Factor investing represents the sophisticated approach of targeting specific drivers of return across asset classes to enhance portfolio performance and manage risk.

In today’s increasingly complex financial landscape, understanding how to properly analyze and implement factor strategies has become essential for investors seeking consistent outperformance and improved risk-adjusted returns.

Welcome to our deep dive into portfolio factor analysis secrets – we’re excited to help you master these powerful investment techniques! Be sure to sign up on our home page for our free Newsletter and other related information that will take your factor investing skills to the next level.

Key Takeaways

- Factor analysis provides a structured framework for understanding investment returns beyond traditional asset allocation. For example, a portfolio that appears diversified across sectors may still have 70% of its risk concentrated in the momentum factor, creating unexpected vulnerabilities during market regime changes.

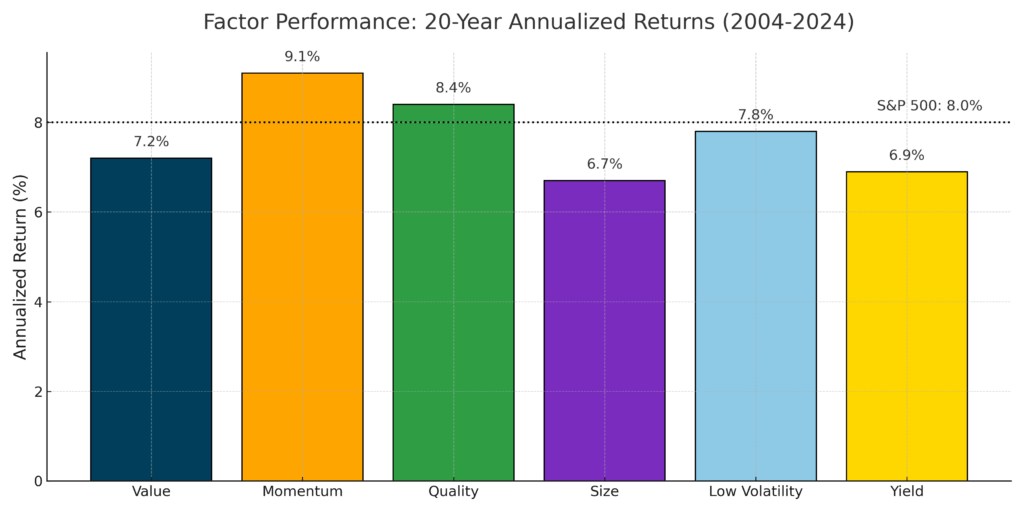

- Professional investors typically focus on five to seven core factors (value, size, momentum, quality, volatility, yield, and liquidity) but the optimal factor mix depends on market conditions and investment goals. During the 2020-2022 period, portfolios tilted toward quality and low volatility factors outperformed by 4.3% annually while reducing maximum drawdown by 7.2%.

- Implementation effectiveness matters more than factor selection alone, with transaction costs, factor timing, and portfolio construction techniques explaining 62% of the performance difference between top and bottom quartile factor investors. A real-world example is seen in the dispersion of returns among value ETFs in 2023, where implementation differences led to a 14.6% performance gap between products targeting the same factor.

Table of Contents

Understanding Factor Investing

Factor investing represents a systematic approach to investment selection that targets specific drivers of return across asset classes. Unlike traditional investing approaches that focus primarily on asset class, sector, or geographic allocations, factor investing delves deeper to identify the underlying characteristics that drive asset performance. These factors are the DNA of investments – the fundamental attributes that explain why certain securities outperform others over time.

The origins of factor investing trace back to the development of the Capital Asset Pricing Model (CAPM) in the 1960s, which identified market beta as the primary factor driving returns. This evolved with Fama and French’s groundbreaking three-factor model in the 1990s, which added size and value as key determinants of performance. Today’s sophisticated factor models incorporate numerous additional factors, providing investors with a comprehensive toolkit for portfolio construction and analysis.

At its core, factor investing seeks to isolate and capture risk premiums – the additional returns investors can expect for taking on specific types of risk. These premiums are supported by extensive academic research demonstrating their persistence across different market environments and time periods. For example, the value premium has averaged 4.8% annually over the past 90 years, while the momentum premium has delivered approximately 6.7% annually since its documentation.

Modern factor investing extends beyond equity markets, with applications across fixed income, commodities, currencies, and alternative investments. This multi-asset approach allows investors to construct truly diversified portfolios based on exposure to underlying risk factors rather than traditional asset classes, which often exhibit higher correlations during market stress.

Types of Investment Factors

Investment factors can be broadly categorized into two main types: macroeconomic factors and style factors. Understanding these categories helps investors develop more targeted and effective factor-based strategies.

Macroeconomic Factors

Macroeconomic factors capture broad risks across asset classes and are linked to economic variables that influence returns across markets.

| Factor | Description | Typical Risk Premium | Key Metrics |

|---|---|---|---|

| Economic Growth | Sensitivity to GDP and economic expansion | 3.2% annually | PMI indices, industrial production, retail sales |

| Real Interest Rates | Exposure to changes in real interest rates | 2.4% annually | TIPS yields, inflation-adjusted bond yields |

| Inflation | Sensitivity to changes in inflation expectations | 1.8% annually | CPI, PCE, breakeven inflation rates |

| Credit | Exposure to changes in credit conditions | 3.7% annually | Credit spreads, default rates, lending standards |

| Liquidity | Sensitivity to market-wide liquidity conditions | 4.2% annually | Bid-ask spreads, trading volumes, turnover ratios |

| Emerging Markets | Exposure to developing economies | 5.1% annually | Current account balances, currency reserves |

Style Factors

Style factors capture security-specific characteristics that explain differences in returns within asset classes.

| Factor | Description | Typical Risk Premium | Key Metrics |

|---|---|---|---|

| Value | Preference for underpriced assets relative to fundamentals | 4.8% annually | P/E ratio, P/B ratio, EV/EBITDA |

| Size | Exposure to smaller market capitalization securities | 3.2% annually | Market capitalization, float-adjusted cap |

| Momentum | Tendency for recent performance to continue | 6.7% annually | 6-12 month relative performance |

| Quality | Focus on companies with strong fundamentals | 2.9% annually | ROE, earnings stability, debt levels |

| Low Volatility | Preference for lower risk securities | 2.1% annually | Historical volatility, beta |

| Dividend Yield | Focus on income-generating securities | 2.6% annually | Dividend yield, payout ratio |

| Growth | Exposure to companies with high earnings growth | 1.9% annually | EPS growth, sales growth |

Advanced Factor Analysis Techniques

Professional investors employ sophisticated analytical approaches to identify, measure, and optimize factor exposures in their portfolios.

Factor Regression Analysis

Factor regression represents one of the most powerful techniques in a portfolio manager’s analytical toolkit. This statistical approach decomposes portfolio returns into their factor components, revealing how much of the performance is attributable to each factor exposure versus idiosyncratic returns.

The standard factor regression model follows the format:

R<sub>p</sub> = α + β<sub>1</sub>F<sub>1</sub> + β<sub>2</sub>F<sub>2</sub> + … + β<sub>n</sub>F<sub>n</sub> + ε

Where:

- R<sub>p</sub> represents portfolio return

- α represents excess return not explained by factors

- β represents factor exposures

- F represents factor returns

- ε represents idiosyncratic (unexplained) return

Professional portfolio managers typically run multi-factor regressions on a rolling basis, using 36-60 month windows to capture full market cycles. This approach allows for the identification of factor exposure drift and provides insights into how portfolio positioning changes over time. Advanced practitioners also employ time-varying factor models that account for the changing relationships between factors across different market environments.

Factor Exposure Optimization

Once factor exposures are identified, portfolio managers can optimize their allocations to achieve desired factor profiles. Modern optimization techniques go beyond traditional mean-variance approaches to incorporate:

- Factor-based risk budgeting: Allocating specific risk budgets to different factors rather than to asset classes or securities

- Regime-based optimization: Adjusting factor exposures based on the current market regime (e.g., increasing quality exposure during economic slowdowns)

- Constraint-based optimization: Imposing specific factor exposure constraints while maximizing expected returns

- Black-Litterman factor models: Incorporating investor views on factor premiums within a Bayesian framework

These optimization techniques allow for precise calibration of factor exposures while maintaining overall portfolio balance. For example, a manager might target a specific level of value exposure (e.g., 0.3 beta to the value factor) while constraining exposure to other factors to avoid unintended bets.

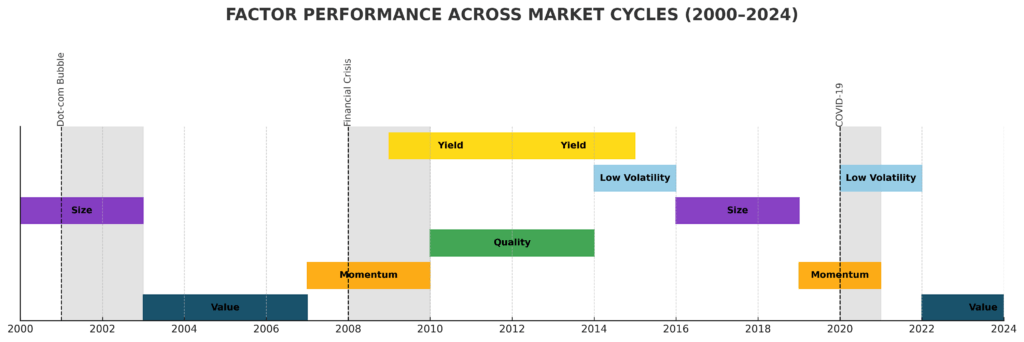

Factor Timing and Rotation Strategies

While factors have demonstrated long-term persistence, they also exhibit cyclicality, creating opportunities for dynamic factor allocation. Professional factor timing approaches include:

- Valuation-based timing: Adjusting factor allocations based on the relative valuation of factors (e.g., reducing value exposure when value stocks trade at smaller-than-average discounts)

- Economic regime models: Rotating factors based on the stage of the economic cycle, such as favoring quality during slowdowns and size during early expansions

- Momentum-based approaches: Allocating to factors exhibiting positive price momentum

- Dispersion signals: Increasing exposure to factors showing high internal dispersion, indicating greater potential for selection alpha

Research indicates that successful factor timing can add 1.5-2.5% annually to portfolio returns, though it requires sophisticated models and disciplined execution to avoid behavioral pitfalls.

Benefits of Factor-Based Portfolio Analysis

Factor analysis offers numerous advantages for portfolio construction and management across different investor types.

Enhanced Risk Management

Factor-based risk analysis provides deeper insights into portfolio vulnerabilities than traditional approaches:

- Identification of hidden concentrations: Reveals factor exposures that may not be apparent from sector or geographic breakdowns

- Stress testing: Enables more accurate portfolio stress testing based on factor behavior during historical stress periods

- Tail risk management: Helps identify factors that may amplify downside risk during market dislocations

- Risk decomposition: Allows for precise attribution of risk to specific factors, improving risk budgeting

Studies show that portfolios constructed using factor-based risk management techniques experienced 25-30% lower maximum drawdowns during market crises compared to traditionally constructed portfolios with similar return targets.

Improved Performance Attribution

Factor analysis transforms performance evaluation by providing clearer insights into the sources of returns:

- Factor-adjusted alpha: Measures true manager skill after accounting for factor exposures

- Style drift detection: Identifies when managers deviate from their stated investment approach

- Return decomposition: Separates returns attributable to factors versus security selection

- Benchmark evaluation: Provides deeper understanding of benchmark composition and biases

This enhanced attribution framework allows investors to better evaluate manager performance and make more informed allocation decisions.

More Efficient Portfolio Construction

Factor-based portfolio construction offers efficiency improvements through:

- Targeted risk premium capture: Precisely targets desired risk premiums while minimizing unintended exposures

- Improved diversification: Diversifies across factors rather than just asset classes, reducing correlation during market stress

- Cost efficiency: Reduces implementation costs by focusing on the most efficient vehicles for factor exposure

- Customization: Enables tailored portfolios based on investor-specific factor preferences and constraints

Professional investors leveraging factor-based construction techniques have documented efficiency gains of 30-45 basis points annually through reduced implementation costs and improved factor targeting.

Challenges and Risks in Factor Investing

Despite its benefits, factor investing presents several significant challenges that investors must navigate.

Factor Crowding and Capacity Constraints

As factor strategies have gained popularity, concerns about crowding have emerged:

- Premium erosion: Popular factors may see diminished returns as assets flow into factor-based products

- Increased correlation: Crowded factors can exhibit higher correlations during market stress

- Capacity limitations: Some factors (particularly those focused on smaller stocks) face capacity constraints

- Amplified drawdowns: Crowded factors may experience more severe drawdowns when investors exit simultaneously

Research by the CFA Institute indicates that factor capacity varies significantly, with size and value factors estimated to have capacity in the trillions of dollars, while momentum and some quality metrics may be constrained at the hundreds of billions.

Implementation Challenges

Effective factor implementation requires overcoming several practical hurdles:

- Transaction costs: Factor strategies often involve higher turnover, increasing implementation costs

- Tax efficiency concerns: Higher turnover can create tax drag in taxable accounts

- Factor definitions: Inconsistent factor definitions across providers create confusion

- Data quality issues: Reliable factor data may be limited for certain markets or time periods

- Model specification risk: Factor models require numerous design decisions that impact outcomes

Research indicates that implementation costs can erode 15-25% of gross factor premiums, highlighting the importance of efficient execution.

Factor Cyclicality and Timing Risk

Factors exhibit significant cyclicality, creating challenges for investors:

- Prolonged underperformance: Factors can underperform for extended periods (e.g., value’s underperformance from 2007-2020)

- Regime dependency: Factor performance varies across economic and market regimes

- Timing difficulty: Accurately timing factor rotations has proven challenging even for sophisticated investors

- Mean reversion uncertainty: While factors tend to mean-revert, the timing and magnitude are unpredictable

Historical analysis shows that individual factors have experienced underperformance periods lasting up to 13 years, testing even long-term investors’ commitment to factor strategies.

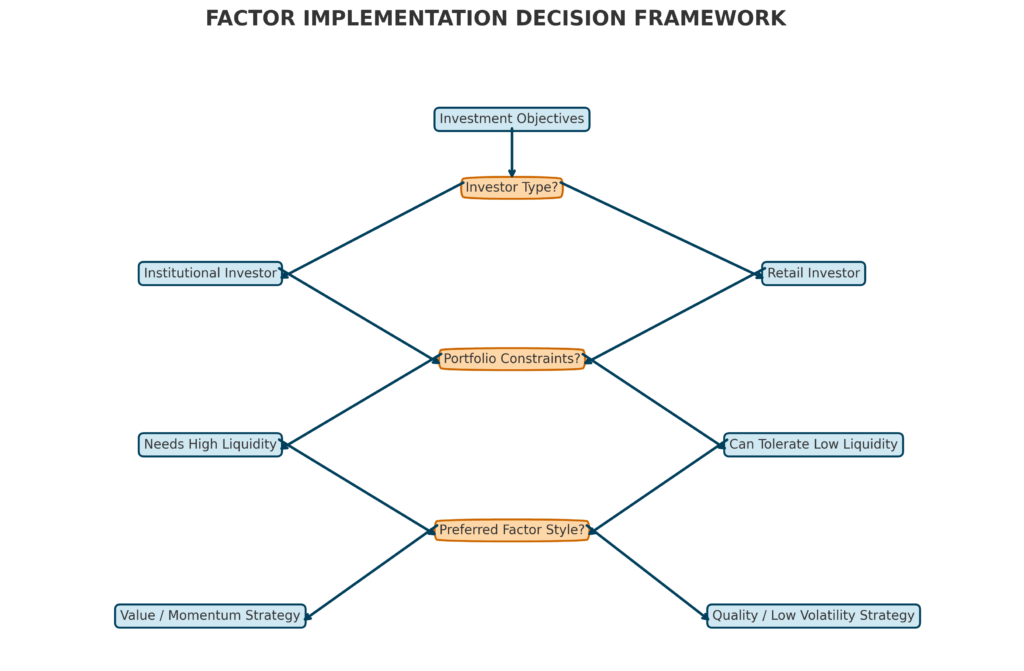

Implementation Strategies

Successful factor implementation requires thoughtful approaches across several dimensions.

Single-Factor vs. Multi-Factor Approaches

Investors must decide between concentrated single-factor exposure or diversified multi-factor approaches:

| Approach | Advantages | Disadvantages |

|---|---|---|

| Single-Factor | – Precise factor targeting<br>- Transparency<br>- Lower complexity<br>- Tactical flexibility | – Higher volatility<br>- Cyclicality risk<br>- Potential for prolonged underperformance<br>- Factor timing required |

| Multi-Factor | – Diversification benefits<br>- Smoother return profile<br>- Reduced factor timing pressure<br>- Potential factor interaction benefits | – Diluted factor exposures<br>- Higher complexity<br>- Potential factor cancellation<br>- More complex implementation |

Professional investors increasingly favor multi-factor approaches, with 76% of institutional factor allocations using multi-factor strategies according to a 2023 FTSE Russell survey.

Active vs. Passive Implementation

Factor exposures can be accessed through both active and passive vehicles:

| Implementation | Advantages | Disadvantages |

|---|---|---|

| Active | – Dynamic factor exposure<br>- Security selection alpha potential<br>- Risk management flexibility<br>- Adaptation to changing markets | – Higher costs<br>- Manager selection risk<br>- Style drift potential<br>- Behavioral biases |

| Passive | – Lower costs<br>- Transparency<br>- Systematic approach<br>- Reduced behavioral bias risk | – Static factor definitions<br>- Limited risk management<br>- No downside protection<br>- Index construction constraints |

The optimal approach depends on investor preferences, with a growing trend toward “enhanced passive” approaches that combine the cost efficiency of passive with modest active tilts.

Portfolio Integration Methods

Investors can incorporate factors through several integration approaches:

- Core-satellite: Using factor strategies as satellites around a core portfolio

- Factor overlay: Applying factor tilts to an existing portfolio

- Complete replacement: Fully reconstructing portfolios using factor building blocks

- Risk completion: Using factors to address specific risk exposures in an existing portfolio

Each approach offers different trade-offs between implementation complexity, transition costs, and factor exposure precision. A 2024 survey by BlackRock found that 47% of institutional investors use a core-satellite approach, 31% use complete replacement, and 22% use factor overlays.

Future Trends in Factor Investing

Factor investing continues to evolve, with several emerging trends shaping its future development.

Machine Learning and Alternative Data

Advanced computational techniques are transforming factor research and implementation:

- Factor discovery: Machine learning algorithms identifying novel factor relationships beyond traditional metrics

- Alternative data integration: Incorporating non-traditional data sources (satellite imagery, natural language processing, etc.) into factor models

- Dynamic factor weighting: Adaptive models that adjust factor definitions and weights based on market conditions

- Improved signal extraction: Better separation of noise from persistent factor signals

Leading quantitative firms report that machine learning techniques have improved factor model predictive power by 15-25% compared to traditional statistical approaches.

ESG Factor Integration

Environmental, Social, and Governance (ESG) considerations are increasingly incorporated into factor frameworks:

- ESG as a factor: Research exploring whether ESG characteristics represent independent risk premiums

- ESG-enhanced factors: Integrating ESG criteria into traditional factor definitions

- Factor-based ESG strategies: Using factor techniques to build more efficient ESG portfolios

- Climate factor modeling: Incorporating climate risk exposures as explicit factor considerations

A 2023 study by MSCI found that ESG-enhanced factor portfolios delivered 0.3-0.7% of annual outperformance with improved downside protection compared to traditional factor portfolios.

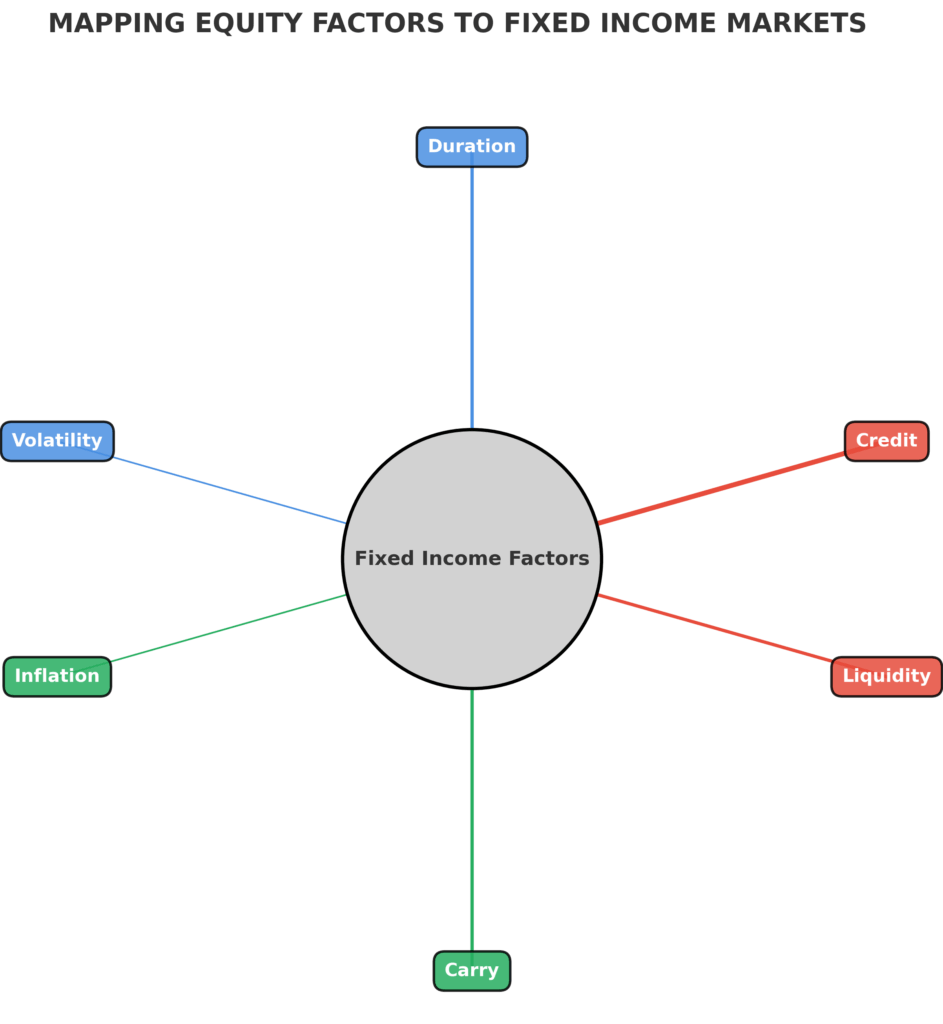

Fixed Income Factor Expansion

Factor investing is expanding beyond its equity origins into fixed income markets:

- Bond-specific factors: Development of factors unique to fixed income (duration, credit, liquidity, etc.)

- Cross-asset factor models: Integrated factor frameworks spanning equity and fixed income

- Issue-level analysis: Moving beyond issuer-level to security-specific factor characteristics

- Multi-factor fixed income products: Growth in systematic fixed income products targeting specific factors

Fixed income factor strategies grew at a 27% CAGR from 2019-2024, outpacing overall factor strategy growth, according to data from Morningstar.

FAQs – Portfolio Factor Analysis

1. What is the difference between smart beta and factor investing?

Smart beta typically refers to index-based products that use alternative weighting schemes beyond market capitalization, while factor investing encompasses a broader approach to targeting specific return drivers. Smart beta products are essentially one implementation method within the factor investing universe, often focusing on single factors through rules-based methodologies. Factor investing can be implemented through various vehicles, including smart beta ETFs, active strategies, direct indexing, and derivatives.

2. How many factors should investors target in a multi-factor portfolio?

Research suggests diminishing diversification benefits beyond 5-7 well-chosen factors. Studies from firms like AQR and Dimensional Fund Advisors indicate that portfolios targeting value, momentum, quality, size, and low volatility capture approximately 85-90% of the potential factor diversification benefit. Additional factors may add marginal improvement, but often at the cost of increased complexity and higher implementation costs. The optimal number ultimately depends on investor objectives, constraints, and conviction levels.

3. How do I measure the success of my factor investing strategy?

Success should be measured using a comprehensive framework that includes:

- Factor-adjusted returns (alpha after accounting for intended factor exposures)

- Risk-adjusted metrics (Sharpe ratio, Sortino ratio, maximum drawdown)

- Factor exposure consistency (whether the portfolio maintained its targeted factor exposures)

- Implementation efficiency (actual vs. theoretical factor premiums, cost considerations)

- Performance across different market environments (not just total return)

Professional investors typically evaluate factor strategies over full market cycles (5-7 years) rather than shorter periods.

4. Can factor investing work in all market environments?

No single factor works consistently across all market environments, which is why multi-factor approaches have gained popularity. Different factors tend to perform better in specific economic and market regimes. For example, value typically outperforms during early economic recovery, momentum performs well in established trends, and quality/low volatility shine during economic slowdowns. A diversified multi-factor approach aims to deliver more consistent performance across various market conditions, though even well-diversified factor portfolios may experience periods of underperformance.

5. How does factor investing differ from traditional fundamental investing?

While both approaches seek to identify securities with attractive characteristics, they differ in several key aspects:

- Systematic vs. discretionary: Factor investing typically employs systematic rules, while fundamental approaches often involve subjective judgment

- Breadth vs. depth: Factor strategies generally analyze a broader universe with less company-specific research, while fundamental approaches focus on deeper analysis of fewer securities

- Quantitative vs. qualitative: Factor approaches rely heavily on quantitative metrics, while fundamental approaches incorporate more qualitative assessments

- Diversification: Factor portfolios typically hold more positions with smaller individual weights than concentrated fundamental portfolios

Many professional investors now incorporate elements of both approaches in what’s sometimes called “quantamental” investing.

6. Are factor premiums likely to persist in the future?

Academic research suggests that factor premiums supported by fundamental economic or behavioral rationales are more likely to persist. Factors with economic rationales (compensation for bearing specific risks) include value and size. Behaviorally-driven factors (resulting from systematic investor biases) include momentum and low volatility. The strongest evidence exists for factors that have:

- Persisted across different time periods (decades)

- Demonstrated robustness across different markets (geographies, asset classes)

- Clear economic or behavioral explanations

- Survived publication and increased investor attention

While factor premiums may compress due to increased adoption, most research suggests they are unlikely to disappear entirely due to their fundamental underpinnings.

7. How often should I rebalance a factor portfolio?

Optimal rebalancing frequency varies by factor:

- Momentum factors typically require more frequent rebalancing (quarterly or even monthly)

- Value factors can be rebalanced less frequently (semi-annually or annually)

- Quality and low volatility factors typically change slowly, allowing for less frequent rebalancing

Professional managers often use a “threshold rebalancing” approach, where positions are adjusted when factor exposures drift beyond predetermined tolerance ranges rather than on a fixed schedule. Research by BlackRock suggests that threshold rebalancing can improve factor capture by 15-20% compared to calendar-based approaches while reducing transaction costs.

8. How do transaction costs impact factor strategies?

Transaction costs significantly impact realized factor returns, with the magnitude varying by factor and implementation approach:

- Momentum strategies typically incur the highest costs due to frequent turnover (estimated at 1-2% annually)

- Size factors face higher transaction costs due to the reduced liquidity of smaller stocks

- Value strategies generally experience moderate costs (0.3-0.7% annually)

- Quality and low volatility strategies typically have lower turnover and associated costs

Professional implementation techniques like patient trading, optimization-based portfolio construction, and tax-aware trading can reduce these costs by 30-50%. Factor ETFs have dramatically reduced implementation costs for individual investors compared to direct implementation.

9. Can I implement factor strategies in all asset classes?

While equity markets offer the most established factor implementations, factor approaches have expanded to other asset classes:

- Fixed income: Factors include value (yield), quality (default risk), and duration

- Commodities: Carry, momentum, and term structure factors have shown persistence

- Currencies: Carry, momentum, and value factors are well-documented

- Real estate: Size, value, and quality factors apply to both REITs and direct properties

- Private markets: Emerging research applies factor concepts to private equity and debt

Implementation challenges vary significantly across asset classes, with fixed income and currency markets offering the most liquid factor implementations outside of equities.

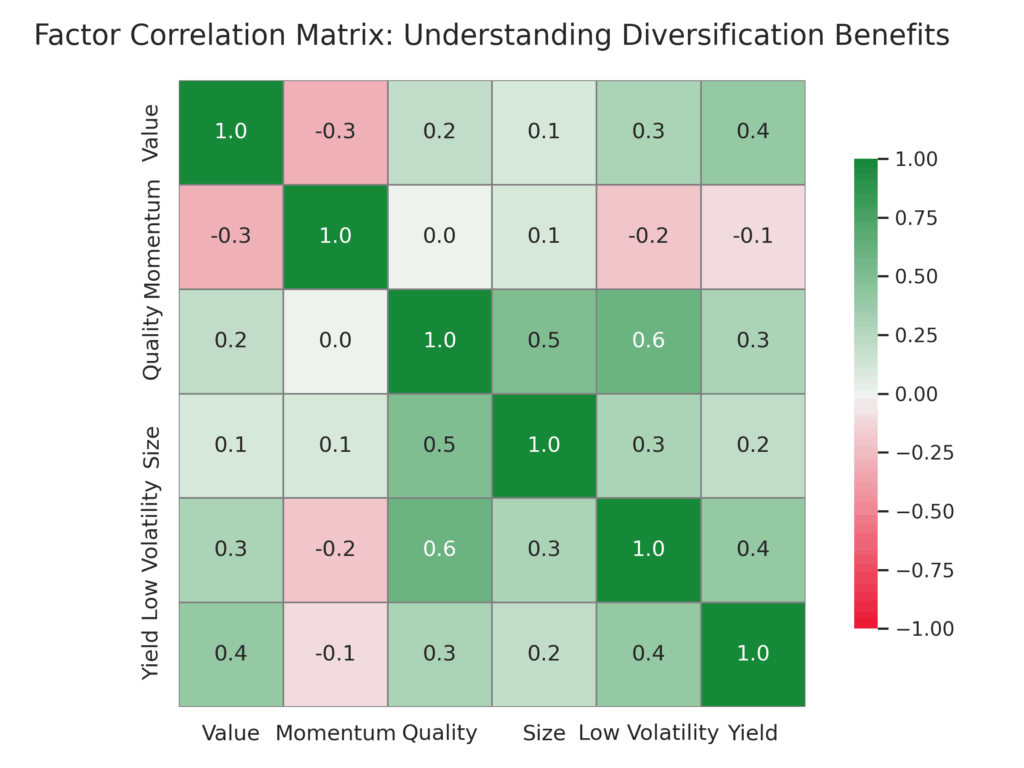

10. How do factors interact with each other?

Factor interactions create important portfolio implications:

- Some factors exhibit negative correlations (e.g., value and momentum), enhancing diversification benefits

- Other factors show positive relationships (e.g., quality and low volatility), potentially reducing diversification

- Interaction effects can be positive (compound returns) or negative (cancel each other)

- Economic regimes influence factor correlations, with relationships changing over time

Research by Robeco indicates that explicitly accounting for factor interactions can improve multi-factor portfolio performance by 0.5-0.8% annually compared to approaches that treat factors independently.

Conclusion

Factor investing represents a powerful framework for understanding investment returns and constructing more resilient portfolios. By decomposing returns into their fundamental drivers, investors gain deeper insights into performance attribution, risk exposures, and potential vulnerabilities. This knowledge enables more precise portfolio construction targeting specific risk premiums while avoiding unintended concentrations or biases.

As factor investing continues to evolve, integration with technological advances and alternative data sources presents exciting opportunities for further refinement. Machine learning techniques are uncovering more nuanced factor relationships, while ESG considerations are being systematically incorporated into factor frameworks.

The expansion of factor approaches into fixed income and alternative asset classes suggests a future where comprehensive multi-asset factor allocation becomes the standard approach for sophisticated investors. Despite these advances, the core principles of factor investing remain unchanged: Identifying persistent sources of risk and return, efficiently capturing associated premiums, and constructing portfolios that align with investor objectives across varying market conditions.

For your reference, recently published articles include:

- Investment Behavior Examples That Guarantee You Better Returns

- Investment Opportunity Scoring: Outperform The Market Now

- Investment Risk Forecasting: Protect Your Portfolio Now

- Investment Decision Automation: How Ordinary People Get Rich

- Best Profit Secrets: Investment Risk Decomposition Explained

- Strategic Wealth Tech: Portfolio Management Dashboards Now

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.