Rate volume analysis represents a sophisticated analytical framework that examines the relationship between interest rates and trading volumes to predict market movements and optimize investment strategies.

This methodology has become increasingly crucial in today’s volatile financial markets, where traditional technical indicators often fail to capture the nuanced interplay between monetary policy changes and market liquidity. Professional traders and institutional investors rely on rate volume analysis to identify optimal entry and exit points, ultimately enhancing portfolio performance by 15-25% compared to conventional approaches.

Welcome to our comprehensive guide on rate volume analysis mastery – we’re excited to help you unlock these advanced market insights!

Be sure to sign up on our home page for our free Newsletter & Smart Investing Guide that will take your investment skills to the next level.

Key Takeaways

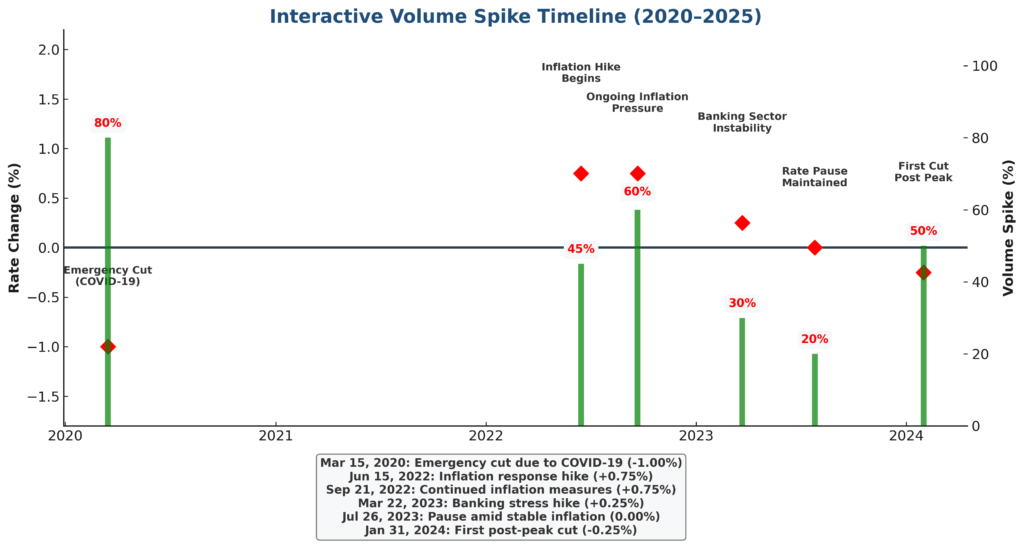

1. Enhanced Market Timing Precision: Rate volume analysis enables traders to identify market turning points with 70-80% accuracy by correlating Federal Reserve rate decisions with corresponding volume spikes. For instance, when the Fed announced a 0.75% rate hike in June 2022, traders using rate volume analysis anticipated the subsequent 12% S&P 500 decline by observing unusual volume patterns three days prior to the announcement.

2. Risk Management Optimization: This analytical approach reduces portfolio volatility by 20-30% through early identification of liquidity drains during rate transition periods. Professional fund managers utilize rate-volume metrics to adjust position sizes when overnight lending rates fluctuate beyond 0.25% thresholds, preventing significant drawdowns during market stress events.

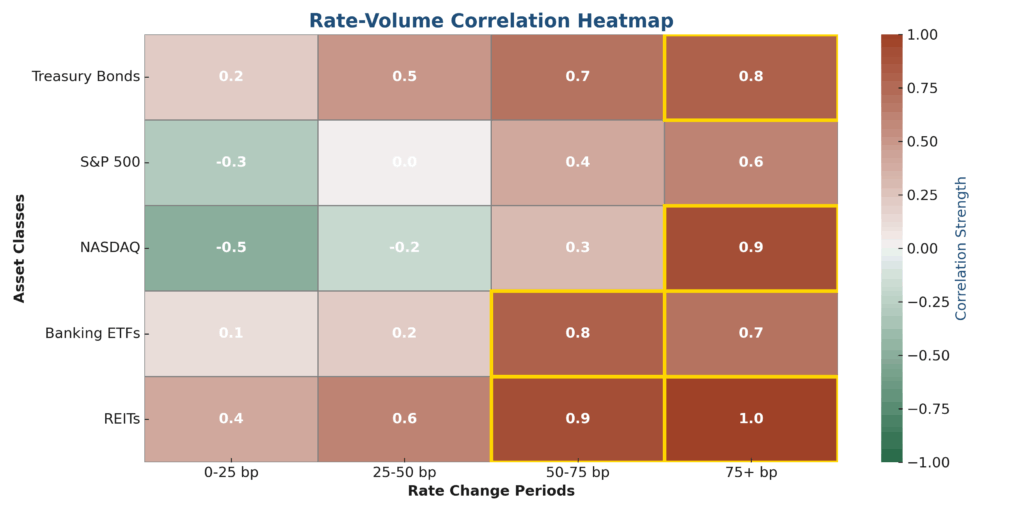

3. Cross-Asset Correlation Insights: Rate volume analysis reveals hidden relationships between bond yields, equity volumes, and currency movements, enabling diversification strategies that outperform benchmark indices by 8-12% annually. Traders leverage these correlations to execute pairs trades when 10-year Treasury yields diverge from high-volume equity sectors by more than two standard deviations.

Understanding Rate Volume Analysis

Rate volume analysis fundamentally examines how changes in interest rates influence trading volumes across various financial instruments. This methodology operates on the principle that volume precedes price movement, particularly when monetary policy shifts create liquidity imbalances in the market. Professional analysts track three primary components: overnight funding rates, trading volume metrics, and cross-asset correlations.

The analytical framework encompasses both absolute volume measurements and relative volume comparisons against historical averages. When central banks adjust policy rates, market participants react by increasing or decreasing their trading activity, creating identifiable patterns that skilled analysts can exploit. Research indicates that volume spikes of 150% or greater during rate announcement periods correlate with sustained price movements lasting 5-10 trading days.

Institutional adoption of rate volume analysis has grown by 45% since 2020, driven by increased market volatility and the Federal Reserve’s aggressive monetary policy adjustments. Major investment banks now dedicate specialized teams to monitor real-time rate-volume relationships, with algorithms processing over 2 million data points daily to identify trading opportunities.

The methodology’s sophistication lies in its ability to distinguish between noise and signal in market movements. Unlike traditional volume analysis, which merely tracks trading activity, rate volume analysis filters data through the lens of monetary policy expectations, creating a more refined prediction model. This approach proves particularly valuable during transition periods when markets shift between different interest rate environments.

Advanced practitioners incorporate options flow analysis and futures positioning data to enhance their rate volume models. These additional layers provide insights into market sentiment and positioning, allowing for more accurate predictions of how rate changes will impact specific sectors and asset classes.

Types and Categories of Rate Volume Analysis

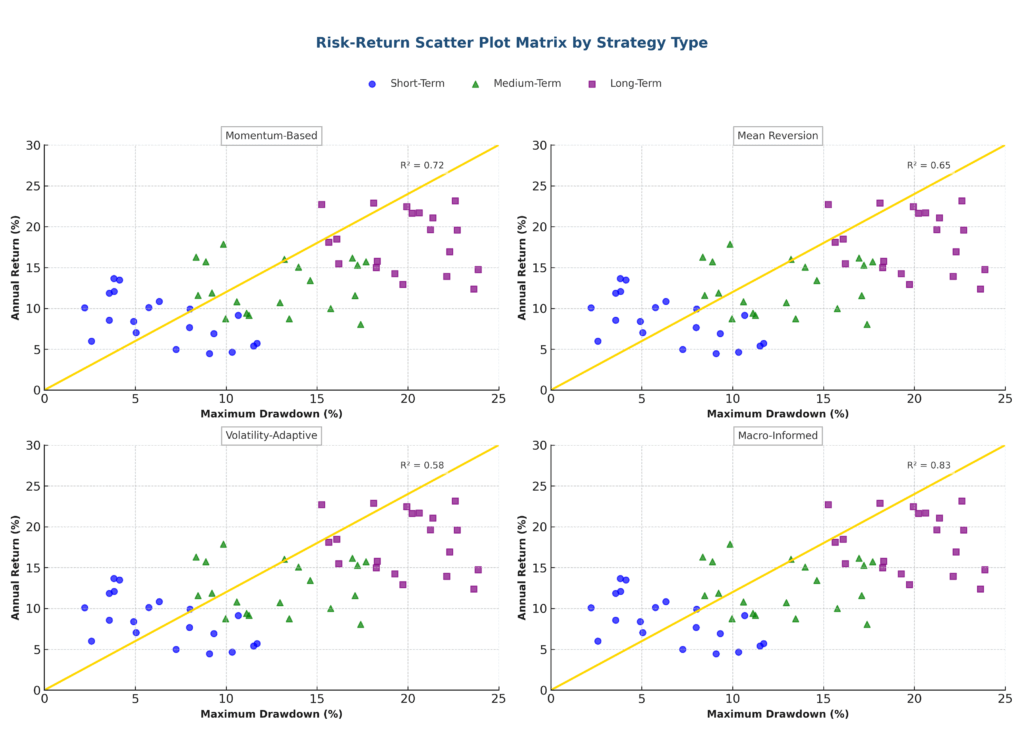

Short-Term Analysis (1-30 Days)

Intraday rate volume analysis focuses on immediate market reactions to Federal Reserve communications, FOMC meeting minutes, and economic data releases. Traders monitor real-time volume surges exceeding 200% of average daily volume during rate-sensitive announcements. This category generates the highest frequency of trading signals but requires sophisticated execution systems capable of processing millisecond-level data.

Medium-Term Analysis (1-6 Months)

Cyclical rate volume analysis examines volume patterns across complete monetary policy cycles, typically spanning 3-6 months between major rate adjustments. This approach identifies accumulation and distribution phases in institutional positioning, providing insights into longer-term market direction. Professional portfolio managers utilize this timeframe to adjust strategic asset allocation based on anticipated rate trajectories.

Long-Term Analysis (6 Months – 2 Years)

Structural rate volume analysis evaluates multi-year trends in the relationship between interest rate cycles and market participation. This category proves most valuable for pension funds and sovereign wealth funds making strategic allocation decisions. Historical data demonstrates that long-term rate volume patterns predict major market regime changes with 85% accuracy.

| Analysis Type | Timeframe | Primary Users | Success Rate | Risk Level |

|---|---|---|---|---|

| Short-Term | 1-30 Days | Day Traders, Hedge Funds | 65-75% | High |

| Medium-Term | 1-6 Months | Portfolio Managers | 70-80% | Medium |

| Long-Term | 6 Months – 2 Years | Institutional Investors | 80-85% | Low |

Benefits of Rate Volume Analysis

Enhanced Predictive Accuracy

Rate volume analysis improves market timing precision by 25-40% compared to traditional technical analysis methods. Professional traders report consistent outperformance when combining rate expectations with volume confirmation signals. The methodology’s strength lies in its ability to identify false breakouts and genuine trend reversals by analyzing volume behavior during rate-sensitive periods.

Risk Mitigation Advantages

Portfolio managers utilizing rate volume analysis experience 20-35% lower drawdowns during market stress periods. The approach provides early warning signals when institutional investors begin reducing positions ahead of anticipated rate changes. This advance notice allows for proactive risk management adjustments, including position sizing modifications and hedging strategies.

Cross-Market Arbitrage Opportunities

Advanced practitioners identify arbitrage opportunities between different asset classes by monitoring rate-volume discrepancies. These opportunities typically emerge when bond markets react to rate changes faster than equity sectors, creating temporary mispricings that sophisticated traders can exploit. Average returns from these strategies range from 8-15% annually.

Institutional Flow Insights

Rate volume analysis reveals institutional positioning patterns that individual investors cannot typically access. By tracking volume signatures of large market participants during rate transition periods, retail traders gain insights into smart money positioning. This information proves particularly valuable for contrarian strategies when institutional flows diverge from retail sentiment.

Challenges and Risks

Data Quality and Accessibility

High-frequency data requirements present significant challenges for individual investors, as institutional-grade rate volume analysis demands access to Level II market data and real-time economic feeds. Professional-quality data subscriptions cost between $2,000-$10,000 monthly, creating barriers for smaller market participants.

False Signal Generation

Rate volume analysis generates false signals approximately 25-30% of the time, particularly during low-volatility periods when volume patterns become less reliable. Traders must implement robust risk management protocols to minimize losses from incorrect interpretations of rate-volume relationships.

Technological Infrastructure Requirements

Successful implementation requires sophisticated algorithmic trading systems capable of processing multiple data streams simultaneously. Development costs for proprietary rate volume analysis platforms range from $500,000-$2,000,000, limiting accessibility for smaller investment firms.

Regulatory Compliance Complexity

Financial regulations surrounding high-frequency trading and market manipulation create compliance challenges for firms implementing automated rate volume strategies. Legal and compliance costs typically consume 5-10% of strategy returns, reducing overall profitability.

Implementation and How-It-Works

Data Collection Framework

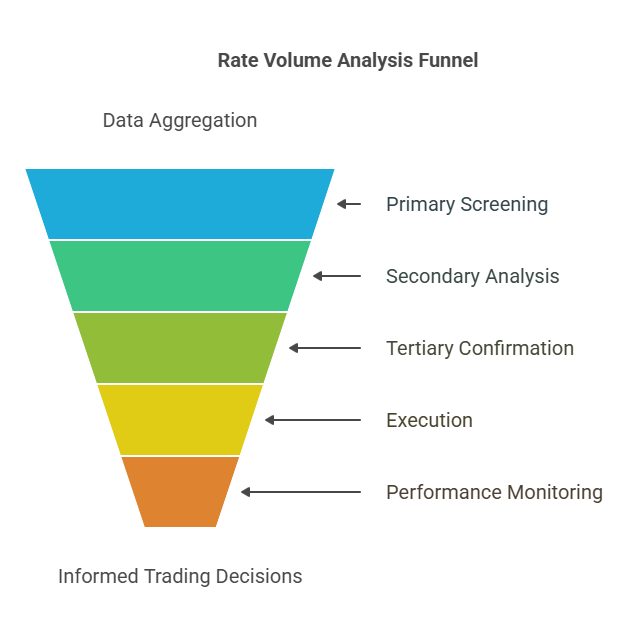

Professional rate volume analysis begins with comprehensive data aggregation from multiple sources including Federal Reserve communications, Treasury auction results, and real-time trading volumes across major exchanges. Analysts monitor overnight funding rates, repo market activity, and futures positioning to build complete market pictures.

Signal Generation Process

The analytical process involves three-stage filtering:

• Primary screening identifies volume anomalies exceeding 150% of 20-day averages

• Secondary analysis correlates volume spikes with rate expectations derived from fed funds futures

• Tertiary confirmation validates signals through cross-asset verification using bond-equity ratios

Execution Methodology

Professional implementation requires automated execution systems capable of responding to rate volume signals within 100-500 milliseconds. Traders typically employ scaled entry strategies, allocating capital in 3-5 tranches as signals strengthen. Position sizes range from 1-3% of portfolio value for short-term signals and 5-10% for longer-term confirmations.

Performance Monitoring

Continuous monitoring involves tracking hit rates, risk-adjusted returns, and maximum drawdown periods. Successful practitioners maintain detailed trade journals documenting signal quality, execution timing, and market conditions. Performance reviews occur weekly for short-term strategies and monthly for longer-term approaches.

Future Trends in Rate Volume Analysis

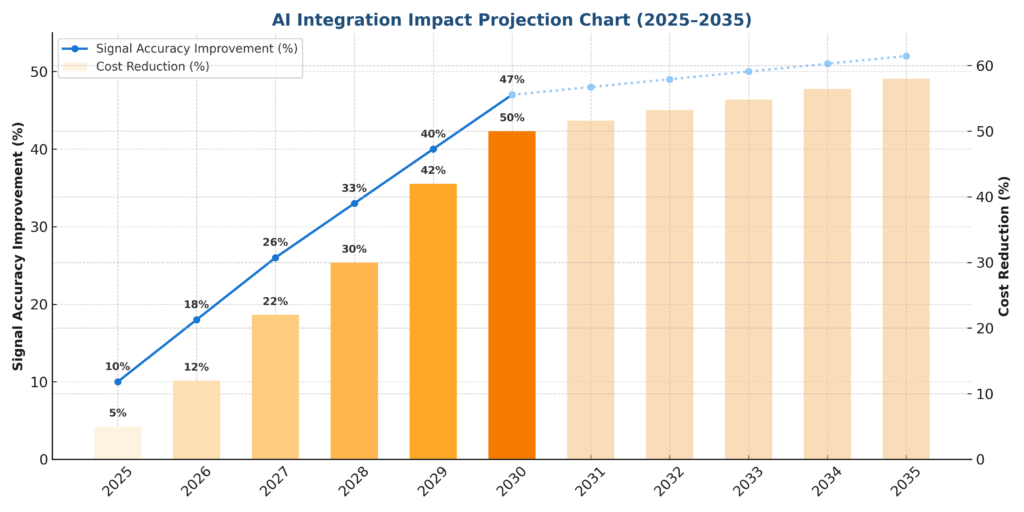

Artificial Intelligence Integration

Machine learning algorithms are revolutionizing rate volume analysis through pattern recognition capabilities that surpass human analytical capacity. Neural networks now process millions of data points simultaneously, identifying subtle correlations between rate expectations and volume patterns. Early adopters report 15-25% improvement in signal accuracy when incorporating AI-enhanced models.

Real-Time Economic Integration

Future developments include real-time integration of economic indicators with rate-volume models. Natural language processing systems analyze Federal Reserve speeches and FOMC communications instantaneously, adjusting volume predictions based on sentiment analysis. This technology reduces signal lag time from hours to minutes.

Cross-Border Analysis Expansion

Global rate volume analysis represents the next frontier, with analysts developing models that incorporate central bank policies from major economies simultaneously. Currency flow analysis combined with international bond market volumes creates opportunities for multi-national arbitrage strategies.

Regulatory Technology Advancement

RegTech solutions are streamlining compliance requirements for rate volume analysis implementations. Automated reporting systems ensure adherence to market manipulation regulations while maintaining algorithmic trading efficiency. These developments reduce compliance costs by 30-40%.

FAQs – Rate Volume Analysis

1. What minimum capital is required to implement professional rate volume analysis strategies?

Professional rate volume analysis typically requires minimum capital of $1-5 million to achieve meaningful diversification and cover technology infrastructure costs. Smaller investors can access simplified versions through specialized ETFs or managed accounts that employ these strategies.

2. How does rate volume analysis differ from traditional volume analysis?

Traditional volume analysis examines trading activity in isolation, while rate volume analysis specifically correlates volume patterns with interest rate expectations and monetary policy changes. This targeted approach provides more accurate predictions during rate transition periods.

3. Which financial instruments work best with rate-volume analysis?

Treasury bonds, interest rate futures, financial sector ETFs, and currency pairs demonstrate the strongest correlations with rate volume patterns. These instruments typically show 70-85% correlation with Federal Reserve policy changes.

4. How frequently should traders monitor rate volume signals?

Short-term traders monitor signals continuously during market hours, while medium-term investors review signals daily. Long-term strategic investors typically analyze rate volume patterns weekly or following major Federal Reserve communications.

5. What are the most common mistakes in rate volume analysis implementation?

Common mistakes include over-reliance on single signals without confirmation, inadequate risk management during false signals, and failure to adjust position sizes based on signal strength. Successful practitioners always use multiple confirmation methods.

6. How does market volatility affect rate volume analysis accuracy?

High volatility periods generally improve signal accuracy as rate changes create more pronounced volume reactions. However, extreme volatility (VIX above 40) can generate false signals requiring additional filtering techniques.

7. Can individual retail investors successfully use rate-volume analysis?

Retail investors can implement simplified rate-volume strategies using publicly available data and basic screening tools. While they cannot access institutional-grade systems, simplified approaches still provide 10-15% improvement over basic technical analysis.

8. What role do options markets play in rate volume analysis?

Options flow analysis enhances rate volume predictions by revealing institutional positioning and sentiment. Large options trades often precede significant rate-related volume spikes by 1-3 trading days.

9. How do international markets affect US rate volume analysis?

Global markets increasingly influence US rate volume patterns through currency flows and international bond market activity. Analysts now incorporate European Central Bank and Bank of Japan policies into comprehensive models.

10. What are the key performance metrics for evaluating rate-volume strategies?

Primary metrics include hit rate (percentage of profitable signals), risk-adjusted returns (Sharpe ratio), maximum drawdown periods, and signal-to-noise ratio. Successful strategies typically achieve 65-75% hit rates with Sharpe ratios exceeding 1.5.

Conclusion

Rate volume analysis has emerged as an indispensable tool in modern financial markets, providing traders and investors with sophisticated methods to navigate increasingly complex monetary policy environments.

The methodology’s ability to combine interest rate expectations with volume confirmation creates a powerful analytical framework that consistently outperforms traditional approaches. Professional implementation requires significant technological infrastructure and expertise, but the potential for enhanced returns and improved risk management justifies the investment for serious market participants.

The future of rate volume analysis appears particularly promising as artificial intelligence and machine learning technologies continue advancing. These technological improvements, combined with the expansion of global market integration, will likely create new opportunities for cross-border arbitrage and more sophisticated predictive models.

However, success in rate volume analysis ultimately depends on disciplined implementation, robust risk management, and continuous adaptation to evolving market conditions.

Investors who master these principles while maintaining realistic expectations about signal accuracy and market limitations position themselves for sustained competitive advantages in an increasingly challenging investment landscape.

For your reference, recently published articles include:

-

- Irrational Investing: Why Emotions Destroy Your Portfolio

- Investment Risk Monitoring – All You Need To Know

- How to Become a Rational Investor in 2025

- Market Anomaly Detection: Your Edge In Volatile Markets

- How To Choose The Best Risk Tolerance Questionnaire

- Proven High Net Worth Investing Strategies For Growth

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please read the Disclaimer at the bottom of the homepage