often overwhelm the intellectual understanding of market mechanics. Loss aversion – the psychological reality that losses feel approximately 2.5 times more painful than equivalent gains feel good – drives destructive behavior. When markets drop 10%, the emotional pain drives many investors to sell, locking in losses. When markets then recover, they’re on the sidelines, missing the bounce.

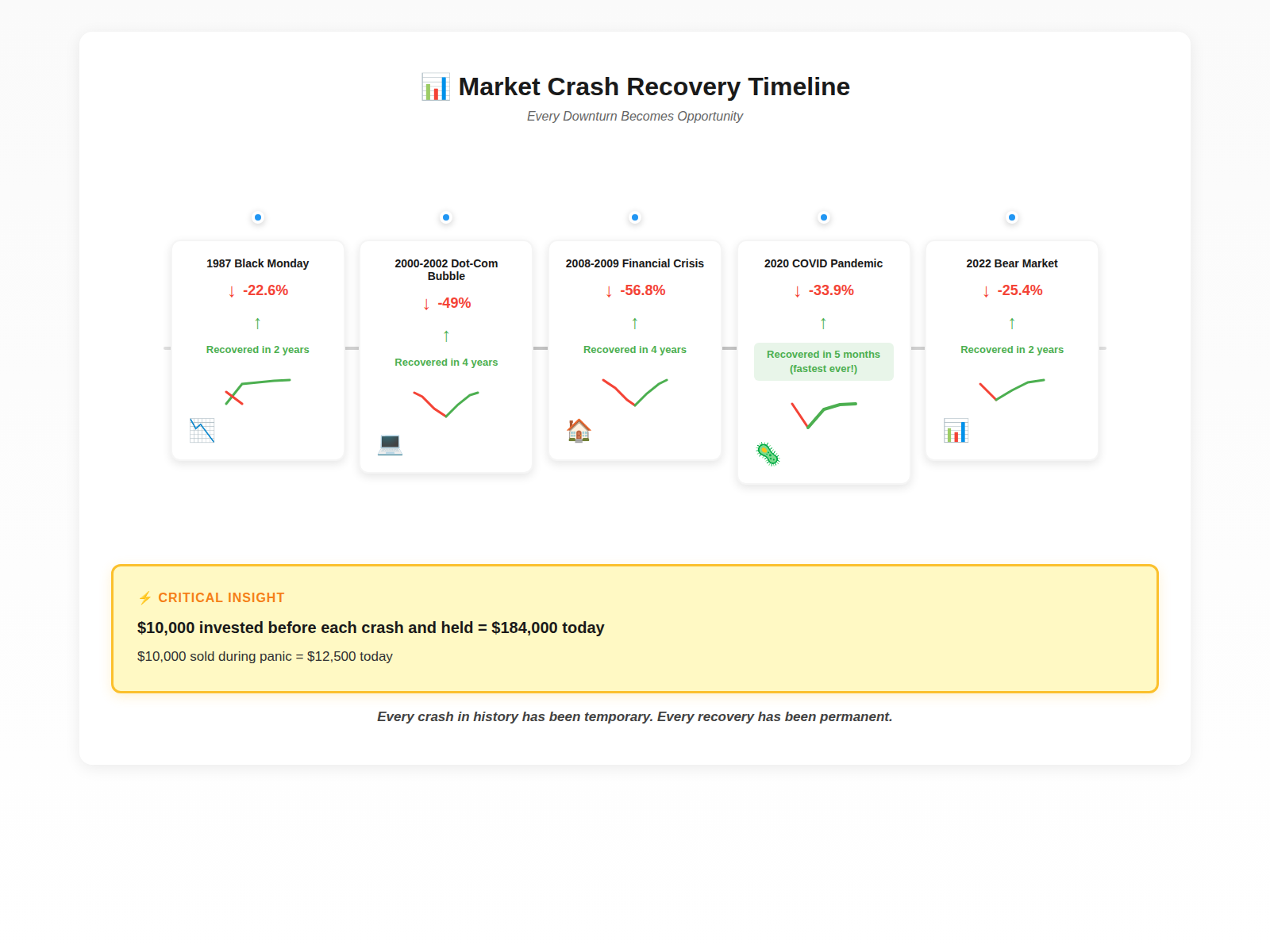

Recency bias compounds these challenges. Recent market movement disproportionately influences predictions about future performance. After the 2008 financial crisis, investors fled stocks and missed the entire 2009-2020 bull market – the longest in history. Conversely, after the 2020-2021 surge in meme stocks and cryptocurrencies, millions of new investors entered markets expecting 50-100% annual returns, leading to devastating losses when speculative bubbles burst.

Information overload creates analysis paralysis. With 24/7 financial news, real-time market data, and millions of opinions on social media, investors face constant psychological pressure to “do something.” Studies show that investors who check portfolio values multiple times daily underperform those who check monthly or quarterly by 2-3% annually. The constant monitoring amplifies emotional reactions to normal volatility.

The “expert” problem misleads beginners. Financial media features confident predictions about market direction, yet academic research consistently shows professional forecasters predict market movements no better than chance. A 2023 study tracking 200 professional market strategists over 20 years found that market-timing recommendations underperformed simple buy-and-hold strategies by 4% annually after fees. New investors mistakenly believe they need to predict market direction to succeed.

Complexity creates vulnerability to poor advice. Between understanding individual stocks, sectors, economic indicators, Federal Reserve policy, geopolitical risks, and technical analysis, the learning curve feels insurmountable. This drives many investors toward “hot tips” from questionable sources – Reddit forums, YouTube personalities, or cousins who “killed it on Tesla options.” Financial regulators estimate retail investors lose $1.5 billion annually to pump-and-dump schemes and fraudulent investment advice.

The solution involves systematic approaches that remove emotional decision-making:

Automate Investment Contributions: Dollar-cost averaging – investing fixed amounts regularly regardless of price – eliminates timing decisions. Research from Vanguard shows this strategy reduces average costs and removes the emotional paralysis of deciding “when to invest.”

Use Target-Date Funds or Robo-Advisors: Automated portfolios based on retirement dates or risk tolerance handle rebalancing and asset allocation without emotional interference. Betterment and Wealthfront users show 2-3% better returns than self-directed investors with similar risk profiles.

Implement “Mental Time-Travel”: Before making emotional sells during market drops, investors should ask: “Will I care about this drop in 10 years?” Historical data shows 10-year rolling returns for the S&P 500 have never been negative – including periods starting right before the 1929 crash, 2008 crisis, and 2020 pandemic crash.

Create Investment Policy Statements: Writing down specific rules – “I will invest X dollars monthly regardless of market conditions” or “I will not check my portfolio more than quarterly” – provides guardrails during emotional moments. Studies show written commitments increase follow-through by 65%.

Step-by-Step Framework for Stock Market Participation Success

Step 1: Establish Financial Foundation (Timeline: 1-2 months)

Before investing a single dollar in stocks, ensure you have:

- Emergency fund covering 3-6 months of expenses in high-yield savings (currently earning 4-5%)

- High-interest debt paid off (credit cards charging 18-24% make stock returns irrelevant)

- Basic budget understanding showing sustainable cash flow

Cost: $0 (organization only) Milestone: Written financial overview confirming readiness to invest

Step 2: Select Appropriate Brokerage Platform (Timeline: 1-2 days)

Choose brokerages based on your needs:

- Fidelity or Schwab: Full-service platforms with research, retirement accounts, and customer service

- Vanguard: Lowest-cost index funds and strong retirement focus

- Robinhood or Webull: Streamlined mobile experience for active traders

- Betterment or Wealthfront: Automated investing with no minimum and tax-loss harvesting

Requirements: Social Security number, bank account, government ID Setup time: 15-30 minutes for account opening, 2-3 days for bank transfers

Step 3: Determine Asset Allocation (Timeline: 1-2 hours)

Follow age-based guidelines:

- Aggressive (age 20-35): 90% stocks, 10% bonds

- Moderate (age 36-50): 70% stocks, 30% bonds

- Conservative (age 51-65): 50% stocks, 50% bonds

Or use the “120 minus your age” rule: subtract your age from 120 to determine stock percentage. A 30-year-old would hold 90% stocks.

Decision tool: Free risk-tolerance questionnaires at Vanguard.com or Fidelity.com provide personalized recommendations.

Step 4: Execute Initial Investment (Timeline: 30 minutes)

Start with broad market exposure:

- Total market index fund: VTI (Vanguard) or ITOT (iShares) provide instant diversification across 3,500+ U.S. companies

- S&P 500 index fund: VOO (Vanguard) or SPY (SPDR) tracks 500 largest U.S. companies

- Target-date fund: Single fund automatically adjusting allocation as retirement approaches

Minimum investment: $1 for fractional shares on most platforms Recommended initial amount: $1,000-$5,000 or 1-2 months of planned contributions

Step 5: Implement Systematic Investment Plan (Timeline: Ongoing)

Set up automatic monthly investments:

- Choose consistent amount ($100, $500, $1,000 – whatever your budget allows)

- Select same calendar date (day after paycheck for easiest cash flow)

- Maintain regardless of market conditions (buy more shares when prices drop, fewer when they rise)

Research from Dimensional Fund Advisors shows investors who automate contributions accumulate 30% more wealth over 20 years compared to those who invest “when they feel right about the market.”

Step 6: Annual Rebalancing (Timeline: 2-3 hours annually)

Once per year, typically in January:

- Review target asset allocation

- Compare to current holdings

- Sell overweight positions, buy underweight positions to restore targets

Example: If stocks surged and you now hold 95% stocks versus 90% target, sell 5% of stock holdings and buy bonds. This forces disciplined “sell high, buy low” behavior.

Tools: Portfolio analyzers at Personal Capital (free) or Morningstar ($35/year) automate calculations.

Step 7: Continuous Education (Timeline: 1-2 hours monthly)

Build expertise gradually:

- Read: “The Intelligent Investor” by Benjamin Graham, “A Random Walk Down Wall Street” by Burton Malkiel

- Follow: SEC.gov for investor education, Bogleheads.org forum for evidence-based strategies

- Track: Your actual returns versus appropriate benchmarks (not against cherry-picked winners)

Annual cost: $50-100 for books and subscriptions Value: Studies show investors who engage in systematic education earn 2-3% higher annual returns by avoiding costly mistakes.

The Future of Stock Markets: What’s Coming Next

Artificial intelligence is fundamentally reshaping market analysis and execution. AI-powered platforms now analyze 10-Q filings, earnings calls, and news sentiment in milliseconds, identifying investment opportunities faster than human analysts. Retail investors gain access to institutional-grade AI through platforms like Magnifi and Composer, which use natural language processing to build portfolios based on conversational queries. However, as AI becomes ubiquitous, competitive advantages shift from information processing to behavioral discipline and long-term thinking – areas where humans still outperform algorithms.

Blockchain technology threatens to disintermediate traditional market infrastructure. Tokenized securities – stocks represented on blockchain – enable 24/7 trading, instant settlement (currently takes two days), and fractional ownership of traditionally illiquid assets like real estate. The Securities and Exchange Commission is developing frameworks for “security tokens,” potentially creating parallel trading systems by 2026-2028. For investors, this means expanded opportunities but also regulatory uncertainty as traditional and blockchain-based systems compete.

Demographic shifts will reshape market structure over the next 20 years. As Baby Boomers shift from accumulation to retirement distribution, systematic selling could create structural headwinds for equity markets. Simultaneously, Millennials and Gen Z will inherit approximately $70 trillion from older generations – the largest wealth transfer in history. This demographic tsunami will likely favor sustainable investing, technology companies, and alternative assets, potentially creating sustained sector rotations.

Regulatory evolution around market structure remains dynamic. The SEC is investigating payment-for-order-flow practices, potentially banning arrangements that enable zero-commission trading. Chair Gary Gensler has proposed reducing settlement times to T+0 (same-day settlement) and increasing transparency around short selling. Any changes could impact retail investor costs and execution quality, though historical regulatory reforms have generally improved investor protection.

Climate-related financial disclosures will become mandatory for public companies by 2025-2026, creating new information streams for investors. Companies will report carbon emissions, climate risks, and transition plans – data that algorithms will immediately incorporate into valuations. This transparency may accelerate the existing trend toward ESG (Environmental, Social, Governance) investing, which now represents over $30 trillion globally.

The democratization trend will continue accelerating. Fractional shares of previously inaccessible assets – pre-IPO companies, fine art, collectibles – are being securitized and offered to retail investors through platforms like EquityZen and Masterworks. While expanding opportunities, this also increases complexity and risk, requiring investors to develop more sophisticated due diligence skills.

For emerging opportunities, focus on:

- International markets: U.S. stocks represent just 60% of global market capitalization; diversifying internationally provides exposure to faster-growing economies

- Thematic investing: AI, robotics, clean energy, and biotechnology offer growth potential but require careful selection and diversification

- Alternative assets: Including real estate investment trusts (REITs), commodities, and infrastructure in portfolios improves risk-adjusted returns

The key insight: as markets evolve, fundamental principles remain constant. Diversification, cost-consciousness, long-term orientation, and behavioral discipline will continue differentiating successful investors from struggling ones regardless of technological or structural changes.

What is Stock Market: Your Most Important Questions Answered

1. How much money do I need to start investing in the stock market?

You can begin with as little as $1 using fractional shares on platforms like Fidelity, Schwab, or Robinhood. However, starting with at least $500-$1,000 provides meaningful diversification and reduces the proportional impact of any account fees. The more important question is consistency – investing $100 monthly for 30 years at 10% returns creates $227,000, while investing $5,000 once creates only $87,000.

2. What’s the difference between the NYSE and NASDAQ exchanges?

The New York Stock Exchange is an auction market where designated market makers facilitate trades on a physical trading floor (though 90% of volume is electronic). NASDAQ is purely electronic with multiple market makers competing for each trade. For investors, the exchange matters little – both are highly regulated, liquid, and provide similar execution quality. Choose stocks based on companies, not which exchange lists them.

3. Should I invest in individual stocks or index funds?

Index funds provide instant diversification across hundreds or thousands of stocks, reducing company-specific risk, and charge fees as low as 0.03% annually. Statistically, 88% of professional stock pickers underperform index funds over 15-year periods. Individual stocks require extensive research, time for monitoring, and acceptance of higher risk. Unless you have expertise, time, and passion for analyzing companies, index funds deliver better risk-adjusted returns.

4. How do market crashes affect long-term investors?

Every stock market crash in history has been followed by recovery and new highs – typically within 2-4 years. The S&P 500 has experienced 12 bear markets (20%+ declines) since 1950, yet a portfolio held from 1950 to 2024 returned over 25,000%. Crashes become opportunities to buy quality assets at discounted prices. Investors who maintain contributions during downturns consistently outperform those who sell or stop investing.

5. What tax implications should I understand before investing?

Long-term capital gains (assets held over one year) face maximum federal rates of 20% versus 37% for short-term gains. Dividends from most U.S. stocks receive “qualified dividend” treatment at these preferential rates. Retirement accounts (401k, IRA, Roth IRA) offer tax-deferred or tax-free growth. Tax-loss harvesting – selling losing positions to offset gains – can save 20-37% on taxes. For investors in higher brackets, these tax efficiencies can add 1-2% to annual returns.

6. How often should I check my investment portfolio?

Quarterly reviews align with corporate earnings cycles and provide sufficient data for meaningful assessment without triggering emotional reactions to normal volatility. Research shows investors who check daily or weekly make more trading decisions, incur higher costs, and underperform less-frequent checkers by 2-3% annually. During market turbulence, reducing check frequency actually improves returns by preventing panic selling.

7. What are dividend stocks and should beginners invest in them?

Dividend stocks are shares of companies that distribute portions of profits directly to shareholders – typically quarterly payments. Coca-Cola, Johnson & Johnson, and Procter & Gamble exemplify stable dividend payers. These stocks provide income (current yields of 2-4%) plus potential appreciation. For beginners, dividend-focused funds like VYM (Vanguard High Dividend Yield) provide diversified exposure without requiring individual stock selection, offering lower volatility than growth-focused investments.

8. How does inflation affect my stock market returns?

Inflation erodes purchasing power – 3% annual inflation cuts money’s value in half every 24 years. Stocks provide inflation protection because companies raise prices and grow earnings in inflationary environments. From 1926-2024, stocks returned 10.2% nominally and approximately 7% after inflation, while bonds returned just 0.3% after inflation. During high-inflation periods, maintaining stock exposure proves essential for preserving purchasing power over decades.

9. What are the warning signs of a potential market downturn?

Reliable market timing is impossible – professional forecasters fail consistently. However, elevated risks appear when: (1) valuations reach historic extremes (Price/Earnings ratios above 25-30), (2) margin debt (borrowed money for stocks) surges, (3) investor sentiment becomes euphoric with FOMO (fear of missing out) driving speculation, and (4) Federal Reserve aggressively raises rates. Rather than trying to time exits, maintain appropriate diversification and asset allocation to weather any downturn.

10. How do I know if I’m ready to start investing in stocks?

You’re ready when: (1) you have 3-6 months of expenses in emergency savings, (2) high-interest debt is eliminated or managed, (3) you can invest money you won’t need for at least 5 years, and (4) you understand that volatility is normal and won’t panic-sell during declines. If you check these boxes, beginning with small amounts in diversified index funds while building knowledge creates the foundation for long-term wealth building.

Take Your First Step Into Market Participation

The stock market isn’t a casino for those who understand its fundamental purpose – channeling capital to productive enterprises while allowing individuals to build wealth through ownership. The numbers are unambiguous: Over the past century, patient stock market investors have consistently built wealth that outpaces inflation, preserves purchasing power, and funds comfortable retirements. The alternative – keeping money in savings while inflation erodes value – guarantees relative poverty over time.

Market evolution through AI, blockchain, and democratized access creates unprecedented opportunity for the next generation of investors. Yet the timeless principles remain: diversification reduces unnecessary risk, low costs enhance returns, behavioral discipline outperforms market timing, and time horizons measure in decades, not days.

Your next step is concrete: open a brokerage account this week (15 minutes on Fidelity, Schwab, or Vanguard), fund it with an amount you can afford monthly, and purchase a total market index fund. Start with $100, $500, or $1,000 – the specific amount matters less than establishing the habit. Markets reward those who begin despite uncertainty, maintain discipline despite volatility, and think in decades despite daily noise.

The gap between understanding what the stock market is and participating in wealth creation closes with one decision. Every day of delay costs compounding potential you’ll never recover. Begin now.

Best wishes & good luck on your journey as an investor!

Didi Somm

For your reference, the latest articles by Didi Somm include:

- Investing 101: Everything You Need to Know to Start in 2025

- How to Invest $10’000: Complete Strategy Guide

- HOW TO START INVESTING IN 2025: COMPLETE BEGINNER’S GUIDE

- Best Robo Advisors 2025: Betterment vs Wealthfront vs Vanguard Digital

Confused by investing terminology? Grab our free Investing Basics Glossary with 50 key terms explained in plain English.

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance