“What is an Index Fund?” – Introduction

Here’s a shocking truth: Over 90% of professional money managers fail to beat the market over the long term. Yet there’s a simple investment strategy that consistently outperforms them – and it was designed for beginners.

It’s called an Index Fund.

Warren Buffett, one of the greatest investors of all time, has repeatedly said that for most people, index funds are the best investment choice. In fact, he’s instructed that 90% of his own estate should be invested in index funds.

But what exactly is an index fund? How does it work? And why do billionaire investors recommend them for regular people?

In this guide, you’ll learn everything you need to know about index funds—in plain English, without the jargon. By the end, you’ll understand why this might be the most important investment decision you’ll ever make.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

Table of Contents

What is an Index Fund? The Simple Definition

An index fund is a type of investment fund that owns all (or most) of the stocks in a specific market index, automatically giving you instant ownership in hundreds or thousands of companies with a single purchase.

Think of it this way:

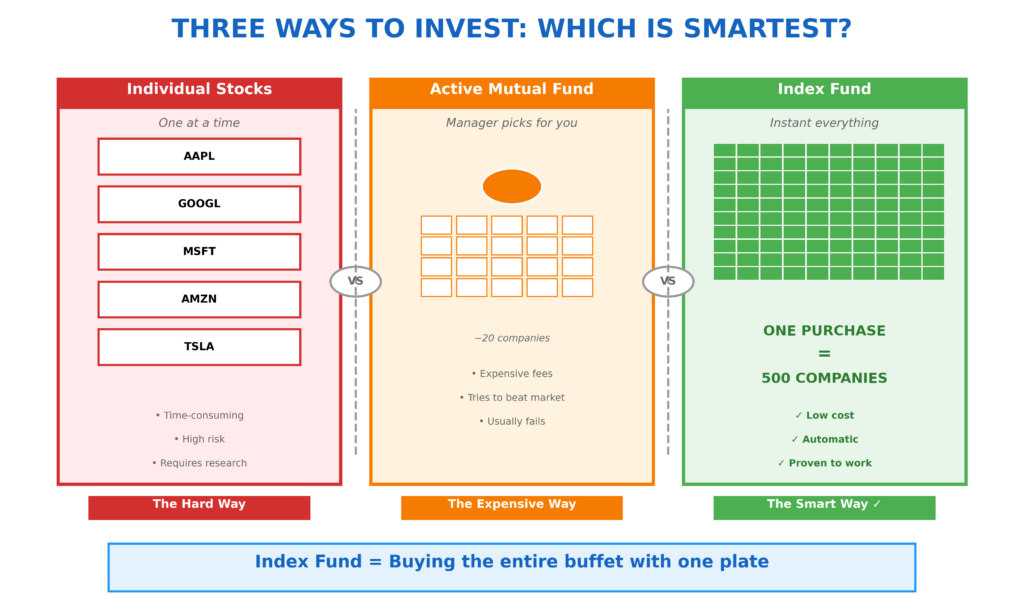

Buying individual stocks is like hand-picking groceries one item at a time. You choose Apple, then Google, then Microsoft, spending time researching each company.

Buying an index fund is like grabbing a pre-made variety pack. One purchase and you instantly own a slice of hundreds of companies – Apple, Google, Microsoft, and 497 others if you buy an S&P 500 index fund.

The Restaurant Buffet Analogy

Imagine you’re at a restaurant:

Individual Stock Picking: You carefully study the menu, agonizing over whether to order the chicken, the fish, or the steak. You hope you chose the best dish, but you won’t know until you taste it.

Index Fund Investing: You walk up to a buffet and get a sample of everything—chicken, fish, steak, vegetables, pasta. You’re guaranteed not to miss the best dish because you own them all.

Index funds take the buffet approach to investing. Instead of betting on individual companies, you own a representative sample of the entire market.

How Index Funds Actually Work

Understanding how index funds work requires knowing three key concepts: Indexes, tracking, and passive management.

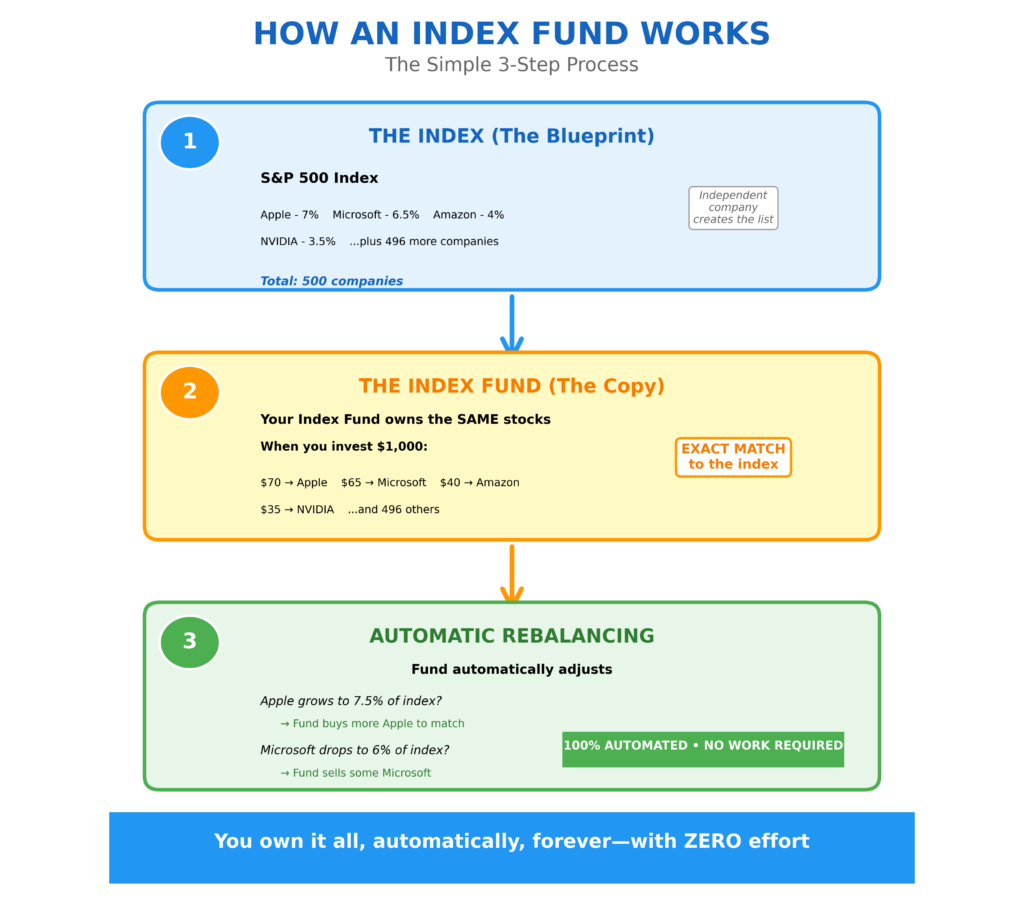

Step 1: The Index (The Blueprint)

An index is simply a list of stocks that represents a particular segment of the market. Think of it as a curated list of companies.

Popular indexes include:

- S&P 500: The 500 largest U.S. companies

- Total Stock Market: Essentially all U.S. stocks (~3,600 companies)

- NASDAQ-100: The 100 largest tech companies

- Russell 2000: 2,000 smaller U.S. companies

- MSCI World: Large companies from developed countries globally

These indexes are maintained by independent companies (like S&P Dow Jones or MSCI) that decide which companies make the list based on specific criteria.

Step 2: The Index Fund (The Copy)

An index fund’s job is incredibly simple: own the exact same stocks that are in its target index, in the same proportions.

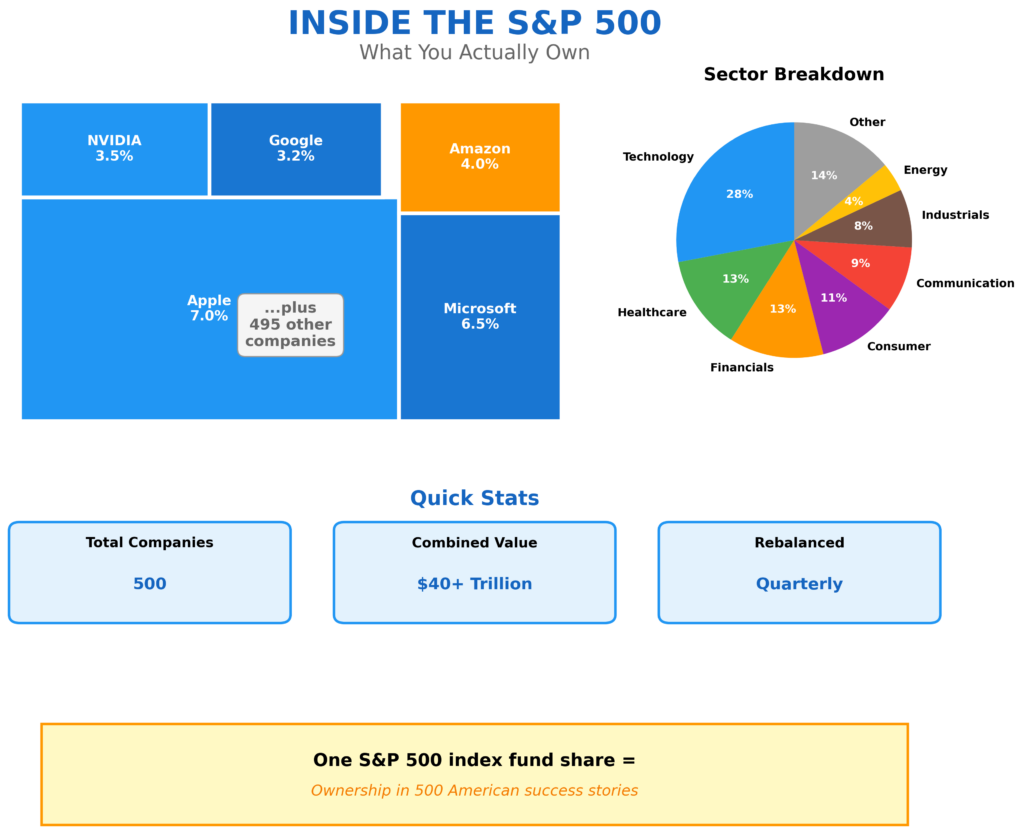

Example: The S&P 500 Index

Let’s say Apple represents 7% of the total S&P 500 index value. An S&P 500 index fund will make sure that Apple also represents about 7% of its holdings.

When you invest $1,000 in an S&P 500 index fund:

- About $70 goes toward Apple stock

- About $65 goes toward Microsoft

- About $40 goes toward Amazon

- And so on, for all 500 companies

The fund automatically maintains these proportions. If Apple’s stock price rises and it now represents 7.5% of the index, the fund will buy more Apple shares to match.

Step 3: Passive Management (The Automation)

This is where index funds save you money.

Active funds employ expensive analysts and portfolio managers who try to pick winning stocks and beat the market. They charge high fees (often 1-2% per year) to pay for all this research.

Index funds simply follow the index. No expensive analysts. No predictions. Just automatic copying. This means fees as low as 0.03% per year—that’s 97% cheaper than many active funds.

Real Example:

Meet Sarah. She has $10,000 to invest and is choosing between two funds:

Option 1: Active Mutual Fund

- Fee: 1.5% per year

- Annual cost: $150

Option 2: Vanguard S&P 500 Index Fund (VFIAX)

- Fee: 0.04% per year

- Annual cost: $4

Sarah saves $146 every year with the index fund. Over 30 years, that difference compounds to over $50,000 in extra returns.

The 5 Major Benefits of Index Funds

1. Instant Diversification

The Problem: If you own just a few individual stocks and one company fails, you could lose a huge portion of your money. Remember Enron? Lehman Brothers? Countless investors lost everything.

The Index Fund Solution: One purchase gives you ownership in hundreds or thousands of companies.

Example: With a single Vanguard Total Stock Market Index Fund share ($100), you own a piece of:

- Apple

- Microsoft

- Amazon

- NVIDIA

- Tesla

- And ~3,595 other companies

If any single company collapses, it barely affects your portfolio. You’re protected.

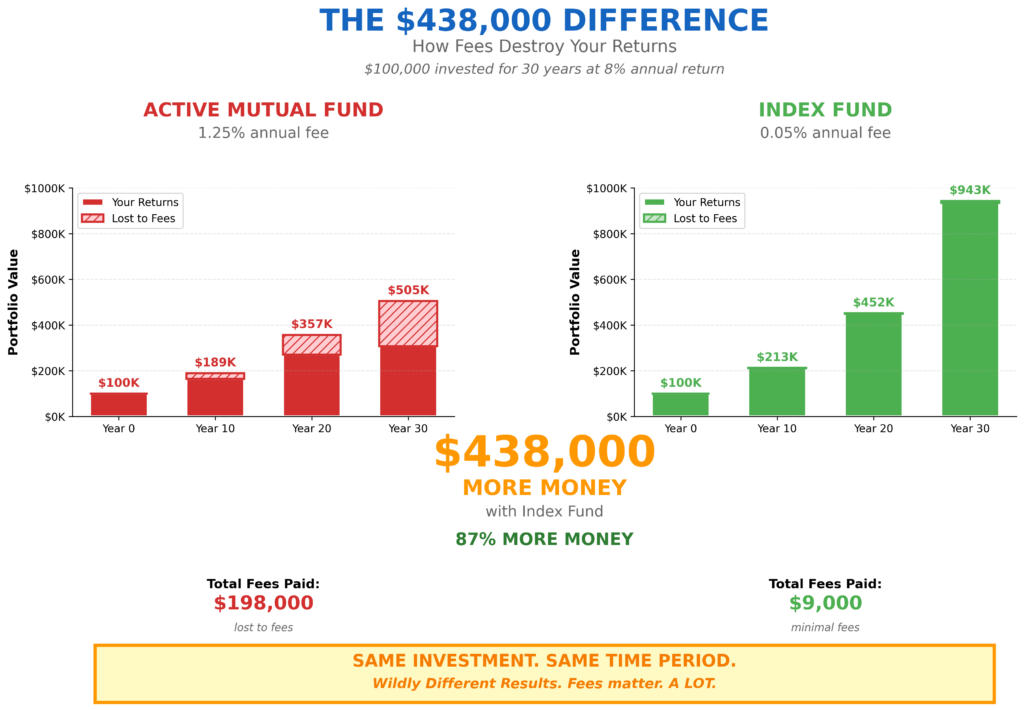

2. Extremely Low Costs

Average actively managed mutual fund fee: 1.25% per year

Average index fund fee: 0.05% per year

That’s 25 times cheaper.

Why does this matter? Fees compound against you.

$100,000 invested for 30 years at 8% return:

- With 1.25% fee: Ends at $505,000

- With 0.05% fee: Ends at $943,000

- Difference: $438,000 lost to fees

That’s nearly half your money gone – not to investment losses, but to fees.

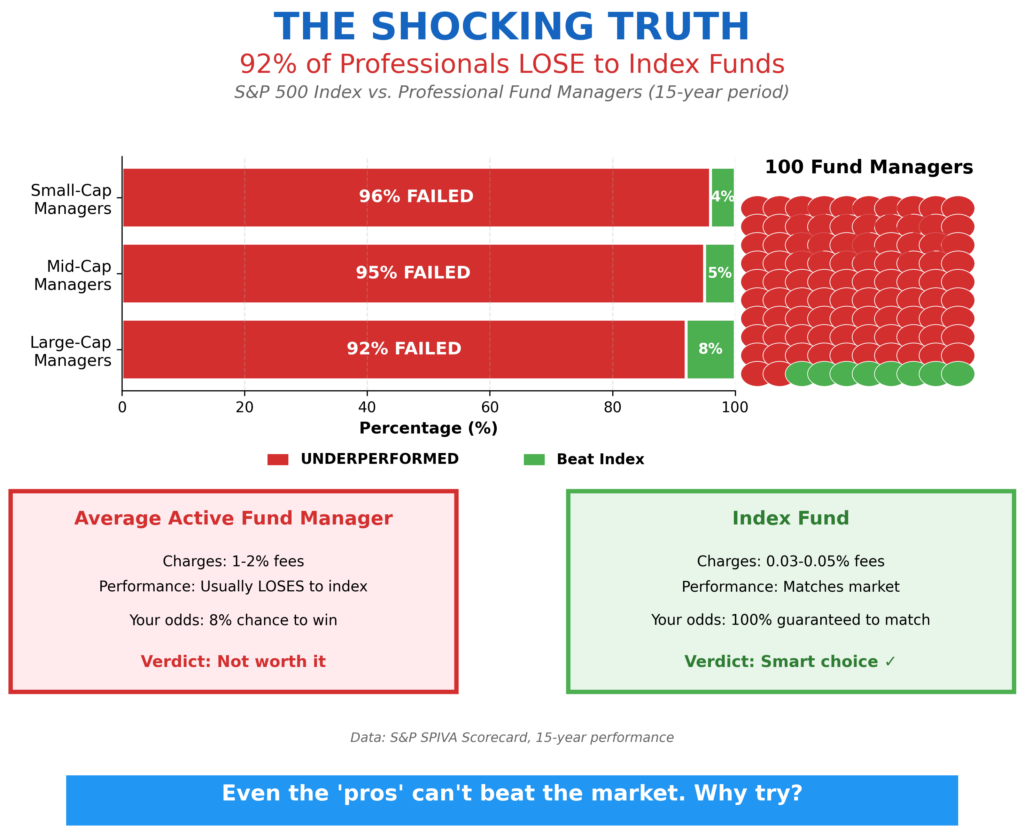

3. Consistently Beats Active Managers

This isn’t theory – it’s proven by data.

S&P SPIVA Scorecard (15-year data):

- 92% of large-cap fund managers failed to beat the S&P 500

- 95% of mid-cap fund managers underperformed their index

- 96% of small-cap fund managers underperformed their index

Even the professionals can’t consistently beat the market. But index funds match it automatically—and at a fraction of the cost.

4. Tax Efficiency

Index funds rarely buy and sell stocks. They only make changes when the index itself changes (maybe a few times a year).

Active funds trade constantly – sometimes turning over their entire portfolio multiple times per year. Every sale triggers capital gains taxes that you have to pay.

Index funds have very low turnover (often under 5% annually), meaning fewer taxable events and more money staying in your account.

Real Impact:

- Active fund annual turnover: 100%+ (you might owe taxes on 100% of gains)

- Index fund annual turnover: 3% (you owe taxes on only 3% of gains)

5. Simple and Hands-Off

Once you buy an index fund, there’s almost nothing to do.

No need to:

- Research individual companies

- Read earnings reports

- Watch CNBC all day

- Worry about missing the “next big thing”

- Constantly buy and sell

You set up automatic investments, and the index fund does the rest. It’s the ultimate set-it-and-forget-it investment strategy.

Popular Types of Index Funds (With Real Examples)

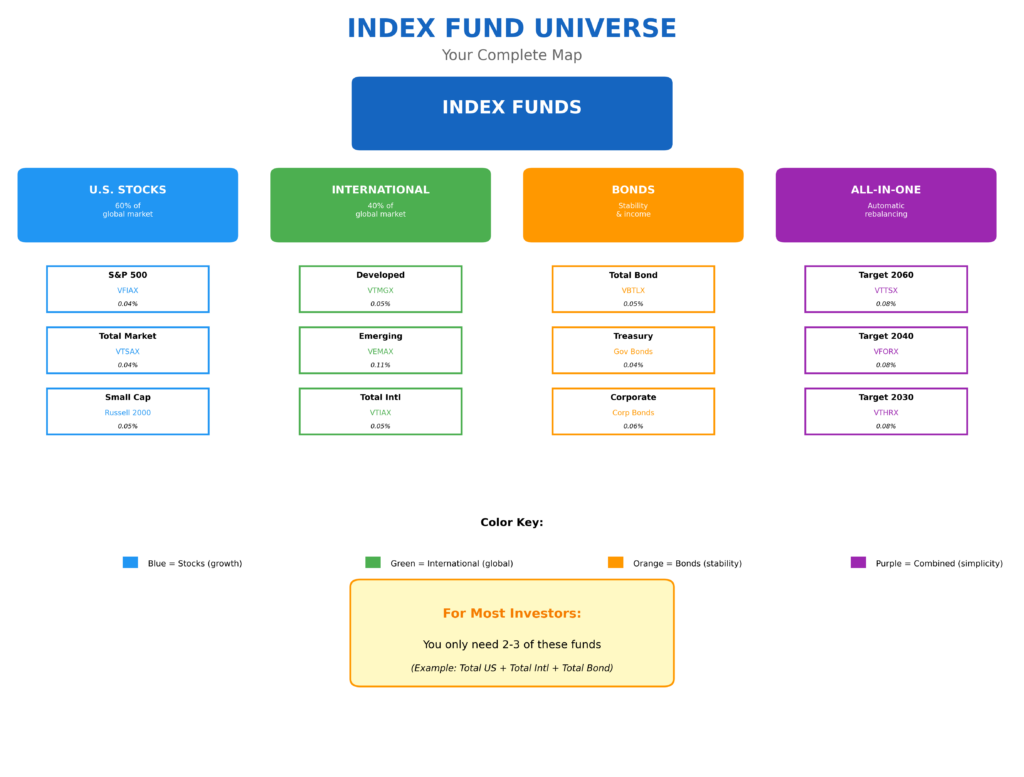

1. U.S. Stock Market Index Funds

S&P 500 Index Funds (Large U.S. Companies)

The S&P 500 represents about 500 of the largest U.S. companies. These are household names that dominate the American economy.

Top holdings include:

- Technology: Apple, Microsoft, NVIDIA, Meta

- Healthcare: UnitedHealth, Johnson & Johnson

- Finance: Berkshire Hathaway, JPMorgan Chase

- Consumer: Amazon, Tesla, Coca-Cola

Popular S&P 500 Index Funds:

- Vanguard 500 Index Fund (VFIAX): 0.04% fee

- Fidelity 500 Index Fund (FXAIX): 0.015% fee

- Schwab S&P 500 Index Fund (SWPPX): 0.02% fee

Total Stock Market Index Funds (All U.S. Companies)

These funds own practically every publicly traded U.S. company – from giants like Apple to tiny companies you’ve never heard of.

Coverage: ~3,600 companies across all sizes

- Large-cap (80%)

- Mid-cap (15%)

- Small-cap (5%)

Popular Total Market Funds:

- Vanguard Total Stock Market Index Fund (VTSAX): 0.04% fee

- Fidelity Total Market Index Fund (FSKAX): 0.015% fee

- Schwab Total Stock Market Index Fund (SWTSX): 0.03% fee

2. International Stock Index Funds

Don’t forget the rest of the world. The U.S. is only about 60% of global stock market value.

International Developed Markets (Europe, Japan, Canada, Australia)

Popular funds:

- Vanguard Developed Markets Index Fund (VTMGX): 0.05% fee

- Fidelity International Index Fund (FSPSX): 0.035% fee

Emerging Markets (China, India, Brazil, South Korea)

These are faster-growing but riskier economies.

Popular funds:

- Vanguard Emerging Markets Index Fund (VEMAX): 0.11% fee

- Fidelity Emerging Markets Index Fund (FPADX): 0.075% fee

3. Bond Index Funds

For the stability portion of your portfolio.

Total Bond Market Index Funds

They own thousands of government and corporate bonds.

Popular funds:

- Vanguard Total Bond Market Index Fund (VBTLX): 0.05% fee

- Fidelity U.S. Bond Index Fund (FXNAX): 0.025% fee

4. All-in-One Index Funds (Target-Date Funds)

These automatically adjust your stock/bond mix as you age.

Example: Vanguard Target Retirement 2060 Fund (VTTSX)

In 2025 (when you’re young):

- 90% stocks (54% U.S., 36% international)

- 10% bonds

In 2060 (near retirement):

- 50% stocks

- 50% bonds

The fund automatically shifts from aggressive to conservative. You literally do nothing but invest.

Index Funds vs. Other Investments: What’s the Difference?

Index Funds vs. Individual Stocks

Individual Stocks:

- Own one company

- High risk (company could fail)

- Requires research

- Can outperform (or underperform) dramatically

Index Funds:

- Own hundreds/thousands of companies

- Market-level risk only

- No research needed

- Match market returns reliably

Bottom line: Individual stocks are for experienced investors willing to research and accept higher risk. Index funds are for everyone else.

Index Funds vs. Actively Managed Funds

Active Funds:

- Fund manager picks stocks

- High fees (0.5-2%)

- Trying to beat the market

- 90%+ fail over 15 years

Index Funds:

- Automatically owns index stocks

- Low fees (0.01-0.15%)

- Matches the market

- Guaranteed to match market (minus tiny fee)

Bottom line: Active funds cost more and perform worse. Index funds are the clear winner for most investors.

Index Funds vs. ETFs

This is a bit tricky because index funds can be structured as either mutual funds or ETFs (Exchange-Traded Funds).

Both can track the same index. For example:

- VOO (ETF) and VFIAX (Mutual Fund) both track the S&P 500

- Nearly identical performance

- Both are index funds, just different structures

Key differences:

- Mutual funds: Buy/sell once per day, can set up automatic investments easily

- ETFs: Trade all day like stocks, might have lower fees, often no minimum investment

How to Invest in Index Funds: Step-by-Step Guide

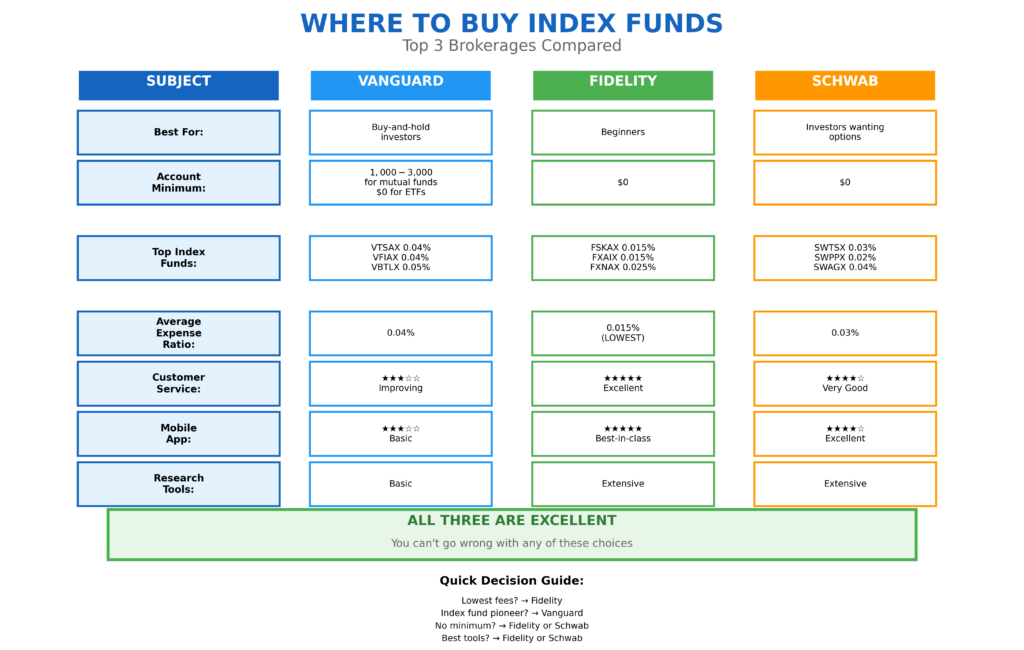

Step 1: Choose Where to Open Your Account

You need a brokerage account or retirement account (IRA, 401k).

Top brokerages for index fund investing:

- Inventor of index funds

- Lowest fees on Vanguard funds

- Best for: Buy-and-hold investors

- Minimum: Often $1,000-$3,000 for mutual funds

- Zero minimums on their index funds

- Excellent customer service

- Best for: Beginners

- Minimum: $0

- Low fees across the board

- Great research tools

- Best for: Investors who want options

- Minimum: $0 for most funds

Step 2: Decide What Index to Follow

Most beginners should start with one of these:

Option 1: Total U.S. Stock Market

- Covers the entire U.S. market

- Maximum diversification within the U.S.

- Fund examples: VTSAX, FSKAX, SWTSX

Option 2: S&P 500

- 500 largest U.S. companies

- Slightly less diversification but still excellent

- Fund examples: VFIAX, FXAIX, SWPPX

Option 3: Three-Fund Portfolio (for intermediate investors)

- 60% Total U.S. Stock Market

- 30% Total International Stock Market

- 10% Total Bond Market

- Gives you global diversification + stability

Internal link: [Learn the complete 3-Fund Portfolio strategy →]

Step 3: Buy Your First Index Fund

If using Fidelity:

- Log into your account

- Click “Trade”

- Search for “FSKAX” (Fidelity Total Market Index Fund)

- Enter amount to invest

- Select “Buy”

- Confirm

First-time investor tip: Start with whatever you can afford. Even $100 is a great start. You can always add more later.

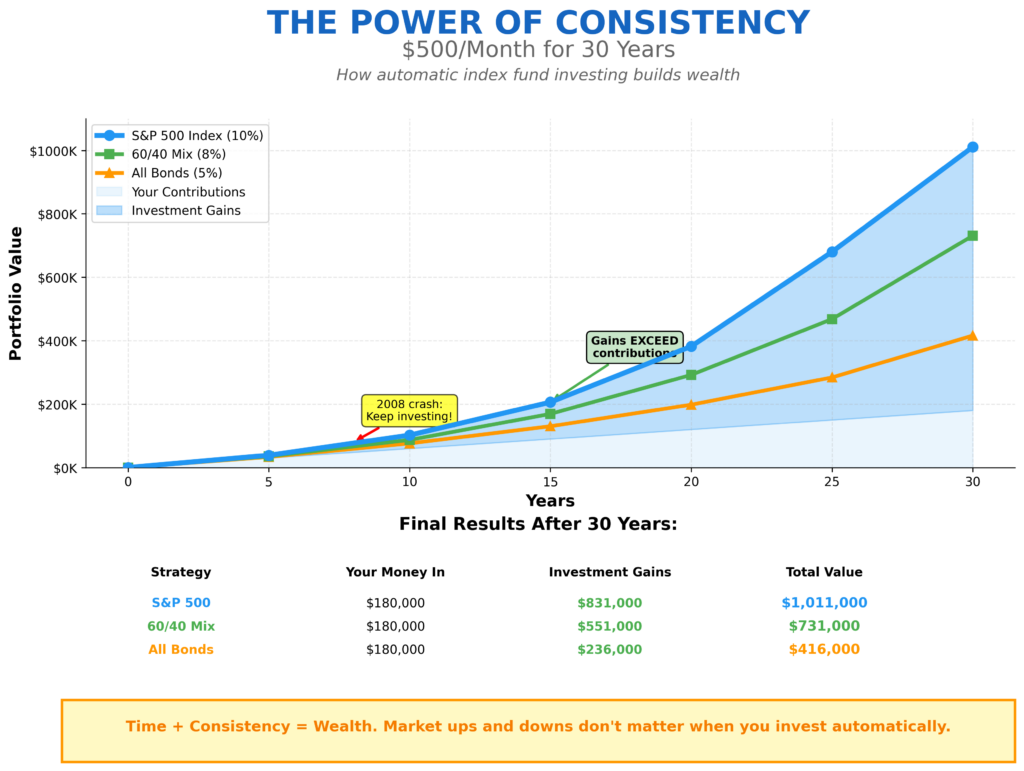

Step 4: Set Up Automatic Investments

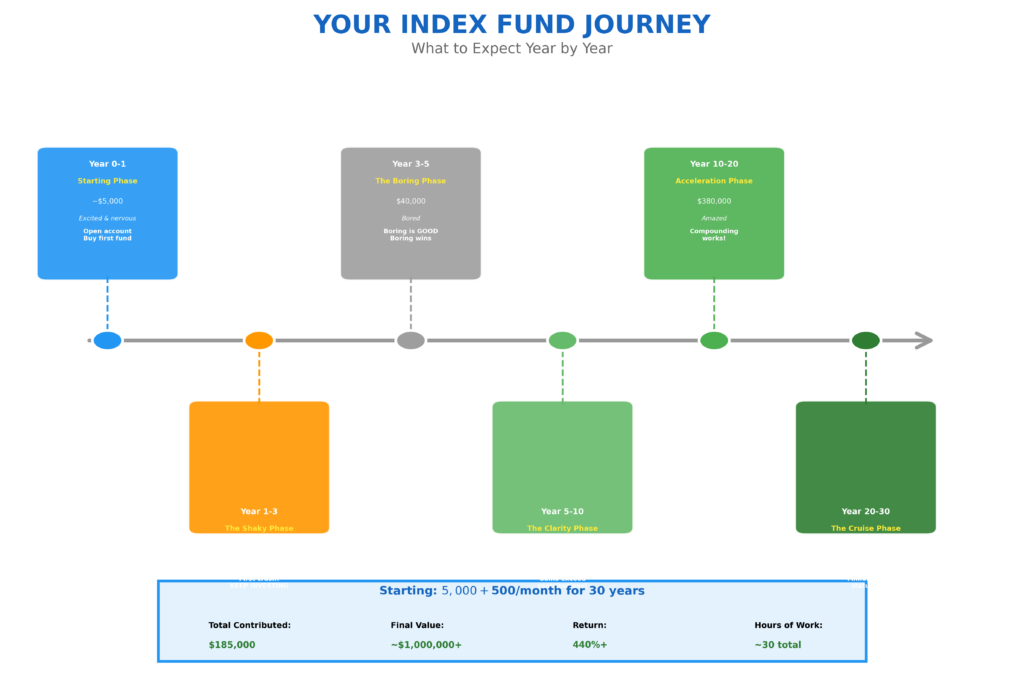

This is the secret weapon of successful index fund investors.

Set up automatic monthly transfers:

- $100/month = $1,200/year

- $500/month = $6,000/year

- Whatever you can afford

Why automatic?

- You can’t forget to invest

- Removes emotion from the decision

- Dollar-cost averaging (you buy more when prices are low, less when high)

- Forces consistent saving

Step 5: Ignore the Day-to-Day Noise

The hardest part of index fund investing is doing nothing.

Don’t check your account daily. The market fluctuates constantly. It doesn’t matter.

Check quarterly or annually. Rebalance if needed, but otherwise, let your money grow.

Keep investing through downturns. Market crashes are when you’re getting stocks on sale.

FAQ – “What is an Index Fund?”

1. “Can I lose money with index funds?”

Yes, in the short term. If the stock market drops 20%, your index fund will drop about 20%.

But historically, the market always recovers and reaches new highs.

- 1929 crash: Recovered

- 2000 dot-com bubble: Recovered

- 2008 financial crisis: Recovered

- 2020 COVID crash: Recovered in 6 months

The S&P 500’s worst 20-year period in history still returned +6.4% per year.

If you have 10+ years until you need the money, short-term drops don’t matter.

2. “Are index funds good for beginners?”

Absolutely – they’re perfect for beginners.

Why:

- Require zero investing knowledge

- Automatically diversified

- Low cost means fewer mistakes

- Set-and-forget approach

- Recommended by Warren Buffett himself

Many professional investors with decades of experience invest in index funds. If they’re good enough for pros, they’re definitely good enough for beginners.

3. “How much money do I need to start?”

It depends on the fund:

- Fidelity index funds: $0 minimum

- Schwab index funds: $0-$100 minimum

- Vanguard index funds: $1,000-$3,000 minimum for mutual funds, $0 for ETFs

Bottom line: You can start with as little as $10-$100 at most brokerages.

4. “What’s the difference between an index fund and the index it tracks?”

The index is just a list – like the S&P 500. You can’t invest directly in it.

The index fund is an actual investment product that owns all the stocks on that list. You invest in the fund, which owns the stocks.

Think of it this way:

- Index: Recipe

- Index fund: The actual meal made from that recipe

5. “Do index funds pay dividends?”

Yes. The companies in the index pay dividends, and the index fund passes those dividends to you.

For example:

- S&P 500 index funds typically yield 1.5-2% in annual dividends

- You can reinvest dividends automatically (recommended) or take them as cash

6. “Can I beat the market with individual stocks instead?”

Statistically, probably not – even professionals can’t.

The data is clear:

- 90%+ of professional fund managers fail to beat the market over 15+ years

- Individual investors do even worse (studies show 80-90% underperform)

The few who succeed often can’t repeat it. Beating the market consistently requires incredible skill, time, and often luck.

Why take the risk when index funds guarantee you’ll match the market?

7. “What happens if the index fund company goes bankrupt?”

Your investments are safe.

The stocks in the fund are held separately from the fund company’s assets. If Vanguard or Fidelity went bankrupt tomorrow (extremely unlikely), your shares would be transferred to another custodian.

You own the underlying stocks, not the fund company.

8. “How often should I check my index fund?”

Once per quarter at most – or even just annually.

Checking daily or weekly creates unnecessary stress and tempts you to make emotional decisions.

The best approach:

- Set up automatic monthly investments

- Review your portfolio 1-4 times per year

- Rebalance only if your allocation drifts significantly (more than 5%)

- Otherwise, ignore it completely

Warren Buffett checks his index fund investments maybe once a year. If it’s good enough for a billionaire, it’s good enough for you.

9. “Should I invest in one index fund or multiple?”

It depends on how simple you want to keep it.

One fund approach (easiest):

- Total Stock Market fund (like VTSAX)

- Gives you instant exposure to ~3,600 U.S. companies

- Perfect for beginners

- Set it and forget it

Three-fund approach (slightly more advanced):

- 60% Total U.S. Stock Market

- 30% Total International Stock Market

- 10% Total Bond Market

- Better global diversification

- Still very simple to manage

Bottom line: One fund is perfectly fine. Adding 2-3 funds gives you more diversification, but don’t overcomplicate it. More than 5 funds is usually unnecessary.

10. “What’s the difference between an index fund and a stock?”

A stock is ownership in ONE company. If you buy Apple stock, you own a tiny piece of Apple.

An index fund owns hundreds or thousands of stocks. When you buy one share of an S&P 500 index fund, you own a tiny piece of 500 companies.

Risk comparison:

- One stock: Company goes bankrupt → you lose 100%

- Index fund: One company goes bankrupt → you lose maybe 0.2%

Index funds are like buying an entire basket of eggs instead of putting all your money into one egg.

11. “Can I withdraw money from my index fund anytime?”

Yes, in most cases – but consider the tax implications.

In a regular brokerage account:

- Sell anytime during market hours

- Money available in 2-3 business days

- BUT: You’ll owe capital gains taxes on any profits

In a retirement account (IRA, 401k):

- Can sell anytime

- BUT: Withdrawals before age 59½ usually trigger penalties + taxes

- Exceptions exist (first home, education, etc.)

Best practice: Only invest money you won’t need for 5+ years. For short-term needs, keep money in a high-yield savings account instead.

12. “Do I need to rebalance my index funds?”

Yes, but not often – maybe once a year.

What is rebalancing?

Let’s say you want 70% stocks, 30% bonds. After a great year, stocks grow and now you have 80% stocks, 20% bonds.

Rebalancing means selling some stocks and buying bonds to get back to 70/30.

How often?

- Most people: Once per year

- Aggressive approach: Quarterly

- Lazy approach: Every 2-3 years, or when allocations drift 5%+

Easy method: Many brokerages offer automatic rebalancing. Turn it on and forget about it.

13. “Are index funds safe during a recession?”

No investment is “safe” during a recession, but index funds are as safe as stocks get.

What happens during recessions:

- Stock prices fall (sometimes 30-50%)

- Your index fund value drops accordingly

- This is temporary and normal

Historical truth:

- Every recession in history has ended

- Markets always recover to new highs

- The 2008 crash recovered fully in 4 years

- The 2020 COVID crash recovered in 6 months

What to do during a recession:

- DO: Keep investing (stocks are on sale!)

- DON’T: Panic and sell (locks in losses)

- REMEMBER: This is exactly what bonds in your portfolio are for—they cushion the fall

If you can’t handle seeing your account drop 30-40%, you probably have too much in stocks. Add more bonds for stability.

14. “What if I’m close to retirement – should I still use index funds?”

Absolutely yes – but shift to more conservative index funds.

Ages 50-60 (approaching retirement):

- 60% stock index funds

- 40% bond index funds

- Still growing, but with less volatility

Ages 60-70 (in early retirement):

- 40-50% stock index funds

- 50-60% bond index funds

- More stability, steady income from bonds

Ages 70+ (later retirement):

- 30-40% stock index funds

- 60-70% bond index funds

- Prioritizing capital preservation

The key: You still need stock index funds even in retirement because you might live 20-30 more years. You need growth to beat inflation.

Consider target-date funds: They automatically shift from aggressive to conservative as you age. Perfect for hands-off retirees.

15. “How long should I hold index funds?”

Ideally, forever – or at least 10+ years minimum.

Why long-term matters:

Holding period vs. probability of profit:

- 1 year: 75% chance of profit

- 5 years: 88% chance of profit

- 10 years: 94% chance of profit

- 20 years: 100% chance of profit (historically)

The S&P 500 has never had a negative 20-year period in history.

When to sell:

- You reach your financial goal (retirement, house down payment)

- You need to rebalance (selling winners to buy losers)

- You’re shifting to more conservative investments as you age

When NOT to sell:

- The market drops 20%

- You see scary news headlines

- Your co-worker tells you about a “hot stock”

- You’re worried about a recession

Remember: Time in the market beats timing the market. The longer you hold, the better your results.

The Bottom Line: Why Index Funds Win

Here’s what you need to remember:

Index funds are the closest thing to a “perfect” investment for most people.

They’re:

- ✅ Simple (buy one fund, own thousands of stocks)

- ✅ Cheap (fees as low as 0.015%)

- ✅ Diversified (instant protection against individual company risk)

- ✅ Proven (consistently beat 90% of professionals)

- ✅ Tax-efficient (low turnover = lower taxes)

- ✅ Hands-off (set up automatic investing and forget it)

“Warren Buffett’s advice:”

“A low-cost index fund is the most sensible equity investment for the great majority of investors. My mentor, Ben Graham, took this position many years ago, and everything I have seen since convinces me of its truth.”

The hardest part about index fund investing isn’t the strategy – it’s having the discipline to stick with it.

Don’t try to time the market. Don’t panic when stocks drop. Don’t chase hot stocks or funds.

Just keep buying, keep holding, and let compounding do its magic.

Your Next Steps

Ready to start investing in index funds?

- Choose a brokerage: Vanguard, Fidelity, or Schwab

- Open an account (IRA for retirement, or regular brokerage account)

- Buy your first index fund (Start with Total Stock Market or S&P 500)

- Set up automatic monthly investments

- Ignore the noise and stay the course

Want to go deeper?

- [Learn the 3-Fund Portfolio Strategy →]

- [ETF vs Mutual Fund: Which Should You Choose? →]

- [Asset Allocation by Age: How to Build Your Perfect Portfolio →]

The best time to start was yesterday. The second-best time is today.

Good luck with your future investments!

Didi Somm & Team

Keep Learning: Get Our Free Investing Resources

Download our Investing Basics Glossary, plus get weekly tips for beginner investors delivered to your inbox.

OUR TIP: We recommend you download the “SMART INVESTING GUIDE” from our homepage too!

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance