Portfolio attribution analysis is the sophisticated process of dissecting investment performance to identify precisely which decisions and factors drove returns.

In today’s complex financial landscape, mastering attribution techniques has become essential for investment professionals seeking to understand their true value-add and optimize future allocation strategies.

Key Takeaways

- Multi-factor attribution models significantly outperform traditional methods, revealing hidden performance drivers that single-factor models miss. For example, a fund manager who appeared to underperform using Brinson models might actually demonstrate skill when sector-neutral stock selection is isolated through multi-factor analysis.

- Risk-adjusted attribution metrics provide a more accurate performance assessment than absolute return comparisons alone. During the 2022 market downturn, several fund managers who underperformed benchmarks by 2% actually outperformed on a risk-adjusted basis due to their lower volatility exposure.

- Attribution analysis must evolve from periodic reporting to continuous decision support to remain relevant. Forward-looking firms like BlackRock and Vanguard have integrated real-time attribution insights into their investment process, allowing immediate portfolio adjustments based on factor exposure shifts.

Table of Contents

What is Portfolio Attribution Analysis?

Portfolio attribution analysis is a quantitative methodology that deconstructs investment performance to determine which specific decisions, allocations, or factors contributed to returns. Unlike simple performance measurement, which only tells you whether you outperformed or underperformed a benchmark, attribution analysis answers the critical question of why that performance occurred.

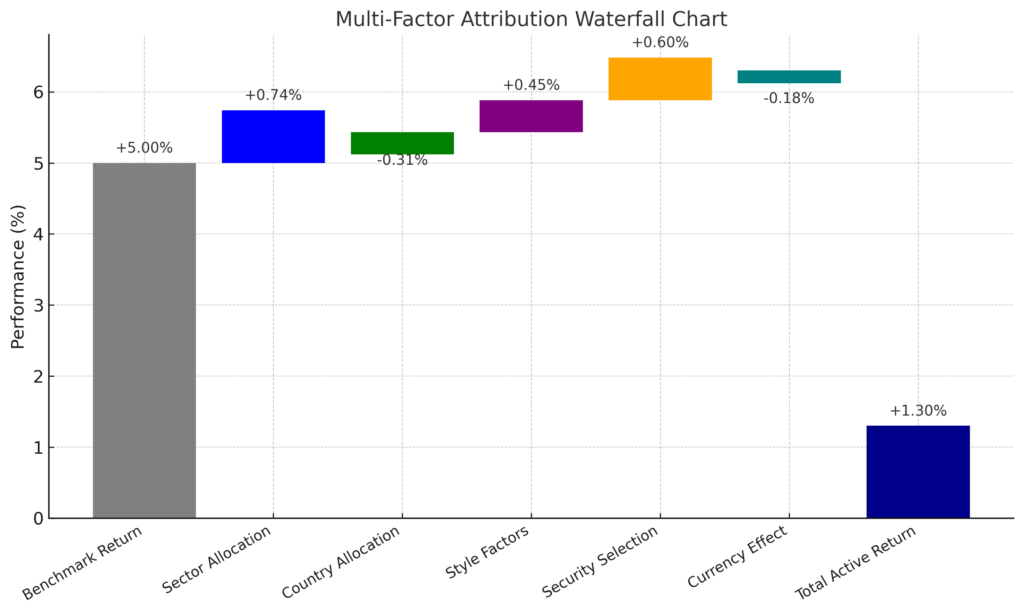

At its core, portfolio attribution analysis separates performance into distinct components that align with the investment decision-making process. These typically include allocation effects (decisions about which asset classes, sectors, or countries to overweight or underweight), selection effects (the specific securities chosen within each segment), and interaction effects (the combined impact of allocation and selection decisions).

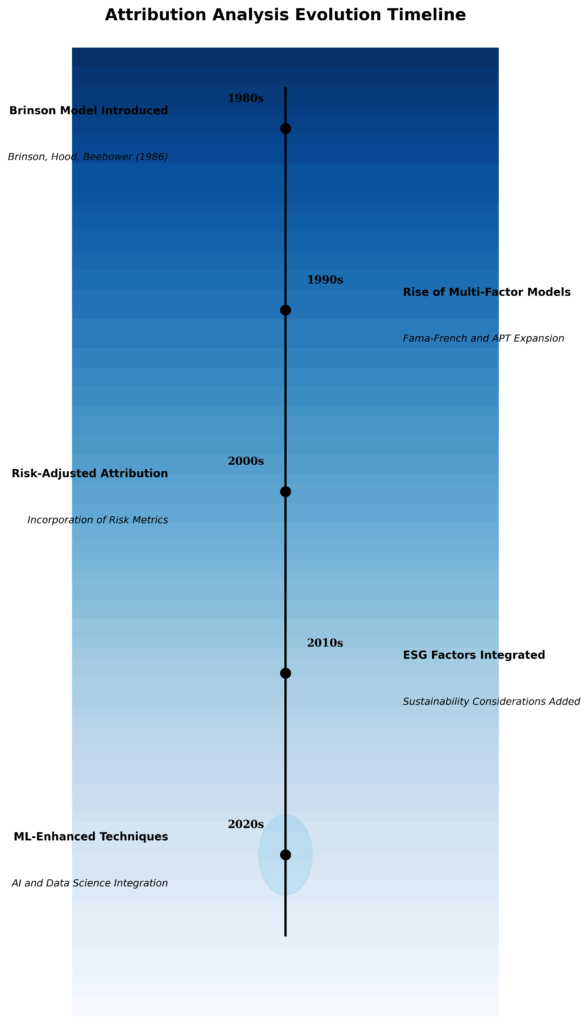

Modern attribution has evolved far beyond these basic components to incorporate style factors, risk exposures, and even ESG (Environmental, Social, and Governance) characteristics. This evolution reflects the increasing sophistication of investment strategies and the growing recognition that performance is driven by multiple, often interconnected factors.

For institutional investors managing complex multi-asset portfolios, attribution analysis provides essential transparency into which investment decisions added value and which detracted from performance. This transparency supports accountability, helps refine investment processes, and ultimately leads to better-informed decisions going forward.

The significance of portfolio attribution analysis has only grown with the rise of factor investing, smart beta strategies, and AI-driven portfolio management. As investment approaches become more nuanced and data-driven, the need for precise, detailed performance attribution becomes increasingly critical.

Types of Portfolio Attribution Models

Brinson Models

The Brinson models (including Brinson-Hood-Beebower and Brinson-Fachler) represent the foundation of modern attribution analysis. Developed in the 1980s, these models decompose excess returns into:

- Allocation effect: Performance attributed to sector/asset class weighting decisions

- Selection effect: Performance from security selection within sectors

- Interaction effect: Combined impact of allocation and selection decisions

Brinson models remain widely used due to their intuitive framework and relatively straightforward implementation. However, they have limitations when applied to complex strategies that involve multiple asset classes or dynamic factor exposures.

Factor-Based Attribution

Factor-based attribution represents a significant evolution beyond traditional approaches by identifying how exposure to systematic factors drove performance:

- Style factors: Value, growth, momentum, quality, size, volatility

- Macro factors: Interest rates, inflation, economic growth

- Statistical factors: Principal components derived from return patterns

Factor models can be either fundamental (based on observable characteristics) or statistical (derived from return patterns). A compelling advantage of factor-based attribution is the ability to separate skill-based returns from factor-driven returns.

Returns-Based vs. Holdings-Based Attribution

| Attribute | Returns-Based Attribution | Holdings-Based Attribution |

|---|---|---|

| Data Requirements | Only portfolio and benchmark returns | Detailed portfolio holdings and transactions |

| Granularity | Lower – approximates exposures | Higher – precise security-level analysis |

| Implementation | Simpler, less resource-intensive | More complex, requires robust data infrastructure |

| Timeliness | Can be performed quickly | May experience delays due to holdings collection |

| Historical Analysis | Possible with limited historical data | Requires historical holdings data |

| Accuracy for Complex Strategies | Limited for derivatives, alternatives | Superior for all instrument types |

Returns-based attribution uses regression analysis to estimate factor exposures based on return patterns, while holdings-based attribution directly measures the contribution of each position based on actual weights and returns.

Multi-Period Attribution

Multi-period attribution addresses the challenge of analyzing performance over multiple time periods. Key approaches include:

- Arithmetic linking: Simple but can produce distorted results over longer periods

- Geometric linking: More mathematically sound but harder to interpret

- Linking algorithm methods: Advanced techniques like Carino and Menchero linking that maintain consistency

For portfolios with significant cash flows or frequent rebalancing, appropriate multi-period attribution becomes essential for accurate performance assessment.

Fixed Income Attribution

Fixed income attribution models decompose returns along dimensions specific to bond portfolios:

- Yield curve effects: Returns from shifts in the yield curve

- Spread effects: Returns from changes in credit or sector spreads

- Carry/roll-down effects: Returns from holding bonds as they mature

- Currency effects: Impact of currency movements in global bond portfolios

These models must account for complex fixed income characteristics, including duration, convexity, and optionality, that aren’t present in equity attribution.

Benefits of Advanced Portfolio Attribution Analysis

Enhanced Decision-Making

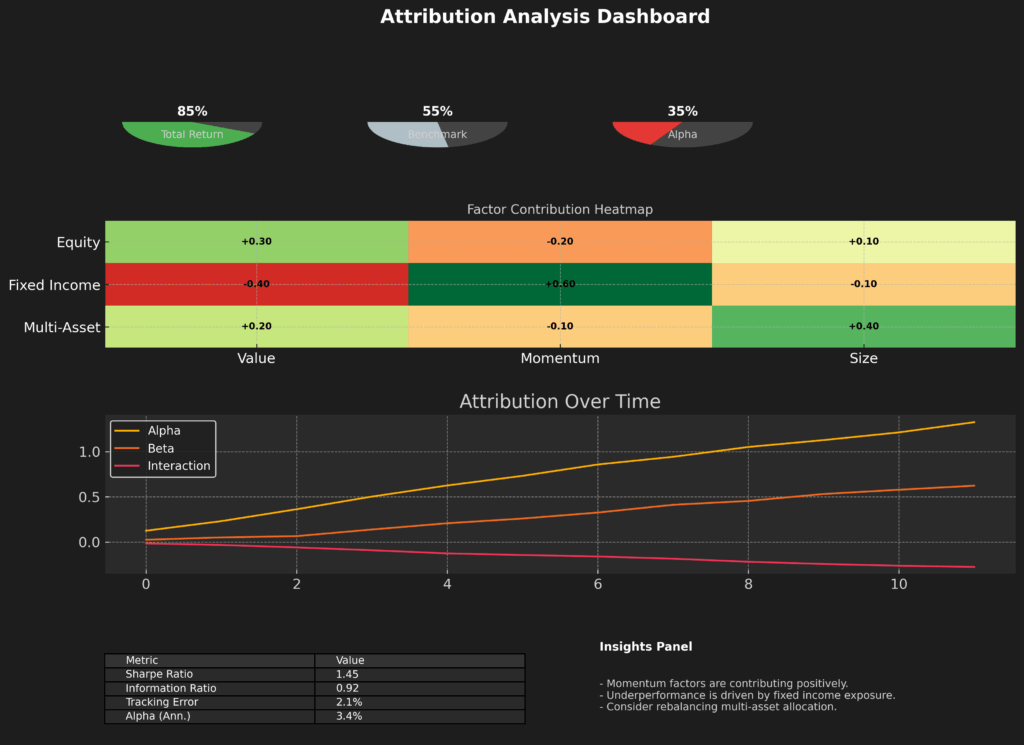

Attribution analysis directly improves investment decision-making by:

- Identifying which strategies consistently add value

- Highlighting unintended factor exposures or concentration risks

- Providing objective feedback on investment hypotheses

- Quantifying the impact of specific decisions rather than relying on intuition

Studies show that investment teams implementing rigorous attribution frameworks improve their information ratios by 15-30% over time through more disciplined decision processes.

Performance Improvement

Systematic attribution analysis leads to performance improvements through:

- Elimination of persistent drags on performance

- Reinforcement of successful approaches

- More effective allocation of research resources

- Better alignment between stated investment philosophy and actual positioning

A 2021 CFA Institute survey found that 78% of investment teams that implemented advanced attribution systems reported meaningful performance improvements within 24 months.

Client Communication and Transparency

Sophisticated portfolio attribution analysis transforms client reporting by:

- Demonstrating investment skill beyond market movements

- Explaining underperformance in specific market environments

- Building trust through transparency and educational insights

- Providing context for performance relative to risk taken

In competitive manager selection processes, detailed attribution analysis often becomes a differentiating factor, particularly for institutional allocators who focus on process consistency.

Risk Management Integration

Modern portfolio attribution analysis systems integrate performance and risk analytics to:

- Assess performance on a risk-adjusted basis

- Identify whether excess returns came from skill or increased risk-taking

- Attribute returns to intended versus unintended risk exposures

- Evaluate the efficiency of risk budgeting decisions

This integration helps investment teams optimize their risk-return profile, rather than maximizing returns without considering risk.

Challenges and Limitations

Data Quality Issues

Portfolio attribution analysis is only as good as the underlying data, with common challenges including:

- Benchmark composition discrepancies: Differences between published and actual benchmark weights

- Corporate action treatment: Inconsistent handling of splits, mergers, and other events

- Pricing discrepancies: Different pricing sources for portfolio and benchmark securities

- Classification inconsistencies: Varying sector or country classifications between systems

These data issues can create attribution “noise” that obscures genuine insights if not properly addressed.

Model Selection and Specification

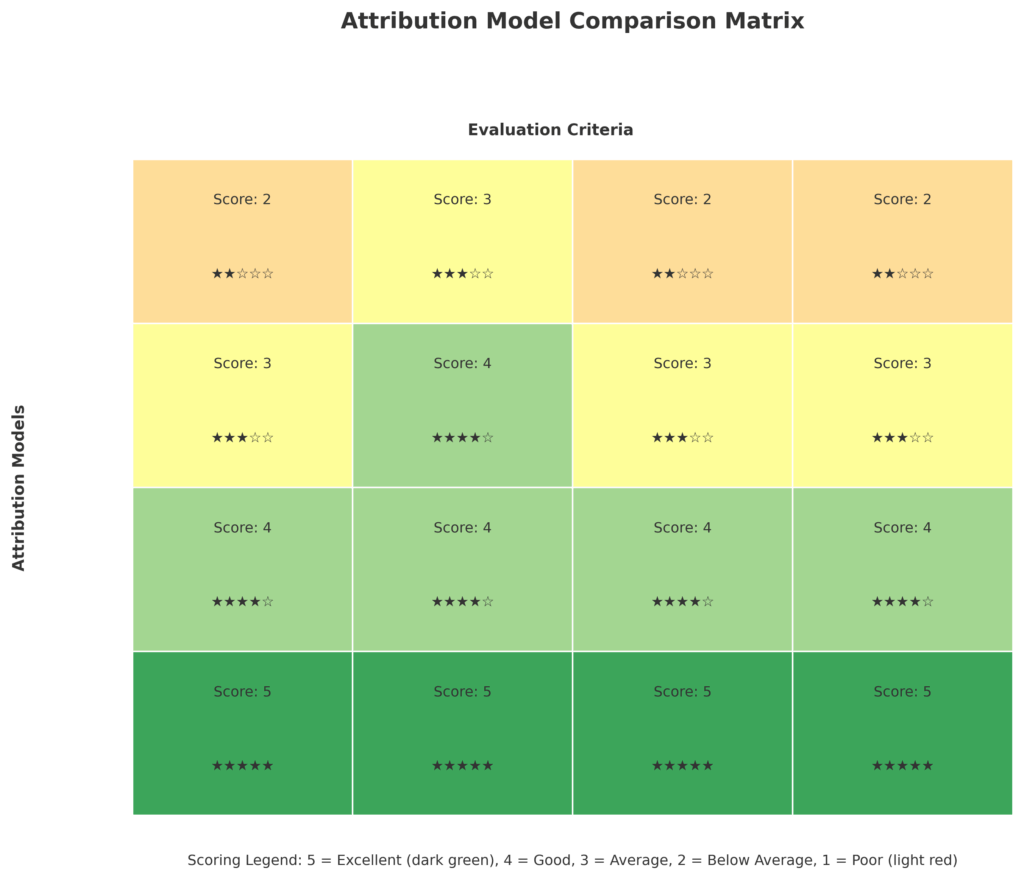

Choosing appropriate attribution models involves navigating several tradeoffs:

- Complexity vs. interpretability: More sophisticated models may provide greater precision but become difficult to explain

- Customization vs. standardization: Custom models better reflect specific processes but complicate peer comparisons

- Historical consistency vs. evolving methodologies: Changing models disrupt time series analysis but may be necessary as strategies evolve

The model selection process should align with the investment approach rather than defaulting to industry standards that may not capture the actual decision-making process.

Implementation Costs

Implementing robust attribution systems requires significant investment:

- Technology infrastructure: Specialized attribution software and data management systems

- Analytical expertise: Quantitative staff who understand both the mathematics and investment context

- Ongoing maintenance: Regular calibration and validation of models

- Integration challenges: Connecting attribution systems with other investment platforms

These costs can be prohibitive for smaller investment firms, giving larger organizations a competitive advantage with more resources.

Interpretation Complexities

Even with perfect data and appropriate models, interpretation challenges remain:

- Statistical significance: Distinguishing genuine skill from random variation

- Time-varying factor exposures: Accounting for changes in factor relationships

- Benchmark appropriateness: Evaluating performance against suboptimal benchmarks

- Behavioral biases: Avoiding confirmation bias when reviewing attribution results

These interpretation challenges highlight why attribution analysis requires both quantitative rigor and qualitative judgment.

Implementation: Building an Effective Attribution System

Assessment of Current Capabilities

Before implementing new attribution systems, organizations should:

- Evaluate existing performance measurement processes

- Identify specific gaps in current attribution capabilities

- Assess data availability and quality across asset classes

- Determine key stakeholders and their analytical needs

This assessment prevents overbuilding systems that don’t address the most critical requirements.

Framework Selection and Customization

Selecting an appropriate attribution framework involves:

- Align with investment process: The attribution methodology should reflect actual decision-making

- Consider multi-asset requirements: Ensure consistency across different portfolio components

- Balance detail and clarity: More granular isn’t always better if it sacrifices understanding

- Incorporate factor exposures: Modern portfolios require factor-aware attribution

- Plan for evolution: Build flexibility to accommodate changing investment approaches

The most successful implementations tailor industry-standard frameworks to organization-specific needs rather than forcing processes to conform to off-the-shelf solutions.

Technology Infrastructure

Effective attribution systems require:

- Centralized data warehouse: Single source of truth for portfolio and benchmark data

- Calculation engine: Specialized software for attribution computations

- Visualization tools: Interactive dashboards for exploring attribution results

- Integration layer: Connections to order management, risk, and client reporting systems

- Automation capabilities: Scheduled analysis and exception-based alerts

Cloud-based solutions have increasingly replaced on-premises infrastructure, reducing implementation costs and improving scalability.

Governance and Process Integration

Attribution analysis must be embedded in investment processes through:

- Regular attribution reviews: Structured sessions to discuss attribution findings

- Decision documentation: Recording how attribution insights influenced subsequent decisions

- Feedback mechanisms: Continuous improvement of attribution methodologies

- Clear responsibilities: Defined roles for data management, analysis, and interpretation

Organizations that treat attribution as a compliance exercise rather than a decision-making tool rarely realize its full benefits.

Future Trends in Portfolio Attribution

Machine Learning Applications

Machine learning is transforming attribution analysis through:

- Pattern recognition: Identifying non-linear relationships between decisions and outcomes

- Unstructured data incorporation: Including news sentiment, earnings call transcripts, and other alternative data

- Attribution signal enhancement: Separating noise from genuine performance drivers

- Scenario modeling: Projecting how portfolios might perform under various market conditions

Early adopters report that ML-enhanced attribution provides 30-40% more explanatory power than traditional linear models.

Real-Time Attribution

Attribution analysis is evolving from periodic reporting to continuous monitoring:

- Intraday attribution: Analyzing performance drivers during market events

- Pre-trade attribution: Estimating the impact of potential trades before execution

- Attribution alerts: Notification when factor exposures or contribution patterns change significantly

- Dynamic benchmarking: Adjusting comparison frameworks as market conditions evolve

This shift to real-time analysis enables more responsive portfolio management, particularly during market dislocations.

ESG Attribution Integration

ESG considerations are being incorporated into attribution frameworks:

- ESG factor contribution: Measuring how environmental, social, and governance exposures affected performance

- Impact attribution: Quantifying the financial impact of sustainability-aligned decisions

- Temperature alignment: Assessing portfolio performance relative to climate scenarios

- Regulatory compliance: Addressing requirements like SFDR and taxonomies with attribution data

As sustainable investing matures, attribution systems that can’t account for ESG factors risk becoming obsolete.

Cross-Asset Integration

Next-generation attribution addresses the challenges of complex multi-asset portfolios:

- Consistent risk factors: Unified factor frameworks across equities, fixed income, and alternatives

- Currency attribution: More sophisticated analysis of currency decisions and impacts

- Liquidity-adjusted attribution: Accounting for the impact of varying liquidity conditions

- Alternative asset incorporation: Extending attribution to private equity, real estate, and other alternatives

These advancements are essential for accurately analyzing the growing complexity of institutional portfolios.

FAQs – Portfolio Attribution Analysis

1. What is the difference between performance measurement and performance attribution?

Performance measurement calculates returns and compares them to benchmarks, answering “how did we do?” Attribution analysis breaks down those returns into components that explain why the performance occurred by linking results to specific decisions and exposures.

2. How frequently should attribution analysis be performed?

While monthly attribution reporting is standard industry practice, leading organizations now conduct attribution analysis at multiple frequencies: daily for monitoring, monthly for regular reporting, quarterly for detailed review, and annually for strategic assessment. The optimal frequency depends on investment strategy, turnover, and client communication needs.

3. Which attribution model is best for multi-asset portfolios?

No single model perfectly addresses multi-asset attribution. Most sophisticated approaches use a layered methodology: strategic asset allocation attribution at the top level, followed by asset-class-specific models (factor models for equities, yield curve models for fixed income), with consistent risk factor translation between layers.

4. How can attribution analysis distinguish between skill and luck?

Distinguishing skill from luck requires: 1) sufficient time periods to establish statistical significance, 2) consistency in decision-making patterns, 3) persistence of attribution results across different market environments, and 4) alignment between attribution results and the stated investment process. Even then, some ambiguity remains.

5. What data challenges most commonly affect attribution accuracy?

The most problematic data issues include: benchmark composition discrepancies, corporate action treatment differences, security classification inconsistencies, derivative pricing complexities, and point-in-time availability of accurate holdings data. Organizations with strong data governance typically experience fewer attribution distortions.

6. How should attribution results influence portfolio decisions?

Attribution findings should inform decision-making by: highlighting persistent strengths and weaknesses, identifying unintended exposures, quantifying the impact of different decision types, and providing feedback on investment hypotheses. However, attribution results should complement rather than replace fundamental investment processes.

7. How are factor exposures incorporated into attribution analysis?

Factor exposures can be incorporated through: 1) explicit factor models that directly measure contribution from factors like value, momentum, and quality, 2) risk-factor decomposition that aligns with risk models, or 3) regression-based analysis that identifies factor exposures based on return patterns. The approach should align with how factors influence the investment process.

8. What are the limitations of Brinson-based attribution models?

Traditional Brinson models have several limitations: they struggle with multi-period analysis, cannot properly handle leveraged portfolios, provide limited insight for complex derivatives, fail to capture factor exposures, and assume independence between allocation and selection decisions that often don’t exist in practice.

9. How should attribution analysis be presented to non-technical stakeholders?

For non-technical audiences, attribution should be presented with visual aids like contribution charts, consistent color-coding for positive and negative effects, clear grouping of related factors, minimal technical jargon, specific examples of decisions that drove results, and connections to the investment narrative discussed in previous communications.

10. How is fixed income attribution different from equity attribution?

Fixed income attribution differs from equity attribution in several ways: it must account for yield curve movements, incorporate duration and convexity effects, analyze spread changes across sectors and ratings, measure carry and rolldown returns, handle complex structures like mortgage-backed securities, and address unique risk factors not present in equity markets.

Conclusion

Portfolio attribution analysis has evolved from a simple performance evaluation tool into a sophisticated decision support framework that drives investment processes at leading asset management firms. By decomposing returns into their fundamental drivers, attribution analysis provides the essential feedback loop that allows investment teams to refine their approaches, focus on genuine sources of alpha, and deliver more consistent results.

As investment strategies continue to increase in complexity and data availability expands exponentially, attribution systems must evolve accordingly. The future of attribution analysis lies in more integrated approaches that seamlessly combine performance, risk, and ESG dimensions while leveraging advanced technologies like machine learning and real-time analytics. Organizations that invest in these capabilities gain a significant competitive advantage through deeper insights, more responsive decision-making, and more transparent client communication.

The true value of attribution analysis ultimately comes not from the mathematical decomposition itself, but from the cultural commitment to understanding performance drivers and continuously improving investment processes. When fully embedded in an organization’s investment approach, sophisticated attribution analysis doesn’t just explain past performance – it meaningfully improves future results.

For your reference, recently published articles include:

- Protect Your Wealth: Investment Risk Mitigation Secrets of the Rich

- Trading Strategy Backtesting: The Ultimate Path To Profits

- Investment Decision Support: Best Secrets For Your Success

- Market Intelligence Platforms – All You Need To Know

- Never Lose Money Again: Investment Scenario Analysis Magic

- Unlock Wall Street’s Hidden Financial Modeling Tools Now

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.