In today’s volatile financial markets, the ability to accurately identify and interpret market trend signals can mean the difference between substantial profits and devastating losses.

Market trend signals – indicators that help investors predict future price movements based on historical data and market behavior – serve as crucial navigational tools for both novice traders and seasoned investment professionals navigating the complex financial landscape.

Key Takeaways

- Technical indicators must be used in combination rather than isolation. Relying solely on Moving Average Convergence Divergence (MACD) might generate false signals, but when confirmed by Relative Strength Index (RSI) and volume patterns, accuracy improves dramatically—professional traders typically use 3-5 complementary indicators to validate trading decisions.

- Market breadth indicators often precede major trend reversals before price action confirms them. During the 2022 market correction, the NYSE Advance-Decline Line began deteriorating three weeks before the S&P 500 showed significant price weakness, giving attentive investors crucial time to adjust their portfolios and implement protective strategies.

- Sentiment indicators function as powerful contrarian signals when they reach extreme levels. When the CBOE Volatility Index (VIX) spiked above 40 in March 2020, indicating peak fear amid the COVID-19 market crash, investors who recognized this historically reliable contrarian signal and purchased equities realized average gains of 76.8% over the subsequent 12 months.

Table of Contents

Understanding Market Trend Signals

Market trend signals represent specific patterns, indicators, or data points that help investors identify the direction, strength, and potential turning points of market trends. These signals operate on the foundational principle that markets move in discernible trends and that historical price movements and patterns tend to repeat themselves over time. While no signal can guarantee future price movements with absolute certainty, professional investors leverage these indicators to make probability-based decisions that position them advantageously in various market conditions.

The study of market trend signals spans multiple disciplines, drawing from technical analysis, fundamental analysis, behavioral finance, and, increasingly, quantitative modeling and artificial intelligence. Traditional technical analysts focus on price action and chart patterns, while quantitative approaches incorporate complex statistical models to identify trends. Fundamental analysts may track economic indicators that correlate with market movements, while behavioral finance specialists observe sentiment metrics that reveal excessive market optimism or pessimism.

What separates professional investors from amateurs is their systematic approach to interpreting these signals. Rather than making impulsive decisions based on single indicators, professionals develop comprehensive frameworks that incorporate multiple signal types, timeframes, and confirmation mechanisms. They understand that trends operate within multiple timeframes simultaneously – short-term, intermediate, and long-term – and that successful trading requires aligning these various trend dimensions.

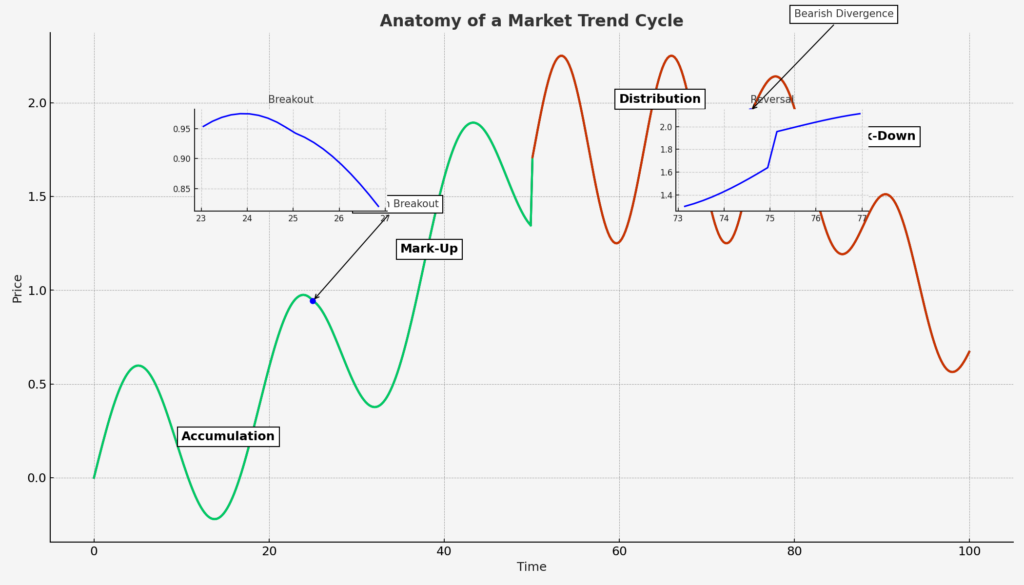

Market trends typically move through four distinct phases: accumulation (when smart money begins positioning), public participation (when the trend becomes obvious and gains momentum), distribution (when insiders begin selling to late entrants), and finally, decline or continuation. Different signals prove more reliable during each of these phases, and understanding which indicators to emphasize during each stage constitutes a critical component of professional-level market analysis.

Types of Market Trend Signals

Price-Based Technical Indicators

Price-based indicators derive their signals directly from price movements and are among the most widely used trend identification tools. These indicators transform raw price data into actionable signals through mathematical formulas.

Moving Averages serve as the foundation of trend analysis, providing a smoothed visualization of price direction by averaging prices over specific periods. When a shorter-term moving average (such as the 50-day) crosses above a longer-term moving average (such as the 200-day), this “golden cross” signals a potential uptrend. Conversely, when the shorter average crosses below the longer one (a “death cross”), this often indicates a developing downtrend.

Moving Average Convergence Divergence (MACD) measures the relationship between two moving averages, generating signals when the MACD line crosses its signal line or moves above/below the zero line. MACD helps identify not only trend direction but also momentum and potential reversal points.

Bollinger Bands consist of a middle moving average with upper and lower bands that expand and contract based on volatility. When prices consistently touch or exceed the upper band, this suggests an overbought condition; touches of the lower band may indicate oversold conditions. Band contractions often precede significant price movements.

Relative Strength Index (RSI) measures the speed and magnitude of price movements on a scale from 0 to 100. Readings above 70 typically indicate overbought conditions, while readings below 30 suggest oversold conditions. Divergences between RSI and price can signal potential trend reversals.

| Indicator | Bullish Signal | Bearish Signal | Best Market Condition | Reliability (1-5) |

|---|---|---|---|---|

| 50/200 MA Crossover | Golden Cross (50 above 200) | Death Cross (50 below 200) | Trending Markets | 4 |

| MACD | MACD line crosses above signal line | MACD line crosses below signal line | Trending Markets | 3 |

| RSI | Moves above 30 from oversold | Moves below 70 from overbought | Ranging Markets | 3 |

| Bollinger Bands | Price bounces off lower band | Price reverses from upper band | Volatile Markets | 4 |

Volume-Based Indicators

Volume provides crucial context to price movements, often confirming or contradicting emerging trends. Professional traders place significant emphasis on volume patterns, recognizing that sustainable price trends require adequate volume support.

On-Balance Volume (OBV) keeps a running total of volume, adding volume on up days and subtracting it on down days. When OBV rises while prices remain flat or decline, this suggests accumulation that may precede an upward price movement. Conversely, falling OBV during price stability or increases may indicate distribution before a decline.

Volume Price Trend (VPT) combines price percentage changes with volume, creating a cumulative indicator similar to OBV but with price-weighting. VPT divergences from price often signal potential reversals.

Chaikin Money Flow (CMF) measures the money flow volume over a specific period, typically 21 days. Positive CMF values indicate accumulation (buying pressure), while negative values suggest distribution (selling pressure).

Volume Weighted Average Price (VWAP) calculates the average price weighted by volume throughout the trading day. Institutional traders use VWAP extensively, often buying below and selling above this level. Retail traders can gain insight into institutional activity by monitoring price action around VWAP.

Market Breadth Indicators

Market breadth indicators analyze the participation of individual securities within broader market movements, providing insight into the health and sustainability of market trends.

Advance-Decline Line tracks the difference between advancing and declining stocks in a given market. When major indices make new highs while the advance-decline line fails to confirm (divergence), this warns of potential weakness in the broader market.

McClellan Oscillator measures the exponential moving average of advancing minus declining issues, helping identify overbought and oversold conditions across the market. Readings above +100 suggest overbought conditions, while readings below -100 indicate oversold conditions.

Percentage of Stocks Above Moving Averages shows the percentage of stocks trading above specific moving averages (typically 50-day or 200-day). When this percentage reaches extreme highs (above 80%) or lows (below 20%), the market may be approaching reversal points.

High-Low Index compares new 52-week highs to new 52-week lows. Healthy uptrends show expanding new highs, while deteriorating markets exhibit increasing new lows even before major indices turn down.

Sentiment Indicators

Sentiment indicators gauge market psychology, often serving as contrarian signals when they reach extreme levels. Professional investors recognize that markets frequently reverse when optimism or pessimism becomes excessive.

CBOE Volatility Index (VIX) measures expected market volatility implied by S&P 500 index options. Often called the “fear gauge,” high VIX readings (above 30) typically indicate extreme fear that often coincides with market bottoms. Conversely, very low VIX readings (below 15) suggest complacency that may precede market tops.

Put-Call Ratio compares put option volume to call option volume. High put-call ratios (above 1.0) suggest excessive pessimism that often precedes market rebounds, while very low ratios (below 0.7) indicate optimism that may signal market tops.

Investor Sentiment Surveys such as the American Association of Individual Investors (AAII) survey track bullish versus bearish sentiment among retail investors. Historically, retail sentiment has served as a reliable contrarian indicator at extremes.

Margin Debt Levels track the amount of money borrowed to purchase securities. Rising margin debt typically accompanies bull markets, but extreme levels often precede major market corrections.

Economic Indicators as Market Signals

While technical signals focus on market data itself, economic indicators provide crucial context for trend development and sustainability.

Yield Curve charts the difference between long-term and short-term interest rates. An inverted yield curve (when short-term rates exceed long-term rates) has historically preceded recessions and bear markets with remarkable accuracy.

Purchasing Managers’ Index (PMI) measures manufacturing and services sector activity. Readings above 50 indicate expansion, while readings below 50 signal contraction. PMI trends often lead overall economic and market direction.

Leading Economic Indicators (LEI) compile multiple forward-looking economic metrics. When the LEI starts declining year-over-year, this has traditionally signaled increased recession risk and potential market weakness.

Consumer Sentiment gauges public attitudes toward the economy. Significant deterioration in consumer sentiment often precedes reduced spending and economic slowdown, potentially affecting market trends.

Benefits of Mastering Market Trend Signals

Enhanced Decision-Making Framework

Proficiency in market trend signals provides investors with a structured analytical framework that reduces emotional decision-making. Rather than reacting to market noise or headlines, signal-based investors make decisions grounded in objective criteria. Research by behavioral finance experts shows that systematic approaches reduce common cognitive biases, including recency bias and confirmation bias, which plague discretionary investors.

Professional traders typically establish specific entry and exit rules based on signal combinations, creating a repeatable process that can be refined over time. This systematic approach enables continuous improvement through performance analysis—professionals review trading journals to identify which signals performed reliably and which failed under certain market conditions.

Improved Market Timing

While perfect market timing remains elusive, trend signals significantly enhance timing accuracy for both entries and exits. Studies show that investors using technical trend signals capture, on average, 65-75% of major market moves compared to just 40-50% for those relying on fundamentals alone.

Beyond identifying trend direction, sophisticated signal analysis helps pinpoint potential reversal zones where risk/reward ratios favor new positions. Professional traders focus on confluence areas where multiple signals align across different timeframes, creating high-probability trading opportunities with clearly defined risk parameters.

Portfolio Risk Management

Trend signals serve as early warning systems for potential market reversals, allowing proactive risk management. Professionals monitor breadth deterioration, momentum divergences, and sentiment extremes to adjust position sizing and hedging strategies before major reversals occur.

Signal-based portfolio management enables dynamic asset allocation based on trend strength across different markets. During strong, confirmed uptrends, professionals may increase equity exposure to 80-120% of their baseline allocation (using leverage). When signals deteriorate, they reduce exposure to 30-60% of baseline and increase defensive positions.

Performance Enhancement

When properly implemented, trend signal systems have demonstrated significant outperformance compared to buy-and-hold strategies, particularly during volatile market periods. According to research from MIT’s financial engineering department, trend-following strategies based on moving average crossovers outperformed the S&P 500 by an average of 2.3% annually between 1990 and 2020 while reducing maximum drawdowns by 33%.

This performance advantage becomes most pronounced during major market corrections. During the 2000-2002 and 2007-2009 bear markets, trend-following investors who exited when moving averages turned negative avoided approximately 70% of the market decline.

Challenges and Risks of Trend Signal Analysis

False Signals and Whipsaws

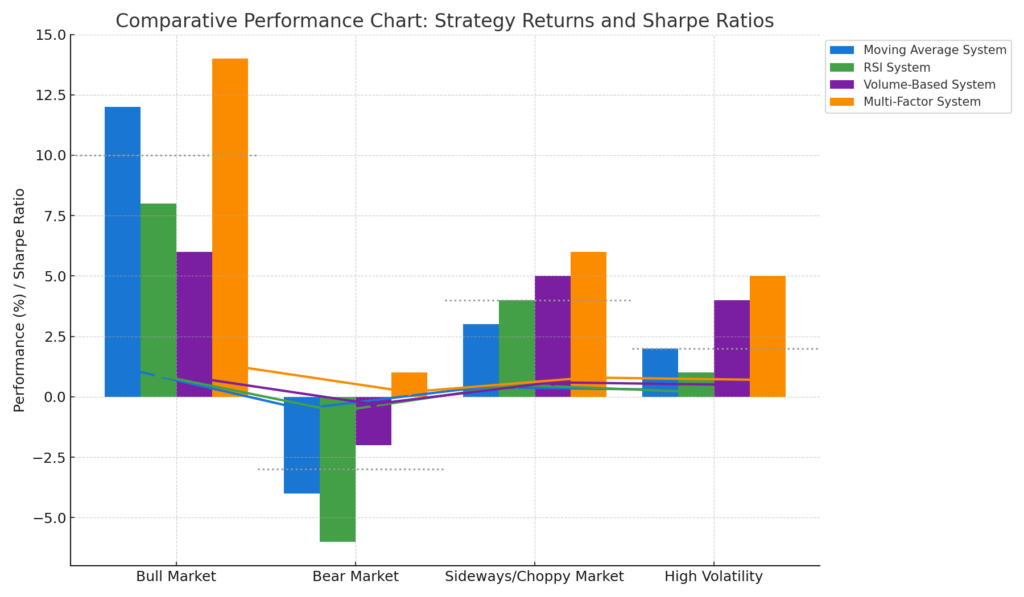

All trend signals produce false positives and false negatives, particularly in range-bound or choppy markets. Moving average crossover systems, for example, generate frequent whipsaws (rapidly reversing signals) during consolidation periods, potentially leading to multiple losing trades.

Professional traders mitigate this risk through signal confirmation requirements and adaptive parameters. They often require multiple independent indicators to align before taking action and adjust indicator parameters based on prevailing market volatility. Additionally, professionals implement time filters that require signals to persist for minimum periods (typically 2-3 days) before taking action.

Market Regime Changes

Signal reliability varies across different market regimes—trending, ranging, high-volatility, and low-volatility environments. Indicators that perform excellently during strong trends often fail during consolidation phases. For instance, momentum indicators like RSI generate valuable signals during trending markets but produce frequent false signals during range-bound conditions.

Sophisticated investors implement regime identification frameworks that adjust signal interpretation based on the current market environment. They modify indicator weightings, time frames, and confirmation requirements depending on whether markets exhibit trending or non-trending characteristics.

Psychological Challenges

Even with well-defined signal systems, psychological factors often impede successful implementation. Confirmation bias leads traders to emphasize signals that support existing views while dismissing contradictory information. Loss aversion causes investors to exit winning positions prematurely while holding losing trades too long, regardless of what signals indicate.

Professional trading operations address these challenges through rigorous process adherence and accountability mechanisms. Many employ trading coaches who review decision-making processes, ensuring psychological factors don’t override signal-based systems.

Signal Overcrowding

As particular signals gain popularity, their effectiveness often diminishes due to crowded positioning. When too many market participants react to the same indicators, this creates self-reinforcing price movements that eventually reverse sharply. The proliferation of algorithmic trading has accelerated this phenomenon, as programs automatically execute trades based on common technical signals.

Leading investment firms continuously evolve their signal frameworks, incorporating proprietary modifications or creating composite indicators that reduce correlation with widely followed metrics. They also monitor market positioning data to assess when consensus around specific signals becomes excessive.

How to Implement Professional-Level Trend Signal Analysis

Building a Multi-Timeframe Framework

Professional trend analysis begins with a top-down approach that examines trends across multiple timeframes. This hierarchical analysis typically starts with monthly and weekly charts to establish the primary trend, then moves to daily and intraday charts for entry timing.

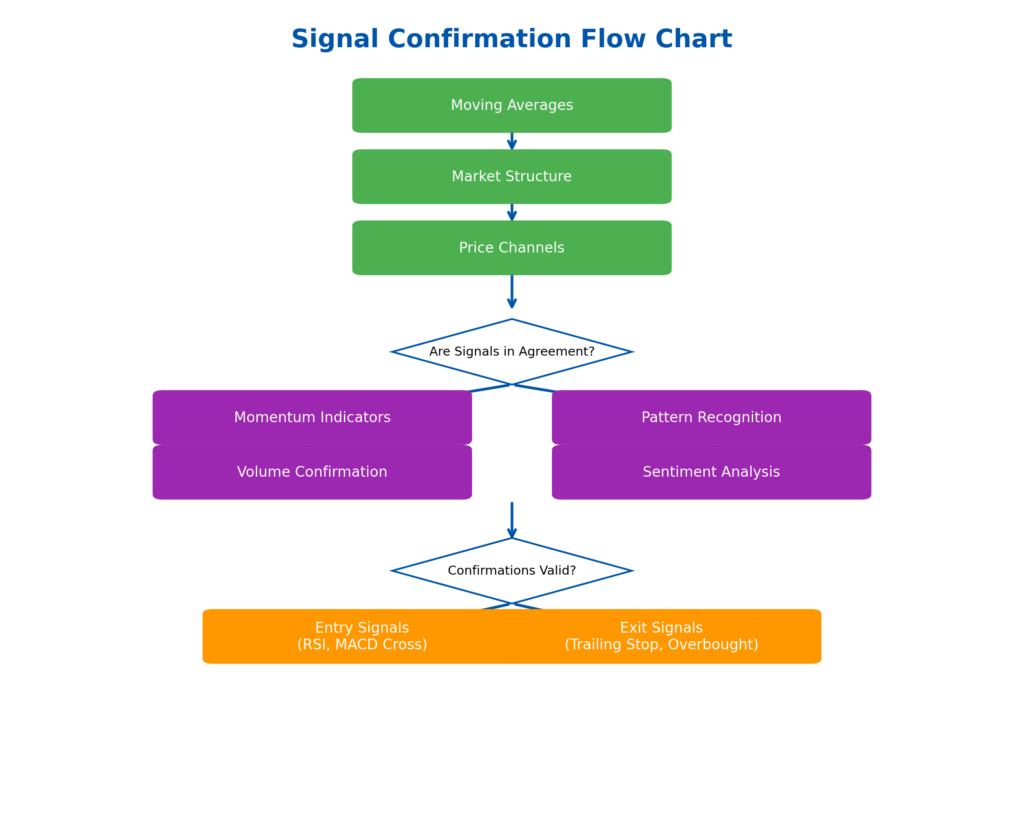

A comprehensive framework categorizes signals into three distinct functions:

- Trend Identification signals (moving averages, MACD) establish the directional bias

- Entry/Exit Timing signals (RSI, Bollinger Bands) optimize execution points

- Confirmation signals (volume patterns, breadth indicators) validate the primary signals

This multi-layered approach creates a “weight of evidence” methodology where no single indicator dictates decisions. Instead, the collective signal picture determines positioning and risk allocation.

Signal Combination Strategies

Rather than relying on individual indicators, professionals develop signal combination rules that require alignment across different analytical dimensions before triggering action.

A well-designed combination strategy might require:

- Primary trend confirmation via 50/200-day moving average relationship

- Momentum confirmation through MACD histogram direction

- Volume confirmation showing expanding volume in trend direction

- Sentiment indicators within reasonable ranges (avoiding extreme contrarian readings)

When signals conflict, most professionals defer to the higher timeframe or give precedence to price action over derivative indicators. They assign different weights to various signals based on historical reliability in current market conditions.

Backtesting and Optimization

Before implementing any signal system, thorough historical testing across different market environments is essential. Professional backtesting protocols test signal performance across full market cycles, including bull markets, bear markets, and sideways consolidations.

Effective optimization focuses on robustness rather than perfect historical performance. Rather than seeking parameters that performed best in the past (which often leads to over-optimization), professionals seek parameters that perform acceptably across various market conditions. They conduct sensitivity analysis by testing parameter ranges rather than specific values.

Continuous Adaptation and Evolution

Market dynamics evolve continuously, requiring regular assessment and refinement of signal methodologies. Professional investors conduct quarterly or annual reviews of signal effectiveness, identifying which indicators are gaining or losing reliability.

Leading hedge funds and professional trading firms dedicate significant resources to signal research, continuously testing new indicators and combinations. They maintain signal performance databases that track the accuracy of various indicators across different market environments and adjust weightings accordingly.

Future Trends in Market Signal Analysis

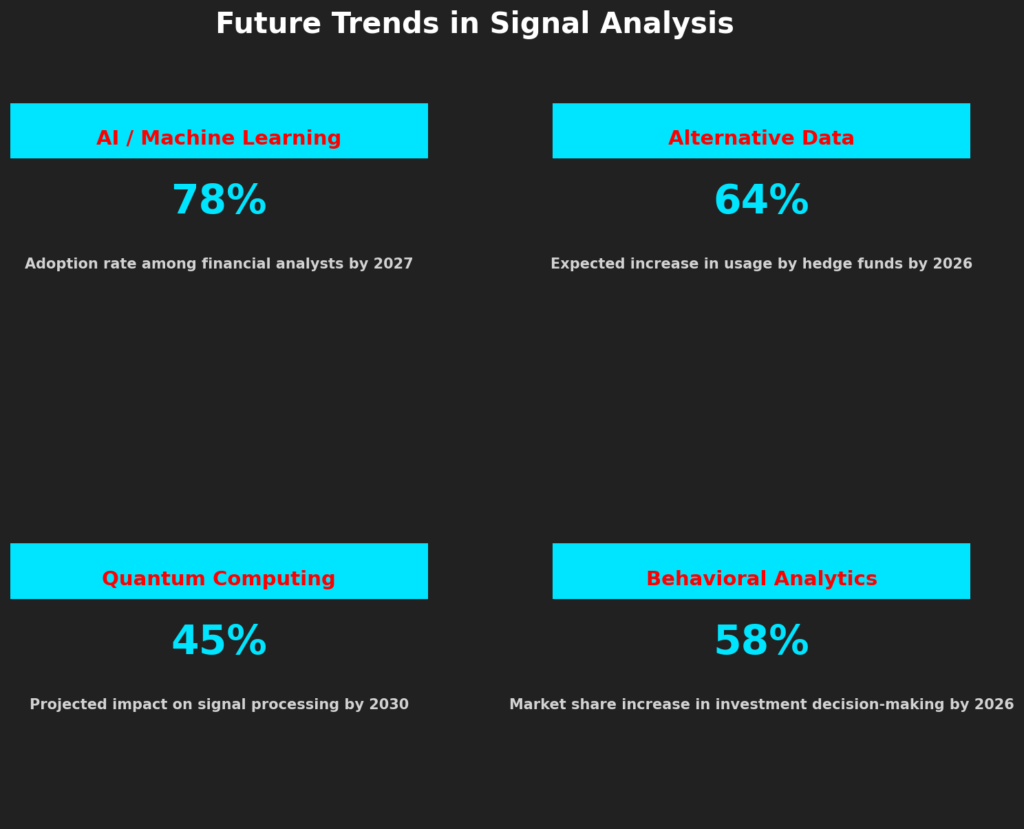

Artificial Intelligence and Machine Learning

AI systems are revolutionizing trend signal analysis by identifying complex, non-linear relationships between indicators. Unlike traditional analysis that relies on predefined rules, machine learning algorithms can discover subtle patterns across hundreds of variables simultaneously.

Leading investment firms already employ neural networks that continuously evaluate thousands of potential signal combinations, adjusting weightings in real-time based on changing market conditions. These systems can identify regime changes earlier than traditional methods and adapt signal interpretation accordingly.

Alternative Data Integration

Beyond conventional market data, cutting-edge signal analysis incorporates alternative datasets that provide unique insights into developing trends. These include:

- Social media sentiment analysis that quantifies investor attitudes

- Satellite imagery that tracks physical economic activity (retail parking lots, shipping traffic)

- Credit card transaction data that reveals consumer spending patterns

- Web search trends that indicate shifting consumer interests

The integration of these alternative data sources with traditional signals creates composite indicators with greater predictive power than conventional approaches alone.

Quantum Computing Applications

Though still emerging, quantum computing promises to transform signal analysis by solving complex optimization problems impossible for traditional computers. Potential applications include:

- Simultaneous optimization across hundreds of parameters without overfitting

- Real-time correlation analysis across global markets and asset classes

- Quantum machine learning algorithms that identify previously undetectable patterns

Leading financial institutions are already partnering with quantum computing researchers to develop the next generation of signal processing capabilities.

Behavioral Analytics Advancement

Advances in behavioral finance are enhancing our understanding of how psychological factors influence market trends. Sophisticated sentiment analysis now extends beyond simple surveys to include:

- Natural language processing of financial news and social media

- Analysis of options positioning to identify institutional hedging patterns

- Insider transaction pattern recognition

- Dark pool activity monitoring

These behavioral indicators complement traditional technical signals, providing context for market movements and improving timing accuracy.

FAQs – Market Trend Signals

1. What are the most reliable market trend signals for beginners?

For those new to trend analysis, simple moving averages provide the most accessible starting point. The 50-day and 200-day moving averages offer reliable trend identification with minimal complexity. Beginners should focus on the relationship between price and these key moving averages before adding more sophisticated indicators. Additionally, volume confirmation (ensuring volume increases in the direction of the trend) adds significant reliability with minimal analytical complexity.

2. How many different signals should be used together for optimal analysis?

Professional traders typically employ 3-5 primary signals from different analytical categories. More than this often leads to analysis paralysis or conflicting signals, while fewer provides insufficient confirmation. The optimal combination includes at least one trend-identifying indicator, one momentum indicator, and one volume/breadth confirmation tool. This creates a balanced system that addresses different aspects of market dynamics without excessive complexity.

3. How can investors distinguish between normal pullbacks and actual trend reversals?

Distinguishing pullbacks from reversals requires multi-factor analysis. In healthy uptrends, pullbacks typically occur on declining volume, maintain support at key moving averages (often the 20-day or 50-day), and show positive divergences in momentum indicators like RSI. True reversals usually involve higher-than-average volume, breaks of significant support levels or trendlines, and breadth deterioration where most stocks participate in the decline. The sequence and magnitude of these factors matter—minor support breaks followed by immediate recovery indicate pullbacks, while sustained breaks with expanding volume suggest potential reversals.

4. Are market trend signals equally effective across all asset classes?

Technical signals show varying effectiveness across asset classes, with traditional patterns generally working best in liquid, widely-followed markets. Equity indices and major forex pairs demonstrate the highest technical signal reliability, with success rates typically 15-20% higher than in less liquid markets. Commodity markets often respond well to momentum and sentiment indicators due to their cyclical nature, while fixed income markets tend to follow trends for extended periods once established. Cryptocurrencies exhibit strong technical patterns but with higher volatility and more frequent false signals. Professional investors adjust signal parameters and confidence thresholds based on the specific characteristics of each asset class.

5. How should investors adapt their signal analysis during high volatility periods?

During high volatility regimes, several adjustments improve signal reliability: (1) Extend the lookback periods for indicators to reduce noise—for example, using 14-period RSI instead of 9-period, (2) Require stronger confirmation through multiple timeframes before acting, (3) Focus on weekly charts rather than daily to filter out short-term volatility, (4) Place greater emphasis on volume patterns which become more revealing during volatile periods, and (5) Widen stop-loss parameters to accommodate larger price swings. Many professionals also reduce position sizing during high volatility to maintain consistent risk levels despite expanded price movements.

6. What role should fundamental analysis play alongside technical signal analysis?

Optimal investment frameworks integrate fundamental and technical analysis rather than treating them as competing methodologies. Fundamentals typically dictate what to buy or sell, while technicals determine when to execute. Professional managers often use fundamental analysis to identify investment candidates, then employ technical signals to optimize entry timing and position sizing. Additionally, fundamental trends provide context for technical signals—technical breakouts supported by improving fundamentals show higher reliability than those occurring despite deteriorating fundamentals. Leading hedge funds maintain separate fundamental and technical research teams that collaborate to create comprehensive investment theses.

7. How frequently should trend signals be monitored and evaluated?

Monitoring frequency should align with your investment timeframe rather than following a universal schedule. Long-term investors focusing on primary trends should evaluate signals weekly, while active traders require daily or even intraday assessment. Professional portfolio managers typically conduct comprehensive trend analysis weekly, with brief daily reviews to catch significant developments. The most common mistake is excessive monitoring relative to your timeframe, which often leads to overtrading and emotional decision-making. Establish a regular review schedule that matches your investment horizon and avoid constantly checking signals between scheduled evaluations.

8. Can market trend signals effectively predict major market crashes?

While no signal system perfectly predicts crashes, certain indicator combinations have historically provided advance warning of major downturns. The most reliable crash predictors include breadth deterioration (declining advance-decline lines despite stable indexes), expanding new lows despite index strength, momentum divergences across multiple timeframes, and significant increases in market volatility. Before the 2000, 2008, and 2020 crashes, these warning signs appeared 3-6 weeks before major price collapses, giving attentive investors time to reduce exposure. However, these same indicators occasionally generate false alarms during normal corrections, highlighting the probabilistic rather than deterministic nature of all signal systems.

9. How have technological advances changed the effectiveness of traditional market signals?

Algorithmic trading has significantly impacted signal reliability, with several notable effects: (1) Traditional patterns complete more quickly as algorithms accelerate price discovery, (2) Some classic patterns generate more false signals due to algorithm-induced stop hunting, (3) Volume-based signals have become more important as algorithmic footprints appear in volume data, and (4) Intraday signals show reduced reliability while multi-day signals maintain effectiveness. To adapt, sophisticated investors now incorporate algorithmic behavior into their analysis, monitoring options positioning, gamma exposure, and institutional order flow to anticipate how algorithmic trading might impact traditional patterns.

10. What psychological practices help investors follow signals rather than emotions?

Implementing a disciplined signal-based approach requires specific psychological techniques: (1) Pre-commitment through written trading plans that specify exactly which signals will trigger actions, (2) Decision journals that document the rationale behind each trade based on specific signals, (3) Regular performance reviews that analyze signal reliability rather than just profit/loss, (4) Systematic risk management where position sizing is determined by signal strength rather than conviction, and (5) Accountability mechanisms such as review with peers or mentors. Professional trading firms institutionalize these practices through formal processes that separate analysis from execution, reducing emotional interference with signal-based decisions.

Conclusion

Mastering market trend signals represents a crucial competency for investors seeking consistent performance across varying market conditions. While no signal or combination of indicators provides perfect foresight, the systematic application of well-tested signal frameworks significantly improves decision quality and risk-adjusted returns. The most successful approaches combine multiple signal types, implement rigorous testing protocols, and continuously adapt to evolving market dynamics.

As markets grow increasingly complex and technology-driven, the future of trend signal analysis lies in the integration of traditional technical approaches with advanced computational methods, alternative data sources, and behavioral insights. Investors who develop flexible, multi-dimensional signal frameworks – rather than searching for single “perfect” indicators – position themselves to navigate both traditional market cycles and the structural changes reshaping global financial markets.

By approaching signal analysis with disciplined processes and realistic expectations, investors can indeed learn to “read the markets like the pros,” achieving the consistent edge that distinguishes successful long-term market participants.

For your reference, recently published articles include:

- Best Mutual Fund Analytics: Your Edge To Win Big

- Investment Return Calculation: The Ultimate Pro Guide

- Never Lose Money Again: The Ultimate Portfolio Diversification Tools

- Risk-Proof Your Wealth: Professional Investment Risk Scoring Methods Revealed

- Market Trend Analysis: Technical Analysis Secrets Exposed

- Digital Age Success Story: With AI To Private Wealth

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.