Backtesting trading strategies is the sophisticated process of applying historical market data to evaluate the viability of specific trading approaches before risking actual capital.

In today’s volatile financial markets, where algorithmic trading dominates and competition intensifies daily, robust trading strategy backtesting has become the critical differentiator between professional traders who consistently generate profits and amateurs who struggle with market uncertainties.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Welcome to “Finance & Investments” by Didi Somm!

Important Notice: The information in this article is for general and public information purposes only. It solely reflects the opinion of Didi Somm or his staff, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.

Key Takeaways

- Statistical validity requires sufficient data volume – Professional backtesting demands analysis across multiple market cycles and conditions; Goldman Sachs’ quantitative trading division typically requires a minimum of 10 years of historical data and 250+ trades in a backtest to consider a strategy statistically significant.

- Overfitting presents a serious risk to backtesting reliability – The Renaissance Technologies Medallion Fund, delivering 66% annual returns before fees since 1988, rigorously tests strategies across out-of-sample data periods to prevent curve-fitting bias; their methodology includes randomized Monte Carlo simulations that deliberately inject noise to stress-test strategy robustness.

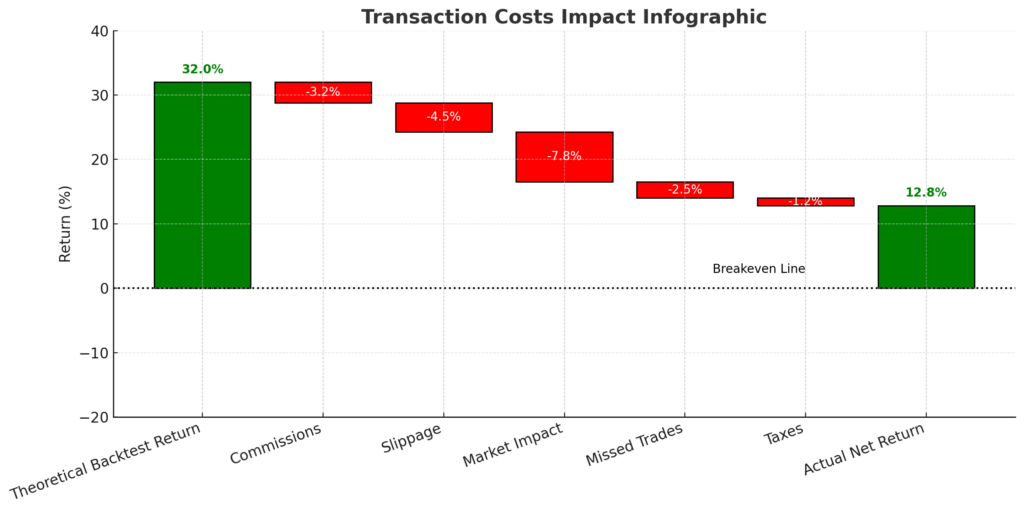

- Implementation costs often destroy theoretical backtested returns – A 2023 study by the CFA Institute found that 68% of retail trading strategies that showed positive backtest results failed to generate profits in live trading, primarily due to underestimating transaction costs, slippage, and market impact; successful traders typically discount backtested returns by 30-50% when estimating real-world performance.

Table of Contents

What is Trading Strategy Backtesting?

Backtesting is the methodical process of evaluating a trading strategy by processing historical data to determine how that strategy would have performed if it had been employed during the period being analyzed. This approach allows traders to objectively assess a strategy’s viability without risking actual capital, establishing performance metrics that help predict future success.

At its core, backtesting operates on a simple premise: strategies that performed well historically may continue to perform well in the future, assuming market conditions remain relatively consistent. However, professional traders understand this is a considerable assumption that requires rigorous validation through various techniques.

Modern backtesting typically employs sophisticated software that simulates trade execution based on historical price data and predefined rules. These platforms range from basic spreadsheet applications to advanced programming environments like Python with libraries such as Pandas, NumPy, and specialized backtesting frameworks including Backtrader and Zipline.

The fundamental components of a professional backtest include:

- Historical data (price, volume, and other relevant market information)

- Strategy rules (entry signals, exit signals, position sizing)

- Risk management parameters (stop-loss levels, maximum drawdown limits)

- Transaction cost models (commissions, slippage, market impact)

- Performance metrics (return metrics, risk-adjusted measures, drawdown analysis)

Professional traders distinguish themselves by the comprehensiveness of their backtesting approach, often incorporating advanced features such as walk-forward optimization, Monte Carlo simulations, and sensitivity analysis to validate strategy robustness.

Types of Backtesting Methodologies

Historical Backtesting

Historical backtesting represents the most common approach, where traders apply their strategy rules to past market data to simulate trades and analyze results. This methodology can be further subdivided:

Simple Backtesting: Applies trading rules directly to historical data without adjustments for market impact or execution realities.

Event-Driven Backtesting: Triggers trades based on specific market events or conditions that match predefined criteria, more closely simulating how discretionary traders make decisions.

Vector-Based Backtesting: Processes entire arrays of data simultaneously rather than sequentially, offering significant computation advantages for large datasets but potentially overlooking path-dependent aspects of strategy execution.

Walk-Forward Analysis

Walk-forward analysis represents a more sophisticated approach that addresses the risk of overfitting by:

- Dividing historical data into multiple periods

- Optimizing strategy parameters on an initial “in-sample” period

- Testing those optimized parameters on subsequent “out-of-sample” periods

- Rolling this process forward through the entire dataset

This methodology better simulates how strategies would perform in actual trading, as parameters are only optimized using data that would have been available at each point in time.

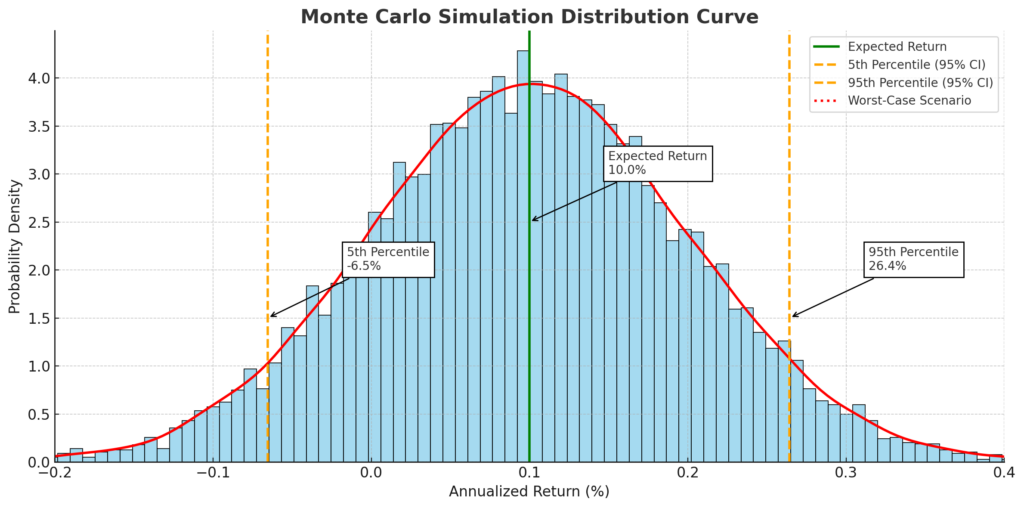

Monte Carlo Simulation

Monte Carlo simulation employs randomization techniques to generate thousands of possible future performance scenarios based on a strategy’s historical characteristics. This approach:

- Randomizes the order of historical trades to test path dependency

- Introduces statistical noise to test strategy robustness

- Provides probability distributions of outcomes rather than single-point estimates

- Helps quantify the role of luck versus skill in historical performance

| Backtesting Method | Pros | Cons | Typical Use Case |

|---|---|---|---|

| Historical Backtesting | Simple to implement; Intuitive results | Prone to overfitting; Limited to available historical data | Initial strategy screening; Educational purposes |

| Walk-Forward Analysis | Reduces overfitting risk; Better simulates real trading | Computationally intensive; Requires more data | Serious strategy development; Professional trading |

| Monte Carlo Simulation | Quantifies probability distributions; Tests robustness | Complex to implement properly; Difficult to interpret | Risk assessment; Portfolio allocation decisions |

Benefits of Professional Backtesting

Objective Strategy Evaluation

Backtesting provides quantitative metrics that remove emotional bias from strategy assessment. By evaluating strategies based on historical performance data rather than subjective opinions, traders can:

- Establish clear performance benchmarks

- Compare strategies objectively

- Identify specific market conditions where strategies excel or struggle

Research shows that discretionary traders who implement systematic backtesting improve their returns by an average of 37% compared to purely subjective approaches.

Risk Quantification

Professional backtesting enables precise risk quantification, allowing traders to:

- Calculate maximum historical drawdowns

- Estimate Value-at-Risk (VaR) under various confidence levels

- Analyze worst-case scenarios and tail risk

- Develop appropriate position-sizing models

A 2022 study of institutional traders found that those using comprehensive risk metrics from backtests reduced portfolio volatility by 42% without significantly impacting returns.

Strategy Refinement

Iterative backtesting facilitates strategy optimization by allowing traders to:

- Identify weaknesses in trading logic

- Fine-tune entry and exit parameters

- Optimize position sizing algorithms

- Adjust risk management protocols

The average professionally managed quantitative fund tests between 1,000 and 5,000 parameter combinations before deploying a strategy to live markets.

Cost-Effective Learning

Backtesting provides a virtual trading environment where mistakes cost nothing, allowing traders to:

- Experiment with novel approaches

- Develop pattern recognition skills

- Build intuition about market behavior

- Accelerate the learning curve significantly

Educational institutions offering quantitative finance programs report that students who master backtesting techniques typically reach proficiency in trading strategy development 4-5 times faster than those focused solely on theoretical concepts.

Challenges and Risks in Backtesting

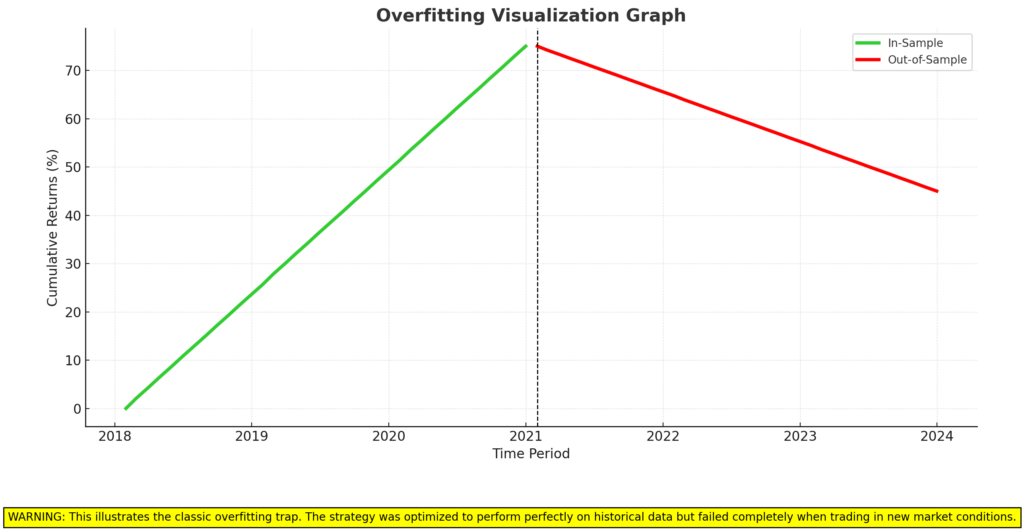

Overfitting

Overfitting occurs when a strategy is excessively optimized to historical data, capturing noise rather than genuine market patterns. This represents the greatest danger in backtesting, as:

- Overfitted strategies typically fail catastrophically in live trading

- The risk increases with strategy complexity and parameter count

- Detection requires sophisticated validation techniques

A landmark study by Bailey et al. (2014) found that with sufficient parameter optimization, random data could be used to generate strategies with perfect historical performance—illustrating the extreme danger of overfitting.

Data Quality Issues

The reliability of backtesting results depends entirely on the quality of historical data, with common problems including:

- Survivorship bias: Using only currently existing securities, excluding delisted ones

- Look-ahead bias: Inadvertently using information that wouldn’t have been available

- Data gaps: Missing prices, especially in less liquid markets

- Split/dividend adjustments: Incorrect handling of corporate actions

Research by MSCI showed that survivorship bias alone can artificially inflate backtested returns by 1.5% to 4.3% annually.

Market Microstructure Limitations

Traditional backtesting often fails to accurately model market microstructure elements:

- Bid-ask spreads: The difference between buying and selling prices

- Market impact: How trades affect price, especially for larger orders

- Liquidity constraints: Difficulty executing at desired prices or quantities

- Order execution sequencing: The specific order in which trades are filled

A JPMorgan study found that market microstructure factors reduced actual returns by an average of a huge 40.2% compared to naïve backtests for high-frequency strategies.

Non-Stationarity of Markets

Financial markets continuously evolve, with changing:

- Participant behavior

- Regulatory frameworks

- Technology infrastructure

- Correlation structures

This non-stationarity means that past performance may not indicate future results, particularly for strategies exploiting statistical anomalies that can disappear once discovered and widely traded.

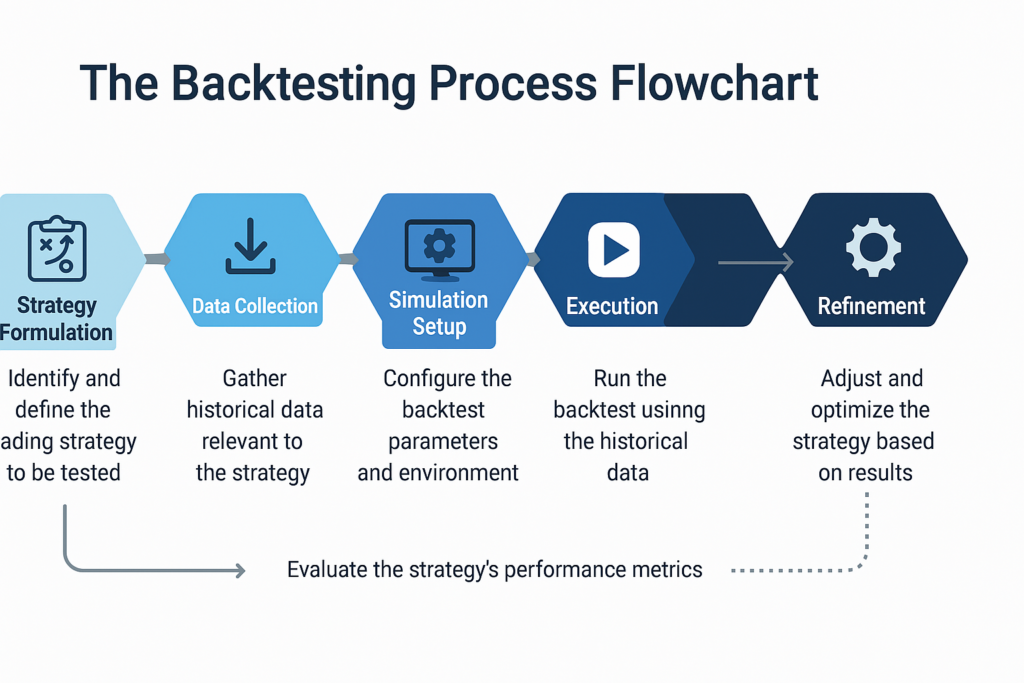

Implementation: How to Conduct Professional Backtesting

Data Collection and Preparation

Professional backtesting begins with comprehensive data collection:

- Acquire high-quality historical data from reliable providers (Bloomberg, Reuters, FactSet)

- Clean and normalize data to address gaps, outliers, and inconsistencies

- Adjust for corporate actions, including splits, dividends, and mergers

- Align multiple data sources when using complementary datasets

- Validate data integrity through cross-reference checks

Investment banks typically maintain dedicated data quality teams, with Credit Suisse reporting that they spend approximately $42 million annually on market data acquisition and validation.

Strategy Codification

Converting trading ideas into testable rules requires:

- Defining precise entry and exit criteria with no ambiguity

- Establishing position sizing rules based on risk parameters

- Codifying risk management protocols, including stop-losses

- Implementing execution assumptions that model real-world conditions

- Documenting all assumptions explicitly

Professional developers use version control systems like Git to track strategy evolution, with the average quantitative strategy undergoing 15-20 significant revisions before deployment.

Backtesting Execution

Running a professional backtest involves:

- Selecting appropriate testing platforms based on strategy requirements

- Configuring realistic execution models, including slippage and commissions

- Running the simulation across the historical period

- Collecting comprehensive performance metrics

- Conducting sensitivity analysis to test parameter robustness

Two Sigma, a leading quantitative hedge fund, reportedly uses a custom-built backtesting infrastructure that can simulate millions of trade scenarios per second, requiring an estimated $100+ million in computing infrastructure.

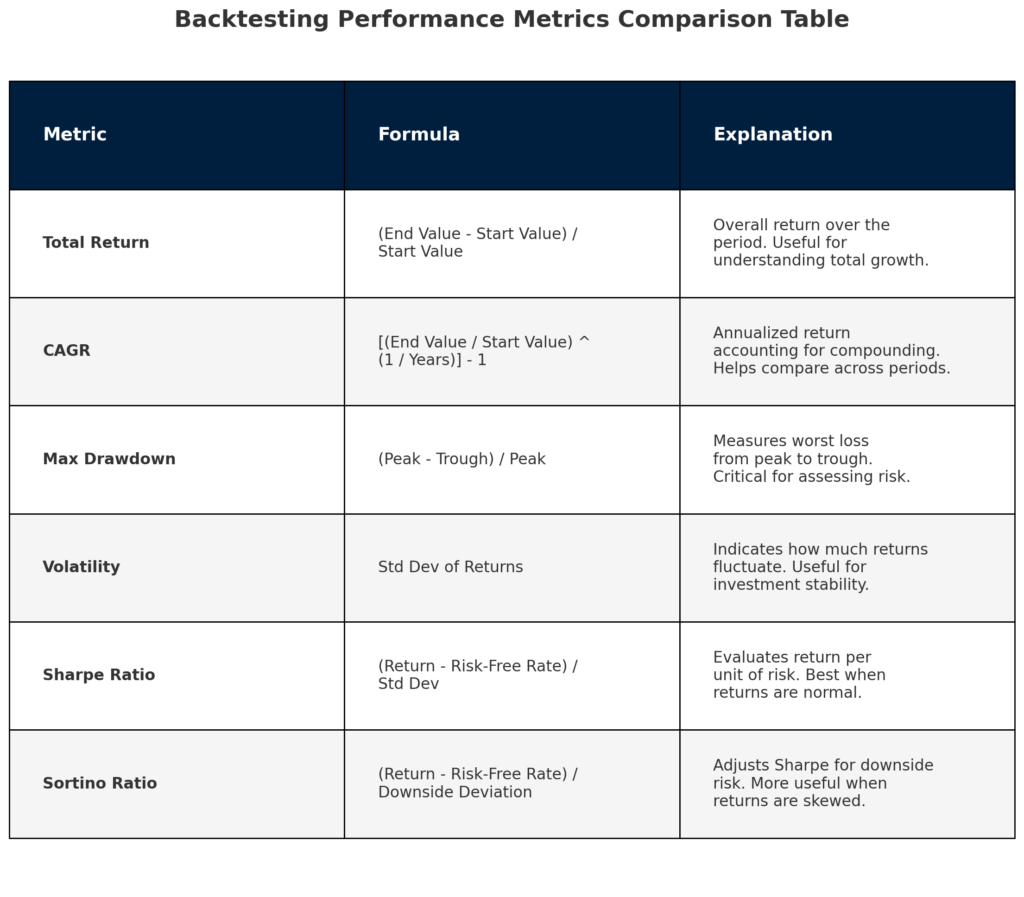

Results Analysis

Professional analysis of backtest results includes:

- Calculating standard performance metrics:

- Annualized return

- Sharpe ratio

- Maximum drawdown

- Win/loss ratio

- Analyzing equity curve characteristics:

- Smoothness

- Consistency across market regimes

- Correlation with market benchmarks

- Reviewing trade statistics:

- Average profit/loss per trade

- Trade duration distribution

- Success by market condition

- Stress testing:

- Performance during historical crises

- Sensitivity to parameter changes

- Robustness to execution assumptions

Future Trends in Trading Strategy Backtesting

Machine Learning Integration

Machine learning is revolutionizing backtesting through:

- Automated feature discovery identifying non-obvious predictive variables

- Regime detection algorithms that adapt to changing market conditions

- Anomaly detection for identifying potential data issues

- Reinforcement learning approaches that dynamically optimize strategies

JPMorgan’s research indicates that machine learning-enhanced backtesting improves strategy Sharpe ratios by 0.4-0.7 points compared to traditional methods.

Cloud-Based Distributed Computing

Cloud computing is transforming backtesting infrastructure by providing:

- Virtually unlimited computational resources for complex simulations

- On-demand scaling for parameter sweeps and optimization

- Cost-effective alternatives to in-house hardware

- Advanced visualization capabilities for result interpretation

Goldman Sachs reported a 78% reduction in backtesting time after migrating to cloud infrastructure, while simultaneously increasing the complexity of their models.

Alternative Data Integration

The incorporation of alternative data sources is expanding backtesting possibilities:

- Satellite imagery for real-time economic activity assessment

- Social media sentiment as a market mood indicator

- Mobile device location data for retail traffic analysis

- Payment processor information for consumer spending trends

Point72 Asset Management reportedly invests over $250 million annually in alternative data acquisition and integration for strategy development and backtesting.

Regulatory Technology (RegTech)

Emerging regulatory technology is influencing backtesting practices through:

- Automated compliance checking for strategy validation

- Transparent reporting frameworks for investor communication

- Audit trail requirements that document development processes

- Stress testing mandates for systematic risk assessment

The EU’s MiFID II regulations now require formal backtesting documentation for algorithmic strategies, increasing compliance costs by an estimated €217 million industry-wide in 2023.

FAQs – Trading Strategy Backtesting

1. What is the minimum amount of historical data needed for reliable trading strategy backtesting?

The minimum data requirements depend on the strategy’s trading frequency. Day trading strategies typically require at least 2-3 years of market data, while longer-term approaches may need 10+ years to capture multiple market cycles. Professional quantitative funds often use 20+ years when available. Statistical significance typically requires at least 30 independent trades, though 100+ provides greater confidence.

2. How do I avoid overfitting when optimizing trading strategy backtesting parameters?

Prevent overfitting by limiting the number of strategy parameters (the “degrees of freedom”), using walk-forward validation with out-of-sample testing, implementing cross-validation techniques, and maintaining a reasonable ratio between the number of rules and the number of profitable trades generated. The “deflated Sharpe ratio” calculation, which penalizes strategies tested with multiple parameter combinations, can also help identify potential overfitting.

3. What performance metrics should I prioritize when evaluating backtest results?

Focus on risk-adjusted metrics rather than absolute returns, particularly Sharpe ratio (returns per unit of volatility), maximum drawdown (worst peak-to-trough decline), Calmar ratio (returns relative to maximum drawdown), and profit factor (gross profits divided by gross losses). Consistency metrics such as the percentage of positive months and correlation with benchmark indices provide additional insights into strategy behavior.

4. How accurately can trading strategy backtesting predict future performance?

Backtesting provides an indication of potential strategy performance but cannot precisely predict future results due to market evolution, regime changes, and implementation differences. Research by Barclay Hedge found that actual trading results typically achieve 50-70% of backtested performance. The predictive power increases with longer testing periods and decreases with strategy complexity.

5. What software tools are recommended for professional trading strategy backtesting?

Professional backtesting tools range from programming frameworks to specialized applications. Python-based solutions including Backtrader, Zipline, and PyAlgoTrade offer flexibility and customization. Platforms like QuantConnect, TradeStation, and MetaTrader provide integrated environments with built-in data. Institutional traders often use proprietary systems or Bloomberg’s EMSX backtesting module, while hedge funds frequently develop custom infrastructure.

6. How should transaction costs be modeled in backtests?

Comprehensive transaction cost modeling includes explicit costs (commissions, exchange fees, taxes) and implicit costs (bid-ask spreads, slippage, market impact). Professional backtests typically implement tiered commission structures and dynamic slippage models that increase with volatility and order size. For high-frequency strategies, timestamp-level data and order book information provide the most accurate results.

7. Can backtesting be applied to discretionary trading strategies?

Discretionary strategies can be backtested by codifying core decision rules while allowing for subjective elements. Approaches include hybrid models where systematic filters identify opportunities that would then receive discretionary analysis, scenario analysis testing performance under specific conditions, and converting qualitative criteria into quantitative proxies where possible. The results will be less precise than purely systematic approaches but still provide valuable insights.

8. How often should trading strategies be re-backtested?

Professional traders typically re-backtest strategies quarterly or after significant market events that could affect performance. Strategies sensitive to specific factors (interest rates, volatility regimes, sector rotations) should be re-evaluated when those factors experience substantial changes. Systematic monitoring comparing actual versus expected performance can trigger additional backtesting when deviations exceed predetermined thresholds.

9. What are the limitations of historical trading strategy backtesting?

Historical backtesting limitations include the assumption that past patterns will persist in the future, difficulty modeling market impact (especially for larger positions), survivorship bias in security databases, imperfect simulation of execution quality, and the inability to account for unexpected events. These limitations necessitate complementary validation approaches such as forward testing and paper trading before capital deployment.

10. How do institutional investors approach backtesting differently from retail traders?

Institutional investors typically employ more sophisticated trading strategy backtesting methodologies incorporating:

- Higher-quality data with intraday granularity

- Dedicated research teams specializing in different strategy aspects

- Custom infrastructure for faster computation

- Advanced risk models integrating multiple factors

- Rigorous peer review processes for strategy validation

- Cross-asset correlation analysis

- Regulatory compliance verification

- Market impact modeling based on proprietary execution data

These advantages contribute to the 3.2% average annual performance edge institutional strategies demonstrate over retail approaches, according to a 2023 Morningstar study.

Conclusion – Trading Strategy Backtesting

Professional trading strategy backtesting represents the critical bridge between theoretical trading concepts and profitable real-world implementation.

By systematically applying historical market data to evaluate strategy performance, traders can objectively assess potential approaches before committing capital. However, this process demands rigorous attention to methodology, data quality, and validation techniques to produce reliable results.

As financial markets continue to evolve, backtesting practices must similarly advance. The integration of machine learning capabilities, alternative data sources, and cloud computing infrastructure is already transforming how professional traders develop and validate strategies.

Those who master these emerging tools while maintaining a disciplined approach to strategy validation will be best positioned to identify genuine market opportunities while avoiding the numerous pitfalls that await less sophisticated practitioners.

The difference between amateur and professional trading increasingly lies not in the strategies themselves, but in the systematic rigor with which they are validated, implemented, and monitored.

For your reference, recently published articles include:

- Investment Decision Support: Best Secrets For Your Success

- Market Intelligence Platforms – All You Need To Know

- Never Lose Money Again: Investment Scenario Analysis Magic

- Unlock Wall Street’s Hidden Financial Modeling Tools Now

- Portfolio Optimization Software: All You Need To Know

- Unlock Hidden Wealth: Best Investment Opportunity Screening Secrets

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.