Stocks vs Bonds – Introduction

You’ve decided to start investing. You’ve opened an account. Now comes the question that stops many beginners in their tracks:

Should I buy stocks or bonds?

If you’ve ever felt confused by this choice, you’re not alone. On the surface, stocks and bonds seem similar – they’re both investments, they both can make you money, and they both sound official and complicated. But underneath, they’re fundamentally different animals.

Think of it this way: Stocks are like becoming a business partner, while bonds are like becoming a bank. One makes you an owner, the other makes you a lender. And that difference changes everything about how they work, how much you can make, how much you can lose, and when you should use each one.

By the end of this guide, you’ll understand exactly what stocks and bonds are, how they differ, and – most importantly – how to use both to build a stronger portfolio. No jargon, no confusion, just clear explanations with real examples.

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Didi Somm & Team

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice. Past performance does not guarantee future results. All dollar amounts and projections are illustrative examples only. Tax situations vary – consult a tax professional for specific guidance

What you’ll learn

- What stocks actually are (and why they’re riskier)

- What bonds actually are (and why they’re safer)

- The 7 key differences that matter

- When to choose stocks vs bonds

- How to combine both for different goals

If you’re brand new to investing, you might want to start with our Investing 101 guide to learn the absolute basics first. But if you’re ready to understand these two fundamental investment types, let’s dive in.

Reading time: 12 minutes

Table of Contents

What Are Stocks? (Ownership = Higher Risk, Higher Reward)

Let’s start with the simplest definition possible.

A stock represents ownership in a company. When you buy a share of stock, you buy a tiny piece of that business. You become a partial owner – like a silent business partner.

The Business Partner Analogy

Imagine your friend starts a coffee shop and asks you to invest $10,000 for 10% ownership. You’re not lending her money – you’re becoming a part-owner of the business.

Here’s what happens:

When the coffee shop succeeds:

- Opens two more locations

- Profits jump from $50,000 to $200,000/year

- Your 10% stake becomes much more valuable

- Someone might offer you $30,000 for your 10% share

- You just made $20,000 profit

When the coffee shop struggles:

- Competition increases, profits drop

- Location closes down

- Your 10% stake might now be worth $5,000

- Or if the business fails completely, it’s worth $0

- You lost $5,000-$10,000

This is exactly how stocks work. You’re betting on the company’s success. When the business thrives, you profit. When it struggles, you lose money.

How You Make Money from Stocks

There are two ways stocks can make you money:

1. Stock Price Appreciation (Capital Gains)

This is the main way most people make money with stocks.

Example:

- You buy 100 shares of Microsoft at $300/share = $30,000 investment

- Microsoft grows, launches successful products, increases profits

- Stock price rises to $400/share

- You sell for $40,000

- Profit: $10,000 (33% return)

2. Dividends (Share of Profits)

Some companies pay part of their profits directly to shareholders.

Example:

- You own 100 shares of Johnson & Johnson

- J&J pays $4.50/share annually in dividends

- You receive $450/year just for holding the stock

- You get this whether the stock price goes up or down

The Ownership Advantage: Unlimited Upside

Here’s the beautiful part about being an owner: there’s no cap on how much you can make.

If you bought Amazon stock in 2001 at $10/share, it’s now worth over $3,000/share. That’s a 30,000% gain. Your $1,000 investment would be worth $300,000.

But here’s the flip side: you could also lose 100% of your investment if the company goes bankrupt (remember Blockbuster? Sears? They went to $0).

Key insight: Stocks give you unlimited profit potential, but also significant loss potential.

What Are Bonds? (Lending = Lower Risk, Lower Reward)

Now let’s look at the other side.

A bond represents a loan you make to a company or government. When you buy a bond, you’re the lender, not the owner. You’re more like a bank than a business partner.

The Bank Analogy

Think of bonds like giving someone a mortgage or car loan, except you’re lending to corporations or governments instead of individuals.

Example: You buy a $10,000 bond from Apple:

- Apple promises to pay you 4% interest annually ($400/year)

- After 10 years, Apple gives you back your $10,000

- Total you receive: $4,000 interest + $10,000 principal = $14,000

Notice something? You know exactly what you’re getting. Apple could triple in size, launch revolutionary products, and dominate the tech industry. Your return? Still $4,000 over 10 years. You don’t benefit from Apple’s success beyond the agreed-upon interest.

But here’s the tradeoff: even if Apple struggles, they still owe you that money (unless they go completely bankrupt, which is rare for major companies).

How You Make Money from Bonds

1. Interest Payments (Coupon Payments)

This is the primary way bonds make money – predictable, regular interest payments.

Example:

- You buy a $10,000 U.S. Treasury bond with 4% interest (coupon rate)

- Every year, the government pays you $400

- After 10 years, you’ve received $4,000 in interest

- Plus you get your $10,000 back

- Total: $14,000

2. Bond Price Fluctuations

Bonds can also increase or decrease in value before they mature, though these fluctuations are typically much smaller than stocks.

Example:

- You buy a bond paying 4% when new bonds pay 3%

- Your bond becomes more valuable (higher yield)

- You could sell it for $10,500 instead of $10,000

- Bonus profit: $500

The Lending Advantage: Predictability and Safety

Here’s what makes bonds attractive: you know what you’re getting.

- Interest rate? Fixed at purchase

- Payment schedule? Known in advance

- Maturity date? Set from day one

- Total return? Calculable immediately

The catch? Your upside is capped. If you lend Apple $10,000 at 4% for 10 years, you get $4,000 in interest regardless of whether Apple becomes the world’s most valuable company or just muddles along.

Key insight: Bonds give you predictable income and lower risk, but limited profit potential.

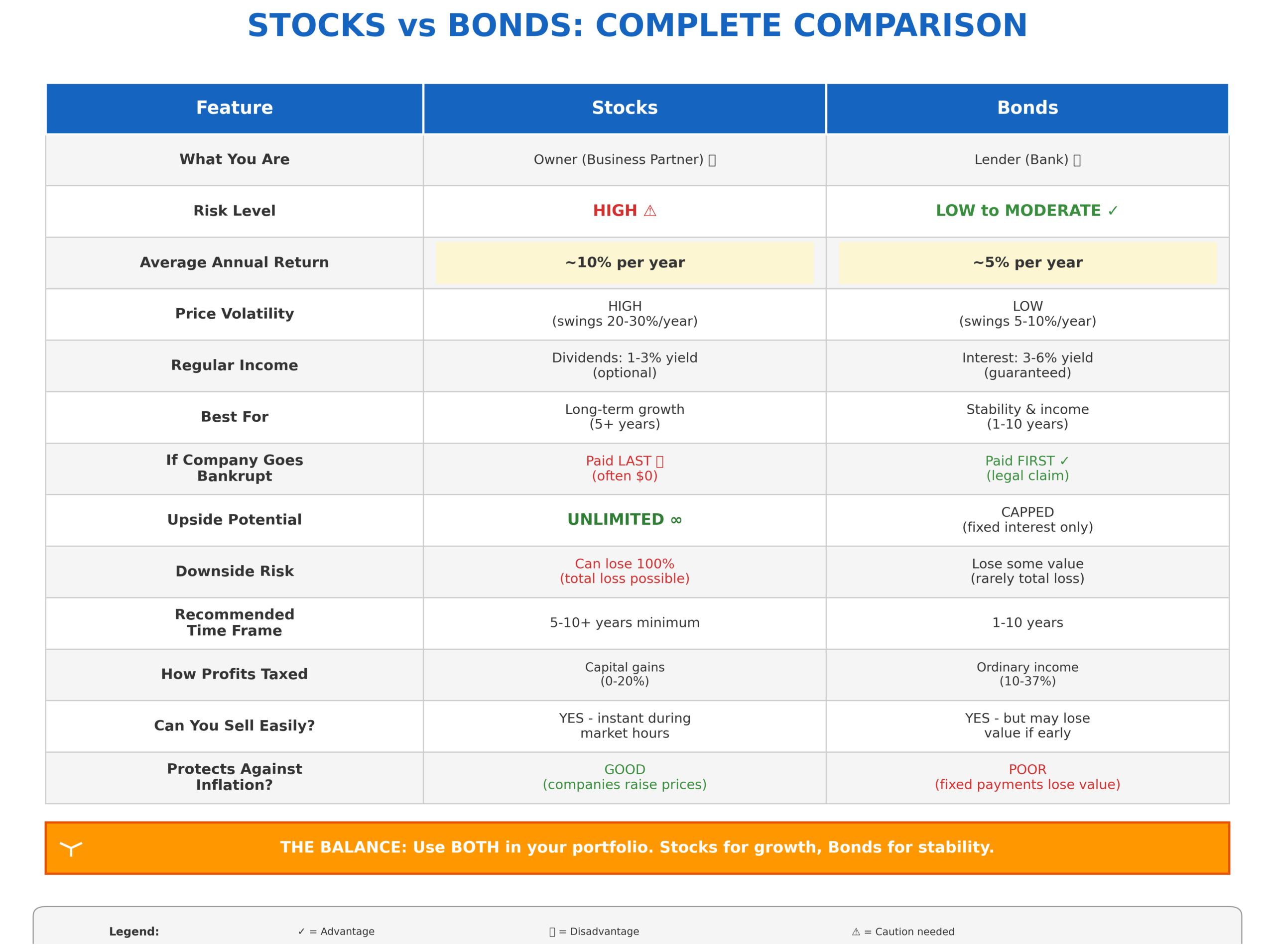

Stocks vs Bonds: The 7 Key Differences

Now that you understand what each one is, let’s break down the differences that actually matter for your investing decisions.

1. Ownership vs Lending

Stocks: You’re an owner

- Share in company’s success or failure

- Have voting rights (usually minimal for small investors)

- Benefit from company growth

- Exposed to company risk

Bonds: You’re a lender

- No ownership stake

- No voting rights

- Receive fixed interest regardless of company performance

- Priority claim if company fails (paid before stockholders)

Real-world impact: If Microsoft doubles in value, stockholders win big while bondholders get the same fixed payment. If Microsoft struggles but stays solvent, bondholders still get paid while stockholders might lose money.

2. Risk Level

Stocks: Higher Risk

- Can lose 50-100% of investment

- Prices swing dramatically day-to-day

- Individual stocks can go to zero

- But diversified stock portfolios historically recover over time

Bonds: Lower Risk

- Unlikely to lose entire investment (unless bankruptcy)

- Prices fluctuate less

- Government bonds extremely safe

- But can lose value to inflation

Example: During the 2008 financial crisis:

- S&P 500 stocks fell 56% (peak to trough)

- But 10-year Treasury bonds gained 21%

- Bonds provided stability when stocks crashed

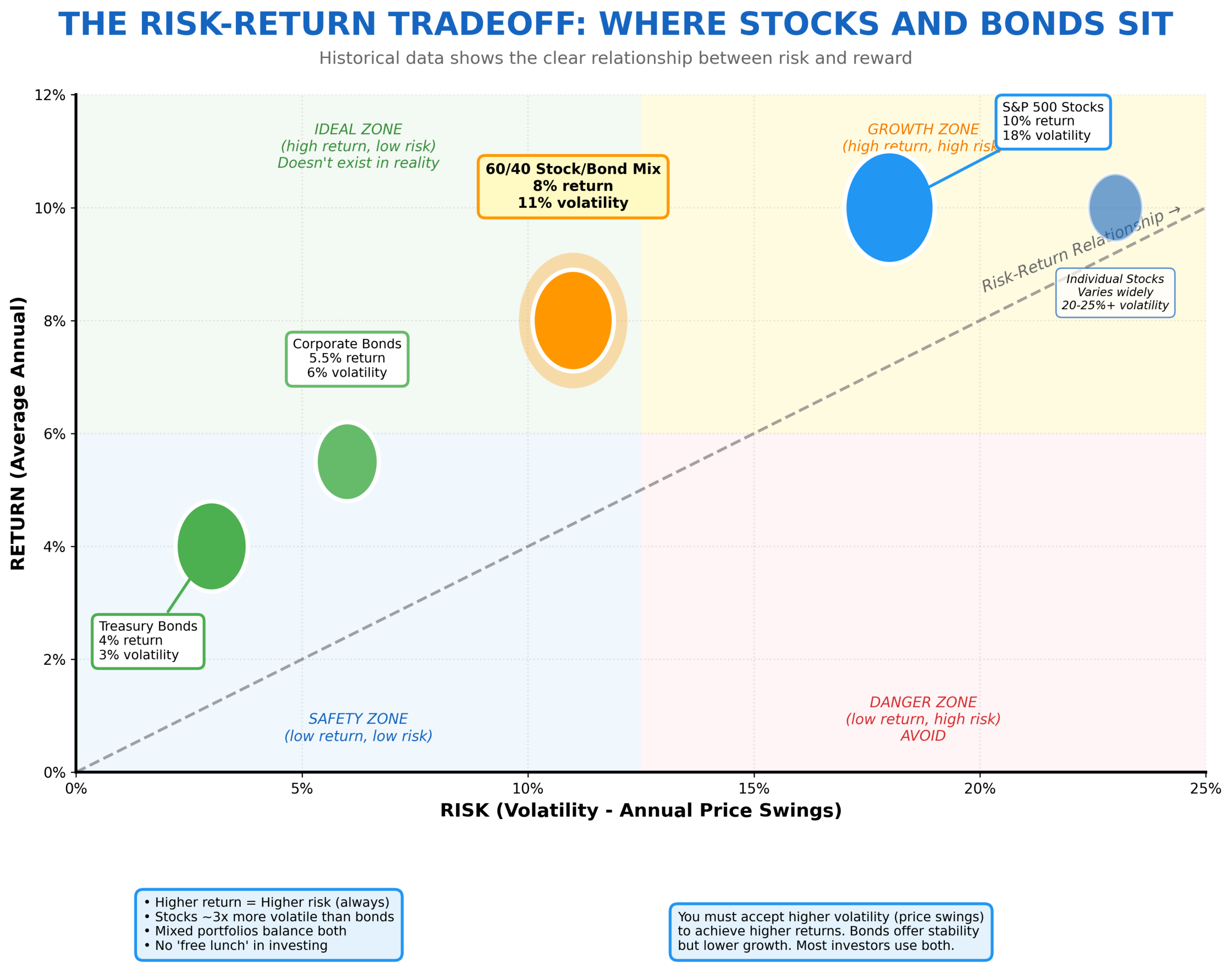

3. Return Potential

Stocks: Higher Long-Term Returns

- Historical average: 10% per year (1926-2023)

- Best year: +52.6% (1954)

- Worst year: -43.8% (1931)

- Wide range of outcomes

Bonds: Lower, More Stable Returns

- Historical average: 5-6% per year

- Government bonds: 3-5%

- Corporate bonds: 4-7%

- Narrower range of outcomes

Example: $10,000 invested for 30 years:

- Stocks at 10% average: $174,494

- Bonds at 5% average: $43,219

- Difference: $131,275

That’s why stocks are powerful for long-term goals – the higher returns compound dramatically over decades.

4. Income vs Growth

Stocks: Primarily Growth-Focused

- Some pay dividends (typically 1-3% yield)

- Main profit comes from price appreciation

- Income is secondary benefit

- Best for building wealth over time

Bonds: Primarily Income-Focused

- Regular interest payments (3-6% yield)

- Main benefit is predictable income

- Price appreciation is secondary

- Best for generating cash flow

Example: Retiree scenario:

- Portfolio: $500,000

- Needs: $25,000/year to live on

Bond approach:

- Buy bonds yielding 5% = $25,000/year income

- Predictable, stable cash flow

- Principal stays intact at $500,000

Stock approach:

- Stocks might gain 10% one year, lose 15% another

- Selling shares in down years depletes portfolio

- Unpredictable income stream

5. Volatility (Price Swings)

Stocks: High Volatility

- Daily price swings of 1-3% are normal

- Can move 20-30% in a year

- Individual stocks even more volatile

- Requires strong stomach for ups and downs

Bonds: Low Volatility

- Daily price changes of 0.1-0.5% typical

- Annual moves usually under 10%

- Government bonds extremely stable

- Much easier to hold through market stress

Example: 2022 market turbulence:

- S&P 500 stocks: down 18%

- Total U.S. Bond Market: down 13%

- Both fell, but stocks fell more

2023 recovery:

- S&P 500: up 26%

- Total U.S. Bond Market: up 5.5%

- Stocks recovered more dramatically

6. Time Horizon

Stocks: Long-Term (5+ Years Minimum)

- Need time to recover from drops

- Volatility smooths out over decades

- Historical data: Never lost money over any 20-year period

- Best for distant goals

Bonds: Short to Medium-Term (1-10 Years)

- More predictable over shorter periods

- Good for goals 3-10 years away

- Less likely to be down when you need the money

- Provides stability in portfolios

Example: Goal: Buy house in 3 years

- Stocks: Too risky – could be down 30% when you need the money

- Bonds: Safer – more likely to preserve capital

Goal: Retirement in 30 years

- Stocks: Ideal – long runway to ride out volatility

- Bonds: Too conservative – missing out on growth

7. What Happens If Things Go Wrong

Stocks: Last in Line

- If company goes bankrupt, stockholders paid last

- Often receive nothing

- Total loss possible

- Examples: Enron, Lehman Brothers, Blockbuster all went to $0

Bonds: First in Line

- Bondholders have legal claim to be repaid

- Paid before stockholders in bankruptcy

- Might receive partial payment even in bankruptcy

- Government bonds backed by taxing power

Example: When a company fails:

- Secured creditors get paid first (banks with collateral)

- Bondholders get paid second (from remaining assets)

- Stockholders get paid last (usually nothing left)

This is why bonds are safer – you have legal priority.

When to Choose Stocks

Choose stocks when:

✅ You have 5+ years before you need the money

- Time allows recovery from market drops

- Volatility becomes less scary

- Compounding has time to work

✅ You can handle seeing your balance drop 30-50%

- You won’t panic sell during crashes

- You understand drops are temporary

- You can sleep at night during bear markets

✅ Your goal is building wealth, not generating income

- Focused on long-term growth

- Don’t need regular cash payments

- Want to maximize portfolio value over decades

✅ You’re young (20s-40s)

- Decades until retirement

- Time to recover from losses

- Benefit most from compounding growth

Example scenarios for stocks:

Sarah, age 28, saving for retirement:

- Goal: Retire at 65 (37 years away)

- Strategy: 90% stocks, 10% bonds

- Why: Decades to ride out volatility, maximize growth

Mike, age 35, saving for kids’ college:

- Goal: College in 13 years

- Strategy: Start 80% stocks, gradually shift to bonds

- Why: Enough time horizon, but shift to safety as date approaches

When to Choose Bonds

Choose bonds when:

✅ You need the money within 5 years

- Can’t afford market crash right before you need it

- Want predictability

- Capital preservation matters more than growth

✅ You need regular income

- Retiree living off portfolio

- Want predictable cash flow

- Stability matters more than growth

✅ You can’t handle volatility

- Stock drops cause you to panic sell

- You check your account daily and stress

- Peace of mind worth sacrificing returns

✅ You’re older (60s+) or in/near retirement

- Limited time to recover from losses

- Need to preserve capital

- Generating income more important than growth

Example scenarios for bonds:

Linda, age 62, retiring in 2 years:

- Goal: Preserve nest egg, generate income

- Strategy: 40% stocks, 60% bonds

- Why: Can’t afford major loss, needs stability and income

Tom, age 45, saving for down payment:

- Goal: Buy house in 3 years

- Strategy: 20% stocks, 80% bonds

- Why: Can’t risk needing to sell stocks in a crash

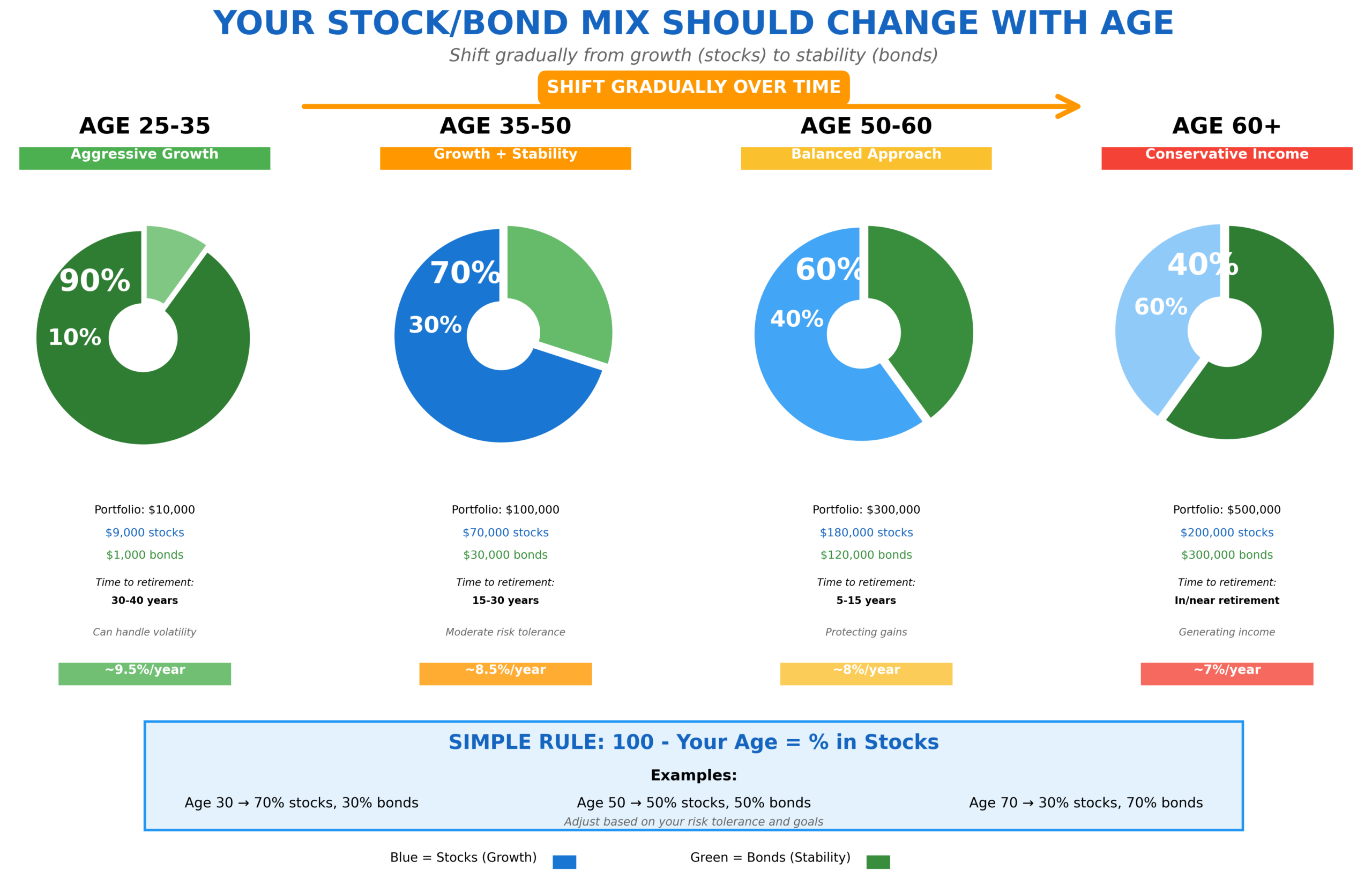

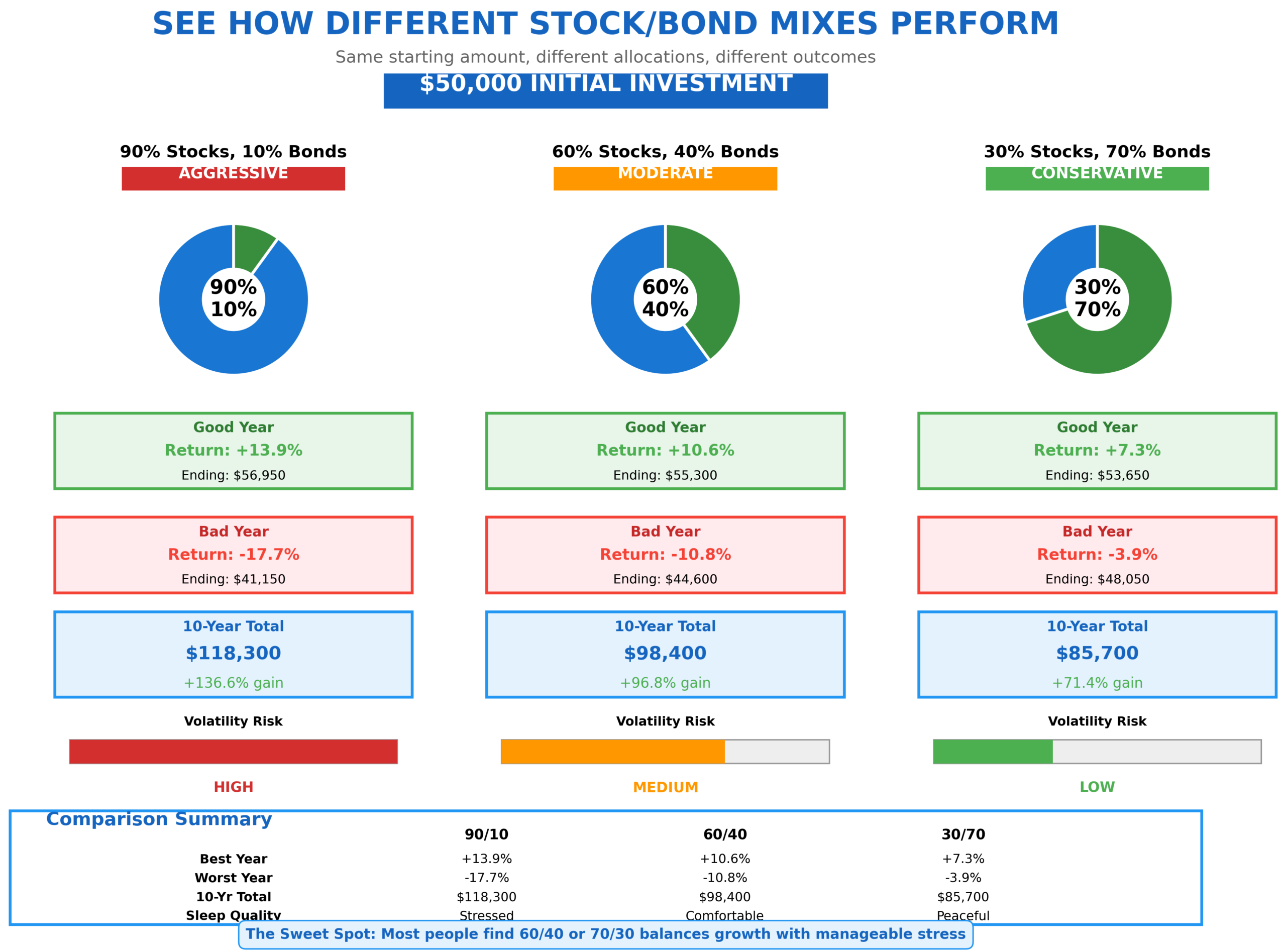

The Power of Combining Both: Portfolio Allocation

Here’s where it gets interesting: you don’t have to choose one or the other.

Most successful investors use both stocks and bonds together. Stocks provide growth, bonds provide stability. Together, they create a balanced portfolio that grows over time while limiting devastating losses.

Portfolio Allocation by Age and Goals

Age 25-35: Aggressive Growth

- 90% stocks, 10% bonds

- Goal: Maximum growth over 30-40 years

- Can recover from any market crash

- Minimal bonds for slight stability

Example: $10,000 portfolio:

- $9,000 in low-cost stock index funds

- $1,000 in bond funds

Age 35-50: Growth with Some Stability

- 70-80% stocks, 20-30% bonds

- Goal: Continue growing while adding stability

- Bonds cushion market crashes

- Still equity-heavy for growth

Example: $50,000 portfolio:

- $37,500 in stock funds (75%)

- $12,500 in bond funds (25%)

Age 50-60: Moderate Balance

- 60% stocks, 40% bonds

- Goal: Growth but protecting what you’ve built

- Approaching retirement, need more safety

- Bonds reduce portfolio swings

Example: $200,000 portfolio:

- $120,000 in stocks (60%)

- $80,000 in bonds (40%)

Age 60+: Conservative Income

- 40% stocks, 60% bonds

- Goal: Generate income, preserve capital

- Living off portfolio soon or already

- Stability crucial, growth secondary

Example: $500,000 portfolio:

- $200,000 in stocks (40%)

- $300,000 in bonds (60%)

For more detailed guidance on allocation, see our complete guide on asset allocation strategies.

Real-World Portfolio Example

Let’s put this all together with a real scenario:

Meet Jennifer, Age 42:

- Current savings: $75,000

- Annual contribution: $10,000

- Goal: Retire at 65 (23 years away)

- Risk tolerance: Moderate

Her allocation: 70% stocks, 30% bonds

Current portfolio:

- $52,500 in stocks (70%)

- $22,500 in bonds (30%)

What this means:

In good years (stocks up 15%, bonds up 4%):

- Stocks gain: $7,875

- Bonds gain: $900

- Total gain: $8,775 (11.7%)

In bad years (stocks down 20%, bonds up 3%):

- Stocks lose: $10,500

- Bonds gain: $675

- Total loss: $9,825 (-13.1%)

Notice how bonds cushion the fall? Without bonds (100% stocks), she’d lose $15,000 in the bad year instead of $9,825.

Over 23 years:

- All stocks (10% average): $823,000

- 70/30 mix (8% average): $630,000

- All bonds (4% average): $280,000

Jennifer gives up some potential gains ($193,000 less than all-stocks), but gets much smoother ride and better sleep at night.

Common Questions About Stocks vs Bonds

Can I lose money with bonds?

Yes, but it’s less likely and usually smaller losses than stocks.

Ways you can lose with bonds:

- Interest rate risk: Bond prices fall when interest rates rise

- Default risk: Company/government could fail to pay (rare for quality bonds)

- Inflation risk: Your purchasing power decreases if inflation exceeds interest

Example: If you buy a bond for $10,000 and sell before maturity when rates have risen, you might get $9,500. But if you hold to maturity, you get your full $10,000 back.

Are stocks always better long-term?

For growth, yes -historically. But “better” depends on your goals.

Stocks win for:

- Building wealth over 10+ years

- Beating inflation

- Maximum portfolio growth

Bonds win for:

- Generating reliable income

- Preserving capital short-term

- Sleeping well during market crashes

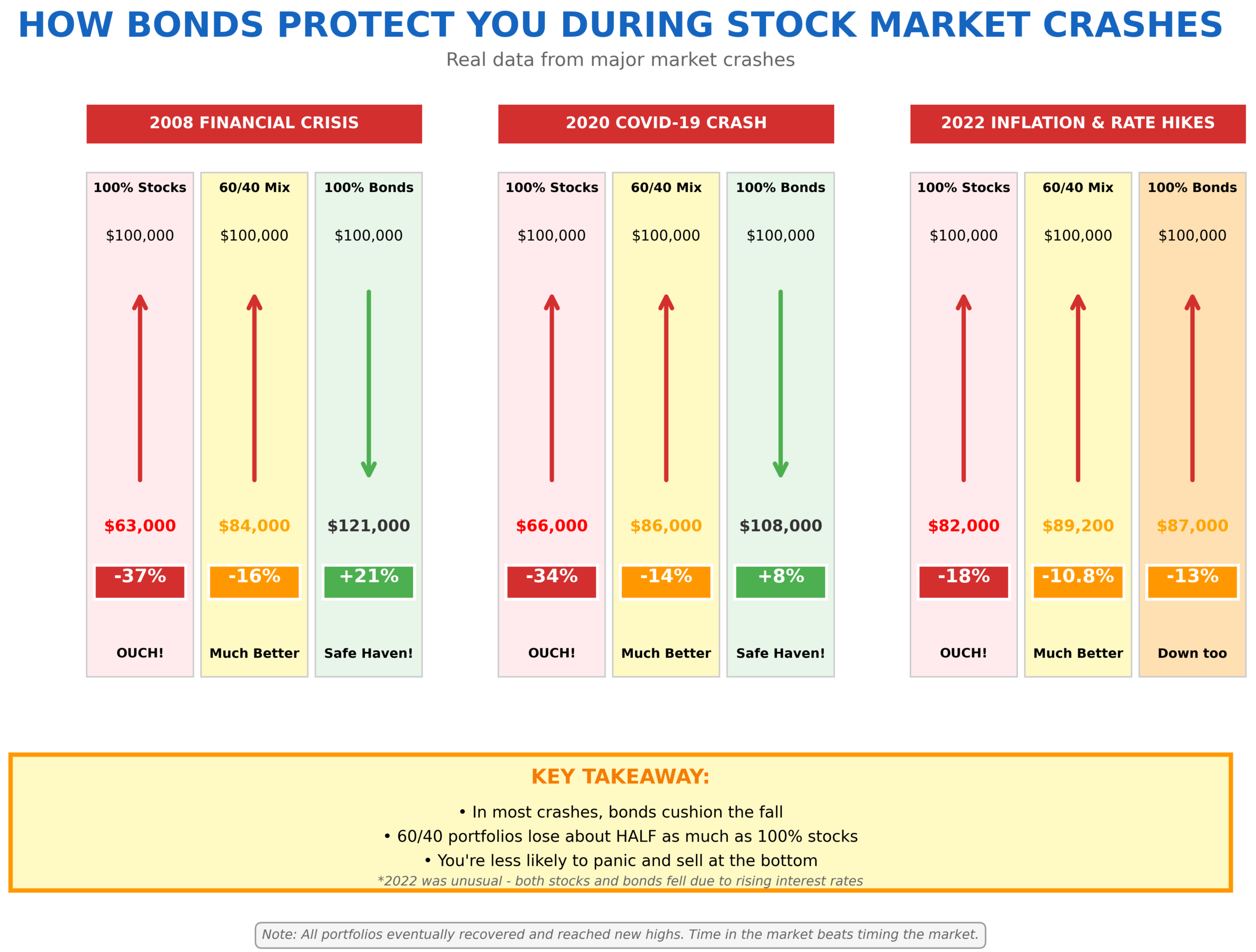

What about stock market crashes?

This is where bonds really shine. During every major crash, bonds have cushioned portfolios.

2008 Financial Crisis:

- Stocks (S&P 500): -37%

- Bonds (10-year Treasury): +21%

- 60/40 portfolio: -16% (much better than pure stocks)

2020 COVID Crash:

- Stocks: -34% (at worst point)

- Bonds: +8%

- 60/40 portfolio: -14%

Having bonds means you’re less likely to panic and sell at the bottom.

Can I just invest in stock index funds and forget about bonds?

If you have 20+ years and strong nerves, yes. But most people benefit from some bonds.

100% stocks works if:

- You’re young (20s-30s)

- You have 20+ years until you need the money

- You can handle 50% portfolio drops without selling

- You don’t check your account often

Add bonds if:

- You’re within 10 years of needing the money

- Market drops make you anxious

- You need income from your portfolio

- You check your balance daily (bonds reduce stress)

How do I actually buy stocks and bonds?

Through the same investment accounts:

For beginners:

- Open account at brokerage (Vanguard, Fidelity, Schwab)

- Buy stock index funds (like VTI – Total Stock Market)

- Buy bond index funds (like BND – Total Bond Market)

- Set allocation (e.g., 70% VTI, 30% BND)

- Rebalance once per year

Even easier: Use target-date funds that automatically mix stocks and bonds based on when you need the money.

- or step-by-step instructions, see our guide on how to start investing.

The Bottom Line: You Need Both

Here’s the truth that takes most investors years to learn: The question isn’t “stocks vs bonds” – it’s “how much of each?”

Stocks and bonds work together like a balanced meal. Stocks are the protein – they build wealth and provide growth. Bonds are the vegetables – they provide stability and protect your gains.

The key lessons:

- Stocks = ownership = higher risk, higher reward

- Use for long-term goals (5+ years)

- Expect 10% average returns with high volatility

- Can lose everything, can gain exponentially

- Bonds = lending = lower risk, lower reward

- Use for stability and income

- Expect 3-6% returns with low volatility

- Protected in company failure, capped upside

- Combine both based on:

- Your age (younger = more stocks)

- Your timeline (longer = more stocks)

- Your risk tolerance (nervous = more bonds)

- Your goals (growth vs income)

- Allocation rule of thumb:

- 100 minus your age = % in stocks

- Age 30 → 70% stocks, 30% bonds

- Age 60 → 40% stocks, 60% bonds

- Both serve a purpose:

- Stocks grow your wealth

- Bonds protect your wealth

- Together, they balance risk and return

Your Next Step

Now you understand the fundamental difference between stocks and bonds. You know when to use each one and how to combine them.

Don’t just read this – act on it:

- Check your current portfolio – What’s your stock/bond mix?

- Compare to recommended allocation – Does it match your age and goals?

- Adjust if needed – Rebalance to target allocation

- Set a calendar reminder – Check allocation once per year

Want to dive deeper?

- Learn the investing basics if you’re brand new

- Understand asset allocation strategies for your specific situation

- Discover how to build a complete portfolio with both

Remember: The best portfolio is one you can stick with through market ups and downs. If 90% stocks keeps you up at night, add more bonds. If 50% bonds feels too conservative and you have decades until retirement, add more stocks.

The perfect balance is the one that helps you sleep well at night while still reaching your financial goals.

You’ve got this. Good luck with your future investments!

Didi Somm & Team

Keep Learning: Get Our Free Investing Resources

Download our Investing Basics Glossary, plus get weekly tips for beginner investors delivered to your inbox.

OUR TIP: We recommend you download the “SMART INVESTING GUIDE” from our homepage too!

Recommended Reading: After understanding these basics, dive deeper with The Simple Path to Wealth by JL Collins – the perfect next step for learning index fund investing strategies.

Disclaimer: This article is for educational purposes only and is not financial advice. Investing involves risk, including potential loss of principal. Consider consulting a financial advisor for personalized advice.