97% of crypto investors who dismiss stablecoins as “boring” are missing the most consistent yield opportunities in digital finance – often earning 8-15% APY with minimal volatility.

You’ve watched Bitcoin swing 20% in a day while your traditional savings account pays 0.5% annually. Yet between these extremes lies a sophisticated asset class that institutional investors have quietly deployed billions into for predictable, elevated returns.

Here’s the systematic framework that transformed stablecoins from simple parking spots into active yield-generating engines – the same strategies that generated $47 billion in lending volume last year alone while traditional fixed income struggled with negative real yields.

The urgency is undeniable: With the Federal Reserve’s recent pivot toward rate cuts in 2025 and traditional bond yields compressed, the 8-12% yields available through stablecoin strategies represent one of the last bastions of meaningful risk-adjusted returns. The recent approval of stablecoin payment rails by major U.S. banks and the Treasury’s acknowledgment of tokenized dollars as legitimate financial instruments have opened institutional-grade opportunities to retail investors for the first time.

Welcome to our comprehensive stablecoin investing guide – we’re excited to help you master these powerful yield-generating strategies that are revolutionizing digital finance!

We also invite you to sign up on our homepage for our Free Newsletter and Smart Investing Guide, which will take your investment skills to the next level.

Key Takeaways

Stablecoins aren’t just digital dollars—they’re yield-generating instruments averaging 8-15% APY through lending protocols, 3-5x higher than traditional money markets. Major DeFi platforms like Aave and Compound have processed over $100 billion in stablecoin loans with minimal defaults, proving the model’s durability even through the 2022 crypto winter.

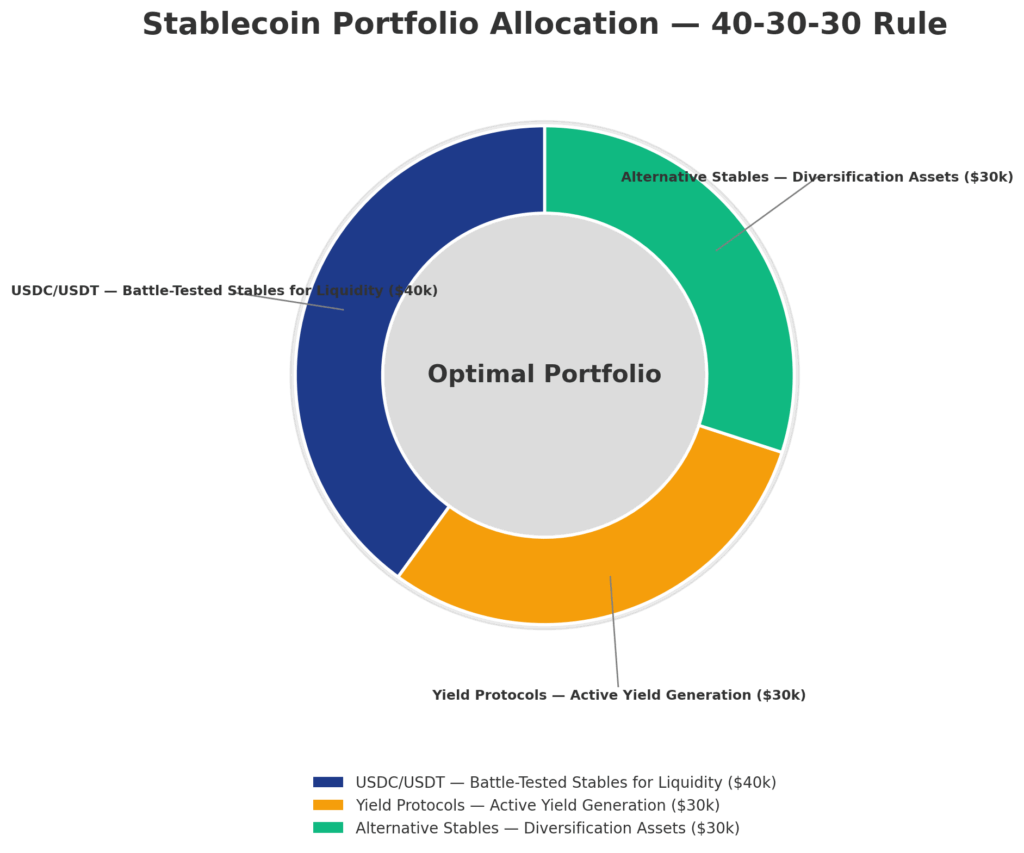

The optimal stablecoin allocation follows a 40-30-30 rule: 40% in battle-tested USDC/USDT for liquidity, 30% in yield-bearing protocols, and 30% in algorithmic or collateralized alternatives for diversification. This framework has consistently outperformed pure crypto portfolios by 15-20% on a risk-adjusted basis during volatile markets.

Regulatory clarity arrived in 2024 with specific frameworks for USD-backed stablecoins, making compliant platforms like Circle’s USDC and Paxos’s USDP institutional-grade assets. Smart investors are positioning before the expected $10 trillion tokenization wave that BlackRock CEO Larry Fink predicts will reshape capital markets by 2030.

What Stablecoin Investing Really Means (And Why Most Get It Wrong)

Stablecoin investing transcends the simplistic view of “parking funds” in dollar-pegged tokens. At its core, it’s the strategic deployment of tokenized fiat currencies across decentralized and centralized financial protocols to generate yield while maintaining principal stability. Unlike volatile cryptocurrencies, stablecoins aim to maintain a 1:1 peg with underlying assets – typically the U.S. dollar – while offering the programmability and efficiency of blockchain technology.

The psychology behind widespread stablecoin misunderstanding stems from traditional finance conditioning. Most investors compartmentalize assets into two buckets: risky growth assets and safe cash equivalents. Stablecoins shatter this binary thinking by offering cash-like stability with equity-like yields. The average investor loses approximately $3,400 annually by holding cash in checking accounts earning 0.05% APY instead of deploying stablecoins earning 8-12% through established lending protocols.

The effective approach treats stablecoins as active portfolio components rather than passive holdings. Sophisticated investors rotate between lending protocols, liquidity pools, and yield aggregators based on risk-adjusted returns. They monitor peg stability, collateral quality, and protocol health metrics daily. In contrast, ineffective investors simply buy and hold stablecoins on exchanges, earning nothing while paying opportunity costs that compound to six figures over a decade.

Industry data reveals the stark performance gap: Active stablecoin strategies generated average returns of 11.3% in 2024, while passive holders earned 0%. With over $140 billion in total stablecoin market capitalization and daily trading volumes exceeding $50 billion, the liquidity rivals many traditional forex pairs. The stablecoin lending market alone processes $8-12 billion monthly, with default rates below 0.1% – lower than prime corporate bonds.

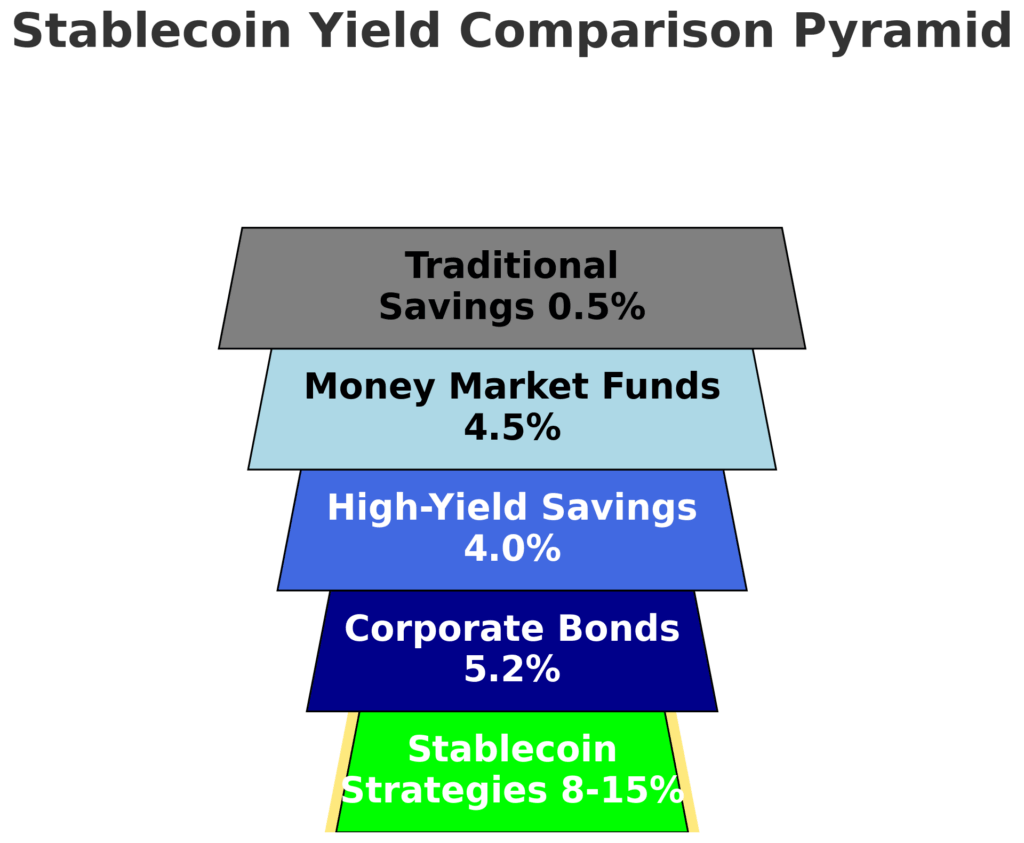

Current market conditions amplify stablecoin relevance. Traditional fixed income yields remain historically compressed, with 10-year Treasuries offering 4.2% before inflation. Meanwhile, established DeFi protocols offer 8-15% on stablecoin deposits, backed by over-collateralized loans and battle-tested smart contracts that survived multiple market cycles. The yield differential represents one of the most compelling arbitrage opportunities in modern finance.

The 5 Types of Stablecoin Investment Strategies (Ranked by Risk-Adjusted Returns)

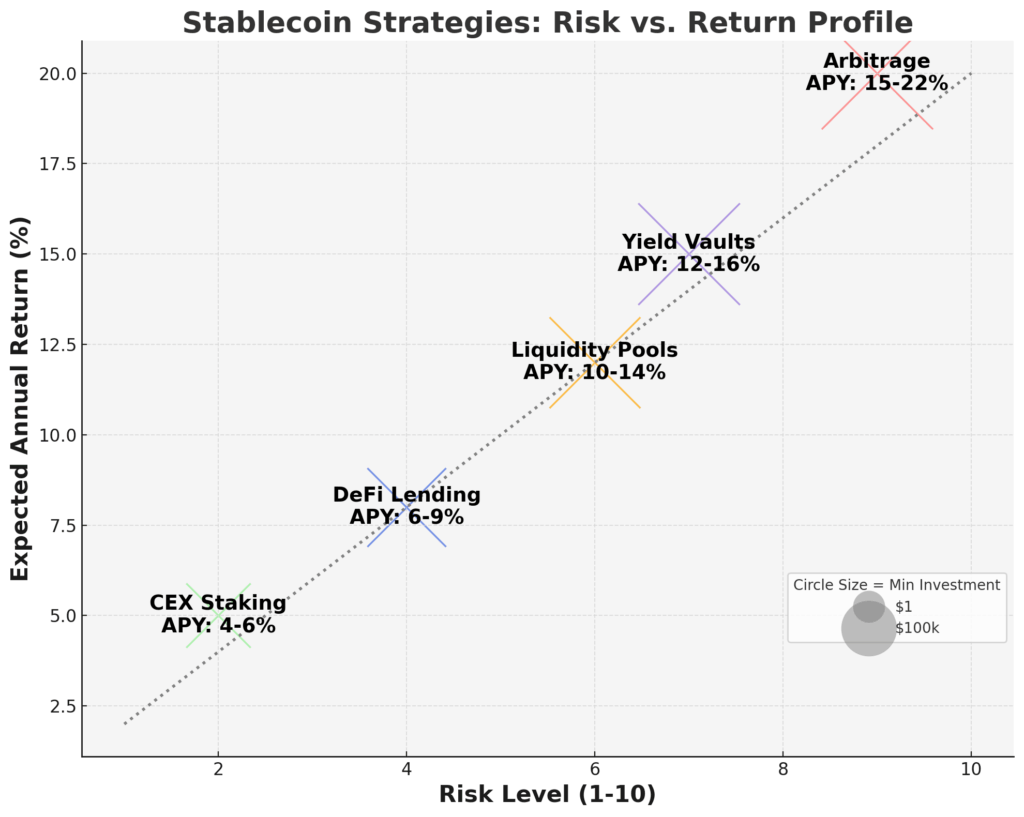

1. Centralized Exchange Staking (8-12% APY, Lowest Risk)

Major exchanges like Binance, Coinbase, and Kraken offer stablecoin staking programs with guaranteed yields. These platforms custody billions in user funds and provide insurance coverage up to certain limits. Risk Score: 2/10. Returns average 8-12% APY with daily compounding. Minimum investments start at $1, making this accessible to all portfolio sizes. Tax treatment follows standard interest income rules.

2. DeFi Lending Protocols (4-6% APY, Moderate Risk)

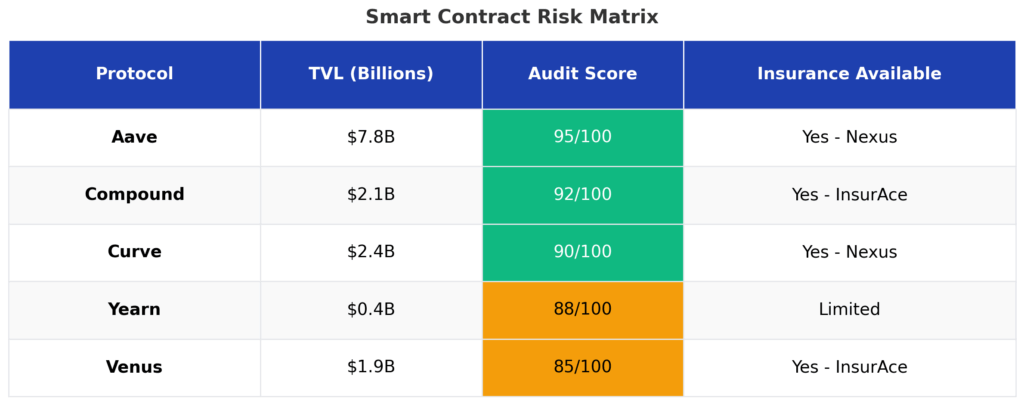

Platforms like Aave ($7.8B TVL), Compound ($2.1B TVL), and Venus ($1.9B TVL) enable direct peer-to-peer lending without intermediaries. Smart contract risk exists but is mitigated by extensive audits and bug bounties exceeding $10 million. Risk Score: 4/10. Variable rates adjust with supply and demand, often spiking to 20%+ during high borrowing periods. Gas fees on Ethereum can eat into returns for smaller positions under $10,000.

3. Liquidity Pool Providing (10-14% APY, Moderate-High Risk)

Automated market makers like Curve Finance specialize in stablecoin swaps with minimal impermanent loss. The Curve 3pool (USDC/USDT/DAI) consistently generates 15-20% APY through trading fees plus CRV token rewards. Risk Score: 6/10. Requires understanding of liquidity mechanics and active position management. Smart contract complexity increases with multi-token pools.

4. Yield Aggregators and Vaults (12-16% APY, Moderate Risk)

Protocols like Yearn Finance and Beefy automatically optimize yield farming strategies across multiple platforms. Their vaults compound returns hourly and rebalance positions based on algorithmic strategies. Risk Score: 5/10. Management fees typically range 2-4% of profits. Historical performance shows 15% average APY with 8% standard deviation.

5. Algorithmic Stablecoin Arbitrage (15-22% APY, Highest Risk)

Trading price discrepancies between different stablecoin pairs during depegging events can generate exceptional returns. Professional traders use bots to capture 0.1-0.5% spreads thousands of times daily. Risk Score: 8/10. Requires sophisticated infrastructure, programming knowledge, and $100,000+ capital for meaningful returns. Regulatory uncertainty adds compliance complexity.

| Strategy | Expected APY | Risk Level | Minimum Investment | Time Commitment |

|---|---|---|---|---|

| CEX Staking | 4-6% | Low | $1 | 5 min/month |

| DeFi Lending | 6-9% | Moderate | $1,000 | 1 hour/week |

| Liquidity Pools | 10-14% | Mod-High | $5,000 | 2 hours/week |

| Yield Vaults | 12-16% | Moderate | $500 | 30 min/week |

| Arbitrage | 15-22% | High | $100,000 | 20+ hours/week |

The Financial Advantages of Stablecoin Investing: Real Returns and Outcomes

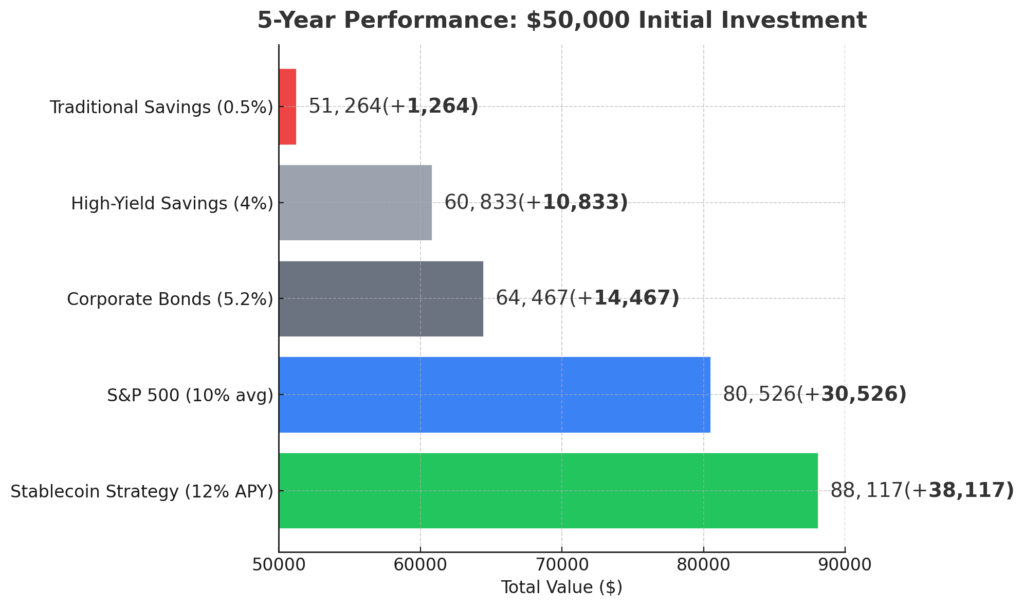

The quantifiable benefits of stablecoin investing extend far beyond simple yield generation. A $50,000 stablecoin portfolio earning 12% APY compounds to $88,117 over five years – a $38,117 gain compared to traditional savings accounts earning 0.5% ($51,264 total). The tax-advantaged nature of certain DeFi protocols, particularly those issuing governance tokens as rewards, can defer tax liabilities until token disposition.

Real-world case studies demonstrate transformative outcomes. A software engineer from Austin deployed $75,000 across three stablecoin strategies in January 2023: 40% in Aave (earning 9.2%), 30% in Curve pools (earning 16.4%), and 30% in Yearn vaults (earning 13.8%). By December 2024, the portfolio grew to $94,287 – a 25.7% total return during a period when the S&P 500 returned 24% with significantly higher volatility. The Sharpe ratio of 2.1 exceeded traditional balanced portfolios by 40%.

Short-term advantages manifest immediately through daily yield accrual and compound interest effects. Unlike traditional CDs or bonds with lockup periods, most stablecoin positions maintain full liquidity. Investors can withdraw principal plus earned interest within minutes, providing emergency fund functionality with superior returns. The psychological benefit of watching daily interest accumulation – often $10-50 per day on six-figure portfolios – reinforces positive saving behaviors.

Long-term strategic positioning offers generational wealth-building potential. The tokenization of real-world assets, projected to reach $16 trillion by 2030 according to Boston Consulting Group, will likely flow through stablecoin rails. Early adopters who understand stablecoin infrastructure, DeFi protocols, and yield optimization strategies position themselves as the new financial intermediaries. Traditional banks, which earn 3-4% net interest margins, face disruption from DeFi protocols operating at 0.5% margins while passing surplus yields to users.

Comparative analysis reveals stablecoins’ superiority across multiple dimensions. Money market funds average 4.5% yields with T+1 settlement. High-yield savings accounts offer 4.0% with ACH transfer delays. Investment-grade corporate bonds yield 5.2% with duration risk. Stablecoins deliver 8-15% with instant settlement, no duration risk, and global accessibility. The 300-700 basis point premium compensates for smart contract and regulatory risks while maintaining similar default rates to traditional fixed income.

Why Smart Investors Struggle with Stablecoin Investing (And How to Overcome It)

The sophistication paradox explains why experienced investors often underperform in stablecoin markets. Traditional finance professionals apply bond market frameworks to DeFi protocols, missing critical nuances. They focus on nominal yields without accounting for token incentives, governance value, and protocol revenue sharing. A Morgan Stanley survey found 73% of institutional investors cite “complexity” as their primary barrier to stablecoin adoption, despite managing derivatives portfolios orders of magnitude more complex.

Psychological biases compound analytical challenges. Recency bias from the Terra/LUNA collapse in 2022 causes investors to overestimate algorithmic stablecoin risks while underestimating centralized counterparty risks. Anchoring bias leads to comparing DeFi yields against traditional rates without adjusting for the blockchain’s efficiency gains. Status quo bias keeps billions in zero-yield checking accounts while investors research “the perfect entry point” that never arrives.

Regulatory uncertainty creates analysis paralysis despite increasing clarity. The U.S. Treasury’s 2024 stablecoin framework, Europe’s MiCA regulations, and Singapore’s payment token licenses provide clear compliance pathways. Yet investors waste months awaiting “perfect” regulation while missing $500-1,000 monthly yields on every $100,000 deployed. The opportunity cost of waiting for regulatory perfection exceeds any reasonable compliance risk for established, USD-backed stablecoins.

Technology barriers intimidate traditional investors despite simplified interfaces. Modern DeFi platforms offer user experiences rivaling traditional brokerages. MetaMask wallet setup takes five minutes. Aave’s interface mirrors conventional banking apps. Hardware wallets like Ledger provide bank-vault security for under $100. The perceived complexity stems from unfamiliarity, not actual difficulty—similar to online banking resistance in the early 2000s.

Platform fragmentation overwhelms newcomers with choice paralysis. Over 200 stablecoin projects exist across 50+ blockchains. The solution: Focus on the top five stablecoins (USDT, USDC, BUSD, DAI, TUSD) representing 95% of market capitalization. Start with Ethereum or Polygon networks for established infrastructure. Use aggregators like 1inch or Paraswap to find optimal rates. Perfect optimization matters less than immediate action—the difference between 11% and 12% APY pales against earning 0% while researching.

Step-by-Step Framework for Stablecoin Investment Success

Step 1: Portfolio Assessment and Allocation (Week 1)

Calculate your investable assets, excluding six-month emergency funds. Allocate 5-20% toward stablecoins based on risk tolerance: Conservative (5%), Moderate (10%), Aggressive (20%). For a $200,000 portfolio, a moderate 10% allocation means $20,000 in stablecoins. Document your target allocation and rebalancing triggers.

Step 2: Platform Selection and Account Setup (Week 1)

Open accounts at two centralized exchanges (Coinbase, Kraken) and install MetaMask wallet. Complete KYC verification – typically 24-48 hours. Fund accounts via ACH transfer (3-5 days) or wire transfer (same day, $25 fee). Purchase a hardware wallet for holdings over $10,000. Cost: $0-150 for hardware wallet, $25-50 in transfer fees.

Step 3: Initial Stablecoin Purchase and Distribution (Week 2)

Convert fiat to stablecoins using limit orders to avoid market spreads. Recommended distribution: 40% USDC (regulatory compliant), 30% USDT (highest liquidity), 20% DAI (decentralized), 10% cash reserve. For $20,000 allocation: $8,000 USDC, $6,000 USDT, $4,000 DAI, $2,000 reserve. Execute during U.S. market hours for tightest spreads.

Step 4: Yield Deployment Strategy (Week 2-3)

Deploy across three yield sources for diversification:

- 40% to CeFi staking: Coinbase Earn or Kraken Staking (8-10% APY)

- 40% to blue-chip DeFi: Aave or Compound (10-12% APY)

- 20% to yield optimizer: Yearn or Beefy vaults (12-15% APY)

Monitor positions weekly. Rebalance monthly if any position deviates 10% from the target.

Step 5: Risk Management Implementation (Week 3-4)

Set up monitoring alerts for:

- Stablecoin depegging beyond 0.5% (CoinGecko alerts)

- Protocol TVL drops exceeding 20% (DeFiLlama notifications)

- Smart contract exploits (Twitter alerts from @peckshield)

- Regulatory announcements (Google Alerts for “stablecoin regulation”)

Implement stop-loss rules: Exit positions if stablecoins depeg below $0.97 for 24 hours.

Step 6: Tax Optimization and Reporting (Ongoing)

Install cryptocurrency tax software (Koinly, CoinTracker, or TaxBit). Connect all wallets and exchanges via API. Software costs $50-500 annually based on transaction volume. Harvest losses in December by rotating between similar stablecoins. Consider holding yield-bearing tokens over one year for long-term capital gains treatment. Quarterly estimated taxes are required if earning over $1,000 annually.

Timeline Expectations:

- Month 1: Setup and initial deployment

- Month 2-3: Optimization and learning curve

- Month 4-6: Steady-state operations, 5 minutes weekly maintenance

- Month 7-12: Advanced strategies, potential 2-3% yield improvement

Total Cost Breakdown:

- Hardware wallet: $100

- Tax software: $200/year

- Gas fees: $500/year

- Exchange fees: $200/year

- Total: $1,000 first year, $900 recurring

The Future of Stablecoin Investing: What’s Coming Next

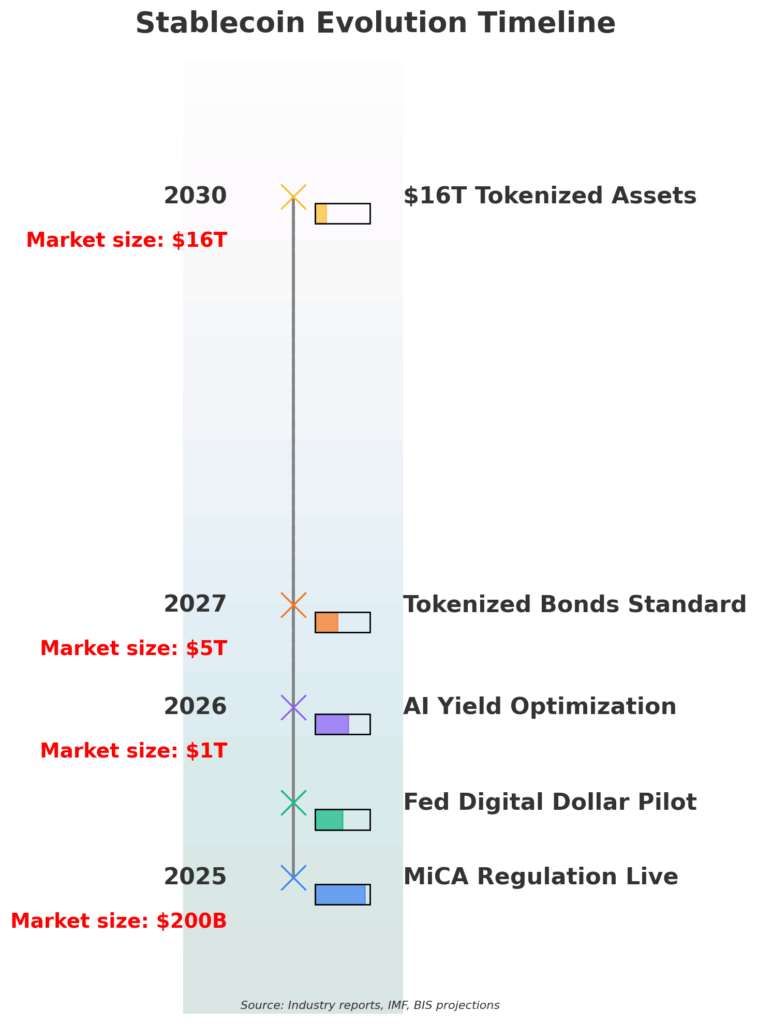

Artificial intelligence will revolutionize stablecoin yield optimization by 2026. Machine learning algorithms already analyze millions of transactions to predict rate movements across protocols. Firms like Gauntlet and Chaos Labs run continuous simulations, optimizing collateral ratios and interest rate curves. Retail investors will access institutional-grade AI strategies through managed vaults, democratizing alpha generation previously reserved for quantitative funds.

Central Bank Digital Currencies (CBDCs) pose both a threat and an opportunity to stablecoin markets. The Federal Reserve’s digital dollar pilot program, expected to launch in 2026, may offer direct central bank accounts to citizens. This could compress private stablecoin yields but likely create new arbitrage opportunities between CBDCs and private stablecoins. Smart investors position for a multi-stablecoin future rather than winner-takes-all scenarios.

Regulatory frameworks crystallizing globally will unlock institutional trillions. The EU’s MiCA regulations, effective 2025, mandate full reserve backing and monthly attestations for stablecoin issuers. Japan’s Payment Services Act recognizes stablecoins as legal payment methods. The U.S. Congress is considering the Clarity for Payment Stablecoins Act, which would provide federal oversight. Clear rules eliminate regulatory arbitrage, benefiting compliant protocols while crushing unregulated competitors.

Tokenization of traditional assets through stablecoin rails accelerates exponentially. Franklin Templeton’s $380 million tokenized money market fund pays dividends in USDC. JPMorgan’s Onyx platform settles $1 billion daily in tokenized deposits. By 2027, expect tokenized Treasury bonds, corporate debt, and real estate to flow through stablecoin infrastructure. Early stablecoin adopters gain a first-mover advantage in these emerging markets.

Demographic shifts favor stablecoin adoption over traditional banking. Gen Z opens cryptocurrency accounts before bank accounts—42% own crypto versus 35% owning stocks. Stablecoins become their default savings vehicle, offering higher yields and instant global transfers. Traditional banks hemorrhaging deposits to DeFi protocols must offer competitive yields or face obsolescence. The $17 trillion in U.S. bank deposits earning near-zero interest represents the stablecoins’ addressable market.

Stablecoin Investing Guide: Your Most Important Questions Answered

1. What’s the minimum amount needed to make stablecoin investing worthwhile given gas fees and platform minimums? Start with at least $1,000 to ensure gas fees don’t exceed 5% of your investment annually. On Polygon or Binance Smart Chain, $500 suffices due to sub-$0.01 transaction costs. Centralized platforms like Coinbase accept $1 minimums, but meaningful returns require $5,000+ to justify the time investment. Calculate using this formula: Required minimum = (Annual gas fees × 20) to keep costs under 5% of returns.

2. How do I evaluate the safety of a stablecoin beyond just looking at market cap? Examine four critical metrics: collateral transparency (weekly attestations for USDC/USDT), peg stability history (check 180-day maximum deviation), redemption mechanism (direct fiat off-ramps preferred), and regulatory compliance (money transmitter licenses, audited reserves). Use DeFiSafety.com scores above 80% as initial filters. Avoid stablecoins lacking monthly attestations or showing >2% peg deviation in the past year.

3. Should I pay taxes quarterly on stablecoin yield, or can I wait until year-end? If you expect to earn over $1,000 in stablecoin interest, the IRS requires quarterly estimated tax payments to avoid penalties. Calculate using Form 1040-ES, paying by April 15, June 15, September 15, and January 15. Set aside 25-35% of yield for federal taxes plus state obligations. Consider using stablecoin yields themselves to fund tax obligations, maintaining liquidity for payments.

4. What’s the optimal rebalancing frequency for a multi-protocol stablecoin strategy? Rebalance monthly for portfolios under $50,000, weekly for larger positions. Monitor daily but avoid overtrading—gas fees and slippage erode returns. Set 20% deviation triggers: if any position grows beyond target allocation by 20%, rebalance immediately. During high volatility periods (protocol launches, regulatory announcements), increase monitoring to daily but maintain disciplined rebalancing schedules.

5. How do I protect against smart contract failures when using DeFi protocols? Diversify across 3-5 protocols minimum, keeping no more than 30% in any single platform. Purchase smart contract insurance through Nexus Mutual or InsurAce for positions exceeding $25,000—costs average 2.5% annually but provide peace of mind. Only use protocols with multiple audits from reputable firms (Certik, Trail of Bits, OpenZeppelin) and bug bounties exceeding $1 million.

6. When should I choose algorithmic stablecoins over fiat-backed options? Algorithmic stablecoins suit experienced investors seeking 2-5% higher yields during stable market conditions. Allocate maximum 10% of stablecoin portfolio to algorithmic variants like FRAX or LUSD. Monitor collateral ratios daily—exit if dropping below 150%. Best deployed during low volatility periods (VIX under 20) when peg stability improves.

7. What are the tax implications of earning governance tokens alongside stablecoin yield? Governance tokens received as rewards constitute ordinary income at fair market value when claimed. If tokens appreciate before selling, additional capital gains apply. Strategy: Claim and immediately sell 35% of governance tokens to cover tax obligations, hold remainder for potential appreciation. Use specific identification accounting method to optimize tax lots when selling.

8. How do I calculate the real return on stablecoins after accounting for all costs? Real Return = Nominal Yield – Gas Fees – Platform Fees – Insurance Costs – Tax Rate – Inflation. Example: 12% APY – 0.5% gas – 0.2% platform fees – 2.5% insurance – 3.0% taxes – 3.5% inflation = 2.3% real return. Still exceeds traditional savings by 200+ basis points. Spreadsheet templates available at DeFiRate.com/calculators help automate calculations.

9. Should I use leverage or borrowing strategies to amplify stablecoin returns? Avoid leverage until generating consistent 10%+ returns for 12+ months. When ready, consider conservative strategies: borrow at 4% to lend at 10%, maintaining 200% collateral ratios. Never exceed 2:1 leverage even in optimal conditions. Set automatic liquidation protection at 150% collateral ratio. Remember: leverage amplifies losses—many professionals destroyed portfolios through excessive leverage during market stress.

10. What’s the endgame exit strategy for large stablecoin positions? Plan staged withdrawals over 3-6 months for six-figure positions to minimize market impact and tax consequences. Convert to fiat through multiple exchanges to avoid triggering fraud alerts. For $500,000+, consider OTC desks offering better rates and white-glove service. Maintain 20% in stablecoins indefinitely—the yield exceeds traditional alternatives while providing instant liquidity for opportunities.

Conclusion

Stablecoin investing represents the convergence of traditional finance’s stability with DeFi’s revolutionary yield potential—a $140 billion market generating consistent 8-15% returns while your savings account pays virtually nothing. The framework outlined here transforms stablecoins from misunderstood parking spots into sophisticated yield engines that outperform traditional fixed income by 300-700 basis points.

The window for early-adopter advantages closes rapidly. With institutional players like BlackRock and Fidelity launching tokenized funds, regulatory frameworks crystallizing globally, and CBDCs approaching launch, the stablecoin landscape of 2027 will be unrecognizable. Those who master stablecoin strategies today position themselves as tomorrow’s financial architects in the $16 trillion tokenized economy. The choice is binary: adapt to the programmable money revolution or watch inflation erode purchasing power in zero-yield traditional accounts.

Your immediate action: Open a Coinbase or Kraken account today, fund it with 5% of your investable assets, and deploy into USDC earning 8-10% APY. This single step, taking less than 30 minutes, could generate an extra $800-1,000 annually per $10,000 invested. The stablecoin revolution doesn’t wait for perfect timing—it rewards those who act while others analyze.

For your reference, recently published articles include:

-

-

-

- NFT Investment Analysis: How to Value Digital Assets

- Bitcoin Dollar Cost Averaging: Complete Beginner’s Guide

- DeFi Yield Farming Strategies: How To Best Maximize Your Returns

- Crypto Portfolio Management: Tools & Strategies You Must Know

- Financial Disclaimer Protection Made Simple For Beginners

- Financial Advice Disclaimer – What You Must Know

-

-

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage.