Warren Buffett, often called the “Oracle of Omaha,” has amassed a fortune exceeding $100 billion through disciplined application of value investing principles. His approach combines quantitative analysis with qualitative business assessment, creating a framework that has consistently outperformed the market over six decades.

In today’s increasingly volatile financial landscape, understanding Buffett’s toolkit offers investors a time-tested strategy for building wealth by using the same value investing tools while minimizing downside risk.

Key Takeaways

1. Intrinsic Value Calculation is the Foundation of Buffett’s Strategy

At the heart of Buffett’s approach lies the discipline of calculating a business’s intrinsic value—what it’s truly worth independent of market sentiment. Buffett famously uses discounted cash flow models but adjusts them based on the quality and predictability of future earnings.

For example, when Buffett invested $5 billion in Bank of America in 2011 during the financial crisis aftermath, his calculations showed the bank was trading at roughly 60% of its intrinsic value despite temporary challenges. This investment has since grown to over $30 billion, demonstrating how intrinsic value calculations, when properly applied, can identify extraordinary opportunities hidden in plain sight.

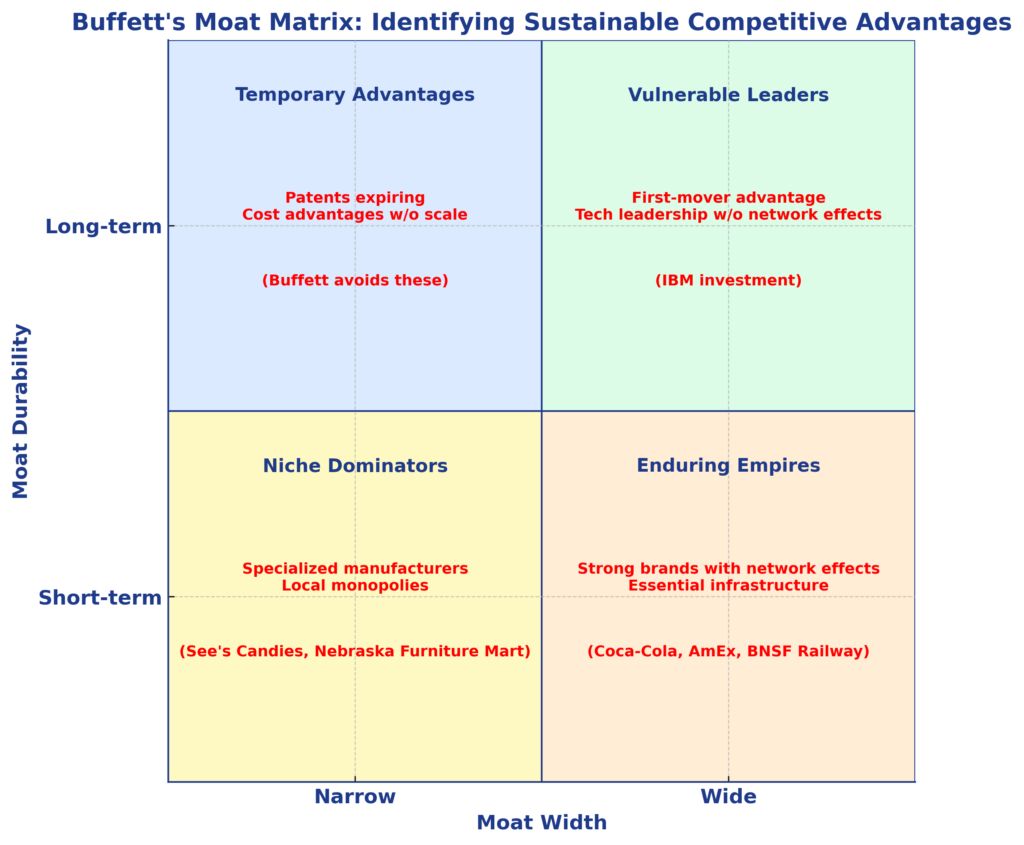

2. Economic Moats Protect Long-Term Competitive Advantage

Buffett prioritizes businesses with sustainable competitive advantages—what he calls “economic moats”—that protect them from competition and margin erosion.

Companies like Coca-Cola, which Buffett began acquiring in 1988, exemplify this principle with their globally recognized brand, distribution network, and pricing power. While competitors have launched countless cola products over decades, Coca-Cola’s moat has allowed it to maintain premium pricing and expand its market share.

For investors, identifying these moats (whether through brand power, switching costs, network effects, cost advantages, or scale) provides a critical filter that separates truly exceptional businesses from merely good ones.

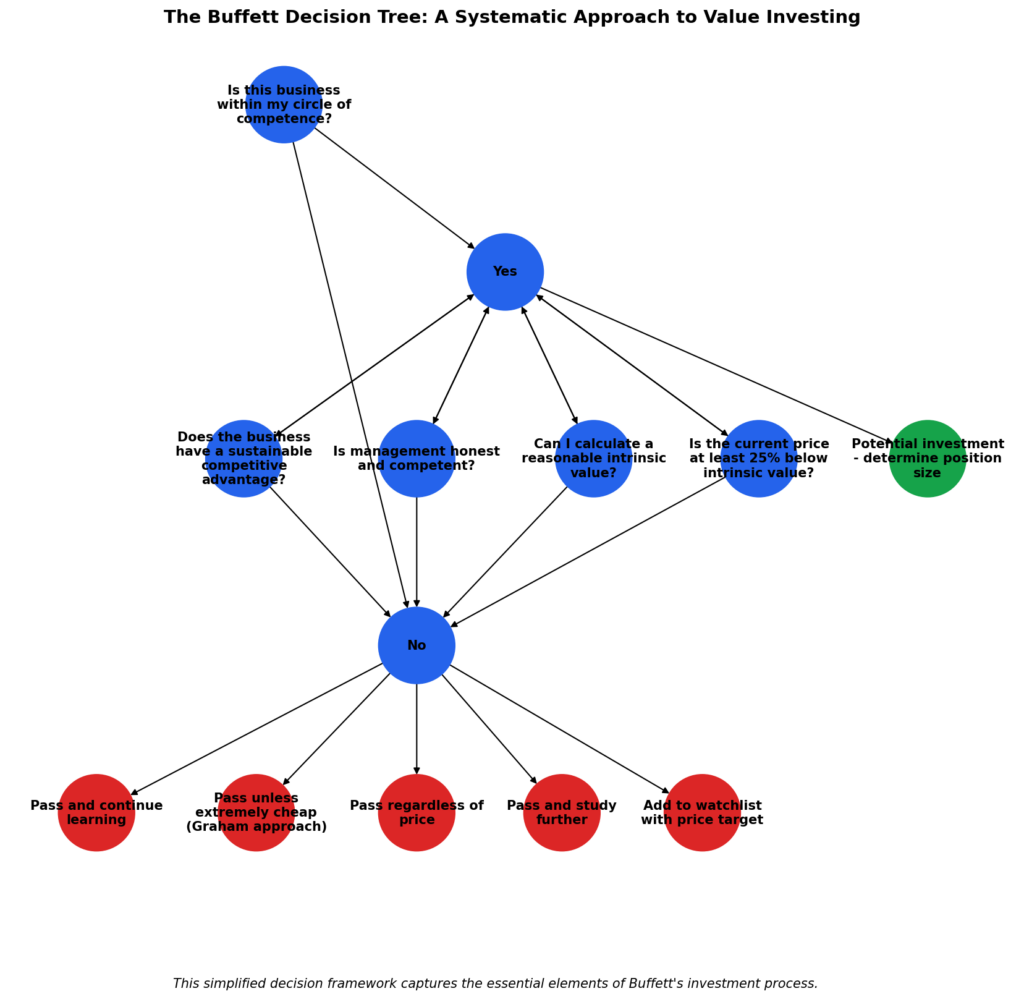

3. Circle of Competence Guides Investment Selection

Buffett’s discipline in staying within his “circle of competence”—investing only in businesses he thoroughly understands—has helped him avoid significant losses in sectors like technology where rapid change makes outcomes unpredictable.

During the 1990s tech boom, Buffett famously avoided internet stocks despite criticism that he was missing the “new economy,” a decision that preserved Berkshire’s capital when the bubble burst in 2000. This approach demonstrates that knowing what you don’t know is equally important as expertise.

Successful value investors systematically define their circles of competence, continuously expand them through deliberate learning, and exercise the discipline to stay within these boundaries even when tempted by seemingly lucrative but unfamiliar opportunities.

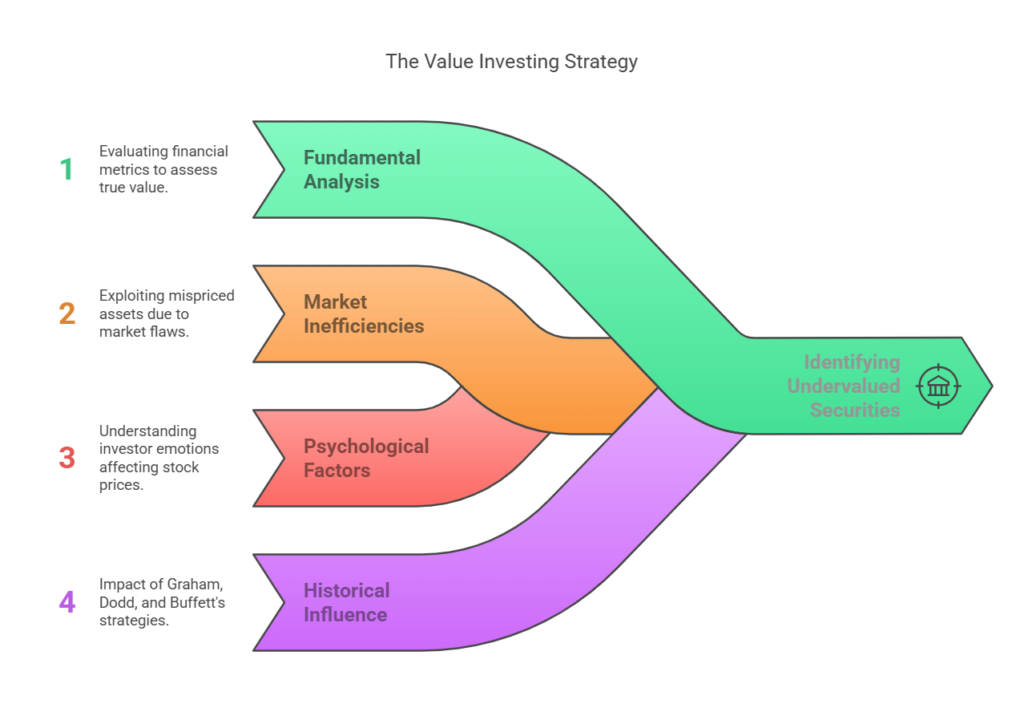

What is Value Investing?

Value investing is an investment strategy that involves selecting securities that appear underpriced based on fundamental analysis. Unlike growth investing, which focuses on companies with strong future growth prospects regardless of current valuation, value investing emphasizes buying securities that trade at a significant discount to their intrinsic value.

Developed primarily by Benjamin Graham and David Dodd at Columbia Business School in the 1920s, value investing was later popularized and refined by Warren Buffett, who studied under Graham. The philosophy centers on the principle that the market frequently misprices assets based on short-term thinking, emotional reactions, or incomplete analysis—creating opportunities for disciplined investors to purchase quality businesses at attractive prices.

Value investing represents a fundamental departure from the efficient market hypothesis, which suggests that stock prices already reflect all available information. Instead, value investors believe that psychological factors, institutional constraints, and various market inefficiencies create persistent pricing anomalies that can be exploited through rigorous analysis and patience.

Warren Buffett’s Value Investing Framework

The Evolution of Buffett’s Approach

Warren Buffett’s investing methodology has evolved significantly over his career, transitioning from Benjamin Graham’s strict “cigar butt” approach to a more qualitative style influenced by his partner Charlie Munger. This evolution can be broadly categorized into three distinct phases:

Phase 1: Pure Graham-Style Investing (1950s-1960s)

During this period, Buffett strictly adhered to Graham’s quantitative approach, seeking:

- Securities trading below working capital value

- Stocks with price-to-earnings ratios below 10

- Companies with strong dividend histories

- Businesses with price-to-book ratios less than 1.2

Phase 2: Transition Period (1960s-1970s)

As Buffett began managing larger sums through Berkshire Hathaway, he adjusted his strategy to:

- Focus more on business quality rather than just statistical cheapness

- Consider companies with sustainable competitive advantages

- Begin weighing qualitative factors alongside quantitative metrics

- Extend his investment time horizon from months to decades

Phase 3: Quality-Focused Value Investing (1980s-Present)

Buffett’s mature investment philosophy now emphasizes:

- Exceptional businesses with durable competitive advantages

- Companies with outstanding management teams

- Businesses with high returns on equity and low capital requirements

- Long-term holdings with minimal portfolio turnover

This evolution demonstrates Buffett’s intellectual flexibility and pragmatism, adapting his approach as circumstances changed while remaining fundamentally grounded in value principles.

Buffett’s First-Principle Tools

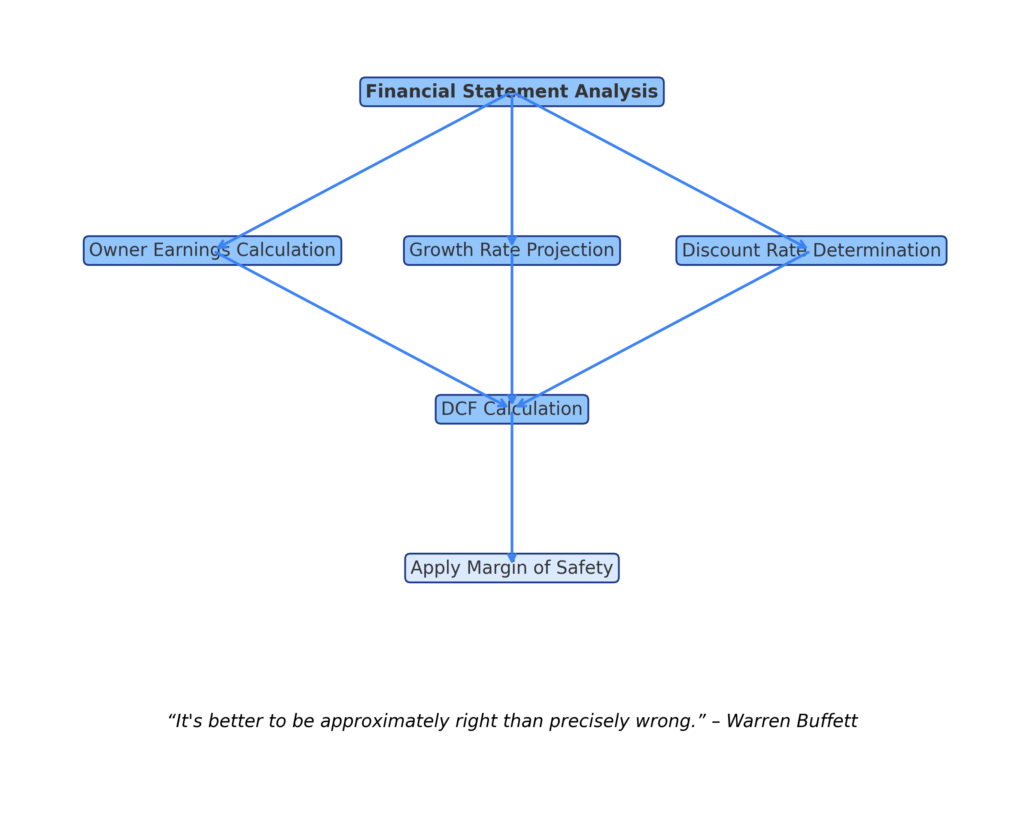

1. Intrinsic Value Calculation

At the heart of Buffett’s methodology lies the concept of intrinsic value—what a business is objectively worth based on its future cash-generating capabilities. Buffett defines intrinsic value as “the discounted value of the cash that can be taken out of a business during its remaining life.”

While many investors use discounted cash flow (DCF) models, Buffett’s approach to intrinsic value calculation includes several distinctive elements:

- Focus on Owner Earnings: Rather than reported earnings, Buffett focuses on “owner earnings”—essentially, cash that could be extracted from the business without impairing operations.

- Conservative Growth Assumptions: Unlike many analysts who project aggressive growth, Buffett typically uses modest, sustainable growth rates based on historical performance and competitive position.

- Quality-Adjusted Discount Rates: While standard DCF models might use a uniform discount rate, Buffett implicitly adjusts discount rates based on business quality, predictability, and management integrity.

- Margin of Safety Application: After calculating intrinsic value, Buffett requires a substantial discount (typically 25-50%) before purchasing, providing a buffer against analytical errors.

The formula for owner earnings that Buffett uses can be expressed as:

Owner Earnings = Net Income + Depreciation/Amortization – Maintenance Capital Expenditures

For companies with predictable earnings, Buffett sometimes uses a simplified approach:

Intrinsic Value = Current Earnings × (8.5 + 2 × Expected Growth Rate)

This formula, adapted from Graham, serves as a quick approximation for stable businesses, though Buffett typically performs more detailed analyses for major investments.

2. Economic Moat Analysis

Buffett places tremendous emphasis on identifying and evaluating economic moats—sustainable competitive advantages that protect a company’s profits from competition. He classifies moats into several categories:

Brand Power

Companies with strong brands can command premium prices and maintain customer loyalty. Buffett’s investments in Coca-Cola, American Express, and Apple exemplify this category. These businesses benefit from:

- Premium pricing ability

- Customer loyalty and repeat purchases

- Lower customer acquisition costs

- Resistance to competitive threats

Cost Advantages

Some businesses achieve structural cost advantages that allow them to either earn higher margins or offer lower prices than competitors. GEICO, a Berkshire subsidiary, exemplifies this advantage through its direct-to-consumer insurance model that eliminates agent commissions.

Switching Costs

When customers face significant costs (financial, time, or risk) to switch to a competitor, companies enjoy enhanced pricing power and customer retention. Operating systems, enterprise software, and certain financial services often benefit from this moat.

Network Effects

Businesses where the value to users increases as more people use the product or service can create powerful, self-reinforcing advantages. Visa and Mastercard in Buffett’s portfolio demonstrate this moat type.

Regulatory Advantages

Government licenses, patents, or regulatory frameworks can create legal barriers to entry. Utilities and railroads (like Berkshire’s BNSF Railway) often benefit from these advantages.

Buffett evaluates moats both qualitatively and quantitatively, looking for evidence in:

- Consistently high returns on capital over extended periods

- Pricing power that exceeds inflation

- Ability to maintain or expand market share despite competition

- Limited capital requirements to maintain competitive position

3. Circle of Competence Discipline

A cornerstone of Buffett’s investment philosophy is the strict adherence to his “circle of competence”—only investing in businesses and industries he thoroughly understands. This discipline has several components:

Defining the Circle

Buffett systematically assesses where he has:

- Industry knowledge and experience

- Ability to predict industry evolution over 10+ years

- Understanding of competitive dynamics and business models

- Capacity to evaluate management quality and capital allocation

Staying Within Boundaries

Even during market frenzies, Buffett maintains the discipline to:

- Avoid investments in trendy but unfamiliar sectors

- Pass on seemingly attractive opportunities outside his circle

- Remain inactive rather than make marginal investments

- Ignore pressure to diversify for diversification’s sake

Expanding the Circle

While maintaining discipline, Buffett continuously expands his circle through:

- Deliberate study of new industries and business models

- Learning from mistakes and investment experiences

- Consulting experts when exploring adjacent areas

- Reading extensively across business literature

Application to Investment Decisions

The circle of competence influences:

- Initial screening of investment opportunities

- Depth of due diligence performed

- Position sizing and concentration decisions

- Holding periods and exit decisions

Quantitative Tools in Buffett’s Arsenal

Financial Statement Analysis

Buffett conducts rigorous analysis of financial statements, focusing on several key areas:

Income Statement Analysis

- Revenue Quality: Examining the predictability, recurring nature, and organic growth of revenue

- Margin Trends: Analyzing gross, operating, and net margins over complete business cycles

- Expense Structure: Evaluating fixed vs. variable costs and operating leverage

- Non-Recurring Items: Identifying truly one-time expenses versus recurring “exceptional” charges

Balance Sheet Examination

- Debt Levels: Assessing total debt, debt-to-equity ratios, and interest coverage

- Asset Quality: Evaluating inventory, receivables turnover, and asset impairment risks

- Off-Balance Sheet Liabilities: Uncovering lease obligations, pension underfunding, and contingent liabilities

- Liquidity Position: Analyzing working capital, current ratio, and cash conversion cycle

Cash Flow Statement Focus

- Free Cash Flow Generation: Calculating cash left after maintaining current operations

- Capital Expenditure Requirements: Determining maintenance versus growth capex

- Working Capital Management: Examining cash tied up in inventory and receivables

- Cash Conversion Efficiency: Assessing how effectively earnings convert to cash flow

Key Financial Metrics Buffett Tracks

| Metric | Formula | Significance | Buffett’s Preference |

|---|---|---|---|

| Return on Equity | Net Income ÷ Shareholder Equity | Measures management’s efficiency using shareholder capital | >15% consistently |

| Return on Invested Capital | (Net Income – Dividends) ÷ (Debt + Equity) | Shows returns generated on all capital | Exceeds cost of capital by >6% |

| Gross Margin | Gross Profit ÷ Revenue | Indicates pricing power and production efficiency | Stable or improving |

| Operating Margin | Operating Income ÷ Revenue | Reflects operational efficiency | >15% with consistency |

| Debt-to-Equity | Total Debt ÷ Shareholder Equity | Measures financial leverage | <0.5 for most industries |

| Interest Coverage Ratio | EBIT ÷ Interest Expense | Shows ability to service debt | >5x minimum |

| Inventory Turnover | Cost of Goods Sold ÷ Average Inventory | Indicates inventory management efficiency | Industry-dependent |

| Free Cash Flow Yield | Free Cash Flow per Share ÷ Share Price | Relates cash generation to market value | >6% |

| Earnings Yield | Earnings per Share ÷ Share Price | Inverse of P/E ratio | Exceeds 10-year Treasury yield by >3% |

Valuation Metrics

While intrinsic value calculation forms the foundation of Buffett’s approach, he uses various valuation metrics as screening tools and reality checks:

Price-to-Earnings (P/E) Ratio

- Application: Buffett examines normalized P/E ratios based on average earnings over complete business cycles

- Adjustments: He makes adjustments for non-recurring items, accounting distortions, and inflation

- Interpretation: Rather than using absolute P/E thresholds, Buffett evaluates them relative to:

- The company’s historical range

- Industry peers

- Market averages

- Interest rates (using the “Fed Model”)

- The company’s growth rate (PEG ratio)

Price-to-Book (P/B) Ratio

- Application: While less emphasized than in his early career, Buffett still considers P/B for capital-intensive businesses

- Adjustments: He adjusts book value for:

- Inflation effects on long-term assets

- Intangible asset values not reflected on balance sheets

- Hidden liabilities or asset impairments

- Interpretation: Used primarily as a supplementary metric rather than a primary valuation tool

Enterprise Value Multiples

- EV/EBITDA: Used to evaluate businesses on a debt-neutral basis

- EV/EBIT: Preferred for businesses where depreciation represents actual economic cost

- EV/FCF: Emphasized for capital-light businesses with strong free cash flow

Dividend Metrics

- Dividend Yield: Considered in context of payout ratio and growth potential

- Dividend Growth Rate: Analyzed over complete business cycles

- Payout Ratio: Evaluated against reinvestment needs and opportunities

Industry-Specific Metrics

Buffett adapts valuation approaches based on industry characteristics:

- Insurance: Combined ratio, float cost, and investment leverage

- Banking: Net interest margin, efficiency ratio, and loan loss reserves

- Retail: Same-store sales growth, inventory turnover, and sales per square foot

- Manufacturing: Return on invested capital, capacity utilization, and gross margin

Qualitative Assessment Tools

Management Evaluation Framework

Buffett places extraordinary emphasis on management quality, using a systematic framework to evaluate leadership teams:

Capital Allocation Skills

- Reinvestment Decisions: Does management reinvest in high-ROIC projects or return capital to shareholders?

- Acquisition Track Record: Do acquisitions create value or destroy it through overpriced deals?

- Share Repurchase Discipline: Does management buy back shares only when they trade below intrinsic value?

- Dividend Policy: Is the dividend sustainable and appropriately balanced with growth investments?

Operational Excellence

- Margin Management: Does the company maintain or expand margins through operational improvements?

- Cost Discipline: Is there a culture of frugality and efficiency without compromising quality?

- Innovation Approach: Does the company innovate effectively without chasing fads or overspending on R&D?

- Crisis Management: How has management performed during industry downturns or company-specific challenges?

Integrity and Shareholder Orientation

- Accounting Practices: Does the company use conservative accounting or aggressive techniques that inflate results?

- Compensation Structure: Is executive pay reasonable and aligned with long-term shareholder interests?

- Transparency: Does management communicate openly about challenges and mistakes, not just successes?

- Insider Ownership: Do executives have meaningful ownership stakes, indicating alignment with shareholders?

Succession Planning

- Leadership Depth: Is there a strong bench of potential future leaders?

- Institutional Knowledge: Are systems in place to preserve the company’s culture and knowledge?

- Transition Management: How have previous leadership transitions been handled?

Assessment Methods

Buffett gathers management intelligence through:

- Annual Report Analysis: Particularly the CEO’s letter for candor and comprehensiveness

- Earnings Call Behavior: Noting how executives respond to challenging questions

- Track Record Evaluation: Comparing promises to actual performance over multiple years

- Industry Reputation: Consulting with industry contacts about management’s standing

- Personal Interaction: Directly meeting executives when possible to assess character

Business Model Analysis

Buffett systematically evaluates business models using several structured frameworks:

Economics and Cash Generation

- Capital Intensity: Does the business require substantial ongoing capital investment?

- Working Capital Requirements: How much cash is tied up in inventory and receivables?

- Pricing Power: Can the company raise prices without losing significant volume?

- Revenue Predictability: Are revenues recurring, contractual, or subscription-based?

- Cost Structure: What is the balance between fixed and variable costs?

Competitive Position Assessment

- Industry Growth Trajectory: Is the overall industry growing, stable, or declining?

- Consolidation Trends: Is the industry fragmented or concentrated?

- Threat of Substitutes: Could new technologies or alternatives displace the product?

- Supplier Power: Does the company depend on powerful suppliers that can capture margin?

- Customer Concentration: Does the business rely on a few large customers?

Adaptability and Disruption Risk

- Technology Vulnerability: Is the business model at risk from technological change?

- Regulatory Exposure: Could regulatory changes fundamentally alter the economics?

- Global Competitiveness: Can the business withstand international competition?

- Adaptation History: Has the company successfully navigated previous industry shifts?

Scalability and Reinvestment Opportunities

- Addressable Market Size: How large is the potential market the company can serve?

- Organic Growth Runways: Can the company expand geographically or into adjacent markets?

- Reinvestment ROIC: What returns does the business generate on incremental capital?

- Diminishing Returns Risk: Does growth come with declining marginal returns?

Risk Assessment Tools

Buffett’s approach to risk differs substantially from modern portfolio theory, focusing on business fundamentals rather than price volatility:

Margin of Safety Calculation

- Valuation Conservatism: Purchasing at 60-70% of calculated intrinsic value

- Scenario Analysis: Evaluating business performance under pessimistic assumptions

- Stress Testing: Assessing how the business would perform during severe downturns

Durability Analysis

- Financial Resilience: Evaluating ability to withstand prolonged challenges

- Customer Dependence: Analyzing vulnerability to customer losses

- Competitive Durability: Assessing moat strength against determined competition

- Technological Obsolescence: Evaluating vulnerability to technological shifts

Black Swan Identification

- Low-Probability Catastrophes: Identifying rare but devastating risks

- Correlational Risks: Finding hidden connections between seemingly unrelated factors

- Systemic Vulnerabilities: Assessing exposure to financial system risks

Business-Specific Risk Frameworks

Buffett adapts risk analysis based on industry characteristics:

- Insurance: Catastrophe exposure, reserve adequacy, and reinsurance quality

- Banking: Credit quality, interest rate sensitivity, and liquidity risks

- Manufacturing: Supply chain resilience, input cost volatility, and product liability

- Retail: Fashion risk, inventory obsolescence, and changing consumer preferences

Types of Value Investing Approaches

While Buffett’s approach represents one prominent style of value investing, the discipline encompasses several distinct methodologies, each with unique characteristics:

1. Deep Value/Net-Net Investing

This approach most closely resembles Benjamin Graham’s original methodology:

Key Characteristics:

- Focuses primarily on statistical cheapness rather than business quality

- Seeks companies trading below liquidation value or net current asset value

- Often involves troubled companies facing temporary challenges

- Typically involves shorter holding periods than quality-focused approaches

Metrics Emphasized:

- Price-to-Book Ratio: Typically seeking P/B < 0.7

- Net Current Asset Value per Share (NCAVPS): Preferring stocks trading below NCAVPS

- Enterprise Value to Fixed Assets: Looking for companies trading near tangible asset value

- Debt-to-Equity: Focusing on companies with limited leverage

Advantages:

- Provides a substantial margin of safety through asset backing

- Performs well during market recoveries after crashes

- Requires less business forecasting ability

- Can work well with a diversified basket approach

Disadvantages:

- May involve troubled businesses with deteriorating fundamentals

- Often comes with significant headline risk and volatility

- Requires substantial emotional discipline

- Performance tends to be cyclical and uneven

Notable Practitioners:

- Seth Klarman (Baupost Group)

- Walter Schloss (Walter & Edwin Schloss Associates)

- Early-career Warren Buffett (1950s)

2. Quality Value Investing

This represents Buffett’s mature approach and that of many contemporary value investors:

Key Characteristics:

- Emphasizes business quality and competitive advantage

- Focuses on companies with high returns on invested capital

- Typically involves long holding periods (often 10+ years)

- Places significant emphasis on management quality and capital allocation

Metrics Emphasized:

- Return on Invested Capital (ROIC): Seeking consistent ROIC > 15%

- Free Cash Flow Yield: Looking for FCF yields exceeding risk-free rates by 5%+

- Earnings Yield: Comparing to corporate bond yields of similar quality

- Earnings Growth Stability: Preferring consistent growth over volatile performance

Advantages:

- Businesses typically compound value over time

- Less vulnerable to permanent capital loss

- Companies often have pricing power to withstand inflation

- Approach tends to perform well in various market environments

Disadvantages:

- Quality businesses rarely trade at deep discounts

- Requires accurate assessment of competitive advantages

- More vulnerable to disruption risk

- Can underperform during sharp market rebounds

Notable Practitioners:

- Warren Buffett (1980s-present)

- Charlie Munger (Daily Journal)

- Tom Gayner (Markel Corporation)

- Terry Smith (Fundsmith)

3. Special Situations/Event-Driven Value

This approach focuses on specific corporate events or circumstances creating temporary mispricings:

Key Characteristics:

- Targets companies undergoing restructurings, spinoffs, or major changes

- Often involves complex situations requiring specialized analysis

- Typically features shorter holding periods tied to event timelines

- Returns depend more on specific events than market movements

Typical Situations:

- Corporate Spinoffs: When subsidiaries are separated from parent companies

- Post-Bankruptcy Reorganizations: Companies emerging from bankruptcy protection

- Merger Arbitrage: Capturing spreads between acquisition announcement and completion

- Activist Situations: When activist investors force change to unlock value

Advantages:

- Returns typically have low correlation to broader markets

- Catalysts can accelerate value realization

- Less dependent on favorable market conditions

- Creates opportunities in all market environments

Disadvantages:

- Requires specialized knowledge and experience

- May involve complex financial structures

- Can face unexpected delays or deal failures

- Often involves concentrated positions with binary outcomes

Notable Practitioners:

- Joel Greenblatt (Gotham Capital)

- Seth Klarman (Baupost Group)

- John Paulson (Paulson & Co.)

- Daniel Loeb (Third Point)

4. Contrarian Value Investing

This approach specifically targets out-of-favor sectors and industries:

Key Characteristics:

- Focuses on industries experiencing cyclical or secular challenges

- Often involves buying during periods of extreme pessimism

- Typically requires longer holding periods to allow for sentiment shifts

- Places heavy emphasis on mean reversion principles

Metrics Emphasized:

- Cyclically-Adjusted P/E (CAPE): Looking at earnings across full business cycles

- Price-to-Peak-Earnings: Comparing current price to previous cycle peak earnings

- Enterprise Value to Replacement Cost: Seeking businesses trading below cost to rebuild

- Price-to-Tangible Book Value: Emphasizing hard asset backing

Advantages:

- Can purchase quality assets at substantial discounts

- Often features limited downside due to already-pessimistic expectations

- May benefit from sentiment shifts as well as fundamental improvement

- Provides natural diversification away from popular market segments

Disadvantages:

- Often involves “catching falling knives” with continued near-term declines

- Industries may face secular rather than cyclical challenges

- Recovery timelines can extend far longer than expected

- Requires substantial emotional discipline and conviction

Notable Practitioners:

- David Dreman (Dreman Value Management)

- John Neff (Wellington Management)

- Bruce Berkowitz (Fairholme Fund)

- Bill Miller (Miller Value Partners)

5. Quantitative Value Investing

This approach uses systematic screening and algorithms to identify value opportunities:

Key Characteristics:

- Relies on quantitative screening to identify potential investments

- Typically involves larger portfolios with systematic position sizing

- Often combines multiple value factors in composite models

- Emphasizes statistical edge across a large sample of stocks

Factors Commonly Used:

- Earnings Yield: Focusing on high earnings relative to price

- EBITDA/EV: Emphasizing operating earnings to enterprise value

- Free Cash Flow Yield: Targeting strong cash generation relative to price

- Shareholder Yield: Combining dividends and share repurchases

Advantages:

- Eliminates behavioral biases from the investment process

- Allows efficient analysis of thousands of potential investments

- Provides statistical edge through diversification

- Maintains consistent factor exposure through market cycles

Disadvantages:

- Lacks qualitative assessment of business models and management

- May miss accounting red flags or one-time factors

- Often lacks catalyst identification for value realization

- Can experience extended periods of underperformance

Notable Practitioners:

- James O’Shaughnessy (O’Shaughnessy Asset Management)

- Joseph Piotroski (Developer of F-Score)

- Joel Greenblatt’s later work (Magic Formula)

- Tobias Carlisle (Acquirers Funds)

Benefits of Value Investing

1. Downside Protection Through Margin of Safety

Value investing’s emphasis on purchasing securities significantly below their intrinsic value creates a built-in cushion against errors, market declines, and negative business developments:

Empirical Evidence of Downside Protection:

- During the 2000-2002 bear market, value stocks (as measured by the Russell 1000 Value Index) declined 30.9% compared to 72.7% for growth stocks (Russell 1000 Growth).

- In the 2008 financial crisis, Berkshire Hathaway’s book value declined 9.6% compared to the S&P 500’s 37% drop.

- According to a Bank of America/Merrill Lynch study, from 1926-2016, value stocks experienced 20% less volatility than growth stocks.

Psychological Benefits:

- Lower drawdowns help investors maintain discipline during market stress

- Reduced volatility facilitates rational decision-making

- Confidence from fundamental backing enables contrarian positioning

Real-World Application: For instance, when Buffett purchased GEICO in 1996, he paid approximately 1.6 times book value for a company historically growing book value at 15%+ annually. When auto insurance underwriting cycles later turned negative, this valuation cushion helped Berkshire withstand temporary earnings pressure while competitors struggled.

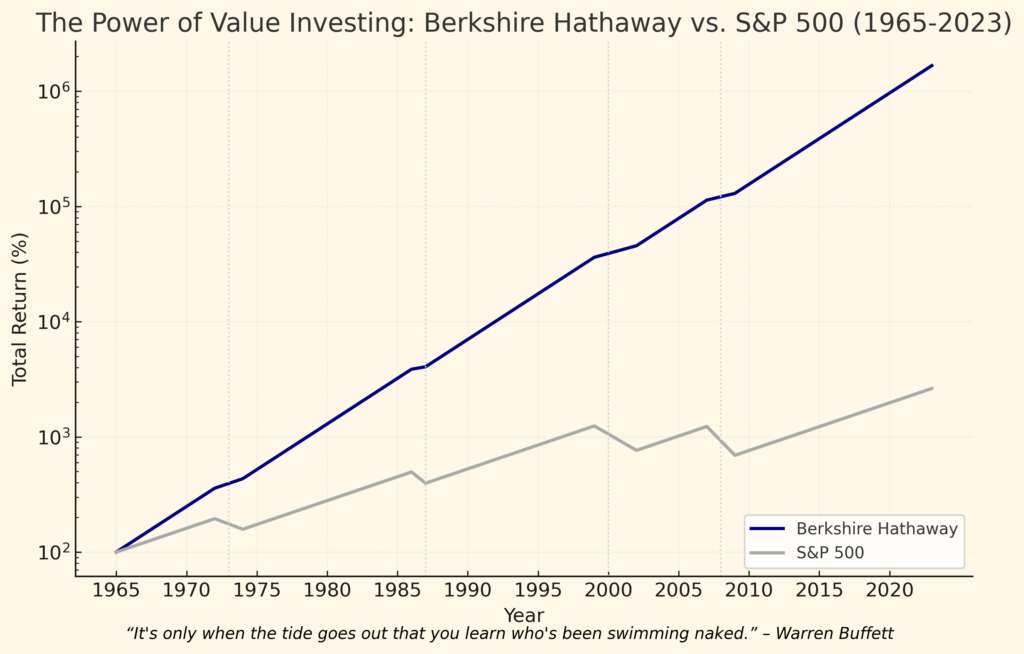

2. Superior Long-Term Returns

Despite periods of underperformance, value investing has historically generated superior long-term returns:

Historical Performance Data:

- From 1926-2020, according to Fama and French data, value stocks outperformed growth stocks by approximately 3.1% annually.

- Buffett’s Berkshire Hathaway has delivered 20%+ compound annual returns over 56 years, significantly outpacing the S&P 500’s roughly 10% return.

- A dollar invested in 1965 following Buffett’s approach would have grown to over $28,000 by 2023, compared to approximately $230 for the S&P 500 (including dividend reinvestment).

Sources of Outperformance:

- Behavioral Exploitation: Value investing capitalizes on market overreaction to negative news

- Operational Improvement: Value investments often benefit from mean reversion in business performance

- Reinvestment at Higher Rates: Lower initial valuations allow dividend reinvestment at more favorable prices

- Compounding at Higher Yields: Higher earnings yields translate to stronger long-term compounding

Sector-Specific Outperformance:

| Sector | Value vs. Growth Annual Outperformance (1957-2020) |

|---|---|

| Financials | +4.7% |

| Consumer Staples | +3.9% |

| Industrials | +3.5% |

| Energy | +3.3% |

| Healthcare | +2.8% |

| Technology | +1.9% |

3. Inflation Protection

Value investing, particularly Buffett’s approach focusing on businesses with pricing power, provides natural inflation protection:

Inflation-Resistant Characteristics:

- Business Quality Focus: Companies with strong competitive positions can raise prices during inflationary periods

- Low Valuation Multiples: Starting valuations for value stocks are typically less vulnerable to multiple compression from rising rates

- Tangible Asset Backing: Many value investments have significant physical assets that appreciate with inflation

- Lower Duration: Value stocks typically have more near-term cash flows compared to growth stocks, reducing duration risk

Historical Performance During Inflationary Periods:

| Period | Inflation Rate | Value Stock Returns | Growth Stock Returns |

|---|---|---|---|

| 1973-1974 | 12.1% | -21.3% | -40.5% |

| 1977-1981 | 10.5% | +87.6% | +56.2% |

| 1987-1990 | 5.2% | +41.2% | +33.8% |

| 2003-2007 | 3.1% | +94.5% | +81.2% |

Buffett’s Inflation Resilience Strategy: Buffett has specifically sought businesses with:

- Pricing power exceeding input cost inflation

- Limited capital reinvestment needs

- Strong brand value that maintains real value during inflation

- Ability to expand during inflationary periods when competitors struggle

4. Behavioral Advantage

Value investing’s structured analytical framework helps investors overcome common behavioral biases:

Psychological Biases Addressed:

- Recency Bias: Value framework counters tendency to extrapolate recent trends

- Loss Aversion: Margin of safety principle helps manage fear of loss

- Herding Behavior: Contrarian positioning prevents following crowds into overvalued assets

- Overconfidence: Explicit margin of safety acknowledges analysis limitations

- Anchoring: Intrinsic value focus prevents anchoring to recent price movements

Decision-Making Improvements:

- Systematic Process: Reduces emotional decision-making during market stress

- Clear Buy/Sell Criteria: Provides objective framework for action

- Long-Term Orientation: Extends time horizons beyond typical market myopia

- Intellectual Humility: Recognizes and accounts for analytical limitations

Real-World Impact: During the 2008-2009 financial crisis, Buffett’s disciplined approach enabled him to purchase preferred stock in Goldman Sachs and Bank of America with 10% dividend yields plus valuable equity warrants—terms unavailable to investors without his analytical discipline and cash reserves.

5. Tax Efficiency

Value investing approaches, particularly Buffett’s quality-focused long-term holding strategy, create natural tax advantages:

Tax Efficiency Mechanisms:

- Low Turnover: Reduced trading frequency minimizes realized capital gains

- Long-Term Holding Periods: Qualify for lower long-term capital gains rates

- Dividend Efficiency: Focus on earnings retention over high dividend payouts

- Qualified Dividend Income: Many value stocks pay qualified dividends taxed at lower rates

Quantified Tax Benefits:

- According to Morningstar data, the average turnover for value mutual funds is 60% compared to 105% for growth funds, resulting in approximately 42% lower tax drag.

- Buffett’s approach of indefinite holding periods has allowed Berkshire to defer billions in capital gains taxes, effectively receiving interest-free loans from the government.

Tax-Optimized Value Strategies:

- Harvesting losses while maintaining overall value exposure

- Strategic lot selection when partial positions must be sold

- Utilizing exchange funds to diversify concentrated positions without triggering taxes

- Charitable giving of appreciated securities to eliminate capital gains liability

Challenges and Risks of Value Investing

1. Extended Underperformance Periods

Value investing has historically experienced prolonged periods of underperformance:

Historical Underperformance Cycles:

- 1998-2000: During the dot-com bubble, value underperformed growth by 37 percentage points

- 2017-2020: Value strategies lagged growth by approximately 76 percentage points cumulatively

- Average Cycle Length: Typical underperformance cycles last 32-40 months, but can extend longer

Causes of Performance Droughts:

- Interest Rate Environments: Prolonged low interest rates extend growth stock multiples

- Technological Disruption: Rapid technological change can undermine traditional valuation methods

- Industrial Evolution: Traditional value sectors (energy, materials, industrials) facing structural challenges

- Momentum Persistence: Self-reinforcing market trends that extend beyond fundamental justification

Psychological Challenges:

- Career Risk: Professional investors face institutional pressure during underperformance

- Self-Doubt: Extended underperformance tests conviction in methodology

- Peer Comparison: Social reinforcement as peers abandon value principles

- Strategy Drift: Temptation to modify approach during difficult periods

Buffett’s Approach to Performance Droughts: Buffett has addressed underperformance periods by:

- Maintaining consistent communication with shareholders about investment philosophy

- Using market downturns to deploy capital aggressively

- Focusing on absolute returns rather than relative performance

- Extending evaluation timeframes beyond typical institutional windows

2. Value Traps

Value traps—companies that appear statistically cheap but face fundamental structural decline—represent a significant risk:

Identifying Characteristics of Value Traps:

- Deteriorating revenue trends beyond cyclical patterns

- Margin erosion not explained by temporary factors

- Declining returns on invested capital over multiple years

- Consistently missing management forecasts and guidance

- Rising debt levels to maintain operations or dividends

- Increasing competitive threats without effective response

- Technological disruption of core business models

Famous Value Trap Examples:

- Kodak: Traded at seemingly attractive valuations of 5-7x earnings during its decline as digital photography replaced film

- Blockbuster: Featured low P/E ratios and strong cash flow before streaming decimated its business model

- Traditional Retailers: Many traded at 6-8x earnings while Amazon fundamentally changed consumer behavior

- Newspaper Publishers: Appeared statistically cheap but faced irreversible advertising migration to digital platforms

Avoidance Strategies:

- Differentiating between cyclical and secular challenges through industry analysis

- Examining capital expenditure trends relative to depreciation

- Analyzing debt structure and refinancing risks

- Evaluating competitive position using Porter’s Five Forces

- Stress-testing business models against technological disruption scenarios

3. Analytical Complexity

Value investing requires substantial analytical skills and business judgment:

Key Analytical Challenges:

- Accounting Interpretation: Identifying conservative vs. aggressive accounting practices

- Industry Knowledge Requirements: Understanding competitive dynamics and industry evolution

- Capital Allocation Assessment: Evaluating management’s use of cash flow and capital

- Moat Durability Estimation: Determining sustainability of competitive advantages

- Terminal Value Uncertainty: Projecting long-term business trajectories

Skill Development Requirements:

- Financial Statement Analysis: Understanding interconnections between income statement, balance sheet, and cash flow

- Accounting Forensics: Identifying red flags and earnings management

- Business Model Assessment: Evaluating how companies create and capture value

- Competitive Analysis: Understanding industry structure and dynamics

- Management Evaluation: Assessing leadership quality and integrity

Buffett’s Approach to Analytical Complexity:

- Staying within his circle of competence where his analytical edge is strongest

- Focusing on businesses with predictable economics

- Avoiding companies requiring complex valuation models

- Compensating for complexity with larger margins of safety

- Continuously developing analytical skills through extensive reading

4. Psychological Demands

Value investing places extraordinary demands on psychological discipline:

Key Psychological Challenges:

- Contrarian Positioning: Buying what others are selling and avoiding popular investments

- Patience Requirements: Tolerating extended periods without positive feedback

- Decision-Making Under Uncertainty: Making high-stakes decisions with incomplete information

- Conviction Maintenance: Sustaining belief in analysis despite market disagreement

- Fear Management: Controlling fear during market panics when opportunity is greatest

Behavioral Hurdles:

- Herd Mentality: Natural human tendency to follow group behavior

- Confirmation Bias: Seeking information that confirms existing beliefs

- Recency Bias: Overweighting recent events in decision-making

- Loss Aversion: Feeling losses more acutely than equivalent gains

- Action Bias: Preference for activity over appropriate inaction

Buffett’s Psychological Discipline Framework:

- Operating from Omaha, physically removed from Wall Street groupthink

- Structuring Berkshire to minimize external pressure for short-term results

- Cultivating a partnership with Charlie Munger focused on rational decision-making

- Developing consistent decision-making frameworks to apply during market stress

- Extensive study of psychological biases and cognitive errors

5. Changing Market Structure

Evolving market structures pose challenges to traditional value approaches:

Structural Market Shifts:

- Passive Investment Growth: Index funds now control over 45% of U.S. equity assets, potentially reducing individual stock inefficiencies

- Algorithmic Trading Dominance: Algorithms execute over 70% of U.S. equity trading volume

- Private Equity Competition: Over $2.5 trillion in private equity dry powder competing for value opportunities

- Declining Public Company Count: The number of publicly traded U.S. companies has fallen from over 8,000 in 1996 to approximately 4,000 today

Implications for Value Investors:

- Efficiency Changes: Markets may be more efficient for widely-followed large-caps but less efficient in smaller or complex situations

- Time Horizon Shifts: Shorter holding periods by institutional investors may create more short-term volatility

- Information Advantage Reduction: Widespread availability of financial data has reduced traditional information edges

- New Value Domains: Value opportunities shifting to complex situations, special assets, and private markets

Adaptation Strategies:

- Expanding analytical scope to include intangible assets and intellectual property

- Developing expertise in alternative data analysis beyond traditional financial statements

- Extending research to global markets with less institutional coverage

- Focusing on special situations where algorithmic approaches struggle

- Expanding time horizons to capitalize on institutional constraints

Implementing Buffett’s Value Approach

Building Your Value Investing Framework

Developing a robust value investing framework involves several interconnected steps:

1. Establishing Your Circle of Competence

The foundation of successful value investing begins with clearly defining your areas of expertise:

Industry Knowledge Assessment:

- Professional Experience: Industries where you have worked or consulted

- Educational Background: Sectors related to your formal education

- Personal Interests: Areas where you have deep personal interest and knowledge

- Network Connections: Industries where you have strong professional networks

Knowledge Depth Evaluation:

- Competitive Dynamics Understanding: Can you name the top 5-10 players and their positions?

- Business Model Clarity: Can you explain how companies in the sector make money?

- Disruption Awareness: Can you identify potential disruptive threats?

- Financial Structure Knowledge: Do you understand industry-specific financial metrics?

Circle Expansion Strategy:

- Begin with 2-3 industries where your knowledge is strongest

- Systematically expand through deliberate study of adjacent sectors

- Develop expertise in one new area annually through focused reading

- Leverage professional networks to accelerate learning curves

Documentation Process:

- Maintain a written statement of your circle of competence

- Review and update quarterly based on new knowledge

- Create industry-specific checklists for consistent analysis

- Document lessons learned from both successful and unsuccessful investments

2. Developing Screening Systems

Efficient screening processes help identify promising value candidates from thousands of possibilities:

Quantitative Screening Parameters:

- Valuation Metrics: P/E < 15, P/B < 1.5, EV/EBITDA < 8

- Financial Strength Indicators: Debt-to-EBITDA < 3, Interest coverage > 4x

- Quality Markers: ROE > 15%, Operating margin > 15%, FCF conversion > 85%

- Growth Factors: 5-year revenue CAGR > 5%, EPS growth > inflation + 3%

Qualitative Overlay Filters:

- Competitive Position: Evidence of sustainable competitive advantages

- Management Quality: Insider ownership > 5%, sensible capital allocation history

- Business Predictability: Limited earnings volatility, recurring revenue > 60%

- Industry Dynamics: Growing or stable industry, rational competitive landscape

Screening Tool Options:

- Free Resources: Finviz, GuruFocus (limited), Morningstar Stock Screener

- Paid Services: ValueLine, Factset, Bloomberg, S&P Capital IQ

- Custom Spreadsheets: Self-built Excel models with imported financial data

- Quantitative Platforms: AAII Stock Investor Pro, Portfolio123, Zacks Research System

Implementation Process:

- Run broad initial screens quarterly to identify candidate universes

- Apply progressively stricter criteria to narrow candidates

- Maintain a watchlist of 50-100 companies for ongoing monitoring

- Set automated alerts for significant price movements or news

3. Creating Analytical Templates

Structured analytical templates ensure consistent, thorough analysis of investment candidates:

Financial Analysis Components:

- Historical Performance Tracking: 10-year revenue, margins, and returns on capital

- Financial Health Assessment: Liquidity ratios, debt structure, and coverage metrics

- Cash Flow Quality Evaluation: FCF conversion rates, working capital trends

- Capital Allocation Analysis: ROIC on new investments, buyback and dividend history

Business Quality Assessment Elements:

- Competitive Position Mapping: Market share trends, pricing power evidence

- Moat Identification Checklist: Brand value, switching costs, network effects, cost advantages, scale

- Management Evaluation Framework: Capital allocation track record, compensation structure, insider ownership

- Industry Dynamics Analysis: Porter’s Five Forces application, disruption vulnerability, regulatory factors

Intrinsic Value Calculation Methods:

- DCF Model Template: With conservative growth and margin assumptions

- Multiple-Based Valuation: Using normalized earnings and historically justified multiples

- Sum-of-the-Parts Analysis: For conglomerates or complex businesses

- Asset-Based Valuation: For asset-heavy businesses or special situations

Template Examples:

| Template Type | Key Components | Best Used For |

|---|---|---|

| Quick Analysis | One-page overview with key metrics and basic business description | Initial screening phase |

| Comprehensive Analysis | 10-15 page deep dive including full financial modeling | Final investment decisions |

| Industry Template | Sector-specific metrics and competitive landscape | Comparative analysis |

| Management Assessment | Capital allocation history, compensation structure, insider dealings | Evaluating leadership quality |

4. Building Information Sources

Developing reliable information sources creates analytical advantages:

Financial Information Sources:

- SEC Filings: 10-Ks, 10-Qs, proxy statements, 8-Ks for material events

- Earnings Call Transcripts: Available through company IR sites or services like Seeking Alpha

- Industry Trade Publications: Sector-specific news and analysis

- Specialized Data Services: Capital IQ, Bloomberg, FactSet, Thomson Reuters

Management Assessment Resources:

- Shareholder Letters: Annual communications revealing management thinking

- Conference Presentations: Often more candid than formal financial communications

- Industry Conference Transcripts: Discussions with competitors and customers

- Former Employee Interviews: Found through networking or specialized services

Competitive Analysis Information:

- Customer Reviews and Feedback: Available through various online platforms

- Industry Association Reports: Macro trends and competitive landscapes

- Supplier Interviews and Information: Value chain insights

- Regulatory Filings and Proceedings: Government interactions and compliance issues

Analytical Workflow Integration:

- Create systematic information collection processes

- Develop templates for consistent note-taking

- Build a searchable database of company and industry information

- Establish regular review schedules for key information sources

Practice and Skill Development

Developing value investing capabilities requires deliberate practice and ongoing learning:

1. Paper Portfolio Implementation

Before committing significant capital, develop and test your approach with a paper portfolio:

Setup Process:

- Select 10-15 companies across 3-5 industries within your circle of competence

- Document thorough investment theses for each position

- Allocate virtual capital based on conviction and margin of safety

- Set specific review intervals (weekly, monthly, quarterly)

Tracking Methodology:

- Create a spreadsheet recording entry prices, position sizes, and investment rationales

- Document news events, earnings reports, and other significant developments

- Recalculate intrinsic value estimates quarterly

- Track performance against relevant benchmarks

Performance Analysis:

- Conduct detailed reviews of both successful and unsuccessful selections

- Identify patterns in decision-making and analytical processes

- Document lessons learned in an investment journal

- Refine screening criteria and analytical templates based on results

Common Learning Opportunities:

- Determining appropriate position sizing based on conviction

- Managing behavioral responses to price volatility

- Identifying when thesis violations require position exits

- Distinguishing between normal business fluctuations and fundamental changes

2. Continuous Learning Resources

Value investing mastery requires ongoing education through various resources:

Essential Reading:

- Books: “The Intelligent Investor” (Graham), “Warren Buffett’s Shareholder Letters,” “Quality of Earnings” (O’Glove)

- Academic Research: Papers from the Journal of Finance and Financial Analysts Journal on value investing factors

- Investment Letters: Communications from successful value investors like Seth Klarman, Howard Marks, etc.

- Specialized Publications: Value Investor Insight, Outstanding Investor Digest, Manual of Ideas

Learning Communities:

- Value Investing Conferences: Berkshire Hathaway Annual Meeting, Value Investing Congress

- Online Forums: Value Investors Club, Corner of Berkshire & Fairfax, Reddit’s r/SecurityAnalysis

- Local Investment Clubs: Groups focused on fundamental analysis

- Professional Organizations: CFA Institute local chapters, AAII chapters

Structured Education:

- Academic Programs: Columbia Business School’s Value Investing Program

- Professional Certifications: CFA curriculum, particularly Level II equity analysis

- Online Courses: MOOCs through platforms like Coursera, specialized investing courses

- Workshops and Seminars: Industry-specific deep dives, financial modeling training

Case Study Learning:

- Study Buffett’s major investment decisions in detail

- Analyze both successful and unsuccessful value investments by prominent practitioners

- Conduct post-mortems on your own investment decisions

- Review SEC filings from periods preceding major corporate developments

3. Developing Psychological Discipline

Cultivation of appropriate temperament may be more important than analytical prowess:

Self-Awareness Development:

- Maintain a decision journal documenting emotional states during investment decisions

- Record predictions with confidence levels to calibrate forecasting abilities

- Identify personal biases through psychological self-assessment tools

- Track periods of maximum emotional stress to recognize behavioral vulnerabilities

Discipline-Building Practices:

- Implement mandatory cooling-off periods before major investment decisions

- Develop pre-commitment devices like investment checklists and threshold criteria

- Practice deliberate thesis invalidation by seeking contradictory evidence

- Establish systematic review periods disconnected from market movements

Stress Management Techniques:

- Develop routines for high-stress market periods

- Maintain physical health through exercise and adequate sleep

- Practice meditation or mindfulness to enhance decision clarity

- Create support networks of like-minded investors for perspective

Financial Planning Integration:

- Ensure personal financial stability to reduce pressure during market declines

- Maintain adequate liquidity to capitalize on severe market dislocations

- Develop realistic return expectations to avoid undue risk-taking

- Structure overall portfolio to match personal risk tolerance

Future Trends in Value Investing

The value investing landscape continues to evolve in response to market changes, technological developments, and shifting economic conditions:

1. Integration of Quantitative and Traditional Value Approaches

The line between quantitative and traditional value approaches is increasingly blurring:

Emerging “Quantamental” Strategies:

- Combining fundamental analysis with systematic factor implementation

- Using machine learning to enhance traditional screening processes

- Applying natural language processing to extract insights from financial filings

- Integrating alternative data into traditional valuation frameworks

Data Advantages for Modern Value Investors:

- Business Quality Metrics: Quantifying competitive advantages through alternative data

- Management Assessment: Using NLP to evaluate management communication consistency

- Customer Sentiment Analysis: Leveraging social media and review data for brand strength

- Operational Efficiency Insights: Using satellite imagery, logistics data, and other non-traditional sources

Implementation Challenges:

- Distinguishing signal from noise in expanding data universes

- Avoiding overfitting and data mining pitfalls

- Developing cross-disciplinary teams with both financial and data science expertise

- Balancing quantitative efficiency with fundamental judgment

Likely Evolution Path: Value investing will likely maintain its fundamental principles while enhancing implementation through data-driven approaches, creating more efficient identification of opportunities while preserving the core focus on business quality and margin of safety.

2. Private Market Expansion

As public markets become more efficient and the number of public companies declines, value investors are increasingly exploring private markets:

Emerging Private Market Opportunities:

- Small Business Acquisitions: Applying value principles to purchasing private businesses

- Search Funds: Investment vehicles focused on acquiring and operating a single private company

- Special Purpose Acquisition Vehicles: Partnerships formed to acquire specific private companies

- Secondaries: Purchasing existing stakes in private equity or venture capital funds

Advantages for Value Investors:

- Inefficiency Premium: Less competition and information availability create pricing anomalies

- Control Opportunities: Ability to directly influence operations and capital allocation

- Longer Time Horizons: Freedom from quarterly reporting pressures

- Multiple Expansion Potential: Opportunity to improve operations and eventually sell at higher multiples

Implementation Challenges:

- Developing networks for deal flow

- Building operational expertise for direct ownership

- Navigating illiquidity and capital concentration issues

- Conducting due diligence with limited information availability

Buffett’s Private Market Evolution: Buffett’s journey from public market investor to acquirer of entire businesses demonstrates this evolution, with Berkshire now owning over 60 private businesses outright in addition to its public market portfolio.

3. Evolution of Value Factors

Traditional value metrics are evolving to accommodate changing business models and economic structures:

Shifting Emphasis in Value Metrics:

- Intangible Asset Valuation: Increasing focus on intellectual property, brands, and networks

- Cash Flow Emphasis: Greater weight on free cash flow vs. earnings or book value

- Return on Invested Capital: Focus on capital efficiency rather than absolute cheapness

- Total Shareholder Return: Including buybacks alongside dividends in yield calculations

New Value Factors Emerging:

- Research & Development Productivity: Measuring efficiency of R&D spending relative to innovation output

- Customer Metrics: Retention rates, lifetime value, and acquisition costs

- Organizational Culture Quality: Employee satisfaction, innovation capacity, and adaptability

- Environmental and Social Impact: Resource efficiency, waste reduction, and stakeholder relationships

Adaptation to Knowledge Economy:

- Adjusting book value calculations to account for unrecorded intangible assets

- Developing new moat metrics for platform and network-based businesses

- Incorporating data assets and intellectual property into valuation models

- Assessing organizational learning capacity and knowledge development

Statistical Evidence of Factor Evolution: Analysis from Research Affiliates shows traditional value metrics (P/B, P/E) have declining predictive power while newer metrics (EV/EBITDA, FCF yield) show stronger predictive value across more recent periods (2000-2020).

4. Global Value Opportunities

As developed markets become more efficient, value investors are exploring global markets for opportunities:

Emerging Market Value Characteristics:

- Information Inefficiencies: Less analyst coverage creates mispricing opportunities

- Corporate Governance Evolution: Improvements creating value catalysts

- Market Structure Advantages: Lower institutional ownership reduces short-term pressures

- Valuation Disparities: Significant discounts for similar business models compared to developed markets

Regions with Attractive Value Characteristics:

- Asia ex-Japan: Strong growth combined with conservative financial cultures

- Eastern Europe: Established industrial bases with EU market access at lower valuations

- Latin America: Natural resource strength with improving governance

- Frontier Markets: Early-stage development opportunities with minimal institutional coverage

Implementation Challenges:

- Navigating different accounting standards and disclosure requirements

- Understanding cultural and business practice differences

- Managing currency and political risks

- Developing local knowledge networks and information sources

Global Value Success Factors:

- Building regional expertise through focused study and networks

- Developing specialized accounting knowledge for different reporting standards

- Creating cross-border analytical frameworks while maintaining local context sensitivity

- Implementing appropriate risk management for currency and political exposures

5. Integration of Sustainability Factors

Value investing is increasingly incorporating sustainability considerations into analysis:

Value-Relevant ESG Integration:

- Risk Mitigation Focus: Identifying environmental and social risks affecting long-term business viability

- Competitive Advantage Assessment: Evaluating sustainability as a source of competitive differentiation

- Capital Efficiency Lens: Measuring resource utilization efficiency and waste reduction

- Regulatory Positioning: Assessing preparedness for evolving regulatory environments

Material Sustainability Factors by Sector:

| Sector | Key Sustainability Value Factors |

|---|---|

| Energy | Climate transition readiness, methane management, water usage |

| Materials | Circular economy adaptation, toxic emission reduction, labor relations |

| Industrials | Product lifecycle design, supply chain resilience, safety performance |

| Consumer | Brand alignment with values, packaging innovation, supply chain transparency |

| Healthcare | Drug pricing practices, clinical trial ethics, healthcare access strategies |

| Financials | Climate risk exposure, financial inclusion, data security |

| Technology | Privacy practices, energy efficiency, circular product design |

Implementation Approaches:

- Integrating material sustainability metrics into valuation models

- Incorporating governance quality assessment into management evaluation

- Developing industry-specific sustainability risk frameworks

- Creating engagement strategies to improve sustainability performance

Buffett’s Evolving Perspective: While historically focused primarily on traditional business metrics, Berkshire has increasingly acknowledged sustainability factors through:

- Significant investments in renewable energy infrastructure

- Focus on insurance risks related to climate change

- Emphasis on corporate culture and business ethics in acquisition decisions

- Recognition of changing consumer preferences toward sustainable products

FAQs – Value Investing Tools

1. What is the difference between Buffett’s approach to value investing and Benjamin Graham’s original methodology?

Benjamin Graham’s approach emphasized statistical cheapness and diversification. He sought companies trading below liquidation value, advocated holding 30+ positions, and focused primarily on quantitative metrics like P/B ratios and current assets minus all liabilities.

In contrast, Buffett evolved toward quality-focused value investing, concentrating on fewer exceptional businesses with sustainable competitive advantages. While Graham sought a margin of safety through balance sheet strength, Buffett finds it in business quality, competitive moats, and excellent management.

Graham typically held investments for 2-3 years until they reached fair value, while Buffett often holds indefinitely, famously stating his favorite holding period is “forever.”

2. How does Buffett calculate intrinsic value?

Buffett defines intrinsic value as “the discounted value of the cash that can be taken out of a business during its remaining life.” While he doesn’t publicly share his exact calculation methodology, his approach includes:

- Focusing on “owner earnings” (net income + depreciation/amortization – maintenance capital expenditures)

- Projecting these earnings over 10+ years using conservative growth assumptions

- Applying appropriate discount rates based on business quality and predictability

- Adding excess assets not required for operations

- Incorporating qualitative factors like management quality and competitive position

Rather than seeking precision, Buffett aims to be “approximately right rather than precisely wrong,” often using multiple valuation methods as cross-checks.

3. What are the Key Components of an “Economic Moat” according to Buffett?

Buffett identifies several distinct types of economic moats that protect businesses from competition:

- Brand Value: Companies with strong brands that command premium prices (Coca-Cola, Apple)

- Network Effects: Businesses that become more valuable as more people use them (Visa, Mastercard)

- Switching Costs: Products or services that are difficult or expensive to switch from (operating systems, financial services)

- Cost Advantages: Structural advantages that allow lower costs than competitors (GEICO’s direct-to-consumer model)

- Scale Advantages: Benefits from being the largest player in a market (Walmart’s purchasing power)

- Regulatory Advantages: Government licenses or approvals creating barriers to entry (railroads, utilities)

The strongest businesses often combine multiple moat types, creating reinforcing competitive advantages.

4. How does Buffett assess management quality?

Buffett evaluates management across several key dimensions:

- Capital Allocation Skills: How effectively they deploy cash flow for acquisitions, dividends, buybacks, or reinvestment

- Operational Excellence: Their ability to consistently improve margins and efficiency

- Integrity: Whether they communicate honestly about both successes and failures

- Owner Orientation: If they think and act like business owners rather than hired managers

- Strategic Vision: Their ability to anticipate industry changes and position the company accordingly

- Succession Planning: Whether they develop leadership talent for the company’s future

Buffett assesses these qualities through annual report analysis (particularly CEO letters), financial track records, compensation structures, and direct interactions when possible.

He places special emphasis on integrity, stating: “In looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if they don’t have the first, the other two will kill you.”

5. What is meant by “margin of safety” in Buffett’s investment approach?

The margin of safety concept, originated by Benjamin Graham and embraced by Buffett, involves purchasing securities at a significant discount to their intrinsic value to provide protection against analytical errors, unforeseen problems, or bad luck. For Buffett, this typically means:

- Paying no more than 70-75% of calculated intrinsic value

- Building in conservative assumptions for growth, margins, and competition

- Requiring stronger margins of safety for businesses with less predictable futures

- Creating additional safety through business quality and competitive advantages

The margin of safety serves as the bridge between investment analysis and risk management, with Buffett noting: “Risk comes from not knowing what you’re doing.” By thoroughly understanding businesses and requiring discounted prices, he addresses both analytical and market risks simultaneously.

6. How does Buffett’s approach to diversification differ from conventional investment advice?

While conventional investment wisdom suggests broad diversification (often 30+ holdings), Buffett practices focused investing with several key differences:

- He typically holds 15-25 major positions rather than dozens of stocks

- His top 5-6 positions often constitute 60-70% of his public equity portfolio

- He famously stated that “diversification is protection against ignorance”

- He views diversification as “deworsification” when it leads to investing in mediocre businesses

Instead of numerical diversification, Buffett focuses on:

- Understanding businesses deeply within his circle of competence

- Requiring larger margins of safety for more concentrated positions

- Diversifying across business models and economic sensitivities

- Ensuring each investment has its own merit rather than serving portfolio statistics

This concentrated approach has been key to Berkshire’s outperformance, allowing his best ideas to meaningfully impact overall returns.

7. What role does macroeconomic analysis play in Buffett’s investment decisions?

Buffett maintains a notably limited focus on macroeconomic factors, stating: “If Federal Reserve Chairman Alan Greenspan were to whisper to me what his monetary policy was going to be over the next two years, it wouldn’t change one thing I do.” His approach to macroeconomics involves:

- Avoiding prediction of interest rates, GDP growth, or market directions

- Focusing instead on business-level decisions within his control

- Seeking businesses that can thrive across different economic environments

- Maintaining a perpetual focus on inflation protection through businesses with pricing power

Rather than timing markets based on economic forecasts, Buffett concentrates on paying reasonable prices for quality businesses that can weather various economic conditions. He summarizes this approach with the famous quote: “Be fearful when others are greedy, and greedy when others are fearful.”

8. How does Buffett approach technological change and disruption risks?

Buffett has historically approached technology with caution, famously avoiding tech investments during the dot-com bubble while acknowledging his limited understanding of the sector. His approach to technological disruption includes:

- Staying primarily within his “circle of competence” in more stable industries

- Seeking businesses with demonstrable resistance to technological obsolescence

- Requiring larger margins of safety for industries facing potential disruption

- Gradually expanding his technology knowledge, leading to significant Apple investments in recent years

Buffett looks for what he calls “inevitable”, i.e. businesses that will almost certainly be more valuable in the future regardless of technological change.

When he does venture into tech, as with IBM and later Apple, he focuses on customer entrenchment and ecosystem advantages rather than trying to predict specific technological developments.

9. What is Buffett’s approach to market timing and cash deployment?

Contrary to conventional investment approaches that maintain relatively consistent equity allocations, Buffett varies his cash positions dramatically based on opportunity availability:

- He has held cash positions ranging from under 10% to over 35% of Berkshire’s assets

- He avoids market timing based on macroeconomic predictions or technical factors

- Instead, cash allocation is driven by the availability of individual opportunities meeting his criteria

- He patiently waits for ideal conditions, sometimes for years, before deploying significant capital

During market panics, Buffett becomes aggressive, as demonstrated during the 2008 financial crisis when he invested billions in Goldman Sachs, Bank of America, and other opportunities.

His patience during bull markets and aggression during crises exemplify his famous advice to “be fearful when others are greedy, and greedy when others are fearful.”

10. How has Buffett adapted his approach over time to changing market conditions?

Buffett’s investment approach has evolved significantly over his 70+ year career:

- Early Phase (1950s-1960s): Followed Graham’s strict quantitative approach seeking statistical cheapness

- Middle Phase (1970s-1980s): Shifted toward quality businesses at fair prices, influenced by Charlie Munger

- Mature Phase (1990s-Present): Focused on exceptional businesses with strong moats, even at fuller valuations

Key adaptations have included:

- Expanding from purely domestic to global investments

- Moving from public markets to entire business acquisitions

- Evolving from balance sheet metrics toward intangible advantages

- Increasing emphasis on management quality and corporate culture

- Growing appreciation for technology-enabled competitive advantages

Despite these evolutions, his core principles remain unchanged: focus on intrinsic value, demand a margin of safety, and invest within his circle of competence. This balance of adaptation and consistency has been crucial to his long-term success.

Conclusion

Warren Buffett’s value investing approach represents one of the most successful investment methodologies ever developed, producing extraordinary returns over more than six decades. While markets have evolved dramatically since Buffett began investing in the 1950s, the fundamental principles underlying his approach remain as relevant as ever in today’s financial landscape.

At its core, Buffett’s methodology combines quantitative rigor with qualitative business assessment, creating a comprehensive framework for identifying exceptional businesses trading below their intrinsic value. His focus on sustainable competitive advantages, management quality, and long-term economic fundamentals provides a powerful counterbalance to the short-term thinking that dominates much of the investment world.

By emphasizing margin of safety and disciplined analysis within defined areas of competence, Buffett’s approach creates structural advantages that have proven durable across market cycles and economic conditions.

Looking ahead, value investing faces both challenges and opportunities. Evolving market structures, technological disruption, and changing business models require thoughtful adaptation of traditional value metrics and analytical frameworks. However, the core principles, i.e. focusing on intrinsic value, requiring a margin of safety, and maintaining psychological discipline, provide a timeless foundation for investment success.

As Buffett himself has demonstrated throughout his career, those who can balance principled consistency with thoughtful adaptation position themselves for superior long-term results.

For today’s investors, Buffett’s approach offers more than just a set of analytical tools; it provides a comprehensive investment philosophy grounded in business fundamentals, rational analysis, and psychological discipline. By studying and implementing these principles as well as applying these value investing tools, investors can develop not only more effective portfolios but also a more rational and rewarding relationship with markets and investment decisions.

In a financial world increasingly dominated by algorithms, short-term thinking, and market noise, Buffett’s methodical, business-focused approach remains a beacon for those seeking sustainable investment success.

For your reference, recently published articles include:

-

- Passive Income Strategies: How To Go To $10K In 12 Months

- Investment Research Platforms That Give You the Edge: Institutional Tools for Exceptional Returns

- Alternative Data Analytics: All You Need To Know About Wall Street’s Best-Kept Secret

- Outperform 90% Of Investors: Best Advice On Investment Benchmarking Tools

- Trading Fee Comparison: Your 2025 Guide to Commission-Free Platforms

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.