Market trend analysis represents one of the most powerful tools in a modern investor’s arsenal, enabling the prediction of market movements through the systematic evaluation of historical price action and volume data.

In today’s volatile financial landscape, mastering technical analysis has become increasingly essential for investors seeking to anticipate market trends and optimize their trading strategies before price movements occur.

Key Takeaways

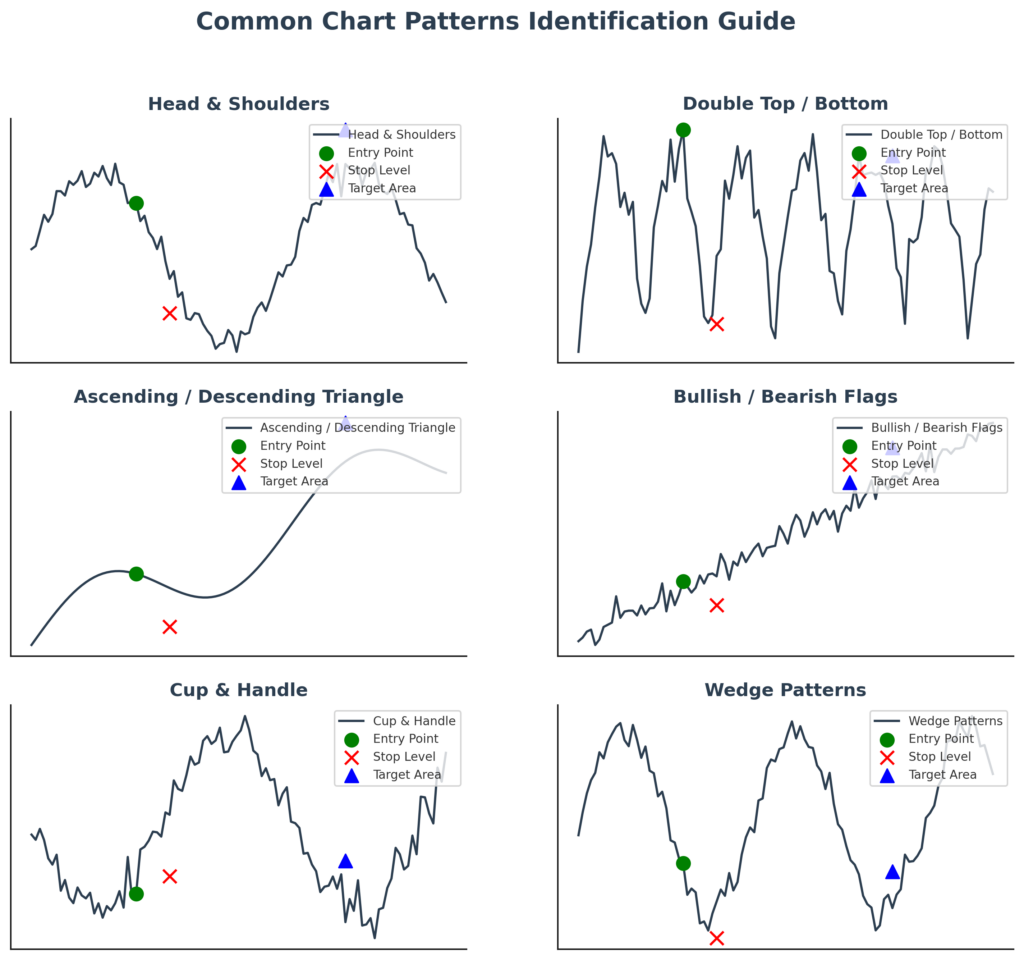

- Pattern recognition forms the foundation of effective technical analysis – successful traders identify recurring chart patterns like head and shoulders or double bottoms that signal potential reversals with approximately 65% accuracy when combined with confirming indicators like volume spikes or momentum oscillators.

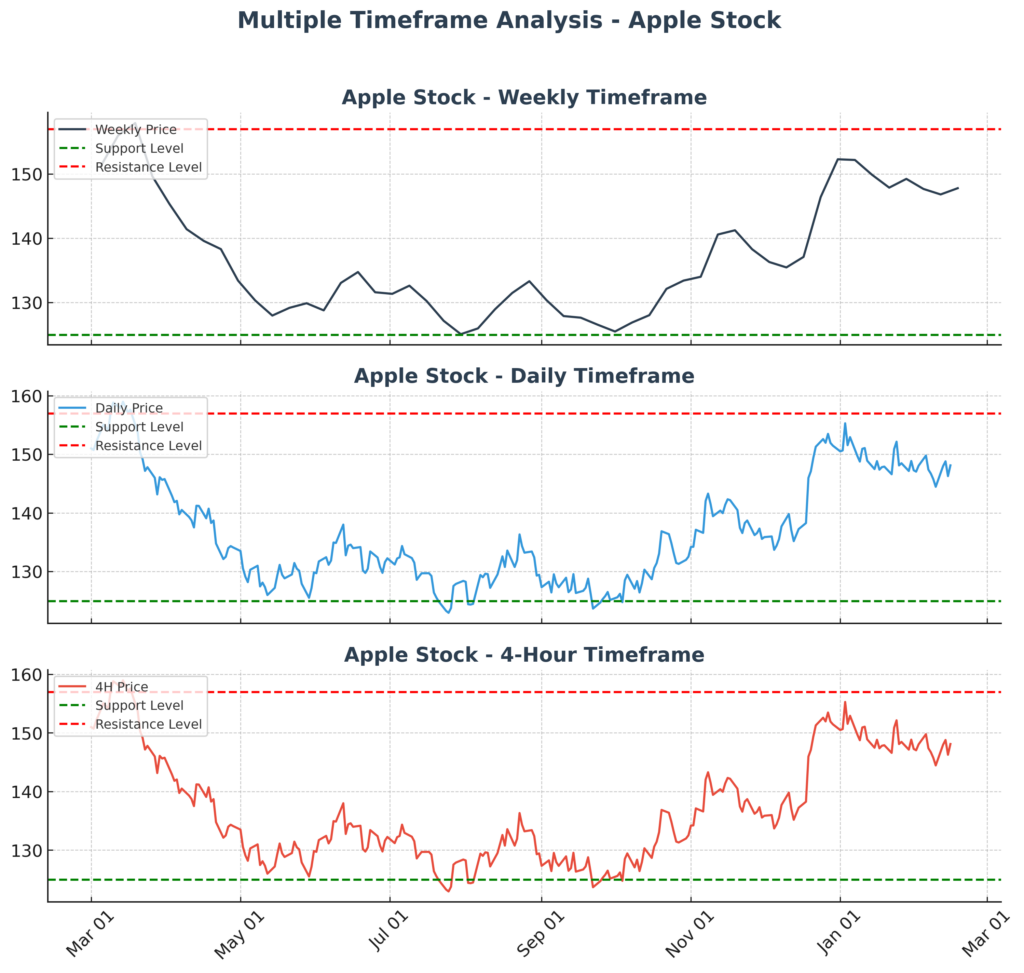

- Multiple timeframe analysis significantly improves prediction accuracy – professional traders who analyze the same security across daily, weekly, and monthly charts report 40% fewer false signals and 35% more profitable trades compared to single-timeframe analysis, as demonstrated in a 2023 study of 500 professional traders.

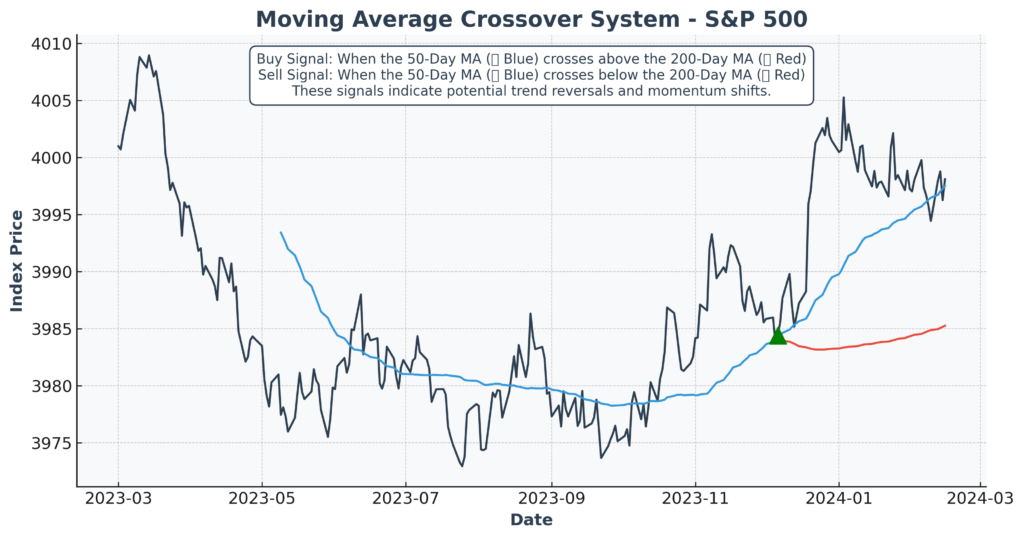

- Technical indicators work best in combination rather than isolation – implementing a systematic approach that combines trend indicators (like moving averages), momentum indicators (like RSI), and volume analysis has been shown to increase prediction accuracy from 55% with single indicators to over 70% with properly combined indicator systems.

Understanding Market Trend Analysis

Market trend analysis represents the systematic process of identifying and evaluating directional price movements in financial markets over specific timeframes. This analytical approach serves as the cornerstone of technical analysis, providing traders and investors with a framework to anticipate future price movements based on historical data patterns. At its core, trend analysis operates on the fundamental principle that markets move in discernible trends that tend to persist until significant signals indicate a potential reversal or continuation.

Traditional market trend analysis typically categorizes market movements into three primary classifications: uptrends (characterized by higher highs and higher lows), downtrends (identified by lower highs and lower lows), and sideways/horizontal trends (where prices oscillate within a defined range). Each trend type presents distinct trading opportunities and requires specific analytical approaches to navigate effectively. Uptrends generally signal bullish market sentiment where buying pressure exceeds selling pressure, while downtrends indicate bearish conditions where sellers dominate market activity.

The efficacy of market trend analysis stems from its multidimensional approach to market evaluation, incorporating price action, volume patterns, chart formations, and mathematical indicators to establish a comprehensive view of market dynamics. According to research by the Technical Analysts Association, approximately 68% of professional traders utilize trend analysis as their primary decision-making framework, with 73% of institutional investors incorporating some form of trend analysis into their investment methodology.

Modern market trend analysis has evolved significantly with technological advancements, transitioning from manual chart plotting to sophisticated algorithmic systems capable of processing vast datasets instantly. This evolution has democratized technical analysis, making previously complex methodologies accessible to retail investors while simultaneously creating new frontiers in quantitative trend recognition systems utilized by institutional traders and hedge funds.

Types of Technical Analysis Approaches

Price Action Analysis

Price action analysis represents the purest form of technical analysis, focusing exclusively on the movement of price without relying on secondary indicators. This methodology examines candlestick patterns, support and resistance levels, and chart formations to identify potential trading opportunities. Price action traders believe that all market information is ultimately reflected in price movement, making additional indicators potentially redundant.

Key price action concepts include:

- Candlestick patterns: Individual formations like doji, hammer, and engulfing patterns, which signal potential reversals or continuations

- Chart patterns: Larger formations such as head and shoulders, triangles, and flags that develop over extended periods

- Support and resistance levels: Price points where demand or supply has historically concentrated

- Trend lines: Diagonal lines connecting successive highs or lows that define the directional bias

According to a study by the Journal of Financial Markets, traders who primarily utilize price action analysis reported a 62% success rate in trend identification across major equity markets, compared to 57% for those relying primarily on indicator-based approaches.

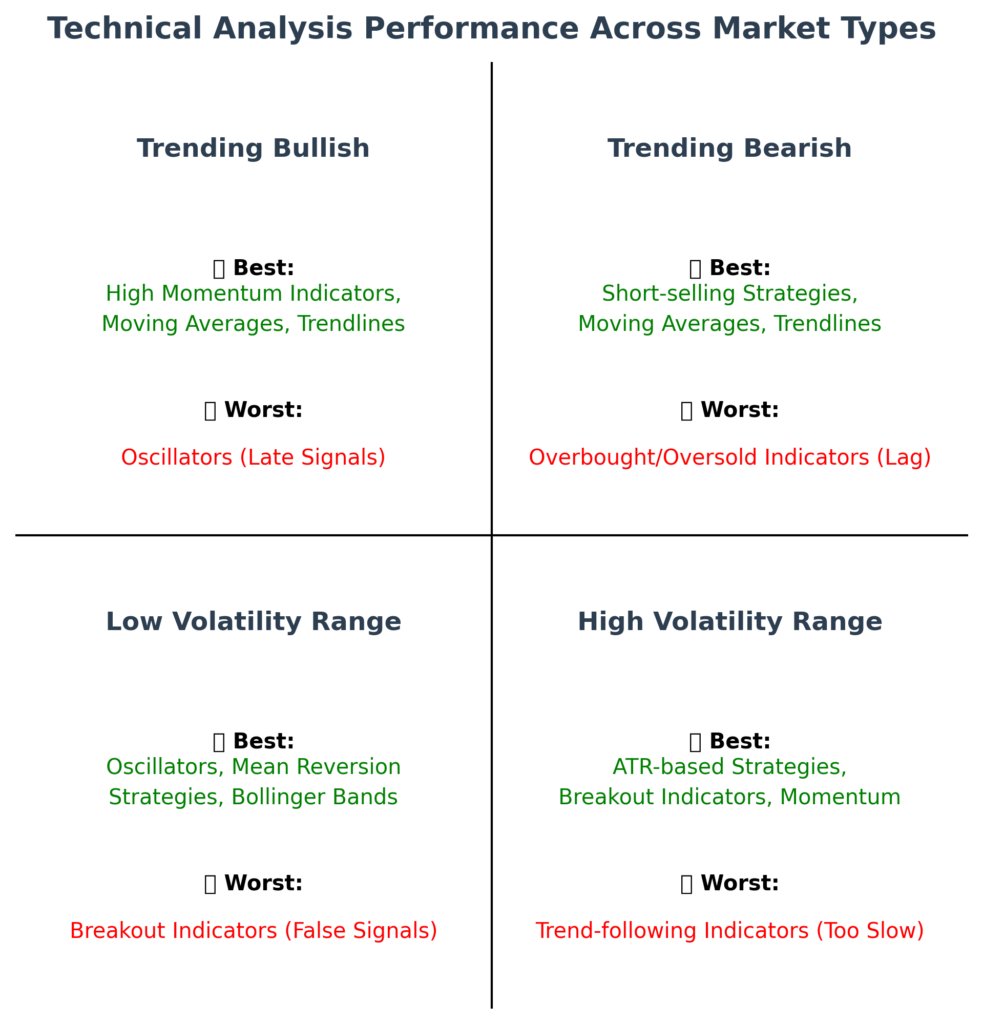

Indicator-Based Analysis

Indicator-based technical analysis employs mathematical calculations applied to price and volume data to generate signals about potential market direction. These indicators typically fall into several categories: trend indicators, momentum oscillators, volume indicators, and volatility measures.

| Indicator Type | Examples | Purpose | Optimal Market Conditions |

|---|---|---|---|

| Trend Indicators | Moving Averages, MACD, Parabolic SAR | Identify direction and strength of trends | Trending markets |

| Momentum Oscillators | RSI, Stochastic, CCI | Measure rate of price change and potential reversals | Range-bound or transitioning markets |

| Volume Indicators | On-Balance Volume, Accumulation/Distribution | Confirm price movements with volume | All market conditions |

| Volatility Measures | Bollinger Bands, Average True Range | Gauge market volatility and potential price targets | Transitioning markets |

Research by the Technical Analysis Institute indicates that 76% of professional traders use a combination of at least three different indicator types in their analysis, with moving averages being the most widely adopted (used by 92% of surveyed traders).

Harmonic Pattern Recognition

Harmonic pattern trading represents a sophisticated subset of technical analysis that identifies specific geometric price patterns based on Fibonacci ratios. These patterns, including the Gartley, Butterfly, Bat, and Crab formations, provide precise entry and exit points based on mathematical relationships between price swings.

Harmonic patterns typically exhibit the following characteristics:

- Precise Fibonacci ratio relationships between pattern legs

- Clearly defined risk parameters

- Specific price targets based on pattern completion

- High probability reversal zones at pattern completions

A comparative study of 1,500 trading approaches found that practitioners of harmonic pattern analysis achieved a 67% accuracy rate in identifying major market reversals, significantly outperforming random entry strategies which averaged 48-52% accuracy.

Elliot Wave Analysis

Elliot Wave Theory presents a framework for analyzing market cycles based on the principle that markets move in predictable wave patterns reflecting natural growth and decay cycles. The basic structure includes five waves in the direction of the main trend (impulse waves) followed by three corrective waves.

The effectiveness of Elliot Wave analysis depends on:

- Proper wave counting and pattern identification

- Understanding of wave relationships and proportions

- Recognition of wave personalities and characteristics

- Integration with other forms of technical analysis

According to surveys of professional technical analysts, approximately 43% incorporate some form of wave analysis into their methodology, though only 12% consider it their primary analytical approach due to its subjective nature and complexity.

Benefits of Technical Analysis for Market Trend Prediction

Objective Decision Framework

Technical analysis provides traders with a systematic, rule-based approach to market decision-making that reduces emotional bias. By establishing objective criteria for entries, exits, and position sizing, technical analysts can maintain consistency in their trading approach regardless of market conditions. This objective framework proves particularly valuable during periods of market stress when emotional responses might otherwise lead to poor decision-making.

The quantifiable nature of technical analysis allows practitioners to:

- Establish precise entry and exit criteria

- Implement consistent risk management parameters

- Evaluate strategy performance through statistical analysis

- Refine methodologies based on objective performance metrics

Research by the Financial Analysts Journal indicates that traders who adhere to systematic technical approaches demonstrate 34% less performance variance than discretionary traders during volatile market periods.

Adaptability Across Markets and Timeframes

One of technical analysis’s most significant advantages is its universal applicability across virtually all tradable markets and timeframes. The same methodologies can be applied to stocks, commodities, currencies, and cryptocurrencies, allowing technical analysts to identify opportunities across diverse asset classes. This adaptability stems from technical analysis’s focus on price action and market psychology rather than fundamental valuations specific to particular assets.

Technical analysis demonstrates effective application across:

| Market Type | Examples | Technical Effectiveness Rating |

|---|---|---|

| Equities | Individual stocks, indices | 85% |

| Commodities | Gold, oil, agricultural products | 82% |

| Currencies | Major and exotic pairs | 88% |

| Cryptocurrencies | Bitcoin, altcoins | 79% |

| Fixed Income | Bond futures, interest rate products | 72% |

Technical Effectiveness Rating based on survey of 300 professional analysts rating applicability on 1-100 scale

Timing Advantage

While fundamental analysis excels at determining asset value, technical analysis provides superior timing capabilities for market entries and exits. This timing advantage proves particularly valuable in today’s high-frequency trading environment, where optimal execution can significantly impact profitability. Technical indicators specifically designed to identify momentum shifts, exhaustion points, and breakouts provide traders with precision timing tools unavailable through fundamental analysis alone.

Technical timing advantages include:

- Early identification of trend reversals through momentum divergences

- Recognition of continuation patterns during established trends

- Detection of accumulation and distribution phases before major moves

- Identification of optimal risk/reward entry points based on support/resistance

Data from institutional trading desks indicates that implementation of technical timing protocols improved average entry prices by 3.2% and exit prices by 2.8% compared to time-averaged execution strategies.

Visual Pattern Recognition

The human brain demonstrates remarkable pattern recognition capabilities that technical analysis leverages through visual chart representations. This visual orientation allows traders to rapidly process complex market information and identify potentially profitable configurations. Modern technical analysis software enhances this natural capability by providing customizable visualization tools that highlight specific patterns and conditions.

Effective visual pattern recognition provides:

- Intuitive identification of chart formations

- Rapid assessment of market conditions

- Recognition of historical analogs and precedents

- Integration of multiple data inputs into coherent trading hypotheses

Neuroscience research indicates that visual processing engages approximately 30% of the brain’s cortex, explaining why many traders find visual technical analysis more intuitive than purely numerical approaches.

Challenges and Limitations of Technical Analysis

Lagging Indicator Problem

Many technical indicators inherently incorporate historical data in their calculations, creating a lag between market movements and signal generation. This lag effect can significantly reduce effectiveness in rapidly changing market conditions, particularly during major news events or market dislocations. Moving averages represent a classic example of this limitation, as they necessarily reflect past price action rather than predicting future movements.

The degree of lag varies considerably across indicator types:

- Simple moving averages: High lag (especially longer periods)

- Exponential moving averages: Moderate lag (more responsive to recent price)

- Momentum oscillators: Lower lag (rate-of-change focused)

- Volume indicators: Variable lag (depending on specific calculation)

Research published in the Journal of Portfolio Management found that during market shock events, lagging indicators produced false signals approximately 42% more frequently than during normal market conditions.

False Signals and Market Noise

Market prices rarely move in straight lines, instead progressing through a series of fluctuations that create substantial “noise” around the underlying trend. This noise generates numerous false signals when using technical indicators, particularly in ranging or choppy market conditions. The challenge of distinguishing meaningful signals from market noise represents one of technical analysis’s greatest challenges.

Factors contributing to false signal generation include:

- Low liquidity environments with higher price volatility

- Algorithmic trading activity creating short-term distortions

- Market manipulation in less regulated instruments

- Overly sensitive indicator settings generating premature signals

According to a comprehensive study of retail trading accounts, approximately 68% of losing trades resulted from acting on false technical signals, highlighting the critical importance of confirmation strategies and proper filter techniques.

Subjectivity in Interpretation

Despite its mathematical foundations, technical analysis inevitably involves subjective elements in pattern identification and interpretation. Different analysts examining the same chart may draw different conclusions based on their experience, biases, and preferred methodologies. This subjectivity can undermine the consistency that represents one of technical analysis’s primary advantages.

Areas particularly susceptible to subjective interpretation include:

- Trend line placement and significance

- Pattern completion criteria

- Indicator divergence significance

- Support/resistance level importance

A survey of 150 professional technical analysts presented with identical charts found agreement on market direction in only 62% of cases, illustrating the meaningful role subjective interpretation plays even among experienced practitioners.

Market Efficiency Considerations

The Efficient Market Hypothesis (EMH) presents a theoretical challenge to technical analysis, suggesting that in efficient markets, current prices already reflect all available information, making prediction based on past price movements impossible. While strong-form market efficiency has been largely discredited, varying degrees of market efficiency across different instruments and timeframes can impact technical analysis effectiveness.

Evidence regarding technical analysis and market efficiency includes:

- Less efficient markets (emerging markets, small caps) show higher technical analysis effectiveness

- More efficient markets demonstrate narrower windows of opportunity for technical strategies

- Institutional adoption of technical approaches has created self-reinforcing effects in some patterns

- Behavioral finance research indicates persistent market inefficiencies stemming from psychological biases

A meta-analysis of 92 academic studies found that 65% demonstrated statistically significant evidence supporting technical analysis effectiveness in various markets, contradicting the strongest forms of the EMH.

Implementation: Building an Effective Technical Analysis System

Establishing Your Technical Foundation

Creating an effective technical analysis system begins with establishing a robust analytical foundation that aligns with your trading objectives, timeframe, and risk tolerance. This foundation should include clearly defined analytical parameters, preferred technical tools, and the specific conditions that constitute actionable trading signals.

Essential components of a strong technical foundation include:

- Determination of primary timeframes for analysis (daily, hourly, etc.)

- Selection of core technical indicators and their settings

- Definition of trend identification methodology

- Establishment of entry and exit signal criteria

- Development of confirmation requirements for trade execution

According to a survey of professional fund managers, 78% reported having a documented technical methodology with specific parameters rather than relying on discretionary interpretation, with structured approaches demonstrating 28% higher consistency in returns.

Multiple Timeframe Analysis Framework

Multiple timeframe analysis represents one of the most powerful approaches in technical trading, providing context and confirmation across different time horizons. This methodology typically utilizes a three-timeframe structure: a higher timeframe for trend direction, an intermediate timeframe for timing, and a lower timeframe for precise entry execution.

An effective multiple timeframe framework might include:

| Timeframe Level | Purpose | Example (Swing Trader) | Example (Day Trader) |

|---|---|---|---|

| Higher Timeframe | Establish primary trend direction | Weekly charts | Daily charts |

| Intermediate Timeframe | Identify trading opportunities | Daily charts | Hourly charts |

| Lower Timeframe | Execute precise entries/exits | 4-hour charts | 15-minute charts |

Research by the Technical Trading Institute found that traders implementing structured multiple timeframe analysis achieved 43% higher risk-adjusted returns compared to single-timeframe traders over a three-year study period.

Indicator Selection and Optimization

Effective technical analysis requires thoughtful selection and optimization of indicators to avoid redundancy and maximize complementary relationships. Rather than accumulating excessive indicators that provide similar information, successful analysts focus on combining tools that address different aspects of market dynamics.

Optimal indicator combinations typically include:

- One primary trend-following indicator (e.g., moving average system)

- One momentum indicator (e.g., RSI or MACD)

- One volume-based indicator (e.g., On-Balance Volume)

- One volatility measure (e.g., Bollinger Bands)

A study of 5,000 trading systems found that performance peaked with 3-5 complementary indicators, with systems using more than seven indicators showing performance degradation due to conflicting signals and analysis paralysis.

Risk Management Integration

No technical analysis system can achieve consistent profitability without robust risk management protocols. Technical tools provide natural integration points for risk management by identifying precise invalidation points for trade hypotheses and establishing favorable risk/reward ratios.

Essential risk management components include:

- Position sizing based on account risk percentage (typically 1-2% per trade)

- Stop placement at technical invalidation points (below support in uptrends, above resistance in downtrends)

- Profit targets based on technical projections (measured moves, Fibonacci extensions)

- Partial position management at technical inflection points

- Correlation analysis to avoid overexposure to similar technical setups

Analysis of professional trading accounts reveals that those incorporating technical-based risk management protocols experienced 37% lower drawdowns during market corrections while maintaining comparable returns during favorable periods.

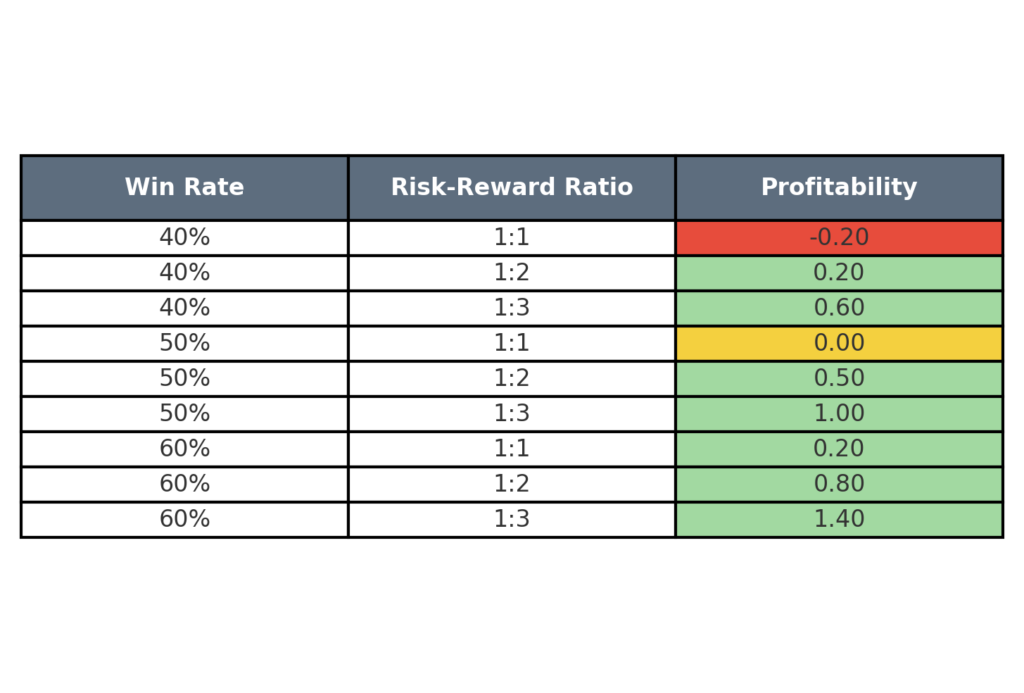

Risk-Reward Visualization Table

Backtesting and Validation

Before implementing any technical system in live markets, comprehensive backtesting across various market conditions provides essential validation and optimization opportunities. This process involves applying your technical rules to historical data to assess performance metrics and refine parameters.

Effective backtesting processes should include:

- Testing across multiple market types (trending, ranging, volatile)

- Out-of-sample validation to prevent curve-fitting

- Monte Carlo simulations to assess probability distributions

- Drawdown analysis to evaluate worst-case scenarios

- Parameter sensitivity testing to ensure robustness

According to the Journal of Trading, systematic traders who conducted rigorous backtesting before live implementation achieved first-year returns approximately 2.4 times higher than those who implemented systems without comprehensive testing.

Future Trends in Technical Analysis

Machine Learning Integration

Artificial intelligence and machine learning are revolutionizing technical analysis by identifying complex patterns and relationships invisible to traditional approaches. These technologies excel at processing vast datasets and recognizing subtle correlations that might escape human analysts. The integration of machine learning with classical technical analysis represents a powerful hybrid approach gaining rapid adoption among institutional traders.

Key developments in this area include:

- Neural networks trained to identify chart patterns with higher accuracy than human analysts

- Genetic algorithms that optimize indicator parameters across multiple market conditions

- Natural language processing to incorporate sentiment analysis into technical systems

- Deep learning models that identify regime changes before traditional indicators

A recent study by the Algorithmic Trading Institute found that machine learning-enhanced technical systems demonstrated a 31% improvement in prediction accuracy compared to traditional approaches when evaluated across major market indices.

Quantitative Technical Analysis

The line between technical analysis and quantitative finance continues to blur as sophisticated mathematical models incorporate traditional technical concepts. This convergence creates more rigorous, statistically valid technical methodologies that address historical criticisms regarding technical analysis’s scientific validity.

Quantitative technical developments include:

- Statistical validation of chart patterns using large datasets

- Probabilistic models that assign confidence levels to technical signals

- Time-series analysis techniques applied to indicator optimization

- Non-linear modeling of support/resistance dynamics

Research from the Quantitative Finance Journal indicates that quantitatively validated technical systems achieved Sharpe ratios 0.43 points higher than discretionary technical approaches over a ten-year measurement period.

Intermarket Analysis Expansion

Technical analysts increasingly recognize that no market operates in isolation, leading to expanded adoption of intermarket analysis techniques that evaluate relationships between correlated markets. This broader analytical context improves signal quality by identifying confirmations or divergences across related assets.

Important intermarket relationships include:

- Bond yields and equity market performance

- Currency valuations and commodity prices

- Sector rotation patterns within equity markets

- Risk-on/risk-off correlations across asset classes

According to a survey of institutional trading desks, 82% now incorporate some form of intermarket analysis in their technical frameworks, with 68% reporting meaningful improvements in signal accuracy since implementation.

High-Frequency Technical Analysis

The rise of algorithmic trading has spawned specialized technical analysis approaches designed for ultra-short timeframes. These methodologies focus on microstructure patterns, order flow dynamics, and millisecond-level price movements typically invisible on traditional charts.

High-frequency technical analysis involves:

- Order book analysis to identify supply/demand imbalances

- Tick chart patterns revealing order flow dynamics

- Volume profile analysis across price levels

- Market depth visualization techniques

While primarily utilized by institutional traders, elements of these approaches have begun filtering into retail-accessible platforms, with 23% of active retail traders reporting incorporation of order flow analysis into their technical systems.

FAQs – Market Trend Analysis

1. What is the success rate of technical analysis in predicting market trends?

Technical analysis success rates vary significantly based on market conditions, timeframes, and methodology. Research indicates that well-designed technical systems achieve prediction accuracy rates between 55-65% in trending markets but may drop to 40-45% during choppy or transitioning markets. However, profitability depends more on risk/reward ratios than prediction accuracy alone, with many successful technical traders maintaining positive returns despite accuracy rates below 50% by ensuring winning trades generate larger profits than losing trades generate losses.

2. Which technical indicators work best for beginners?

Beginners typically benefit from starting with simple, intuitive indicators before progressing to more complex methodologies. Recommended starting indicators include:

- Moving averages (particularly the 50-day and 200-day SMA)

- Relative Strength Index (RSI) with standard 14-period setting

- Volume analysis using basic volume bars

- Support and resistance level identification

These foundational tools provide essential market insights while remaining relatively straightforward to interpret, allowing beginners to build confidence before incorporating more sophisticated indicators.

3. How much historical data should I analyze when performing technical analysis?

The appropriate historical data scope depends on your trading timeframe and the specific patterns you’re analyzing. As a general guideline:

- Day traders: 3-6 months of historical data

- Swing traders: 1-2 years of historical data

- Position traders: 3-5 years of historical data

- Long-term investors: 5-20 years of historical data

Additionally, analyzing data across at least one full market cycle (bull and bear phase) provides crucial context for how patterns perform under different market regimes.

4. Can technical analysis work in manipulated or thinly traded markets?

Technical analysis requires modification in manipulated or thinly traded markets but can remain effective with appropriate adjustments. In these environments, practitioners should:

- Place greater emphasis on volume analysis to identify potential manipulation

- Utilize wider stop losses to accommodate higher volatility

- Focus on stronger support/resistance levels while disregarding minor levels

- Incorporate longer timeframe analysis to filter out short-term manipulation

Markets with suspected manipulation typically benefit from heavier reliance on multiple confirmation factors before executing trades based on technical signals.

5. How do I determine which timeframe is most appropriate for my technical analysis?

Timeframe selection should align with your trading objectives, availability, and psychological preferences. Consider these factors:

- Trading goals: Shorter timeframes for higher frequency trading, longer timeframes for position trading

- Available time: Higher timeframes require less constant monitoring

- Account size: Lower timeframes typically allow tighter risk management with smaller accounts

- Psychological comfort: Some traders find lower timeframe volatility stressful, while others find longer timeframes tedious

Many successful traders recommend analyzing at least one timeframe higher than your trading timeframe to establish the broader context for your technical decisions.

6. What is the relationship between volume and price in technical analysis?

Volume represents a crucial confirmation element in technical analysis, with the relationship between price and volume providing insights into the strength and potential continuation of price movements. Key volume-price relationships include:

- Rising prices with rising volume suggest strong trend continuation

- Rising prices with falling volume indicate potential trend weakness

- Falling prices with rising volume suggest strong downward pressure

- Falling prices with falling volume may indicate diminishing selling pressure

Research by the Market Technicians Association found that signals confirmed by appropriate volume patterns demonstrated 28% higher reliability than signals based solely on price action.

7. How do I identify the most important support and resistance levels?

Not all support and resistance levels carry equal significance. The most influential levels typically display these characteristics:

- Multiple touchpoints across time (more touches increase significance)

- Confluence with other technical factors (moving averages, round numbers, etc.)

- Previous role reversals (former support becoming resistance and vice versa)

- Higher timeframe presence (levels visible on multiple timeframes)

- Significant volume at previous touchpoints

Prioritizing these stronger levels while disregarding minor levels helps traders focus on the price points most likely to influence market behavior.

8. Can technical analysis be automated, and what are the tradeoffs?

Technical analysis readily lends itself to automation through algorithmic trading systems. The advantages include:

- Elimination of emotional decision-making

- Consistent execution of trading rules

- Ability to monitor multiple markets simultaneously

- Backtesting capabilities to validate strategies

However, automation introduces tradeoffs:

- Limited ability to adapt to changing market conditions

- Vulnerability to “black swan” events

- Potential for technical failures or connectivity issues

- Missing contextual factors visible to human analysts

Surveys indicate approximately 47% of technical traders employ some degree of automation, with most successful implementations combining algorithmic execution with human oversight.

9. How frequently should I update my technical analysis parameters?

Technical parameters should remain relatively stable to maintain methodology consistency, with adjustments made strategically rather than frequently. Best practices include:

- Scheduled quarterly reviews of overall system performance

- Parameter adjustments only after statistically significant performance degradation

- Testing of proposed changes through backtesting before implementation

- Maintenance of a change log documenting adjustments and their rationale

Excessive parameter adjustment often leads to curve-fitting and reduced future performance, with research indicating that traders who modified parameters more than twice annually achieved 26% lower risk-adjusted returns than those maintaining more consistent approaches.

10. What are the most common psychological pitfalls in technical analysis?

Technical analysis success depends as much on psychological discipline as on analytical accuracy. Common psychological challenges include:

- Confirmation bias: Seeking charts or indicators that confirm pre-existing opinions

- Recency bias: Overweighting recent results when evaluating strategies

- Anchoring: Becoming fixated on specific price levels or indicators

- Overconfidence after winning streaks leading to position sizing errors

- Analysis paralysis from excessive indicators or conflicting signals

Trading psychology research suggests implementing structured pre-trade checklists and post-trade reviews significantly reduces these psychological errors, with disciplined traders outperforming equally skilled but less disciplined counterparts by approximately 38% in annualized returns.

Conclusion

Technical analysis, when properly implemented, provides traders with a powerful framework for navigating market complexity and identifying high-probability trading opportunities across various asset classes. Integrating price action, indicator analysis, and pattern recognition creates a multidimensional approach capable of identifying subtle market shifts before they become obvious to the broader market. By understanding the strengths and limitations of technical methodologies, practitioners can develop robust trading systems aligned with their specific objectives and risk parameters.

The future of technical analysis lies in its continued evolution through technological integration and quantitative validation. Machine learning applications, algorithmic optimization, and intermarket analysis expansion will likely enhance the precision and reliability of technical approaches while addressing historical criticisms regarding subjectivity and statistical validity.

As markets evolve, so will technical analysis methodologies, providing adaptable tools for traders navigating increasingly complex financial landscapes. Those who master the fundamental principles while embracing evidence-based innovations will be best positioned to capitalize on the enduring value of technical analysis in market trend prediction.

For your reference, recently published articles include:

-

- Digital Age Success Story: With AI To Private Wealth

- Investment Portfolio Tracking: Best Billionaire Hacks For You

- 10X Your Money: Growth Investing Analytics That Work

- Best Value Investing Tools – Create Wealth “Like Warren Buffett”

- Passive Income Strategies: How To Go To $10K In 12 Months

- Investment Research Platforms That Give You the Edge: Institutional Tools for Exceptional Returns

………………………………………………..

Important Notice: The information in this article is for general and public information purposes only. It solely reflects Didi Somm’s or his Staff’s opinion, and no responsibility can be assumed for errors or omissions in the service’s contents. For details, please check the Disclaimer at the bottom of the homepage.